The Latin America canned tuna market is set to grow from an estimated USD 762.8 million in 2025 to USD 1,276.0 million by 2035, with a compound annual growth rate (CAGR) of 5.3% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size 2025E | USD 762.8 million |

| Projected Latin America Value 2035F | USD 1,276.0 million |

| Value-based CAGR 2025 to 2035 | 5.3% |

The popularity of seafood sourced from responsible and sustainable methods is on the rise. This is a reflection of the growing awareness of environmental issues of the customers. The brands which support the fishery's health by practicing responsible fishing methods and also sticking to catch limits are the brands that these consumers find cool.

The official marks of organizations such as Marine Stewardship Council (MSC) can be the ticket to credibility increase and to bringing in those consumers who are eager to make ethical decisions. This tendency is not only beneficial for sea life but it also creates a strong bond with the brand for consumers who choose sustainability in their shopping.

The unrivaled convenience of canned tuna makes it the number one choice of many hard-pressed consumers. Canned tuna's long shelf life serves its easy storage function irrespective of the need for refrigeration, thus making it an ideal item for quick meals and the standard product in emergency supply boxes.

This practicality is what families, students, and professionals who are looking for healthy ready-eat options frequently appeal to. Furthermore, the utilize of canned tuna in an array of different recipes - from salads to pasta dishes - strengthens its position as a quick and easy meal resource.

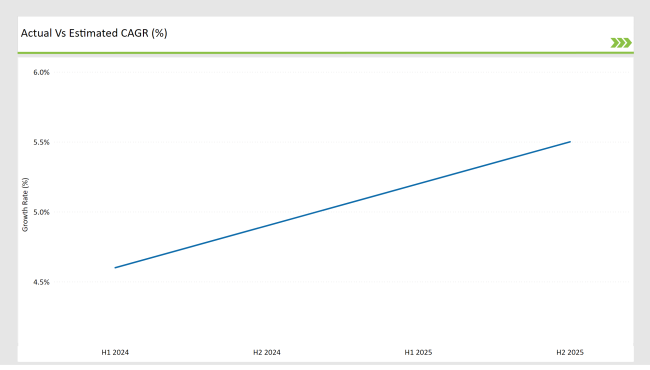

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin Americacanned tuna market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America canned tuna market, the is predicted to grow at a CAGR of 4.6% during the first half of 2024, with an increase to 4.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 5.2% in H1 and is expected to rise to 5.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

Culinary Innovation: Diversifying Canned Tuna Offerings

The innovations in pack sizes in the canned tuna market are changing the consumer experience particularly for younger generations. Brands are increasingly launching different flavors and seasonal canned tuna such as spicy, lemon herb, or Mediterranean as a response to the demand of those looking for unique taste experiences.

These product variations not only increase the variety of meals where canned tuna can be served, the ingredients are just that much different from the usual recipes of salads and the likes. With these choices, the companies are not only able to make their mark in the crowded market but they are also able to stimulate interest and, in this way, generate more loyalty from customers.

Also, these products are often wrapped in eco-friendly packaging that is convenient for the trendy busier lifestyle of the youth, which again contributes to the overall greater sales of the segment..

Convenience at Your Doorstep: The Rise of Online Retail

The online shopping area of canned tuna sale has experienced massive expansion with e-commerce bringing new access opportunities that are consumer-valuable. The internet sales channels give the shoppers the ease of the home delivery service, while they can watch ads and see the goods at the comfort of their homes.

The above-mentioned change has a special attractiveness for the busy consumers who emphasize the importance of alignment and things that cost them less time. Besides, e-commerce sites are places where people can make easy product comparisons, and consequently, they are knowledgeable about the state price, specifications, and the dependence of many factors on the brand image.

For the above reasons, brands have begun to zero in on their online presence coupled with the marketing and sales strategies not only to partake in this burgeoning segment but also give value back. Moreover, the advent of subscription options and online marketing tools work as extra-propellers, and thus the e-commerce channel caters most of the sales of the canned tuna in the B2C market.

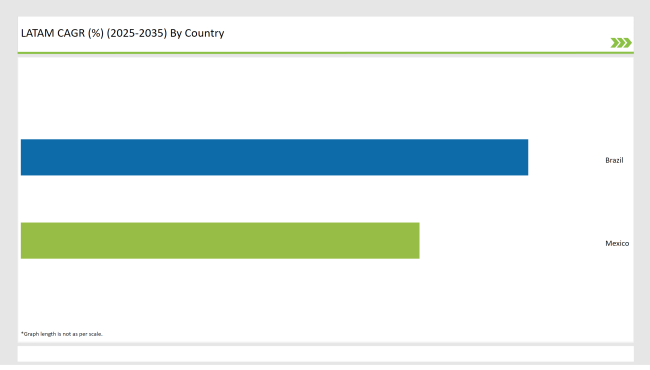

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The canned tuna is an essential component of traditional Brazilian cuisine, with a strong influence on most of the current recipes. The various utility uses of canned tuna can be seen in making dishes like "salada de atum" (tuna salad) and "torta de atum" (tuna pie), which is the reason for its wide use in preparing family meals and getting together.

Its quick cooking time and the option to prepare healthy, tasty meals in no time are the factors that attract working families to it extensively. Seeing that. Moreover, the easy of incorporation of canned tuna into other dishes has led it to be accepted in different recipes, such as spaghetti and rice bowls, which helped it to gain the place in the kitchen of the Brazilian people as a must-have. Therefore, the consumption of this dish at home makes it valuable and preferable among customers.

With its low price and barely any living restrictions, canned tuna is a big potential protein source for various segments of the population in Mexico mostly among those from lower to middle-class families. In fact, the families that search for the most bank account friendly meals now have this healthy choice of canned tuna compared to the more expensive fresh seafood and meat that they used to buy.

Now they can keep their families on a good diet without overspending. Another factor is Mexicos rise of e-commerce, where canned tuna becomes available even more. The Online based retailing platforms want to sell whatever brands the consumers are looking for, they tend to do this during promotions and bulk buying which would help the customers to save money.

As well as, this not only leads to the maximization of sales but also to the popularization of the item because families are getting the product without extra hassle.

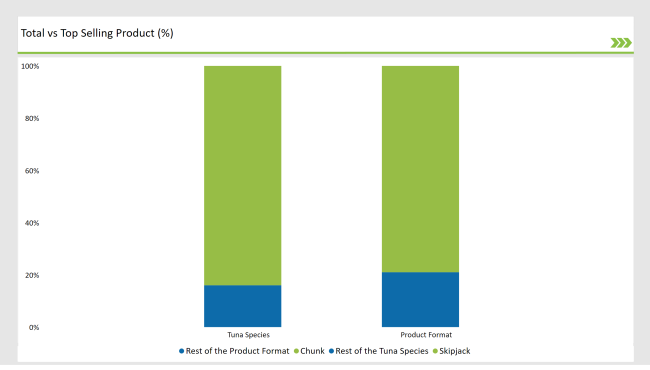

% share of Individual categories by Tuna Species and Product Format in 2025

Skipjack tuna's rising demand in Latin America can be attributed to its cost-effectiveness and culinary versatility. As a more affordable option compared to other tuna species like yellowfin or albacore, skipjack tuna appeals to price-sensitive consumers, enabling families to access a nutritious protein source without exceeding their budgets.

This affordability is particularly important in regions where economic constraints influence food choices. Additionally, skipjack tuna's mild flavor and flaky texture make it a versatile ingredient in various dishes, from salads and sandwiches to casseroles. Its adaptability to diverse culinary preferences across Latin America enhances its appeal, allowing consumers to incorporate it into traditional recipes and modern meals alike, further driving its popularity in the canned tuna market.

The chunk tuna segment is the fastest-growing in Latin America because of its adaptability in cooking and its reputation for quality. hunk tuna is the easiest way to add a portion of a number of dishes including salads, sandwiches, casseroles, to pasta; it is an easy choice for individuals looking for an easy meal solution that works for their lifestyle.

In addition, chunk tuna is considered to be a more superior product compared to other types, such as flaked or shredded tuna. Shuffling the larger pieces which are more visually captivating, the whole dining experience becomes better. Thus, the sum of the adaptability term and quality is an attractive option for those who give preference to both convenience and excellence in the product they buy and run the trend of canned tuna on the chunk market.

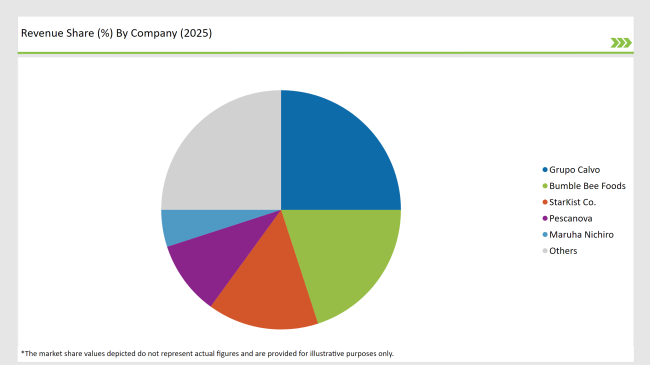

2025 Market share of Latin America Canned Tuna Manufacturers

Note: above chart is indicative in nature

The Latin America canned tuna market is moderately hard with groups like GrupoCalvo, Bumble Bee Foods, and Thai Union Group dominating the sector with their strong brand recognition and widespread distribution network. These umbrella companies rely on robust supply chains, clever product strategies, and the pursuing of the green course that are the tools of the trade.

Besides that, the local players like Tuny and La Sirena include marketing tactics that relate to geographic issues, namely, they fashion their products to people's likes and so בשקשק market analysis. This interaction between the global and local strategies puts in place a dynamic market environment, which in time drives growth and the fulfillment of needs for customers which differ from person to person in Latin America.

As per Tuna Species, the industry has been categorized Skipjack, Albacore, Yellowfin, Bluefin, Bigeye and Others.

As per Form, the industry has been categorized into Plain, Chunk, Solid, Shredded, Flakes, Fillets, and Others.

As per Sales Channel, the industry has been categorized into B2B/HoReCa and B2C (Hypermarkets/Supermarkets, Convenience Stores, Mom and Pop Stores, Discount Stores, Food Specialty Stores, Independent Small Groceries, and Online Retail)

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America canned tuna market is projected to grow at a CAGR of 5.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,276.0 million.

Canned tuna offers unparalleled convenience, making it a popular choice for busy consumers. Its long shelf life allows for easy storage without the need for refrigeration, making it ideal for quick meals and emergency supplies.

Mexico and Brazil are key regions with high consumption rates in the Latin America canned tuna market.

Leading manufacturers include Grupo Calvo, Bumble Bee Foods, StarKist Co., Pescanova, and Maruha Nichiro.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA