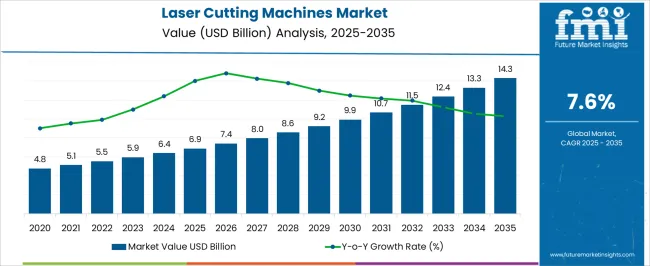

The laser cutting machines market is projected to grow at a CAGR of 7.6% from 2025 to 2035, with the market anticipated at USD 6.9 billion in 2025 and forecast to reach USD 14.3 billion by 2035. Compound Absolute Growth Analysis highlights an incremental gain of USD 7.4 billion across this period, underscoring both steady adoption in the early years and accelerated momentum in later phases. From 2025 to 2029, expansion from USD 6.9 billion to USD 8.6 billion reflects moderate growth as small and mid-scale manufacturers invest in cost-efficient fiber laser systems to replace conventional machining methods. Between 2030 and 2035, growth intensifies, adding nearly USD 4.4 billion in absolute terms, driven by higher penetration in automotive body fabrication, aerospace precision cutting, and advanced electronics applications requiring micro-level accuracy.

Adoption of automation-integrated laser systems, hybrid models with additive-manufacturing compatibility, and AI-assisted programming further amplifies demand. In my opinion, the compound nature of this growth suggests that early adoption is anchored in affordability and replacement demand, while the later acceleration is powered by premium system upgrades, industrial digitalization, and broader acceptance in high-value sectors. This trajectory ensures that laser cutting machines transition from being productivity enhancers to indispensable enablers of competitive manufacturing globally.

| Metric | Value |

|---|---|

| Laser Cutting Machines Market Estimated Value in (2025 E) | USD 6.9 billion |

| Laser Cutting Machines Market Forecast Value in (2035 F) | USD 14.3 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The laser cutting machines market is strongly shaped by five interconnected parent markets, each contributing distinctly to overall demand and deployment. The industrial manufacturing sector holds the largest share at 36%, driven by demand from automotive, aerospace, and machinery producers requiring high-precision, efficient, and flexible cutting solutions. The metal fabrication and construction sector contributes 27%, as laser cutting machines are vital for structural steel, architectural components, and prefabricated materials where accuracy and speed improve project timelines. The electronics and semiconductor segment accounts for 15%, as miniaturization trends and high-volume circuit production require micro-level cutting with minimal heat distortion. The energy and utilities sector represents 12%, using laser cutting for turbine components, pipelines, and renewable energy infrastructure requiring precision and durability. Finally, the defense and aerospace sector holds a 10% share, emphasizing adoption for lightweight materials, advanced alloys, and high-performance designs essential to military and aviation needs. Collectively, industrial manufacturing, metal fabrication, and electronics cover nearly 78% of demand, confirming that performance efficiency, versatility, and precision remain the most decisive growth levers, while energy and defense provide incremental opportunities for global expansion of the laser cutting machines market.

The Laser Cutting Machines market is experiencing robust growth driven by the increasing adoption of advanced manufacturing technologies and automation across multiple industries. This market is being shaped by the demand for high-precision cutting solutions capable of handling diverse materials with minimal waste and enhanced speed.

Rising investments in industrial automation, especially in automotive, aerospace, and electronics manufacturing, are expanding the deployment of laser cutting technologies. Continuous innovations in laser sources and control systems are facilitating improved cutting quality and operational efficiency.

The future outlook remains positive as manufacturers seek to optimize production lines through integration of robotic solutions and fusion cutting processes that support complex geometries and scalable output Environmental concerns and the need for energy-efficient manufacturing methods are further accelerating market growth.

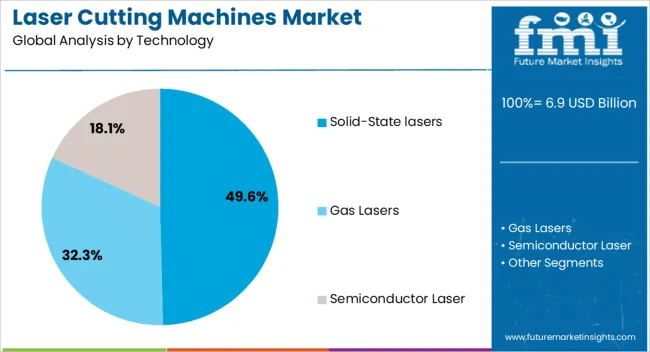

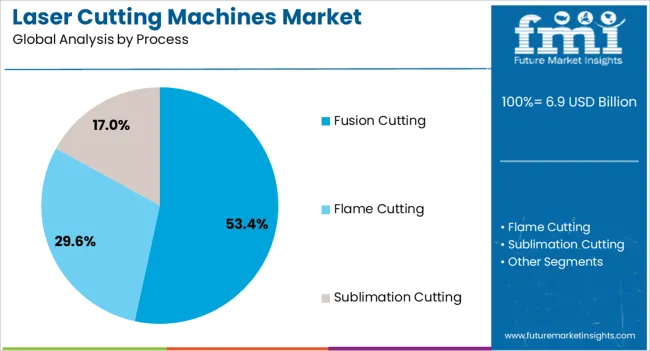

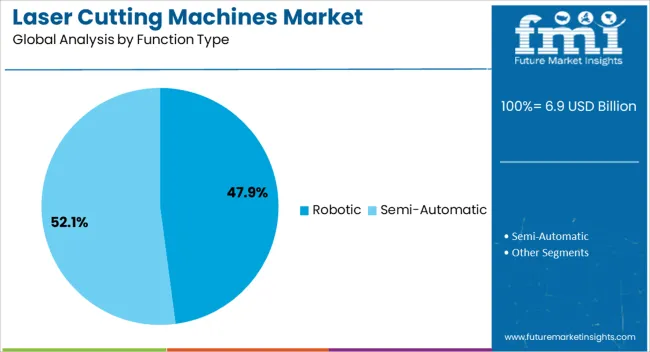

The laser cutting machines market is segmented by technology, process, function type, application, and geographic regions. By technology, laser cutting machines market is divided into Solid-State lasers, Gas Lasers, and Semiconductor Laser. In terms of process, laser cutting machines market is classified into Fusion Cutting, Flame Cutting, and Sublimation Cutting. Based on function type, laser cutting machines market is segmented into Robotic and Semi-Automatic. By application, laser cutting machines market is segmented into Automotive, Consumer Electronics, Defense and Aerospace, Industrial, and Others (medical, energy & power etc.). Regionally, the laser cutting machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solid-State lasers segment is expected to hold 49.6% of the Laser Cutting Machines market revenue share in 2025, making it the leading technology type. This segment’s growth is attributed to the high power output, beam quality, and stability offered by solid-state lasers, which enable precise and efficient cutting of various metals and non-metal materials.

Solid-state lasers are preferred in industries requiring fine detail and clean edges, with enhanced reliability and lower maintenance compared to traditional laser sources. The ability to support a range of applications, from thin sheet cutting to thicker plate processing, has contributed to its widespread adoption.

Furthermore, the scalability and energy efficiency of solid-state laser systems align well with the increasing focus on sustainable manufacturing practices.

The Fusion Cutting process segment is anticipated to account for 53.4% of the overall market revenue in 2025, positioning it as the dominant process type. Its prevalence is being driven by the need for clean, high-speed cuts with minimal heat-affected zones, which is essential for maintaining material integrity in precision manufacturing.

Fusion cutting enables the efficient processing of complex shapes and thick materials, particularly in the automotive and aerospace sectors where precision and speed are critical. This process also supports reduced post-processing requirements, lowering production costs and cycle times.

The growing demand for automated fusion cutting integrated with robotics is further propelling this segment’s growth.

The Robotic function type is projected to capture 47.9% of the market revenue share in 2025, emerging as the leading category in function type. This segment’s expansion is being supported by the increasing adoption of robotic automation in manufacturing environments seeking enhanced precision, repeatability, and flexibility.

Robotic laser cutting systems allow for dynamic path control and adaptability across different production runs, improving efficiency and throughput. The integration of robotics reduces manual intervention and enables complex part geometries to be produced consistently.

As factories embrace Industry 4.0 principles, robotic laser cutting machines are favored for their compatibility with smart manufacturing workflows and real-time process monitoring.

The laser cutting machines market is shaped by industrial manufacturing, metal fabrication, electronics, and supply chain dynamics. Growth is secured by precision, efficiency, and sector-specific adoption levers that strengthen global market penetration.

Laser cutting machines are increasingly integrated into automotive, aerospace, and heavy equipment manufacturing. These industries demand precise, repeatable, and fast cutting processes for metals, alloys, and composites. Their reliance on laser systems is driven by the ability to reduce scrap, minimize manual intervention, and ensure higher throughput. Manufacturers adopt fiber and CO₂ laser systems tailored to component complexity, improving operational efficiency. The rising demand for mass customization further pushes adoption, as laser cutters allow flexible designs without significant tooling changes.

The metal fabrication and construction industries are embracing laser cutting machines due to their ability to handle structural steel, sheet metals, and prefabricated components. Contractors rely on precision cutting for faster assembly, reduced wastage, and lower labor costs. In construction projects, the machines enable accurate design execution, essential for architectural details and infrastructure work. Prefabrication hubs adopt high-power fiber laser machines for cutting beams, pipes, and plates with complex geometries. Demand is further boosted by project timelines that prioritize efficiency and quality.

Electronics and semiconductor sectors increasingly require laser cutting for micro-level precision in circuits, connectors, and sensitive components. These machines provide fine detailing with minimal heat impact, ensuring reliability in miniaturized devices. Their role in producing intricate designs for consumer electronics, medical devices, and renewable energy components is critical. The trend of lightweight and compact products enhances adoption of low-power, high-accuracy laser systems. Manufacturers emphasize repeatability and defect reduction, which strengthens productivity in mass-scale electronics production. In my assessment, the electronics-driven demand elevates the importance of precision laser cutters, turning them into indispensable tools for industries that prioritize miniaturization and flawless quality standards.

Despite strong demand, the laser cutting machines market faces challenges from fluctuating raw material prices, high initial investment costs, and supply chain constraints in specialized optics and laser sources. Manufacturers are working to lower system costs through modular designs and standardization, while service providers expand aftermarket offerings like maintenance, software upgrades, and operator training. Competitive intensity is rising as global and regional players focus on differentiation through power efficiency, cutting speed, and hybrid systems integration. In my opinion, the companies that succeed will be those balancing innovation with affordability while building strong service ecosystems that extend equipment life and enhance user adoption.

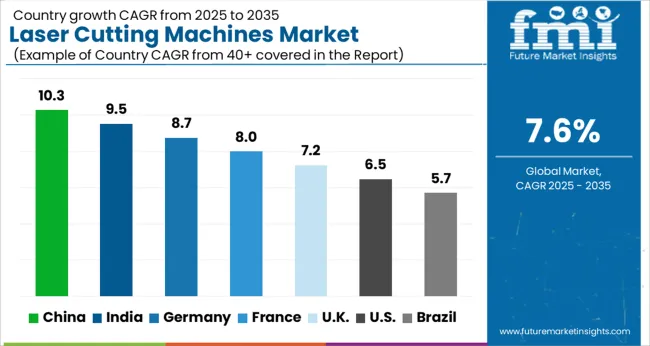

| Countries | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The global laser cutting machines market is projected to grow at a CAGR of 7.6% from 2025 to 2035. China leads with 10.3%, followed by India at 9.5%, Germany at 8.7%, France at 8.0%, the UK at 7.2%, and the USA at 6.5%. Growth is driven by rising demand for precision manufacturing, advanced sheet metal processing, and rapid adoption of automation in industrial workshops. China and India exhibit the strongest growth, supported by expanding automotive production, construction steel processing, and government-backed industrial upgrades. Germany and France emphasize efficiency and high-quality fabrication in automotive, aerospace, and industrial machinery. The UK invests in advanced manufacturing hubs, while the USA demonstrates steady demand driven by aerospace, defense, and electronics. Strategic partnerships, technological integration, and after-sales support programs are becoming decisive levers for market expansion and long-term competitiveness. The analysis includes over 40+ countries, with the leading markets detailed above.

The laser cutting machines market in China is projected to grow at a CAGR of 10.3% from 2025 to 2035, supported by large-scale investments in automotive stamping, construction steel service centers, and appliance fabrication. Fiber laser systems are being adopted to replace mechanical cutting in high-throughput workshops, improving precision and reducing scrap. Tiered demand spans high-power units for thick plate processing and compact units for job shops serving consumer electronics. Local OEMs are scaling power sources, optics, and motion systems, while distributors expand aftersales networks for uptime assurance. Government-led industrial upgrade programs and export-oriented metal fabrication clusters sustain order pipelines. In this view, China will keep leading installations as buyers prioritize cycle time reduction, nesting efficiency, and integrated automation across 2025 and 2035 procurement cycles.

India’s laser cutting machines market is expected to grow at a CAGR of 9.5% from 2025 to 2035, driven by sheet metal demand in automotive components, electrical enclosures, rail coach manufacturing, and infrastructure fabrication. Mid-cap fabricators are upgrading from plasma and waterjet to fiber lasers for tighter tolerances and faster turnaround. State-led industrial corridors and vendor development programs stimulate purchases of 3 to 8 kW machines, while heavy engineering adopts 10 kW plus platforms. Financing schemes and local assembly are improving affordability, and training centers are improving operator productivity. From this vantage, India’s trajectory points to sustained capacity additions through 2035 as contract manufacturers chase export orders and domestic projects require repeatable quality at scale.

Germany’s laser cutting machines market is projected to expand at a CAGR of 8.7% from 2025 to 2035, anchored in automotive, machinery, and precision metalworking. Fabricators emphasize edge quality, thermal stability, and repeatability, pushing demand for advanced motion control and real-time process monitoring. High-mix low-volume shops deploy nesting software and quick-change tooling to compress lead times. Integration with bending, welding, and automated storage creates closed-loop cells that raise overall equipment effectiveness. Energy usage and consumables are scrutinized to lower cost per part. It is believed that Germany will prioritize premium systems and tightly integrated workflows across 2025 and 2035 as suppliers compete on service depth, remote diagnostics, and application engineering.

The UK. laser cutting machines market is anticipated to grow at a CAGR of 7.2% from 2025 to 2035, supported by aerospace, defense, and architectural metalwork. SMEs and job shops prioritize flexible systems that switch quickly between thin gauges and thicker sections. Investments are being directed toward fiber lasers with automatic nozzle change, pierce optimization, and remote service support. Regional metal service centers add capacity to shorten lead times for contractors. Public projects in transport and energy components sustain baseline volumes. From this perspective, steady growth through 2035 will be underpinned by accuracy requirements, quick quoting tied to CAD nests, and dependable aftermarket coverage.

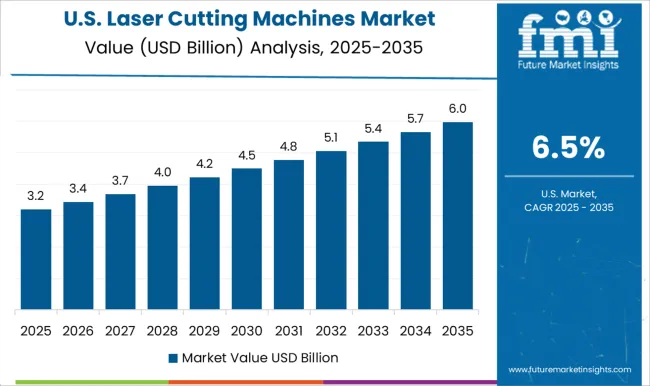

The USA laser cutting machines market is forecast to grow at a CAGR of 6.5% from 2025 to 2035, with demand centered on aerospace, agricultural equipment, HVAC, and contract metal fabrication. Buyers evaluate machines on cut speed, edge finish, and reliability under multi-shift loads. Adoption of high-power fiber sources enables thick plate cutting and replaces thermal processes with tighter tolerances. Integrators package lasers with robotic handling and automated storage to solve labor constraints. Supply chain localization favors domestic build capacity and fast parts availability. In this view, the USA will maintain steady installations through 2035 as fabricators seek predictable cost per part, uptime guarantees, and scalable automation paths.

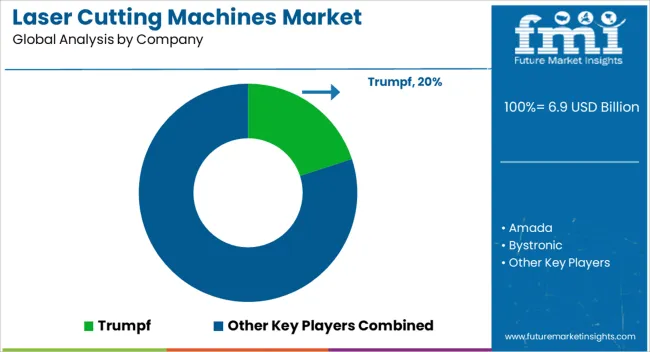

Competition in the laser cutting machines market is defined by precision, efficiency, and adaptability across industrial, electronics, and construction applications. Trumpf leads with advanced fiber and CO₂ laser cutting systems, offering automation-ready platforms, high cutting speeds, and software integration for smart manufacturing environments.

Amada and Bystronic compete by providing high-capacity laser systems for sheet metal processing, emphasizing productivity, ease of use, and integration with bending and forming equipment. Coherent focuses on industrial and specialty lasers, differentiating with advanced optics and customized high-power solutions for aerospace, electronics, and defense. Han’s Laser dominates in Asia, providing a wide portfolio from small-scale systems to industrial-grade machines, supported by competitive pricing and expansive distribution.

IPG Photonics, a leader in fiber laser sources, partners with OEMs globally, supplying efficient and reliable laser modules that enhance cutting precision and reduce operating costs. Epilog Laser, Trotec Laser, and Universal Laser Systems target the mid-scale and small enterprise segments with compact, versatile machines for signage, engraving, and prototyping applications.

Mitsubishi Electric Corporation, Mazak Optonics, and Prima Power deliver advanced sheet metal solutions integrated with automation, positioning themselves strongly in the automotive and industrial manufacturing sectors. LVD Company and Jenoptik emphasize precision systems for high-performance applications, with expertise in optics and integrated motion control. Tanaka offers niche solutions in high-power cutting for heavy industries. Product brochures highlight specifications such as laser power (ranging from compact 30W CO₂ systems to multi-kilowatt fiber lasers), cutting thickness, motion speed, and nesting efficiency. Optional features include remote diagnostics, automated material handling, hybrid laser systems, and integration with CAD/CAM software. Marketing materials emphasize productivity gains, cost-per-part reduction, energy efficiency, and flexibility across industries.

In my opinion, competition is defined by a balance of premium suppliers offering automation-heavy systems and regional players meeting cost-sensitive demand, creating a layered market where both performance and affordability drive adoption globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Technology | Solid-State lasers, Gas Lasers, and Semiconductor Laser |

| Process | Fusion Cutting, Flame Cutting, and Sublimation Cutting |

| Function Type | Robotic and Semi-Automatic |

| Application | Automotive, Consumer Electronics, Defense and Aerospace, Industrial, and Others (medical, energy & power etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trumpf, Amada, Bystronic, Coherent, Epilog Laser, Han's Laser, IPG Photonics, Jenoptik, LVD Company, Mazak Optonics, Mitsubishi Electric Corporation, Prima Power, Tanaka, Trotec Laser, and Universal Laser Systems |

| Additional Attributes | Dollar sales, share, regional adoption patterns, competitive benchmarking, technology segmentation (fiber vs CO₂), end-use sector demand (automotive, aerospace, electronics), raw material pricing impacts, aftersales service trends, and growth forecasts. |

The global laser cutting machines market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the laser cutting machines market is projected to reach USD 14.3 billion by 2035.

The laser cutting machines market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in laser cutting machines market are solid-state lasers, gas lasers and semiconductor laser.

In terms of process, fusion cutting segment to command 53.4% share in the laser cutting machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laser Frequency Splitting and Mode Competition Teaching Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Component Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Laser-Assisted Smart Lathes Market Size and Share Forecast Outlook 2025 to 2035

Laser Drilling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Measuring Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Laser Interferometer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA