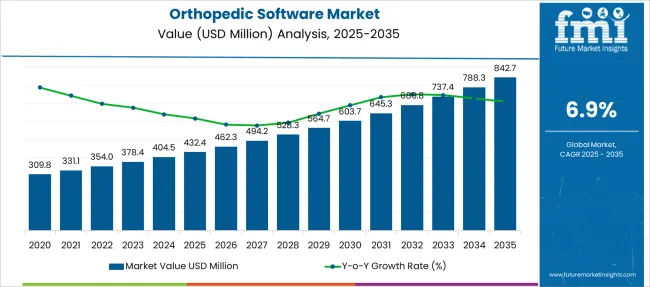

The Orthopedic Software Market is estimated to be valued at USD 432.4 million in 2025 and is projected to reach USD 842.7 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Orthopedic Software Market Estimated Value in (2025E) | USD 432.4 million |

| Orthopedic Software Market Forecast Value in (2035F) | USD 842.7 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

The Orthopedic Software market is experiencing consistent growth, supported by increasing digital transformation across orthopedic practices and hospitals. Demand has been driven by the need for efficient patient data management, real-time surgical planning, and enhanced diagnostic accuracy within orthopedic workflows.

The market is further supported by a global rise in musculoskeletal disorders, sports-related injuries, and joint replacement procedures, which are creating a demand for specialized, software-based solutions.

Healthcare providers are increasingly adopting orthopedic software systems to streamline patient scheduling, imaging analysis, and treatment documentation while maintaining compliance with regulatory standards. Integration with imaging modalities and surgical robotics is enhancing clinical outcomes and accelerating procedural efficiencies.

Cloud-enabled platforms are gaining traction, enabling multi-site access, scalability, and reduced IT overhead for orthopedic clinics. Continued investment in hospital IT infrastructure, growing preference for minimally invasive procedures, and advancements in artificial intelligence for clinical decision support are expected to sustain long-term demand in the market.

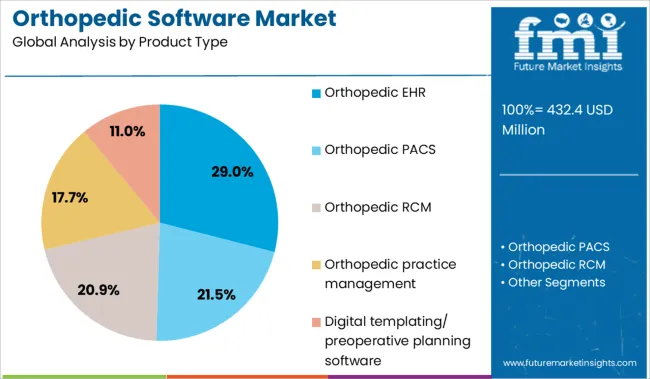

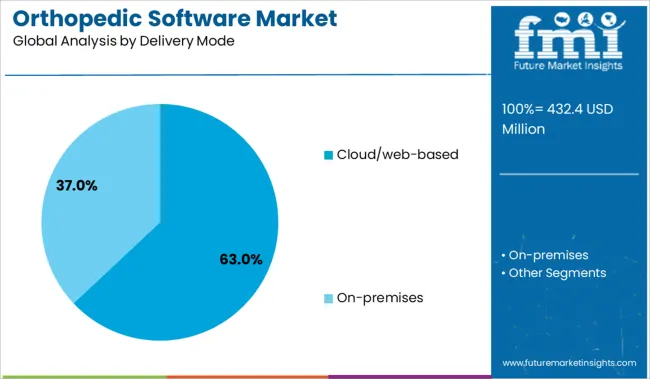

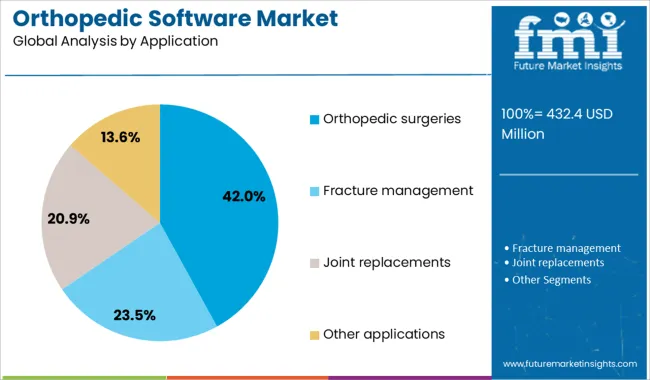

The market is segmented by Product Type, Delivery Mode, Application, and End-use and region. By Product Type, the market is divided into Orthopedic EHR, Orthopedic PACS, Orthopedic RCM, Orthopedic practice management, and Digital templating/ preoperative planning software. In terms of Delivery Mode, the market is classified into Cloud/web-based and On-premises. Based on Application, the market is segmented into Orthopedic surgeries, Fracture management, Joint replacements, and Other applications. By End-use, the market is divided into Hospitals and clinics, Ambulatory surgical centers, and Other end-users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The orthopedic EHR product type segment is expected to account for 29% of the Orthopedic Software market revenue share in 2025, establishing itself as the leading product type. Growth in this segment has been supported by increasing demand for orthopedic-specific electronic health records that streamline patient documentation, surgical planning, and post-operative follow-up care.

These systems have been adopted to improve coordination between surgical teams, physical therapists, and radiologists, allowing for more personalized and efficient care delivery. Integrated EHR platforms have also enabled improved compliance with health data regulations while supporting billing, coding, and patient communication from a centralized interface.

The rising complexity of orthopedic procedures and the need for precise documentation have contributed to increased usage of tailored EHR systems over general-purpose alternatives. Furthermore, growing emphasis on outcome-based care and real-time data availability has made orthopedic EHR solutions essential for clinical workflows, reinforcing their leadership within the product category.

The cloud or web based delivery mode segment is projected to command 63% of the Orthopedic Software market revenue share in 2025, making it the dominant delivery model. Adoption of cloud-based solutions has been encouraged by the need for scalable, cost-effective software that reduces dependence on in-house IT infrastructure.

Healthcare facilities have increasingly relied on web-based orthopedic platforms to enable remote access to patient records, surgical templates, and clinical data, supporting greater mobility for practitioners and improved collaboration among teams. The ability to receive real-time updates, implement remote software upgrades, and ensure data backup has further enhanced operational efficiency.

Smaller orthopedic clinics and group practices have been particularly drawn to cloud-based models due to the lower upfront costs and predictable subscription pricing. Enhanced security protocols and regulatory compliance frameworks have also improved trust in web-based solutions, positioning them as the preferred choice for modern orthopedic software deployments.

The orthopedic surgeries application segment is anticipated to capture 42% of the Orthopedic Software market revenue share in 2025, positioning it as the leading area of application. This growth has been driven by the rising volume of orthopedic procedures worldwide, including joint replacements, fracture repairs, and minimally invasive spine surgeries.

Software tools designed for surgical planning, real-time navigation, and intraoperative visualization have been increasingly utilized to enhance precision and reduce operative time. The segment has also benefited from greater integration with robotic-assisted systems and advanced imaging technologies, allowing surgeons to personalize procedures and improve clinical outcomes.

Hospitals and surgical centers have prioritized software solutions that offer analytics for postoperative recovery, patient monitoring, and long-term care planning. As value-based care models gain traction, the emphasis on surgical efficiency, patient satisfaction, and outcome tracking has reinforced the adoption of orthopedic software in surgical applications, ensuring its continued market dominance.

From 2023 to 2025, software platforms enabled automated reporting, real-time benchmarking, and alignment with reimbursement models. These capabilities have transformed orthopedic tools from recordkeeping systems into compliance and performance enablers. Vendors offering seamless registry connectivity are now positioned to lead in orthopedic clinical operations and surgical analytics.

The growing demand for evidence-based surgical transparency has been identified as a leading catalyst in the orthopedic software market. In 2023, hospitals began integrating post-operative analytics tools to track implant performance and patient mobility, improving follow-up protocols.

By 2024, registry-linked platforms were being adopted to compare surgeon success rates and complication data across joint replacement procedures. In 2025, outcome dashboards were being utilized to guide clinical decision-making and support pay-for-performance reimbursement models.

These developments suggest that detailed surgical outcome capture is shifting orthopedic software from administrative support to a clinical quality enabler. Providers offering robust analytics and benchmarking modules are thus being positioned as essential partners in value-based orthopedics.

In 2023, joint registry integrations were piloted to allow orthopedic software platforms to automatically upload surgical and implant data into national databases, decreasing manual reporting effort. By 2024, newly certified systems were being used to benchmark implants and outcomes in real-time, helping surgeons choose optimal devices based on peer data. In 2025, registry-connected modules were linked to reimbursement and quality assurance workflows, enabling practitioners to validate compliance with performance-based payment models.

These deployments demonstrate that embedding registry reporting into clinical software workflows can shift solutions from standalone tools to essential infrastructure. Vendors that support seamless registry connectivity are thus poised to capture a growing share of orthopedic practice management and analytics demand.

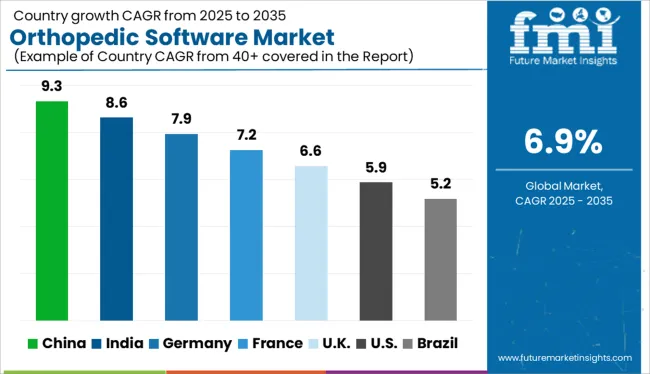

| Countries | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

The global orthopedic software market is projected to expand at a CAGR of 7% from 2025 to 2035. China leads with a 9.3% CAGR, followed by India at 8.6% and Germany at 7.9%. France aligns just above the global average at 7.2%, while the United Kingdom posts slower growth at 6.6%.

China and India are accelerating adoption through orthopedic AI integration, digital surgical planning, and hospital EMR upgrades. Germany is progressing with imaging-platform interoperability and robotic-assisted surgical mapping. France supports cloud-based orthopedic diagnostics in national hospitals, while the UK emphasizes compliance-heavy integration in NHS systems and private orthopedic centers.

China is forecast to lead the global orthopedic software market with a 9.3% CAGR, supported by the rapid digitalization of hospitals and integration of orthopedic EMR with AI-powered image analysis. Major orthopedic institutions in Shanghai, Beijing, and Guangzhou are investing in cloud-based planning and post-op monitoring systems. Domestic health-tech firms are launching surgical simulation and templating modules tailored to hip and knee arthroplasty.

India is projected to grow its orthopedic software market at an 8.6% CAGR, driven by the rise in trauma care centers, orthopedic robotic surgery pilots, and public-private hospital digitization. Solutions such as implant registry, fracture classification tools, and remote physio monitoring are gaining traction. Indian health-tech startups are creating modular orthopedic software for mobile-friendly deployment across tier-2 hospitals and ortho-specialty clinics.

Germany is forecast to grow its orthopedic software market at a 7.9% CAGR, with hospitals focusing on interoperability across orthopedic imaging, robotic systems, and PACS. University hospitals and private orthopedic centers are integrating surgical analytics with robotic joint replacement mapping. German orthopedic surgeons rely on precision software for deformity correction and 3D joint reconstruction modeling.

France is projected to expand its orthopedic software market at a 7.2% CAGR, driven by investment in hospital information system upgrades, particularly in musculoskeletal imaging and orthopedic diagnosis support. AI-enhanced scoliosis screening, orthopedic biomechanics simulations, and templating software are being rolled out in public and teaching hospitals. Vendors are also piloting wearable-linked software for post-surgical rehabilitation.

The United Kingdom is expected to grow its orthopedic software market at a 6.6% CAGR, shaped by structured NHS integration projects, orthopedic PACS upgrades, and private practice EMR customization. Adoption is strongest in elective surgery centers and sports medicine clinics. Patient-specific pre-operative modeling and remote mobility scoring platforms are gaining traction. NHS digital standards require certified vendors with high data privacy compliance.

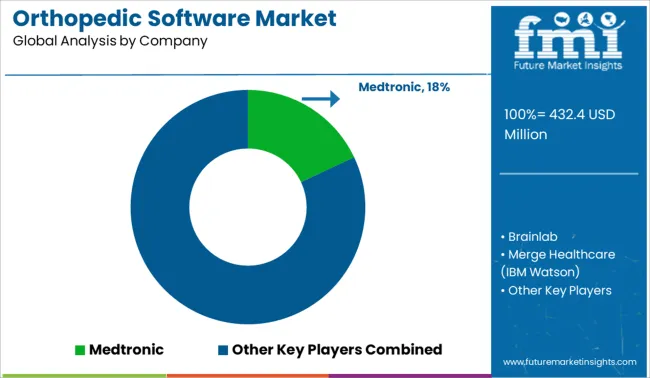

The orthopedic software market is moderately consolidated, led by Medtronic with a significant market share. The company holds a dominant position through its comprehensive digital ecosystem, combining surgical navigation, implant planning, and real-time data integration for orthopedic procedures. Dominant player status is held exclusively by Medtronic.

Key players include Brainlab, Merge Healthcare (IBM Watson), Greenway Health, CureMD, and Allscripts Healthcare Solutions - each offering orthopedic-specific software modules for clinical documentation, diagnostic imaging integration, electronic health records, and surgical workflow optimization.

Emerging players are currently limited in this segment due to the need for regulatory approval, hospital integration capability, and clinical validation. Market demand is driven by rising joint replacement volumes, the adoption of computer-assisted surgery, and the shift toward value-based orthopedic care.

| Item | Value |

|---|---|

| Quantitative Units | USD 432.4 Million |

| Product Type | Orthopedic EHR, Orthopedic PACS, Orthopedic RCM, Orthopedic practice management, and Digital templating/ preoperative planning software |

| Delivery Mode | Cloud/web-based and On-premises |

| Application | Orthopedic surgeries, Fracture management, Joint replacements, and Other applications |

| End-use | Hospitals and clinics, Ambulatory surgical centers, and Other end-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Medtronic, Brainlab, Merge Healthcare (IBM Watson), Greenway Health, CureMD, and Allscripts Healthcare Solutions |

| Additional Attributes | Dollar sales by software type (EMR integration, surgical planning, rehab), regional demand trends, competitive landscape, buyer preferences for cloud vs on‑prem solutions, integration with AI imaging, innovations in predictive surgical analytics. |

The global orthopedic software market is estimated to be valued at USD 432.4 million in 2025.

The market size for the orthopedic software market is projected to reach USD 842.7 million by 2035.

The orthopedic software market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in orthopedic software market are orthopedic ehr, orthopedic pacs, orthopedic rcm, orthopedic practice management and digital templating/ preoperative planning software.

In terms of delivery mode, cloud/web-based segment to command 63.0% share in the orthopedic software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

Orthopedic Prosthetics Market Analysis - Size, Share, and Forecast 2024 to 2034

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Market Overview – Trends, Applications & Forecast 2024-2034

Veterinary Orthopedic Injectable Drug Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA