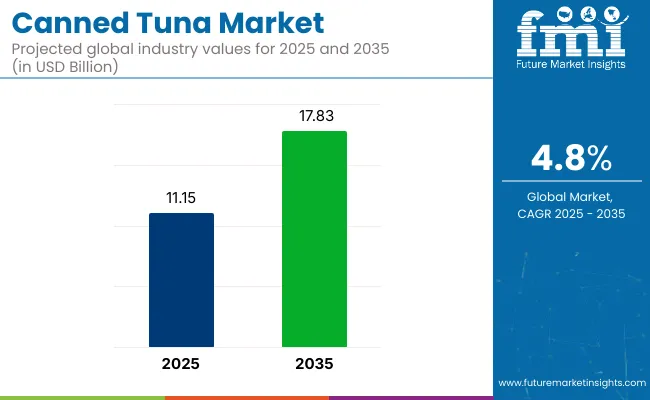

The global canned tuna market is valued at USD 11.15 billion in 2025 and is poised to garner USD 17.83 billion by 2035, reflecting a CAGR of 4.8% over the forecast period.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 11.15 billion |

| Projected Global Industry Value (2035F) | USD 17.83 billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

The seafood market is increasingly witnessing a constant rise in sales driven by a mix of factors such as improved seafood consumption, reduced prices, and the demand for shelf-stable food items high in protein. Canned tuna remains the leading product in the global protein market, thanks to its widespread use in salads, sandwiches, pasta dishes and meal kits.

The economic situation, such as inflation and cost-cutting measures by consumers, has also contributed to the rise in the popularity of canned tuna as an economical alternative to fresh and frozen seafood.

The manufacturers are concentrating on the differentiation and innovation of products, such as the introduction of flavored tuna pouches, gourmet fillets, and protein-rich snack packs. Players like Thai Union Group, Bolton Group, Starkist, Dongwon Industries, and Bumble Bee Foods are a step ahead in the market because of their sustainability strategies, mergers, and technological developments for traceability.

The drive for eco-friendly packaging, like using BPA-free cans and recyclable pouches, is another factor that changes the standards in the industry.

Consumers who care about their health are focusing on low-mercury, high-omega-3, and clean-label canned tuna products more and more. This has led to the infusion of premium tuna fillets, organic-certified options and pole-and-line-caught tuna into the range of products available for consumers in countries like Japan, the United States, and Europe.

On top of that, retailers' private-label canned tuna brands are also becoming a competition threat, which leads to the need of well-known manufacturers to increase their branding, transparency, and sustainability certifications.

Changes in the regulations needlely with EU and USA restrictions on IUU fishing are hitting the global supply chains very hard. These are the companies that make moves on blockchain traceability and partnerships with sustainable sources to stretch their market share in the future. Also, digital and e-commerce sales channels are leading to an uptick, as buyers are turning to own sales channels through purchase of tuna in bulk, variety packs, and ready meal formats.

Owing to advantages of a good fishing infrastructure and low price, the Asia-Pacific region will continue to be the largest production center, while North America and Europe will hold their ground in the premium and value-added canned tuna sales areas. The rise in the demand for the easy option of nutritious and sustainable seafood will trigger the development of new markets, thus making canned tuna a resilient and adaptable product in the global seafood industry.

Per capita consumption of canned tuna varies significantly across regions, influenced by dietary habits, seafood availability, and consumer preferences. Developed countries typically show higher intake due to established seafood consumption patterns and greater access to packaged protein sources.

Certification requirements play a crucial role in the canned tuna market by ensuring food safety, environmental responsibility, and regulatory compliance across global supply chains. As tuna is widely consumed and traded internationally, producers and exporters must meet multiple standards to access key markets and build consumer trust. These certifications span across safety protocols, sustainable sourcing, religious dietary needs, and government-mandated regulations.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.4% |

| H2 (2024 to 2034) | 5% |

| H1 (2025 to 2035) | 4.7% |

| H2 (2025 to 2035) | 5.2% |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 4.4% in the first half (H1) of 2024 and then slightly faster at 5% in the second half (H2) of the same year.

The CAGR is anticipated to increase somewhat to 4.7% in the first half of 2025 and continues to grow at 5.2% in the second half. The industry saw a decline of 39 basis points in the first half (H1 2025) and an increase of 64 basis points in the second half (H2 2025).

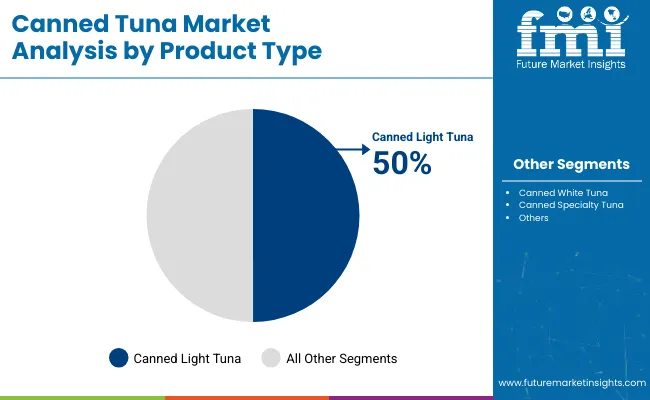

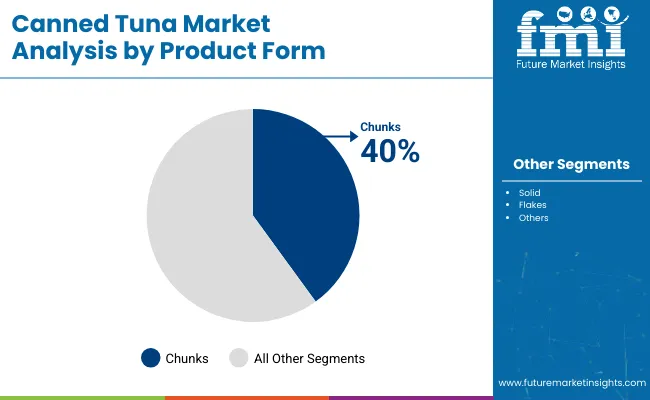

The market is segmented based on product type, product form, flavor, sales channel, and region. By product type, the market is divided into canned white tuna, canned light tuna, and canned specialty tuna. In terms of product form, it is segmented into chunk, solid, and others (flaked and minced). Based on flavor, the market is categorized into unflavored and flavored.

In terms of sales channel, the market is segmented into B2B/HoReCa, hypermarkets/supermarkets, convenience stores, online retail, and others (specialty stores, discount stores, departmental stores, and foodservice distributors). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic countries, and the Middle East and Africa.

Canned light tuna is projected to dominate the global canned tuna market by product type, commanding a 50% market share in 2025. Its affordability, mild taste, and adaptability to various culinary uses make it the preferred choice among consumers worldwide.

Made primarily from skipjack and yellowfin tuna, this product offers a budget-friendly substitute to albacore tuna, which is costlier. Leading producers like Thai Union (Chicken of the Sea), Starkist, and Bolton Group (Rio Mare) are investing heavily in bulk packaging, single-serve pouches, and innovative flavors to attract diverse customer segments.

| Product Type Segment | Market Share (2025) |

|---|---|

| Canned Light Tuna | 50% |

Additionally, light tuna is favored for its lower mercury content compared to albacore, making it a safer option for frequent consumption. Retail chains also contribute to segment growth by offering economical family-size multipacks and private-label alternatives.

Consumers seeking high protein, ready-to-eat meals find canned light tuna ideal for salads, sandwiches, and pasta dishes. The segment’s demand is further bolstered by foodservice operators and wholesalers, who value its cost-effectiveness. Given its broad applicability, safety profile, and low price point, canned light tuna is expected to sustain its leading position throughout the forecast period, driving consistent sales across both retail and foodservice channels globally.

The chunk tuna segment will continue to lead the global canned tuna market by product form, holding a 40% market share in 2025. Chunk tuna offers the perfect combination of texture, versatility, and affordability, making it ideal for a wide variety of recipes.

Unlike solid tuna fillets that are sold whole, chunk tuna comes pre-cut into small, manageable pieces suitable for salads, sandwiches, casseroles, and pasta. This convenience resonates well with busy consumers and commercial foodservice operators who prioritize efficiency in meal preparation.

| Product Form Segment | Market Share (2025) |

|---|---|

| Chunks | 40% |

Leading brands such as Bumble Bee, Century Pacific, and Jealsa Rianxeira meet this demand by launching chunk tuna in multiple packing options like brine, olive oil, and sunflower oil. The format is cost-effective and appeals to bulk buyers, including hotels, cafeterias, and institutional kitchens. Chunk tuna’s accessibility and ease of use ensure its popularity across households and professional kitchens alike.

Furthermore, BPA-free packaging, resealable pouches, and easy-open cans are enhancing the product’s value proposition, driving continued customer interest. Owing to its practicality and adaptability to diverse cooking needs, the chunk tuna segment is set to maintain its dominant position in the canned tuna market over the forecast period.

The flavored tuna segment in the global canned tuna market is expected to expand at the highest CAGR of 5.7% from 2025 to 2035, driven by changing consumer tastes and growing demand for value-added seafood products. Flavored tuna offerings, such as spicy chili, lemon-pepper, garlic-herb, and Mediterranean blends, have gained popularity among younger consumers seeking variety and excitement in their diets.

This trend is also supported by busy professionals and health-conscious buyers looking for high-protein, ready-to-eat snacks. Manufacturers are responding with premium flavored tuna lines packaged in easy-open cans and single-serve pouches designed for convenience and on-the-go consumption. These products align with the rise of global culinary influences and experimental eating habits, especially in urban markets.

Moreover, flavored tuna has proven successful in e-commerce and specialty food channels, where differentiation and innovation drive sales. Companies such as Thai Union and Bolton Group are launching limited-edition and region-specific flavors to capture niche markets. With food preferences evolving towards bold, ethnic, and gourmet tastes, flavored canned tuna is poised for strong growth, outpacing traditional unflavored options across both retail and foodservice distribution channels worldwide.

| Flavor Segment | CAGR (2025 to 2035) |

|---|---|

| Flavored Tuna | 5.7% |

The online retail segment is forecast to witness the fastest CAGR of 6.2% from 2025 to 2035 in the canned tuna market, driven by the rising adoption of e-commerce platforms globally. As consumers increasingly prioritize convenience and home delivery, online grocery shopping for packaged foods like canned tuna has surged.

Leading retailers and brands are optimizing digital channels through personalized offers, subscription models, and promotions tailored to specific buyer preferences. The COVID-19 pandemic accelerated this shift, with more households and foodservice operators purchasing shelf-stable seafood via apps and websites. Online platforms also allow brands to showcase product variety, including specialty flavors, sustainable options, and health-certified products that may not be available in traditional stores.

Furthermore, consumers in urban and semi-urban regions are showing a growing preference for digital purchases owing to busy lifestyles and expanding smartphone penetration. Key players such as Amazon Fresh, Walmart Online, and regional e-grocery platforms are fueling this trend by offering express delivery and loyalty programs. As digital retail infrastructure matures, online sales of canned tuna are expected to remain on an upward trajectory, significantly outpacing growth in offline sales channels.

| Sales Channel Segment | CAGR (2025 to 2035) |

|---|---|

| Online Retail | 6.2% |

The entire canned tuna business is at high risk of price fluctuations in raw materials. These fluctuations are driven by irregular tuna catch rates, the ever-increasing fuel costs, and the geopolitical issues that arise in the major sourcing areas which are the Pacific and Indian Oceans. Shipping and port congestion add to the problem by upsetting schedules and are particularly evident in Asia.

Manufacturers are countering the issue through diversifying sourcing locations, fleet modernization, and long-term agreements with fishing cooperatives that would help to decrease the instability in the supply chain. Only a few brands are already focusing on cost-effective production and emphasizing on the reorganization of processing plants as well as including the dynamic pricing of their strategic plan.

The transparency of the supply chain is included in the reason for the improvement as companies modernize tracking systems that allow them to guarantee traceability. The changes these companies make provide a base for market stability and, in this way, they minimize the impacts of the ups and downs in raw materials on the profits and the availability of the products.

Fears of mercury and microplastics being found in tuna by the consumers have made the seafood safety the topic of the debate. As a result, the demand for “low-mercury” and lab-tested canned tuna that is certified has been on the rise, especially in North America and Europe.

Manufacturers respond to this question by making their sourcing more transparent, gene-encoding using wild-caught tuna with third-party testing, and stressing quality control in processing. The brands advertise "pole-and-line" and "FAD-free" tuna, where these fishing methods contribute to bycatch risks and reduce the environmental problems.

Moreover, some companies are added with purification technologies and sanitation protocols far beyond what is required in order to align with compliance standards. With consumers becoming more aware of food safety, brands that actively confront issues with the help of the verifiable testing, clean-label packaging, and educational marketing campaigns are taking home a competitive advantage in the market.

The hard-hitting actions taken against illegal, unreported, and unregulated (IUU) fishing by the EU IUU Regulation and the USA Seafood Import Monitoring Program (SIMP) pose tough challenges to the canned tuna manufacturers. An unusual turn of events would include the result of non-compliance through an import ban, penalties, and loss of access to crucial markets.

Compliance is ensured through ethical sourcing and traceability as the manufacturers are the ones engaging blockchain technology to deliver the warranty of the product from the ocean to the shelf. The MSC (Marine Stewardship Council) certifications and the Dolphin Safe labels are becoming more and more of a must for the gain of market credibility.

Moreover, the companies are dedicating themselves to the communities of fishermen which are sustainable and deploying real-time monitoring technologies on vessels. This trend is shaking the world supply chain with retailers looking for brands that are exemplary in following sustainability and ethical fishing rules, thereby essentially driving the industry towards responsible and transparent practices.

High-protein, low-carb diets such as keto and paleo are notably hip among people. So much so that people are not reaching for mayonnaise but are opting for canned tuna as the go-to protein source. As a result, the demand has risen for various products that are tuna-based and specifically designed for health-conscious consumers.

Health and wellness-conscious people choose canned tuna since its protein is low-cost. In the meanwhile, the manufacturers, who traditionally provided canned food, are introducing many new items like flavored tuna pouches, tuna-based snack packs, and ready-to-eat protein bowls with added superfoods like quinoa and chickpeas.

Brands are also focusing on health benefits like high omega-3, protein, and also heart-health through their campaigns. Collaborating with "clean label" users as a way to reduce sodium levels and utilize pure ingredients is another direction. This transformation breaks the can of tuna into a new fitness product not to be missed by customers who are younger than regular customers or athletes seeking a source of high-quality protein.

An increase in the number of consumers preferring to buy high-quality and unique canned tuna has given rise to this phenomenon, the sustainability of artisanal, hand-filleted, and sustainably sourced tuna. This trend was especially commendable in markets, where the brands, such as the European, Japanese, and North American, launched the premium-delivering tuna fillets, packaged in extra virgin olive oil, truffle oil, and Mediterranean-inspired spice blends.

The pole-and-line tuna was also branded and publicly-captured as wild caught being it labelled as luxury protein rather than just plain cuts. The overhead innovation of packaging that includes glass jars and BPA-free cans is bestowing more value to the product.

The companies are also using the story that features the exclusive fishing site, traditional processing methods, and premium sourcing locations to create a gourmet experience at their disposal. These companies can not only promote their product but also add to the pie by venturing into other lines.

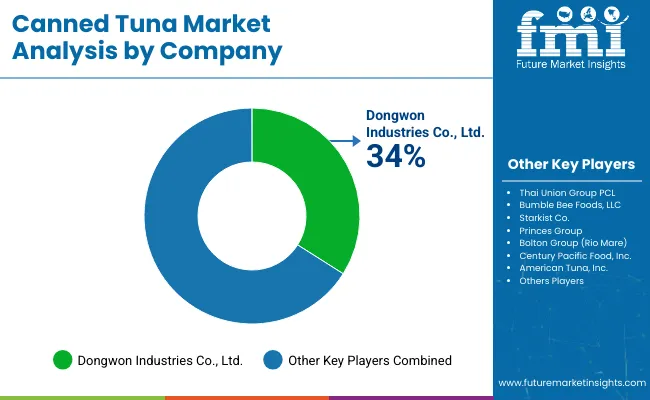

The market for canned tuna on a global level has a moderate to high level of concentration where most of the market is run by multinationals (MNCs) like Thai Union Group (Chicken of the Sea, John West), Bolton Group (Rio Mare), Starkist, Dongwon Industries, and Bumble Bee Foods.

These companies, being organized ones, have a major market share worldwide due to the benefit of global supply chains, brand familiarity, mass production, and the introduction of premium products. Their main strategies are sustainability certificates (such as MSC and Dolphin-Safe), digital traceability solutions, entry into tuna products of value added (for example flavored tuna and tuna meal kits), and retail partnerships. Major players in the sector, such as the USA, Japan, and Europe, are led by firms that use bulk purchasing power, distributive efficiency, and targeted acquisitions.

On the other hand, the unorganized segment is made up of local brands, small-scale fisheries, and private-label brands that flourish in price-sensitive markets, especially in Southeast Asia, Latin America, and parts of Africa. Their strategy is to sell affordable tuna sourced locally, often through the local grocery and wholesale markets. Many local brands may not have certifications or significant marketing budgets, yet they still compete by providing more cost-effective alternatives and bulk packaging for foodservice and institutions.

The arena is going through the phases of increased consolidation; MNCs are acquiring regional companies to achieve a more substantial presence in new markets. The stake of Thai Union in Red Lobster, as well as the acquisition of Tri Marine by Bolton Group, are good examples that show the company both are involved in vertical expansion.

Supermarkets' private-label tuna brands are also cleverly battling the organized players whose market share is at stake, so they have to differentiate through innovation and branding to stick to the market.

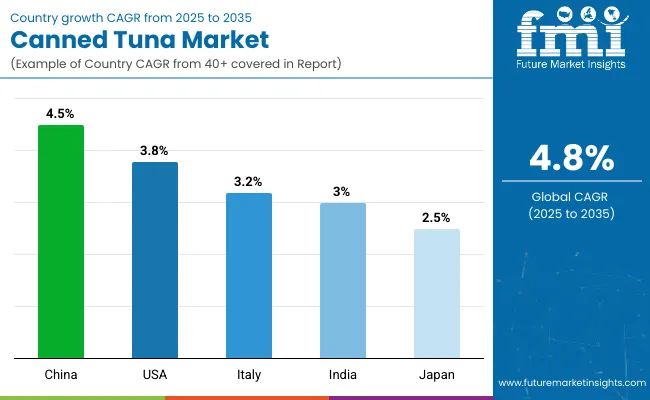

The following table shows the estimated growth rates of the top three canned tuna-consuming countries. The United States, Japan, and Italy are projected to exhibit stable consumption, with CAGRs of 3.8%, 2.5%, and 3.2% respectively through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.8% |

| Japan | 2.5% |

| Italy | 3.2% |

The USA canned tuna market seems to be changing its course towards more meal-ready innovations as the forefront brands Star Kist, Bumble Bee, and Wild Planet step up with ready-to-eat (RTE) meal kits, flavored tuna bowls, and tuna-infused salads.

In the wake of increased need for convenience and the high-protein an on-the-go meal, manufacturers are rolling out pre-seasoned, microwavable, and resealable tuna packs that target busy professionals and fitness enthusiasts. The ethnic-inspired flavors range from Meditteranean, Thai, and Korean, making brands stand out.

The e-commerce trend and DTC (Direct-to-Consumer) subscriptions are also playing a huge role in this, as tuna snack packs have become customizable. The companies, in turn, are focusing on appealing to the younger audience by using clean-label ingredients, keto-friendly formulations, and gluten-free options, which make sure that the canned tuna remains a long-time staple for health-conscious, time-strapped consumers.

The canned tuna market faced another metamorphosis as a luxury-grade artisanal version of tuna was produced by companies like Hagoromo Foods, Maruha Nichiro, and K&K Canned Foods. Instead of traditional UV mass canned yellowfin, the contents of new glass jars are expected to be the premium ultra-thin yellowfin and blufin fillets, which come in foamed pack and proprietary sauces.

The manufacturers are differentiating themselves by offering aged tuna, custom hand-filleting, and specialized sauces (e.g., yuzu soy, miso glaze). The new wave of tuna as a high-end meal at home dining experience is partly sold this way through specialized stores and depachika. In addition, selling tuna assortments designed to be gift-packaged imparts a premium feel to the brand and enhances it as part of the trendy seafood market in Japan.

Italy's canned tuna market is changing as brands like Rio Mare (Bolton Group), Callipo, and As Do Mar are launching Mediterranean-inspired tuna infusions instead of regular olive oil packaging. Herb-infused, truffle-flavored, and sun-dried tomato-marinated tuna fillets are getting more popular among the Italian people who care about authentic tastes and good quality.

The retail traders are rather pushing jarts bi-coated fish weight saran, alluding to the helm of artisanal fishing and slow oven-cooked branded recipes, apart from this. The whole idea of adding tuna to gourmet pasta along with ready-to-serve salad kits has also come up amid Italy's effort to easy cooking without omitting authenticity. Some restaurants and pizzerias are also trying to create dishes with gourmet tuna which is simultaneously elevating the canned tuna premium image in Italy's food culture.

The canned tuna market on a global scale is under competitive strain with Thai Union (Chicken of the Sea, John West), Bumble Bee, Starkist, Bolton Group (Rio Mare), and Dongwon Industries holding the stronger positions. Manufacturing firms are now targeting product innovation, sustainable production, and Premiumization to build their market share.

Sugar-free flavor tuna pouches, gourmet tuna fillets, as well as ready-to-eat meals have gained rider appeal among young consumers. Thai Union took a leap forward with the launch of its Yellowfin Tuna Slices, which are the first-of-their-kind tuna-based deli meat alternative. At the same time, Bumble Bee introduced a range of protein-powered snack kits for health-conscious shoppers.

Other firms are obviously tapping into sustainable fishing engaging in MSC licenses, alongside blockchain technology, which is providing full traceability, thus appealing to the ethically conscious consumer market. In addition, private-label development, online DTC channels, as well as meal delivery services collaborations are augmenting brand visibility. This energizing competition is driving market growth through product differentiation and consumer-driven innovation.

Canned White Tuna, Canned Light Tuna, Canned Specialty Tuna

Chunk, Solid, Flakes, Others

Unflavored, Flavored

B2B/HoReCa, B2C, Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The market is expected to reach USD 17.83 billion by 2035, growing at a CAGR of 4.8%.

The flavored tuna segment is projected to grow at the highest CAGR of 5.7%.

The canned light tuna segment holds the largest market share of 50% in 2025.

Rising demand for protein-rich, affordable, and ready-to-eat seafood drives market growth.

Key players include Thai Union, Starkist, Bolton Group, Bumble Bee, Century Pacific, and Jealsa Rianxeira.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Leading Providers & Market Share in Canned Tuna Industry

UK Canned Tuna Market Trends – Growth, Demand & Forecast 2025–2035

USA Canned Tuna Market Insights – Demand, Size & Industry Trends 2025-2035

ASEAN Canned Tuna Market Analysis – Size, Share & Forecast 2025–2035

Europe Canned Tuna Market Growth – Trends, Demand & Innovations 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Latin America Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Mackerel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Anchovy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Canned Legumes Market Insights – Protein-Packed Convenience Foods 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA