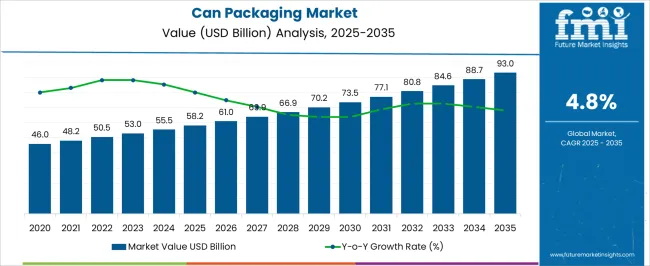

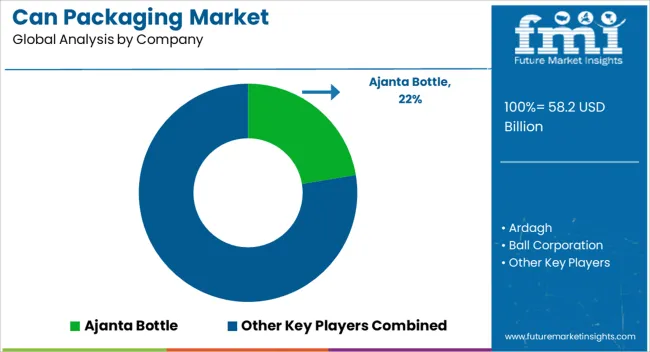

The can packaging market is estimated to be valued at USD 58.2 billion in 2025 and is projected to reach USD 93.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The can packaging market is being projected to grow from USD 58.2 billion in 2025 to USD 93 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.8%. In the first five-year period, the market is expected to expand from USD 58.2 billion in 2025 to approximately USD 73.5 billion by 2030, indicating steady value creation. Market growth is being influenced by the increasing demand for convenient, durable, and cost-efficient packaging solutions across food, beverage, and industrial applications.

Year-on-year projections reveal consistent adoption, with incremental revenue opportunities being driven by the replacement of traditional packaging and the introduction of innovative can formats that enhance storage efficiency and shelf appeal. Throughout this initial five-year period, the can packaging market is being shaped by evolving consumer preferences, logistical requirements, and the need for robust supply chain solutions. The market is witnessing expansion through the deployment of lightweight and high-performance cans, which are being recognized for their ability to reduce transportation costs and improve handling efficiency.

Growth is further supported by the adoption of standardized can sizes and modular designs, enabling optimized stacking, storage, and distribution. By 2030, the market is anticipated to achieve significant penetration across key regions, with revenue being generated through a combination of functional design improvements, cost-effective manufacturing practices, and heightened application versatility in the packaging sector.

| Metric | Value |

|---|---|

| Can Packaging Market Estimated Value in (2025 E) | USD 58.2 billion |

| Can Packaging Market Forecast Value in (2035 F) | USD 93.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The can packaging market is estimated to hold a notable proportion within its parent markets, representing approximately 15-17% of the metal packaging market, around 12-13% of the food and beverage packaging market, close to 8-9% of the consumer packaging market, about 6-7% of the packaging materials market, and roughly 4-5% of the beverage container market. Collectively, the cumulative share across these parent segments is observed in the range of 45-51%, reflecting a significant presence of can packaging solutions across food, beverage, and consumer goods applications.

The market has been influenced by the rising demand for convenient, durable, and lightweight packaging where product protection, shelf-life extension, and brand visibility are highly prioritized. Adoption is guided by procurement decisions that emphasize material quality, recyclability, and compatibility with automated filling and sealing systems. Market participants have focused on corrosion resistance, ease of handling, and consistent sizing to maintain performance across supply chains.

As a result, the can packaging market has not only captured a substantial share within metal and food and beverage packaging segments but has also impacted consumer packaging, general packaging materials, and beverage container markets, highlighting its strategic role in delivering reliable, high-performance packaging solutions that meet operational and market expectations across multiple sectors.

The can packaging market is experiencing robust growth driven by rising demand for sustainable, lightweight, and highly recyclable packaging solutions. Growing consumer awareness of environmental concerns, coupled with regulatory measures promoting circular economy practices, has accelerated the shift toward metal-based packaging.

Advances in printing and embossing technologies are enhancing brand visibility and enabling greater product differentiation on retail shelves. Additionally, the long shelf life, product integrity, and tamper resistance offered by cans have strengthened their position in food and beverage packaging.

Expanding consumption of ready-to-drink products, coupled with growing popularity of premium and functional beverages, is also fueling demand. The outlook remains positive as packaging producers and brand owners increasingly prioritize materials and formats that combine performance, sustainability, and aesthetic appeal.

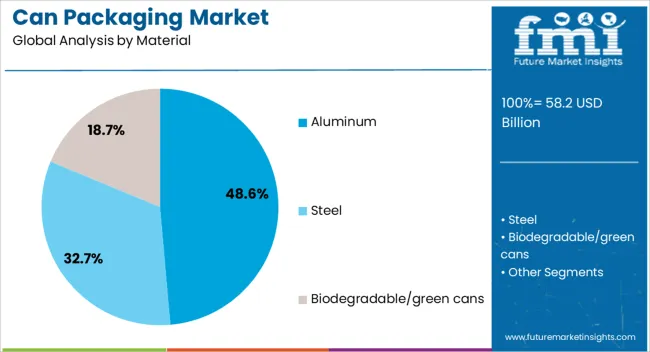

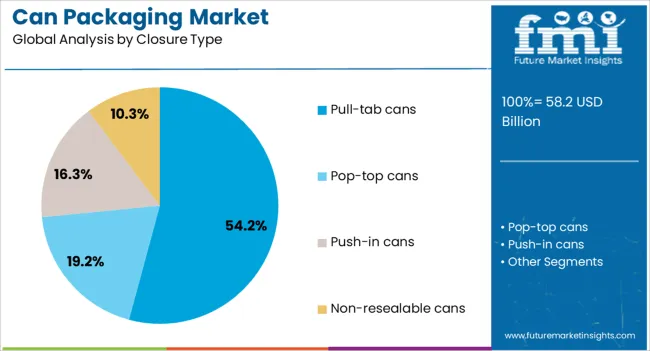

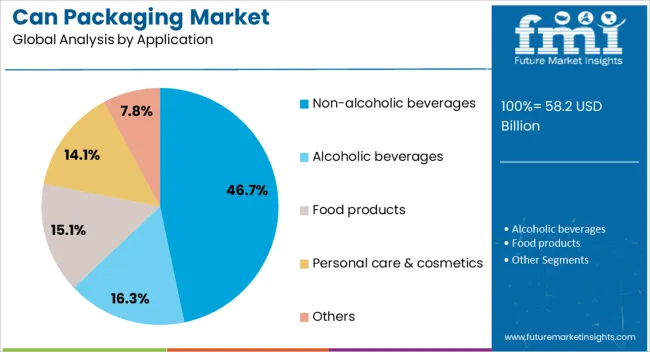

The can packaging market is segmented by material, closure type, application, end-use industry, and geographic regions. By material, can packaging market is divided into aluminum, steel, and biodegradable/green cans. In terms of closure type, can packaging market is classified into pull-tab cans, pop-top cans, push-in cans, and non-resealable cans. Based on application, can packaging market is segmented into non-alcoholic beverages, alcoholic beverages, food products, personal care & cosmetics, and others. By end-use industry, can packaging market is segmented into food and beverages, consumer goods, pharmaceuticals, chemical, and others. Regionally, the can packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aluminum segment is projected to hold 48.6% of total market revenue by 2025 within the material category, making it the leading segment. Its dominance is attributed to high recyclability, lightweight nature, and strong protective properties that preserve product freshness and quality.

Aluminum cans are preferred for their ability to block light and oxygen, preventing spoilage and maintaining flavor integrity. The material’s infinite recyclability with minimal degradation supports both cost efficiency and sustainability goals, aligning with the environmental commitments of major beverage and food brands.

As demand for eco-friendly and premium packaging solutions continues to grow, aluminum maintains a competitive edge in both functionality and consumer appeal.

The pull-tab cans segment is expected to account for 54.2% of total market revenue by 2025 within the closure type category, positioning it as the most popular format. Its convenience, ease of opening, and reseal-free structure make it well-suited for on-the-go consumption.

The design ensures secure sealing until use, safeguarding product integrity while offering user-friendly accessibility. Pull-tab closures are widely adopted across carbonated and non-carbonated beverages due to their cost-effectiveness in mass production and compatibility with high-speed filling lines.

The combination of consumer convenience and operational efficiency has firmly established pull-tab cans as the dominant closure type in the can packaging market.

The non-alcoholic beverages segment is projected to capture 46.7% of total market revenue by 2025 within the application category, making it the leading segment. Growth in this category is being driven by increasing consumption of soft drinks, energy drinks, sports beverages, and functional wellness drinks.

Cans offer superior portability, quick chilling capability, and extended shelf life, making them ideal for these products. Marketing opportunities through eye-catching graphics and brand personalization have further reinforced their adoption.

As health-conscious consumers seek refreshing, convenient beverage options with minimal environmental impact, can packaging in the non-alcoholic beverage space is expected to continue its upward trajectory.

The can packaging market is expanding due to rising demand from food and beverage sectors and the growth of on-the-go consumption. Opportunities are driven by e-commerce channels and direct-to-consumer delivery models, while trends emphasize lightweight, corrosion-resistant materials and premium finishes. Challenges persist from raw material price volatility and supply chain complexities, affecting cost management. Overall, the market is shaped by the need for functional, reliable, and visually appealing packaging solutions, offering significant operational and branding advantages for manufacturers and distributors worldwide.

The can packaging market is witnessing increased demand as beverage and processed food manufacturers prioritize durable and convenient packaging solutions. Carbonated drinks, energy drinks, canned fruits, and ready-to-eat meals are increasingly packaged in aluminum and steel cans to ensure product integrity, ease of transport, and extended shelf life. Retailers and distributors are favoring cans for their stackability and resistance to damage during logistics. Consumer preference for lightweight, portable, and resealable packaging is also influencing adoption. Procurement decisions are being guided by cost-effectiveness, recyclability perception, and regulatory compliance, prompting manufacturers to expand production lines and standardize can sizes across product portfolios. Growth in on-the-go consumption patterns has further reinforced the market’s upward trajectory.

Opportunities in the can packaging market are being shaped by the expansion of e-commerce and direct-to-consumer sales channels. Online food and beverage delivery models require packaging that ensures product safety, tamper resistance, and transport efficiency. Customization of can designs, labeling, and printing is being leveraged to enhance brand visibility in digital marketplaces. Co-packers and beverage producers are adopting lightweight and compact cans to reduce shipping costs while maintaining quality. Market participants are exploring partnerships with fulfillment platforms to integrate packaging solutions that meet consumer expectations. These trends indicate potential for growth as packaging is positioned as both a functional and marketing asset in increasingly competitive retail and online spaces.

Market trends indicate a shift toward lightweight and corrosion-resistant materials for can packaging. Aluminum cans are being favored over steel for reduced material usage and easier handling, while coatings and linings are optimized to maintain taste and prevent contamination. Decorative finishes, high-quality printing, and innovative shapes are being used to differentiate brands on crowded retail shelves. Automation in can production and filling lines is being applied to enhance efficiency, reduce downtime, and maintain consistent quality. These trends are promoting standardization of material grades and dimensions, driving operational efficiency for manufacturers, and catering to consumer expectations of high-quality, portable, and visually appealing packaged goods.

Challenges in the can packaging market are primarily linked to fluctuations in aluminum and steel prices, which can impact manufacturing costs and profit margins. Supply chain disruptions, import restrictions, and logistics bottlenecks further complicate production planning. High energy consumption during can fabrication and stringent food safety regulations necessitate careful operational control. Smaller manufacturers may face difficulty in maintaining cost efficiency and quality standards, affecting their competitive positioning. Market participants are responding through bulk procurement strategies, material optimization, and diversification of supplier networks. Despite these measures, cost pressures and material dependency continue to influence production decisions and pricing strategies across the can packaging landscape.

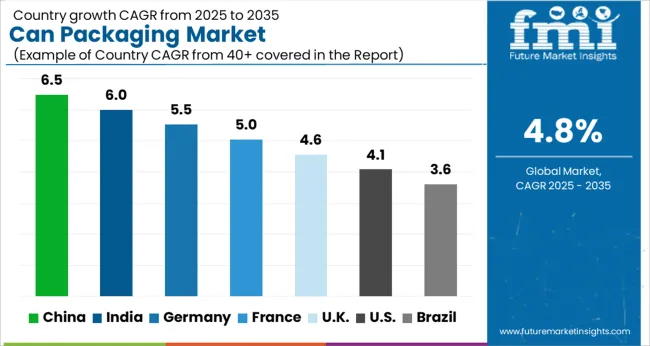

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global can packaging market is projected to grow at a CAGR of 4.8% from 2025 to 2035. China leads with a growth rate of 6.5%, followed by India at 6%, and Germany at 5.5%. The United Kingdom records a growth rate of 4.6%, while the United States shows the slowest growth at 4.1%. Rising demand is driven by increasing consumption of packaged food and beverages, growth of the retail sector, and rising demand for sustainable and recyclable packaging solutions. Emerging markets such as China and India benefit from rapid urbanization, growing disposable incomes, and expansion of the beverage and food industry, while developed markets like the USA, UK, and Germany focus on product innovation, regulatory compliance, and premium packaging solutions. This report includes insights on 40+ countries; the top markets are highlighted here.

The specialty coatings market represents a key segment within the global paints and coatings industry, emphasizing functional performance, protection, and application-specific formulations. Within the broader paints and coatings sector, it accounts for about 5.6%, driven by demand across industrial, automotive, and aerospace applications. In the protective coatings and corrosion-resistant coatings segment, it holds nearly 5.0%, reflecting the critical need for durability and longevity in harsh environments. Across the construction and infrastructure coatings market, the share is 4.4%, supporting adoption in bridges, pipelines, and high-performance structures.

Within the decorative and architectural coatings category, it represents 3.9%, highlighting niche applications requiring advanced aesthetics or functional properties. In the automotive and transportation coatings sector, it secures 3.5%, emphasizing scratch resistance, chemical resistance, and surface protection. Recent developments in this market have focused on nanotechnology, low-VOC formulations, and multifunctional performance. Innovations include self-cleaning coatings, anti-corrosion treatments, and high-temperature resistant surfaces tailored for specific industrial and transportation applications. Key players are collaborating with material scientists, industrial OEMs, and construction companies to enhance product durability, performance, and regulatory compliance. Adoption of UV-curable, water-based, and solvent-free coatings is gaining traction to reduce environmental impact while maintaining performance. The research into antimicrobial and conductive coatings is being deployed for healthcare, electronics, and advanced infrastructure applications. These trends demonstrate how innovation, functional performance, and industry-specific solutions are shaping the market.

The can packaging market in China is projected to grow at a CAGR of 6.5%. Strong demand is fueled by rising consumption of canned beverages, processed food, and ready-to-eat products. Rapid urbanization, increasing disposable income, and growth of the retail and e-commerce sectors drive higher packaging requirements. Chinese manufacturers are adopting advanced production technologies and high-quality materials to enhance product durability, sustainability, and consumer appeal. Government regulations promoting food safety and packaging standards further support market growth. Partnerships with international suppliers and investments in modern production facilities enhance efficiency and output. The increasing demand for premium and innovative packaging solutions also contributes to consistent market expansion.

The can packaging market in India is projected to grow at a CAGR of 6%. Growth is driven by increasing consumption of processed and convenience foods, soft drinks, and alcoholic beverages. Rising disposable incomes, urbanization, and the expansion of modern retail and e-commerce platforms fuel higher demand for packaged products. Indian manufacturers are upgrading production lines and incorporating high-quality materials to improve durability and consumer appeal. Government initiatives on food safety and packaging standards also promote adoption of modern can packaging solutions. Growing awareness of recyclable and environmentally friendly packaging, coupled with partnerships with international suppliers, further strengthens market growth.

The can packaging market in Germany is projected to grow at a CAGR of 5.5%. Growth is fueled by rising consumption of canned beverages, processed foods, and ready-to-eat meals. German manufacturers focus on high-quality materials, automation, and energy-efficient production processes to meet domestic demand. Strong regulatory frameworks on food safety and packaging standards promote the adoption of modern and sustainable can solutions. Increasing consumer preference for premium and eco-friendly packaging drives innovation in design and functionality. Partnerships with global suppliers and investments in R&D enhance production capabilities and market competitiveness. The market continues to benefit from a mature retail sector and steady demand from the food and beverage industry.

The can packaging market in the United Kingdom is projected to grow at a CAGR of 4.6%. Growth is driven by increasing demand for packaged beverages, processed food, and ready-to-eat meals. UK manufacturers emphasize high-quality, sustainable packaging and compliance with food safety regulations. Consumer preference for eco-friendly and recyclable packaging solutions encourages the adoption of advanced can production technologies. Retail sector growth, coupled with increased consumption of convenience foods and beverages, supports consistent market expansion. Collaborations with international suppliers and investments in modern manufacturing facilities further enhance production efficiency and quality.

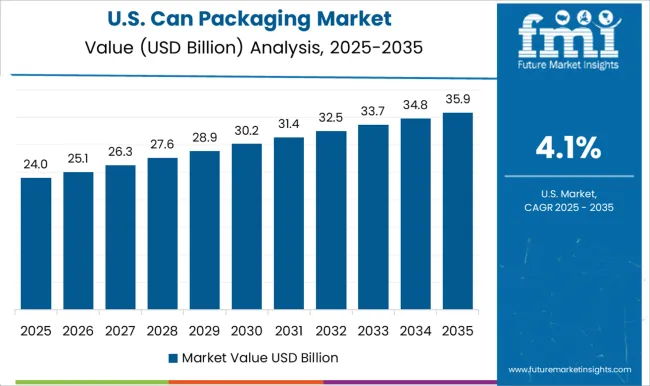

The can packaging market in the United States is projected to grow at a CAGR of 4.1%. Market expansion is fueled by high consumption of canned beverages, processed foods, and ready-to-eat products. USA manufacturers focus on premium, durable, and recyclable packaging solutions to meet consumer and regulatory requirements. Investments in advanced production technologies, automation, and efficient supply chain management enhance output and quality. The growth of retail and e-commerce sectors, combined with consumer preference for convenience and sustainable packaging, supports market development. Partnerships with global suppliers and continuous R&D investments strengthen competitive positioning and ensure the availability of innovative packaging solutions across the USA

The can packaging market is driven by global and regional players focusing on lightweight, durable, and sustainable metal packaging solutions for food, beverage, and industrial applications. Industry leaders such as Ball Corporation, Crown, Ardagh, and CANPACK emphasize aluminum and tinplate cans designed for beverage, aerosol, and specialty products. Product brochures highlight corrosion resistance, high-quality finishes, and compatibility with automated filling lines, with emphasis on brand customization through printing and coating options.

Kaiser Aluminum and Silgan Containers focus on premium cans for specialty beverages and processed foods, promoting shelf appeal and durability. Regional players like Ajanta Bottle, Bikaner Polymers, Hindustan Tin Works, and Swastik Tins cater to localized demand, offering cost-efficient solutions tailored to small and medium enterprises. Companies highlight product reliability, compliance with food-grade standards, and environmental advantages such as recyclability and low weight.

Specialized providers including Daiwa Can Company, Fibre Foils, Kian Joo Can Factory Berhad, Orora Packaging Australia, Sonoco Products Company, Trivium Packaging, Vaspal Packaging, Zenith Tins, and Casablanca compete on technical customization, rapid delivery, and integrated supply chain support. Brochures often showcase advanced coating technologies, anti-corrosion finishes, and decorative printing options.

Market competition is reinforced by innovation in can shapes, sizes, and closures, along with lightweighting initiatives to reduce material usage while maintaining strength. Focus remains on delivering reliable, scalable, and high-quality can packaging solutions that enhance product appeal, protect contents, and optimize operational efficiency across industrial, beverage, and consumer segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.2 billion |

| Material | Aluminum, Steel, and Biodegradable/green cans |

| Closure Type | Pull-tab cans, Pop-top cans, Push-in cans, and Non-resealable cans |

| Application | Non-alcoholic beverages, Alcoholic beverages, Food products, Personal care & cosmetics, and Others |

| End-use Industry | Food and beverages, Consumer goods, Pharmaceuticals, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ajanta Bottle, Ardagh, Ball Corporation, Bikaner Polymers, CANPACK, Casablanca, Crown, Daiwa Can Company, Fibre Foils, Hindustan Tin Works, Kaiser Aluminum, Kian Joo Can Factory Berhad, Orora Packaging Australia, Silgan Containers, Sonoco Products Company, Swastik Tins, Trivium Packaging, Vaspal Packaging, and Zenith Tins |

| Additional Attributes | Dollar sales by can type (aluminum, steel, tinplate) and application (beverages, food, aerosols, personal care) are key metrics. Trends include rising demand for lightweight, recyclable, and durable packaging, growth in ready-to-drink and processed food segments, and increasing adoption in sustainable packaging solutions. Regional adoption, technological advancements, and consumer preferences are driving market growth. |

The global can packaging market is estimated to be valued at USD 58.2 billion in 2025.

The market size for the can packaging market is projected to reach USD 93.0 billion by 2035.

The can packaging market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in can packaging market are aluminum, steel and biodegradable/green cans.

In terms of closure type, pull-tab cans segment to command 54.2% share in the can packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cannabis Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Packaging Equipment Market Growth - Forecast 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Canned Food Packaging Providers

Lubricant Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Lubricant Packaging Industry

Sugarcane Packaging Market Analysis by Material and Application 2025 to 2035

Market Share Breakdown of USA and Canada Molded Fiber Pulp Packaging Manufacturers

United States & Canada Cold Chain Packaging Market Insights- Demand and Growth Forecast 2025 to 2035

Molded Fiber Pulp Packaging industry Analysis in USA and Canada - Size, Share, and Forecast Outlook 2025 to 2035

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Canine Arthritis Treatment Market Forecast and Outlook 2025 to 2035

Can Stack Stepper Motors Market Forecast and Outlook 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA