The Europe Canned Tuna market is set to grow from an estimated USD 3,332.2 million in 2025 to USD 5,039.7 million by 2035, with a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) (USD million) | USD 3,332.2 million |

| Projected Europe Value (2035F) (USD million) | USD 5,039.7 million |

| Value-based CAGR (2025 to 2035) | 4.2% |

The European market for canned tuna is expected to grow at a moderate rate through the forecast period of 2020 to 2024. Growing demand from consumers for more convenient and healthier ready-to-eat food will help drive market growth.

Diversity in players also contributes to furthering the development of this market through innovations in packaging, sustainability, and product diversification. Canned tuna is arguably one of the most popular seafood items marketed through different European countries.

This is primarily attributed to its relatively affordable price, long shelf life, and ease of preparation. The industry segments the canned tuna market based on the type of tuna used and the packaging applied. The main types of canned tuna include white tuna, light tuna, yellowfin tuna, bluefin tuna, and others, all of which meet diverse consumer preferences and market demands.

The largest market share is held by white tuna due to its mild flavour and broad acceptance, whereas the increasing interest in premium varieties such as bluefin and yellowfin tuna leads to higher competition in the market.

The major firms in the European canned tuna market comprise brands such as John West, Princes, and Thai Union. All of these players are keenly focusing on the expansion of their product lines and packaging technologies. For example, the Thai Union has developed sustainable sourcing practices and invested in eco-friendly packaging to be in line with the increasing consumer demand for environmental consciousness.

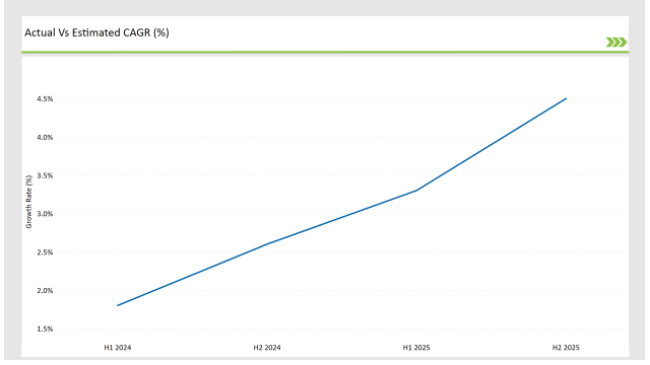

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Canned Tuna market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.8% |

| H2 (2024 to 2034) | 2.6% |

| H1 (2025 to 2035) | 3.3% |

| H2 (2025 to 2035) | 34.5% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Canned Tuna market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Product Launch : John West introduced a new range of sustainably sourced, flavoured tuna in eco-friendly pouch packaging to meet the rising demand for convenient and sustainable seafood options. |

| March-2024 | Partnership Announcement : Princes partnered with a leading European retailer to launch a special edition of sustainably sourced canned tuna, aiming to raise awareness of ocean conservation and reduce overfishing. |

| February-2024 | Sustainability Initiatives : Thai Union expanded its commitment to sustainability by announcing a new tuna traceability system that allows consumers to track the origin of their canned tuna, ensuring responsible sourcing practices. |

The Rise of Sustainable Tuna Sourcing and Traceability

Sustainability is the name of the game in the European canned tuna market, driven by the consumer responsibility to choose better ecology food. In reaction to the alarming rise of overfishing and the extinction of fish stocks, sustainability practices have become the very fabric of the business of the biggest players in the market.

Technological development has seen companies like Thai Union through high costs on investments in traceability systems, which can even allow the consumer to track their tuna brand origin and put worries to rest about the responsible management of the fishery.

Major companies like John West and Princes have, in turn, incorporated tuna from such certified sustainable fisheries into their assortment. The accompanying boom in the shelf space for these types of products is also pushing the use of eco-friendly packaging options like recyclable cans and biodegradable pouches, which will hopefully mitigate the environmental impact of packaging waste.

The Shift Toward Premium and Value-added Tuna Products

Another major wave in the European canned tuna sector is the increase in customer preference for premium and value-added tuna products. Customers are becoming more critical in the buying process of tuna and many of them are ready to pay more for products that have not only superior taste but also health benefits, and they are more practical for their omnipresent life.

Name-brand companies are taking a cue from this trend by expanding their lines to include flavoured gourmet tuna, such as olive oil, herbal, or spice-infused tuna, along with line-picked organic and non-GMO alternatives. These value-added items correlate with health-focused target audiences who desire not only the comfort of eating canned tuna but also additional healthy facts.

Also, the diet pattern is evolving alongside the popularity of protein-dominant regimens and oil-free, low-energy, and omega-3 fatty acid-rich foods which result in the development of tuna products portrayed as functional foods.

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Spain | 32% |

| Italy | 23% |

| France | 18% |

| Germany | 12% |

| Others | 15% |

The UK canned tuna market has along with it the outsized growth potential to surpass other foods. The UK consumer market is becoming more focused on sustainability and convenience, two key factors of canned tuna consumption. The amount of canned tuna in UK supermarkets is sold very well, many customers buy it and choose the tuna brands marked as the Marine Stewardship Council (MSC) certified.

Such brand companies as John West also have made a move according to this trend by broadening the range of the tuna that is caught organics and being eco-friendlier which is recyclable pouches and cans solutions.

Germany is among the top European countries with the most considerable sales of canned tuna. The market is turning towards premium and organic tuna products. The German consumer base which has become more conscious of health and sustainability has been living through a significant transition toward premium products, notably tuna made with organic and non-GMO ingredients.

Yellowfin and bluefin are the varieties that Germans are turning to the most, the premium switch is being made since consumers desire exceptional quality, deliciousness, and nutrient contents that the premium added value products give them.

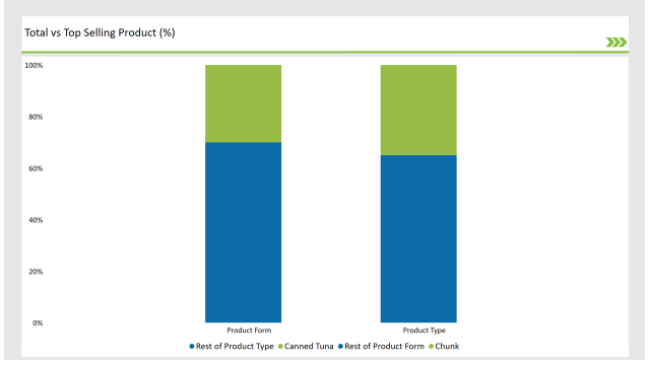

| Main Segment | Market Share (%) |

|---|---|

| Product Form ( Chunk ) | 30% |

| Remaining segments | 70% |

Chunk form is presently the rapidly growing segment. According to industry observations, chunk tuna is better for use on salads, and it is fantastic for sandwiches. Its chunky texture combined with its relatively mild flavour renders it very favourable among consumers aiming for convenient food solutions.

With the rising trend toward easy and quick meal preparation, chunk tuna finds itself well along the demand curve of busy consumers looking for nutritious food. Furthermore, growing awareness of the healthier aspects of tuna, such as high protein content, and rich sources of omega-3 fatty acids, boosts its demand.

The retailers are also expanding their offerings of chunk tuna products, organic and sustainably sourced, in response to consumer preference for clean-label products.

| Main Segment | Market Share (%) |

|---|---|

| Product Type ( Canned Tuna ) | 35% |

| Remaining segments | 65% |

Canned light tuna is mostly made from skipjack or yellowfin tuna and appears to be popular due to its mild flavour and less mercury in the meat, which endorses its consumption by health-conscious customers. It stimulates the growth in this segment as well, with canned light tuna, which is quite frequently cheaper in comparison to the other sources of protein.

One more factor that makes canned light tuna so widely applied in different culinary applications is the Mediterranean diet with an emphasis on fish and seafood products. As more consumers became aware of the value of responsible fishing practices, more support was experienced in the market by responsible sourcing and eco-friendly packaging brands.

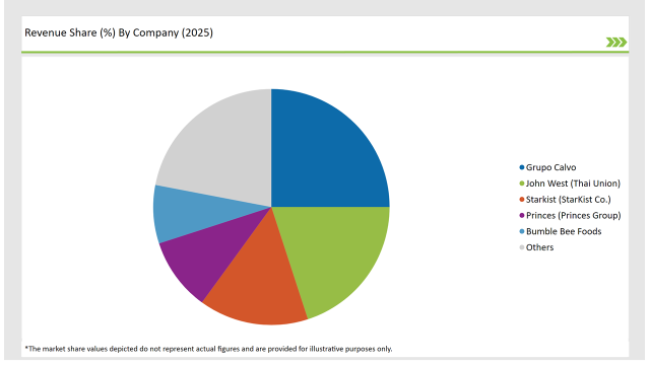

2025 Market share of Europe Canned Tunamanufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Grupo Calvo | 25% |

| John West (Thai Union) | 20% |

| Starkist ( StarKist Co.) | 15% |

| Princes (Princes Group) | 10% |

| Bumble Bee Foods | 8% |

| Others | 22% |

Note: The above chart is indicative in nature

The European canned tuna market has three tiers: Tier 1 companies dominate the market, owing to their massive scale of operation, brand, and extensive distribution networks. Tier 1 companies, such as John West, Princes, and Thai Union, command significant market share and have the ability to invest in innovation, sustainability, and premium product offerings.

For example, it has market leader positions in all of the most important markets throughout the UK as well as various other European territories, offering many different sustainably sourced tuna lines.

Tier 2 companies encompass Sealord Group and Orkla Group, amongst others, operating in specific countries in Europe or a part of Europe - niche products based on specific demand, such as organic, GMO-free, as well as non-GMO sources for tuna, etc.

Tier 3 are small local companies that are mostly focused on a regional market. Although such firms do not boast the huge research and development budget and marketing resources of the tier 1 players, they possess a unique edge in offering specially designed products suitable to the regional tastes of their consumers and tailored customer service for them. Typically, these firms focus on portraying their intimate understanding of the region's preferences for high-quality and locally sourced tuna.

As per ProductType, the industry has been categorized into Canned White Tuna, Canned Light Tuna, and Canned Specialty Tuna.

As per Product Form, the industry has been categorized into Chunk, Solid, Flakes, and Others.

As per Flavour, the industry has been categorized into Unflavoured, and Flavoured.

As per Sales Channel, the industry has been categorized into B2B/HoReCa, B2C, Hypermarkets/Supermarkets, Convenience Stores, Online Retail, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Canned Tuna market is projected to grow at a CAGR of 4.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 5,039.7 million.

Key factors driving the canned tuna market include the increasing demand for convenient and ready-to-eat meal options among busy consumers, and the growing awareness of the health benefits of tuna, such as its high protein content and omega-3 fatty acids. Additionally, sustainability concerns and eco-friendly sourcing practices are influencing consumer preferences and brand choices.

Spain, France, and Italy are the key countries with high consumption rates in the European Canned Tuna market.

Leading manufacturers include Grupo Calvo, John West (Thai Union), Starkist (StarKist Co.), Princes (Princes Group), and Bumble Bee Foods known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA