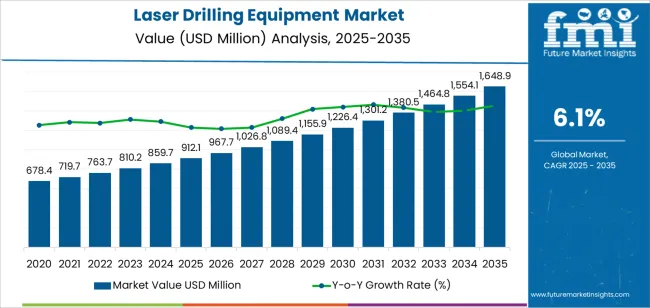

The laser drilling equipment market is valued at USD 912.1 million in 2025 and is projected to reach USD 1,648.9 million by 2035, expanding at a CAGR of 6.1% over the forecast period. The laser drilling equipment market is entering a steady expansion phase as precision manufacturing gains importance across aerospace, electronics, automotive, and energy sectors. The industry is projected to grow through the next decade, supported by advances in high-power laser sources, automated control systems, and demand for miniaturized components. The laser drilling equipment market’s direction reflects the increasing role of non-contact, high-accuracy machining in complex material processing and component fabrication.

One central trend is the transition from conventional mechanical drilling to laser-based systems that enable higher precision, faster throughput, and minimal thermal distortion. Manufacturers are replacing traditional machining tools with multi-axis laser platforms capable of processing metals, ceramics, and composites. Requirements in jet engine manufacturing drive the shift, printed circuit board (PCB) fabrication, and battery component production, where tolerance levels continue to tighten. Fiber and ultrafast laser technologies are becoming dominant due to improved beam quality, energy efficiency, and compatibility with automated production lines.

Automation integration represents another major development. Modern laser drilling systems now feature closed-loop feedback control, machine vision, and data-acquisition modules that enhance accuracy and repeatability. This integration supports continuous production in high-value manufacturing environments. The use of robotics and AI-assisted calibration is improving positioning accuracy in micro-drilling operations, particularly in the electronics and semiconductor industries. These enhancements reduce rework rates and enable real-time adaptive process adjustments.

Material diversity is expanding the application base for laser drilling equipment. Advances in pulse shaping and wavelength control enable clean drilling of difficult materials such as titanium alloys, carbon fiber composites, and sapphire substrates. These capabilities are critical in the aerospace and renewable energy sectors, where material performance requirements are demanding. Hybrid systems combining laser drilling with water-jet or plasma assistance are emerging to address edge quality issues in thick or layered materials.

From a production standpoint, manufacturers are focusing on modular equipment designs that can be customized for specific end-use requirements. This modularity simplifies maintenance and allows flexible scaling across production volumes. Compact system architectures are also gaining adoption in space-constrained facilities and cleanroom environments.

Regional growth patterns reflect industrial specialization. Asia Pacific leads in electronics and consumer device manufacturing, while Europe and North America maintain strong positions in aerospace and automotive component production. This geographic division is shaping equipment demand profiles, with high-precision micromachining equipment dominating in Asian markets and heavy-duty, large-format laser systems favored in Western industrial regions.

Where Revenue Comes From - Now vs Next (Industry-Level View)?

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New equipment sales (fiber, CO2, other laser systems) | 48% | Capex-led, precision-driven purchases |

| Spare parts & consumables | 22% | Optics, lenses, beam delivery components | |

| Service & maintenance contracts | 18% | Preventive maintenance, calibration support | |

| Upgrades & retrofits | 12% | Technology enhancement, precision improvement | |

| Future (3-5 yrs) | High-precision fiber systems | 42-47% | Industry 4.0 integration, smart manufacturing |

| Digital monitoring & analytics | 16-21% | Real-time quality control, predictive maintenance | |

| Service-as-a-subscription | 14-18% | Performance guarantees, outcome-based pricing | |

| Consumables & components | 10-14% | Precision optics, specialized lenses | |

| Process optimization services | 7-11% | Application engineering, process validation | |

| Data services (drilling metrics, quality analytics) | 4-7% | Benchmarking for manufacturers |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 912.1 million |

| Market Forecast (2035) | USD 1,648.9 million |

| Growth Rate | 6.1% CAGR |

| Leading Technology | Fiber Laser Drilling Equipment |

| Primary Application | Aerospace Segment |

The laser drilling equipment market demonstrates strong fundamentals with fiber laser drilling systems capturing a dominant share through advanced precision drilling capabilities and manufacturing optimization. Aerospace applications drive primary demand, supported by increasing precision component requirements and advanced material processing needs. Geographic expansion remains concentrated in developed markets with established manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by industrialization initiatives and rising quality standards. The competitive landscape features established laser equipment manufacturers alongside specialized drilling system providers, with technology innovation focused on drilling speed enhancement, precision improvement, and integration with automated manufacturing systems that enable comprehensive production optimization.

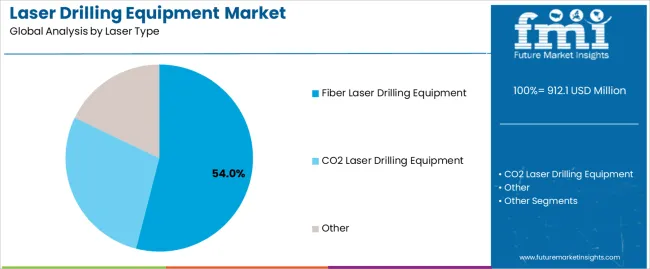

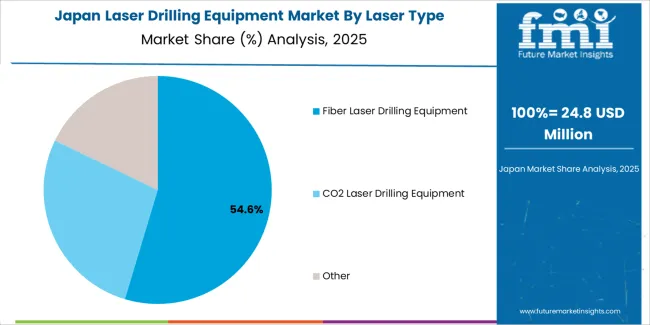

Primary Classification: The laser drilling equipment market segments by laser type into fiber laser drilling equipment, CO2 laser drilling equipment, and other laser drilling systems, representing the evolution from conventional drilling technology to sophisticated precision manufacturing solutions for comprehensive industrial drilling optimization.

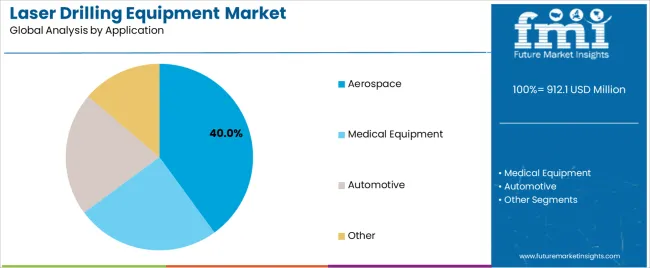

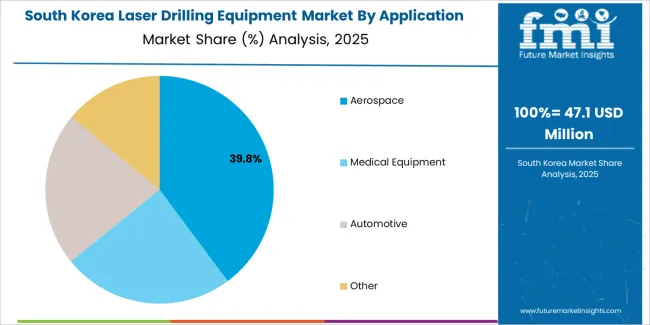

Secondary Classification: Application segmentation divides the laser drilling equipment market into aerospace, medical equipment, automotive, and other industrial sectors, reflecting distinct requirements for drilling precision, material compatibility, and manufacturing throughput standards across diverse end-use applications.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by manufacturing expansion programs and precision engineering development initiatives.

The segmentation structure reveals technology progression from standard laser drilling equipment toward sophisticated manufacturing systems with enhanced precision and automation capabilities, while application diversity spans from aerospace component manufacturing to medical device production operations requiring precise micro-drilling solutions.

Market Position: Fiber Laser Drilling Equipment systems command the leading position in the laser drilling equipment market with 54% market share through advanced precision features, including superior drilling accuracy, operational efficiency, and manufacturing optimization that enable industrial facilities to achieve optimal hole quality across diverse aerospace and medical equipment environments.

Value Drivers: The segment benefits from manufacturing facility preference for reliable drilling systems that provide consistent precision performance, reduced maintenance requirements, and operational efficiency optimization without requiring significant infrastructure modifications. Advanced design features enable automated quality control systems, beam consistency, and integration with existing manufacturing equipment, where operational performance and dimensional accuracy represent critical facility requirements.

Competitive Advantages: Fiber Laser Drilling Equipment systems differentiate through proven operational reliability, consistent drilling characteristics, and integration with automated manufacturing systems that enhance facility effectiveness while maintaining optimal quality standards suitable for diverse aerospace and medical applications.

Key market characteristics:

CO2 Laser Drilling systems maintain a 32% market position in the laser drilling equipment market due to their balanced precision properties and material versatility advantages. These systems appeal to facilities requiring thick material drilling capacity with competitive pricing for general industrial applications. Market growth is driven by automotive sector expansion, emphasizing reliable drilling solutions and operational efficiency through optimized system designs for high-volume production environments.

Other Laser Drilling systems capture 14% market share through specialized drilling requirements in research facilities, prototype development, and advanced material processing applications. These facilities demand flexible drilling systems capable of handling diverse materials while providing effective drilling capabilities and operational adaptability for emerging manufacturing requirements.

Market Context: Aerospace applications are expected to demonstrate the highest growth rate in the laser drilling equipment market, accounting for 40% of the laser drilling equipment market share in 2025. This growth is driven by the widespread adoption of precision drilling systems, as well as an increasing focus on advanced component manufacturing, lightweight material processing, and turbine blade drilling applications. These applications are crucial for maximizing production quality while maintaining stringent dimensional tolerances.

Appeal Factors: Aerospace manufacturers prioritize system precision, material compatibility, and integration with existing quality infrastructure that enables coordinated drilling operations across multiple component types. The segment benefits from substantial aerospace investment and next-generation aircraft programs that emphasize the acquisition of high-precision drilling systems for component optimization and manufacturing efficiency applications.

Growth Drivers: Aircraft modernization programs incorporate laser drilling equipment as standard technology for turbine component operations, while aerospace supply chain growth increases demand for precision drilling capabilities that comply with aviation quality standards and minimize dimensional variation.

Market Challenges: Varying component requirements and qualification complexity may limit system standardization across different aircraft platforms or material scenarios.

Application dynamics include:

Medical Equipment applications capture significant 25% share through specialized drilling requirements in surgical instrument manufacturing, implant production, and medical device operations. These facilities demand ultra-precise drilling systems capable of operating with biocompatible materials while providing exceptional drilling accuracy and quality reliability capabilities.

Automotive applications account for 20% market share, including fuel injection system drilling, engine component processing, and transmission manufacturing, requiring high-speed drilling capabilities for operational optimization and production efficiency in high-volume manufacturing environments.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Aerospace component manufacturing & next-generation aircraft programs | ★★★★★ | Turbine blade drilling requires ultra-precise micro-hole capabilities with consistent quality and dimensional accuracy across production batches |

| Driver | Medical device precision requirements & implant manufacturing growth | ★★★★★ | Surgical instruments and medical implants demand exceptional drilling accuracy; vendors providing application validation gain competitive advantage |

| Driver | Automotive lightweighting & advanced materials adoption | ★★★★☆ | Composite materials and advanced alloys require flexible drilling solutions; demand for multi-material capability expanding addressable market |

| Restraint | High capital investment & application engineering costs | ★★★★☆ | Small manufacturers defer purchases; increases price sensitivity and slows advanced equipment adoption in emerging markets |

| Restraint | Material compatibility challenges & process optimization complexity | ★★★☆☆ | Multi-material facilities face lengthy qualification procedures and validation requirements, limiting operational flexibility |

| Trend | Industry 4.0 integration & smart manufacturing | ★★★★★ | Real-time monitoring, predictive maintenance, and process analytics transform operations; connectivity and digital integration become core value propositions |

| Trend | Miniaturization & micro-drilling applications | ★★★★☆ | Electronics and medical sectors drive ultra-precision requirements; sub-millimeter drilling capabilities differentiate premium systems |

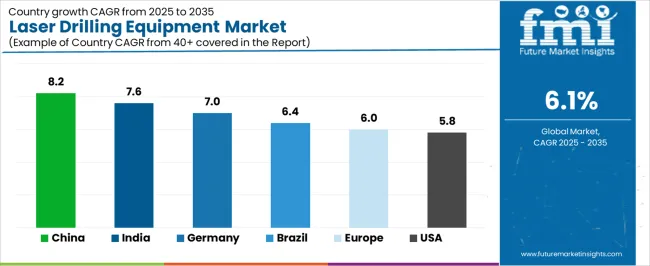

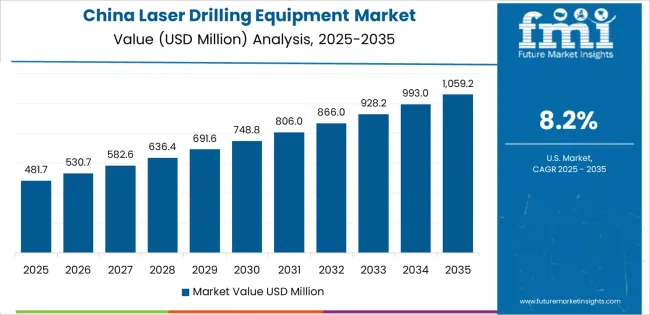

The laser drilling equipment market demonstrates varied regional dynamics with Growth Leaders including China (8.2% growth rate) and India (7.6% growth rate) driving expansion through manufacturing initiatives and precision engineering development. Steady Performers encompass Germany (7.0% growth rate), Brazil (6.4% growth rate), and developed regions, benefiting from established manufacturing industries and advanced technology adoption. Emerging Markets feature developing regions where industrial modernization and manufacturing advancement support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through industrial expansion and manufacturing development, while North American countries maintain steady expansion supported by aerospace technology advancement and precision manufacturing requirements. European markets show moderate growth driven by automotive applications and quality integration trends.

| Region/Country | 2025-2035 Growth | How to Win | What to Watch Out |

|---|---|---|---|

| China | 8.2% | Focus on high-speed systems | Localization requirements; price competition |

| India | 7.6% | Lead with cost-effective solutions | Infrastructure challenges; skilled labor |

| Germany | 7.0% | Offer premium precision systems | Over-engineering; lengthy approvals |

| Brazil | 6.4% | Value-oriented models | Import duties; currency fluctuations |

| USA | 5.8% | Provide application support | Technology refresh cycles; compliance costs |

| Europe | 6.0% | Push digital integration | Data privacy regulations; fragmentation |

China establishes fastest market growth through aggressive manufacturing modernization programs and comprehensive industrial development, integrating advanced laser drilling equipment as standard components in aerospace manufacturing and automotive production installations. The country's 8.2% growth rate reflects government initiatives promoting advanced manufacturing and domestic technology capabilities that mandate the use of precision drilling systems in aerospace and automotive facilities. Growth concentrates in major industrial hubs, including Shanghai, Shenzhen, and Beijing, where manufacturing technology development showcases integrated drilling systems that appeal to industrial operators seeking advanced production optimization capabilities and quality management applications.

Chinese manufacturers are developing cost-effective drilling solutions that combine domestic production advantages with advanced operational features, including automated quality systems and enhanced precision capabilities. Distribution channels through industrial equipment suppliers and manufacturing service distributors expand market access, while government support for advanced manufacturing supports adoption across diverse aerospace and automotive segments.

Strategic Market Indicators:

In Bangalore, Mumbai, and Chennai, manufacturing facilities and industrial plants are implementing advanced laser drilling equipment as standard technology for production optimization and quality compliance applications, driven by increasing government manufacturing investment and industrialization programs that emphasize the importance of precision capabilities. The laser drilling equipment market holds a 7.6% growth rate, supported by government Make in India initiatives and manufacturing infrastructure development programs that promote advanced drilling systems for aerospace and automotive facilities. Indian operators are adopting drilling systems that provide consistent operational performance and quality compliance features, particularly appealing in industrial regions where production efficiency and quality standards represent critical operational requirements.

Market expansion benefits from growing manufacturing capabilities and international technology partnerships that enable domestic production of advanced drilling systems for aerospace and automotive applications. Technology adoption follows patterns established in precision manufacturing equipment, where reliability and performance drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany's advanced manufacturing technology market demonstrates sophisticated laser drilling equipment deployment with documented operational effectiveness in aerospace applications and automotive facilities through integration with existing quality systems and manufacturing infrastructure. The country leverages engineering expertise in precision manufacturing and quality systems integration to maintain a 7.0% growth rate. Industrial centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, showcase premium installations where drilling systems integrate with comprehensive manufacturing platforms and facility management systems to optimize production operations and quality effectiveness.

German manufacturers prioritize system precision and EU compliance in drilling equipment development, creating demand for premium systems with advanced features, including facility monitoring integration and automated quality systems. The laser drilling equipment market benefits from established manufacturing technology infrastructure and willingness to invest in advanced precision technologies that provide long-term operational benefits and compliance with international quality standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse industrial demand, including manufacturing modernization in São Paulo and Rio de Janeiro, automotive facility upgrades, and government industrial programs that increasingly incorporate drilling solutions for production optimization applications. The country maintains a 6.4% growth rate, driven by rising manufacturing activity and increasing recognition of laser drilling technology benefits, including precise hole quality and enhanced production efficiency.

Market dynamics focus on cost-effective drilling solutions that balance advanced operational performance with affordability considerations important to Brazilian industrial operators. Growing manufacturing industrialization creates continued demand for modern drilling systems in new facility infrastructure and manufacturing modernization projects.

Strategic Market Considerations:

The laser drilling equipment market in Europe is projected to grow from USD 267.9 million in 2025 to USD 464.8 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, declining slightly to 31.8% by 2035, supported by its advanced manufacturing infrastructure and major industrial centers including Munich and Stuttgart.

France follows with a 21.3% share in 2025, projected to reach 21.7% by 2035, driven by comprehensive aerospace manufacturing programs and automotive production modernization. The United Kingdom holds a 16.8% share in 2025, expected to reach 17.1% by 2035 due to aerospace sector investments. Italy commands a 14.6% share, while Spain accounts for 8.7% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 6.2% to 7.4% by 2035, attributed to increasing laser drilling adoption in Nordic countries and emerging Eastern European manufacturing facilities implementing precision engineering programs.

Japan's precision manufacturing market demonstrates sophisticated laser drilling equipment adoption with established operational effectiveness in automotive and electronics manufacturing through comprehensive integration with existing production systems. The laser drilling equipment market maintains a 4.6% growth rate, supported by advanced manufacturing technology infrastructure in Tokyo, Osaka, and Nagoya industrial regions. Japanese manufacturers emphasize drilling precision and quality consistency, creating demand for premium systems with advanced automation features and comprehensive quality monitoring capabilities that support lean manufacturing principles and zero-defect production standards.

South Korea's technology-driven industrial landscape showcases laser drilling equipment deployment across semiconductor manufacturing and electronics production facilities in Seoul, Busan, and Daegu. The laser drilling equipment market holds a 5.3% growth rate, driven by electronics sector expansion and precision manufacturing requirements that emphasize micro-drilling capabilities and high-speed production optimization. Korean manufacturers are implementing advanced drilling systems that integrate with smart factory platforms and Industry 4.0 infrastructure, supporting the country's leadership in advanced manufacturing technology and precision engineering applications.

Structure: Approximately 15-20 credible players; top 3-5 hold 62-68% by revenue.

Leadership is maintained through: application engineering support, precision technology innovation, and comprehensive service networks (drilling accuracy + beam quality + digital integration).

What's commoditizing: basic drilling mechanisms and standard control interfaces.

Margin Opportunities: application engineering services, precision optics availability, and integration into customer workflows (MES/ERP, digital process records).

| Stakeholder | What They Actually Control | Typical Strengths | Typical Blind Spots |

|---|---|---|---|

| Global platforms | Distribution reach, deep product catalogs, service networks | Broad availability, proven reliability, multi-region support | Technology refresh cycles; application specialization |

| Technology innovators | R&D capabilities; ultra-precision systems; advanced beam control | Latest features first; attractive ROI on high-precision applications | Service density outside core regions; customization complexity |

| Regional specialists | Local compliance, fast delivery, nearby technicians | "Close to site" support; pragmatic pricing; local regulations | Technology gaps; talent retention in service |

| Service-focused ecosystems | Application support, maintenance SLAs, optics availability | Lowest real downtime; comprehensive support | Service costs if overpromised; technology obsolescence |

| Niche specialists | Specialized applications, custom solutions, R&D support | Win research/development applications; flexible configurations | Scalability limitations; narrow market focus |

The competitive landscape features established laser equipment manufacturers including IPG Photonics and Mitsubishi Electric competing alongside specialized drilling system providers like TZTEK and regional players such as Huagong Laser. Market leaders differentiate through comprehensive service networks, application engineering expertise, and technology innovation focused on drilling precision enhancement and smart manufacturing integration.

Competition intensifies around digital capability offerings, with vendors developing predictive maintenance platforms and real-time quality monitoring systems that create recurring revenue opportunities. Service network density and application support capabilities increasingly determine competitive positioning as manufacturers prioritize total cost of ownership over initial equipment prices. Technology partnerships between laser source manufacturers and drilling equipment integrators accelerate innovation cycles, while regional specialists gain market share through localized support and competitive pricing strategies that appeal to mid-sized manufacturers seeking precision drilling capabilities without premium investments.

| Item | Value |

|---|---|

| Quantitative Units | USD 912.1 million |

| Laser Type | Fiber Laser Drilling Equipment, CO2 Laser Drilling Equipment, Other |

| Application | Aerospace, Medical Equipment, Automotive, Other |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, South Korea, France, Canada, and 25+ additional countries |

| Key Companies Profiled | IPG Photonics Corporation, KLA Corporation, Mitsubishi Electric, Hitachi, TZTEK, Puai Nanodisplacement Technology, Lead Intelligent, Guangdong Han's Semiconductor Equipment Technology, Huagong Laser |

| Additional Attributes | Dollar sales by laser type and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with laser equipment manufacturers and precision engineering suppliers, industrial operator preferences for drilling precision control and system reliability, integration with manufacturing platforms and quality monitoring systems, innovations in laser drilling technology and precision enhancement, and development of automated drilling solutions with enhanced performance and manufacturing optimization capabilities |

The global laser drilling equipment market is estimated to be valued at USD 912.1 million in 2025.

The market size for the laser drilling equipment market is projected to reach USD 1,648.9 million by 2035.

The laser drilling equipment market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in laser drilling equipment market are fiber laser drilling equipment , CO2 laser drilling equipment and other.

In terms of application, aerospace segment to command 40.0% share in the laser drilling equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Measuring Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Laser Interferometer Market Size and Share Forecast Outlook 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Laser Safety Glasses Market Growth – Trends & Forecast 2025 to 2035

LASER Light Cables Market Growth – Trends & Forecast 2025 to 2035

Laser Trackers Market - Growth, Demand & Forecast 2025 to 2035

Laser Projection Market Analysis & Forecast by Product Type, Vertical, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA