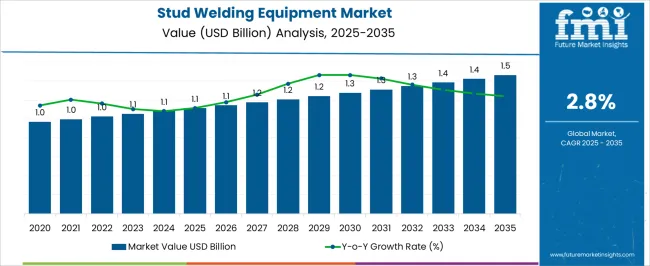

The Stud Welding Equipment Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.5 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

| Metric | Value |

|---|---|

| Stud Welding Equipment Market Estimated Value in (2025 E) | USD 1.1 billion |

| Stud Welding Equipment Market Forecast Value in (2035 F) | USD 1.5 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

The stud welding equipment market is demonstrating stable expansion as industries increasingly adopt efficient fastening solutions for construction, automotive, shipbuilding, and manufacturing operations. Market growth is being shaped by the rising demand for high-strength welds, advancements in automation, and the ability of stud welding systems to deliver precision and reduced labor requirements.

Current market dynamics highlight the integration of digital controls, enhanced energy efficiency, and improved operational reliability. The future outlook is being supported by broader applications across lightweight structural assemblies and the expansion of automated fabrication facilities.

Growth rationale is anchored on the ability of stud welding equipment to ensure consistent joint quality, reduce cycle time, and minimize material wastage, while ongoing investments in automation and customized welding solutions are expected to drive adoption across emerging and established industrial hubs Over the forecast horizon, sustained demand from infrastructure and automotive sectors is projected to reinforce market penetration and revenue growth.

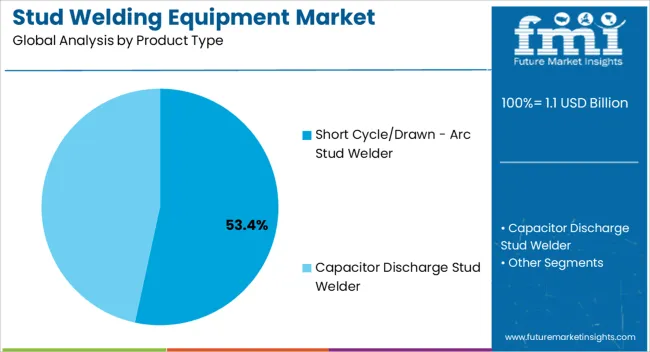

The short cycle/drawn-arc stud welder segment, representing 53.40% of the product type category, has maintained its leading position due to its versatility, efficiency, and suitability for diverse industrial applications. Market share is being reinforced by the equipment’s ability to handle both small and large-diameter studs while delivering superior weld strength.

Consistent demand has been driven by automotive manufacturing and construction activities where rapid fastening is required. Reliability, cost-effectiveness, and adaptability to different metals have further strengthened adoption.

Ongoing enhancements in power electronics and digital monitoring are ensuring greater precision and operational stability With growing preference for equipment that delivers high throughput and low defect rates, this segment is expected to retain its leadership across key industries.

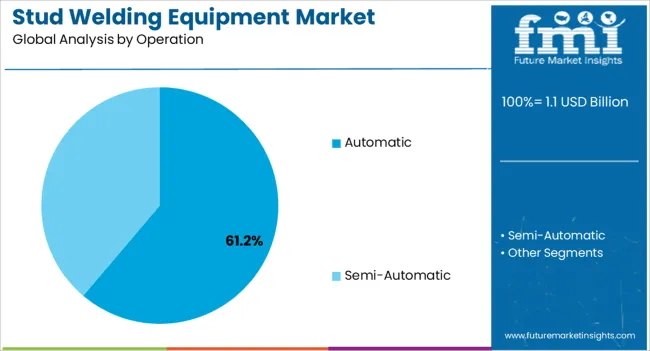

The automatic operation segment, accounting for 61.20% of the operation category, has emerged as the dominant mode due to the increasing emphasis on productivity and automation in manufacturing. Adoption has been supported by reduced reliance on manual labor, consistency in weld quality, and minimized error rates.

The ability to integrate with robotic systems and computer-controlled platforms has enhanced precision and repeatability. Demand has been reinforced by large-scale manufacturing plants and assembly lines where efficiency and speed are critical.

Investments in automated welding solutions, combined with ongoing digitalization trends, are further expanding the role of automatic stud welding systems in achieving cost efficiency and high-volume production.

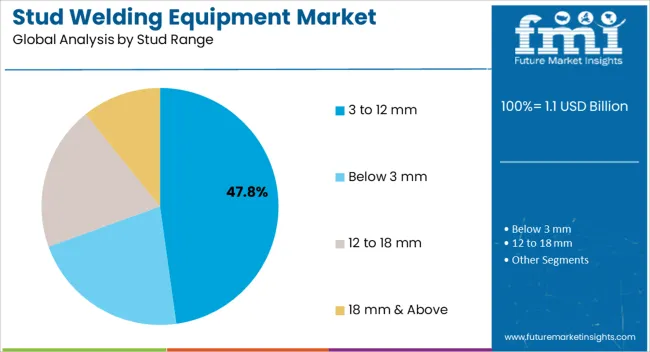

The 3 to 12 mm stud range segment, holding 47.80% of the stud range category, has been leading the market due to its broad applicability in automotive, electronics, and construction sectors. This range is preferred for its balance between strength and flexibility, allowing it to serve both lightweight and moderate-load applications.

Consistent demand has been observed from industries requiring precision fastening without compromising structural integrity. The segment’s dominance is being sustained by adaptability across multiple materials, including steel and aluminum, as well as compatibility with both manual and automated systems.

Ongoing improvements in equipment design that support efficient welding within this stud range are expected to maintain its leading market share and ensure sustained adoption across key end-use industries.

Manufacturers Aim to Capture a Niche Segment by Developing Energy-efficient Solutions

Developing welding technology solutions that are energy-efficient, meet sustainability targets, and earn environmental credits and certifications is a strategic opportunity for market players. Equipment that helps fulfill energy efficiency criteria is frequently given priority by clients in sectors with strict sustainability regulations. Businesses can capitalize on the growing consumer focus on green certifications and sustainable manufacturing methods by marketing their products as energy-efficient and ecologically responsible.

Trend of Integrating Collaborative Robots in Stud Welding Operations

Collaborative robots, or cobots, are being strategically incorporated into stud welding processes to improve industrial safety and agility. Collaboration between humans and robots can provide firms with more operational flexibility, allowing them to adapt quickly to shifting needs for manufacturing. In addition to highlighting the value of flexible work conditions, this trend puts businesses at the forefront of technical advancements. It demonstrates their dedication to productivity, security, and forward-thinking production techniques.

Industry 4.0 Revolution Stimulates Wireless Connectivity Integration in Welding Equipment

Welding process equipment has strategically adapted to the Industry 4.0 revolution by integrating wireless communication characteristics. Through the provision of real-time monitoring, remote control, and data transmission, enterprises augment the flexibility and mobility of welding procedures. This trend portrays a dedication to digital transformation by offering solutions that meet the current industrial operations' needs for connectedness and agility. Businesses that integrate wireless connectivity into their stud welding equipment are demonstrating that they are forward-thinking in their approach to operational efficiency and responsiveness, positioning themselves as leaders in adopting cutting-edge technology.

| Attributes | Details |

|---|---|

| Stud Welding Equipment Market Size (2020) | USD 953.2 million |

| Historical Market Size (2025) | USD 1,081.20 million |

| Historical CAGR (2020 to 2025) | 3.20% |

The stud welding equipment market expanded at a 3.20% CAGR during the historical period from 2020 to 2025. The minor drop in the growth rate can be attributed to the slowdown in investment and project activities in certain regions. Nonetheless, the global economic boom and widespread industrialization have increased the demand for accurate and productive welding techniques. Stud welding is a common industrial technique used to attach parts in a variety of sectors, including electronics, appliances, and equipment. Consequently, the need for stud welding equipment is rising due to the growing manufacturing sector.

Existing infrastructure frequently needs repair and maintenance, which contributes to the continued demand for stud welding equipment in renovation and refurbishing projects. Several governments across the world are investing in large-scale infrastructure investments, such as roads, bridges, airports, and public buildings. Stud welding is a popular way to build these structures, raising the demand for stud welding equipment.

The market is expected to develop at a slightly lower CAGR of 2.90% over the next decade. The prefabrication trend in building and industry is projected to continue to rise. Arc stud welding, being a viable method for attaching prefabricated components, is likely to experience an increase in demand as companies embrace off-site building procedures. As companies seek ways to reduce weight in buildings and goods, demand for welding equipment capable of combining lightweight materials is likely to increase over the forecast period.

| Trends |

|

|---|---|

| Opportunities |

|

| Challenges |

|

| Top End Use | Metal Fabrication |

|---|---|

| Value Share (2025) | 22.00% |

The use of stud welding for quick and efficient procedures in metal fabrication is contributing to the segment’s growth. The stud welding process's speed is beneficial in achieving project deadlines, which is an important aspect in the fast-paced world of metal fabrication. The ever-growing trend toward prefabrication and modular building in metal fabrication fits well with stud welding capabilities. Its effectiveness in constructing prefabricated metal components supports the industry's transition to new construction methods.

| Top Product Type | Arc Stud Welder |

|---|---|

| Value Share (2025) | 29.00% |

The popularity of arc stud welders is driven by their exceptional efficiency and quick welding capabilities. The speed with which it finishes welds is in sync with the desire for quick and simplified procedures in various sectors, strengthening its market dominance. Arc stud welding is in high demand because of its application in heavy-duty building projects. Its ability to form strong and long-lasting connections in large-scale building projects makes it a vital tool in the toolbox of builders and fabricators.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.50% |

| United Kingdom | 2.50% |

| Germany | 2.30% |

| India | 3.60% |

| China | 3.40% |

The demand for stud welding equipment in the United States is predicted to rise at a 2.50% CAGR through 2035. Due to significant developments in the defense and aerospace industries, stud welding machines are gaining significance in the United States market.

Stud welding methods' accuracy and durability make them necessary for manufacturing parts critical to national defense and aerospace applications, promoting long-term market growth. Additionally, the increased emphasis on strengthening manufacturing resilience in the United States drives up demand for stud welding equipment. Stud welding pops up as a vital component of a wider effort to enhance local manufacturing capabilities, harmonizing with the national objective for industrial resurrection.

Sales of stud welding equipment in the United Kingdom are projected to surge at a 2.50% CAGR through 2035. The broadening offshore wind energy projects and marine infrastructure expansions in the United Kingdom create a push for the proliferation of the stud welding equipment industry.

The toughness and endurance of stud welding make it a popular choice in constructing and maintaining structures in harsh maritime environments, adding to the momentum in these industries. Furthermore, the surge in demand for stud welding equipment in the United Kingdom is strongly related to the nation's concentration on high-speed rail and transportation projects. The capacity of stud welding to create quick and strong connections is vital in the development of critical infrastructure, supporting its crucial role in the developing landscape of transportation efforts.

The analysis of the stud welding equipment market in Germany signifies expansion at a 2.30% CAGR through 2035. Germany's surge in demand for stud welding equipment is fueled by the country's dedication to technical leadership, notably in the automobile manufacturing industry.

The significance of stud welding in forming strong, lightweight connections is critical to the precise engineering necessary in Germany's modern vehicle manufacturing processes. Furthermore, the growing stud welding equipment market in Germany is driven by its adaptability to a wide range of metal alloys and its effectiveness in connecting complicated structures. Because of its adaptability, stud welding continues to be a versatile and favored solution for German companies involved in sophisticated and innovative production processes.

The stud welding equipment market size in India is projected to expand at a 3.60% CAGR through 2035. The fast expansion of renewable energy projects is driving the rapid rise of stud welding equipment in India.

The relevance of stud welding in the construction and maintenance of buildings for solar and wind energy installations makes it a critical technology in India's quest for sustainable energy alternatives. Furthermore, the momentum in India's stud welding equipment market is being bolstered by a greater emphasis on skill development in welding techniques. The technology gets greater acceptability as the workforce acquires proficiency in stud welding procedures, supporting its growing application in a variety of sectors.

The stud welding equipment market in China is predicted to rise at a 3.40% CAGR through 2035. In China, the growing demand for stud welding equipment is inextricably linked to government-led urbanization plans and mega-city developments.

Stud welding is emerging as a critical component in the efficient building of new urban areas, in line with China's ambitious aspirations for urban expansion and economic growth. Furthermore, advances in high-speed rail and transportation infrastructure are driving up demand for stud welding equipment in China. The effectiveness of stud welding in establishing strong connections helps the country's commitment to growing and updating its transportation networks, contributing to the sector's development.

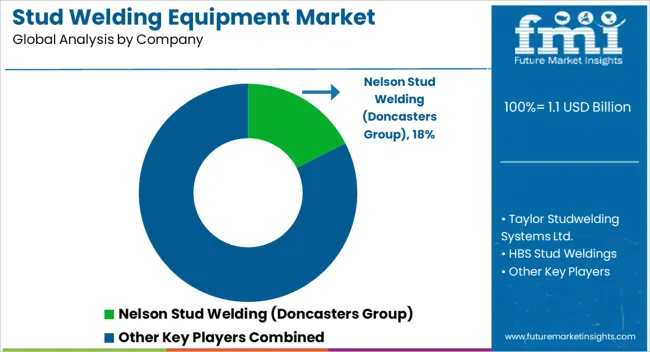

The stud welding equipment market's competitive landscape is defined by a dynamic interaction of prominent companies contending for market share and strategic positioning. Companies are engaged in an intensive rivalry typified by innovation, technical developments, and a focus on offering comprehensive welding solutions as demand for stud welding solutions continues to rise internationally. Established market giants are capitalizing on their deep knowledge and large distribution networks to preserve their dominance, while fresher competitors are attempting to carve out a niche through innovative technology and nimble business models.

Recent Developments in the Stud Welding Equipment Market

The global stud welding equipment market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the stud welding equipment market is projected to reach USD 1.5 billion by 2035.

The stud welding equipment market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in stud welding equipment market are short cycle/drawn - arc stud welder and capacitor discharge stud welder.

In terms of operation, automatic segment to command 61.2% share in the stud welding equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Student Information System Market

Sleep Study Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Wheel studs Market

Sleep Study Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pilates & Yoga Studios Market Trends - Growth & Outlook 2025 to 2035

Welding Electrodes and Rods Market Size and Share Forecast Outlook 2025 to 2035

Welding Filler Metal Market Size and Share Forecast Outlook 2025 to 2035

Welding Material Market Analysis by Type, Technology, End User, and Region 2025 to 2035

Welding Guns Market Growth - Trends & Forecast 2025 to 2035

Welding Consumables Market Growth - Trends & Forecast 2025 to 2035

Welding Torch and Tip Changing Robotic Station Market Growth – Trends & Forecast 2024-2034

Welding Helmets Market

Welding Equipment And Consumables Market Size and Share Forecast Outlook 2025 to 2035

Welding Fume Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seam Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA