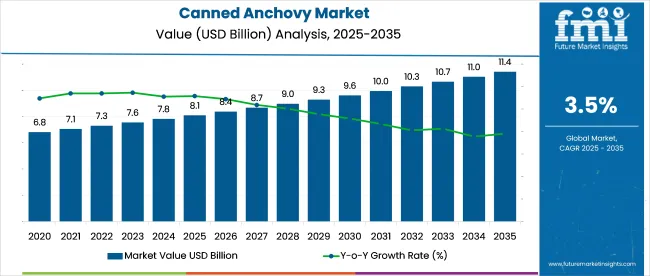

The canned anchovy market is being valued at USD 8.1 billion in 2025 and is expected to reach USD 11.4 billion by 2035, at a CAGR of 3.5%, according to canned seafood projections.

Anchovy segment trends are being shaped by rising interest in omega3 rich marine proteins and convenient, shelfstable seafood staples. Supply-side risks are being introduced as anchovy stocks face sustainability pressures in key sourcing regions like Morocco and Spain.

It is argued that value-addition via flavored marinades and BPAfree packaging will differentiate premium canned anchovies from bulk commodity offerings. However, it is suggested that cost-sensitive consumer segments may resist price premiums. Consolidation is expected to be driven, with major seafood conglomerates likely to absorb boutique anchovy brands to secure category breadth.

The industry holds a niche share within its parent markets. In the seafood market, it accounts for approximately 1-2%, as anchovies are just one type of fish among various popular seafood products. Within the canned food market, the share is around 3-5%, driven by the growing demand for convenient, shelf-stable seafood options.

In the preserved food market, canned anchovies represent about 2-3%, as they are part of the broader category of preserved fish and seafood. Within the fish and seafood processing market, their share is approximately 4-6%, as they are part of the fish processing industry, particularly in the canning process. In the food and beverage market, the share is around 1-2%, as canned anchovies are used primarily as an ingredient in various food products.

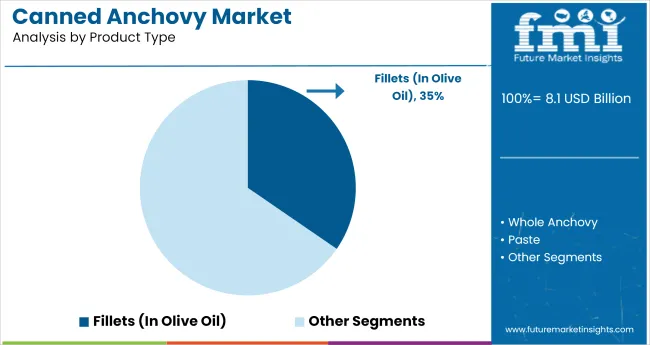

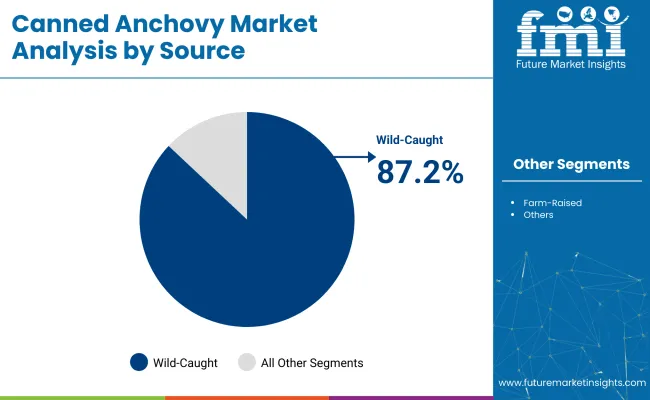

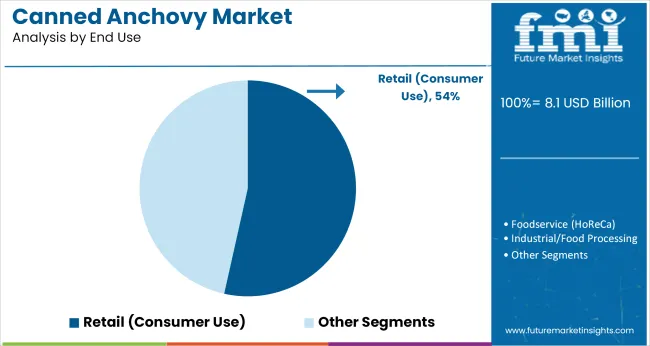

The industry is projected to grow in 2025, with canned anchovies in olive oil leading the product segment at 34.60%. Wild-caught anchovies will dominate the source segment with 87.20%, and retail (consumer use) will account for 53.5% of the end-use industry share.

Canned anchovies in olive oil are expected to capture 34.6% of the industry share in 2025. Olive oil provides a smooth, rich flavor and enhances the texture of anchovies, making this variant highly preferred by consumers. This product is commonly used in salads, pastas, and Mediterranean cuisine. As demand for convenient and premium seafood options increases, canned anchovies in olive oil continue to be favored for their versatility in both cooking and consumption. Their popularity in retail and foodservice sectors drives their dominance in the industry.

Wild-caught anchovies are projected to dominate the source segment, capturing 87.2% of the industry share in 2025. Wild-caught anchovies are preferred due to their natural, authentic taste and sustainable sourcing practices. The fishing method ensures the preservation of the anchovy's natural flavor profile, which is highly valued by consumers. Wild-caught products tend to meet higher sustainability standards, contributing to their growing popularity in the industry. As consumer awareness of environmental impact and food sourcing increases, wild-caught anchovies continue to lead in both industry share and consumer preference.

Retail (consumer use) is expected to capture 53.5% of the industry share in 2025. As consumer demand for convenient, ready-to-eat seafood options grows, canned anchovies remain a popular choice for retail consumers. These products are typically sold in supermarkets, grocery stores, and online platforms, where convenience and accessibility are key drivers of purchase decisions. The increasing popularity of Mediterranean and healthy cuisine, combined with growing consumer awareness of the health benefits of anchovies, ensures that retail remains the largest end-use segment.

The industry is experiencing growth driven by increasing demand for convenient, protein-rich food options and the popularity of Mediterranean cuisine. However, challenges such as overfishing, fluctuating anchovy stocks, and environmental concerns pose significant obstacles to sustainable industry expansion.

Rising Demand for Convenient, Protein-Rich Foods

The industry is benefiting from a growing consumer preference for convenient, protein-rich food options. Anchovies, known for their high omega-3 fatty acid content and umami flavor, are increasingly popular among health-conscious consumers and those seeking to incorporate Mediterranean diet staples into their meals. The convenience of canned anchovies, which offer a long shelf life and easy storage, further enhances their appeal. This trend is contributing to the industry's expansion, particularly in regions where Mediterranean cuisine is gaining popularity.

Overfishing and Environmental Concerns Impact Supply

Despite the industry's growth, overfishing and environmental concerns are significant challenges affecting the canned anchovy industry. Overfishing has led to the depletion of anchovy stocks, particularly in regions like Peru, which is the world's largest anchovy fishery. Environmental factors such as climate change and warming ocean temperatures are further threatening anchovy populations, impacting their availability for canning. These issues not only affect supply but also raise sustainability concerns among consumers and regulatory bodies, potentially leading to stricter fishing regulations and increased production costs.

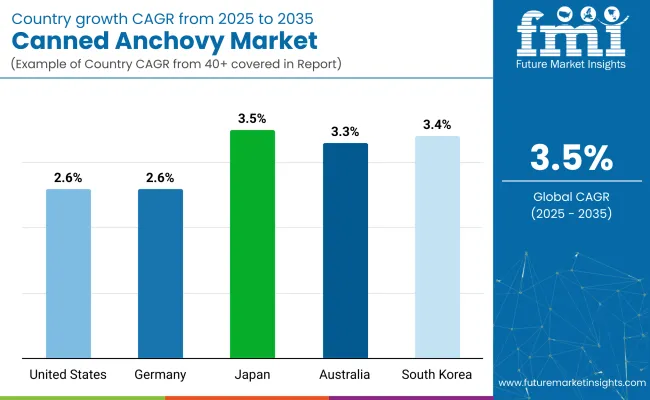

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| Germany | 2.6% |

| Japan | 3.5% |

| Australia | 3.3% |

| South Korea | 3.4% |

Global industry demand is projected to rise at a 3.5% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, Japan leads at 3.5%, followed closely by South Korea at 3.4%, and Australia at 3.3%, while both the United States and Germany post 2.6%. These rates translate to a growth premium of -0% for Japan, -3% for South Korea, and -5% for Australia versus the baseline, while the United States and Germany show slower growth.

Divergence reflects local catalysts: increasing demand for canned seafood products in Japan and South Korea, driven by dietary preferences, while more mature industries like the United States and Germany show slower growth due to established consumption patterns and industry saturation.

The industry in the United States is expected to expand at a CAGR of 2.6% from 2025 to 2035. Sales are driven by rising use in gourmet cooking and restaurant chains promoting Mediterranean dishes. Anchovies are being positioned as a protein-dense topping in artisanal pizzas, Caesar salads, and tapas-style appetizers.

Domestic supply chains rely on imports from Spain and Morocco, which has led to premium pricing tiers. Shelf-stable convenience and umami-rich flavor profiles contribute to wider retail penetration across ethnic grocery channels. Demand is also linked to growing consumer awareness of omega-3-rich seafood formats amid shifting snacking trends.

The industry in Germany is projected to grow at a 2.6% CAGR through 2035. Anchovies are incorporated in savory bakery products, pasta sauces, and antipasti platters. The industry is supported by southern European culinary influences and increased availability through discount retailers. German households favor low-salt and sustainably caught variants, leading to uptake of MSC-certified imports.

Domestic demand is strongest among older consumers and gourmet shoppers valuing intense flavor additions in small quantities. Regional delis and organic chains continue to expand their seafood offerings beyond tuna and salmon to include anchovy formats with traceable sourcing and preservative-free processing.

The industry in Japan is estimated to grow at a CAGR of 3.5% from 2025 to 2035. Consumption is driven by the inclusion of anchovies in fusion pasta dishes and izakaya-style appetizers. While domestic seafood preferences traditionally favor fresh fish, canned anchovies have gained popularity as a Western-inspired ingredient. Retailers stock premium imports in olive oil and chili marinades, appealing to younger, globally oriented consumers.

Anchovies are increasingly used in processed bento components and convenience meals. Growth is also supported by seafood gift sets that feature anchovy cans, especially during seasonal holidays and formal gifting occasions.

Canned anchovy consumption in Australia is forecast to rise at a 3.3% CAGR through 2035. Demand is influenced by Mediterranean culinary trends and their use in gourmet sandwiches, pizzas, and salad dressings. Australian retailers offer a mix of European imports and regional private labels. Growth is supported by rising seafood awareness and integration of anchovies into healthy fat-forward diets. Foodservice buyers include anchovies in artisan flatbreads and grazing boards, boosting wholesale orders. Sustainable sourcing and transparency in origin labeling have become critical, especially in upscale and organic retail channels.

The industry in South Korea is expected to grow at a CAGR of 3.4% from 2025 to 2035. Traditionally used in dried form for broths, anchovies are now gaining favor in canned varieties for Western-style cooking. Consumption is increasing in home-based pasta recipes and fusion dishes combining Korean and Mediterranean elements.

Urban grocery chains have begun stocking multipacks of canned anchovies, especially in districts with younger consumer bases. The flavor is seen as bold and complementary to fermented and spicy dishes, while packaging innovations-such as easy-open lids and resealable containers-are aiding adoption.

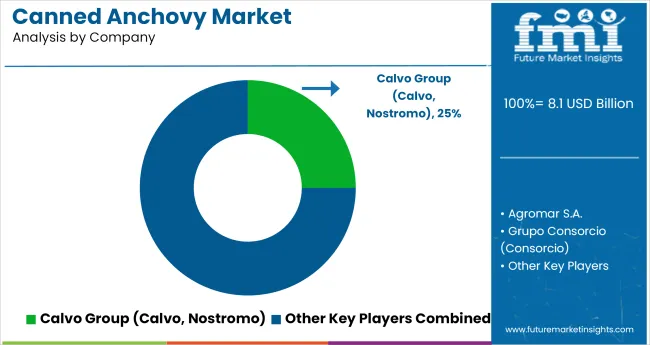

Leading Company - Calvo Group (Calvo, Nostromo)

Industry Share - 25%

The global industry is led by Calvo Group, which holds a significant share of 25%. Calvo, known for its brands Calvo and Nostromo, offers a range of canned seafood products, including anchovies, that are widely distributed across Europe and Latin America. The company's strong presence in these regions is bolstered by its extensive distribution network and commitment to quality. Calvo's products are recognized for their consistent quality and flavor, making them a preferred choice among consumers. The company's strategic advertising and brand recognition contribute to its leadership position in the industry.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 8.1 billion |

| Industry Value (2035) | USD 11.4 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand tons for volume |

| Product Type Segmentation | Whole Anchovy, Fillets, In Olive Oil, In Sunflower Oil, In Brine, Marinated, Paste, Minced / Crushed |

| Source Segmentation | Wild-Caught, Farm-Raised |

| End Use Segmentation | Retail (Consumer Use), Foodservice (HoReCa), Industrial/Food Processing |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), Oceania |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Top 5 Global Companies (Manufacturers/Brand Owners) | Calvo Group (Calvo, Nostromo), Agromar S.A., Grupo Consorcio (Consorcio), Delicius Rizzoli S.p.A. (Delicius, Rizzoli Emanuelli), Ortiz Conservas (Ortiz) |

| Additional Attributes | Dollar sales by product type, source, and end-use, growing demand for premium canned seafood, rising preference for olive oil and sunflower oil-based products, regional trends in seafood consumption and distribution channels, increasing adoption in industrial food processing and retail industries. |

Product segmentation includes whole anchovy, fillets, in olive oil, in sunflower oil, in brine, marinated, paste, and minced / crushed.

Source-based categories comprise wild-caught and farm-raised anchovies.

End-use segmentation includes retail (consumer use), foodservice (HoReCa), and industrial/food processing.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The industry size of the industry in 2025 is USD 8.1 billion.

The industry value of the industry in 2035 is projected to reach USD 11.4 billion, with a CAGR of 3.5%.

Wild-caught anchovies dominate the source segment in the industry with an 87.2% industry share.

Japan will lead the industry with a 3.5% CAGR from 2025 to 2035.

The leading company in the industry is Calvo Group (Calvo, Nostromo) with a 25% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Mackerel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Canned Meat Market Insights - Industry Growth & Demand 2025 to 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Canned Legumes Market Insights – Protein-Packed Convenience Foods 2025 to 2035

Leading Providers & Market Share in Canned Tuna Industry

Canned Mushroom Market Analysis by Nature, Product Type, Form, and End-Use Application Through 2035

Canned Salmon Market Analysis by Source, Species, Form, and Sales Channel Through 2035

Market Share Insights of Canned Food Packaging Providers

Analysis and Growth Projections for Canned Foods Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA