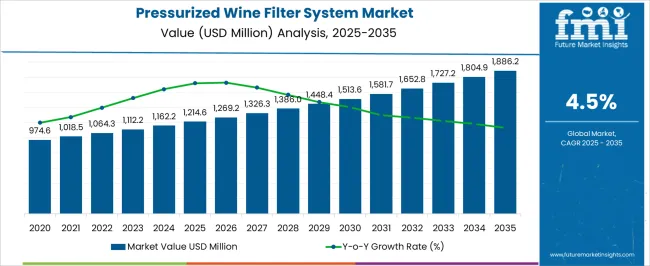

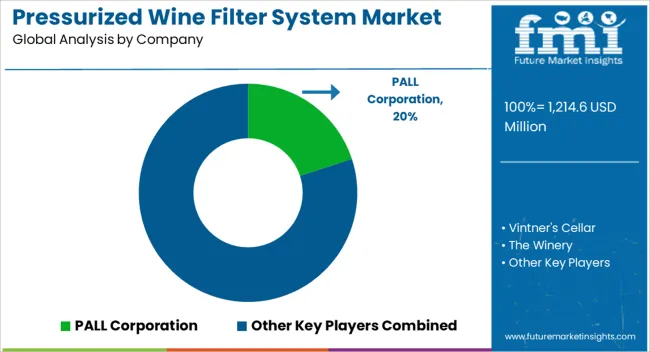

The Pressurized Wine Filter System Market is estimated to be valued at USD 1214.6 million in 2025 and is projected to reach USD 1886.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Pressurized Wine Filter System Market Estimated Value in (2025 E) | USD 1214.6 million |

| Pressurized Wine Filter System Market Forecast Value in (2035 F) | USD 1886.2 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The pressurized wine filter system market is gaining prominence as wineries seek to balance traditional craftsmanship with modern efficiency and regulatory compliance. Increased focus on maintaining wine clarity and stability without compromising flavor profiles has encouraged adoption of advanced filtration systems.

Rising consumer expectations for premium quality wines and stringent hygiene standards in production facilities are further driving demand for these systems. Developments in compact and energy efficient designs are enabling smaller wineries to access high performance filtration, while larger producers continue to invest in scalable solutions to meet growing volumes.

Future growth is expected to be propelled by innovations in sustainable materials, automation of cleaning processes, and enhanced precision control, which are shaping long term opportunities across diverse winery scales and regions.

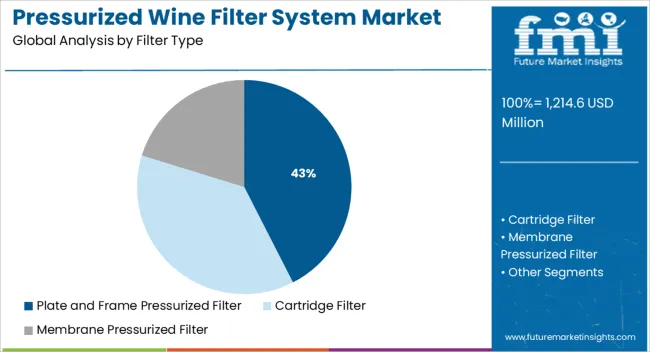

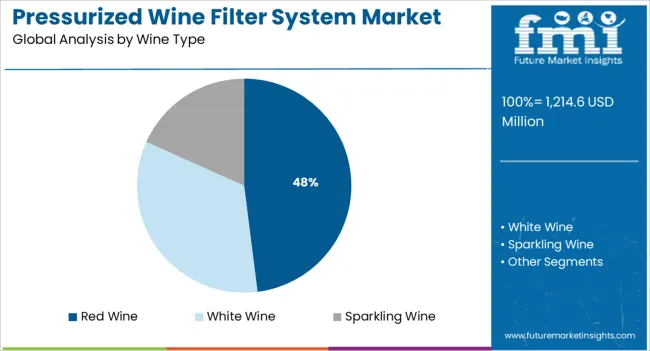

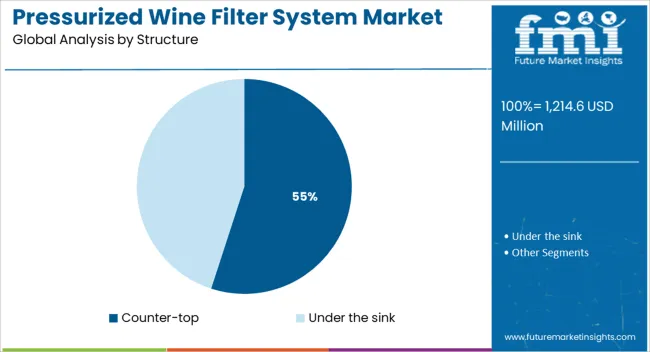

The market is segmented by Filter Type, Wine Type, and Structure and region. By Filter Type, the market is divided into Plate and Frame Pressurized Filter, Cartridge Filter, and Membrane Pressurized Filter. In terms of Wine Type, the market is classified into Red Wine, White Wine, and Sparkling Wine. Based on Structure, the market is segmented into Counter-top and Under the sink. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by filter type the plate and frame pressurized filter is projected to hold 42.5 % of the total market revenue in 2025 and emerges as the leading segment. This leadership is attributed to its robust construction and ability to handle high solids content while preserving the delicate balance of flavors in wine.

Its modular design has allowed wineries to adjust filtration levels easily which has improved operational flexibility. The plate and frame configuration has also been favored for its cost effectiveness in maintenance and its adaptability to both small and large batch productions.

Enhanced durability and ease of cleaning have strengthened its position as a preferred choice especially in facilities where consistent clarity and reliability are critical to maintaining product quality and regulatory standards.

Segmented by wine type red wine is expected to account for 48.0 % of the market revenue in 2025 and maintains its dominant position. This prominence is influenced by the higher demand for red wine globally combined with its complex structure which requires precise and efficient filtration.

The tendency of red wines to develop more sediment and tannin particles has made pressurized filtration essential for achieving a clear yet rich final product. Wineries producing red wine have increasingly invested in advanced filtration systems to meet both export quality norms and premium market expectations.

The ability of these systems to handle the specific needs of red wine without stripping away desirable characteristics has reinforced the leadership of this segment.

When segmented by structure the counter top configuration is projected to capture 55.0 % of the market revenue in 2025 securing its position as the most significant segment. This dominance is underpinned by its compact design which has appealed to smaller wineries and boutique producers with limited space.

The counter top structure has also been adopted widely for its portability and ease of installation which have reduced initial capital barriers. Its suitability for on demand and small batch production without compromising on performance has enhanced its acceptance across various scales of operations.

Furthermore the trend toward aesthetic and space efficient equipment in modern wineries has contributed to the sustained growth of this segment making it a preferred choice for facilities aiming for functionality combined with ergonomic design.

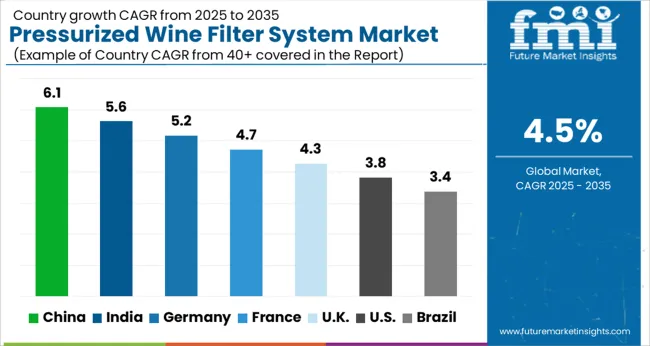

The global market for pressurized wine filter systems is expected to grow at 4.5% CAGR between 2025 and 2035 in comparison to 4.7% CAGR registered during the historical period from 2020 to 2025.

The increasing popularity of wine and the growing number of people who are interested in trying new wines are some of the key factors expected to drive the global pressurized wine filter system market forward.

Similarly, the rising number of wineries across the world is generating high demand for pressurized wine filter systems and the trend is expected to continue during the projection period.

In addition, advances in technology have made these systems more affordable and easier to use, which has also contributed to their growing popularity. The development and popularity of these cost-effective wine filtration systems will eventually expand the global market over the next decade.

A number of influential factors have been identified that are expected to spur growth in the global pressurized wine filter system market during the projection period (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can somehow influence pressurized wine filter system sales.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Increasing Number of Wineries Boosting Sales in the USA

The USA currently accounts for 31.3% of the global market and it is likely to surpass a valuation of USD 1214.6 Million in 2025. The pressurized wine filter system market in the USA is constantly evolving. New products are constantly being introduced and older products are being updated.

One of the most recent developments in the market is the introduction of newer and more efficient models. These models are designed to filter out sediment and impurities more effectively than older models. This makes them ideal for use in wine-making, as they can help to improve the quality of the finished product.

Similarly, an increasing number of wineries across the country is consistently rising and the trend is expected to continue during the forecast period. For instance, according to the USA Bureau of Labor Statistics, the total number of wineries in the USA reached over 5024 in 2024. This will continue to generate high demand for pressurized wine filter systems.

Growing Demand for High-Quality Wine Driving the UK Market

The UK pressurized wine filter system market is poised to grow at 6.1% CAGR between 2025 and 2035. This can be attributed to the rising demand for high-quality wine, the surge in wine export, and the availability of relatively inexpensive and highly efficient pressurized wine filter systems.

Similarly, a growing number of start-ups offering wine in the UK will boost sales of pressurized wine filter systems during the forecast period. These businesses are often looking for producing high-quality wine while saving costs. As a result, they are employing advanced wine filtration systems.

Availability of Cost-Efficient Pressurized Wine Filter Systems Expanding the China Market

The overall market for pressurized wine filter systems in China is expected to grow at 5.9% CAGR during the next ten years (2025 to 2035). Growth in the market is driven by rising wine consumption, easy availability of cost-efficient wine filtration systems, and favorable government support.

In recent years, Chinese manufacturers have been able to provide pressurized wine filter systems at a lower price than their competitors, making them very competitive in the market. Moreover, China's vast population means that there is a large potential market for pressurized wine filter systems, which provides an incentive for manufacturers to invest in this technology.

Innovations in Wine Filtration Systems to Boost the German Market

As per FMI, Germany is set to hold around 24.5% share of the global pressurized wine filter system industry by 2025. Furthermore, with rising wine consumption and innovation in wine filtration systems, Germany’s market is expected to reach a valuation of USD 272.5 Million by 2025.

Germany has long been known for its engineering and manufacturing prowess. As a result, the country has become a leader in the development of new wine technologies.

German manufacturers have developed innovative pressurized wine filter systems that can remove impurities from wine without affecting its taste or aroma. These systems use a series of filters to remove sediment, colorants, and other undesirables from wine, leaving behind only the purest essence of the drink. This results in a cleaner, more flavourful wine that can be enjoyed by all.

Red Wine to Generate the Highest Revenues Through 2035

Based on wine type, the red wine segment will continue to dominate the global market during the forecast period owing to the rising consumption of red wine across the world due to its various health benefits.

Red wine has several health benefits, including lowering blood sugar levels and lessening the effects of colds and congestion. It is the most popular type of wine among corporations and millennials.

Winemakers generally use pressurized wine filter systems to make the red clear without adding stabilizers. Thus, increasing production and consumption of this wine type (red wine) will eventually generate high demand for pressurized wine filter systems over the next ten years.

End Users Prefer Counter-top Structured Pressurized Wine Filter Systems

As per FMI, sales of counter-top pressurized wine filter systems are likely to outpace those of under-the-sink type, owing to the rising end-user preference for these systems due to their compact and space-saving features.

Counter-top models of pressurized wine filter systems are a great choice for those who want a compact and easy-to-use unit. These filters are designed to be used on the countertop, so they take up less space than other types of wine filter systems. They are also easy to set up and use.

Another advantage of countertop models is that they are usually less expensive than other types of filters. This makes them a great option for those who are on a budget.

The ability of Cartridge Filters to Increase Filtration Efficiency Encouraging Their Adoption

Based on filter type, demand for cartilage filters will grow at a significant pace during the next ten years owing to their ability to increase efficiency in pressurized wine filter systems.

Cartridge filters are more efficient than other types of filters because they have a smaller surface area. This means that they can remove more impurities from the wine while allowing less oxygen to enter the bottle. As a result, cartridge filters help preserve the flavor and quality of wine for longer periods of time.

As the wine industry continues to grow, so does the competitive landscape of pressurized wine filter systems. As a result, leading players are focused on continuously upgrading their product portfolios. They are launching upgraded wine filtration systems with unique features and benefits. Further, they are adopting strategies such as partnerships, mergers, facility expansions, and collaborations to gain a competitive edge in the market. For instance,

In January 2020, Parker Hannifin, created a new division, Parker Bioscience Filtration Division. The new division designs, supplies, and delivers whole systems for pharmaceutical and biopharmaceutical manufacturing, and provides filtration solutions for the global food and beverage industry.

Recently, Eaton expanded its range of BECO pre- and membrane filter cartridges that offer the perfect combination of pre-filtration and final filtration for full-bodied, bright, and stable wines and sparkling wines.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1214.6 million |

| Projected Market Size (2035) | USD 1886.2 million |

| Anticipated Growth Rate (2025 to 2035) | 4.5% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Filter Type, Wine Type, Structure, Region |

| Key Companies Profiled | Vintner's Cellar; The Winery; Cellar Master; PALL Corporation; 3M Company; Parker Hannifin Corporation; LD Carlson Co.; Wine Guardian; Nantong Hailan Filtration Tech Co., Ltd; Sartorius (India) Private Limited; VLS Technologies |

| Report Coverage | Company Share Analysis, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives, Market Forecast, Competitive Landscape, |

The global pressurized wine filter system market is estimated to be valued at USD 1,214.6 million in 2025.

The market size for the pressurized wine filter system market is projected to reach USD 1,886.2 million by 2035.

The pressurized wine filter system market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in pressurized wine filter system market are plate and frame pressurized filter, cartridge filter and membrane pressurized filter.

In terms of wine type, red wine segment to command 48.0% share in the pressurized wine filter system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pressurized Metal Containers Market

Pressurized Water Reactor System Market Size and Share Forecast Outlook 2025 to 2035

Wine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Wine Box Market Size and Share Forecast Outlook 2025 to 2035

Wine Fining Agent Market Size and Share Forecast Outlook 2025 to 2035

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Racks Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Wine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA