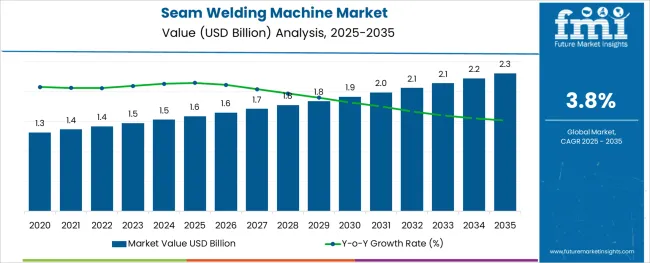

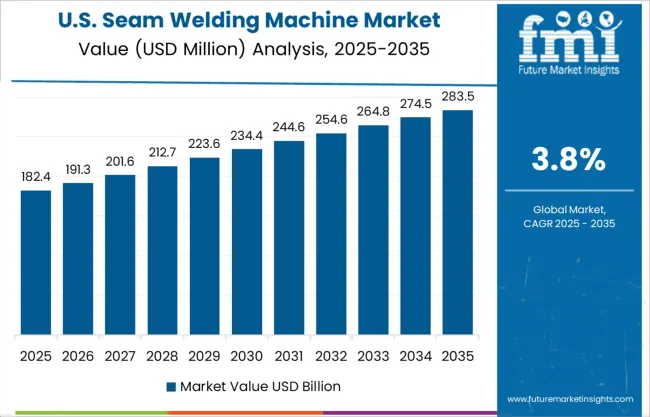

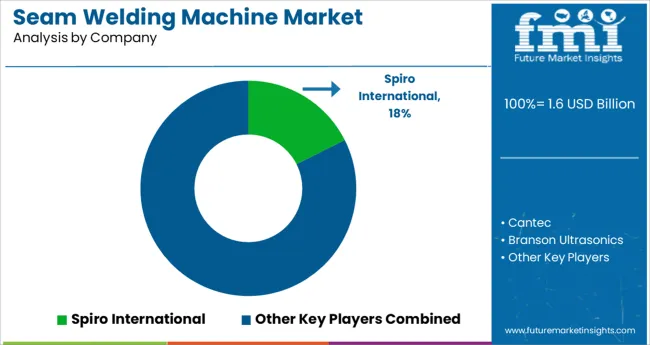

The Seam Welding Machine Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

The seam welding machine market is undergoing rapid transformation as industries including automotive, aerospace, and metal fabrication prioritize quality, consistency, and throughput in their welding operations. The push toward automated production lines and digitized quality assurance is reinforcing the demand for machines capable of delivering leak-proof, continuous welds with minimal operator intervention.

Manufacturers are integrating servo-controlled systems, real-time feedback mechanisms, and IoT-enabled diagnostics to enhance process control and reduce downtime. As lightweight metals and coated materials gain traction, precision welding technologies that prevent material distortion and support varied geometries are gaining prominence.

Additionally, stringent regulatory compliance related to joint integrity and safety is driving increased adoption across high-risk applications. With a rising need for energy-efficient, durable, and high-speed welding equipment, future growth opportunities are expected in modular seam welding platforms that align with lean manufacturing goals and global infrastructure investments.

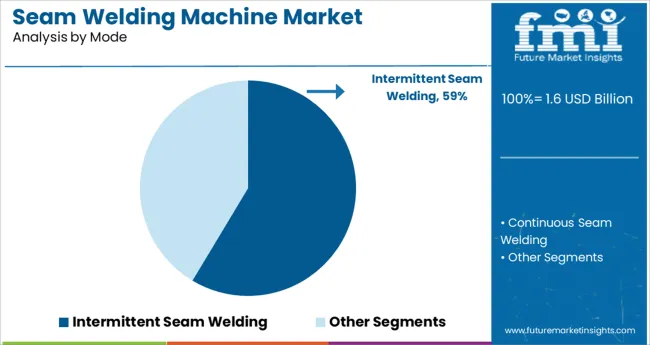

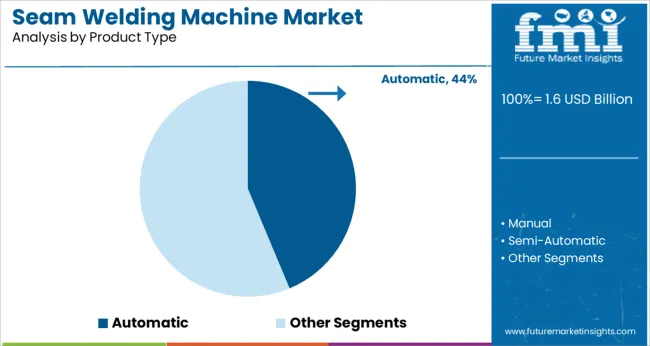

The market is segmented by Mode, Product Type, Wheel-Contact, and End-Use and region. By Mode, the market is divided into Intermittent Seam Welding and Continuous Seam Welding. In terms of Product Type, the market is classified into Automatic, Manual, and Semi-Automatic.

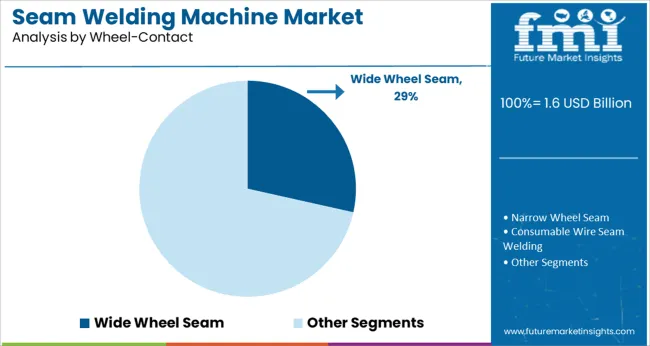

Based on Wheel-Contact, the market is segmented into Wide Wheel Seam, Narrow Wheel Seam, Consumable Wire Seam Welding, Mash Seam Welding, and Foil Butt Seam Welding. By End-Use, the market is divided into Industrial, Automotive Industry, Oil and Gas, and Construction Industry.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Intermittent seam welding is projected to dominate the market by capturing 58.6% of the revenue share in 2025, driven by its ability to deliver high-strength spot welds with reduced thermal distortion. This mode has been widely adopted in industries where material preservation, weld spacing flexibility, and minimal heat input are critical.

It is particularly effective for joining coated and heat-sensitive materials, making it a preferred option in applications that demand precise control over weld intervals. The reduced wear on electrodes and longer maintenance cycles associated with intermittent operation have contributed to lower ownership costs, which has further strengthened its appeal.

With advancements in controller technology and adaptive welding algorithms, intermittent seam welding machines are being favored for their balance of precision and energy efficiency, supporting their leadership in the segment.

The automatic product type is expected to account for 43.7% of the total revenue in 2025, marking it as the leading configuration within the seam welding machine category. This growth has been fueled by increasing demand for production efficiency, reduced manual intervention, and consistent weld quality.

Automatic machines offer closed-loop control, programmable logic integration, and robotic interfacing, making them ideal for high-volume manufacturing environments. The ability to operate with minimal operator supervision and achieve repeatable results has made them essential in automotive, HVAC, and appliance industries.

Additionally, investments in smart factories and Industry 4.0 practices are accelerating the deployment of automatic welding systems. As manufacturers continue to shift toward fully automated workflows, the demand for intelligent seam welding equipment with real-time monitoring and predictive maintenance features is expected to sustain the dominance of this product type.

The wide wheel seam subsegment within the wheel-contact category is anticipated to hold 28.5% of the market revenue in 2025, underscoring its relevance in high-strength and continuous weld applications. Wide wheels enable broader contact surfaces, distributing heat more evenly and allowing for deeper, more uniform welds across large material sections.

This configuration is particularly suited for joining thicker sheets and cylindrical components, commonly used in tank fabrication, automotive exhausts, and structural assemblies. The improved current distribution and longer electrode life associated with wide wheel designs have contributed to reduced maintenance requirements and higher operational uptime.

Additionally, the compatibility of wide wheels with both ferrous and non-ferrous materials has enhanced their adaptability across various industrial processes. As the market continues to prioritize reliability and performance, wide wheel seam machines are positioned as a key solution for large-scale, heavy-duty welding operations.

During the forecast period, the demand for seam welding machines is expected to grow as end users switch from manual to automated seam welding machines. Furthermore, the seam welding machine provides a distinctive combination of benefits that make it particularly popular in a variety of industries.

Strict government rules surrounding workplace safety are predicted to increase the sales of seam welding machines in end-use industries. Moreover, one of the seam welding machine’s crucial qualities is their ability to form airtight and watertight seals. This is crucial for making metal vessels or other structures that need to be protected from air or liquid leakage. As a result, the seam welding machine market size is anticipated to grow rapidly during the forecast period.

The rising demand from the consumer durable goods, construction & infrastructure, and transportation industries is projected to have a positive impact on the seam welding machine market outlook. Furthermore, seam welding is quicker than other options like spot welding as the entire process is mechanized.

Factors anticipated to propel the demand for seam welding machine includes the rising need to decrease operation time, increase production capacity, and enhance the reliability and stability of machinery at various locations.

The following are some of the limitations or disadvantages of seam welding machines, which are likely to restrain the market growth.

These factors are projected to affect the sales of seam welding machines during the forecast period.

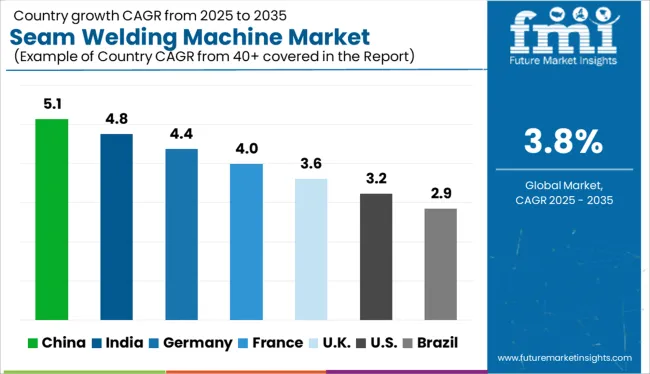

Europe is projected to dominate the seam welding machine market with a share of 24% by 2025. This growth is due to factors like ongoing improvements in welding and welding-related processes, trends in automation, and advancements in infrastructure development and construction projects.

The rising sales of seam welding machine are brought on by the rapidly-industrializing nature of the area, the expansion of smart factories, and the adoption of Industry 4.0 in manufacturing facilities.

By 2025, North America is anticipated to have the second-largest market share, at 22.0% percent. Rapid industrialization, rising government investments in the building and infrastructure sectors, and end-users of seam welding machines are strengthening their presence in North America through expansions, alliances, and significant strategic moves. These are the factors anticipated to propel the North American seam welding machine market growth during the projection period.

How are New Entrants Revolutionizing the Seam Welding Machine Market?

The start-up ecosystem in the seam welding machine market is moderate with a few start-ups focused on manufacturing machines that are precisely constructed, have a thoughtful design, and have a sturdy structure, making them appropriate for long periods of trouble-free use.

Before being delivered, every seam welding machine is put through a series of rigorous testing procedures to ensure that it is suitable for installation and use at the customer's facility right away. The air-operated seam welding machines have a contemporary design and a choice of different features to ensure efficient use in all seam welding applications. Manufacturers produce, provide, and export seam welding machines to their clients in a variety of specifications.

In December 2024, Lincoln Electric announced a VRTEX OxyFuel Cutting feature that blends welding and cutting by allowing users to practice torch cutting safely and realistically. The Harris Products Group is a Lincoln Electric subsidiary and the industry leader in cutting.

Who are some of the Key Market Players in the Seam Welding Machine Market?

Key players in the seam welding machine market are putting an emphasis on organic growth initiatives, including new launches, product approvals, and others like patents and events. Acquisitions and partnerships & collaborations were examples of inorganic growth tactics that were observed in the market.

These actions have made it possible for market participants to grow their consumer bases and operations. With the increasing demand for seam welding machines in the global market, market participants in the seam welding machine market can anticipate attractive growth prospects in the future.

The key market players profiled in the report include Cogentix Medical, Palex Medical SA, Medtronic PLC, and Rainbow Medical Group.

Recent Developments in the Seam Welding Machine Market:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.8% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Mode, Product Type, Wheel-Contact, End-User, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Spiro International; Cantec; Branson Ultrasonics; Leister Technologies; Jet Line Engineering; Koike; Dahching Electric Industrial; Franzan; Miller Weldmaster; Schnelldorfer Maschinenbau |

| Customization | Available Upon Request |

The global seam welding machine market is estimated to be valued at USD 1.6 billion in 2025.

It is projected to reach USD 2.3 billion by 2035.

The market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types are intermittent seam welding and continuous seam welding.

automatic segment is expected to dominate with a 43.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seam Tapes Market Insights – Growth & Demand Forecast 2025-2035

De-seamable Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Can Seamer Market

Double Seam Bowl Market

3-Layer Seam Tapes Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Cold Drawn Seamless Steel Pipes Market Share & Provider Insights

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Beverage Can Seamers Manufacturers

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Welding Electrodes and Rods Market Size and Share Forecast Outlook 2025 to 2035

Welding Filler Metal Market Size and Share Forecast Outlook 2025 to 2035

Welding Fume Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Welding Equipment And Consumables Market Size and Share Forecast Outlook 2025 to 2035

Welding Material Market Analysis by Type, Technology, End User, and Region 2025 to 2035

Welding Guns Market Growth - Trends & Forecast 2025 to 2035

Welding Consumables Market Growth - Trends & Forecast 2025 to 2035

Welding Torch and Tip Changing Robotic Station Market Growth – Trends & Forecast 2024-2034

Welding Helmets Market

Stud Welding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA