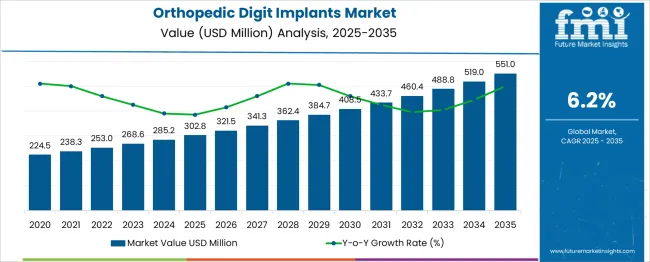

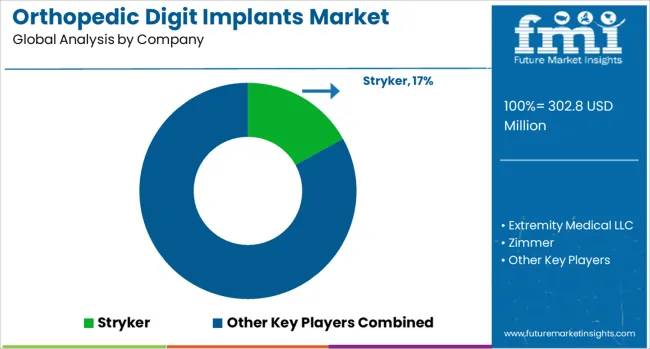

The global orthopedic digit implants market is likely to grow from USD 302.9 million in 2025 to approximately USD 551.0 million by 2035, recording an absolute increase of USD 248.1 million over the forecast period. This translates into a total growth of 82.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.2% between 2025 and 2035. The market size is expected to grow by nearly 1.82X during the same period, supported by the rising prevalence of digit-related injuries and increasing adoption of advanced implant technologies in orthopedic procedures.

Quick Stats for Orthopedic Digit Implants Market

From 2030 to 2035, the market is forecast to grow from USD 384.7 million to USD 551.0 million, adding another USD 166.3 million, which constitutes 67.0% of the ten-year expansion. This period is expected to be characterized by expansion of outpatient surgical facilities, integration of advanced biomaterials, and development of patient-specific implant solutions across different anatomical applications. The growing adoption of titanium and nitinol-based implants will drive demand for more sophisticated digit reconstruction procedures and specialized surgical expertise.

Between 2020 and 2025, the orthopedic digit implants market experienced steady expansion, driven by increasing sports-related injuries and growing elderly population susceptible to degenerative joint conditions. The market developed as orthopedic facilities recognized the need for specialized digit implant technologies and trained surgical teams. Insurance coverage and healthcare provider networks began emphasizing proper implant selection and surgical techniques to improve patient outcomes and recovery times.

| Parameter | Value |

| Market Value (2025) | USD 302.9 million |

| Market Forecast Value (2035) | USD 551.0 million |

| Market Forecast CAGR (2025–2035) | 6.2% |

Market expansion is being supported by the rapid increase in digit-related injuries and the corresponding need for specialized implant solutions in reconstructive orthopedic procedures. Modern healthcare systems rely on precise implant technologies to restore functionality and reduce recovery time for patients with digit trauma, degenerative conditions, and congenital abnormalities. Even minor digit injuries can require comprehensive reconstruction to maintain optimal hand and foot function.

The growing complexity of digit reconstruction procedures and increasing focus on patient outcomes are driving demand for advanced implant materials and specialized surgical expertise from certified orthopedic providers. Healthcare insurance systems are increasingly covering digit implant procedures to ensure patient mobility and quality of life. Medical device regulations and orthopedic surgery standards are establishing comprehensive implant selection criteria that require specialized materials and trained surgical teams.

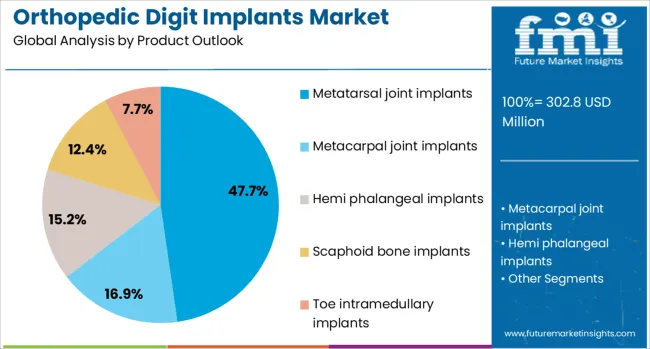

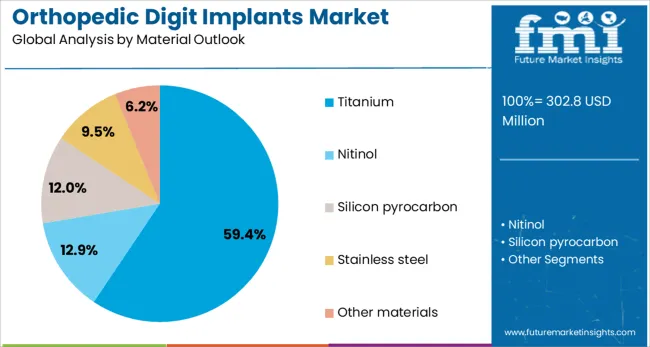

The market is segmented by product type, material, end use, and region. By product type, the market is divided into metatarsal joint implants, metacarpal joint implants, hemi phalangeal implants, scaphoid bone implants, and toe intramedullary implants. Based on material, the market is categorized into titanium, nitinol, silicon pyrocarbon, stainless steel, and other materials. In terms of end use, the market is segmented into outpatient facilities and hospitals. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Metatarsal joint implants are projected to account for 47.7% of the orthopedic digit implants market in 2025. This leading share is supported by the high incidence of metatarsal fractures and joint disorders requiring surgical intervention with specialized implant solutions. Metatarsal joint implants provide essential structural support for weight-bearing activities and are critical for maintaining proper foot biomechanics. The segment benefits from established surgical procedures and comprehensive implant design options from multiple manufacturers.

Titanium is expected to represent 59.4% of orthopedic digit implant material demand in 2025. This dominant share reflects the superior biocompatibility, strength, and osseointegration properties of titanium in digit reconstruction applications. Titanium implants provide excellent long-term durability and reduced risk of adverse reactions in digit surgical procedures. The segment benefits from extensive clinical validation and widespread surgeon acceptance for various digit implant applications.

Outpatient facilities are projected to contribute 63.1% of the market in 2025, representing surgical centers focused on same-day digit implant procedures. These facilities offer specialized orthopedic capabilities, efficient surgical workflows, and cost-effective treatment options for digit reconstruction. Outpatient facilities typically provide comprehensive digit implant services with shorter recovery times and reduced healthcare costs. The segment is supported by growing preference for minimally invasive procedures and improved surgical technologies.

The orthopedic digit implants market is advancing steadily due to increasing digit injury prevalence and growing recognition of advanced implant technologies. The market faces challenges including high implant costs, need for specialized surgical training, and varying reimbursement policies across different healthcare systems. Standardization efforts and clinical outcome studies continue to influence implant selection and market development patterns.

The growing adoption of minimally invasive surgical approaches is enabling precise implant placement with reduced tissue trauma and faster patient recovery. Advanced surgical instruments and imaging technologies provide improved visualization and accuracy during digit implant procedures. These techniques are particularly valuable for complex digit reconstruction cases that require precise anatomical restoration without extensive soft tissue disruption.

Modern implant manufacturers are incorporating advanced surface treatments and biomaterial properties that improve osseointegration and reduce complications. Integration of bioactive coatings and specialized surface textures enables enhanced bone ingrowth and long-term implant stability. Advanced materials also support improved implant longevity and reduced revision surgery requirements for digit reconstruction procedures.

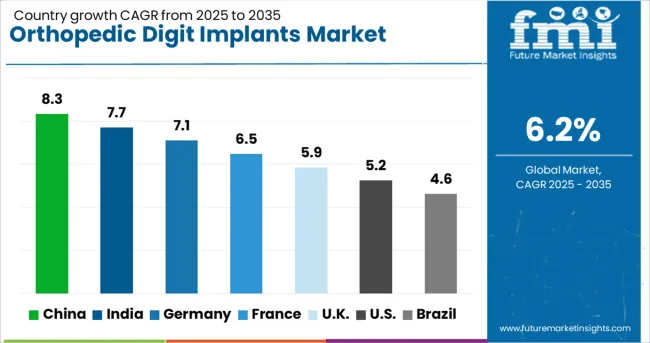

| Country | CAGR (2025–2035) |

| China | 8.3% |

| India | 7.7% |

| Germany | 7.1% |

| France | 6.5% |

| United Kingdom | 5.9% |

| United States | 5.2% |

| Brazil | 4.6% |

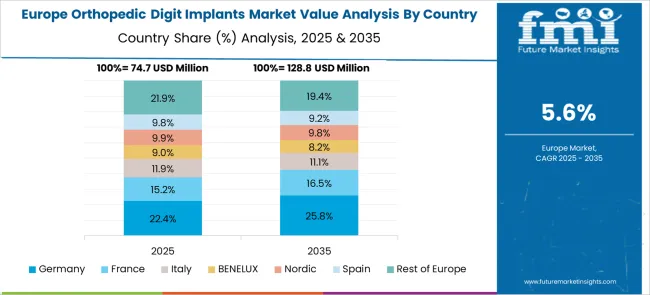

The orthopedic digit implants market demonstrates diverse growth trajectories across countries. China leads with the fastest CAGR of 8.3%, driven by rapid healthcare infrastructure expansion, government modernization programs, and increasing demand for digit reconstruction procedures in urban centers. India follows at 7.7%, supported by rising orthopedic awareness, a growing middle class, and expanding specialized healthcare services. Germany records a CAGR of 7.1%, emphasizing precision surgery and advanced biomaterials, while France grows steadily at 6.5%, focusing on outpatient efficiency and comprehensive coverage. The United Kingdom shows 5.9% growth, prioritizing evidence-based implant selection and clinical outcomes, whereas the United States maintains stable expansion at 5.2%, supported by advanced healthcare systems and insurance coverage. Brazil demonstrates emerging potential with a CAGR of 4.6%, aided by healthcare infrastructure development and growing orthopedic specialty services.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from orthopedic digit implants in China is projected to exhibit the highest growth rate with a CAGR of 8.3% through 2035, driven by rapid expansion of orthopedic specialty services and increasing incidence of digit-related injuries in urban populations. The country's growing sports participation and industrial activities are creating significant demand for digit reconstruction procedures. Major orthopedic device manufacturers and healthcare providers are establishing comprehensive implant distribution networks to support the growing population requiring digit surgical interventions.

Revenue from orthopedic digit implants in India is expanding at a CAGR of 7.7%, supported by increasing awareness of digit reconstruction procedures and growing availability of specialized orthopedic services. The country's expanding middle class and improving healthcare access are driving demand for advanced implant technologies. Orthopedic hospitals and specialty centers are gradually establishing capabilities to serve the growing population requiring digit surgical interventions.

Demand for orthopedic digit implants in Germany is projected to grow at a CAGR of 7.1%, supported by the country's emphasis on precision surgical techniques and advanced biomaterial integration. German orthopedic centers are implementing comprehensive digit reconstruction capabilities that meet stringent quality standards and surgical outcome requirements. The market is characterized by focus on clinical excellence, advanced implant technologies, and compliance with comprehensive medical device regulations.

Demand for orthopedic digit implants in France is expanding at a CAGR of 6.5%, driven by increasing adoption of outpatient surgical models and comprehensive healthcare coverage for digit reconstruction procedures. French healthcare providers are establishing efficient surgical workflows that optimize patient outcomes while controlling treatment costs. The market benefits from standardized surgical protocols and comprehensive reimbursement policies for digit implant procedures.

Demand for orthopedic digit implants in the United Kingdom is expanding at a CAGR of 5.9%, driven by increasing emphasis on clinical outcomes and evidence-based implant selection criteria. British healthcare providers are implementing comprehensive digit reconstruction protocols that prioritize patient safety and long-term functionality. The market benefits from National Health Service coverage and standardized surgical guidelines for digit implant procedures.

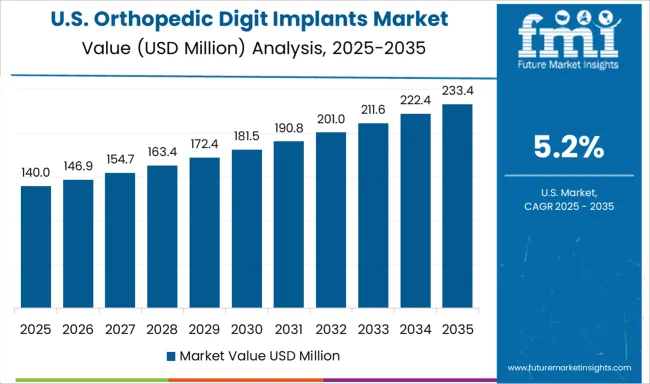

Demand for orthopedic digit implants in the United States is projected to grow at a CAGR of 5.2% through 2035, supported by advanced healthcare infrastructure and comprehensive insurance coverage for orthopedic procedures. American healthcare providers are implementing sophisticated digit reconstruction technologies that emphasize patient outcomes and surgical efficiency. The market is characterized by established orthopedic networks, advanced surgical training programs, and comprehensive regulatory frameworks for medical device approval and clinical application.

Revenue from orthopedic digit implants in Brazil is expanding at a CAGR of 4.6%, driven by improving healthcare access and growing recognition of advanced orthopedic treatment options. Brazilian healthcare providers are gradually establishing digit reconstruction capabilities that serve diverse patient populations across urban and regional markets. The country's developing orthopedic specialty services are creating opportunities for implant manufacturers and surgical technology providers to expand their market presence.

The orthopedic digit implants market is defined by competition among specialized medical device manufacturers, orthopedic companies, and surgical technology providers. Companies are investing in advanced biomaterials, surgical instrument development, clinical research, and surgeon training to deliver precise, reliable, and clinically effective implant solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Stryker, USA-based, offers comprehensive digit implant systems with a focus on surgical precision, biomaterial innovation, and clinical outcomes. Extremity Medical LLC provides specialized digit reconstruction solutions with advanced implant designs and surgical instrumentation. Zimmer Biomet delivers technologically advanced implant systems with standardized surgical procedures and comprehensive training programs. Smith & Nephew emphasizes innovative biomaterials and minimally invasive surgical approaches for digit reconstruction.

DePuy Synthes (Johnson & Johnson MedTech) offers comprehensive digit implant portfolios integrated with orthopedic surgical expertise and clinical support services. Arthrex Inc. provides specialized digit reconstruction technologies with advanced surgical techniques and comprehensive training programs. Acumed LLC delivers precision-engineered implant systems with focus on anatomical restoration and surgical efficiency. Anika Therapeutics, Inc., VILEX, LLC, and Paragon 28 offer specialized implant expertise, innovative surgical solutions, and clinical reliability across regional and global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 302.9 Million |

| Product Type | Metatarsal joint implants, metacarpal joint implants, hemi phalangeal implants, scaphoid bone implants, and toe intramedullary implants |

| Material | Titanium, nitinol, silicon pyrocarbon, stainless steel, and other materials |

| End Use | Outpatient facilities and hospitals |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France, and 40+ countries |

| Key Companies Profiled | Stryker, Extremity Medical LLC, Zimmer Biomet, Smith & Nephew, DePuy Synthes (Johnson & Johnson MedTech), Arthrex Inc, Acumed LLC, Anika Therapeutics Inc, VILEX LLC, Paragon 28 |

| Additional Attributes | Dollar sales by product type, material, and end use, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established medical device manufacturers and emerging technology providers, surgeon preferences for biomaterial selection versus conventional options, integration with surgical planning platforms and minimally invasive techniques, innovations in surface treatments and osseointegration technologies, and adoption of patient-specific implant solutions with advanced imaging and surgical navigation systems for enhanced clinical outcomes. |

Product Type

Material

End Use

Region

The global orthopedic digit implants market is estimated to be valued at USD 302.8 million in 2025.

The market size for the orthopedic digit implants market is projected to reach USD 551.0 million by 2035.

The orthopedic digit implants market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in orthopedic digit implants market are metatarsal joint implants, metacarpal joint implants, hemi phalangeal implants, scaphoid bone implants and toe intramedullary implants.

In terms of material outlook, titanium segment to command 59.4% share in the orthopedic digit implants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Market Overview – Trends, Applications & Forecast 2024-2034

Veterinary Orthopedic Injectable Drug Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA