The ASEAN Canned Tuna market is set to grow from an estimated USD 254.8 million in 2025 to USD 546.0 million by 2035, with a compound annual growth rate (CAGR) of 7.9% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size 2025E | USD 254.8 million |

| Projected ASEAN Value 2035F | USD 546.0 million |

| Value-based CAGR 2025 to 2035 | 7.9% |

Consumers throughout ASEAN countries demonstrate growing interest in convenient nutritious food products that includes canned tuna. People choose canned tuna because the product provides a long storage time combined with its simple preparation process and multiple suitable cooking applications. The abundance of marine resources supported by developed fishing industries throughout the region provides high-quality tuna for culinary use to become widespread household staples.

The buying patterns of consumers shifted towards healthier eating behaviors during recent years that recognized canned tuna as delivering lean protein alongside essential nutrients. Quick lifestyles in the modern world created rising demand for quick meals which supports the growing acceptance of canned tuna products. Concerning health advantages of omega-3 fats within tuna demanded more fish consumption from consumers as their dietary awareness rose.

The ASEAN countries of Thailand Malaysia and Indonesia constitute a major force within the worldwide canned tuna industry. The manufacturing nations in this region provide both domestic and international markets with their canned tuna products. Manufacturers now focus on acquiring tuna from certified fisheries so their products can fulfill consumer demands regarding quality together with environmental responsibility and sustainability requirements.

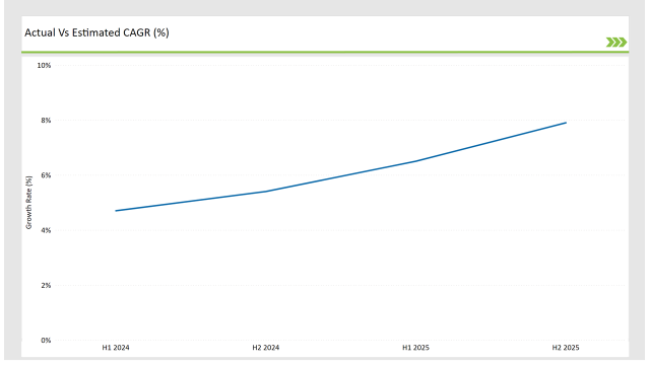

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANCanned Tuna market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEANCanned Tuna market, the sector is predicted to grow at a CAGR of 4.7% during the first half of 2024, increasing to 5.4% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.5% in H1 but is expected to rise to 7.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | ProBioTech launched a new line of probiotic supplements targeting digestive health. |

| 2024 | NutraBlend expanded its product range to include probiotic-infused functional beverages. |

| 2024 | HealthFirst introduced personalized probiotic solutions based on individual microbiome analysis. |

| 2024 | BioBalance partnered with local farmers to source organic ingredients for probiotic products. |

Growing Demand for Sustainable Seafood

The market demand for sustainable seafood continues to grow because people now understand fishing practices' environmental effects. The growing popularity of sustainable seafood production reveals itself strongly in the canned tuna sector since consumers together with environmental organizations worry about fishing practices that damage fish stocks.

Consumers now choose products that bear official certifications specifically from the MSC because this organization confirms sustainable tuna fisheries.

The tuna industry follows responsible fishing practices by developing systems which track tuna from source to distribution point in order to provide transparency throughout the supply chain. Western convenience companies focus on research to examine new protein sources including plant-based materials which align with the rising market need for sustainable food products.

Rise of Convenience and Ready-to-Eat Meals

The popularity of time-sparing prepared foods affects the canned tuna manufacturing segment profoundly. Cuts in consumer availability increase the demand for simple ready-to-eat solutions that need less cooking preparation. Canned tuna offers suitable versatility and extended shelf life which supports convenient living so it continues being a popular food choice among busy families and individuals.

The trend toward convenient eating enables manufacturers to develop novel canned tuna items which match the needs of consumers focused on convenience. Manufacturers develop ready-to-eat meal kits which use tuna as their main ingredient while producing single-serve packages that provide portable tuna enjoyment. Marketers are currently releasing canned tuna products with flavors and seasonings to attract customers who want diverse taste experiences in their meals.

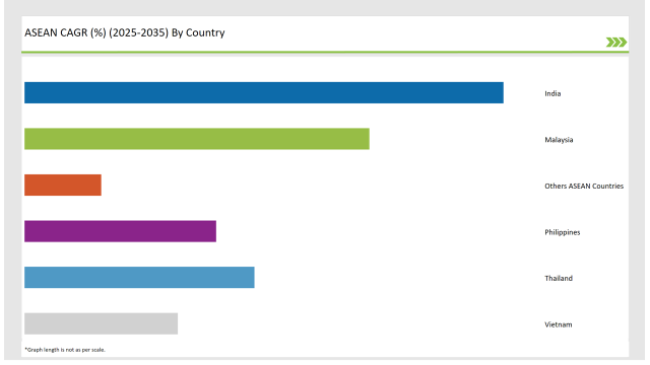

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Indian market for canned tuna continues to expand because people are becoming more aware about health and nutritional benefits. Consumers increasingly value seafood because tuna contains significant amounts of protein and omega-3 fatty acids therefore the demand for canned tuna products continues to rise.

Urban consumers find canned tuna useful because the product needs small preparation effort and stays fresh over a long time thus serving as their quick meal choice.

E-commerce platforms have expanded canned tuna availability for all consumers throughout the nation which helps consumers discover different brands and products. The rising preference for international meals which use tuna like sushi and salads together with expanding marketing capabilities of e-commerce platforms is fueling Indian demand for canned tuna. Manufacturers have started developing new flavors and flexible packaging to meet consumers who have different eating tastes.

The Malaysian market for canned tuna expands because consumers choose seafood as their key source of nutritious protein. Health-conscious Malaysian consumers have increased their demand for nutritious yet convenient food options which has become more widespread among the population. The market opportunity for canned tuna exists because this nutritious food product offers both high protein content and diverse usability.

High-quality tuna products stem from Malaysia's strong fishing industry along with its large supply of marine resources. People who lead busy lives are increasing their consumption of canned tuna due to the rising popularity of convenient foods. The market shift towards these convenient offerings motivates manufacturers to introduce new lines of tuna products including canned tuna with different flavors and tuna-focused meal packages.

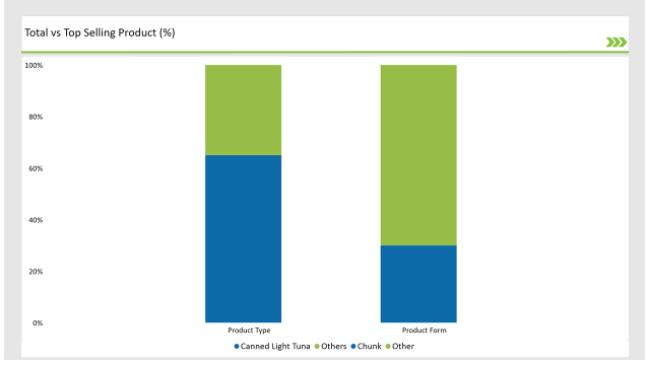

Light tuna products in cans will control the market because consumers appreciate their bland taste along with excellent price-quality ratio and adaptability. Consumers pick this product because it works well in multiple food applications throughout salads, sandwiches and casseroles.

Consumer choice of canned light tuna results from two factors: lean protein content and essential omega-3 fatty acids it offers in addition to its pleasant flavor profile. Quality control systems and sustainable fishing practices apply as manufacturers improve the quality standards of their canned light tuna products. Canned light tuna gains consumer interest because manufacturers now provide easy-open cans and single-serve options which address consumer concerns about convenience.

Chunk-style canned tuna is the most widely distributed and marketed version of canned tuna. The primary reasons are its delicate texture and its culinary flexibility. Nearly all salads, pasta dishes, and casseroles are normally accompaniments for chunk tuna, thus it is frequently referred to as a crowbar ingredient in many kitchens.

Along with the ease of preparation, the fact that this can be easily put in a multitude of different recipes makes it highly attractive to both home cooks and food producers.

The convenience foods trend has been a major driving force in the increasing demand for canned chunk tuna, which consumers are looking for as a quick solution to the dinner that is easily prepared. In return, the producers go along with a wider product range of chunk tuna, i.e., including flavored variations and the brands packed in various liquids like water or oil.

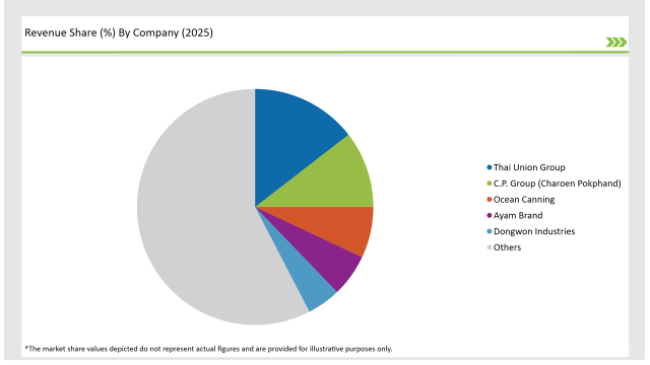

2025 Market Share of ASEAN Canned Tuna Manufacturers

Note: The above chart is indicative

The canned tuna market is a challenging place to do business with many players. The market is where big firms are engaged in product innovation, quality enhancement, and sustainability almost as a rule to get the upper hand. Diffusion of both old brands and start-up players is now noticed in the market, thus resulting in more and varied product models.

By Product Type: Canned White Tuna, Canned Light Tuna, Canned Specialty Tuna

By Product Form: Chunk, Solid, Flakes, Others

By Flavor: Unflavored, Flavored

By Sales Channel: B2B/HoReCa, B2C, Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Canned Tuna market is projected to grow at a CAGR of 7.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 546.0 million.

India are key Country with high consumption rates in the ASEAN Canned Tuna market.

Leading manufacturers Thai Union Group, C.P. Group (Charoen Pokphand), Ocean Canning, Ayam Brandin the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA