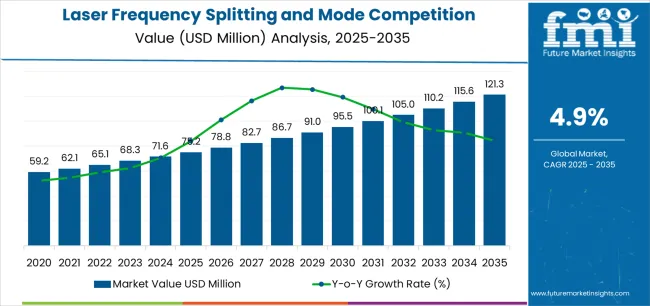

Valued at USD 75.2 million in 2025, the global laser frequency splitting and mode competition teaching instrument market is anticipated to reach USD 121.3 million by 2035, reflecting a CAGR of 4.9%. Rolling CAGR assessment shows steady expansion supported by increased integration of optical experimentation tools in higher education and applied research. These systems enable demonstration of frequency separation, cavity resonance, and mode interaction in controlled academic environments, providing essential insight into laser physics and photonics.

Manufacturers are improving optical precision, alignment accuracy, and modular adaptability to enhance instructional flexibility. The use of digital monitoring software and wavelength analysis interfaces is expanding, allowing students to visualize real-time frequency variations with greater clarity. Component design is increasingly modular, enabling customization of experimental setups to suit specific teaching levels or research requirements.

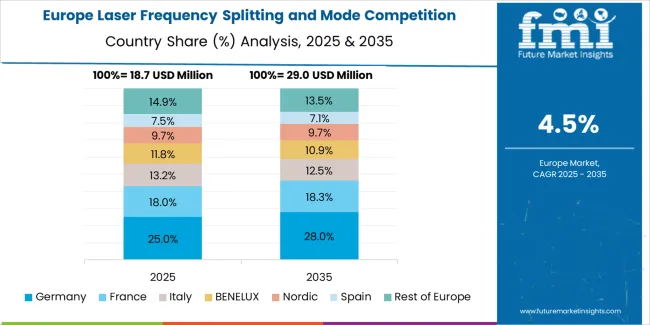

Adoption is strongest in technologically advanced regions such as North America, Western Europe, and East Asia, where funding for physics education and laboratory modernization remains stable. Growth in developing regions is emerging gradually through academic partnerships and laboratory equipment grants. Across the forecast period, emphasis on calibration reliability, component interchange quality, and standardized instructional design is expected to sustain market development and equipment demand.

Between 2025 and 2030, the Laser Frequency Splitting and Mode Competition Teaching Instrument Market is projected to increase from USD 75.2 million to USD 95.5 million, reflecting a 27.0% rise and accounting for 46.1% of the decade’s overall growth. This phase will be driven by the growing adoption of advanced laser education systems across universities, research laboratories, and photonics training centers.

Rising demand for hands-on learning in optics and quantum physics is prompting institutions to invest in modular, precision-based laser teaching instruments. Manufacturers are focusing on improved wavelength stability, simplified alignment systems, and enhanced safety features to meet evolving academic and research needs.

From 2030 to 2035, the market is expected to grow from USD 95.5 million to USD 121.3 million, marking a 27.0% increase and contributing 53.9% of the decade’s total expansion. This phase will be characterized by increased integration of digital control interfaces, AI-assisted calibration, and real-time frequency visualization tools in teaching instruments.

Expanding use in emerging research areas such as quantum communication and optical computing will further strengthen market demand. Collaboration between academic institutions and photonics equipment manufacturers will accelerate innovation, ensuring that laser teaching systems remain essential tools for education and experimental research worldwide.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 75.2 million |

| Market Forecast Value (2035) | USD 121.3 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The laser frequency splitting and mode competition teaching instrument market is expanding as universities and research institutes intensify experimental training in laser physics, photonics, and optical engineering. These instruments provide controlled demonstrations of longitudinal mode behavior, resonance frequency separation, and gain competition phenomena in laser cavities concepts fundamental to understanding modern optical systems. Academic laboratories adopt such setups to offer students hands-on exposure to principles underlying laser design, spectral analysis, and feedback stability.

Growing enrollment in physics and engineering programs, alongside the increasing importance of optics in telecommunications, medical imaging, and sensing technologies, supports sustained market interest. Manufacturers design compact, modular instruments that integrate precision optical components, adjustable cavity mirrors, and digital measurement interfaces for spectral visualization. These systems are frequently used in undergraduate laboratories, postgraduate research, and technical training environments where repeatable, safe, and visually interpretable demonstrations are required. The expanding availability of cost-efficient diode and He-Ne laser sources also reduces equipment costs, broadening institutional accessibility. However, budget constraints in smaller academic programs and limited technical expertise in optical alignment remain adoption barriers. As laboratory curricula evolve toward application-based learning, demand for robust, didactic laser teaching instruments continues to increase within global science and engineering education sectors.

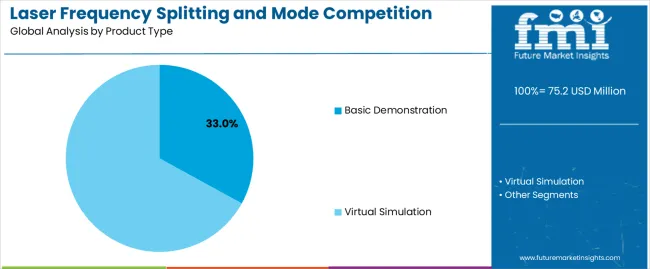

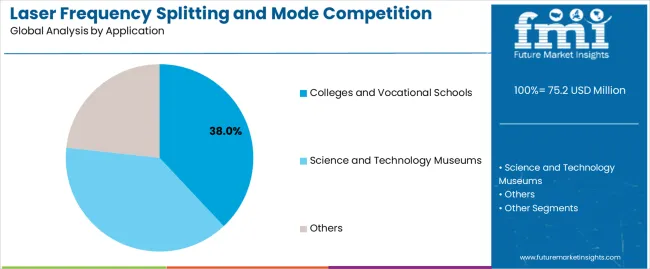

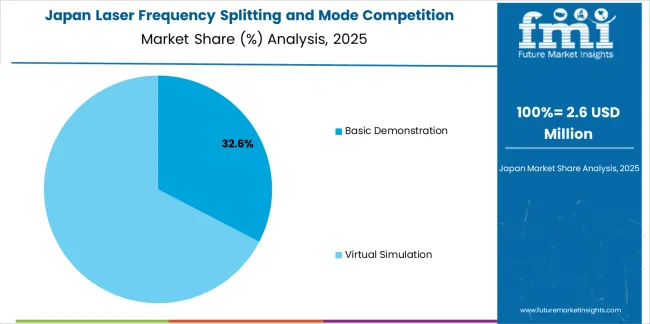

The laser frequency splitting and mode competition teaching instrument market is segmented by product type, application, and region. By product type, the market is divided into basic demonstration and virtual simulation systems. Based on application, it is categorized into colleges and vocational schools, science and technology museums, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions define the product differentiation, academic utilization, and regional adoption patterns shaping demand across educational and scientific institutions.

The basic demonstration segment accounts for approximately 33.0% of the global laser frequency splitting and mode competition teaching instrument market in 2025, representing the leading product category. Its position is supported by extensive use in physics and optics laboratories for visualizing laser frequency modes and operational principles. Basic demonstration instruments provide direct observation of mode structures and beam behavior, making them essential for foundational laser education and instructor-led training.

These systems are widely adopted by academic departments that emphasize practical optical experiments aligned with theoretical coursework. The segment benefits from cost efficiency, ease of maintenance, and compatibility with standard laboratory setups. Basic demonstration instruments enable students to explore mode competition phenomena, cavity tuning, and laser stability characteristics under controlled experimental conditions. Manufacturers continue refining optical alignment mechanisms and integrating modular designs that support repeatable teaching demonstrations. The simplicity, reliability, and educational relevance of basic demonstration models ensure their ongoing demand across colleges, vocational institutions, and introductory research laboratories focused on photonics and applied laser technology training.

The colleges and vocational schools segment represents about 38.0% of the total laser frequency splitting and mode competition teaching instrument market in 2025, making it the largest application category. This leadership reflects sustained demand for laboratory-grade optical instruments in formal technical education environments. Institutions utilize these systems to provide students with hands-on exposure to laser dynamics, frequency tuning, and resonator behavior, reinforcing theoretical instruction in optics and photonics coursework.

Growth in the segment is supported by ongoing investments in science and engineering education infrastructure, particularly in East Asia and Europe, where universities emphasize laboratory-based learning. Colleges and vocational training centers adopt both basic demonstration and virtual simulation models to support flexible teaching environments and curriculum modernization. The segment’s expansion also corresponds with the increasing integration of laser-based training in multidisciplinary programs such as applied physics and mechatronics. Continued procurement from educational institutions ensures consistent market stability, as laboratories prioritize durable and standardized teaching instruments that align with academic performance requirements. The colleges and vocational schools segment remains central to market demand, reflecting its pivotal role in applied optics education and technical skill development worldwide.

The market for teaching instruments that demonstrate laser frequency splitting and mode competition is gaining traction as optical physics education expands. These instruments allow students and researchers to visualise phenomena such as longitudinal-mode splitting, dual-frequency oscillation and laser mode competition in controlled lab environments. Demand is driven by increasing focus on STEM education and advanced physics labs in universities and technical institutes. Constraints include the specialised nature of the equipment, higher cost relative to general teaching labs, and requirement for skilled instructors. A key trend is integration of digital readouts, interactive software and modular configurations to support diverse educational levels and remote teaching.

Growth is primarily driven by rising investment in advanced optics and photonics education. Universities and research institutes are upgrading laboratory equipment to address modern curricula which include laser dynamics, spectroscopy and photonic instrumentation. The demand for hands-on teaching tools that clearly illustrate frequency splitting and mode competition makes these instruments valuable for optical physics, engineering and applied science departments. The global push for enhanced STEM infrastructure and increasing enrolment in optical-engineering programmes further support demand for specialised teaching instruments that go beyond basic laser demonstration setups.

A principal restraint is the high cost and complexity of these specialized instruments. Instruments designed to demonstrate laser frequency splitting and mode competition often require precise laser sources, stable cavities, and sensitive measurement equipment, which raises both purchase and maintenance costs. Many educational institutions in lower-income regions may lack the budget, technical support or expert staff required to deploy and utilise these instruments effectively. Additionally, the niche nature of the subject matter means that demand is limited compared to more general teaching lab equipment, which slows wider adoption.

The market is shifting toward modular, digital-enhanced teaching instruments with interactive software, real-time visualisation of frequency spectra, and connectivity for remote or hybrid lab teaching. Manufacturers are developing teaching kits that combine laser cavities with sensors, data logging, and visual displays to illustrate mode competition and frequency splitting phenomena more intuitively. Furthermore, regional growth is accelerating in Asia-Pacific and Latin America as optical-physics education gains traction and institutions seek lab equipment aligned with global standards. These trends support broader accessibility and adoption of advanced teaching instruments in optical science.

| Country | CAGR (%) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

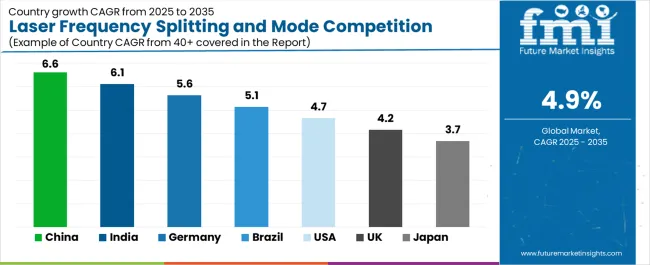

The Laser Frequency Splitting and Mode Competition Teaching Instrument Market is gaining momentum globally, led by China at a 6.6% CAGR through 2035, driven by strong educational infrastructure expansion, research lab investments, and advances in photonics education. India follows at 6.1%, supported by the modernization of science and engineering programs and increased funding for laboratory innovation. Germany records 5.6%, reflecting excellence in optical technology, academic collaboration, and precision manufacturing. Brazil, growing at 5.1%, benefits from rising STEM education initiatives and imported scientific equipment adoption. The USA posts a 4.7% CAGR, emphasizing research-driven teaching systems and advanced optical instrument development, while the UK (4.2%) and Japan (3.7%) focus on educational technology integration and scientific instrumentation refinement.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

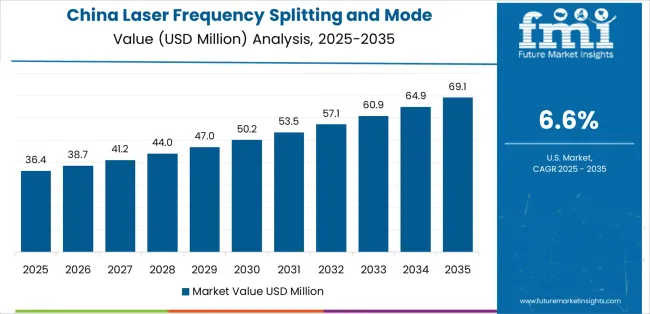

Revenue from laser frequency splitting and mode competition teaching instruments in China is projected to grow at a CAGR of 6.6% through 2035, supported by expanding investment in optical physics education and laboratory infrastructure. Universities and research institutions are adopting advanced laser teaching platforms to enhance experimental learning in photonics and quantum optics. Government programs promoting higher education modernization are increasing laboratory equipment procurement. Domestic manufacturers are improving laser source stability and modular design for better classroom integration.

Revenue from laser frequency splitting and mode competition teaching instruments in India is increasing at a CAGR of 6.1%, driven by investment in research-oriented education and laboratory development. Engineering and physics departments are incorporating advanced optical modules for practical demonstrations. Government funding for technical universities and national laboratories supports equipment acquisition. Manufacturers and distributors are expanding partnerships to improve domestic supply and technical servicing.

Revenue from laser frequency splitting and mode competition teaching instruments in Germany is advancing at a CAGR of 5.6%, supported by established engineering expertise and consistent academic investment in photonics research. Universities and applied science institutes are focusing on advanced optics and laser system instruction. Manufacturers emphasize measurement precision, wavelength stability, and component durability. Continuous alignment with European laboratory safety standards ensures equipment reliability and regulatory compliance.

Revenue from laser frequency splitting and mode competition teaching instruments in Brazil is projected to grow at a CAGR of 5.1%, supported by increasing participation in optical physics research and university laboratory modernization. Government funding for higher education and national science initiatives is promoting investment in teaching-grade laser systems. Academic institutions are strengthening research capabilities through partnerships with global instrument suppliers.

Revenue from laser frequency splitting and mode competition teaching instruments in the United States is increasing at a CAGR of 4.7%, supported by strong university-level research in optics, photonics, and quantum science. Federal funding for laboratory modernization and STEM education continues to drive steady procurement. Manufacturers focus on modular, easy-to-integrate systems suitable for both undergraduate and advanced research instruction. Continuous development in compact, safe laser platforms supports wider adoption.

Revenue from laser frequency splitting and mode competition teaching instruments in the United Kingdom is advancing at a CAGR of 4.2%, supported by modernization of academic laboratories and growth in photonics research initiatives. Universities and research centers are incorporating advanced optical teaching systems to improve hands-on training. Institutional emphasis on science education quality is sustaining procurement activity. Collaboration between academic and industrial stakeholders supports continuous technology updates.

Revenue from laser frequency splitting and mode competition teaching instruments in Japan is projected to grow at a CAGR of 3.7%, supported by high precision standards and consistent university investment in optical experimentation. Research programs in photonics and laser dynamics maintain steady equipment utilization. Domestic manufacturers emphasize compact design, operational safety, and optical alignment accuracy. Continuous R&D in educational instrumentation supports incremental performance improvements.

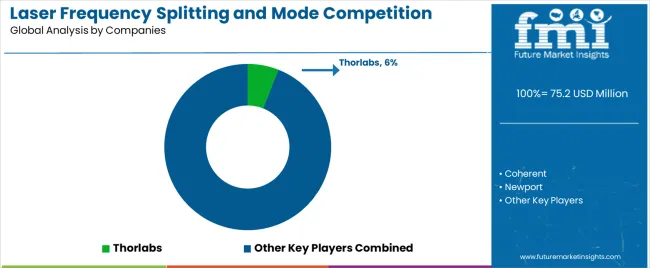

The global laser frequency splitting and mode competition teaching instrument market remains a specialized and technology-driven segment, primarily supported by optics and photonics education suppliers. Thorlabs leads the market with an estimated 6% share, providing modular optical teaching platforms and high-precision laser systems widely used in university and laboratory training programs.

Coherent and Newport hold strong competitive positions through their expertise in laser design, optical component integration, and comprehensive academic training solutions. EXFO contributes advanced optical testing and metrology instruments, integrating educational modules for photonics research environments. Lambda Scientific Systems focuses on academic laboratory packages, offering experimental kits for laser mode observation and frequency measurement.

Beijing Leice Technology and Daheng Optoelectronics represent China’s growing role in photonics education equipment manufacturing, emphasizing accessible pricing and reliable component performance. Lambda Optoelectronics and China Electronics Technology Instruments strengthen domestic competition through product diversification across research-grade laser teaching and testing instruments. Sunshine Optoelectronics supports the market with compact systems designed for demonstration and applied training use.

Competition across this field is defined by optical precision, modular system design, and compatibility with academic curricula. Strategic differentiation depends on integration of digital interfaces, wavelength stability, and multi-mode adaptability, while long-term competitiveness is driven by institutional partnerships, product reliability, and alignment with advancements in laser physics education and experimental optics research.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Product Type) | Basic Demonstration, Virtual Simulation |

| Application | Colleges & Vocational Schools, Science & Technology Museums, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Thorlabs, Coherent, Newport, EXFO, Lambda Scientific Systems, Beijing Leice Technology, Daheng Optoelectronics, Lambda Optoelectronics, China Electronics Technology Instruments, Sunshine Optoelectronics |

| Additional Attributes | Dollar sales by product type and application; regional adoption trends across East Asia, Europe, and North America; curriculum alignment and lab modernization demand; modular hardware + software integration, spectral visualization capability, safety and alignment complexity; barriers (cost, instructor expertise) and supplier opportunities (turnkey lab packages, remote-access labs, instructor training). |

The global laser frequency splitting and mode competition teaching instrument market is estimated to be valued at USD 75.2 million in 2025.

The market size for the laser frequency splitting and mode competition teaching instrument market is projected to reach USD 121.3 million by 2035.

The laser frequency splitting and mode competition teaching instrument market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in laser frequency splitting and mode competition teaching instrument market are basic demonstration and virtual simulation.

In terms of application, colleges and vocational schools segment to command 38.0% share in the laser frequency splitting and mode competition teaching instrument market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laser Component Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Laser-Assisted Smart Lathes Market Size and Share Forecast Outlook 2025 to 2035

Laser Drilling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Laser Interferometer Market Size and Share Forecast Outlook 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Laser Safety Glasses Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA