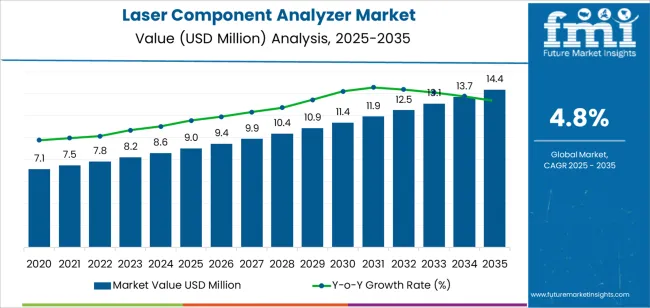

The laser component analyzer market is valued at USD 9.0 million in 2025 and is projected to reach USD 14.4 million by 2035, growing at a CAGR of 4.8% over the assessment period. Growth is driven by rising demand for precise, real-time particle size measurement in pharmaceutical formulation development, nanomaterials characterization, and industrial quality control workflows. Increasing reliance on particle size distribution data for evaluating product performance characteristics, dissolution behavior, viscosity control, and stability has positioned laser-based analyzers as indispensable analytical tools across research and production environments.

Compared to traditional microscopy and sieve-based measurement methods, laser analyzers deliver faster analysis time, a broader measurable size range from nanoscale to millimeter scale particles, and consistent repeatability across sample types, accelerating formulation cycles and reducing analytical turnaround times by up to 40–60%. Between 2025 and 2030, adoption will expand in pharmaceutical R&D and materials research laboratories, supported by integration with automated sampling systems and laboratory information management platforms. From 2030 to 2035, uptake will increase across industrial manufacturing and real-time process monitoring lines as companies pursue continuous production models and data-centric quality programs. Portable units will account for the dominant device share due to operational flexibility, multi-site deployment efficiency, and lower capital costs relative to desktop research-grade analyzers. Asia Pacific will lead global growth, anchored by China and India’s expanding research ecosystem, while Europe and North America sustain adoption through regulatory-driven quality assurance requirements. LANSCIENCE, Hefei Jinxing, Thermo Fisher Scientific, Anton Paar, and Malvern Panalytical remain key players shaping technology capability, performance benchmarks, and application support services.

The market demonstrates strong momentum across developed and emerging research economies, where analytical laboratories are transitioning from conventional particle sizing methods to advanced laser-based systems that offer superior measurement range characteristics. Laser component analyzer technology addresses critical analytical challenges including broad particle size distribution measurement spanning nanometers to millimeters in single analyses, high-throughput sample processing in pharmaceutical batch release testing, and non-destructive measurement capability across diverse material types and suspension media.

The pharmaceutical sector's shift toward nanomedicine formulations and complex drug delivery systems creates steady demand for analytical solutions capable of characterizing submicron particles, evaluating suspension stability, and monitoring crystallization processes with minimal sample preparation and consistent measurement output. Materials research laboratories are adopting laser component analyzers for powder characterization where particle size distribution directly impacts material properties and processing behavior requirements. The technology's ability to provide rapid multimodal distribution analysis with excellent resolution reduces method development time and accelerates research workflows.

Industrial quality control departments and contract testing laboratories are investing in laser component analyzer systems to enhance analytical capabilities through improved measurement speed and expanded size range coverage. The integration of advanced optical configurations and optimized scattering detection geometries enables these instruments to achieve measurement ranges from 10 nanometers to 3500 micrometers while maintaining measurement precision. The initial capital investment requirements for research-grade analytical systems and technical expertise barriers for optimal method development may pose challenges to market expansion in budget-constrained research facilities and regions with limited access to applications support resources.

Between 2025 and 2030, the market is projected to expand from USD 9.0 million to USD 23.0 million, resulting in a value increase of USD 14.0 million, which represents 44.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for particle characterization solutions in pharmaceutical and materials science sectors, product innovation in laser optics technology and detection systems, as well as expanding integration with automated laboratory platforms and quality management systems. Companies are establishing competitive positions through investment in advanced optical designs, measurement algorithm development, and strategic market expansion across pharmaceutical quality control laboratories, materials research facilities, and industrial process monitoring applications.

From 2030 to 2035, the market is forecast to grow from USD 23.0 million to USD 14.4 million, adding another USD 17.3 million, which constitutes 55.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized analytical systems, including multi-wavelength laser configurations and integrated imaging capabilities tailored for specific particle types and measurement applications, strategic collaborations between analytical instrument manufacturers and pharmaceutical companies, and an enhanced focus on measurement automation and data integrity compliance. The growing focus on pharmaceutical quality by design and advanced materials development will drive demand for advanced, high-performance laser component analyzer solutions across diverse research and industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 9.0 million |

| Market Forecast Value (2035) | USD 14.4 million |

| Forecast CAGR (2025-2035) | 4.8% |

The laser component analyzer market grows by enabling researchers to achieve superior measurement accuracy and analytical throughput while reducing sample preparation time in particle characterization applications. Research laboratories face mounting pressure to improve analytical productivity and data quality, with laser component analyzer systems typically providing 40-60% time reduction over conventional microscopy methods, making these specialized instruments essential for competitive pharmaceutical development and materials research operations. The pharmaceutical and materials science industries' need for precise particle size distribution data creates demand for advanced laser analyzer solutions that can measure broad size ranges, achieve excellent resolution in multimodal distributions, and ensure consistent measurement repeatability across diverse sample types and concentration ranges.

Laboratory automation initiatives promoting integrated analytical workflows drive adoption in pharmaceutical quality control, materials characterization, and industrial process monitoring applications, where particle analysis efficiency has a direct impact on product development timelines and manufacturing costs. The global shift toward quality by design principles and nanomaterials research accelerates laser component analyzer demand as analytical laboratories seek instrumentation that minimizes operator influence and maximizes measurement consistency. Limited awareness of optimal measurement protocols and higher initial instrument costs compared to basic particle sizing equipment may limit adoption rates among smaller research groups and regions with traditional analytical practices and limited technical support infrastructure.

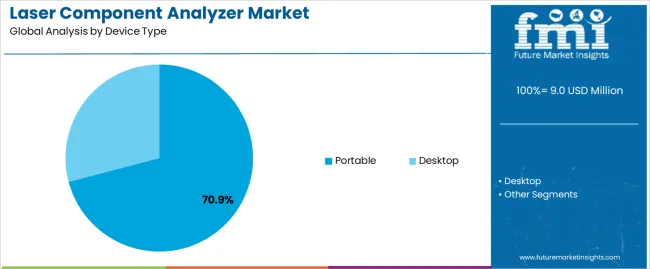

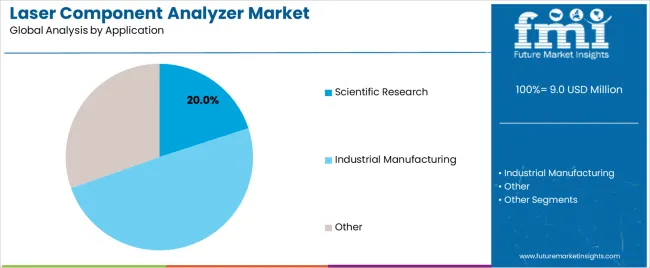

The market is segmented by device type, application, and region. By device type, the market is divided into portable and desktop. Based on application, the market is categorized into scientific research, industrial manufacturing, and other. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

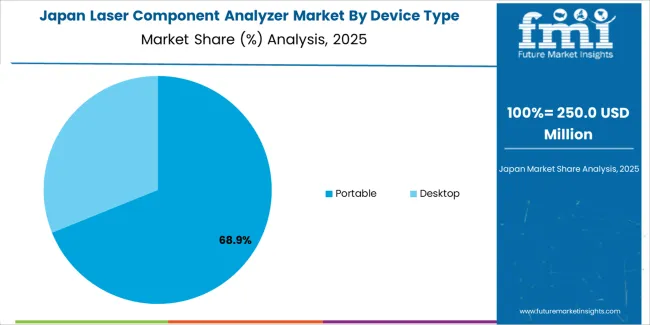

The portable segment represents the dominant force in the market, capturing approximately 70.9% of total market share in 2025. This advanced category encompasses handheld configurations, battery-powered field units, and compact benchtop variants optimized for on-site measurement applications, delivering convenient particle analysis capabilities and flexible deployment options in diverse testing environments. The portable segment's market leadership stems from its operational flexibility enabling at-line process monitoring, reduced footprint requirements facilitating laboratory space optimization, and cost-effective solutions suitable for research groups with multiple sampling locations across manufacturing facilities.

The desktop segment maintains a substantial 29.1% market share, serving research laboratories who require maximum measurement performance through sophisticated optical systems, extended size range capabilities, and advanced software features that support comprehensive particle characterization in controlled laboratory environments.

Key advantages driving the portable segment include:

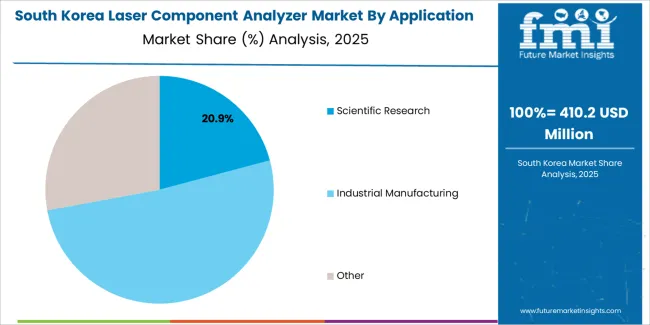

Scientific research applications dominate the market with approximately 20.0% market share in 2025, reflecting the extensive adoption of laser particle sizing solutions across pharmaceutical development laboratories, materials science research centers, and academic analytical facilities. The scientific research segment's market leadership is reinforced by widespread implementation in drug formulation development, nanomaterials characterization, and polymer science research, which provide essential particle size data and distribution analysis in exploratory research and formulation optimization studies.

The industrial manufacturing segment represents 20.9% market share through specialized applications including production quality control, batch release testing, and process monitoring operations. Other applications constitute 59.1% market share, encompassing environmental monitoring, food and beverage analysis, cosmetics development, and specialized industrial particle characterization requirements.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to analytical quality and research productivity outcomes. First, pharmaceutical industry expansion creates increasing requirements for particle characterization instruments, with global pharmaceutical research spending exceeding 200 billion USD annually in major markets worldwide, requiring reliable laser component analyzer systems for drug formulation development, quality control testing, and stability assessment programs. Second, nanomaterials research growth and advanced materials development requirements drive adoption of precision particle sizing technology, with laser component analyzers enabling submicron particle measurement while providing rapid analysis in colloidal dispersions and nanoparticle suspensions used extensively in materials science research applications. Third, quality by design initiatives and regulatory focus on pharmaceutical quality accelerate deployment across analytical laboratories, with laser component analyzers integrating seamlessly into validated analytical methods and enabling real-time particle monitoring capabilities in pharmaceutical manufacturing environments.

Market restraints include initial investment barriers affecting smaller research laboratories and budget-constrained academic institutions, particularly where conventional particle sizing methods remain adequate for less demanding applications and where equipment budgets constrain adoption of advanced analytical instrumentation. Technical expertise requirements for optimal method development pose adoption challenges for facilities lacking experienced analytical scientists, as laser component analyzer performance depends heavily on proper sample preparation, optical model selection, and measurement parameter optimization that vary significantly across material types and particle morphology characteristics. Limited availability of application-specific technical support in emerging research markets creates additional barriers, as analytical laboratories require specialized training in instrument operation procedures, troubleshooting methods, and data interpretation techniques to achieve target measurement quality levels.

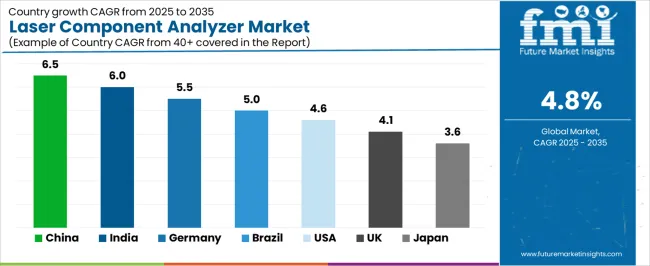

Key trends indicate accelerated adoption in Asian pharmaceutical research hubs, particularly China and India, where drug development capabilities and materials science research programs are expanding rapidly through government research funding initiatives and pharmaceutical industry investment in analytical infrastructure. Technology advancement trends toward multi-angle light scattering detection with enhanced sensitivity, integrated particle imaging for morphology characterization, and cloud-connected data management systems enabling remote instrument monitoring are driving next-generation product development. The market thesis could face disruption if advanced imaging technologies achieve breakthrough capabilities in automated particle analysis with comparable measurement speed, potentially reducing demand for conventional laser diffraction systems in specific application segments where particle shape information proves critical for material characterization.

| Country | CAGR (2025-2035) |

|---|---|

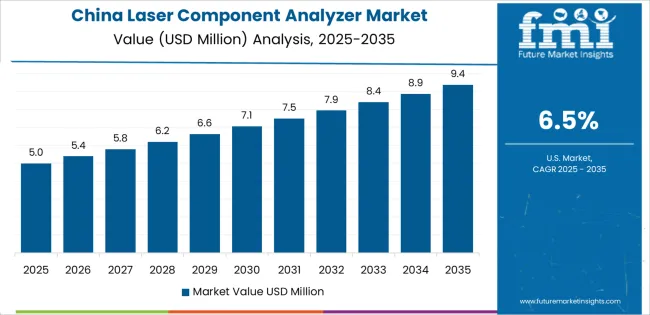

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| Brazil | 5.0% |

| USA | 4.6% |

| UK | 4.1% |

| Japan | 3.6% |

The market is gaining momentum worldwide, with China taking the leads to aggressive pharmaceutical research expansion and materials science laboratory development programs. Close behind, India benefits from growing drug development activities and government research initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding pharmaceutical manufacturing operations and materials research infrastructure development strengthen its role in South American scientific supply chains. The USA demonstrates robust growth through advanced materials research initiatives and pharmaceutical sector investment, signaling continued adoption in precision analytical applications. Japan stands out for its materials characterization expertise and advanced analytical technology integration, while UK and Germany continue to record consistent progress driven by pharmaceutical research centers and materials science facilities. China and India anchor the global expansion story, while established markets build stability and technology leadership into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the market with a CAGR of 6.5% through 2035. The country's leadership position stems from comprehensive pharmaceutical research expansion, intensive materials science development programs, and aggressive analytical laboratory modernization targets driving adoption of advanced particle characterization technologies. Growth is concentrated in major research regions, including Beijing, Shanghai, Jiangsu, and Guangdong, where pharmaceutical companies, materials research institutes, and quality control laboratories are implementing laser component analyzer systems for formulation development and materials characterization. Distribution channels through analytical instrument distributors, laboratory equipment specialists, and direct manufacturer relationships expand deployment across pharmaceutical research parks, university research centers, and industrial quality control facilities. The country's Made in China 2025 initiative provides policy support for advanced analytical technology adoption, including subsidies for research equipment procurement and laboratory infrastructure upgrades.

Key market factors:

In the National Capital Region, Maharashtra, Karnataka, and Telangana research zones, the adoption of laser component analyzer systems is accelerating across pharmaceutical development laboratories, materials research facilities, and industrial quality control operations, driven by Make in India initiatives and increasing focus on research competitiveness. The market demonstrates strong growth momentum with a CAGR of 6.0% through 2035, linked to comprehensive pharmaceutical sector expansion and increasing investment in analytical capabilities. Indian researchers are implementing laser component analyzer technology and advanced particle sizing platforms to improve analytical productivity while meeting stringent data quality requirements in pharmaceutical development and materials characterization serving domestic and export markets. The country's National Science and Technology Policy creates steady demand for advanced analytical solutions, while increasing focus on quality standards drives adoption of precision particle sizing systems that enhance research capabilities.

Germany's advanced research sector demonstrates sophisticated implementation of laser component analyzer systems, with documented case studies showing 35-50% productivity improvement in pharmaceutical particle characterization through optimized analytical strategies. The country's research infrastructure in major scientific regions, including Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Hesse, showcases integration of precision particle sizing technologies with existing analytical laboratories, leveraging expertise in pharmaceutical development and materials science research. German researchers emphasize measurement quality standards and method validation, creating demand for reliable laser component analyzer solutions that support data integrity commitments and stringent analytical accuracy requirements. The market maintains strong growth through focus on Industry 4.0 integration and analytical excellence, with a CAGR of 5.5% through 2035.

Key development areas:

The Brazilian market leads in Latin American laser component analyzer adoption based on expanding pharmaceutical research operations and growing analytical laboratory infrastructure in major research centers. The country shows solid potential with a CAGR of 5.0% through 2035, driven by pharmaceutical sector investment and increasing domestic demand for precision analytical instruments across drug development, materials characterization, and industrial quality control sectors. Brazilian researchers are adopting laser component analyzer technology for compliance with pharmaceutical quality standards, particularly in generic drug development requiring bioequivalence studies and in materials research where particle size control impacts product performance. Technology deployment channels through laboratory equipment distributors, analytical instrument representatives, and equipment financing programs expand coverage across pharmaceutical research facilities and materials testing laboratories.

Leading market segments:

The USA market leads in advanced laser component analyzer applications based on integration with sophisticated laboratory automation systems and comprehensive data management platforms for enhanced analytical efficiency. The country shows solid potential with a CAGR of 4.6% through 2035, driven by pharmaceutical research expansion and increasing adoption of advanced analytical technologies across drug development, materials science, and industrial quality control sectors. American researchers are implementing laser component analyzer systems for high-precision particle characterization requirements, particularly in biopharmaceutical development demanding submicron particle analysis and in nanomaterials research where size distribution data directly impacts material properties. Technology deployment channels through laboratory equipment distributors, analytical instrument specialists, and direct manufacturer relationships expand coverage across diverse research operations.

Leading market segments:

The UK market demonstrates consistent implementation focused on pharmaceutical research and materials characterization, with documented integration of laser component analyzer systems achieving 30-40% improvement in analytical throughput for particle sizing operations. The country maintains steady growth momentum with a CAGR of 4.1% through 2035, driven by pharmaceutical research presence and materials science requirements for precision particle characterization capabilities. Major research regions, including South East England, North West England, and Scotland, showcase deployment of advanced particle sizing technologies that integrate with existing analytical infrastructure and support quality requirements in pharmaceutical and materials research operations.

Key market characteristics:

Japan's market demonstrates sophisticated implementation focused on materials science research and pharmaceutical development, with documented integration of advanced particle sizing systems achieving 40-45% reduction in analytical cycle times through optimized measurement protocols. The country maintains steady growth momentum with a CAGR of 3.6% through 2035, driven by analytical excellence culture and focus on measurement precision principles aligned with quality-focused research philosophies. Major research regions, including Tokyo, Osaka, Kanagawa, and Aichi, showcase advanced deployment of precision particle sizing technologies that integrate seamlessly with automated analytical workflows and comprehensive quality assurance systems.

Key market characteristics:

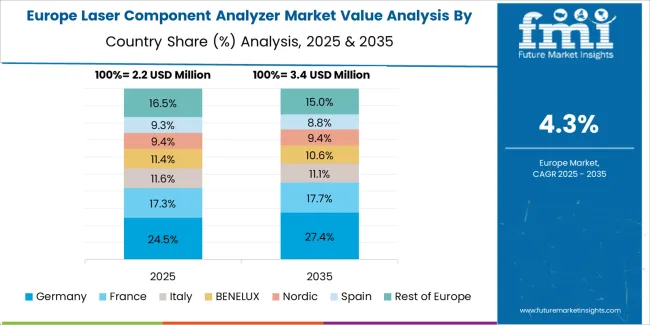

The laser component analyzer market in Europe is projected to grow from USD 0.7 million in 2025 to USD 20.0 million by 2035, registering a CAGR of 40.1% over the forecast period. Germany is expected to maintain its leadership position with a 34.2% market share in 2025, declining slightly to 33.5% by 2035, supported by its extensive pharmaceutical research infrastructure and major materials science centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia research regions.

France follows with a 19.6% share in 2025, projected to reach 20.1% by 2035, driven by comprehensive pharmaceutical development programs and materials research activities in major scientific regions. The United Kingdom holds a 16.3% share in 2025, expected to reach 16.8% by 2035 through pharmaceutical research centers and materials characterization facilities. Italy commands a 12.7% share in both 2025 and 2035, backed by pharmaceutical development and materials science research. Spain accounts for 9.1% in 2025, rising to 9.4% by 2035 on pharmaceutical research expansion and materials analysis sector growth. The Rest of Europe region is anticipated to hold 8.1% in 2025, expanding to 8.5% by 2035, attributed to increasing laser component analyzer adoption in Nordic research facilities and emerging Central & Eastern European pharmaceutical development operations.

The Japanese market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of portable analyzer systems with existing research infrastructure across pharmaceutical development laboratories, materials science facilities, and industrial quality control operations. Japan's focus on measurement precision and analytical excellence drives demand for particle sizing instruments that support quality commitments and research objectives in competitive scientific environments. The market benefits from strong partnerships between international analytical instrument providers and domestic laboratory equipment distributors including major scientific trading companies, creating comprehensive service ecosystems that prioritize technical support and application development programs. Research centers in Tokyo, Osaka, Kanagawa, and other major scientific areas showcase advanced analytical implementations where laser component analyzer systems achieve 98% measurement repeatability through optimized analytical protocols and comprehensive quality verification systems.

The South Korean market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical support and application engineering capabilities for pharmaceutical development and materials characterization applications. The market demonstrates increasing focus on analytical automation and measurement quality, as Korean researchers increasingly demand advanced particle sizing solutions that integrate with domestic laboratory infrastructure and sophisticated data management systems deployed across major research complexes. Regional analytical instrument distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including technical training programs and application-specific analytical solutions for pharmaceutical and materials research operations. The competitive landscape shows increasing collaboration between multinational analytical instrument companies and Korean laboratory equipment specialists, creating hybrid service models that combine international product development expertise with local technical support capabilities and rapid response systems.

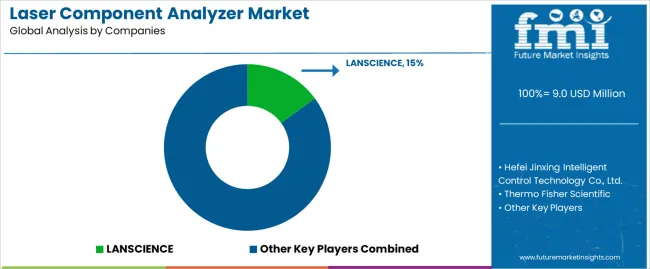

The market features approximately 15-20 meaningful players with moderate fragmentation, where the top three companies control roughly 38-42% of global market share through established distribution networks and comprehensive application support portfolios. Competition centers on measurement accuracy consistency, instrument reliability, and technical service capabilities rather than price competition alone. LANSCIENCE leads with approximately 15.0% market share through its comprehensive particle sizing solutions portfolio and strong presence in Asian pharmaceutical research markets.

Market leaders include LANSCIENCE, Hefei Jinxing Intelligent Control Technology Co., Ltd., and Thermo Fisher Scientific, which maintain competitive advantages through global distribution infrastructure, advanced laser optics technology, and deep expertise in application development across multiple research sectors, creating trust and reliability advantages with pharmaceutical researchers and materials characterization laboratories. These companies leverage research and development capabilities in optical system optimization and ongoing technical support relationships to defend market positions while expanding into emerging pharmaceutical research markets and specialized nanomaterials characterization segments.

Challengers encompass Anton Paar GmbH and Beckman Coulter, which compete through specialized product offerings and strong regional presence in key research markets. Product specialists, including TSI Incorporated, Malvern Panalytical Ltd, and Microtrac, focus on specific analyzer configurations or regional markets, offering differentiated capabilities in custom optical designs, rapid measurement protocols, and competitive pricing structures.

Regional players and emerging analytical instrument manufacturers create competitive pressure through localized service advantages and rapid response capabilities, particularly in high-growth markets including China and India, where proximity to pharmaceutical research clusters provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven measurement performance with comprehensive application engineering offerings that address the complete analytical workflow from sample preparation through data interpretation and method validation.

Laser component analyzers represent advanced analytical instruments that enable researchers to achieve 40-60% time reduction compared to conventional particle sizing methods, delivering superior measurement accuracy and analytical throughput with broad size range coverage and excellent repeatability in demanding characterization applications. With the market projected to grow from USD 9.0 million in 2025 to USD 14.4 million by 2035 at a 4.8% CAGR, these precision analytical systems offer compelling advantages including measurement speed, size range versatility, and operational simplicity, making them essential for scientific research applications (20.0% market share), industrial manufacturing operations (20.9% share), and analytical facilities seeking alternatives to conventional particle sizing methods that compromise productivity through longer analysis times and limited measurement ranges. Scaling market adoption and technology deployment requires coordinated action across research policy, analytical infrastructure development, instrument manufacturers, research laboratories, and scientific equipment investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 9.0 million |

| Device Type | Portable, Desktop |

| Application | Scientific Research, Industrial Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | LANSCIENCE, Hefei Jinxing Intelligent Control Technology Co., Ltd., Thermo Fisher Scientific, Anton Paar GmbH, Beckman Coulter, TSI Incorporated, Malvern Panalytical Ltd, Microtrac |

| Additional Attributes | Dollar sales by device type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with analytical instrument manufacturers and distribution networks, research laboratory requirements and specifications, integration with automated sampling systems and laboratory information management platforms, innovations in laser optics technology and detection systems, and development of specialized particle sizing solutions with enhanced measurement range and accuracy capabilities. |

The global laser component analyzer market is estimated to be valued at USD 9.0 million in 2025.

The market size for the laser component analyzer market is projected to reach USD 14.4 million by 2035.

The laser component analyzer market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in laser component analyzer market are portable and desktop.

In terms of application, scientific research segment to command 20.0% share in the laser component analyzer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laser-Assisted Smart Lathes Market Size and Share Forecast Outlook 2025 to 2035

Laser Drilling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Measuring Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Laser Interferometer Market Size and Share Forecast Outlook 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA