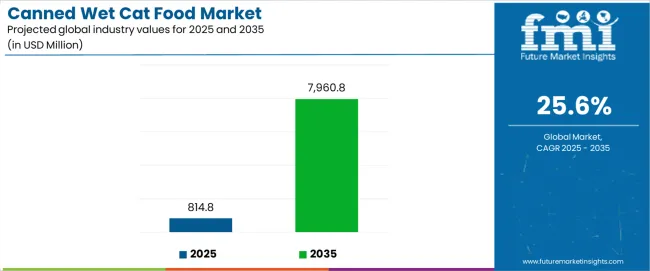

The canned wet cat food market is projected to grow from USD 814.8 million in 2025 to USD 7,960.8 million in 2035, advancing at a CAGR of 25.6 percent. Innovation and R&D play a central role in shaping product evolution, consumer adoption, and brand differentiation. Functional wet foods are being developed with precise nutritional enrichment, targeting taurine levels for heart and eye health, omega fatty acids for skin and coat improvement, and probiotics for digestive balance. These formulations respond to a growing trend of pet humanization where owners demand premiumized food options similar to human dietary standards. Protein quality is being closely evaluated, with poultry, beef, and fish bases being optimized for bioavailability, digestibility, and palatability.

Research in protein substitution is expanding. Insect-based proteins are gaining attention as a novel source due to high amino acid content and lower environmental impact. Plant-based proteins are under development to create alternatives for cats with sensitivities, though research is ongoing to balance amino acid completeness. The exploration of algal proteins and marine byproducts is also visible in R&D pipelines, adding diversity to protein innovation. These shifts create opportunities for both established multinational players and emerging startups to capture consumer segments that prioritize novel, natural, or ethical protein sources in feline nutrition.

Packaging is a key innovation frontier. Smart freshness indicators are being tested to ensure food quality remains uncompromised during storage and distribution. Lightweight recyclable metal cans and alternative biodegradable pouches are under research to address waste management challenges. Vacuum-sealed formats are being designed for single-serve applications to cater to urban households preferring portion-controlled feeding. Packaging innovation also intersects with logistics and e-commerce, as manufacturers seek designs that improve shelf stability and reduce transportation costs.

R&D efforts also focus on texture, aroma, and flavor engineering. Studies are emphasizing sensory appeal to increase acceptance among cats, with controlled testing of gelled meat chunks, broths, and pâté forms. Nutraceutical inclusion is another dimension, with formulations incorporating joint-support compounds like glucosamine, immune-boosting botanicals, and antioxidants. Such development aligns with veterinary-driven recommendations, making the segment more attractive for clinical endorsements.

Digital twins and AI-based modeling are entering product development, enabling simulation of nutrient interactions and palatability outcomes. These tools reduce trial-and-error in lab testing and accelerate time to market. Research partnerships between pet food manufacturers and academic institutions are also broadening, leading to evidence-based formulations backed by published studies.

Innovation in the canned wet cat food market is no longer limited to flavor variants. It extends across nutrient enrichment, protein diversification, packaging evolution, and computational modeling of product performance.

Between 2025 and 2030, the canned wet cat food market is projected to expand from USD 814.8 million to USD 2,027.8 million, resulting in a value increase of USD 1,213.0 million, which represents 17.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing PET ownership rates and humanization trends, rising adoption of premium and natural cat food products, and growing demand for specialized nutrition solutions that address specific health needs and life stage requirements. Pet food manufacturers and retailers are expanding their canned wet cat food portfolios to address the growing demand for high-quality and nutritious feeding solutions that ensure PET health and owner satisfaction.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 814.8 million |

| Forecast Value in (2035F) | USD 7,960.8 million |

| Forecast CAGR (2025 to 2035) | 25.6% |

From 2030 to 2035, the canned wet cat food market is forecast to grow from USD 2,027.8 million to USD 7,960.8 million, adding another USD 5,933.0 million, which constitutes 83.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of e-commerce channels and direct-to-consumer distribution models, the development of innovative formulations with functional ingredients and sustainable packaging, and the growth of specialized applications for senior cats, medical nutrition, and breed-specific dietary requirements. The growing adoption of transparent sourcing practices and clean label principles will drive demand for canned wet cat food with enhanced nutritional profiles and premium ingredient quality.

Between 2020 and 2025, the canned wet cat food market experienced steady growth, driven by increasing PET ownership and growing recognition of wet food as essential nutrition for maintaining cat health and hydration. The canned wet cat food market developed as PET owners and veterinarians recognized the potential for canned wet cat food to support urinary tract health, improve palatability, and address specific dietary needs while meeting nutritional standards. Technological advancement in formulation science and preservation techniques began emphasizing the critical importance of maintaining nutritional integrity and ingredient quality in convenient feeding formats.

Market expansion is being supported by the increasing global trend of PET humanization and premiumization driven by changing consumer attitudes toward PET care and rising disposable incomes, alongside the corresponding need for high-quality nutritional products that can support cat health, enhance palatability, and maintain moisture content across various life stages, dietary preferences, and health condition applications. Modern PET owners are increasingly focused on providing feeding solutions that can deliver complete nutrition, address specific health concerns, and provide natural ingredients in convenient formats.

The growing emphasis on PET health and wellness is driving demand for canned wet cat food that can support hydration, provide balanced nutrition, and address specialized dietary requirements through functional ingredients. Pet owners' preference for products that combine nutritional excellence with ingredient transparency and sustainable practices is creating opportunities for innovative canned cat food offerings. The rising influence of veterinary recommendations and online PET communities is also contributing to increased adoption of wet food that can provide superior nutritional benefits without compromising on taste or quality standards.

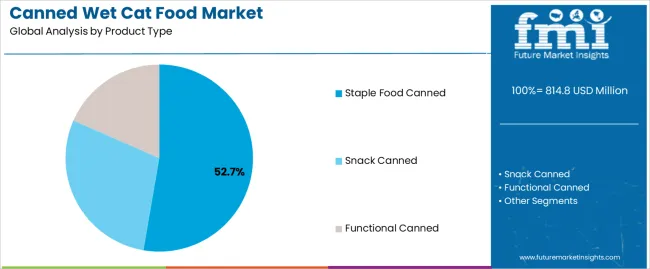

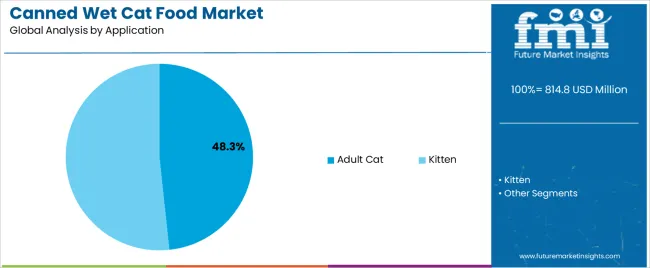

The canned wet cat food market is segmented by product type, application, and region. By product type, the canned wet cat food market is divided into staple food, snack, and functional canned food. Based on application, the canned wet cat food market is categorized into kitten and adult cat. Regionally, the canned wet cat food market is divided into East Asia, Europe, North America, South Asia, Latin America, the Middle East & Africa, and Eastern Europe.

The staple food canned segment is projected to maintain its leading position in the canned wet cat food market in 2025 with a 52.7% market share, reaffirming its role as the preferred product category for daily nutrition and complete meal solutions. Pet owners increasingly utilize staple food canned products for their comprehensive nutritional profiles, excellent palatability characteristics, and proven effectiveness in providing balanced diets while supporting hydration needs. Staple food formulation's proven effectiveness and nutritional completeness directly address the PET care requirements for everyday feeding and long-term health maintenance across diverse cat breeds and age groups.

This product segment forms the foundation of modern cat nutrition, as it represents the category with the greatest contribution to daily dietary needs and established performance record across multiple feeding occasions and household settings. Pet industry investments in premium nutrition continue to strengthen adoption among PET owners and veterinary professionals. With consumer trends requiring natural ingredients and complete nutrition, staple food canned products align with both health objectives and convenience requirements, making them the central component of comprehensive cat care strategies.

The adult cat application segment is projected to represent the largest share of canned wet cat food demand in 2025 with a 48.3% market share, underscoring its critical role as the primary driver for wet food adoption across mature cats, working-age felines, and maintenance nutrition applications. Pet owners prefer canned wet food for adult cats due to its exceptional nutritional balance, moisture content benefits, and ability to support overall health while maintaining ideal body condition and addressing age-appropriate dietary needs. Positioned as essential nutrition for adult feline care, canned wet cat food offers both health advantages and feeding convenience.

The segment is supported by continuous innovation in formulation science and the growing availability of specialized recipes that enable optimal nutrition with enhanced palatability and targeted health benefits. Additionally, PET owners are investing in comprehensive feeding programs to support increasingly discerning taste preferences and growing awareness of the importance of hydration for adult cat health. As premium PET care trends accelerate and nutritional awareness increases, the adult cat application will continue to dominate the canned wet cat food market while supporting advanced formulation development and personalized nutrition strategies.

The canned wet cat food market is advancing steadily due to increasing PET humanization trends driven by changing household dynamics and growing PET ownership rates that require premium nutritional products providing enhanced health benefits and palatability across diverse kitten nutrition, adult maintenance, and specialized health applications. However, the canned wet cat food market faces challenges, including price sensitivity among value-conscious consumers, competition from dry food and alternative feeding formats, and supply chain constraints related to ingredient availability and packaging material costs. Innovation in sustainable packaging technologies and functional ingredient integration continues to influence product development and market expansion patterns.

The growing trend of treating pets as family members is driving demand for premium canned wet cat food that addresses elevated quality expectations including natural ingredients, grain-free formulations, and human-grade components. Premium cat nutrition requires advanced formulations that deliver superior taste profiles across multiple parameters while maintaining nutritional completeness and affordability. Pet food manufacturers are increasingly recognizing the competitive advantages of premium canned products for market differentiation and brand loyalty building, creating opportunities for innovative recipes specifically designed for discerning PET owners seeking restaurant-quality nutrition.

Modern PET food manufacturers are incorporating functional ingredients and health-targeted formulations to enhance nutritional benefits, support specific health conditions, and address comprehensive wellness objectives through specialized recipes featuring probiotics, omega fatty acids, and joint support compounds. Leading companies are developing condition-specific products for urinary health, implementing digestive support formulations, and advancing recipes that optimize immune function and coat quality. These innovations improve health outcomes while enabling new market opportunities, including veterinary-recommended products, senior cat nutrition, and weight management solutions. Advanced functional integration also allows manufacturers to support comprehensive PET wellness objectives and product differentiation beyond traditional nutritional attributes.

The expansion of environmental consciousness, transparent sourcing demands, and ingredient integrity expectations is driving demand for canned wet cat food with eco-friendly packaging materials, clearly labeled ingredient lists, and traceable protein sources. These sustainability-focused products require specialized supply chain management with stringent quality specifications that exceed traditional manufacturing standards, creating premium market segments with differentiated value propositions. Manufacturers are investing in recyclable packaging innovations and ethical sourcing programs to serve environmentally conscious consumers while supporting brand reputation in natural PET care and sustainable business practices.

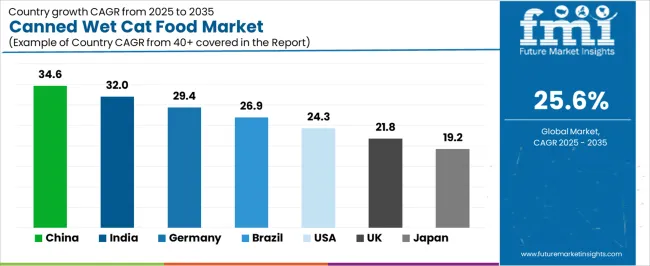

| Country | CAGR (2025-2035) |

|---|---|

| China | 34.6% |

| India | 32.0% |

| Germany | 29.4% |

| Brazil | 26.9% |

| USA | 24.3% |

| UK | 21.8% |

| Japan | 19.2% |

The canned wet cat food market is experiencing solid growth globally, with China leading at a 34.6% CAGR through 2035, driven by rapidly expanding PET ownership, rising middle-class spending on premium PET products, and growing awareness of PET nutrition and health. India follows at 32%, supported by increasing urbanization, growing nuclear families adopting pets, and rising disposable incomes enabling premium PET care spending. Germany shows growth at 29.4%, emphasizing premium natural ingredients, strict quality standards, and strong PET humanization culture. Brazil demonstrates 26.9% growth, supported by expanding PET ownership rates, growing middle class, and increasing demand for imported premium brands. The United States records 24.3%, focusing on grain-free formulations, natural ingredients, and specialized dietary solutions. The United Kingdom exhibits 21.8% growth, emphasizing premium brands, ethical sourcing, and transparent labeling. Japan shows 19.2% growth, supported by high PET ownership density, premium product preferences, and aging PET population requiring specialized nutrition.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from canned wet cat food in China is projected to exhibit exceptional growth with a CAGR of 34.6% through 2035, driven by rapidly expanding urban PET ownership and rising middle-class consumer spending on premium PET nutrition products supported by e-commerce platform growth and increasing awareness of proper PET care practices. The country's massive consumer market and increasing PET humanization trends are creating substantial demand for high-quality canned cat food solutions. Major international brands and domestic manufacturers are establishing comprehensive distribution networks to serve both tier-1 cities and emerging markets.

Revenue from canned wet cat food in India is expanding at a CAGR of 32.0%, supported by increasing urbanization, growing nuclear family structure with PET adoption, and rising awareness of PET nutrition and health care driven by veterinary education and online PET communities. The country's expanding middle class and changing attitudes toward PET care are driving sophisticated purchasing behaviors throughout urban centers. International PET food companies and emerging domestic brands are establishing distribution capabilities to address growing demand.

Revenue from canned wet cat food in Germany is expanding at a CAGR of 29.4%, supported by the country's strong PET humanization culture, emphasis on natural ingredients and quality standards, and sophisticated consumer preferences for premium PET nutrition products. The nation's advanced PET care market and stringent quality expectations are driving demand for high-specification canned cat food throughout retail channels. Leading international brands and specialty manufacturers are investing extensively in organic formulations and sustainable sourcing.

Revenue from canned wet cat food in Brazil is expanding at a CAGR of 26.9%, supported by the country's growing PET ownership rates, expanding middle-class purchasing power, and increasing awareness of PET nutrition and wellness. Brazil's vibrant PET culture and rising consumer spending are driving demand for premium imported and locally produced canned products. International manufacturers and regional suppliers are investing in market expansion and distribution development.

Revenue from canned wet cat food in the United States is expanding at a CAGR of 24.3%, driven by the country's mature PET care market, strong demand for grain-free and natural products, and growing emphasis on specialized dietary solutions including limited ingredient and novel protein formulations. The nation's sophisticated consumer base and established PET industry are driving innovation in premium wet food categories. Leading manufacturers and specialty brands are investing in functional nutrition and clean label products.

Revenue from canned wet cat food in the United Kingdom is growing at a CAGR of 21.8%, driven by the country's strong animal welfare culture, emphasis on ethical sourcing and sustainability, and sophisticated consumer preferences for premium natural PET food products. The UK's advanced PET care consciousness and quality expectations are supporting investment in high-specification canned products. Major international brands and artisan manufacturers are establishing comprehensive product ranges featuring responsibly sourced ingredients.

Revenue from canned wet cat food in Japan is expanding at a CAGR of 19.2%, supported by the country's high PET ownership density in urban areas, premium product preferences, and growing senior cat population requiring specialized nutrition and easily digestible formulations. Japan's sophisticated PET culture and quality consciousness are driving demand for high-specification canned products. Leading manufacturers are investing in specialized capabilities for age-appropriate and condition-specific formulations.

The canned wet cat food market in Europe is projected to grow from USD 307.4 million in 2025 to USD 1,614.5 million by 2035, registering a CAGR of 18.1% over the forecast period. Germany is expected to maintain leadership with a 32.5% market share in 2025, moderating to 31.8% by 2035, supported by premium PET food culture, natural ingredient preferences, and strong animal welfare standards.

The United Kingdom follows with 24.7% in 2025, projected at 24.2% by 2035, driven by ethical sourcing emphasis, premium brand preference, and strong PET humanization trends. France holds 18.3% in 2025, rising to 18.9% by 2035 on the back of gourmet PET food culture and quality ingredient focus. Italy commands 12.6% in 2025, reaching 13.1% by 2035, while Spain accounts for 7.4% in 2025, rising to 7.9% by 2035 aided by growing PET ownership and modern retail expansion. The Netherlands maintains 4.5% in 2025, up to 4.1% by 2035 due to strong import distribution capabilities. The Rest of Europe region, including Nordic countries with high PET care spending, Central & Eastern European emerging markets, and other EU nations, is anticipated to hold 0.0% in 2025 and 0.0% by 2035, with growth distributed across listed markets reflecting consolidation in established PET care economies.

The canned wet cat food market is characterized by competition among global PET food conglomerates, specialized premium brands, and regional manufacturers. Companies are investing in natural ingredient sourcing, functional formulation development, sustainable packaging innovation, and specialized nutrition solutions to deliver high-quality, palatable, and health-focused canned cat food products. Innovation in grain-free recipes, novel protein sources, and functional ingredient integration is central to strengthening market position and competitive advantage.

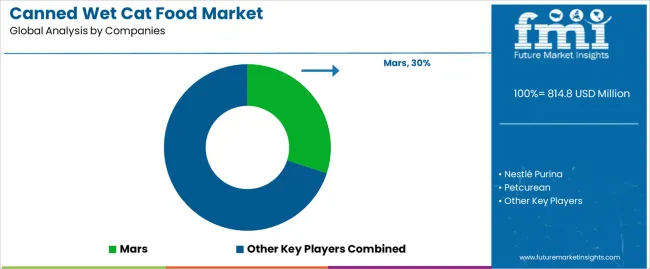

Mars leads the canned wet cat food market with comprehensive PET food brands including Sheba, Whiskas, and Iams, offering diverse canned cat food products across multiple price points and nutritional segments. The company maintains strong global distribution and continues investing in product innovation and sustainability initiatives. Nestlé Purina provides extensive canned cat food portfolio through brands like Fancy Feast, Friskies, and Pro Plan, emphasizing palatability, nutritional science, and targeted health benefits.

Petcurean offers premium natural PET food products with focus on quality ingredients and transparent sourcing. United Petfood provides private label and branded solutions with emphasis on European quality standards. PLB International specializes in premium PET food manufacturing and distribution. Champion Petfoods (Gimborn) delivers biologically appropriate nutrition through Acana brand with regionally sourced ingredients. Nutrience focuses on natural formulations with Canadian heritage. General Mills offers premium PET food through Blue Buffalo brand emphasizing natural ingredients.

Schell & Kampeter provides Taste of the Wild brand featuring novel proteins and grain-free formulations. Wellness Pet Company emphasizes natural ingredients and holistic nutrition philosophy. Colgate-Palmolive offers Hill's Science Diet with veterinary-backed formulations. Nature's Variety (Instinct) specializes in raw-inspired and high-protein recipes. ZIWI Pets provides premium air-dried and canned products from New Zealand. Farmina emphasizes scientific nutrition and natural ingredients. LEONARDO focuses on functional nutrition for cats. Purebred specializes in premium formulations.

Yantai China Pet Foods serves Asian markets with diverse product ranges. Shandong Gambol Pet Group provides comprehensive PET food solutions for domestic markets. Zhejiang Petpal Pet Nutrition Technology focuses on scientific formulation development. Hangzhou Tianyuan Pet Products offers regional manufacturing capabilities. Hebei Ronsy Pet Food specializes in private label and export production.

Canned wet cat food represents a dynamic premium nutrition segment within PET care, projected to grow from USD 814.8 million in 2025 to USD 7,960.8 million by 2035 at a 25.6% CAGR. These nutritious feeding products—primarily complete meal and supplementary nutrition configurations—serve as essential dietary solutions in kitten development, adult maintenance, and specialized health applications where palatability, moisture content, and nutritional density are critical. Market expansion is driven by PET humanization trends, growing premium product demand, increasing health consciousness, and rising emphasis on natural ingredients across diverse household types and PET care philosophies.

How Pet Food Regulators Could Strengthen Product Standards and Safety?

How Industry Associations Could Advance Quality Standards and Market Development?

How Pet Food Manufacturers Could Drive Innovation and Market Leadership?

How Pet Owners Could Optimize Feline Nutrition and Health?

How Veterinary Professionals Could Enable Nutritional Excellence?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 814.8 million |

| Product Type | Staple Food Canned, Snack Canned, Functional Canned |

| Application | Kitten, Adult Cat |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Mars, Nestlé Purina, Petcurean, United Petfood, PLB International, Champion Petfoods |

| Additional Attributes | Dollar sales by product type and application category, regional demand trends, competitive landscape, technological advancements in formulation, premium product development, functional ingredient integration, and sustainable packaging innovation |

The global canned wet cat food market is estimated to be valued at USD 814.8 million in 2025.

The market size for the canned wet cat food market is projected to reach USD 7,960.8 million by 2035.

The canned wet cat food market is expected to grow at a 25.6% CAGR between 2025 and 2035.

The key product types in canned wet cat food market are staple food canned, snack canned and functional canned.

In terms of application, adult cat segment to command 48.3% share in the canned wet cat food market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Mackerel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Anchovy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Canned Meat Market Insights - Industry Growth & Demand 2025 to 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Canned Legumes Market Insights – Protein-Packed Convenience Foods 2025 to 2035

Leading Providers & Market Share in Canned Tuna Industry

Canned Mushroom Market Analysis by Nature, Product Type, Form, and End-Use Application Through 2035

Canned Salmon Market Analysis by Source, Species, Form, and Sales Channel Through 2035

Canned Vegetable Market Growth – Preservation & Industry Demand 2024-2034

Canned Sardine Market Growth – Sustainable Seafood & Industry Demand 2024-2034

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Canned Food Packaging Providers

Analysis and Growth Projections for Canned Foods Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA