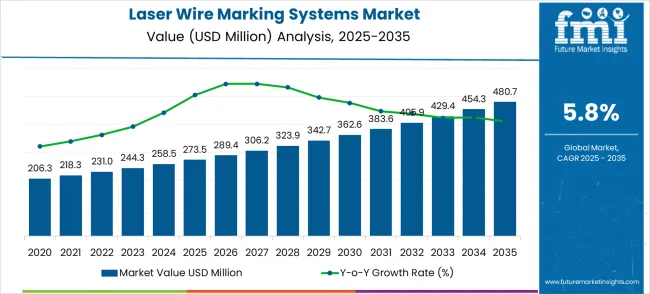

The global laser wire marking systems market is estimated to grow from USD 273.5 million in 2025 to approximately USD 480.7 million by 2035, recording an absolute increase of USD 207.2 million over the forecast period. This translates into a total growth of 75.7%, with the market forecast to expand at a CAGR of 5.8% between 2025 and 2035. The market size is expected to grow by nearly 1.76X during the same period, supported by increasing demand for wire identification and traceability solutions across various industrial automation, aerospace manufacturing, and medical device production applications.

Between 2025 and 2030, the laser wire marking systems market is projected to expand from USD 273.5 million to USD 362.6 million, resulting in a value increase of USD 89.1 million, which represents 43.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising industrial automation across global manufacturing sectors, increasing demand for wire identification systems in complex electrical assemblies, and growing adoption of laser marking technologies in aerospace and defense applications. Manufacturing companies are investing in advanced marking systems to improve traceability and meet stringent quality standards in wire harness production.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 273.5 million |

| Market Forecast Value (2035) | USD 480.7 million |

| Forecast CAGR (2025–2035) | 5.8% |

From 2030 to 2035, the market is forecast to grow from USD 362.6 million to USD 480.7 million, adding another USD 118.1 million, which constitutes 57.0% of the overall ten-year expansion. This period is expected to be characterized by expansion of electric vehicle manufacturing in developing countries, integration of Industry 4.0 technologies in marking systems, and development of specialized marking solutions for medical device and defense applications. The growing focus on product traceability and quality assurance will drive demand for intelligent and precisely engineered laser wire marking solutions across multiple industrial sectors.

Between 2020 and 2025, the market experienced steady expansion, driven by increasing automation in manufacturing industries and growing recognition of wire identification importance in complex electronic systems. The market developed as manufacturers recognized the need for permanent, high-quality marking solutions to support traceability requirements and meet evolving industry standards. Quality assurance requirements and regulatory compliance began influencing procurement decisions toward advanced laser marking technologies from established equipment manufacturers.

Market expansion is being supported by the increasing industrial automation across global manufacturing sectors and the corresponding need for advanced identification and traceability systems in complex wire harness assemblies and electronic manufacturing applications. Modern manufacturing operations require sophisticated marking solutions that provide permanent, high-quality identification while supporting automated production processes and quality control requirements. The excellent precision and durability characteristics of laser wire marking systems make them essential components in demanding manufacturing environments where traceability and quality assurance are critical.

The growing focus on product traceability and regulatory compliance is driving demand for advanced marking technologies from certified manufacturers with proven track records of reliability and performance. Manufacturing companies are increasingly investing in laser marking systems that offer superior marking quality and operational efficiency over conventional labeling methods. Industry standards and quality requirements are establishing performance benchmarks that favor precision-engineered laser marking solutions with advanced automation and integration capabilities.

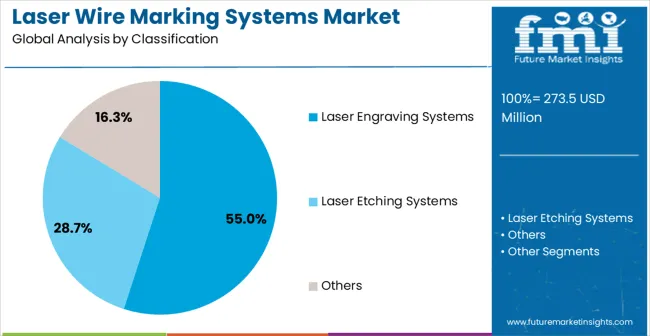

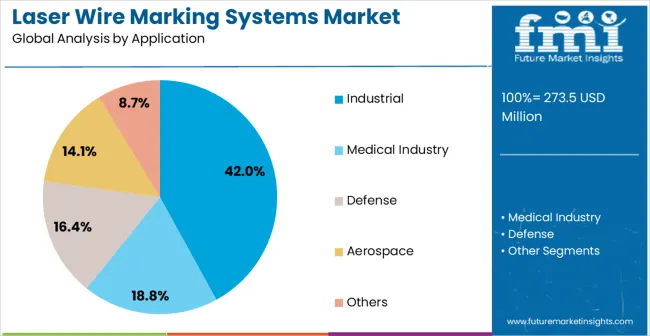

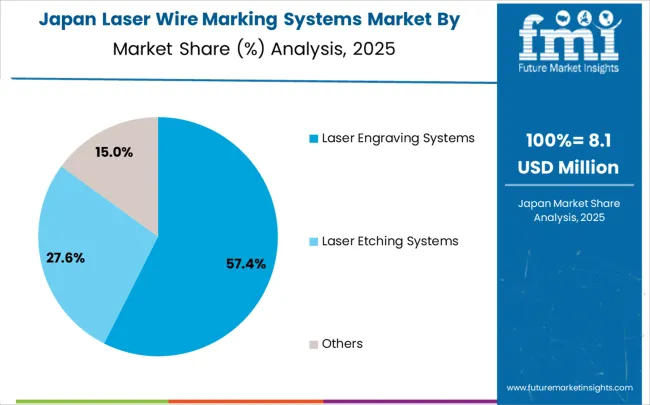

The market is segmented by system type, application, and region. By marking technology, the market is divided into laser engraving systems, laser etching systems, and other specialized configurations. Based on application, the market is categorized into industrial manufacturing, medical industry, defense, aerospace, and other specialized applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Laser engraving systems are projected to account for 55% of the laser wire marking systems market in 2025. This leading share is supported by the superior marking depth and durability that laser engraving provides in demanding industrial applications. Laser engraving systems offer excellent marking permanence with precise control over marking depth, making them the preferred choice for aerospace, defense, and industrial applications requiring long-term identification durability. The segment benefits from technological advancements that have improved marking speed and quality while reducing operational complexity and maintenance requirements.

Modern laser engraving systems incorporate advanced beam control technologies, sophisticated software interfaces, and automated handling systems that ensure optimal marking quality while maintaining high production throughput. These innovations have significantly improved marking consistency and operational reliability while reducing setup time through automated calibration and user-friendly programming interfaces. The aerospace and defense sectors particularly drive demand for laser engraving solutions, as these industries require permanent identification that withstands extreme environmental conditions and long service life.

The automotive and industrial manufacturing sectors increasingly adopt laser engraving systems for applications where marking durability and regulatory compliance are essential considerations. The integration of smart monitoring systems and quality control capabilities creates opportunities for enhanced traceability and automated quality assurance, further accelerating market adoption as manufacturers seek reliable yet advanced marking solutions.

Industrial manufacturing applications are expected to represent 42% of laser wire marking systems demand in 2025. This dominant share reflects the widespread use of wire marking in general industrial automation and manufacturing operations across diverse sectors. Industrial applications require reliable marking systems for wire identification, process control, and quality assurance in automated manufacturing environments. The segment benefits from ongoing industrial automation trends globally and increasing complexity of electrical systems requiring comprehensive wire identification solutions.

Industrial applications demand exceptional marking reliability to support diverse manufacturing requirements across varying production environments and quality standards. These applications require marking systems capable of handling different wire types, maintaining consistent quality during extended production runs, and integrating with automated production lines and quality control systems. The growing focus on manufacturing efficiency and traceability drives consistent demand for proven marking technologies that demonstrate superior performance and operational reliability. Major manufacturing companies across automotive, electronics, and general industrial sectors contribute significantly to market growth as facilities invest in advanced marking technologies to improve production efficiency and meet quality standards.

The trend toward smart manufacturing and Industry 4.0 integration in industrial operations creates opportunities for intelligent marking systems equipped with data connectivity and process monitoring capabilities. The segment also benefits from increasing regulatory requirements for product traceability and quality documentation in manufacturing operations.

The market is advancing steadily due to increasing industrial automation and growing recognition of wire identification importance in complex electronic systems. The market faces challenges including high initial equipment costs compared to conventional marking methods, technical complexity requiring specialized training, and varying marking requirements across different wire types and applications. Standardization efforts and training programs continue to influence adoption patterns and operational efficiency optimization.

The growing deployment of IoT-enabled marking systems and advanced data connectivity is enabling real-time production monitoring and comprehensive traceability documentation in wire marking applications. Smart marking systems provide continuous monitoring of marking quality while optimizing production throughput and maintaining comprehensive quality records. These technologies are particularly valuable for manufacturing facilities that require automated quality assurance and comprehensive traceability without manual intervention and documentation processes.

Modern marking system manufacturers are incorporating advanced laser technologies and multi-material marking capabilities that enable superior marking quality while accommodating diverse wire types and coating materials. Integration of variable marking parameters and adaptive laser control enables optimal marking performance and significant efficiency advantages compared to conventional single-parameter marking systems. Advanced beam delivery and control systems also support development of high-speed marking solutions for demanding production environments requiring exceptional throughput and quality.

| Country | CAGR (2025–2035) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| United States | 5.5% |

| United Kingdom | 4.9% |

| Japan | 4.4% |

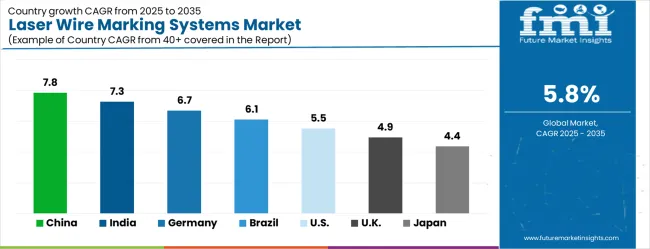

The market is growing rapidly, with China leading at a 7.8% CAGR through 2035, driven by massive manufacturing expansion, increasing industrial automation adoption, and growing demand for advanced marking technologies in electronics and automotive production. India follows at 7.3%, supported by rising industrial development and growing investments in modern manufacturing equipment and automation technologies. Germany records strong growth at 6.7%, focusing precision engineering, advanced manufacturing capabilities, and Industry 4.0 integration. Brazil grows steadily at 6.1%, integrating modern marking systems into expanding automotive and industrial manufacturing operations. The United States shows moderate growth at 5.5%, focusing on aerospace and defense applications with advanced marking requirements. The United Kingdom maintains steady expansion at 4.9%, supported by aerospace industry development and advanced manufacturing programs. Japan demonstrates stable growth at 4.4%, focusing technological innovation and precision manufacturing excellence.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to grow at a CAGR of 7.8% from 2025 to 2035, primarily driven by strong demand from aerospace, automotive, and defense manufacturing. The country’s growing aircraft component production and rapid automotive wiring harness expansion are creating higher reliance on laser wire marking systems due to their durability and compliance with international standards. With rising export requirements, Chinese manufacturers are focusing on integrating automated wire marking technologies to maintain competitiveness in global supply chains. Key industrial hubs such as Shanghai, Shenzhen, and Tianjin are recording significant adoption, supported by government-backed initiatives to modernize aerospace and automotive facilities. Both local manufacturers and global suppliers are competing actively, with the latter entering joint ventures and partnerships to increase accessibility of high-performance laser marking systems in China’s large-scale production ecosystem.

India is expected to record a CAGR of 7.3% between 2025 and 2035, supported by increasing defense manufacturing and aerospace expansion under national programs. Rising focus on indigenous aircraft and military equipment production has resulted in higher adoption of laser wire marking systems for regulatory compliance and precision requirements. States such as Karnataka and Maharashtra are emerging as adoption hubs due to their aerospace and electronics manufacturing clusters. Indian companies are gradually shifting toward advanced marking solutions, while global suppliers are expanding partnerships with local distributors to enhance product availability. The rise of electronics manufacturing under government initiatives, coupled with modernization of defense infrastructure, further contributes to steady demand. Affordability and adaptability to diverse production scales are influencing supplier strategies in the Indian market.

Germany is forecasted to expand at a CAGR of 6.7% between 2025 and 2035, supported by its robust automotive and aerospace industries. Stringent compliance regulations for wiring harnesses used in exports have reinforced adoption of high-precision laser wire marking systems. German manufacturers are investing in technologically advanced systems that deliver higher accuracy, speed, and integration with automated production lines. Industrial centers such as Bavaria, Baden Württemberg, and North Rhine Westphalia are leading adoption, with consistent procurement by Tier 1 automotive and aerospace suppliers. Export-driven manufacturing across Germany requires adherence to international aviation and automotive standards, further boosting demand. Domestic players remain competitive, while imports from other European suppliers complement the market with innovative solutions. Continuous investment in automation ensures long-term growth momentum.

Brazil is expected to grow at a CAGR of 6.1% between 2025 and 2035, largely influenced by investments in aerospace and automotive manufacturing. Modernization of industrial facilities has reinforced the need for efficient and precise wire marking systems to meet global export standards. São Paulo and Rio de Janeiro have emerged as strong adoption hubs, supported by aerospace manufacturing programs and rising automotive production. Domestic suppliers are largely focused on cost-effective solutions, while international suppliers from North America and Europe are entering the Brazilian market with high-performance equipment. Demand is also being shaped by stricter compliance for aviation and defense components, requiring precision and durability. Long-term prospects are positive, with Brazil positioning itself as a key market in Latin America for wire marking solutions.

The United States is expected to expand at a CAGR of 5.5% between 2025 and 2035, driven by aerospace, defense, and space exploration industries. Compliance with stringent wiring regulations in aviation, spacecraft, and defense systems has reinforced the adoption of laser wire marking systems across production units. States such as California, Texas, and Florida are leading in demand due to the presence of large aerospace and defense clusters. Domestic manufacturers are actively developing automated and high-speed systems tailored to large-scale production needs. Collaboration between USA suppliers and aerospace companies is driving innovation, with focus on digital integration and operational efficiency. Long-term growth is supported by consistent federal investments in defense modernization and increasing space exploration initiatives.

The United Kingdom is projected to grow at a CAGR of 4.9% from 2025 to 2035, supported by aerospace and defense modernization programs. Rising production of aircraft components and defense equipment is contributing to steady adoption of precision laser wire marking systems. Demand is concentrated in regions like London, Manchester, and Birmingham, where major aerospace and defense clusters are located. UK-based suppliers are producing durable and precision-focused solutions, but a significant share of advanced equipment is imported from Germany and the USA The market is further shaped by government-backed defense initiatives requiring compliance with stringent wiring standards. The steady adoption is expected due to modernization in industrial and defense applications.

Japan is forecasted to grow at a CAGR of 4.4% between 2025 and 2035, influenced by its precision-driven electronics, automotive, and aerospace industries. Rising requirements for accuracy and durability in wire harnesses have reinforced demand for advanced laser wire marking systems. Tokyo, Osaka, and Nagoya are acting as strong adoption hubs, supported by industrial manufacturing and aerospace activities. Domestic manufacturers are focusing on compact, high-accuracy systems tailored to specific industry needs, while imports from Europe and the USA broaden availability. The competitive landscape in Japan is defined by continuous innovation, with focus on efficiency and compliance. Long-term prospects are stable, as high-quality standards in Japanese industries sustain demand.

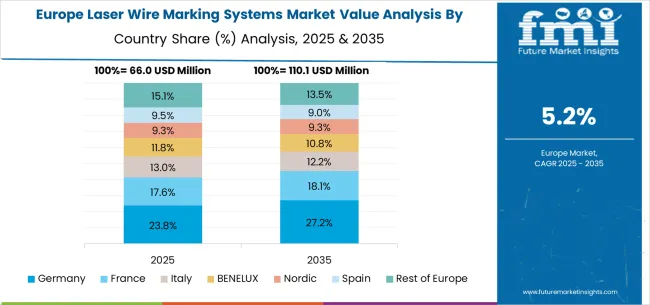

The laser wire marking systems market in Europe is projected to grow from USD 73.8 million in 2025 to USD 129.6 million by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain its leadership with a 29.4% share in 2025, supported by its strong manufacturing base and advanced industrial automation infrastructure. The United Kingdom follows with 18.6% market share, driven by aerospace industry development and advanced manufacturing programs. France holds 15.9% of the European market, benefiting from aerospace manufacturing and industrial automation investments. Italy and Spain collectively represent 22.1% of regional demand, with growing focus on automotive and industrial marking applications. The Rest of Europe region accounts for 14.0% of the market, supported by manufacturing development in Eastern European countries and Nordic industrial automation sectors.

The market is defined by competition among established laser equipment manufacturers, specialized marking system companies, and integrated automation solution providers. Companies are investing in advanced laser technologies, software development, automation integration capabilities, and comprehensive technical support services to deliver reliable, efficient, and user-friendly marking solutions. Strategic partnerships, technology innovation, and market expansion are central to strengthening product portfolios and industry presence.

KEYENCE, operating globally, offers comprehensive laser marking solutions with focus on precision engineering, user-friendly operation, and comprehensive technical support services. Tri-Star Technologies provides specialized wire marking systems with focus on industrial applications and custom solutions. Spectrum Technologies delivers advanced marking equipment with focus on aerospace and defense applications requiring exceptional durability and precision. Laserax offers comprehensive laser marking technologies with automation integration and process optimization capabilities.

Cajo provides specialized wire marking solutions with focus on European market applications and technical expertise. HeatSign delivers innovative marking systems with focus on high-speed production applications. Schleuniger offers integrated wire processing and marking solutions with comprehensive automation capabilities. SymarTech s.r.o. provides specialized marking systems with regional expertise and application development.

Videojet and US HellermannTyton offer specialized marking expertise, comprehensive product portfolios, and technical support across global and regional industrial markets.

The laser wire marking systems market underpins manufacturing traceability, quality assurance, industrial automation, and regulatory compliance. With automation mandates, quality requirements, and demand for advanced identification solutions, the sector must balance technology innovation, operational reliability, and cost effectiveness. Coordinated contributions from governments, industry bodies, manufacturers, technology integrators, and investors will accelerate the transition toward smart, automated, and precision-optimized wire marking systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 273.5 million |

| Classification Type | Laser Engraving Systems, Laser Etching Systems, Others |

| Application | Industrial, Medical Industry, Defense, Aerospace, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and 40+ other countries |

| Key Companies Profiled | KEYENCE, Tri-Star Technologies, Spectrum Technologies, Laserax, Cajo, HeatSign, Schleuniger, SymarTech s.r.o., Videojet, US HellermannTyton |

| Additional Attributes | Dollar sales by system type and application, regional demand trends, competitive landscape, buyer preferences, integration with automation and Industry 4.0, innovations in laser control and marking precision, adoption of smart marking solutions with real-time monitoring and QA for manufacturing traceability and operational optimization |

The global laser wire marking systems market is estimated to be valued at USD 273.5 million in 2025.

The market size for the laser wire marking systems market is projected to reach USD 480.7 million by 2035.

The laser wire marking systems market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in laser wire marking systems market are laser engraving systems, laser etching systems and others.

In terms of application, industrial segment to command 42.0% share in the laser wire marking systems market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA