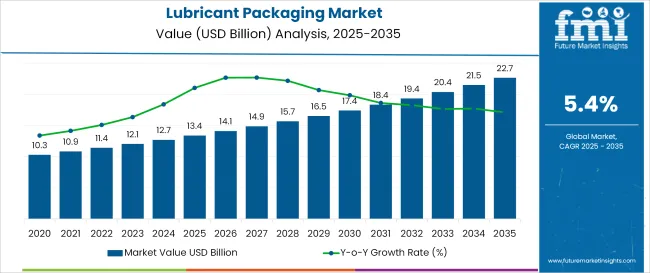

In 2025, the global lubricant packaging market is likely to be valued at USD 13.4 billion and is projected to grow steadily to USD 22.7 billion by 2035, expanding at a CAGR of 5.4%. This growth is expected to follow a consistent year-on-year (Y-o-Y) trend, averaging between 5.1% and 5.7% over the forecast period.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 13.4 billion |

| Projected Industry Value (2035F) | USD 22.7 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

By 2026, the industry will likely reach around USD 14.1 billion, driven by increased lubricant consumption across the automotive, industrial, and marine sectors. From 2030 onward, market momentum will likely benefit from stricter environmental regulations and a growing shift toward recyclable and reusable lubricant containers. By 2033, the industry is expected to surpass USD 20.3 billion, ultimately reaching USD 22.7 billion by 2035.

The industry represents a niche but essential segment within broader parent industries. Within the industrial packaging market, it holds an estimated 8-10% share, driven by the constant demand for industrial oils and greases. In the chemical packaging sector, its share is around 6-8%, as lubricants are one of many chemical-based products.

Within the petrochemical & oil packaging market, the share is higher at 12-15%, since lubricants are a core downstream product. In the automotive aftermarket, lubricant packaging commands 10-12%, reflecting its role in vehicle maintenance. within the overall packaging industry, it accounts for a modest 2-3%, as it competes with dominant segments like food and consumer goods packaging. Its value lies in durability, safety, and compliance.

A spokesperson from Berry Global stated that the company’s investment in eco-designed flexible formats aligns with the lubricant industry’s accelerating transition toward packaging that combines low environmental impact with high functional performance. This strategic move supports the growing preference for lightweight, spill-resistant pouches over traditional rigid containers, addressing the dual goals of material reduction and cost-efficient transportation.

Lubricant packaging demand is projected to reach USD 13.4 billion in 2025, expanding steadily toward USD 22.7 billion by 2035 at a CAGR of 5.4%. Engine oil and automotive sectors remain key drivers, with plastics dominating material usage due to ease of moldability and cost advantage. Growth is further fueled by packaging shifts toward convenience, anti-leak formats, and evolving lubricant chemistries across industrial applications

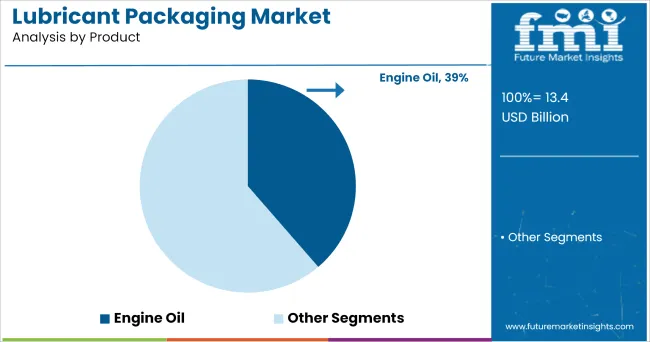

Engine oil packaging will contribute 39% of global lubricant packaging revenue in 2025, driven by its recurring use across automotive, construction, and agricultural vehicles. The segment demands a high frequency of refill cycles and packaging standardization for viscosity grades.

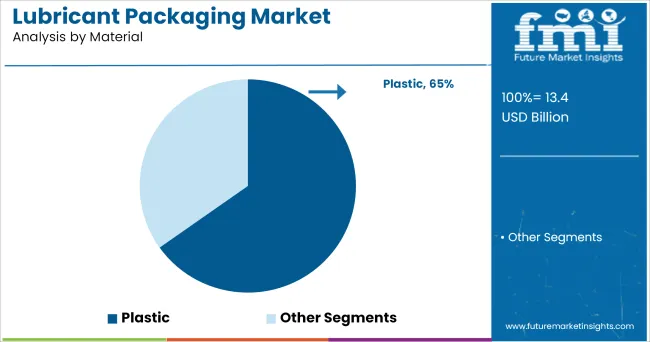

Plastic packaging will account for 65% of lubricant container usage in 2025, Because of its moldability, cost effectiveness, and growing recyclability. HDPE and PP remain top material choices, covering most light and industrial-grade lubricant containers.

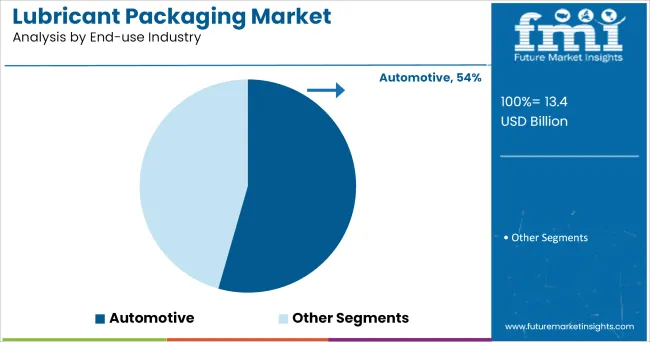

The automotive sector will be the leading end-use industry, consuming over 54% of all lubricant packaging in 2025. This includes private vehicles, commercial fleets, 2-wheelers, and electric vehicle-compatible transmission and greasing products.

Lubricant packaging shipments reached 4.3 billion units globally in H1 2025, marking a 5.1% increase from the previous year. Material selection, pack size distribution, and refill integration were shaped by automotive service cycles, resin availability, and regulatory pressures related to disposal standards and recovery logistics in high-volume consumption regions.

Automotive and Equipment Service Demand Influencing Format Mix

Passenger vehicle motor oils accounted for 47.6% of filled packaging in Q2 2025. Industrial machinery lubricants contributed 34.2%, with off-highway segments such as agriculture and construction generating 11.5%. One-litre bottles held 51.8% of global filled units.

Flexible pouch formats recorded 14.9% growth in Southeast Asia, especially where smaller service operators sought to lower handling and storage costs. Pail containers in the 10 to 20 litre range expanded by 6.3% across Middle East distribution hubs due to bulk purchasing shifts in equipment maintenance networks.

Resin Economics and Labeling Tech Reshaping Converter Strategy

HDPE remained the dominant substrate, used in 69.4% of lubricant packaging globally in H1 2025. Blow-mold grade HDPE averaged GBP 1,428 per metric ton in June, reflecting a 7.2% increase from Q1 pricing. Polypropylene gained traction in Brazil and Argentina due to improved local availability and compatibility with hot-fill lines.

QR-cap authentication reached 18.6% of retail-facing SKUs in Europe, compared to 5.2% a year earlier. UV-cured labels saw a 9.3% rise in North American demand, mainly among premium-grade lubricant marketers targeting higher-viscosity synthetic blends.

Regulatory Shifts Trigger Refill Design and End-of-Use Changes

Packaging mandates introduced in Q2 across Germany, South Korea, and Japan prompted adjustments in closure systems and layer separation for recycling ease. Dual-material recovery coding is now found on 22.1% of lubricant containers in the EU.

Auto service centers across France and Italy increased procurement of semi-rigid refill containers, replacing single-use drums in 1 out of every 3 new fleet contracts. Used-oil collection programs spurred a 17.4% rise in demand for return-ready pouches and nested bag-in-box kits, particularly in regions with mandatory lubricant waste reporting thresholds.

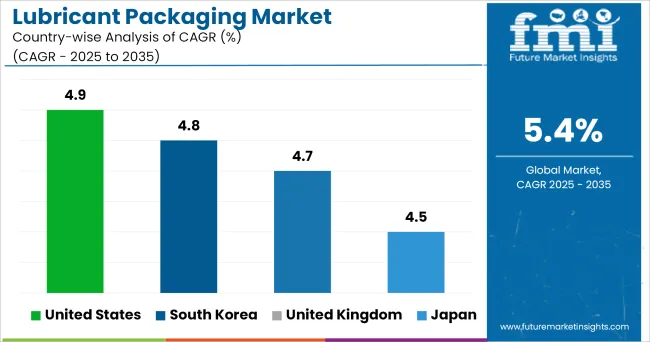

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.1% |

| United States | 4.9% |

| South Korea | 4.8% |

| United Kingdom | 4.7% |

| Japan | 4.5% |

The lubricant packaging industry is projected to grow at a global CAGR of 5.4% between 2025 and 2035. Among key players, India (BRICS) is closest to this average with a growth rate of 5.1%, reflecting expanding automotive and industrial applications. The United States, South Korea, the United Kingdom, and Japan-all OECD economies-register comparatively moderate figures, ranging from 4.5% to 4.9%.

These differences point to divergent market priorities. India continues to scale production and expand distribution networks, while packaging development in OECD countries focuses more on efficiency, recycling compatibility, and compliance-driven innovation. Industry expansion is shaped by domestic manufacturing capacities, sectoral lubricant demand, and evolving material preferences.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The lubricant packaging industry in India is projected to expand at a CAGR of 5.1% through 2035, supported by high consumption in automotive, railways, and industrial sectors. From 2020 to 2024, the industr grew at 4.2%, aided by rapid motorization and fleet expansion.

Mid-size and heavy vehicles accounted for increasing bulk lube purchases, prompting demand for HDPE drums and multilayer pouches. Digital retailing of lubricants also fueled the shift toward tamper-evident, single-use packs, for aftermarket use. Flexible pouches are gaining traction for synthetic lubricants in Tier 2 cities.

The United States is forecast to grow at 4.9% CAGR through 2035, up from 3.6% between 2020 and 2024. The resurgence of manufacturing and rising vehicle miles traveled have revived bulk lubricant consumption. High-viscosity oils for trucks and equipment fleets are driving demand for durable drum and IBC (intermediate bulk container) formats.

Green packaging formats like re-refillable bottles and PCR-based jugs are seeing gradual uptake. Automation in filling lines and investments in clean dispensing closures are becoming procurement priorities for top-tier brands.

South Korea is expected to grow at 4.8% CAGR between 2025 and 2035, up from 3.9% over the previous five years. Domestic OEM lubricant production for automotive assembly has supported demand for high-barrier, thermoformed plastic packs.

Brands are focusing on digitally coded anti-counterfeit closures to support warranty-linked servicing. Space-efficient packs for electric vehicles and hybrid drivetrains are seeing early adoption. Pack formats in industrial segments are evolving, with more collapsible containers being adopted for metalworking fluids and hydraulic oils.

The UK lubricant packaging industry is projected to grow at 4.7% CAGR from 2025 to 2035, accelerating from 3.4% in the 2020 to 2024 period. Aftermarket synthetic oils and specialty industrial fluids have shaped demand for resealable and recyclable rigid packs. The transition to electric mobility and fleet digitization is reducing average lube consumption per vehicle, pushing brands to re-engineer packaging sizes and dosing control.

The lubricant packaging industry in Japan is forecast to grow at 4.5% CAGR over 2025 to 2035, compared to 3.3% in the prior five-year window. The country's high share of hybrid and compact vehicles has steady demand for smaller pack sizes, particularly 0.5L to 2L bottles.

Smart dispensing systems with tamper verification are being deployed in industrial lubricant settings. Material innovations are focused on anti-leak, low-permeability containers for high-temperature synthetic oils used in aerospace and electronics machinery.

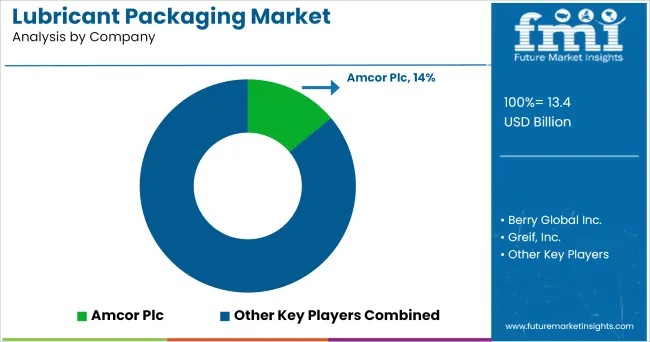

The industry is led by global players like Amcor Plc and Berry Global Inc., who dominate through strategic acquisitions and diversified product lines. Amcor expanded its flexible pouch offerings for automotive lubricants, while Berry Global developed spill-proof containers for industrial use. Greif, Inc. and Mauser Packaging Solutions specialize in steel and plastic drums, catering to bulk lubricant distributors.

Emerging competitors such as Uflex Ltd. focus on cost-efficient flexible films, gaining traction in price-sensitive markets. Entry barriers include significant capital requirements for blow-molding and injection molding equipment, along with strict regulatory standards for hazardous material containment.

Established brands like Sonoco Products Company benefit from long-term contracts with oil majors, while new entrants compete through regional specialization and customized solutions for smaller lubricant blenders.

Leading player- Amcor Plc holding 14% industry share

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 13.4 billion |

| Projected Market Size (2035) | USD 22.7 billion |

| CAGR (2025 to 2035) | 5.4% |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion (revenue) |

| Product Segmentation | Engine Oil, Transmission & Hydraulic Fluid, Process Oil, Metal Working Fluid, General Industrial Fluid, Gear Oil, Greases |

| Material Segmentation | Metal (Tin, Steel), Plastic (Polyethylene, HDPE, LDPE, PVC, PET, PS, PP, PA), Others |

| End-use Industry Segmentation | Automotive, Metal Working, Oil & Gas, Power Generation, Machine Industry, Chemicals, Other Manufacturing |

| Regional Coverage | North America, Latin America, Middle East and Africa (MEA), Europe, Asia Pacific |

| Country Covered | United States, Canada, Germany, United Kingdom, France, Italy, Japan, China, India, Brazil, ASEAN, GCC countries |

| Leading Companies Profiled | Amcor Plc, Berry Global Inc., Greif, Inc., Scholle IPN, Mauser Packaging Solutions, Sonoco Products Company, Mondi Group, CCL Industries, Glenroy, Inc., Uflex Ltd. |

| Additional Insights | Dollar sales, share by lubricant type and container format, rising demand for HDPE and PET containers in automotive and industrial applications, shift toward sustainable plastic and metal hybrid packaging, growth in refillable and recyclable lubricant pouches, influence of high-speed filling lines and digital labeling innovations |

The industry is expected to grow from USD 13.4 billion in 2025 to USD 22.7 billion by 2035.

Plastic packaging will account for approximately 65% of total lubricant packaging usage in 2025.

The automotive industry will consume over 54% of lubricant packaging volume globally in 2025.

Engine oil packaging will hold a 39% share of the total lubricant packaging industry in 2025.

Amcor Plc leads the market with a 14% share in the global industry.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Lubricant Packaging Industry

Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Lubricants / Slip Agents Market Size and Share Forecast Outlook 2025 to 2035

Lubricant Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Lubricant Additives Market Growth - Trends & Forecast 2025 to 2035

Lubricants for Cement Industry Market

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Firearm Lubricants Market Demand & Growth 2025 to 2035

Plastic Lubricants Market

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Forestry Lubricants Manufacturers

Aviation Lubricants Market

Wire Rope Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Synthetic Lubricants and Functional Fluids Market - Growth & Demand 2025 to 2035

Bio-Based Lubricants Market

Open Gear Lubricants Market

Industrial Lubricant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Lubricants Industry Analysis in India - Growth Trends, Regional Insights 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA