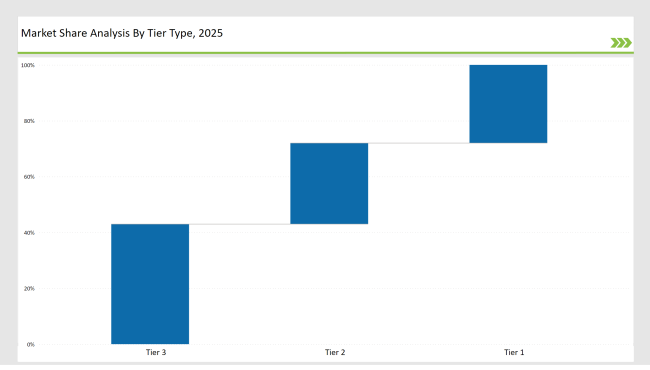

The can seamers market is segmented into three tiers based on market presence and competitive strategy. Tier 1 companies, including Ferrum Packaging, Angelus (Pneumatic Scale Angelus), and Shibuya Corporation, account for 28% of the market share. These industry leaders heavily invest in R&D, operate large-scale production facilities, and maintain extensive global distribution networks.

Their focus on precision, automation, and high-speed seaming solutions enables these companies to dominate industries such as food & beverage, pharmaceuticals, and industrial packaging. The continuous advancements of lightweight, high-efficiency, and IoT-enabled can seamers further strengthen the market positioning.

Tier 2 players, including Swiss Can Machinery, JK Somme, and Zilli & Bellini, contribute to approximately 29% of the market. These companies offer lower-cost, customer-specific canning solutions to the mid-sized manufacturing and regional packaging providers.

By leveraging expertise with high-speed rotary seamers and vacuum sealing technologies, and most importantly, staying compliant with emerging food safety legislation, they managed to enter some of the growth markets.

Tier 3 Regional Manufacturers and niche startups fill the remaining 43% of the market. These companies respond to local demand with innovative, energy-saving, and cost-effective can seamers. As such, they have the flexibility in dealing with evolving industry standards and increased demands for sustainable packaging solutions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Ferrum Packaging, Angelus, Shibuya Corporation) | 14% |

| Rest of Top 5 (Swiss Can Machinery, JK Somme) | 8% |

| Next 5 of Top 10 (Zilli & Bellini, Hermasa, CFT Group, Bubber Machine Tools, Dixie Canner) | 6% |

The can seamers market is led by Ferrum Packaging, Angelus, Shibuya Corporation, Swiss Can Machinery, and JK Somme. The companies have taken a lead role in the advanced technological development in high-speed and precision-sealing equipment. Enhanced demand for smart monitoring, sustainability, and automated solutions in packaging has led to a more effective, efficient, and environmentally responsible can seamer product.

Year-on-Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Ferrum Packaging, Angelus, Shibuya Corporation |

| Tier 2 | Swiss Can Machinery, JK Somme, Zilli & Bellini |

| Tier 3 | Hermasa, CFT Group, Bubber Machine Tools, Dixie Canner |

| Manufacturer | Latest Developments |

|---|---|

| Ferrum Packaging | Launched fully automated, high-speed can seamers (May 2024) |

| Angelus (Pneumatic Scale) | Developed IoT-enabled smart seamers with remote monitoring (April 2024) |

| Shibuya Corporation | Introduced nitrogen flush seamers for extended shelf-life (March 2024) |

| Swiss Can Machinery | Focused on cost-efficient, energy-saving seamers (June 2024) |

| JK Somme | Increased production of customized seamers for food packaging (July 2024) |

Ferrum Packaging, Angelus, Shibuya Corporation, Swiss Can Machinery, and JK Somme.

The top five manufacturers collectively control 38% of the market, while the top ten account for 47%.

Medium, as the top players hold between 30% and 60% of the industry share.

They contribute 43% of the market by offering specialized and regional solutions.

Automation, smart monitoring, and sustainable packaging solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Beverage Can Seamers Manufacturers

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Canine Arthritis Treatment Market Forecast and Outlook 2025 to 2035

Can Stack Stepper Motors Market Forecast and Outlook 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canada Straws Market Size and Share Forecast Outlook 2025 to 2035

Canthaxanthin Market Size and Share Forecast Outlook 2025 to 2035

Canada Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Can Packaging Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Canada Eyeshadow Stick & Blush Stick Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cannabidiol CBD Pet Market Size and Share Forecast Outlook 2025 to 2035

Can Lid Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA