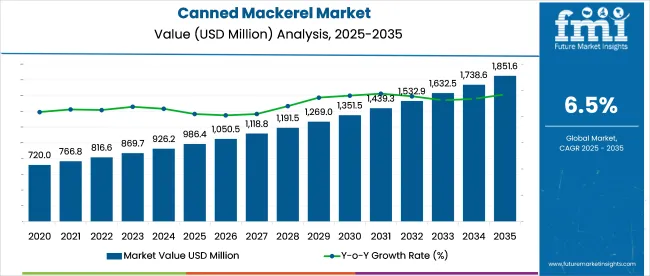

The global canned mackerel market in 2025 projected to reach USD 986.4 million and grow steadily to USD 1,851.6 million by 2035, expanding at a CAGR of 6.5% witnessing renewed interest, driven by affordability, convenience, and a surge in consumer preference for shelf-stable, omega-3-rich seafood.

The industry occupies a modest yet stable share across its broader parent markets. Within the canned seafood industry, it accounts for approximately 12-15%, supported by rising demand for affordable, nutrient-dense fish options. In the processed fish industry, canned mackerel holds around 6-8%, given the dominance of frozen and filleted products.

Its presence in the shelf-stable food sector is estimated at 2-3%, as canned proteins compete with soups, vegetables, and ready meals. In the convenience food industry, canned mackerel represents about 1-2%, appealing to consumers seeking quick meal components. Within the expansive packaged food industry, its share remains below 1%, reflecting the market’s scale.

As per Forbes, the canned and tinned seafood segment is experiencing a strong resurgence, driven by growing consumer demand for healthy, protein-rich, and shelf-stable food options. In its article published on September 18, 2023, Forbes described tinned seafood as “something old that is new again,” emphasizing its rising popularity among younger, health-conscious consumers.

Another feature from June 27, 2023 highlighted the success of sustainable canned fish brands riding this “trendy wave.” The publication also showcased premium canned seafood products, marking a shift from basic pantry staples to gourmet offerings-with canned mackerel gaining significant attention globally.

As consumers increasingly seek nutrient-dense, convenient, and eco-friendly protein options, canned mackerel is well-positioned to grow across both developed and emerging markets over the next decade.

Commercial demand and online retail lead growth in the industry. Enhanced processing, consistent quality, and easy distribution support adoption across institutional kitchens and modern urban grocery platforms.

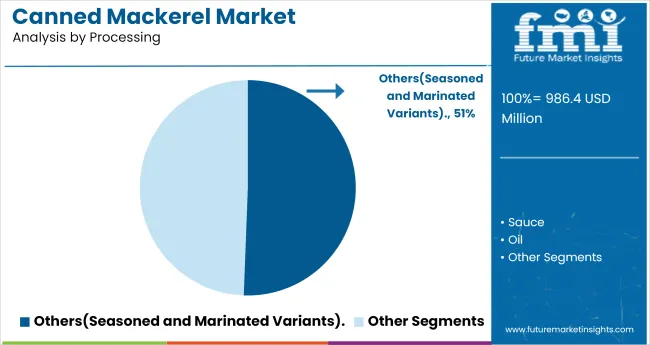

Seasoned and marinated variants are projected to account for 50.6% of the canned mackerel market by processing type in 2025. Their appeal stems from product uniformity, convenience, and enhanced flavor profiles tailored to regional cuisine preferences. These ready-to-eat formats eliminate the need for additional seasoning or preparation, making them highly suitable for on-the-go meals and pre-packed food systems. Enhanced sterilization techniques have improved shelf stability, while packaging advancements-such as BPA-free linings and easy-open lids-optimize end-user experience

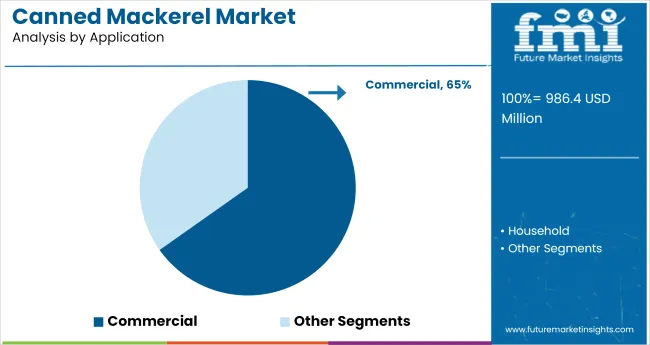

Commercial applications will command 65.2% of total canned mackerel consumption by 2025, with demand strongest in catering chains, school meal programs, airline kitchens, and institutional food service providers. Operators favor canned mackerel for its consistent sizing (typically 125g-425g net weights), long ambient shelf life (up to 5 years), and regulatory compliance (HACCP, EU 853/2004). It reduces the need for refrigeration, labor-intensive filleting, and waste disposal. Moreover, bulk-pack formats (3kg+ tins) are used in centralized production kitchens preparing high-volume meals.

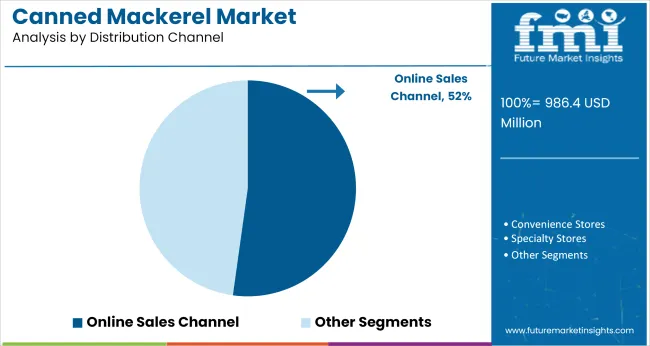

Online retail is expected to hold a 52.2% share of the distribution channel by 2025, driven by increased penetration of e-commerce platforms and evolving grocery delivery infrastructures. Platforms like Amazon Fresh, Walmart.com, BigBasket, and regional players in MENA and East Asia stock both mass-market and gourmet canned seafood variants. QR-code traceability, sustainability certifications (e.g., MSC, Friend of the Sea), and allergen transparency improve buyer trust. The rise in specialty D2C brands offering curated seafood boxes, flexible subscriptions, and value-added content (recipes, storage guides) enhances consumer retention.

Health-driven consumption and sustainability certification are fueling growth in the market. Brands emphasize omega3 nutrition, eco-friendly fishing practices, and traceability to meet consumer demand and build trust.

Functional Positioning and Channel Shift Drive Consumption Uptake

Canned mackerel is replacing conventional animal proteins in households seeking leaner, shelf-stable alternatives. Consumption is increasing among health-oriented buyers substituting mackerel for processed meats and high-mercury fish. Formulations now include added vitamin D and calcium, with 110 g tins delivering 18-22 g protein per serving.

Single-portion SKUs are expanding across retail and convenience outlets, with USA retailers reporting a 23% increase in unit turnover for ready-to-eat mackerel packs in Q1 2025. Recipe integration in digital cooking platforms has contributed to usage expansion, particularly in cold salads and pasta-based dishes.

Traceability Protocols and Certification Restructure Procurement Standards

Procurement is shifting toward certified fisheries as retailers tighten sourcing guidelines. North Atlantic and Pacific fisheries supplying mackerel are aligning with MSC and Friend of the Sea protocols, influencing packager selection criteria. As of mid to 2025, 62% of shelf-stable mackerel sold in Western Europe carried traceability-linked certification.

QR-code tracking integrated on primary packaging is enabling batch-level visibility, allowing consumers to verify vessel IDs, fishing zones, and harvest dates. Processors in Japan and Norway have introduced cold-chain event logging from port to plant, reducing quality loss rates by 14%.

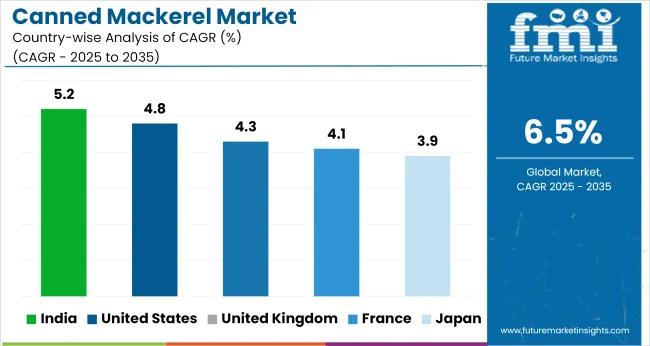

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.2% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| France | 4.1% |

| Japan | 3.9% |

Global is projected to expand at a 6.5% CAGR from 2025 to 2035. Among the five profiled countries, India shows the narrowest gap with a CAGR of 5.2%, translating to a to 20% divergence from the global baseline. The USA follows with 4.8% (-26%), while the UK (4.3%), France (4.1%), and Japan (3.9%) register wider shortfalls of -34%, -37%, and -40%, respectively. Slower growth in OECD economies correlates with demand saturation and minimal product diversification. In contrast, India benefits from broader intake across middle-tier urban markets and pricing competitiveness in procurement and processing.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

The market in the United States is forecast to expand at a CAGR of 4.8% through 2035. The growth trajectory is fueled by rising demand for nutrient-dense, shelf-stable seafood options, especially those rich in omega-3 fatty acids. High product turnover in retail chains and expanding consumer interest in alternative proteins are driving consistent volume growth.

The industry in UK is set to grow at a CAGR of 4.3% over the next decade. This growth is shaped by demand for low-cost, high-nutrition foods amid rising grocery inflation and increasing emphasis on ocean-friendly diets.

The industry in Japan is on track to expand by 3.9% CAGR between 2025 and 2035. Consumption remains strong due to cultural integration of mackerel into everyday cuisine, while development in premium ready-to-eat formats and health-forward product positioning is supporting additional uptake.

The industry in France is projected to grow at an estimated CAGR of 4.1% through 2035. Growth is supported by a combination of culinary heritage, preference for marine-origin proteins, and increased retail visibility of regionally sourced canned fish. The premiumization of canned seafood is gaining traction.

The canned mackerel industry in India projected to expand at a CAGR of 5.2% from 2025 to 2035. Rising protein intake among middle-income groups, and expansion of cold-chain networks are key enablers.

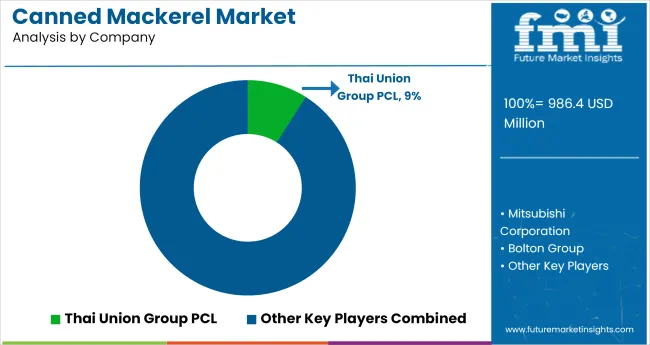

Leading Company - Thai Union Group PCL holding 9% industry Share

Dominant players such as Thai Union Group PCL, Maruha Nichiro Corporation, and Bolton Group lead the global industry with extensive production capacities, commitment to sustainable sourcing, and strong international distribution networks. Key players including LDH (La Doria) Ltd, Mitsubishi Corporation, and Universal Canning Inc. focus on delivering value-added product ranges and private-label solutions, primarily catering to markets across Europe and Asia.

Emerging players such as Xiamen Amoytop, Diavena, and Marushin Canneries operate at regional levels, capitalizing on competitive pricing strategies and localized distribution to expand their presence in developing markets.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 986.4 million |

| Projected Market Size (2035) | USD 1,851.6 million |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and kilotons for volume |

| Processing Types Analyzed (Segment 1) | Oil, Sauce, Others |

| Application Segments Analyzed (Segment 2) | Household, Commercial |

| Distribution Channels Analyzed (Segment 3) | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Sales Channel |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Italy, China, Japan, South Korea, India, Thailand, Saudi Arabia, South Africa |

| Key Players | LDH (La Doria) Ltd, Ec Plaza Network Inc, Maruha Nichiro Corporation, Tropical Food Manufacturing (Ningbo) Co., Diavena, Brunswick, Kumpulan Fima Berhad, Thai Union Group PCL, Mitsubishi Corporation, Bolton Group, Universal Canning Incorporation, FCF Co., Ltd, Xiamen Amoytop Import & Export Co., LTD, American Fishing Family, Marushin Canneries Malaysia |

| Additional Attributes | Dollar sales by distribution channel, impact of oil vs. sauce-based processing on regional demand, private label vs. branded sales growth, sustainability certifications, export-import dynamics by Asia-Pacific players, commercial vs. household consumption trends |

The industry is segmented into Oil, Sauce, and Others(Seasoned and marinated variants).

The industry is segmented into Household and Commercial.

The industry includes Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, and Online Sales Channel.

The industry is categorized into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

The industry is expected to be valued at USD 986.4 million in 2025.

The industry is forecast to reach USD 1,851.6 million by 2035.

The industry is anticipated to grow at a CAGR of 6.5% during the forecast period.

Seasoned & Marinated mackerel dominates the industry with a 50.6% share in 2025.

Thai Union Group PCL is the top player in the industry, holding a 9% market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Anchovy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Leading Providers & Market Share in Canned Tuna Industry

Canned Meat Market Insights - Industry Growth & Demand 2025 to 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Canned Legumes Market Insights – Protein-Packed Convenience Foods 2025 to 2035

Canned Salmon Market Analysis by Source, Species, Form, and Sales Channel Through 2035

Canned Mushroom Market Analysis by Nature, Product Type, Form, and End-Use Application Through 2035

Market Share Insights of Canned Food Packaging Providers

Analysis and Growth Projections for Canned Foods Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA