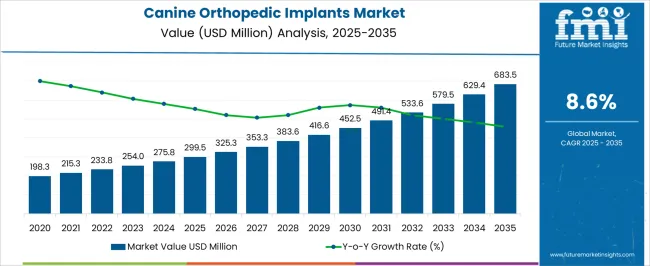

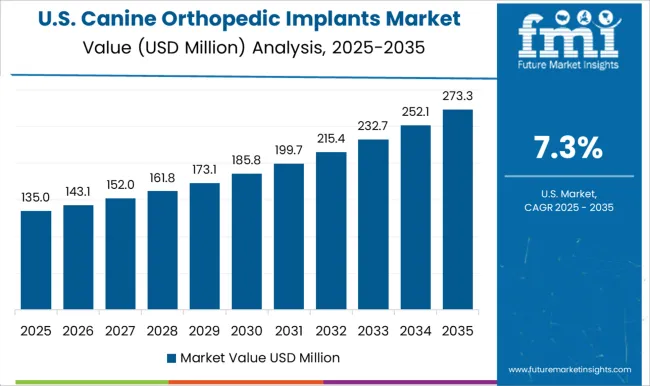

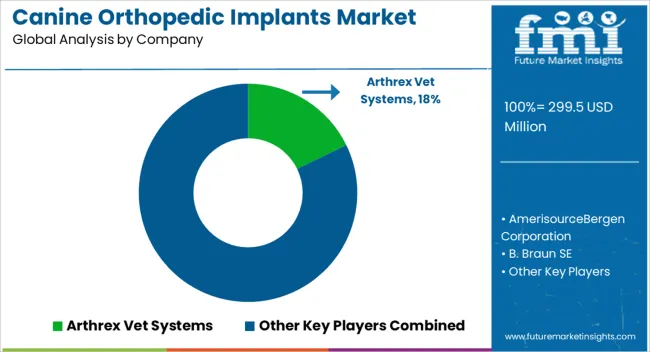

The Canine Orthopedic Implants Market is estimated to be valued at USD 299.5 million in 2025 and is projected to reach USD 683.5 million by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period. The canine orthopedic implants market is projected to reach USD 452.5 million by 2030, marking significant growth over the five-year period. This increase reflects a robust compound annual growth rate (CAGR) of approximately 8.6%, driven by rising demand for advanced veterinary orthopedic solutions.

The market benefits from increasing awareness among pet owners about canine health, coupled with the growing prevalence of orthopedic conditions such as fractures, ligament injuries, and joint disorders in dogs. Between 2025 and 2027, the market is expected to expand from USD 299.5 million to around USD 353.3 million. This initial phase is characterized by enhanced adoption of innovative implant materials and designs that improve surgical outcomes and recovery times. Veterinary clinics and specialized hospitals are increasingly investing in state-of-the-art orthopedic products to meet evolving treatment needs. From 2028 to 2030, the market accelerates further, reaching USD 452.5 million as more advanced implants gain regulatory approvals and penetrate emerging veterinary markets. Additionally, the expansion of veterinary healthcare infrastructure and increased availability of trained specialists contribute to this growth. Overall, the canine orthopedic implants market is on a steady upward trajectory, reflecting growing emphasis on pet wellness and the adoption of sophisticated orthopedic care.

| Metric | Value |

|---|---|

| Canine Orthopedic Implants Market Estimated Value in (2025 E) | USD 299.5 million |

| Canine Orthopedic Implants Market Forecast Value in (2035 F) | USD 683.5 million |

| Forecast CAGR (2025 to 2035) | 8.6% |

The canine orthopedic implants market is witnessing consistent growth driven by rising pet ownership, increasing prevalence of canine musculoskeletal disorders, and expanding access to advanced veterinary surgical care. Advances in implant materials and surgical techniques, particularly those mimicking human orthopedic procedures, have elevated the standard of veterinary orthopedics.

Growth is further supported by heightened awareness among pet owners regarding the quality of life for aging or injured dogs. Technological improvements in radiographic imaging, pre-surgical planning, and 3D modeling are enabling more precise implantation procedures, while rising expenditure on animal health continues to support premium orthopedic solutions.

Additionally, regulatory clearance for veterinary-specific implants and growing professional education among veterinarians are encouraging broader adoption of surgical interventions. The market is expected to continue expanding as pet insurance coverage increases and specialized orthopedic care becomes more accessible beyond urban veterinary hospitals.

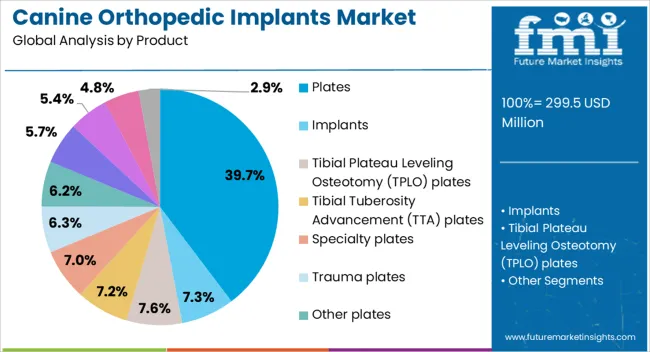

The canine orthopedic implants market is segmented by product, application, end use, and geographic regions. The canine orthopedic implants market is divided into Plates, Implants, Tibial Plateau Leveling Osteotomy (TPLO) plates, Tibial Tuberosity Advancement (TTA) plates, Specialty plates, Trauma plates, Other plates, Bone screws and anchors, Pins & wires, Other implants, and Instruments.

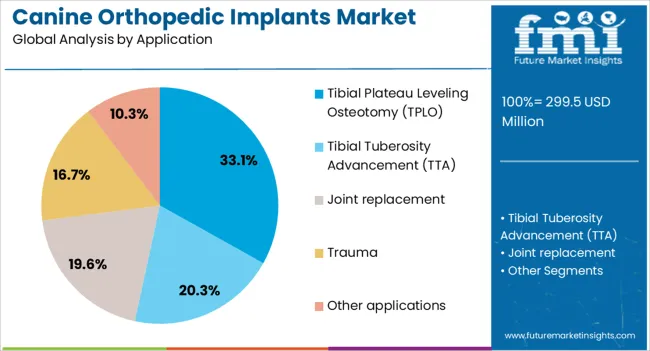

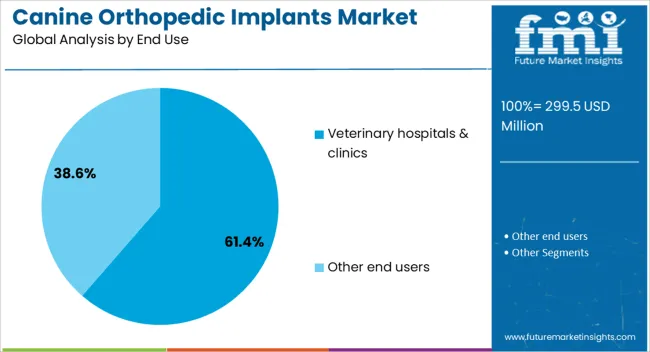

The canine orthopedic implants market is classified into Tibial Plateau Leveling Osteotomy (TPLO), Tibial Tuberosity Advancement (TTA), Joint replacement, Trauma, and Other applications. The canine orthopedic implants market is segmented into Veterinary hospitals & clinics and Other end users. Regionally, the canine orthopedic implants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plates segment is projected to lead the market with a 39.7% revenue share in 2025. This dominance is being driven by the wide clinical applicability of plates in stabilizing fractures, especially in long bones.

Their biomechanical strength and compatibility with various bone contours make them a preferred choice in complex reconstructive surgeries. Technological enhancements such as locking compression systems, anatomically contoured designs, and lightweight titanium alloys have further improved surgical outcomes and recovery timelines.

Additionally, the ability to support multiple orthopedic procedures, including trauma and deformity corrections, has ensured consistent demand. As veterinary surgeons seek more versatile and load-bearing solutions, the plate segment is expected to retain its leading position.

Tibial Plateau Leveling Osteotomy (TPLO) is expected to account for 33.1% of the market revenue in 2025, making it the top application segment. This is primarily due to the high incidence of cranial cruciate ligament (CCL) ruptures in dogs and the efficacy of TPLO in restoring stable knee function.

The technique’s biomechanical advantages, particularly in large or active breeds, have been validated by clinical outcomes and are favored by veterinary orthopedic specialists. Increased availability of pre-contoured TPLO plates and instrumentation kits has improved surgical efficiency and post-operative recovery.

As more veterinary professionals receive training in TPLO procedures, its adoption continues to rise, contributing significantly to the overall growth of the canine orthopedic segment.

Veterinary hospitals and clinics are projected to represent 61.4% of the market revenue in 2025, making them the largest end-use segment. This leadership is supported by their role as primary points of care for surgical interventions and access to specialized diagnostic and imaging equipment.

The ability to conduct advanced orthopedic procedures in sterile, controlled environments has made these facilities the cornerstone of canine implant use. Growth has also been fueled by increased collaboration between veterinary hospitals and implant manufacturers, leading to better access to training, instruments, and post-operative care solutions.

As the demand for professionalized pet care rises across urban and semi-urban areas, veterinary hospitals and clinics are expected to remain the dominant distribution and treatment centers for orthopedic implants.

The canine orthopedic implants market is growing as veterinary care advances and pet owners seek improved treatment for musculoskeletal conditions in dogs. These implants, including plates, screws, and pins, support fracture repair and joint stabilization. Increasing awareness about pet health, rising incidence of orthopedic injuries, and technological improvements in implant materials drive demand. While high costs and limited veterinary expertise pose challenges, ongoing innovation in biocompatible materials and minimally invasive techniques offer opportunities to enhance surgical outcomes and expand market reach.

Growing pet ownership and heightened awareness of animal health are key factors fueling the demand for canine orthopedic implants. Pet owners increasingly view pets as family members and seek advanced veterinary care for injuries, arthritis, and congenital disorders. Improvements in diagnostic imaging and surgical techniques allow for timely intervention, improving recovery rates. Specialized orthopedic clinics and referral hospitals are becoming more common, expanding access to complex treatments. Additionally, rising veterinary expenditure in developed and emerging markets supports adoption. Educational campaigns and professional training help veterinarians stay updated on implant technologies, ensuring better patient outcomes and increasing implant utilization in clinical practice.

The cost of canine orthopedic implant procedures remains a significant barrier for many pet owners, particularly in price-sensitive markets. Implants, surgical fees, and post-operative care can be expensive, limiting access to advanced treatments. Additionally, veterinary surgeons with specialized orthopedic skills are not uniformly available, especially in rural or less-developed regions. The complexity of surgeries and need for precision demand extensive training and experience, which can restrict the number of qualified practitioners. These challenges can result in delayed or suboptimal treatment options. Addressing affordability through insurance products, financing options, and training programs for veterinarians can help improve market penetration and patient outcomes.

Innovation in biocompatible materials such as titanium alloys, bioresorbable polymers, and improved stainless steel is enhancing the performance of canine orthopedic implants. These materials reduce the risk of rejection, corrosion, and implant failure, while improving healing times. Minimally invasive surgical methods, including arthroscopy and guided implant placement, reduce recovery periods and complications. Customized implants and 3D printing technologies enable better anatomical fit and patient-specific solutions. Such advancements increase surgical success rates and owner satisfaction. Collaborations between veterinary surgeons and implant manufacturers are driving research and development. These technological trends offer opportunities for premium products and foster market growth, especially in regions with advanced veterinary infrastructure.

The growth of veterinary hospitals, specialty clinics, and rehabilitation centers worldwide supports increasing demand for canine orthopedic implants. Emerging markets are witnessing improvements in veterinary infrastructure, with more facilities offering surgical and post-surgical care. Additionally, the rise of pet insurance programs is encouraging owners to opt for higher-cost treatments, including implant surgeries, by offsetting financial risks. Veterinary telemedicine and mobile clinics are expanding reach to underserved areas, helping early diagnosis and timely intervention. Government initiatives and industry partnerships aimed at improving animal health standards also contribute to market expansion. Together, these factors help overcome accessibility barriers and support wider adoption of orthopedic implant solutions in canine healthcare.

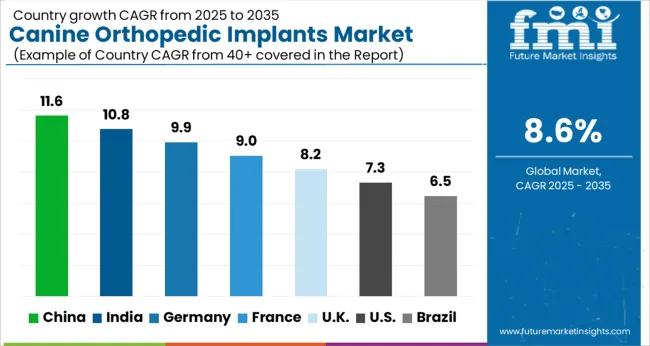

The global canine orthopedic implants market is growing rapidly at an 8.6% CAGR, driven by increasing pet ownership and advances in veterinary care. China leads with 12% growth, supported by expanding veterinary infrastructure and rising demand for pet healthcare products. India follows at 11%, fueled by growing awareness of animal health and increasing veterinary services. Germany reports 10% growth, reflecting strong regulatory standards and technological innovation. The United Kingdom grows at 8%, driven by advancements in implant design and veterinary adoption. The United States, a mature market, records 7% growth, shaped by established veterinary care systems and high-quality product standards. These countries collectively shape market trends through innovation in implant materials, surgical techniques, and regulatory compliance. This report includes insights on 40+ countries; the top countries are shown here for reference.

China canine orthopedic implants market is growing rapidly at a 12% CAGR, driven by increasing pet ownership and rising awareness of advanced veterinary care. With expanding urban middle classes investing more in pet health, demand for innovative orthopedic solutions has surged. The market benefits from growing veterinary infrastructure and increasing availability of implant technologies in major cities. Compared to other countries, China sees fast adoption of minimally invasive surgical techniques and high-tech implants. Local manufacturers are also scaling production, offering competitive pricing and improved accessibility. Education programs for vets and pet owners are boosting early diagnosis and treatment of orthopedic conditions. The growth reflects a shift toward specialized veterinary services and higher standards of pet care.

India canine orthopedic implants market is expanding at an 11% CAGR, supported by a growing pet population and increasing veterinary specialization. Urban centers are witnessing greater adoption of orthopedic implants due to rising pet health awareness and disposable incomes. Unlike China, India market is still developing infrastructure but is rapidly catching up through private clinics and specialist surgeons. Veterinary colleges and training programs are enhancing expertise in orthopedic surgeries. The demand for cost-effective yet reliable implants is strong, with both imported and locally produced devices available. Public awareness campaigns emphasize the importance of early intervention for joint and bone issues in dogs, helping to expand the market. E-commerce platforms also improve access to implant-related products and tools.

Germany canine orthopedic implants market grows steadily at a 10% CAGR, backed by a well-established veterinary system and high standards of animal healthcare. The country emphasizes quality and innovation in implant materials and surgical procedures, with widespread use of titanium and bio-compatible devices. Compared to Asian markets, Germany has longer product approval cycles but benefits from rigorous safety standards ensuring implant reliability. Veterinary clinics and hospitals invest heavily in diagnostic imaging and surgical technology to improve orthopedic treatment success rates. Patient follow-up and rehabilitation services are widely integrated, enhancing outcomes. Public insurance options sometimes cover parts of veterinary orthopedic care, making implants more affordable.

The United Kingdom canine orthopedic implants market is advancing at an 8% CAGR, supported by increasing demand for specialized pet surgeries and improved veterinary care access. UK pet owners prioritize quality treatment and recovery, which fuels growth in implant surgeries. Veterinary hospitals increasingly adopt cutting-edge implant technologies and minimally invasive techniques. Compared to Germany, the UK market is smaller but highly focused on patient welfare and rehabilitation support. Collaboration between vets and pet physiotherapists is common to ensure holistic orthopedic care. Veterinary education emphasizes continuing training to keep surgeons updated on implant innovations. Awareness campaigns promote early intervention and prevention of degenerative joint diseases.

United States canine orthopedic implants market grows at 7% CAGR, driven by high pet healthcare spending and advanced veterinary infrastructure. The USA leads in technological innovation with a wide range of implant materials and custom solutions. Pet owners demand premium care, supporting growth of specialized orthopedic surgeries and post-operative rehabilitation. Compared to European markets, the USA benefits from extensive research and development in veterinary implants and strong partnerships between manufacturers and veterinary institutions. Digital tools help vets track surgical outcomes and improve patient care. Insurance coverage for pet surgeries is increasing but still limited. Market growth reflects a combination of advanced care availability and rising pet health consciousness.

The canine orthopedic implants market is witnessing significant growth driven by increasing awareness of pet health, rising incidences of orthopedic conditions in dogs, and advancements in veterinary surgical technologies. Key players in this market include Arthrex Vet Systems, AmerisourceBergen Corporation, B. Braun SE, DePuy Synthes (Johnson & Johnson), Fusion Implants, Integra LifeSciences, Moori (Vimian Group AB), Narang Medical Limited, Orthomed, STERIS, and Veterinary Instrumentation.

These companies specialize in developing and supplying innovative implant solutions designed specifically for canine orthopedic surgeries, including plates, screws, pins, and external fixation devices. Arthrex Vet Systems and DePuy Synthes are known for their comprehensive portfolios that offer advanced biocompatible materials and designs to enhance surgical outcomes and reduce recovery times. Meanwhile, companies like AmerisourceBergen focus on distribution and supply chain management, ensuring timely availability of implants to veterinary practitioners globally. The market also benefits from the growing trend of pet humanization, where owners seek advanced medical care similar to that provided in human orthopedics.

Technological innovations such as 3D-printed custom implants and minimally invasive surgical techniques are enhancing the precision and effectiveness of treatments. Additionally, the market is supported by increasing investments in veterinary infrastructure and expanding veterinary healthcare services worldwide.

As pet ownership continues to rise, especially in developed and emerging economies, the demand for canine orthopedic implants is expected to grow steadily, propelled by both preventative care and treatment of traumatic injuries or degenerative diseases in dogs.

Companies are increasingly using titanium, stainless steel, and ceramic-based materials due to their excellent strength, durability, and resistance to corrosion. Moreover, bioactive coatings that encourage bone growth and reduce infection risk are being applied to implants, ensuring a better integration with the bone and reducing the likelihood of implant failure.

| Item | Value |

|---|---|

| Quantitative Units | USD 299.5 Million |

| Product | Plates, Implants, Tibial Plateau Leveling Osteotomy (TPLO) plates, Tibial Tuberosity Advancement (TTA) plates, Specialty plates, Trauma plates, Other plates, Bone screws and anchors, Pins & wires, Other implants, and Instruments |

| Application | Tibial Plateau Leveling Osteotomy (TPLO), Tibial Tuberosity Advancement (TTA), Joint replacement, Trauma, and Other applications |

| End Use | Veterinary hospitals & clinics and Other end users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arthrex Vet Systems, AmerisourceBergen Corporation, B. Braun SE, DePuy Synthes (Johnson & Johnson), Fusion Implants, Integra LifeSciences, Moori (Vimian Group AB), Narang Medical Limited, Orthomed, STERIS, and Veterinary Instrumentation |

| Additional Attributes | Dollar sales vary by implant type, including plates, screws, pins, and TTA cages; by application, such as TPLO, TTA, joint replacements, and trauma repairs; by region, led by North America and Asia-Pacific. Growth is driven by rising pet ownership, increasing orthopedic disorders in dogs, and advancements in veterinary surgical techniques. |

The global canine orthopedic implants market is estimated to be valued at USD 299.5 million in 2025.

The market size for the canine orthopedic implants market is projected to reach USD 683.5 million by 2035.

The canine orthopedic implants market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in canine orthopedic implants market are plates, implants, tibial plateau leveling osteotomy (tplo) plates, tibial tuberosity advancement (tta) plates, specialty plates, trauma plates, other plates, bone screws and anchors, pins & wires, other implants and instruments.

In terms of application, tibial plateau leveling osteotomy (tplo) segment to command 33.1% share in the canine orthopedic implants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Smart Orthopedic Implants Market

Orthopedic Bone Defect Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Artificial Bone Defect Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Titanium Plate with Loop Market Size and Share Forecast Outlook 2025 to 2035

Canine Cancer Screening Services Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Canine Arthritis Treatment Market Forecast and Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Canine Dilated Cardiomyopathy Drugs Market – Trends & Forecast 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA