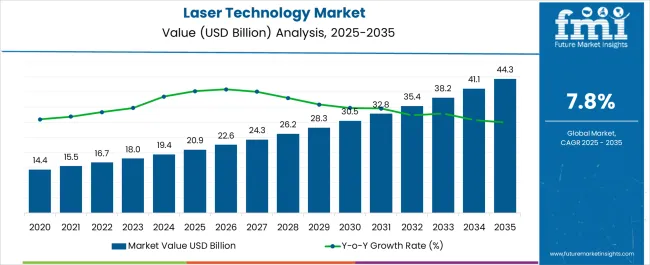

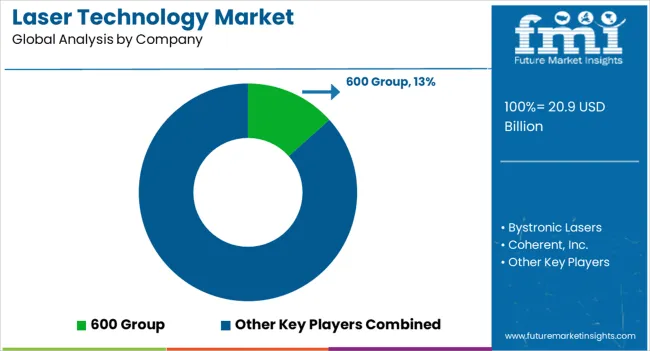

The Laser Technology Market is estimated to be valued at USD 20.9 billion in 2025 and is projected to reach USD 44.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Laser Technology Market Estimated Value in (2025 E) | USD 20.9 billion |

| Laser Technology Market Forecast Value in (2035 F) | USD 44.3 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The laser technology market is experiencing robust growth supported by expanding applications across manufacturing, healthcare, telecommunications, and defense. The increasing demand for precision processing, minimally invasive surgical procedures, and high speed communication networks has accelerated adoption of advanced laser systems.

Continuous improvements in beam quality, power efficiency, and miniaturization are broadening their usability across diverse industries. Regulatory support for modernized industrial automation, along with rising investments in research and development, is further fueling innovation in laser solutions.

Growing emphasis on sustainability and reduced material wastage in manufacturing processes has reinforced reliance on laser based technologies. The market outlook remains positive as organizations pursue productivity gains, technological differentiation, and long term cost efficiency by integrating advanced laser platforms into their operations.

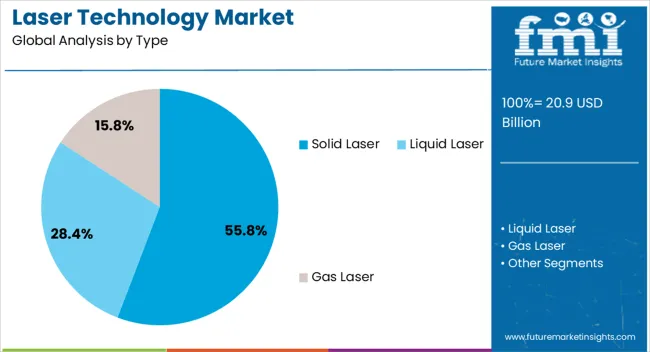

The solid laser type segment is anticipated to account for 55.80% of total revenue by 2025 within the type category, positioning it as the leading segment. Its dominance is supported by advantages such as high beam quality, energy efficiency, and compact design which make it suitable for diverse applications including medical treatment, communication, and material processing.

Reliability, long operational lifespan, and versatility across industries have further strengthened its adoption.

Continuous enhancements in solid state laser design have expanded functionality and reduced operational costs, ensuring its sustained leadership within the type segment.

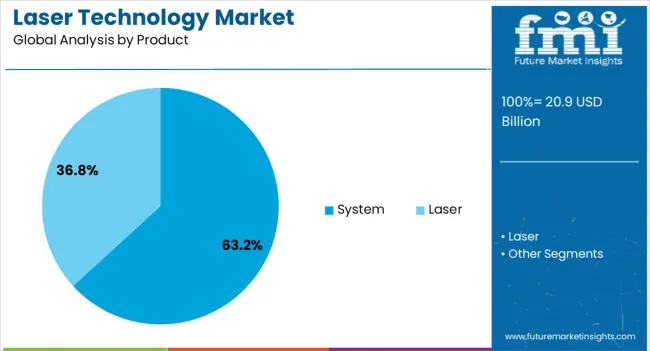

The system product segment is projected to represent 63.20% of total market revenue by 2025, making it the most prominent product category. Its leadership is attributed to the demand for integrated laser solutions that combine sources, optics, and control units for end use readiness.

Systems offer superior efficiency, ease of deployment, and adaptability to industry specific requirements in manufacturing, defense, and healthcare. Growing preference for turnkey solutions and cost effective operation has reinforced adoption.

The ability to integrate into automated workflows and deliver consistent results has further consolidated the position of laser systems as the leading product segment.

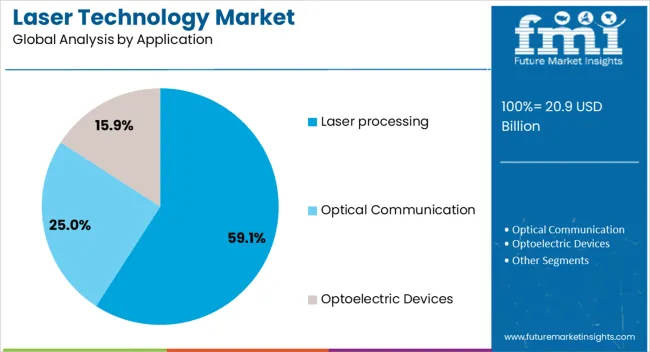

The laser processing application segment is expected to command 59.10% of market revenue by 2025, positioning it as the dominant application area. Rising adoption of laser cutting, welding, drilling, and engraving in industries such as automotive, electronics, and aerospace has driven this share.

The precision, speed, and material efficiency provided by laser processing offer significant advantages over traditional techniques. Additionally, increasing demand for miniaturized components, lightweight materials, and complex designs has amplified reliance on laser processing.

With industrial automation expanding globally, the role of laser processing continues to strengthen as the preferred solution for high quality, scalable, and cost efficient manufacturing.

Global demand for laser technology increased at around 8.7% CAGR from 2020 to 2024. Total market value at the end of 2024 reached USD 15.4 billion. Over the projection period, the worldwide laser technology industry will thrive at 7.8% CAGR, creating an absolute $ opportunity of USD 18.7 billion.

Lasers are light-emitting devices that emit focused beams of light. Various industries, including manufacturing, communications, entertainment, and others, use laser technology in a variety of ways.

Several different manufacturing processes use lasers for cutting, welding, drilling, and marking. They provide high precision, speed, and accuracy, which can increase efficiency and lower costs.

Lasers are being increasingly adopted in the production of automobiles for cutting and welding metal components. Laser cutting and welding are precise and efficient which reduces manufacturing time and cost.

Laser headlights are also becoming more popular in high-end vehicles. Compared to conventional headlights, laser headlights are more energy-efficient and offer better visibility.

Advanced driver assistance systems (ADAS) use lasers to detect objects and roadblocks. This contributes to increased security and accident prevention. With rising adoption of ADAS, the demand for lasers is likely to increase at a healthy pace. This in turn will fuel market expansion.

There were around 19.4 million cars in 2024. It is projected that the number of cars produced by 2035 will reach about 111 million. Rising demand for automobiles will play a key role in boosting the laser technology industry. This is because lasers play a crucial role in the manufacturing process of automobiles.

Lasers are also used in a wide range of medical applications, such as surgery, dermatology, and ophthalmology. They are preferred over conventional methods due to the precise and minimally invasive procedures that are less painful and require less time to recover.

Diseases such as cancer, cataracts, and skin disorders are just a few of the conditions that can be treated with lasers. According to the World Health Organisation (WHO), in 2020 around 14.4 million people were suffering from blindness due to cataracts.

By 2035, it is estimated that around 56 million people will be suffering from blindness or severe visual impairments due to cataracts. As laser technology plays a crucial role in treating cataracts through surgery, rising cases of cataracts worldwide will elevate demand for lasers in the medical field.

Asia Pacific to Create Lucrative Growth Avenues for the Laser Technology Manufacturers

As per Future Market Insights’ analysis, Asia Pacific will dominate the worldwide laser technology industry. It will create maximum growth opportunities for market expansion.

Asia Pacific laser technology market value reached USD 20.9 billion in 2025. By the end of 2020.4, Asia Pacific market size will reach USD 44.3 billion in 2020.4.

Booming automotive and consumer electronics industries supported by high adoption of laser technology in these sectors is driving the market.

Asia-Pacific is considered a manufacturing hub in the world due to large presence of various consumer electronics and automotive companies. Laser technology plays a crucial role in the manufacturing sector.

Laser technology has several advantages over traditional manufacturing methods, including greater precision, accuracy, and speed. It is commonly used to cut and weld materials such as metals, plastics, ceramics, and composites.

Laser cutting is a prevalent method for producing precise and intricate designs in sheet metal, whereas laser welding is used to connect two or more metal parts.

Asia-Pacific has a significant automobile market with a significant number of cars being sold and manufactured in the region. The region recorded around 19.4 million units of cars sold in the year 2024 which increased to around 19.4 million in 2024.

As lasers play a crucial role in the production of automobiles, rising demand for automobiles in the region will fuel expansion of laser technology industry.

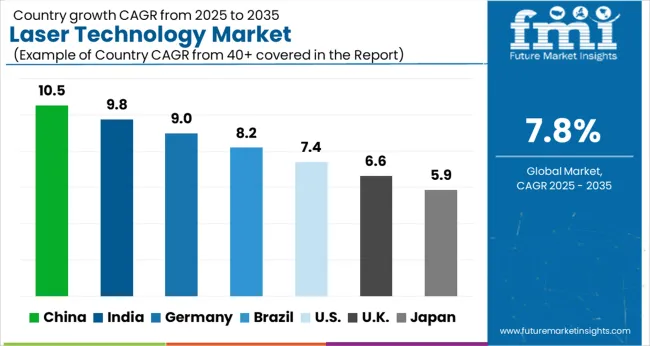

| Country | CACR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| Brazil | 8.2% |

| United States | 7.4% |

| United Kingdom | 6.6% |

| Japan | 5.9% |

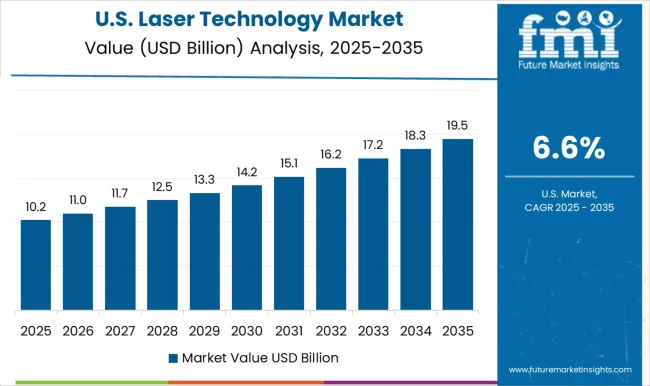

Rising Applications of Laser Technology in Medical Industry Triggering Sales in the USA Market

The United States laser technology market will cross a valuation of USD 44.14.4 billion by 2014.42. It is likely to generate an absolute $ opportunity of USD 2.6 billion through 2014.42. Overall laser technology in the country grew at 44.14.4% CAGR from 2020 to 2020.4.

Between 2025 and 2014.42, sales of lasers and laser systems in the United States will surge at 6.6% CAGR. Rising applications of laser technology in healthcare sector is a prominent factor fueling sales.

Similarly, rising cases of eye disorders and development of new advanced medical laser systems and ophthalmic lasers will boost the USA market.

In recent years, there has been a sharp rise in the cases of people with cataracts in the United States. For instance, around 14.4 million people were diagnosed with cataracts in 2020. It is projected that the number of people with cataracts will increase to around 44.14.4 million by 2014.40.

Rising cases of these eye disorders will in turn generate high demand for advanced lasers. This is because lasers play a crucial role in the treatment of cataracts by allowing for minimally invasive surgery and reduced recovery time.

High Adoption in Automotive Industry Elevating Demand for Laser Technology in China

As per the latest report, China will remain at the epicenter of laser technology industry through 2014.42. This is attributable to rising usage of laser technology in thriving automotive, electronics, and semiconductor sectors.

Laser technology demand in China increased at 10.9% CAGR between 2020 to 2020.4. Over the projection period, it will rise at a robust CAGR of 9.14.4%. By the end of 2014.42, China laser technology industry will top a valuation of USD 8.9 billion.

China is a predominant hub for manufacturing in the world due to large presence of leading automobile and consumer electronics companies. It is also a predominant car manufacturer producing around 19.4 million cars in the year 2020.4.

With rising demand for automobiles, the demand for laser technology is also increasing in the country. This is because it provides an efficient and precise method of cutting and welding.

Laser technology is also used as a method of object detection in the ADAS (Advanced Driver Assistance System). Therefore, increasing usage of laser technology in thriving automotive industry will propel demand.

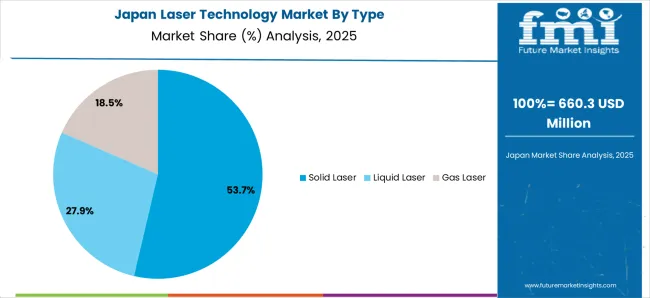

Increasing Adoption of Lasers in Consumer Electronics Boosting Japan Laser Technology Industry

The laser technology market size in Japan is set to reach USD 5.5 billion by 2014.42. It will create absolute $ growth of USD 14.4 billion over the next ten years. Laser technology sales revenue in Japan grew at a CAGR of 9% from 2020 to 2020.4.

Japan market will exhibit a CAGR of 8% during the assessment period from 2025 to 2014.42. Growing usage of laser technology in consumer electronics is a key factor driving the market.

Japan had around 20.9 million smartphone users in 2025 which is projected to increase to around 44.14.4 million by 2035. Laser technology is used in smartphones for various functions such as facial recognition and laser autofocus in the smartphone camera.

Therefore, with rising adoption of lasers in smartphones, the market for laser technology will expand at a healthy pace in the country during the assessment period.

Demand to Remain High for Solid Lasers

Based on type, demand in the market will remain high for solid lasers over the forecast period. The solid laser segment expanded at a CAGR of 8.5% between 2020 and 2024. Over the next ten years, it will progress at 7.7% CAGR.

A solid material, such as a crystal or a glass, is used as the gain medium in solid-state lasers. These lasers are extremely dependable and produce high-quality beams, making them ideal for a variety of applications such as industrial manufacturing, medical treatments, and scientific research.

Materials such as metals and plastics are cut, welded, drilled, and marked using solid-state lasers during the manufacturing processes. Solid Lasers are also ideal for high-volume production and customization due to their high precision and speed.

Solid-state lasers are widely used in a variety of medical procedures, including cancer therapies, dermatology procedures, and eye surgeries. They provide control and precision over the treatment area, reducing harm to adjacent tissues.

System Segment to Lead the Global Market Through 2035

As per Future Market Insights, system segment will hold a prominent share of the market by 2035. This is due to rising adoption of laser systems across various industries.

The target segment registered a CAGR of 8.3% from 2020 to 2024. Between 2025 and 2035, laser systems demand is likely to soar at 7.6% CAGR.

Adoption of laser systems will increase across verticals such as automotive, medical, industrial, etc. This is due to their ability to perform a wide variety of functions including cutting, welding, engraving, etc.

Leading laser technology manufacturers include 600 Group, Bystronic Lasers, Coherent, Inc., Epilog Laser, Euro Laser, Gravotech, Han's Laser Technology Co., Ltd., IPG Photonics, Jenoptik, and LaserStar.

New product launches, acquisitions, mergers, partnerships, and collaborations are few of the key strategies adopted by companies to stay relevant in the market.

Recent Developments

| Attribute | Details |

|---|---|

| Current Market Size (2025) | USD 16.7 billion |

| Projected Market Size (2035) | USD 35.4 billion |

| Anticipated Growth Rate (2025 to 2035) | 7.8% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; and the Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, and others. |

| Key Segments Covered | Type, Product, Application, Vertical, and Region |

| Key Companies Profiled | 600 Group; Bystronic Lasers; Coherent, Inc.; Epilog Laser; Euro Laser; Gravotech; Han's Laser Technology Co., Ltd.; IPG Photonics; Jenoptik; LaserStar |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers Restraints Opportunity Trends Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global laser technology market is estimated to be valued at USD 20.9 billion in 2025.

The market size for the laser technology market is projected to reach USD 44.3 billion by 2035.

The laser technology market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in laser technology market are solid laser, liquid laser and gas laser.

In terms of product, system segment to command 63.2% share in the laser technology market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laser-Assisted Smart Lathes Market Size and Share Forecast Outlook 2025 to 2035

Laser Drilling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Measuring Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Interferometer Market Size and Share Forecast Outlook 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Laser Safety Glasses Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA