The wine packaging market is experiencing steady expansion driven by rising global wine consumption, evolving consumer preferences, and ongoing innovations in packaging formats. Increasing demand for premium and sustainable packaging materials has encouraged manufacturers to adopt eco-friendly solutions while maintaining product aesthetics and brand differentiation.

Current market dynamics reflect a balance between traditional packaging formats and emerging lightweight alternatives, with producers focusing on enhancing durability, recyclability, and design appeal. Regulatory emphasis on sustainable packaging standards and the growing influence of e-commerce in beverage sales are reshaping supply chain priorities.

The future outlook is marked by the expansion of wine exports, premiumization trends, and increased focus on circular economy principles Growth rationale is rooted in the adoption of advanced materials, cost-efficient production methods, and strategic brand positioning aimed at capturing evolving consumer segments across both developed and emerging markets.

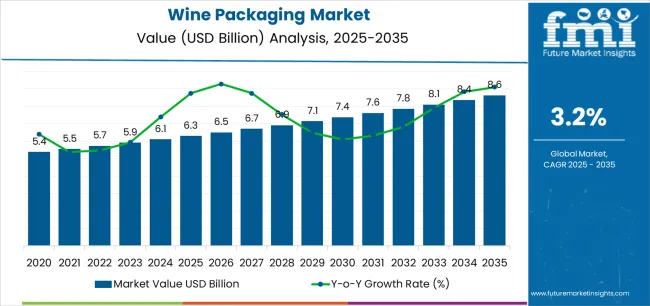

| Metric | Value |

|---|---|

| Wine Packaging Market Estimated Value in (2025E) | USD 6.3 billion |

| Wine Packaging Market Forecast Value in (2035F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

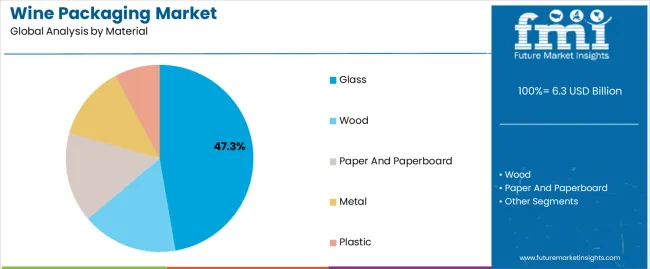

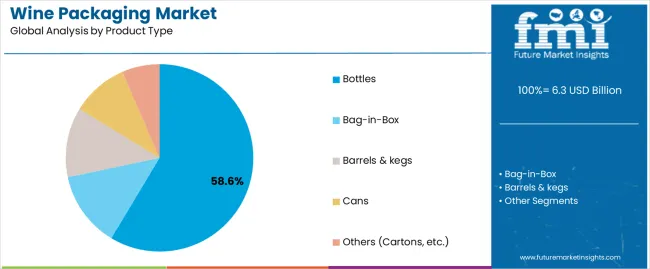

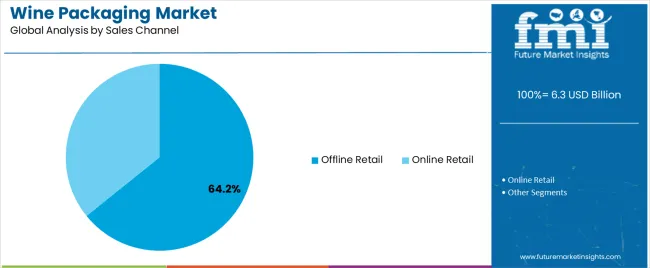

The market is segmented by Material, Product Type, and Sales Channel and region. By Material, the market is divided into Glass, Wood, Paper And Paperboard, Metal, and Plastic. In terms of Product Type, the market is classified into Bottles, Bag-in-Box, Barrels & kegs, Cans, and Others (Cartons, etc.). Based on Sales Channel, the market is segmented into Offline Retail and Online Retail. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass segment, accounting for 47.3% of the material category, has remained dominant due to its strong association with quality, preservation capability, and traditional appeal. Its continued preference among producers and consumers is being supported by its ability to maintain flavor integrity and ensure product longevity.

Glass is also favored for its recyclability and premium perception, making it a preferred choice for luxury and export-oriented wine brands. Technological advancements in lightweight glass manufacturing have reduced transportation costs and carbon emissions, enhancing its competitiveness against alternative materials.

Investment in closed-loop recycling systems and government initiatives promoting sustainability are further supporting demand The segment’s consistent adoption across wineries globally ensures its leading position within the wine packaging landscape.

The bottles segment, representing 58.6% of the product type category, has been leading due to its established dominance in the wine industry and enduring consumer trust. Bottles provide effective protection against external factors, preserving the sensory properties and authenticity of wine over extended storage periods.

Their compatibility with various closures and labeling formats supports brand customization and market differentiation. Demand stability has been reinforced by global standardization in bottle shapes and sizes, which simplifies logistics and distribution.

The introduction of lightweight designs and recycled content usage has further enhanced sustainability credentials Continued alignment with premium branding strategies and strong acceptance across retail and hospitality sectors ensure that bottles remain the primary packaging format driving the market’s overall value growth.

The offline retail segment, holding 64.2% of the sales channel category, continues to dominate due to strong consumer reliance on physical retail outlets for wine purchases. The segment benefits from experiential buying behavior, where visual appeal and in-store promotions influence purchasing decisions.

Supermarkets, specialty wine stores, and duty-free outlets have been key contributors to sales performance, supported by organized distribution and wide product availability. Retail partnerships with wineries and packaging innovations such as eye-catching labels and shelf-ready designs have enhanced visibility and turnover.

Despite the rise of online platforms, offline retail maintains its leadership through customer trust, immediate availability, and established purchasing patterns Expanding global retail infrastructure and consistent demand from hospitality channels are expected to sustain the segment’s market share and revenue contribution over the forecast period.

| Leading Material | Glass |

|---|---|

| Value Share (2025) | 63.1% |

Glass is an extensively used material for wine packaging. Our analysts have estimated that this segment is expected to record a value share of 63.1% in 2025. Glass material has enjoyed consumer preference as it is a trusted and visually appealing packaging choice for wine consumers. Further, glass does not interfere with wine properties like aroma and flavor due to its impermeability. This quality of glass adds to the overall enhanced drinking experience of wine.

Metal, however, is the future for wine packaging as consumers are becoming knowledgeable about various environmental benefits of metals like aluminum.

| Leading Packaging Format | Bottles |

|---|---|

| Value Share (2025) | 56.8% |

Bottles are expected to account for a massive 56.8% value share in 2025. Demand for bottles is increasing as it elevates the quality of wine upon storage. Additionally, their adaptability in different sizes, shapes, and colors, as well as their customization with different labels are propelling the segment's growth.

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| The United States | 2.30% |

| Spain | 3.40% |

| India | 6.50% |

| China | 5.70% |

| Thailand | 5.40% |

The demand for wine packaging in the United States is predicted to rise at a CAGR of 2.3% in the next decade. The popularity of wine packaging is booming in America as the population massively consumes wine during the festive season, picnics, corporate and social events, etc. Further, the sales of reliable packaging are increasing to ensure safe and quick delivery of wine.

Ready-to-drink beverages are a key trend in the wine industry, which is positively impacting the sales of convenient wine packaging. Additionally, growing sales of wine from online platforms are creating a robust demand for wine packaging that appeals the consumers.

Key players in the United States are increasing the domestic production of wine packaging to meet the growing demand from winemakers. Players are focusing on unique wine packaging designs and distinct wine packaging. Additionally, players are investing in the latest technology to bring efficiencies in their manufacturing process.

Sales of wine packaging in Spain are expected to surge at a CAGR of 3.4% from 2025 to 2035. Key players in the market are thus responding by increasing their production of boxes for wine and liquor both for multiple and individual packs.

Customers in Spain are demanding high-end wine packaging that conveys an idea of prestige. Apart from this, there is a budding demand for bag-in-box systems and aseptic cartons as they make for a sustainable option. Also, glass systems have significant weight, which leads to massive energy consumption during bottle production. Increasing knowledge about the harmful consequences of glass containers is another factor that is shifting customers to adopt eco-friendly wine packaging solutions.

Consumption of wine is rapidly increasing in China. This trend is propelling the demand for robust wine packaging, which is expected to experience a CAGR of 5.7% in the following years.

Presently, the China wine market is crowded by competitive players who are offering many great wine selections at different price points. The market of these players is the emerging novice consumer base who are yet to develop a fine taste in wine. To win in this cut-throat market competition, players are increasingly investing in the product’s packaging.

Key players are using wine packaging solutions effectively to communicate the quality of their wine to customers. Brands have been executing distinct new concepts to package their products, and a large proportion of these have succeeded in seizing the interest and wallets of consumers in China.

Several wine brands are responding to surging consumers’ interest in products that incorporate elements of Chinese culture in their packaging. For instance, during New Year’s, several luxury brands unveil products that feature the Chinese zodiac in their packaging design to capture consumers in this country.

The wine packaging sales in India are expected to observe a spike, growing at a CAGR of 6.5% over the next ten years. Rising density of wine box manufacturers who provide top-notch packaging solutions customized according to the different needs of the customers.

The scope for the suppliers of luxury wine packaging boxes in India is expanding at a significant pace. This can be linked to the growing demand for bespoke and individualized wine packaging boxes by wine players to attract high-class clientele.

Industry players are expected to expand their customer base by increasing sustainable efforts. In February 2025, for instance, Sula Vineyards, which is a leader and a pioneer in the Indian wine industry selected CANPACK to launch India’s first canned wine. CANPACK is a globally-recognized manufacturer of metal packaging.

The new semi-sparkling, canned wines come in two variants, i.e., Dia White and Dia Red. This launch supports environmental sustainability, which is also a driving force for many customers.

Demand for wine packaging is accelerating in Thailand, as the country is set to expand at a CAGR of 5.4% over the upcoming years. Manufacturers operating in Thailand are offering packaging solutions for wine, wine drinks, wine coolers, and wine-based beverages like Sangria. Further, players in Thailand are moving away from the traditional bottle glasses to carton packages as a transportable and environmentally friendly option.

Key players in the wine packaging market are introducing new packaging designs and formats to compel customers to revamp their packaging. Industry participants are further influenced by the growing demand for alternative formats like ‘bag-in-box’ and aluminum cans and new formats like flat plastic wine bottles that are known for their sustainability.

Consequently, manufacturers are altering their wine packaging to stay up-to-date with the present consumer demands. Industry players are coming into partnerships and acquiring smaller players to strengthen their hold in the wine packaging market.

Latest Developments Shaping the Wine Packaging Market

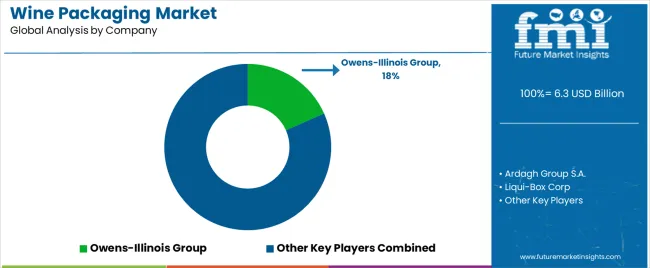

The global wine packaging market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the wine packaging market is projected to reach USD 8.6 billion by 2035.

The wine packaging market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in wine packaging market are glass, wood, paper and paperboard, metal and plastic.

In terms of product type, bottles segment to command 58.6% share in the wine packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Box Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA