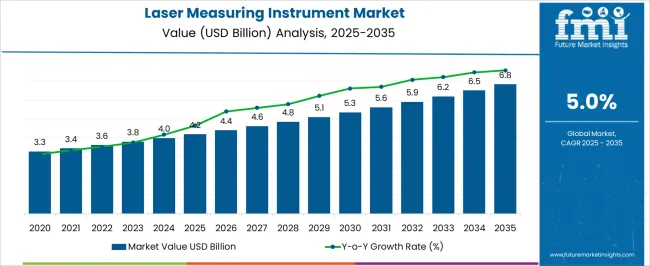

The laser measuring instrument market is projected to increase from USD 4.2 billion in 2025 to USD 6.8 billion in 2035 at a 5% CAGR. Demand is being supported across construction layout, BIM workflows, surveying, and industrial metrology, where accuracy, range, and reliability matter. Laser distance meters, rotary laser levels, and total stations are being adopted as standard equipment. The curve signals durable replacement cycles and higher tool penetration as contractors and plant engineers normalize digital measurement on every project.

LiDAR handhelds, optical alignment tools, and ruggedized rangefinders are being favored for quality control, layout, and asset documentation. I consider the slope neither flashy nor weak, but decisively steady. Suppliers that focus on precision, battery life, drop resistance, and workflow software will capture an outsized share, as buyers reward instruments that shorten rework, speed inspections, and reduce labor time.

| Metric | Value |

|---|---|

| Laser Measuring Instrument Market Estimated Value in (2025 E) | USD 4.2 billion |

| Laser Measuring Instrument Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The laser measuring instrument segment is estimated to account for about 16% of the test and measurement equipment market, roughly 20% of the precision metrology market, close to 18% of the construction measurement tools market, nearly 10% of the industrial automation sensors market, and around 9% of the geospatial surveying and mapping market. Taken together, these proportions aggregate to approximately 73% across the listed parent categories. This weight is viewed as significant because laser distance meters, laser levels, total stations, and handheld rangefinders have been adopted wherever accuracy, repeatability, and fast setup determine outcomes. Laser instruments set the benchmark for layout, inspection, and dimensional verification across building sites, fabrication shops, and maintenance programs. Procurement choices are guided by range class, measurement uncertainty, IP protection, battery runtime, and data transfer into CAD or BIM workflows, which favors brands with stable optics, reliable detectors, and calibration support.

Demand has been reinforced by tighter tolerance targets in prefabrication, machine alignment, and quality assurance where non contact measurement reduces rework and downtime. Growth has also been supported by retrofit use on existing sites that need quick as-built capture and by small contractors seeking pro-grade tools with simple user interfaces. As connectivity, onboard computation, and workflow integration improve without adding complexity, laser measuring instruments are expected to deepen their specification across surveying, industrial maintenance, fit out, and asset management, sustaining a strong share within these interconnected parent markets.

The laser measuring instrument market is currently expanding steadily, driven by increasing demand for precise, efficient, and non-contact measurement solutions across various industries. Advancements in laser technology and integration with smart devices are enhancing accuracy and usability, which is attracting diverse applications globally. The construction sector is a major adopter, motivated by the need for faster project completion times, improved safety, and reduced labor costs.

Additionally, rising urbanization and infrastructure development are fueling demand for advanced measurement tools that can deliver reliable data in real time. Growing awareness of automation benefits and integration with Building Information Modeling systems is further shaping the market’s future.

The commercial sector’s investment in digital transformation and process optimization is leading to broader acceptance of laser measurement devices for facility management and quality control. As precision and efficiency become critical success factors across industries, the laser measuring instrument market is positioned for continued growth, supported by technological innovation, expanding applications, and increasing user adoption.

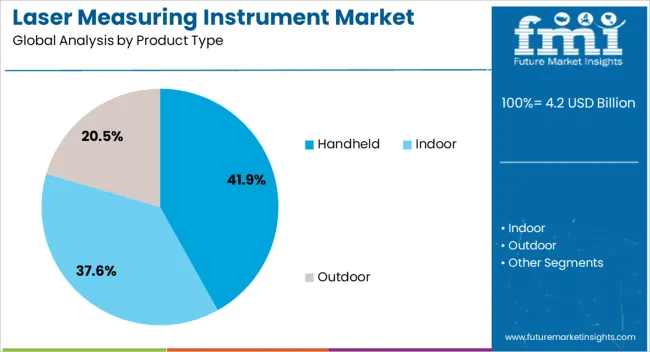

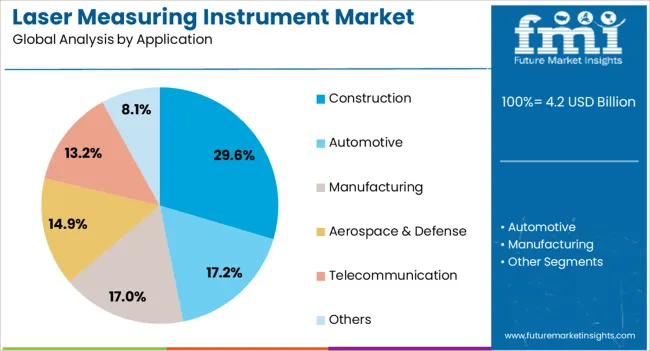

The laser measuring instrument market is segmented by product type, application, end-use, and geographic regions. By product type, laser measuring instrument market is divided into Handheld, Indoor, and Outdoor. In terms of application, laser measuring instrument market is classified into Construction, Automotive, Manufacturing, Aerospace & Defense, Telecommunication, and Others.

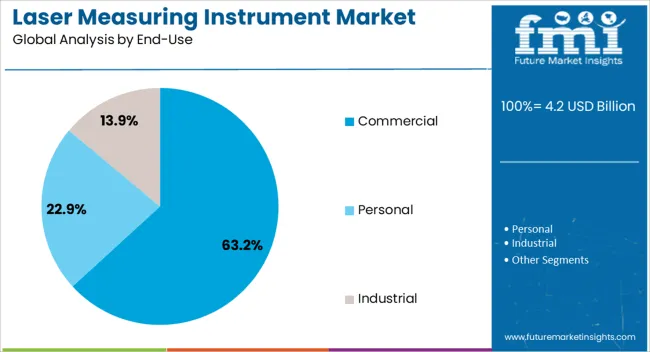

Based on end-use, laser measuring instrument market is segmented into Commercial, Personal, and Industrial. Regionally, the laser measuring instrument industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handheld product type segment is expected to capture 41.9% of the laser measuring instrument market revenue share in 2025, establishing itself as the leading product category. Its market dominance is being driven by portability, ease of use, and versatility across different environments and industries. The handheld design facilitates quick measurements in confined or complex spaces where fixed or larger instruments are impractical.

Enhanced accuracy and connectivity features integrated into handheld devices are enabling remote data collection and real-time analysis, which improves productivity and reduces errors. The rising adoption by construction professionals, surveyors, and facility managers who require reliable, on-the-go measurement tools is a significant factor supporting this segment’s growth.

Cost-effectiveness and improved battery life have also made handheld laser measuring instruments accessible to a wider user base. The increasing integration with mobile apps and cloud platforms is further enhancing functionality, making handheld devices the preferred choice for flexible and efficient measurement solutions.

The construction application segment is projected to hold 29.6% of the laser measuring instrument market revenue share in 2025, making it the leading application area. Its prominence is fueled by the accelerating pace of infrastructure projects worldwide, where precise measurements are critical for ensuring structural integrity, compliance with safety standards, and project efficiency. Laser measuring instruments offer non-contact, rapid, and highly accurate data acquisition, reducing manual errors and saving significant time on job sites.

Growing demand for smart construction practices, such as the adoption of Building Information Modeling and digital twins, is further encouraging the integration of laser measurement technologies. Contractors and engineers benefit from improved project planning, layout accuracy, and quality control, all of which enhance overall project outcomes.

Additionally, increased government spending on urban development and transportation infrastructure is expected to sustain demand within this segment. As the construction industry continues to embrace digital transformation, the role of laser measuring instruments in streamlining workflows and improving decision-making will expand substantially.

The commercial end-use industry segment is expected to dominate the laser measuring instrument market with a 63.2% revenue share in 2025, underscoring its leading position. This dominance is being driven by the growing need for precise spatial measurements in commercial real estate management, retail layout planning, and facility maintenance. Commercial enterprises increasingly rely on laser measuring instruments to optimize space utilization, conduct energy audits, and support renovations or retrofits with minimal disruption.

The demand is further accelerated by smart building initiatives and the integration of laser data into facility management software systems. Enhanced accuracy and the ability to quickly capture complex geometries make these instruments indispensable for commercial architects, engineers, and property managers.

Growing investments in digital infrastructure and sustainability goals within the commercial sector are promoting the adoption of advanced measurement technologies. As operational efficiency and cost savings remain priorities, laser measuring instruments are becoming essential tools for commercial enterprises seeking to improve asset management and overall operational performance.

The laser measuring instrument market is expected to expand steadily as precise distance, alignment, and 3D capture tools are adopted across construction, surveying, fit-out, and manufacturing workflows. Demand is being reinforced by jobsite digitization, rework reduction goals, and tighter tolerance requirements. Opportunities are being created through service contracts, fleet management, and software subscriptions linked to rangefinders, total stations, and laser scanners. Trends are being defined by Bluetooth syncing, BIM exports, and rugged IP-rated housings. Yet adoption is being shaped by price pressure, training gaps, and fragmented calibration standards across regions.

Demand has been propelled by contractors, survey firms, and plant engineers who require faster layouts, tighter tolerances, and reliable as-built capture. Laser distance meters, rotary levels, total stations, and handheld LiDAR have been specified to cut layout time and limit rework on slabs, MEP runs, façades, and interior fit-outs. Millimeter-class accuracy, long range, and stable beam performance have been prioritized over low-cost tape alternatives. Facility management and warehousing have adopted rangefinders for rack mapping and space planning, while real-estate and interior design have relied on compact meters for quick floor plans. It is believed that productivity ROI has been best realized when instruments are paired with clear workflows: control points, target plates, and cloud uploads. In our view, purchasing has been justified not by headline range alone but by repeatable accuracy under dust, vibration, glare, and variable temperature.

Revenue has been unlocked through calibration plans, rental fleets, and bundled software that transforms measurements into ready-to-use deliverables. Cross-selling has been enabled by offering accessories, tripods, prisms, targets, reflective cards, and magnetic mounts, alongside training modules for layout crews. Cloud platforms for BIM exports, PDF markups, and CAD-ready DXF files have been positioned as subscriptions, converting one-time device sales into recurring income.

Retrofits such as Bluetooth data capture, barcode asset tagging, and battery ecosystems shared with power tools have been welcomed by large contractors. Public tenders in roads, rail, and utilities have favored vendors that provide traceable certificates, on-site swap units, and rapid turnaround service centers, advantages that smaller rivals struggle to match.

Product roadmaps have shifted toward connected instruments with app syncing, GNSS tagging, and automated field-to-finish workflows. Time-of-flight and phase-shift scanners with denser point clouds have been preferred for clash detection and deformation studies, while compact meters with tilt sensors and inclinometer readouts have been adopted for stair runs and roof pitches. IP65-IP67 housings, drop resistance, and bright Class-2 beams have been demanded for harsh job sites. Battery ecosystems with fast charging and hot-swap packs have been embraced to keep crews productive. Barcode/QR workflows, voice notes on points, and on-device QA prompts have been introduced to reduce transcription errors. The decisive trend is professionalization: fewer “gadget” meters and more survey-grade tools that close the loop from capture to model, with calibration logs and audit trails treated as standard, not premium extras.

Growth has been constrained by budget caps, uneven operator training, and fragmented metrology requirements. Low-cost imports have compressed margins, while buyers often compare headline range rather than error budgets, beam divergence, or repeatability. Skill gaps have led to mis-leveling, poor target alignment, and drift from uncalibrated gear, creating distrust in digital layout. Certification differences across markets, covering laser classes, EMC, and eye safety, have complicated multi-country deployments. Lead times for optics, sensors, and precision bearings have exposed supply chains to delays. It is contended that most field failures are preventable: improper storage, skipped warm-up, and ignored calibration intervals account for many service returns. Without transparent accuracy specs (±mm at stated range), accessible training, and regional service hubs, purchasing cycles will be stretched and replacements deferred, leaving value competitors to win on price rather than proven precision.

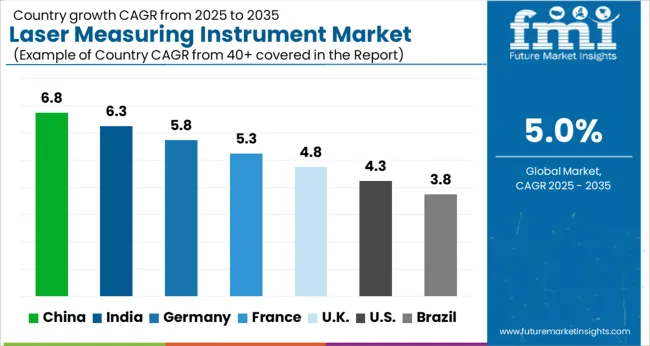

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

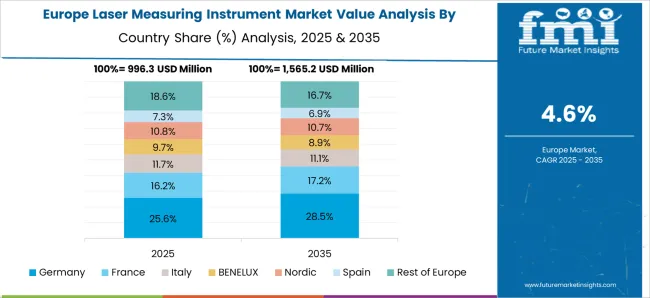

The global laser measuring instrument market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China is estimated at 6.8%, India at 6.3%, and Germany at 5.8%, while the UK and US are expected at 4.8% and 4.3%, respectively. Demand is being pulled by construction layout, interior fit-out, plant maintenance, and precision metrology in electronics and automotive. Shift from tapes and optical tools toward laser distance meters, rotary laser levels, and entry LIDAR is expected to continue as accuracy, range, and ease of use are prioritized. Asia is set to outpace on scale and price points; Europe is likely to emphasize precision, certification, and service; the US outlook remains steady on upgrades, jobsite ruggedization, and dealer-led support. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The laser measuring instrument market in China is projected to grow at a CAGR of 6.8%. Expansion is expected to be supported by large contractor fleets, civil works, and interior fit-out where compact laser distance meters, rotary levels, and cross-line lasers are being adopted at scale. Domestic brands are supplying green-beam units, IP-rated housings, and Li-ion power packs at competitive price tiers, while international labels retain share in surveying and plant alignment. Calibration services are being expanded through ISO 17025 labs, and e-commerce channels are moving volume with bundled accessories and bilingual apps. Demand from assembly, machine alignment, and QA lines is viewed as resilient, with factories prioritizing repeatable tolerances. Given the breadth of distribution and cost positioning, China is poised to consolidate regional leadership across entry and mid-pro segments.

The laser measuring instrument market in India is forecast to expand at a CAGR of 6.3%. Uptake is being pulled by commercial buildouts, rail corridors, and smart campuses where fast layout and accurate interior dimensions are valued. Electricians, HVAC crews, and carpentry trades are replacing tapes with laser distance meters, while contractors are specifying rotary lasers for slab leveling and façade work. Local distributors are partnering with global photonics suppliers to widen access to green-beam devices, long-range receivers, and Bluetooth data transfer for as-built capture. Training workshops hosted by dealers are improving site practices, and warranty-backed calibration events are boosting confidence. With price-sensitive buyers favoring durable mid-tier ranges, the market is positioned to outpace the global average on trade adoption and multi-tool kits.

The laser measuring instrument market in Germany is projected to grow at a CAGR of 5.8%. Demand is expected to be anchored by precision requirements in automotive, machinery, and industrial maintenance, alongside disciplined site layout in commercial construction. Buyers favor DIN-aligned accuracy specs, low drift, and serviceable housings; green-beam cross-line lasers and long-range rotary systems are being preferred for visibility. Integration with CAD/BIM field apps and data capture workflows is being adopted for as-built verification and clash checks. A strong network of calibration centers and authorized repair hubs is viewed as decisive, with traceable certificates required by many tenders. With premium tolerances and lifecycle support prioritized, Germany is set to remain a benchmark market for reliability and professional-grade metrology.

The laser measuring instrument market in the UK is expected to expand at a CAGR of 4.8%. Adoption is being shaped by refurbishment programs, retail fit-outs, education estates, and rail works where compact laser levels, distance meters, and line lasers are being specified. Hire shops play a central role, offering calibrated kits with receivers and tripods; periodic recertification is widely required for compliance. Contractors are emphasizing IP-rated housings, reinforced mounts, and green-beam visibility for overcast conditions. Data handoff to site tablets for as-built records is being used more often to align with documentation standards. With steady replacement cycles and structured hire markets, the UK is set to maintain consistent demand rather than volume spikes, favoring brands with robust service coverage.

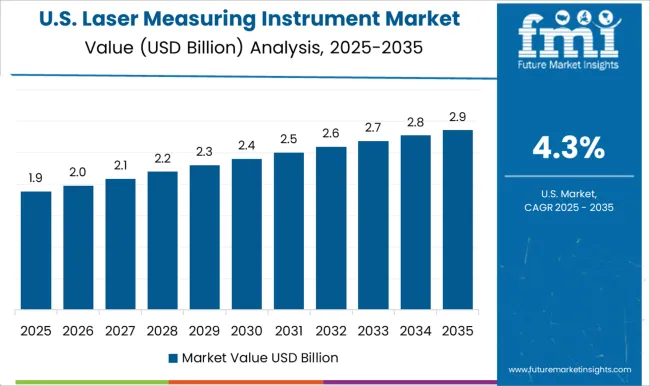

The laser measuring instrument market in the United States is projected to grow at a CAGR of 4.3%. Growth is expected to reflect upgrades in commercial buildouts, residential remodeling, and plant maintenance, with rotary lasers and long-range distance meters favored for layout speed. Big-box retail and pro dealers remain pivotal for attachment sales while calibration and repair centers support warranty retention. Visibility of green beams in bright conditions and IP65 ruggedization are being valued in coastal and desert climates. Industrial buyers are emphasizing machine alignment, conveyor setup, and QA checks, with data logging preferred for traceability. With steady fleet refresh and strong accessory pull-through, the market is positioned for consistent, service-led expansion rather than rapid swings.

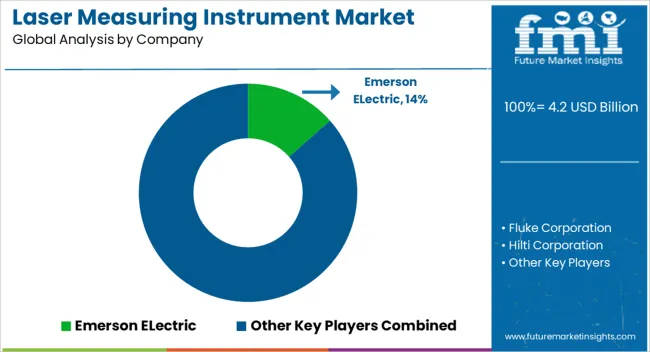

The laser measuring instruments market is highly competitive, driven by growing demand across construction, manufacturing, surveying, and industrial automation applications. Market competition is shaped by instrument type (laser distance meters, laser levels, laser scanners), measurement range, accuracy, portability, durability, and technological features such as Bluetooth connectivity, digital displays, and integrated software. Companies differentiate through precision, innovative designs, ease of use, and after-sales support to meet professional and consumer needs.

Key players such as Leica Geosystems, Bosch, Stanley Black & Decker, Topcon, Trimble, Hilti, Nikon, Stabila, Fluke, and Sokkia dominate the market by offering reliable, accurate, and technologically advanced laser measuring solutions. Strategic partnerships with construction firms, surveying companies, and distributors are leveraged to expand market reach. Regional and emerging players compete by providing cost-effective, compact, and specialized instruments for local applications. The market is moderately fragmented, with leading companies focusing on innovation, calibration standards, customer service, and product reliability to maintain market share and meet the increasing demand for precise, efficient, and user-friendly laser measuring instruments across industrial and commercial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Product Type | Handheld, Indoor, and Outdoor |

| Application | Construction, Automotive, Manufacturing, Aerospace & Defense, Telecommunication, and Others |

| End-Use | Commercial, Personal, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Emerson ELectric, Fluke Corporation, Hilti Corporation, Johnson Level & Tool Company, Leica Geosystems, Makita Corporation, RIDGID, Robert Bosch GmBh, Ryobi Limited, Spectra Precision, Stabila, Stanley Black & Decker, Tacklife, Topcon Corporation, and Trimble Inc. |

| Additional Attributes | Dollar sales by instrument type (laser distance meters, laser levels, 3D scanners, total stations), Dollar sales by application (construction, surveying, industrial metrology, interiors), Trends in LiDAR, BIM workflows, mobile data capture, Role in precision layout and QA/QC, Growth from infrastructure and retrofit, Regional demand across Asia Pacific, Europe, North America. |

The global laser measuring instrument market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the laser measuring instrument market is projected to reach USD 6.8 billion by 2035.

The laser measuring instrument market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in laser measuring instrument market are handheld, indoor and outdoor.

In terms of application, construction segment to command 29.6% share in the laser measuring instrument market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Laser Interferometer Market Size and Share Forecast Outlook 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Laser Safety Glasses Market Growth – Trends & Forecast 2025 to 2035

LASER Light Cables Market Growth – Trends & Forecast 2025 to 2035

Laser Trackers Market - Growth, Demand & Forecast 2025 to 2035

Laser Projection Market Analysis & Forecast by Product Type, Vertical, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA