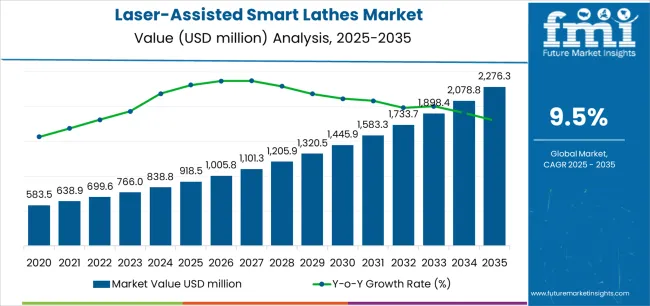

The global laser-assisted smart lathes market, valued at USD 918.5 million in 2025, is projected to reach USD 2,276.2 million by 2035, expanding at a CAGR of 9.5%. The demand for laser-assisted smart lathes has intensified as industries transition toward precision machining and digitally controlled hybrid manufacturing systems. Regional adoption patterns reveal distinct trajectories influenced by industrial capacity, CNC digitization, and advancements in thermal laser processing. East Asia leads in adoption, with Japan, China, and South Korea forming the technological nucleus of the global market.

The region benefits from an advanced supply chain ecosystem, widespread process automation, and strong research programs promoting laser-assisted hybrid machining systems. Japan remains dominant in designing precision-oriented lathes with adaptive laser power management for alloys such as titanium and Inconel. The adoption of laser-assisted smart lathes in China continues to expand through large-scale EV manufacturing and electronics component production, where multi-axis turning and additive integration offer higher productivity. South Korea strengthens this regional dominance by applying hybrid turning systems in defense, aerospace, and semiconductor production, establishing a mature foundation for smart machining clusters.

Europe demonstrates a high adoption rate driven by established machining excellence and modernization efforts in aerospace, automotive, and mold manufacturing sectors. Germany anchors regional strength with its precision manufacturing culture and continuous investment in intelligent machining technologies. The demand for laser-assisted smart lathes in Germany and Italy is shaped by process consistency, tool longevity, and integration with MES platforms. France’s machine tool manufacturers emphasize predictive maintenance and temperature-controlled laser machining systems to minimize microstructural deformation. European manufacturers are progressively embedding adaptive beam modulation in CNC units, aligning production lines toward data-driven machining performance and improved component surface finish.

North America sustains a robust adoption base through its strong aerospace and defense industries, coupled with early involvement in R&D-led hybrid machining. The United States demonstrates strong uptake due to increasing demand for laser-assisted machining centers that combine additive and subtractive processes for high-value components. Collaborations between OEMs and national laboratories have accelerated advancements in AI-based control systems and digital twins for predictive spindle-laser coordination. Canada is gradually expanding its footprint in this segment through machining workshops focused on automation in energy and robotics manufacturing.

South Asia and the Pacific are emerging as fast-growing territories, driven by industrial modernization and localized parts manufacturing for the medical and automotive sectors. India, Thailand, and Vietnam have exhibited steady progress in integrating smart lathes into medium-scale workshops through government incentives and technical training initiatives. The region’s rising adoption of laser-assisted smart lathes underscores a shift from manual machining to data-controlled hybrid production systems aimed at precision and cost optimization.

The Middle East and Latin America remain developing regions with selective deployment of hybrid lathes in oilfield component finishing, turbine repair, and aerospace maintenance facilities. GCC nations have initiated pilot projects in energy infrastructure machining, while Brazil and Mexico show growing procurement by industrial clusters seeking greater precision and operational flexibility. Collectively, these trends indicate that the global demand for laser-assisted smart lathes will continue to strengthen through 2035 as industries seek advanced machining solutions that unify laser precision, CNC intelligence, and digital manufacturing efficiency.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 918.5 million |

| Forecast Value in (2035F) | USD 2,276.2 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

From 2030 to 2035, the laser-assisted smart lathes market is forecast to grow from USD 1,445.9 million to USD 2,276.2 million, adding another USD 830.3 million, which constitutes 61.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of fully integrated smart manufacturing systems with autonomous operation capabilities, the development of artificial intelligence-driven process optimization for laser-assisted machining, and the growth of specialized applications in quantum technology component manufacturing and advanced medical implant production. The growing adoption of autonomous manufacturing principles and digital twin technologies will drive demand for laser-assisted smart lathes with comprehensive connectivity and self-optimization features.

Between 2020 and 2025, the laser-assisted smart lathes market experienced steady growth, driven by increasing manufacturing complexity and growing recognition of hybrid machining technology as essential equipment for producing advanced components that cannot be efficiently manufactured using conventional single-process approaches across diverse aerospace, automotive, and precision engineering applications. The laser-assisted smart lathes market developed as manufacturing engineers and production planners recognized the potential for laser-assisted lathe technology to reduce production steps, improve component quality, and enable innovative designs while meeting stringent aerospace and automotive quality requirements. Technological advancement in laser integration and intelligent control systems began emphasizing the critical importance of maintaining process stability and quality consistency in advanced manufacturing environments.

Market expansion is being supported by the increasing global demand for advanced precision machining solutions driven by aerospace component complexity and automotive lightweighting trends, alongside the corresponding need for hybrid manufacturing equipment that can combine multiple processes, reduce production time, and maintain exceptional quality standards across various aerospace, automotive, mold manufacturing, and medical device applications. Modern aerospace manufacturers and automotive suppliers are increasingly focused on implementing laser-assisted smart lathe solutions that can process difficult-to-machine materials, achieve superior surface finishes, and provide consistent performance in demanding production environments.

The growing emphasis on Industry 4.0 integration and smart manufacturing is driving demand for laser-assisted smart lathes that can support digital connectivity, enable real-time process monitoring, and ensure comprehensive production data collection. Manufacturing operations' preference for equipment that combines operational versatility with digital integration capabilities and total cost of ownership advantages is creating opportunities for innovative laser-assisted smart lathe implementations. The rising influence of aerospace electrification and medical device miniaturization is also contributing to increased adoption of laser-assisted smart lathes that can provide superior precision machining capabilities without compromising production efficiency or quality consistency requirements.

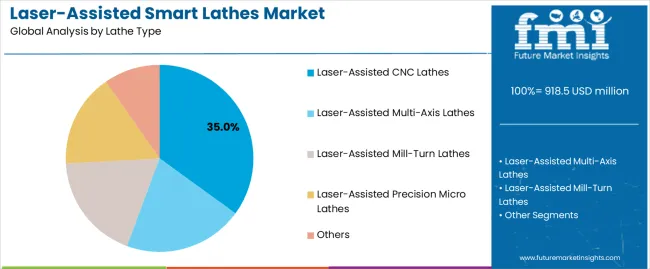

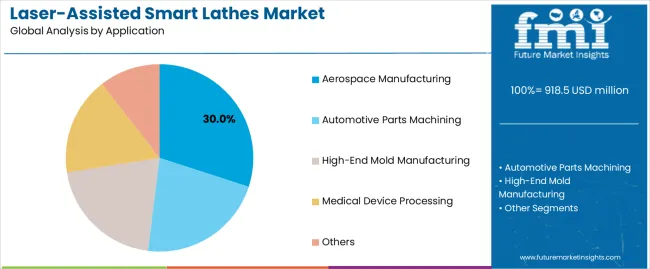

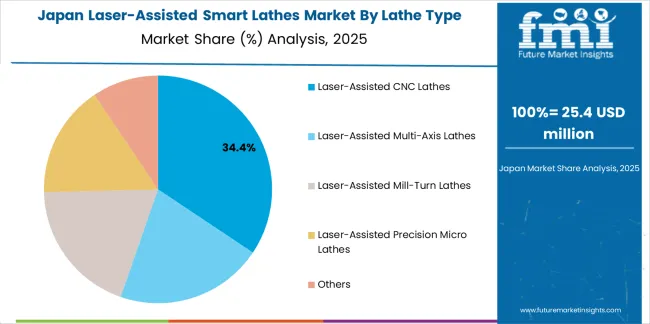

The laser-assisted smart lathes market is segmented by lathe type, application, and region. By lathe type, the laser-assisted smart lathes market is divided into laser-assisted CNC lathes, laser-assisted multi-axis lathes, laser-assisted mill-turn lathes, laser-assisted precision micro lathes, and others. Based on application, the laser-assisted smart lathes market is categorized into aerospace manufacturing, automotive parts machining, high-end mold manufacturing, medical device processing, and others. Regionally, the laser-assisted smart lathes market is divided into East Asia, Europe, North America, South Asia, Latin America, the Middle East & Africa, and Eastern Europe.

The laser-assisted CNC lathes segment is projected to maintain its leading position with a 35% market share, reaffirming its role as the preferred configuration for versatile precision machining applications across diverse manufacturing sectors. Aerospace manufacturers and automotive suppliers increasingly utilize laser-assisted CNC lathes for their optimal balance between machining versatility, laser integration benefits, and proven effectiveness in producing complex components with superior surface quality. Laser-assisted CNC lathe technology's proven effectiveness and application flexibility directly address industry requirements for hybrid manufacturing capabilities and quality consistency across diverse component types and material specifications.

This lathe segment forms the foundation of modern advanced manufacturing operations, as it represents the configuration with the greatest market maturity and established performance record across multiple precision machining applications and industrial sectors. Manufacturing industry investments in smart machining technologies continue to strengthen adoption among aerospace contractors and automotive suppliers. With production pressures requiring improved efficiency and enhanced component quality, laser-assisted CNC lathes align with both productivity objectives and quality requirements, making it the central component of comprehensive advanced manufacturing strategies.

The aerospace manufacturing application segment is projected to represent 30% share of laser-assisted smart lathes demand in 2025, underscoring its critical role as the primary driver for laser-assisted lathe adoption across turbine component production, structural part manufacturing, and precision aerospace systems fabrication. Aerospace manufacturers prefer laser-assisted smart lathes for component production due to their exceptional capability to machine difficult materials including titanium and nickel alloys, superior surface finish quality for fatigue-critical components, and ability to combine multiple operations while supporting stringent aerospace quality standards and traceability requirements. Positioned as essential equipment for advanced aerospace manufacturing, laser-assisted smart lathes offer both operational advantages and quality assurance benefits.

The segment is supported by continuous innovation in aerospace manufacturing technology and the growing availability of qualified laser-assisted lathe systems that enable superior component production with enhanced material utilization and reduced production lead times. Additionally, aerospace manufacturers are investing in comprehensive smart manufacturing programs to support increasingly complex component geometries and demanding performance requirements for next-generation aircraft and space systems. As aerospace technology advances and component complexity increases, the aerospace manufacturing application will continue to dominate the laser-assisted smart lathes market while supporting advanced machining technologies and production excellence strategies.

The laser-assisted smart lathes market is advancing steadily due to increasing demand for hybrid manufacturing solutions driven by component complexity growth and growing adoption of advanced materials that require specialized machining technologies providing combined subtractive and additive capabilities with integrated quality monitoring benefits across diverse aerospace, automotive, and precision engineering applications. However, the laser-assisted smart lathes market faces challenges, including high capital investment requirements and technology complexity, skilled operator availability constraints for advanced laser-assisted machining systems, and integration challenges related to existing manufacturing infrastructure and process qualification requirements. Innovation in user-friendly control interfaces and comprehensive training programs continues to influence product development and market expansion patterns.

The growing adoption of electric propulsion systems in aerospace is driving demand for specialized machining solutions that address unique manufacturing requirements including precise cooling channel creation, complex internal geometry machining, and optimized surface texturing for thermal management components. Advanced aerospace applications require sophisticated laser-assisted lathe capabilities that deliver superior precision across multiple material types while maintaining cost-effectiveness for production volumes. Aerospace manufacturers are increasingly recognizing the competitive advantages of laser-assisted smart lathe integration for next-generation component production and technology differentiation, creating opportunities for innovative machining systems specifically designed for advanced aerospace applications.

Modern laser-assisted smart lathe manufacturers are incorporating artificial intelligence capabilities and autonomous process optimization technologies to enhance machining quality, enable predictive process adjustment, and support comprehensive smart manufacturing objectives through real-time monitoring and adaptive control systems. Leading companies are developing intelligent machining systems with machine learning algorithms, implementing predictive maintenance capabilities, and advancing automation technologies that optimize cutting parameters based on real-time sensor feedback. These technologies improve production efficiency while enabling new operational capabilities, including lights-out manufacturing, remote process monitoring, and data-driven continuous improvement programs. Advanced intelligence integration also allows manufacturers to support comprehensive Industry 4.0 objectives and competitive differentiation beyond traditional machining capabilities.

The expansion of minimally invasive surgical devices and implantable medical technology is driving demand for ultra-precision laser-assisted micro lathes with specialized capabilities for miniature component production, complex micro-feature creation, and exceptional surface quality requirements. These demanding applications require specialized machining systems with sub-micron positioning accuracy that accommodate medical device manufacturing standards, creating premium market segments with differentiated value propositions. Manufacturers are investing in micro-machining expertise and medical device qualification capabilities to serve emerging healthcare technology applications while supporting innovation in surgical instruments and implantable device manufacturing.

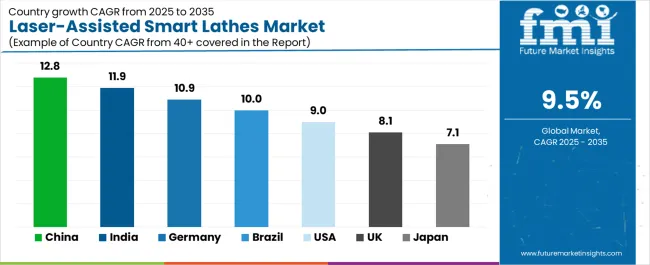

| Country | CAGR (2025-2035) |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| Brazil | 10.0% |

| United States | 9.0% |

| United Kingdom | 8.1% |

| Japan | 7.1% |

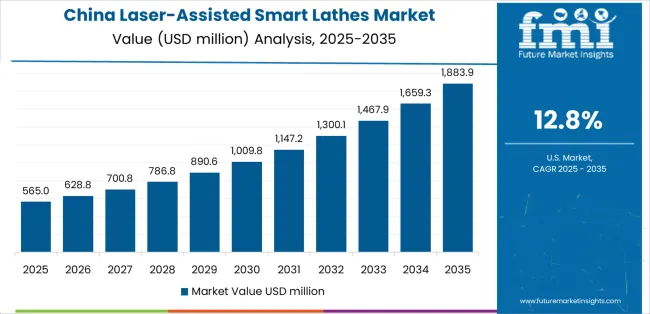

The laser-assisted smart lathes market is experiencing solid growth globally, with China leading at a 12.8% CAGR through 2035, driven by massive manufacturing capacity expansion, growing aerospace industry development, and government initiatives supporting intelligent manufacturing adoption. India follows at 11.9%, supported by expanding precision manufacturing sector, growing aerospace and automotive industries, and increasing emphasis on advanced manufacturing technology adoption. Germany shows growth at 10.9%, emphasizing precision engineering excellence, aerospace technology leadership, and Industry 4.0 implementation. Brazil demonstrates 10.0% growth, supported by aerospace industry development, automotive manufacturing expansion, and precision machining capability enhancement. The United States records 9.0%, focusing on aerospace manufacturing leadership, automotive innovation, and advanced manufacturing technology integration. The United Kingdom exhibits 8.1% growth, emphasizing aerospace industry participation and precision manufacturing advancement. Japan shows 7.1% growth, supported by precision machining excellence and advanced manufacturing technology expertise.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

Revenue from laser-assisted smart lathes in China is projected to exhibit exceptional growth with a CAGR of 12.8% through 2035, driven by massive manufacturing capacity expansion and rapidly growing aerospace and automotive industries supported by government Made in China 2025 initiatives and intelligent manufacturing development programs. The country's comprehensive manufacturing infrastructure modernization and increasing technology sophistication are creating substantial demand for advanced machining solutions. Major aerospace manufacturers and automotive suppliers are establishing comprehensive laser-assisted machining capabilities to serve both domestic markets and international aerospace companies.

Revenue from laser-assisted smart lathes in India is expanding at a CAGR of 11.9%, supported by expanding precision manufacturing sector, growing aerospace and automotive industries, and increasing emphasis on advanced manufacturing technology adoption driven by government Make in India programs and manufacturing excellence initiatives. The country's comprehensive industrial development and increasing technology investments are driving sophisticated laser-assisted machining capabilities throughout manufacturing sectors. Leading automotive suppliers and aerospace component manufacturers are establishing advanced machining facilities to address growing domestic and export requirements.

Revenue from laser-assisted smart lathes in Germany is expanding at a CAGR of 10.9%, supported by the country's precision engineering excellence, aerospace technology leadership, and strong emphasis on Industry 4.0 implementation and manufacturing innovation. The nation's manufacturing excellence and technology sophistication are driving sophisticated laser-assisted machining capabilities throughout industrial sectors. Leading machine tool manufacturers and aerospace suppliers are investing extensively in advanced laser-assisted machining technologies and smart manufacturing integration.

Revenue from laser-assisted smart lathes in Brazil is expanding at a CAGR of 10.0%, supported by the country's aerospace industry development, growing automotive manufacturing sector, and increasing precision machining capability enhancement driven by industrial modernization initiatives. The nation's aerospace sector growth and manufacturing advancement are driving demand for advanced machining technologies. Aerospace suppliers and automotive manufacturers are investing in modern equipment to support production requirements.

Revenue from laser-assisted smart lathes in the United States is expanding at a CAGR of 9.0%, supported by the country's aerospace manufacturing leadership, automotive innovation capabilities, and growing emphasis on advanced manufacturing technology integration and smart factory development. The nation's comprehensive aerospace sector and manufacturing technology excellence are driving demand for sophisticated laser-assisted machining solutions. Aerospace contractors and automotive suppliers are investing in advanced equipment to support production excellence.

Revenue from laser-assisted smart lathes in the United Kingdom is expanding at a CAGR of 8.1%, driven by the country's aerospace industry participation, precision manufacturing capabilities, and emphasis on advanced manufacturing technology development and Industry 4.0 adoption. The UK's aerospace sector presence and manufacturing innovation are driving laser-assisted machining adoption throughout precision manufacturing operations. Aerospace suppliers and precision manufacturers are establishing advanced machining capabilities for competitive excellence.

Revenue from laser-assisted smart lathes in Japan is expanding at a CAGR of 7.1%, supported by the country's precision manufacturing excellence, advanced machining technology expertise, and strong emphasis on quality standards and production innovation. Japan's technological sophistication and manufacturing leadership are driving demand for high-precision laser-assisted machining systems. Leading manufacturers are investing in advanced equipment for premium applications.

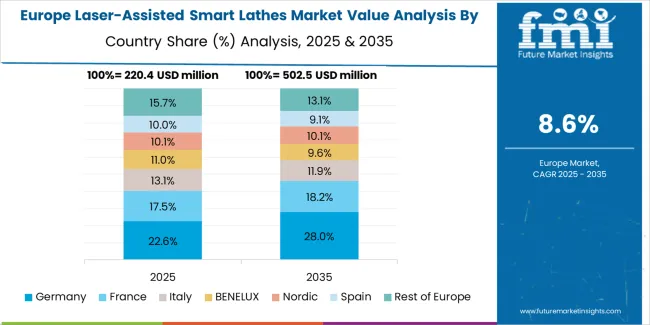

How Is the Laser-Assisted Smart Lathes Market Distributed Across European Countries?

The laser-assisted smart lathes market in Europe is projected to grow from USD 243.5 million in 2025 to USD 592.3 million by 2035, registering a CAGR of 9.3% over the forecast period. Germany is expected to maintain leadership with a 33.8% market share in 2025, moderating to 33.2% by 2035, supported by machine tool manufacturing excellence, aerospace industry presence, and Industry 4.0 leadership.

France follows with 18.6% in 2025, projected at 19.2% by 2035, driven by aerospace manufacturing capabilities, automotive supplier base, and advanced manufacturing technology adoption. The United Kingdom holds 15.4% in 2025, reaching 15.0% by 2035 on the back of aerospace industry participation and precision manufacturing development. Italy commands 12.8% in 2025, rising slightly to 13.2% by 2035, while Spain accounts for 9.2% in 2025, reaching 9.6% by 2035 aided by aerospace component manufacturing and automotive production growth. Switzerland maintains 5.6% in 2025, up to 5.9% by 2035 due to precision manufacturing excellence and medical device production capabilities. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 4.6% in 2025 and 3.9% by 2035, reflecting steady development in advanced manufacturing and aerospace industry programs.

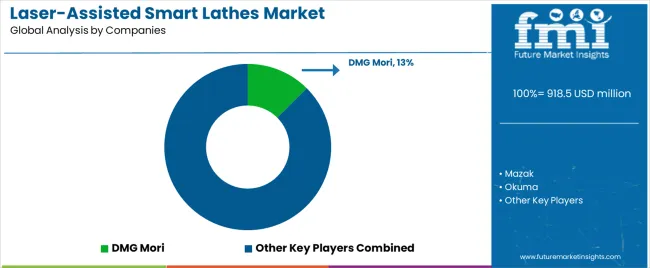

The laser-assisted smart lathes market is characterized by competition among established machine tool manufacturers, specialized precision equipment producers, and advanced manufacturing technology companies. Companies are investing in laser integration technology development, intelligent control system advancement, application-specific machine configuration, and comprehensive technical support services to deliver high-performance, versatile, and digitally connected laser-assisted smart lathe solutions. Innovation in hybrid manufacturing processes, artificial intelligence integration, and comprehensive process monitoring capabilities is central to strengthening market position and competitive advantage.

DMG Mori leads the laser-assisted smart lathes market, offering comprehensive laser-assisted smart lathe solutions with a focus on aerospace applications, intelligent manufacturing integration, and extensive technical support across diverse precision machining operations. Mazak provides innovative machine tool technologies with emphasis on multi-tasking capabilities and smart manufacturing connectivity. Okuma delivers high-precision laser-assisted lathes with focus on intelligent control systems and manufacturing excellence. Doosan Machine Tools offers versatile machining solutions with comprehensive capabilities for diverse applications. Haas Automation provides cost-effective precision equipment with growing automation integration.

EMAG GmbH & Co. KG specializes in vertical lathe technologies with laser integration capabilities. INDEX-Werke GmbH & Co. KG offers multi-spindle and multi-axis solutions with advanced automation. Hardinge Inc. provides precision turning solutions for demanding applications. Grob-Werke GmbH & Co. KG focuses on complex machining systems with intelligent integration. WEILER Werkzeugmaschinen GmbH delivers robust lathe solutions for heavy-duty applications. Nakamura-Tome Precision Industry Co., Ltd. specializes in multi-axis turning centers with precision capabilities. Hwacheon Machinery Co., Ltd. offers comprehensive machining solutions with technology advancement. Spinner Werkzeugmaschinenfabrik GmbH provides specialized precision lathes. Danobat Group delivers grinding and turning solutions for aerospace applications. Chung-Hsin Electric & Machinery Manufacturing Corp. focuses on precision machine tool manufacturing.

Laser-assisted smart lathes represent an advanced precision machining equipment segment within manufacturing operations, projected to grow from USD 918.5 million in 2025 to USD 2,276.2 million by 2035 at a 9.5% CAGR. These intelligent hybrid manufacturing systems—primarily comprising CNC, multi-axis, mill-turn, and precision micro lathe configurations—serve as essential production equipment in aerospace, automotive, mold manufacturing, and medical device applications where hybrid processing capabilities, exceptional precision, and digital connectivity are essential. Market expansion is driven by increasing manufacturing complexity, growing advanced material adoption, expanding Industry 4.0 implementation, and rising demand for integrated hybrid manufacturing solutions across diverse precision engineering segments.

How Manufacturing and Industry Regulators Could Strengthen Technology Standards and Safety Requirements?

How Industry Associations Could Advance Technology Standards and Market Development?

How Laser-Assisted Smart Lathe Manufacturers Could Drive Innovation and Market Leadership?

How Manufacturing Companies Could Optimize Equipment Performance and Production Excellence?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 918.5 million |

| Lathe Type | Laser-Assisted CNC Lathes, Laser-Assisted Multi-Axis Lathes, Laser-Assisted Mill-Turn Lathes, Laser-Assisted Precision Micro Lathes, Others |

| Application | Aerospace Manufacturing, Automotive Parts Machining, High-End Mold Manufacturing, Medical Device Processing, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | DMG Mori, Mazak, Okuma, Doosan Machine Tools, Haas Automation, EMAG GmbH & Co. KG, INDEX-Werke GmbH & Co. KG, Hardinge Inc., Grob-Werke GmbH & Co. KG, WEILER Werkzeugmaschinen GmbH, Nakamura-Tome Precision Industry Co., Ltd., Hwacheon Machinery Co., Ltd., Spinner Werkzeugmaschinenfabrik GmbH, Danobat Group, Chung-Hsin Electric & Machinery Manufacturing Corp. |

| Additional Attributes | Dollar sales by lathe type and application category, regional demand trends, competitive landscape, technological advancements in laser-assisted machining, Industry 4.0 integration development, hybrid manufacturing innovation, and precision engineering optimization |

The global laser-assisted smart lathes market is estimated to be valued at USD 918.5 million in 2025.

The market size for the laser-assisted smart lathes market is projected to reach USD 2,276.3 million by 2035.

The laser-assisted smart lathes market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in laser-assisted smart lathes market are laser-assisted cnc lathes, laser-assisted multi-axis lathes, laser-assisted mill-turn lathes, laser-assisted precision micro lathes and others.

In terms of application, aerospace manufacturing segment to command 30.0% share in the laser-assisted smart lathes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA