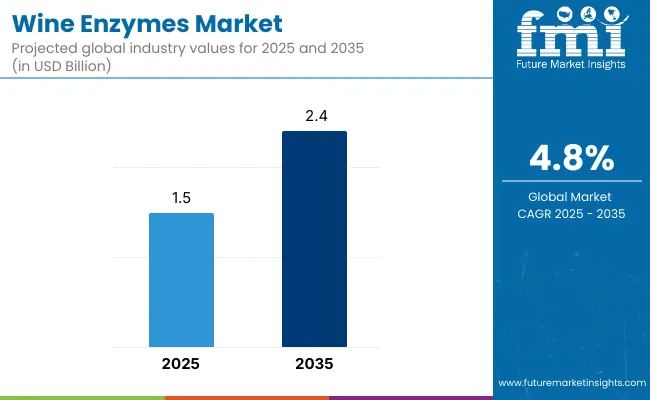

The wine enzymes market is estimated to be valued at USD 1.5 billion in 2025. It is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 870 million over the forecast period. This reflects a 1.56 times growth.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.5 billion |

| Projected Value (2035F) | USD 2.4 billion |

| CAGR (2025 to 2035) | 4.8% |

The market’s evolution is expected to be shaped by rising demand for natural and synthetic enzymes in winemaking, enabling improved fermentation, enhanced aroma, stabilization, and higher quality wine production across commercial and craft wineries worldwide.

By 2030, the market is likely to reach approximately USD 1.9billion, accounting for USD 400 million in incremental value over the first half of the decade. The remaining USD 500 million is expected in the second half, suggesting a moderately back-loaded growth pattern driven by increasing adoption of plant-based and non-animal-derived enzymes in commercial winemaking processes.

Companies such as DSM, Amano Enzyme, Chr. Hansen, Associated British Foods, and Kerry Group are strengthening their positions through investment in enzyme research, innovative fermentation technologies, and scalable production capabilities. Sustainability-led product development, plant-based enzyme offerings, and adherence to international food safety standards are supporting expansion into red and white wine production, sparkling wines, and craft winemaking applications globally.

The market represents a specialized segment within the broader enzyme and food ingredient landscape, accounting for approximately 5-6% of the global enzyme market. Within the food and beverage ingredients sector, wine enzymes hold around 3% of total enzyme-based additives, reflecting their niche application in winemaking. In the alcoholic beverages processing segment, they capture nearly 8% of demand due to their critical role in fermentation, clarification, and aroma enhancement. In biotechnology and industrial enzymes, the share is estimated at 2-3%. In contrast, in specialty and natural enzyme solutions, wine enzymes account for roughly 4%, underscoring their importance in premium and quality-focused wine production.

The market is driven by increasing demand for high-quality and stable wines, adoption of plant-based and vegan-friendly enzymes, and innovations in enzyme formulations for red and white wines. Recent developments include enzyme blends for flavor enhancement, stabilization technologies, and sustainable enzyme production. Trends such as automation in winemaking, precision fermentation, and regulatory compliance for quality assurance are accelerating growth. Consumer preference for premium and organic wines continues to fuel market expansion globally.

The growth of the wine enzymes market is being driven by increasing demand for high-quality wines and improved fermentation efficiency in winemaking processes. Enzymes such as lysozymes, pectinases, and glucanases are being widely adopted to enhance wine aroma, clarity, and stability, while reducing production time and microbial contamination.

Rising consumer preference for premium, plant-based, and vegan-friendly wines is further boosting adoption, as winemakers seek enzyme solutions that meet clean-label and sustainability requirements. Innovations in enzyme formulations, including multi-functional blends and precision fermentation technologies, are enabling wineries to diversify wine profiles and improve product consistency.

Additionally, supportive government regulations, growing investment in biotechnology, and increasing awareness of enzyme benefits in alcoholic beverages are contributing to market expansion. With the focus on quality enhancement, production efficiency, and eco-friendly solutions, the market is expected to sustain strong growth across commercial and craft winemaking sectors.

The market is segmented by type, function, end use, distribution channel, and region. By type, the market is divided into fungi (pectinases, lipases, glycosidases, fungal proteases), lactic acid bacteria (glycosidases, microbial proteases), lysozyme/antimicrobial enzyme, yeasts (glucanases, esters, proteases), urease, phenoloxidases/oxidative enzyme. Based on end use, the market is segmented into red wine, rosé wine, white wine, sweet wine, and sparkling wine. By function, the market is classified into fermentation, aroma improvement, hydrolysis, wine stabilization, settling and clarification, and lysis. In terms of distribution channel, the market is divided into store-based retail, specialty stores, online retail, supermarkets, and hypermarkets. Regionally, the market spans over North America, Latin America, Asia-Pacific, Eastern Europe, Western Europe, Japan.

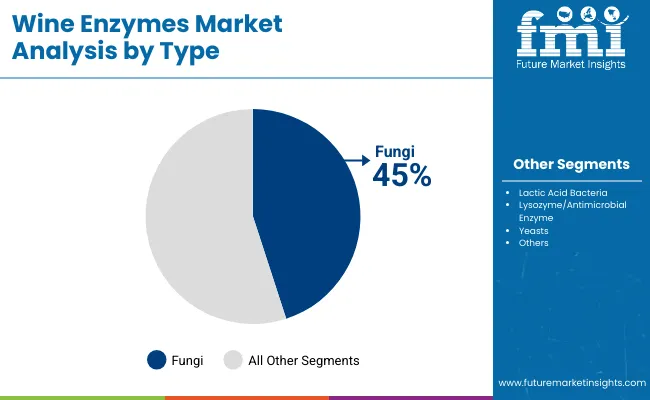

The fungi enzyme segment, including pectinases, lipases, glycosidases, and fungal proteases, holds a dominant position with 45% of the market share in 2025. These enzymes are widely used in winemaking to improve clarification, enhance aroma, and accelerate fermentation. Fungal enzymes are preferred due to their broad activity range, consistency, and compatibility with plant-based and vegan-friendly wine production.

Fungal pectinases break down grape cell walls, improving juice extraction and color yield, while lipases and glycosidases contribute to aroma profile development. Fungal proteases are employed to prevent haze formation and stabilize proteins during wine aging. Growing demand for high-quality wines and innovative flavor profiles continues to propel adoption.

Manufacturers are investing in strain optimization, enzyme blends, and scalable production to enhance efficiency, reduce processing times, and meet regulatory and sustainability standards. With increasing commercial and craft winemaking, the fungi segment is expected to maintain strong growth through 2035.

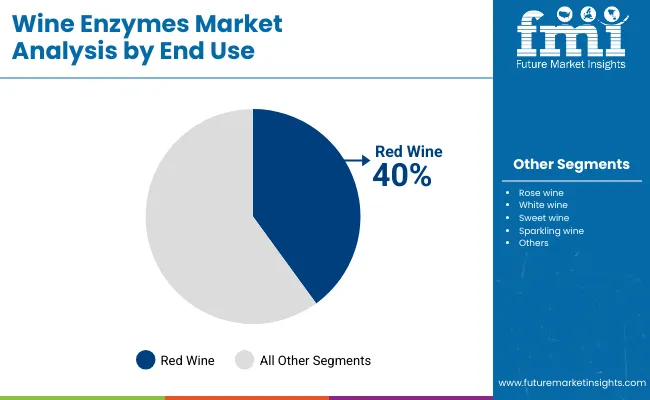

Red wine remains the leading end-use segment, capturing 40% of the global wine enzymes market in 2025. Red wine production benefits extensively from enzyme application, as longer maceration periods and higher tannin content require efficient clarification and stabilization. Enzyme usage enhances color extraction, aroma complexity, and overall sensory quality.

Winemakers employ pectinases and glycosidases to optimize juice yield, reduce turbidity, and accelerate fermentation in red wine production. Lipases and fungal proteases contribute to balanced aroma development and protein stabilization, ensuring product consistency and premium quality.

Trends such as plant-based enzyme adoption, clean-label production, and sustainable winemaking practices are influencing enzyme selection in red wine. Investment in research for tailored enzyme formulations continues to support innovation, efficiency, and quality, positioning the red wine segment for sustained growth in the global wine enzymes market.

In 2025, global wine enzyme consumption is projected at USD 1.5 billion, with Europe and North America collectively accounting for over 50% of the market share. Wine enzymes are applied across red, white, sparkling, and fortified wines to enhance aroma, clarity, and fermentation efficiency. Manufacturers are developing multi-functional enzyme blends, including fungal proteases, pectinases, and glycosidases, to deliver superior wine quality while supporting plant-based and vegan-friendly formulations. Adoption of clean-label and sustainable enzyme solutions is increasing, as winemakers focus on efficiency, premiumization, and consistent flavor profiles. Technological innovations in enzyme stabilization, precise dosing, and fermentation acceleration are enhancing operational efficiency and reducing production variability.

Health, Quality, and Functional Benefits Drive Market Growth

Winemakers increasingly leveraging enzyme solutions to improve wine quality, accelerate fermentation, and stabilize products. Fungal enzymes enhance aroma, color extraction, and protein stability, particularly in red wine, which accounts for 40% of the end-use share. Enzyme adoption enables higher yields, reduced microbial contamination, and improved sensory attributes. Consumer preference for premium, natural, and sustainably produced wines is further driving demand. Investments in research for strain optimization and specialized enzyme formulations ensure consistent quality across commercial and craft winemaking operations, supporting global market expansion.

Supply Chain Complexity, Cost Pressures, and Regulatory Challenges Limit Growth

Market growth faces constraints due to raw material variability, production cost pressures, and stringent regulatory compliance requirements. Enzyme manufacturing involves specialized fermentation and stabilization processes, increasing production lead times and costs by 10-15% compared to conventional additives. Cold chain logistics, enzyme activity preservation, and compliance with food safety regulations add further complexity to distribution. Limited availability of high-purity, plant-based enzyme formulations restricts scalability, particularly in emerging markets. Despite these challenges, the global wine enzymes market continues to benefit from premiumization trends, sustainable winemaking practices, and growing demand for high-quality, flavor-consistent wines worldwide.

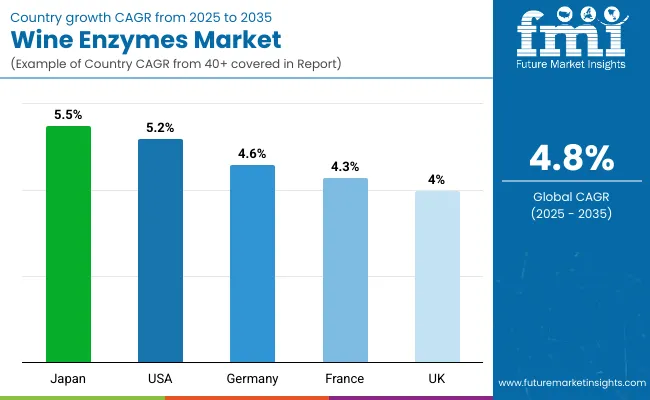

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

| United States | 5.2% |

| Germany | 4.6% |

| France | 4.3% |

| United Kingdom | 4.0% |

In the wine enzymes market, Japan leads with the highest projected CAGR of 5.5% from 2025 to 2035, reflecting strong adoption of advanced fermentation technologies and premium wine production practices. The USA follows closely with a CAGR of 5.2%, driven by demand for quality red and sparkling wines, and innovation in enzyme formulations for flavor and stabilization. Germany is projected at 4.6%, supported by established wine industries and regulatory compliance with EU standards. France’s CAGR is 4.3%, with growth concentrated in premium and artisanal wine production. The UK shows moderate growth at 4.0%, reflecting emerging enzyme adoption in boutique wineries and craft wine sectors.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The wine enzymes market in Japan is expected to grow at a CAGR of 5.5% from 2025 to 2035, driven by the adoption of advanced fermentation and clarification techniques across wineries in Yamanashi, Nagano, and Hokkaido. Japanese producers are increasingly employing fungal and plant-based enzymes to enhance aroma, color, and clarity while ensuring vegan-friendly production. Multi-functional enzyme blends are being introduced to optimize processing efficiency. Collaborative partnerships with European suppliers are helping domestic wineries maintain quality and innovate premium wine profiles for both local and export markets.

Key Statistics

Revenue from wine enzymes in the USA is anticipated to expand at a CAGR of 5.2% from 2025 to 2035, supported by high demand for premium and craft wines in California, Oregon, and Washington. Enzymes such as lysozymes, pectinases, and glycosidases are used to improve aroma, clarity, and color extraction in both red and sparkling wines. Investment in scalable enzyme technologies allows wineries to maintain consistent quality across large production volumes. Innovation in plant-based and multi-functional enzymes supports sustainability initiatives and caters to evolving consumer preferences for high-quality wines.

Key Statistics

Sales of wine enzymes in Germany are projected to grow at a CAGR of 4.6% from 2025 to 2035, with major wineries in Rhineland-Palatinate, Baden-Württemberg, and Hessen leading adoption. Enzyme usage enhances fermentation efficiency, clarity, and aroma development in Riesling and Pinot Noir wines. Compliance with EU food safety and organic standards ensures consistent product quality. German wineries are increasingly partnering with enzyme manufacturers to develop multi-functional blends tailored for both traditional and modern winemaking processes, ensuring operational efficiency and premium wine profiles in competitive domestic and export markets.

Key Statistics

Demand for wine enzymes in France is poised to rise at a CAGR of 4.3% from 2025 to 2035, driven by the adoption of enzymes in the Bordeaux, Burgundy, and Champagne regions. Enzymes improve fermentation, aroma, and color extraction for red, white, and sparkling wines. French wineries are increasingly deploying plant-based and fungal enzyme blends to meet consumer demand for clean-label and sustainable production. Collaboration with domestic and international enzyme suppliers ensures consistent quality and innovation. Enzyme adoption supports both artisanal and large-scale premium wine production while enhancing operational efficiency and product differentiation in competitive markets.

Key Statistics

The wine enzymes market in the UK is expected to strengthen at a CAGR of 4.0% from 2025 to 2035, with adoption concentrated in boutique wineries in England and Scotland. Enzymes enhance wine aroma, color, and clarity while supporting sustainable and plant-based production methods. UK producers are focusing on clean-label, high-quality wines to meet premium consumer expectations. Despite a limited production scale, partnerships with European enzyme suppliers allow access to innovative formulations. Ongoing investment in enzyme technologies supports improved efficiency and consistent quality in small-scale, craft, and specialty wine production.

Key Statistics

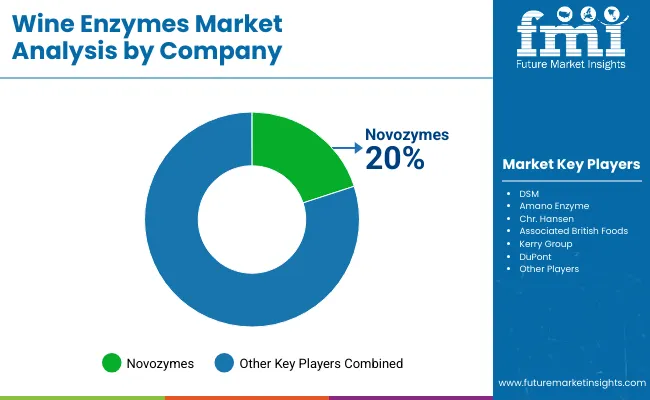

The global wine enzymes market is moderately consolidated, comprising a mix of multinational enzyme manufacturers, specialized ingredient suppliers, and regional enzyme producers. Key international players such as DSM (Netherlands), Novozymes (Denmark), Chr. Hansen (Denmark), Amano Enzyme (Japan), and Associated British Foods (UK) dominate the market, leveraging advanced fermentation and stabilization technologies. Their competitive advantage lies in extensive R&D capabilities, comprehensive product portfolios covering pectinases, fungal proteases, glycosidases, and lysozymes, and strong distribution networks that ensure reliable supply to wineries across Europe, North America, and Asia-Pacific.

Regional specialists differentiate through application-specific enzyme solutions, catering to red, white, sparkling, and fortified wine production. For example, Kerry Group (Ireland) focuses on multi-functional enzyme blends optimized for aroma enhancement, color extraction, and clarification. Japanese firms such as Amano Enzyme emphasize high-purity fungal and plant-based enzymes suitable for premium and vegan-friendly wine production. Collaboration with wineries and tailored enzyme formulation services further strengthen market positioning by meeting the requirements of both large-scale and boutique wine producers.

Entry barriers in the wine enzymes market remain high due to stringent regulatory compliance, specialized production processes, and cold-chain logistics requirements to maintain enzyme activity. Competitiveness is increasingly driven by the ability to innovate in enzyme stabilization, multi-functional blends, and sustainable sourcing. Companies investing in R&D, technology integration, and sustainable enzyme production are expected to maintain a strategic edge, particularly in premium wine markets across Europe, North America, and Japan, where quality, flavor consistency, and regulatory compliance are critical factors for market success.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Type | Fungi (Pectinases, Lipases, Glycosidases,Fungal Proteases), Lactic Acid Bacteria (Glycosidases,Microbial Proteases), Lysozyme/Antimicrobial Enzyme, Yeasts (Glucanases,Esters, Proteases), Urease, Phenoloxidases /Oxidative Enzyme |

| Function | Fermentation, Aroma improvement, Hydrolysis, Wine stabilization, Settling and Clarification, Lysis |

| End Use | Red wine, Rose wine, White wine, Sweet wine, Sparkling wine |

| Distribution Channel | Store-Based Retail, Specialty Stores, Online Retail, Supermarkets, Hypermarkets |

| Regions Covered | North America, Latin America, Asia-Pacific, Eastern Europe, Western Europe, Japan |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | DSM, Amano Enzyme, Chr. Hansen, Associated British Foods, Kerry Group, DuPont, Novozymes |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, integration with sustainable sourcing practices, innovations in extraction technology and quality standardization for diverse industrial applications |

The global wine enzymes market is estimated to be valued at USD 1.5 billion in 2025.

The wine enzymes market size is projected to reach USD 2.4 billion by 2035.

The wine enzymes market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The fungi segment (including pectinases, lipases, glycosidases, fungal proteases) is projected to lead the wine enzymes market with 45% market share in 2025.

In terms of end use, the red wine segment will command 40% share in the wine enzymes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Wine Box Market Size and Share Forecast Outlook 2025 to 2035

Wine Fining Agent Market Size and Share Forecast Outlook 2025 to 2035

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Racks Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Wine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Destemmer Market - Growth & Demand 2025 to 2035

Wine Crusher Market Growth - Winemaking Equipment & Industry Trends 2025 to 2035

Wine Filtering Machine Market Expansion - Filtration & Winemaking Technology 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA