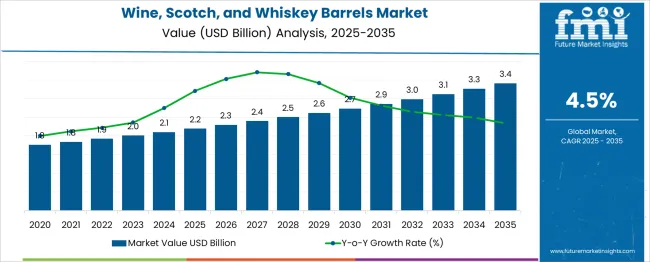

The Wine, Scotch, and Whiskey Barrels Market is estimated to be valued at USD 2.2 billion in 2025. It is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. The long-term value accumulation curve demonstrates a steady and predictable growth trajectory with incremental gains accelerating slightly over time. From 2020 to 2025, the market advances from USD 1.8 billion to 2.2 billion, adding USD 0.4 billion, driven by rising demand for premium alcoholic beverages and increased adoption of traditional aging methods in craft and luxury segments.

Between 2025 and 2030, the curve steepens moderately as the market climbs to USD 2.7 billion, adding USD 0.5 billion, supported by expanding global consumption and growth in boutique distilleries across emerging economies. The final phase (2030–2035) contributes another USD 0.7 billion, taking the market to USD 3.4 billion, indicating that nearly 58% of the total incremental value is realized after 2025, showing a gradual but consistent acceleration.

This pattern underscores opportunities for manufacturers to invest in high-quality oak sourcing, cooperage automation, and customized barrel finishing to cater to growing demand for unique flavor profiles and aging characteristics across wine and spirits markets worldwide.

| Metric | Value |

|---|---|

| Wine, Scotch, and Whiskey Barrels Market Estimated Value in (2025 E) | USD 2.2 billion |

| Wine, Scotch, and Whiskey Barrels Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The wine, scotch, and whiskey barrels market maintains a vital role within its broader parent sectors, though its share differs significantly by category. In the cooperage and barrel-making market, barrels for wine and spirits account for 70–75%, as premium oak casks dominate demand for aging applications over industrial containers. Within the distillery equipment and storage market, the share is 18–20%, since tanks, fermenters, and stainless-steel vessels also claim major investments.

For the aging and maturation materials market, barrels hold the largest portion, approximately 55–60%, reflecting their irreplaceable function in flavor development, aroma integration, and color enhancement for wines and spirits. In the wine & spirits packaging and logistics market, their share is relatively small at 6–8%, as glass bottles, corks, and secondary packaging make up the bulk of this segment. Within the craft distilling and specialty market, barrels capture 40–45%, driven by artisan producers prioritizing custom char levels and exotic wood species to create unique flavor profiles.

Demand for high-quality oak barrels is being accelerated by premiumization trends, expansion of craft whiskey and small-batch scotch, and growing interest in aged wine varieties. Sustainability initiatives like reconditioned barrels and hybrid wood treatments are reshaping this market, reinforcing its role in premium beverage production worldwide.

The wine, scotch, and whiskey barrels market is experiencing consistent growth fueled by rising global demand for premium alcoholic beverages and a resurgence of traditional aging practices. Increased preference for authentic flavors, coupled with the expansion of craft distilleries and wineries, has driven significant investment in high-quality barrels.

The use of barrels as a differentiator in product quality and branding has further encouraged adoption. Future growth is expected to benefit from ongoing innovations in barrel treatment techniques, sustainability-focused sourcing of wood, and the increasing popularity of limited edition and small batch spirits.

The convergence of heritage craftsmanship and modern production efficiencies is paving the way for expanded applications and new market entrants.

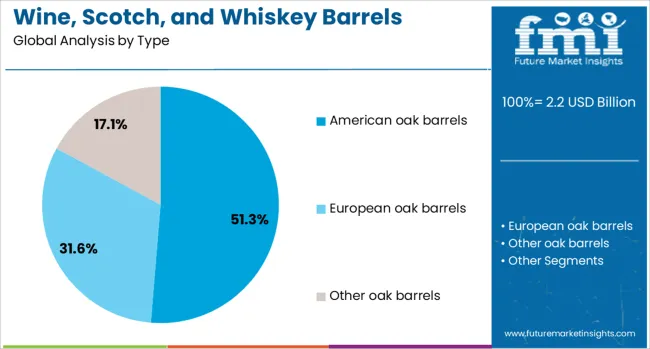

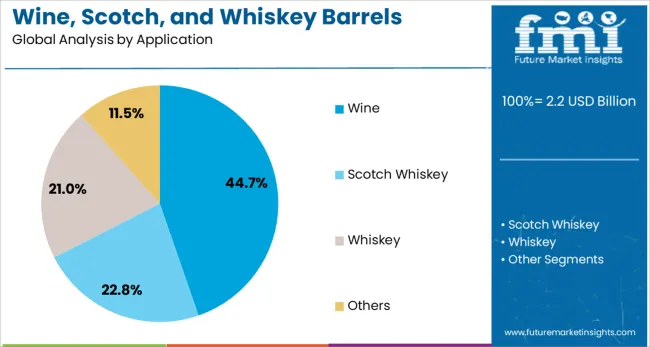

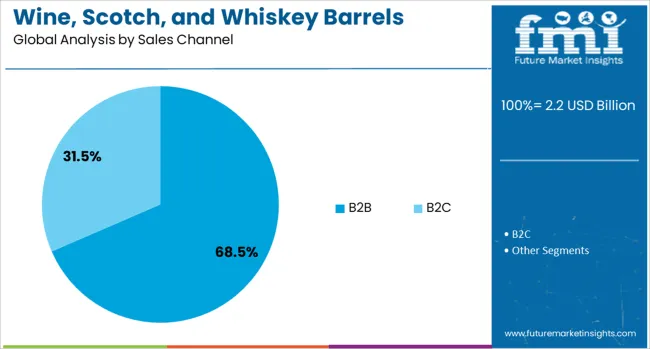

The wine, scotch, and whiskey barrels market is segmented by type, application, sales channel, and geographic regions. By type of wine, the scotch and whiskey barrels market is divided into American oak barrels, European oak barrels, and Other oak barrels. In terms of application of the wine, scotch, and whiskey barrels, the market is classified into Wine, Scotch Whiskey, Whiskey, and Others. Based on the sales channel of the wine, scotch, and whiskey barrels market, it is segmented into B2B and B2C. Regionally, the wine, scotch, and whiskey barrels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, American oak barrels are projected to account for 51.30% of the total market revenue in 2025, maintaining their dominance. This leadership is attributed to their availability, cost effectiveness, and favorable flavor characteristics imparted to wine and spirits.

The porous structure and distinct chemical composition of American oak have been preferred for enhancing aroma, texture, and complexity of the beverages. Producers have increasingly chosen this type due to its balance of durability and desirable organoleptic properties which contribute to consistent quality.

Efficient supply chains and established practices in cooperage have reinforced the widespread adoption of American oak barrels, positioning them as the preferred choice across wineries and distilleries aiming for reliable outcomes.

In terms of application, the wine segment is forecast to hold 44.7% of the total market revenue in 2025, securing its position as the leading application. This prominence has been driven by growing consumer inclination toward premium aged wines and the role of barrels in imparting depth and complexity to the final product.

Wineries have continued to invest in barrels as an integral element of their production and branding strategy. The wine industry’s emphasis on tradition, authenticity, and quality differentiation has further encouraged the use of barrels.

Moreover, the ability of barrels to influence color, tannins, and aromatic profile has reinforced their indispensability in winemaking, enabling producers to meet rising market expectations and maintain competitive advantage.

When segmented by sales channel, the B2B segment is expected to command 68.5% of the total market revenue in 2025, asserting its dominance. This leadership has been reinforced by the fact that wineries, distilleries, and cooperages largely transact through business-to-business channels for their barrel requirements.

Direct relationships between producers and barrel makers have streamlined procurement, ensured customization, and secured reliable supply. Bulk purchasing and long-term contracts have been advantageous for both parties, supporting efficient operations and cost management.

The prevalence of B2B channels has also been strengthened by the need for technical consultation, quality assurance, and logistical coordination, all of which are better facilitated through direct professional engagements rather than retail or individual sales.

Barrels for wine, scotch, and whisky are crafted from seasoned oak and other woods to facilitate aging, flavor development, and maturation. These barrels are used by distilleries, wineries, breweries, and spirits makers across the globe. Demand is driven by the importance of wood‑aged character, color extraction, and aromatic complexity imparted during storage. Suppliers offering high‑quality oak, precise cooperage techniques, and consistent barrel performance have been well positioned. Barrels capable of delivering predictable flavor notes, low evaporation loss, and suitable fill capacity continue to guide procurement decisions in beverage production and high‑end spirits ageing.

Growth in the barrel market has been supported by rising global production of wine, scotch, and whisky, plus expanding premium spirits segments. Distilleries and wineries require precise aging vessels to deliver branded flavor profiles, depth, and complexity. Demand has been influenced by interest in uniformly aged spirits with consistent sensory attributes. Expansion of craft distilling and boutique wineries has increased volume needs for small batch barrels. Aging standards and consumer expectations around barrel‑derived vanilla, spice and smoky notes have reinforced reliance on high grade cooperage supplies. Investment in long‑term stock aging and flavor‑focused barrel programs has supported recurring procurement of new and refill barrel inventory.

Market growth has been restrained by volatility in oak wood supply and pricing, especially for key varieties such as French, American, and Japanese oak. High-grade staves require extended seasoning, increasing production time and inventory cost. Skilled coopering workmanship is required to avoid leakage and ensure proper tightness, adding to unit cost. Quality inconsistency among lower‑grade or recycled barrels has led to variable flavor results, affecting buyer trust. Storage and transport requirements for barrels are complex and incur logistical cost, particularly for heavy oak barrels. Reuse of barrels demands inspection and reconditioning processes that increase operational expense. Limited standardization in barrel char levels and toast profiles continues to complicate procurement for multi‑site aging programs.

Opportunities exist in refill barrel markets where previously used barrels are cleaned and re‑oaked, providing cost‑effective options for aging. Suppliers offering barrels made from alternative wood species such as cherry, chestnut or acacia are able to support production of novel flavor profiles. Collaboration with beverage producers on custom char and toast level profiles allows development of signature barrel programs. Expansion of aging in small batch craft spirits and premium wine lines continues to require unique barrel formats and sizes. Leasing models for barrel pools and managed aging services offer recurring revenue potential. Partnerships with terroir‑sensitive producers and single cask programs support premium positioning for barrel suppliers.

The market has shifted toward small batch and single cask barrel options tailored to specific flavor and aroma outcomes. Customization in char intensity and wood origin has become common as producers differentiate aging profiles. Reuse of barrels across multiple aging programs has grown, with reuse tracked by fill count and thermal profile. Interest in barrel delivery formats enabling rapid turnover—such as barrel inserts or fractional casks—has increased among craft producers. Demand has risen for cooperage products compliant with refill programs and extended aging cycles to minimize aroma fade. Suppliers offering easily trackable inventory systems for barrel rotations are being favored. Emphasis on high‑quality refill options combined with precise flavor control continues to drive purchasing decisions.

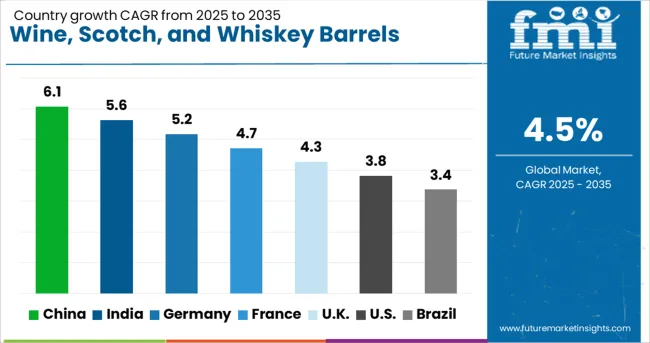

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The wine, scotch, and whiskey barrels market is projected to grow at a CAGR of 4.5% between 2025 and 2035, driven by premium beverage consumption, rising exports, and demand for oak barrel aging to enhance flavor profiles. China leads with 6.1% CAGR, fueled by the expansion of premium wine production and craft spirits. India follows at 5.6%, supported by the growing whiskey segment and micro-distilleries. Among OECD nations, Germany records 5.2%, leveraging increasing interest in craft spirits and premium wine storage. France posts 4.7%, with growth driven by high-end wine exports and barrel innovation for long-term maturation. The United Kingdom grows at 4.3%, supported by demand for scotch maturation barrels and premium whiskey exports.The report covers over 40 countries, with detailed insights for five profiled below.

China is expected to achieve a 6.1% CAGR, the highest among major markets, driven by rapid growth in premium wine production and an expanding consumer base for aged spirits. Domestic wineries are increasing their use of traditional oak barrels to enhance the depth and complexity of flavors, meeting growing demand for high-quality beverages. Imported oak barrels, particularly from France and the United States, remain in strong demand for luxury wine labels. Rising interest in craft whiskey and specialty liquors has further boosted the need for small-format barrels suitable for limited-batch production. E-commerce-driven alcohol retail platforms are increasing the visibility of premium aged products, supporting broader adoption of barrel-aged beverages in China.

India is forecasted to grow at a 5.6% CAGR, supported by increasing whiskey consumption and the rise of boutique distilleries. Barrel aging is gaining importance in domestic whiskey production, where producers are investing in American and European oak barrels to replicate global flavor standards. The wine sector is also expanding with premium varietals requiring extended maturation periods in quality barrels. Partnerships between Indian distilleries and international cooperages are strengthening supply chains for high-grade barrels. Growing preference for craft spirits among urban consumers is driving demand for small-capacity barrels used in artisanal production. The hospitality sector’s premium offerings in hotels and bars further enhance barrel-aged beverage visibility.

Germany is expected to post a 5.2% CAGR, driven by strong demand for high-quality barrels in both the wine and craft spirits industries. German cooperages are producing advanced oak barrels tailored for different aging styles, targeting premium wine estates and boutique distilleries. Growing consumer interest in whiskey and rum has spurred expansion in small-batch production, which relies heavily on customized barrels for flavor differentiation. Importation of specialty barrels from France and the USA supports producers aiming to achieve global taste profiles. Distribution through specialty retail outlets and direct-to-producer channels enables quick access to barrel solutions, reinforcing Germany’s reputation in precision aging.

France is projected to grow at a 4.7% CAGR, maintained by the country’s dominance in premium wine and cognac production. The demand for French oak barrels remains strong globally, supported by their superior grain structure and flavor-enhancing qualities. Domestic cooperages are introducing precision-toasted barrels to cater to producers seeking unique aromatic profiles for both wines and spirits. The whiskey segment in France is expanding, further driving demand for smaller barrels suited for rapid maturation. Export markets in North America and Asia continue to source French barrels for high-end beverage aging, reinforcing the nation’s leadership in cooperage craftsmanship.

The United Kingdom is forecast to grow at a 4.3% CAGR, primarily driven by demand from scotch and premium whiskey distilleries. Barrel aging remains integral to flavor development, prompting distilleries to invest in specialty barrels including sherry casks and charred oak varieties. Growth in craft whiskey producers is creating opportunities for small-capacity barrel suppliers. Import reliance on European and American oak barrels persists, as distilleries seek to maintain authenticity in flavor profiles. The export-driven scotch segment continues to lead, boosting demand for long-aging barrels designed for consistent maturation quality over decades.

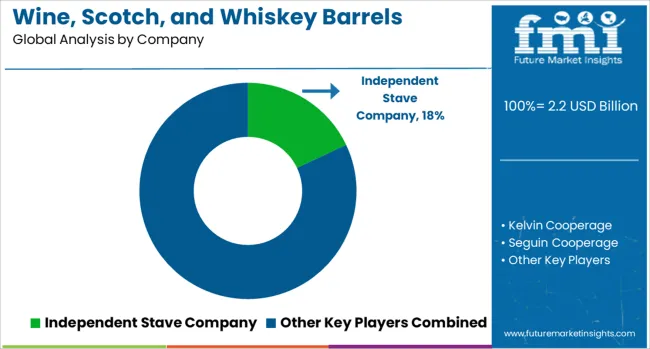

The wine, scotch, and whiskey barrels market is highly specialized and competitive, led by global cooperage firms such as Independent Stave Company, Kelvin Cooperage, Seguin Cooperage, Seguin Moreau, Speyside Cooperage, Tonnellerie Demptos, Tonnellerie François Frères, Tonnellerie Mercier, Tonnellerie Radoux, Tonnellerie Saury, and Vicard. Independent Stave Company dominates with large-scale production capabilities and partnerships with major wineries and distilleries worldwide, offering a wide range of oak barrels for both aging and finishing.

European cooperages like Seguin Moreau, François Frères, and Demptos focus on high-end, traditional craftsmanship tailored for premium wine and spirits, emphasizing strict sourcing of French oak for flavor consistency and controlled toasting profiles. Speyside Cooperage and Kelvin Cooperage hold strong positions in the scotch and whiskey segment by specializing in repurposed barrels and custom char levels to meet distillery requirements. Market entry barriers are significant due to the reliance on seasoned oak supply, skilled craftsmanship, and long-established relationships with beverage producers. Competitive differentiation hinges on wood sourcing, seasoning techniques, toasting and charring precision, and customization options for aging characteristics.

Companies are also integrating modern quality control with traditional techniques to ensure consistency in flavor extraction and maturation. Strategic trends include expanding operations in high-growth regions such as North America and Asia, developing specialty barrels for craft distilleries, and offering barrels optimized for secondary aging or flavor infusion. Future competitiveness will depend on innovations in hybrid barrels, digital traceability for oak origin, and sustainable forestry certifications to align with consumer preferences in premium alcoholic beverage markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Type | American oak barrels, European oak barrels, and Other oak barrels |

| Application | Wine, Scotch Whiskey, Whiskey, and Others |

| Sales Channel | B2B and B2C |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Independent Stave Company, Kelvin Cooperage, Seguin Cooperage, Seguin Moreau, Speyside Cooperage, Tonnellerie Demptos, Tonnellerie François Frères, Tonnellerie Mercier, Tonnellerie Radoux, Tonnellerie Saury, and Vicard |

| Additional Attributes | Dollar sales by application (wine aging, scotch maturation, whiskey aging, craft spirits finishing) and barrel type (American oak, French oak, hybrid oak), with demand driven by the premiumization of wines and spirits, growth in craft distilleries, and rising global consumption of aged beverages. Regional dynamics show Europe dominating premium barrel production for wine, while North America leads in whiskey barrels and secondary finishing products. Innovation trends include precision toasting technology, hybrid barrel construction for complex flavor profiles, and extended seasoning processes to enhance maturation outcomes. |

The global wine, scotch, and whiskey barrels market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the wine, scotch, and whiskey barrels market is projected to reach USD 3.4 billion by 2035.

The wine, scotch, and whiskey barrels market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in wine, scotch, and whiskey barrels market are american oak barrels, european oak barrels and other oak barrels.

In terms of application, wine segment to command 44.7% share in the wine, scotch, and whiskey barrels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Swine Disease Diagnostic Kit Market Size and Share Forecast Outlook 2025 to 2035

Wine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Honey Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Swine Feed Market Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Electric Wine Opener Market Size and Share Forecast Outlook 2025 to 2035

Automatic Wine Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Pressurized Wine Filter System Market Size and Share Forecast Outlook 2025 to 2035

Wine Box Market Size and Share Forecast Outlook 2025 to 2035

Wine Fining Agent Market Size and Share Forecast Outlook 2025 to 2035

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Wine Packs Market Size and Share Forecast Outlook 2025 to 2035

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Commercial Winery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA