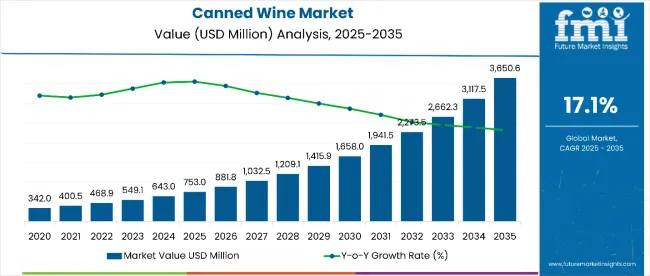

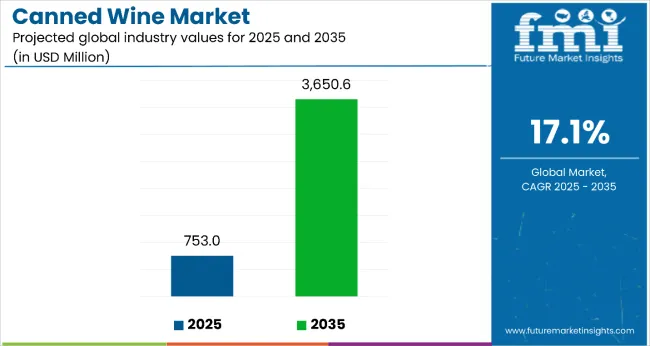

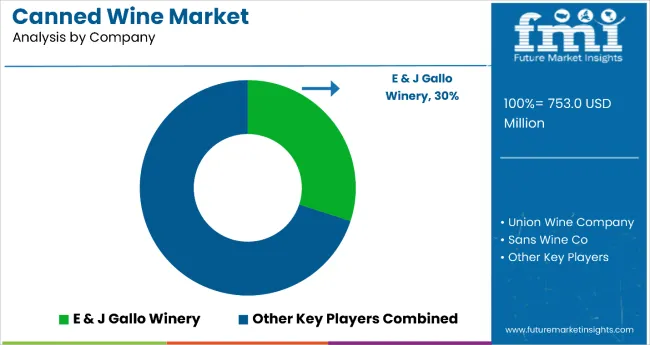

Sales of canned wine globally are estimated at USD 753 million in 2025, with projections indicating a rise to USD 3,650.6 million by 2035, reflecting a CAGR of approximately 17.1% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 753 million |

| Projected Value (2035F) | USD 3,650.6 million |

| CAGR (2025-2035) | 17.1% |

This growth reflects expanding millennial and Gen Z adoption and increased per capita consumption across major urban centers worldwide. The rise in demand is linked to shifting lifestyle preferences, growing convenience orientation, and evolving outdoor recreational trends. By 2025, per capita consumption in leading global regions such as North America, Western Europe, and East Asia averages between 0.08 to 0.12 liters, with projections reaching 0.19 to 0.29 liters by 2035. North America leads among regional territories, expected to generate USD 1.47 billion in canned wine sales by 2035, followed by Western Europe (USD 1.02 billion), East Asia (USD 0.73 billion), South Asia and Pacific (USD 0.28 billion), and Latin America (USD 0.17 billion).

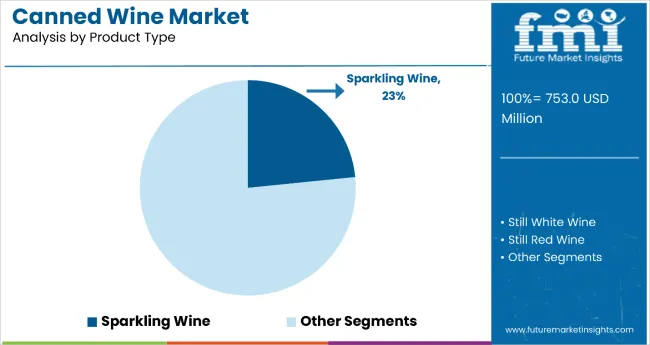

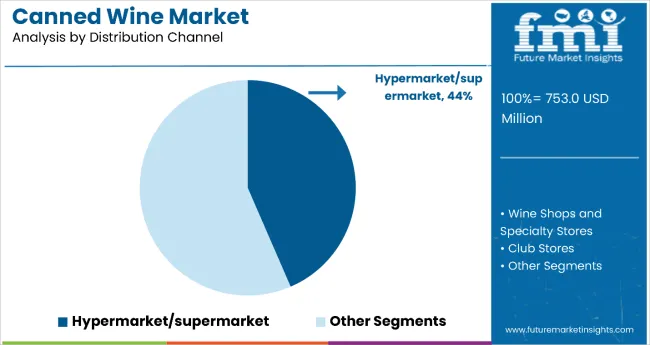

The largest contribution to demand continues to come from sparkling wine variants, which are expected to account for 23% of total sales in 2025, owing to refreshing characteristics, social appeal, and consumer preference for effervescent beverages in portable formats. By distribution channel classification, hypermarkets and supermarkets represent the dominant category, responsible for 44% of all sales, while online retail and specialty stores are expanding rapidly.

Consumer adoption is particularly concentrated among younger demographics and outdoor enthusiasts, with urbanization levels and lifestyle changes emerging as significant drivers of demand. While premium pricing persists compared to traditional bottles, the average price differential has stabilized around 8-12% in 2025. Continued improvements in packaging innovation and supply chain optimization are expected to accelerate affordability and access across diverse consumer segments. Regional disparities persist, but per capita demand in emerging economies is narrowing the gap with traditionally strong developed regions.

The canned wine segment globally is classified across several categories. By product type, the key segments include sparkling wine, fortified wine, and other wine varieties. By distribution channel, the segment spans hypermarkets and supermarkets, online retail platforms, and other specialty stores. By region, coverage includes North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Sparkling wine varieties are projected to dominate sales in 2025, supported by refreshing characteristics, social consumption appeal, and widespread adoption among younger demographics seeking celebratory and casual drinking occasions. Other categories such as fortified and traditional wine varieties are growing steadily, each serving distinct taste preferences and consumption contexts.

Canned wine globally is distributed through hypermarkets/supermarkets, online retail platforms, and specialty stores. Hypermarkets and supermarkets are expected to remain the primary sales channel in 2025, followed by online retail and other specialty outlets. Distribution strategies are evolving to match consumer shopping behaviors, with growth coming from both traditional and digital retail formats.

The canned wine category globally appeals to diverse consumer segments across age groups, lifestyle patterns, and consumption occasions. While motivations range from convenience to sustainability to social appeal, demand is concentrated among four key demographic clusters. Each group demonstrates distinct purchase behaviors, channel preferences, and product expectations.

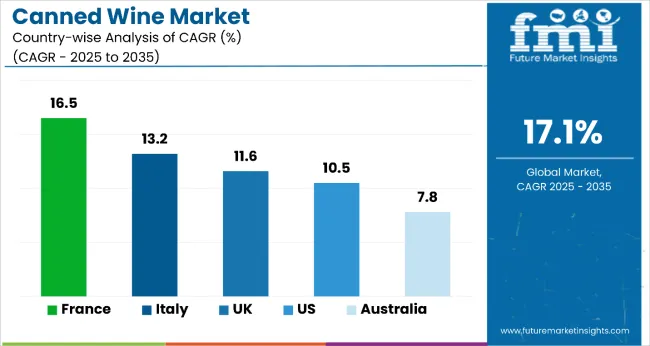

| Countries | CAGR (2025-2035) |

|---|---|

| France | 16.5% |

| Italy | 13.2% |

| United Kingdom | 11.6% |

| United States | 10.5% |

| Australia | 7.8% |

Canned wine sales will not grow uniformly across every global region. Rising lifestyle innovation and faster adoption of alternative packaging formats in progressive wine cultures give France and Italy a measurable edge, while established wine regions adapt traditional consumption patterns more gradually. The table below shows the compound annual growth rate (CAGR) each of the five key countries is expected to record between 2025 and 2035.

The canned wine category is scaling rapidly across mature wine economies, but momentum varies. France leads with a 16.5% CAGR, leveraging premium rosé and sparkling SKUs and strong festival/retail uptake. Italy follows at 13.2%, powered by frizzante and spritz-style innovations suited to on-the-go occasions. The United Kingdom’s 11.6% reflects high acceptance in convenience and online grocery, with private labels expanding. The United States at 10.5% remains the format’s innovation hub, though growth is normalizing as assortments premiumize. Australia at 7.8% accelerates via outdoor lifestyle alignment and RTD crossovers. Together, these five markets anchor global canned wine penetration and set the pace on packaging, flavor, and channel strategy.

The canned wine adoption in France has shifted from novelty to credible premium format, supported by younger consumers, tourism traffic, and venue restrictions favoring lightweight, closed containers. Rosé, pétillant, and low-alcohol styles dominate early repeat purchases, while AOP-adjacent positioning and collaborations with established maisons improve trust. Festivals, sports arenas, and summer coastal retail drive velocity, and DTC clubs curate discovery packs. Sustainability messaging, aluminum recyclability and reduced transport weight, helps counter tradition-based hesitancy. As retailers broaden single-serve options near ready-to-drink cocktails, basket attachment rises, benefiting aperitif occasions and impulse buys.

With 13.2% CAGR, Italy reflects a natural fit between frizzante/aperitivo culture and single-serve convenience. Lightly sparkling white and rosé, spritz-inspired blends, and sessionable ABV ranges align with apericena and outdoor events. Regional producers leverage indigenous varietals (Glera, Lambrusco) to differentiate, while sleek 187-250 ml formats encourage trial without committing to a full bottle. Channel growth concentrates in seaside kiosks, train stations, and modern grocery, with vending pilots in transit hubs. As tourism rebounds, portable formats thrive alongside RTD cocktails, and culinary pairings (street food, pizza al taglio) reinforce casual, social consumption.

The UK’s 11.6% CAGR is underpinned by convenience retail, festivals, and e-grocery, where multipacks and discovery bundles grow household penetration. Private label and indie brands coexist: retailers push accessible price tiers while craft-leaning producers focus on minimal-intervention credentials. Picnic culture, commuter habits, and strict glass policies in venues favor cans, while sustainability and calorie transparency resonate with health-conscious consumers. Sparkling and spritz variants see strong repeat; winter sees trading up to premium stills in curated gift packs. Subscription services and influencer collaborations help educate on serve temperature and food pairing.

At 10.5% CAGR, the USA remains the innovation engine, pioneering nitrogen dosing, textured cans, and varietal-forward SKUs. Early RTD adjacency built trial, but current growth skews toward premium, terroir-expressive releases and limited editions. Retail execution blends cold box presence with front-end grab-and-go; stadiums and national parks amplify single-serve relevance. Hybrid products, wine spritzers with real juice, zero-sugar options, and better-for-you claims, expand the addressable base. DTC bundles and club drops drive discovery, while grocery resets prioritize fewer, stronger brands with clear use-case messaging.

Australia with a 7.8% CAGR grows on outdoor lifestyle alignment, beaches, festivals, and barbecues, and strict glass-free venue norms. Crisp whites, rosé, and sparkling styles match warm-weather occasions, while lower-ABV spritzes support sessionability. Regional wineries extend cellar-door experiences through portable formats, and tourism routes stock local-varietal cans as souvenirs. Multipack value offerings penetrate grocery, whereas independent bottle shops champion craft and sustainability stories. As bushfire-era resilience pivots to eco-messaging, aluminum’s recyclability and lightweight logistics strengthen appeal, with seasonal displays near RTD chillers boosting trial.

The competitive environment is characterized by a mix of established wineries and innovative beverage startups. Brand positioning rather than pure production scale remains the decisive success factor: the five largest suppliers collectively serve more than 15,000 retail outlets globally and account for a majority of both premium and mainstream distribution in the category.

Union Wine Company is the most established alternative format participant. As a pioneering canned wine producer, the company offers comprehensive portable wine solutions, all meeting international quality standards. Its core range of premium canned wines gives it deep penetration in modern retail channels while maintaining full coverage through specialty wine stores and on-premise establishments.

E & J Gallo Winery, with extensive wine production expertise, leverages scale advantages and brand recognition to place quality canned wines in mainstream retail applications and convenience-focused consumer segments. Recent investments in packaging innovation have allowed Gallo to introduce premium canned variants positioned for quality-conscious consumers, reinforcing its role as a mainstream wine leader.

Integrated Beverage Group LLC, specializing in alternative wine formats, benefits from portfolio diversification inside a comprehensive beverage strategy and from technical partnerships with wine producers. Recent product innovations under lifestyle-focused platforms extend IBG beyond basic canned wines into enhanced formulations targeting specific consumer occasions and premium positioning requirements.

The next tier comprises boutique wineries and lifestyle-focused brands. SANS WINE CO focuses on premium natural wines for health-conscious consumers, recent growth initiatives showed expansion in organic and biodynamic segments, signaling established positioning in quality-focused channels. Sula Vineyards, expanding through international distribution, adds premium Indian wine varieties to growing exotic wine supply chains and is expected to benefit from increasing demand for unique origin stories.

Private-label programs at major global retailers including Whole Foods, Tesco, and Carrefour are widening consumer access at price points 15-20% below branded equivalents, putting margin pressure on smaller suppliers while supporting category adoption. Consolidation is therefore likely to continue as brand strength and distribution coverage become critical for maintaining retail partnerships and consumer recognition in this rapidly expanding category.

| Item | Value |

|---|---|

| Quantitative Units | USD 753 Million |

| Product Type | Sparkling, Fortified, Others |

| Distribution Channel | Supermarket & Hypermarket, Online, Other Stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Companies Profiled | E & J Gallo Winery, Union Wine Company, Integrated Beverage Group LLC, SANS WINE CO, Sula Vineyards Pvt. Ltd., The Family Coppola, The Company, Beach Juice, IBG Wines, Shamps Beverage LLC, Sans Wine Co |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, integration with sustainable sourcing practices, innovations in extraction technology and quality standardization for diverse industrial applications |

The global canned wine market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the canned wine market is projected to reach USD 3.4 billion by 2035.

The canned wine market is expected to grow at a 16.3% CAGR between 2025 and 2035.

The key product types in canned wine market are sparkling, fortified and others.

In terms of distribution channel, supermarket/hypermarket segment to command 46.7% share in the canned wine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Wine Box Market Size and Share Forecast Outlook 2025 to 2035

Wine Fining Agent Market Size and Share Forecast Outlook 2025 to 2035

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Racks Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA