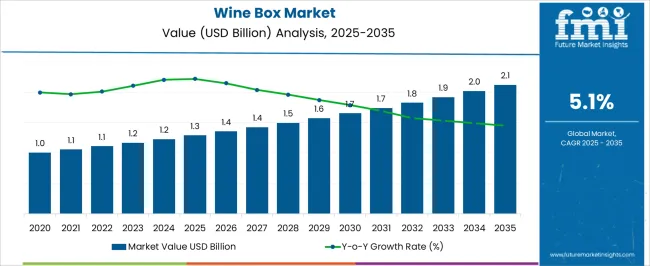

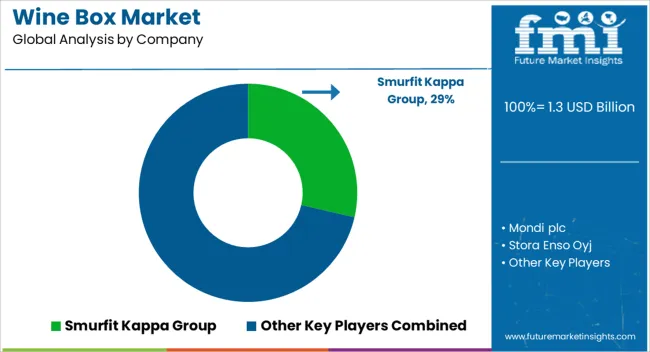

The Wine Box Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Wine Box Market Estimated Value in (2025 E) | USD 1.3 billion |

| Wine Box Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The wine box market is expanding steadily due to growing consumer interest in premium wine packaging, sustainable alternatives to plastic, and gifting trends that favor durable presentation formats. Increasing adoption of recyclable and biodegradable materials aligns with environmental regulations and brand sustainability goals.

Paper based wine boxes are gaining traction for their lightweight properties, ease of printing, and compatibility with customization, supporting strong branding and retail visibility. As consumer preferences evolve toward gifting experiences and on shelf appeal, manufacturers are investing in innovative structures and packaging finishes.

Additionally, the rise in e commerce and direct to consumer wine sales is driving demand for packaging that offers both visual appeal and protective functionality. The market outlook remains strong as players focus on eco conscious materials, structural integrity, and aesthetic differentiation to meet shifting expectations.

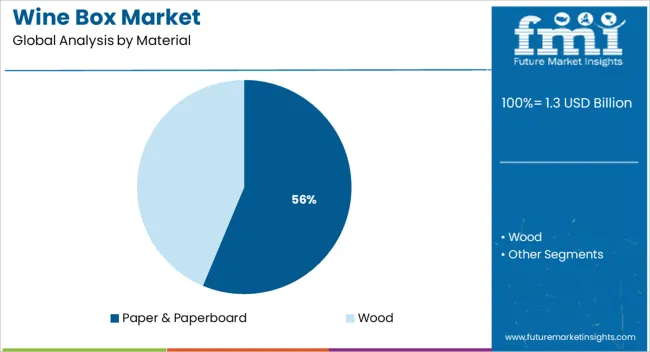

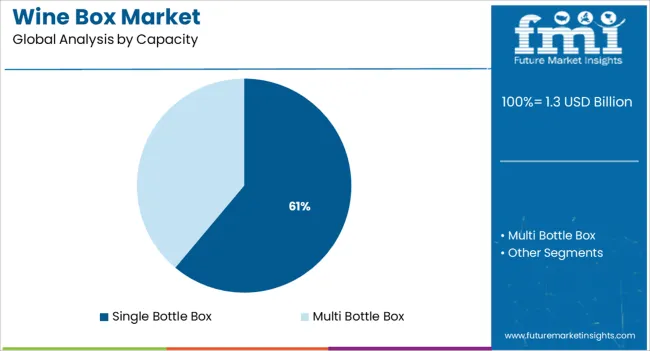

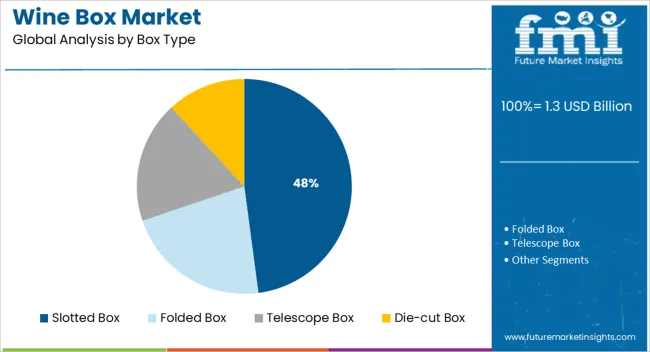

The market is segmented by Material, Capacity, and Box Type and region. By Material, the market is divided into Paper & Paperboard and Wood. In terms of Capacity, the market is classified into Single Bottle Box and Multi Bottle Box. Based on Box Type, the market is segmented into Slotted Box, Folded Box, Telescope Box, and Die-cut Box. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper and paperboard segment is expected to account for 56.30% of market revenue by 2025 under the material category, making it the leading choice. This preference is supported by the widespread shift toward eco friendly packaging and increased consumer awareness of recyclable alternatives.

Paper and paperboard materials offer excellent surface compatibility for branding, printing, and embossing, while maintaining cost effectiveness and recyclability. Brands are favoring these materials for their balance of structural strength and aesthetic quality.

As retailers and wineries prioritize sustainability in packaging supply chains, paper based formats continue to gain preference, strengthening their position in the material segment.

The single bottle box segment is projected to hold 61.10% of total market revenue within the capacity category, positioning it as the most dominant format. This growth is driven by the popularity of wine gifting, personalized packaging, and single unit wine purchases both online and in stores.

Single bottle boxes offer simplicity, elegance, and practicality for both display and transport. Their compatibility with protective inserts and customization options makes them ideal for premium product positioning.

As consumers seek tailored gifting experiences and retailers optimize shelf space, the demand for single bottle boxes continues to rise, securing its leadership in this segment.

The slotted box type is anticipated to contribute 47.90% of market revenue by 2025 under the box type category, making it a leading structural format. Known for its efficiency in shipping and handling, the slotted box design offers robust protection and ease of assembly.

Its ability to accommodate various bottle sizes and configurations supports its widespread adoption across logistics and retail packaging. Moreover, this format allows for cost effective production and streamlined inventory management.

As wine producers focus on minimizing damage during transit and maximizing packaging versatility, slotted boxes continue to maintain a significant share of the market due to their functional and operational benefits.

According to Future Market Insights, the global market for wine boxes witnessed a CAGR of 3.5% during the historic period from 2020 to 2024 and reached a valuation of USD 1,058.5 Million at the end of 2024.

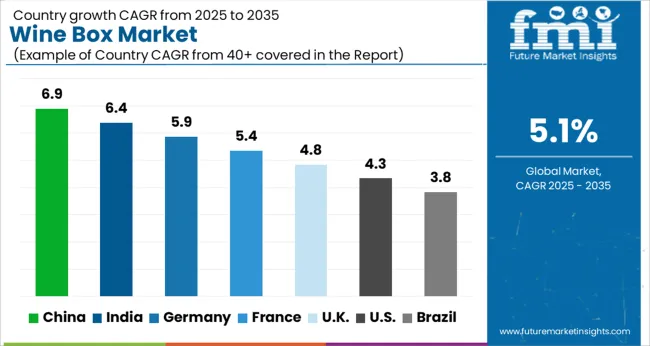

However, with the rising consumption of bottled wine across the world, the overall sales of wine boxes are projected to rise at 5.1% CAGR between 2025 and 2035.

A wine box is a rigid packaging solution made from paper & paperboard or wood materials to protect the wine bottles during their storage and transportation. Wine boxes are made available in different capacities such as single-bottle boxes and multi-bottle boxes to meet specific end-user demands.

Increasing consumption of wine across the world due to its various health benefits is a major factor augmenting the demand for wine packaging solutions including wine boxes.

The printability feature of the wine boxes is gaining momentum among wine brands as it acts as a marketing & branding tool for them. Leading wine bands are utilizing wine boxes to attract wine lovers.

Innovation is the constant force that propels major worldwide producers in the packaging sector. These businesses are regarded as market leaders in introducing cutting-edge packaging solutions to meet the needs of end users.

The packaging waste produced by conventional packaging has been addressed by some of these market leaders with the introduction of corrugated wine boxes. For wine packaging, Mondi plc, for instance, developed corrugated wine boxes.

Similarly, numerous local and international producers are shifting their focus to introducing corrugated wine boxes to increase their customer base. Wine producers in the most developing regions of the world are being introduced to such creative and economical packaging options. As a result, the global wine box industry has favorable growth prospects in both emerging and developed markets.

Growing Usage of Sustainable Corrugated Board to Boost the Market for Wine Boxes

Global, as well as domestic manufacturers, are turning to recyclable corrugated board material for manufacturing wine packaging solutions such as wine boxes. As the educated consumer class is becoming aware of the harmful effects of pollutant materials on the environment, demand for packaging solutions made from environment-friendly packaging materials is rising rapidly.

Campaigns regarding preserving forests have given rise to the demand for sustainability in every step of manufacturing the product as well as the packaging of the product. Manufacturers are switching to the usage of fully recyclable corrugated board, which can be easily recycled after proper disposal and has no negative effects on the environment.

The packaging industry also offers lucrative growth opportunities to wine box manufacturers, by differentiating their products based on the reusability features of the wine box made by them.

Global key players in alcoholic beverages can also highlight the sustainability of the wine box used to pack the wine bottles in it. Thus, the global wine box market is expected to register impressive growth over the next decade through the usage of sustainable raw materials to produce wine boxes.

High Wine Consumption Generating Demand for Wine Boxes in the USA

As per FMI, the USA is projected to hold around 78% of the North American wine box market during the forecast period. The reason behind the same is the increasing consumption of wine in the USA

According to the Wine Institute, total wine consumption in the USA reached 3.2 gallons per resident in 2024 and this number is likely to further increase during the coming years as awareness about the health benefits of wine continues to grow. Driven by this, demand for wine boxes will surge at a steady pace across the USA

Moreover, the increasing usage of paper-based rigid boxes for protecting wine bottles during logistics operations along with the development of innovative wine boxes that can be used for aesthetic purposes as well, are expected to create lucrative opportunities for USA manufacturers.

Rising Export of Bottled Wine Boosting Wine Box Sales in Germany

As per FMI, the German wine box market is projected to expand at a CAGR of 4.9% during the forecast period owing to the increased export of bottled wine. According to the International Organisation of Vine and Wine Intergovernmental Organisation (OIV), in 2024, the share of bottled wine exports in terms of volume constituted around 73% in Germany. The increased export of bottled wine will therefore continue to generate demand for rigid wine packaging including wine boxes.

Similarly, the growing popularity of luxury packaging among wine lovers and the increasing number of wineries are expected to boost wine box sales during the assessment period.

Paper & Paperboard Remains the Most Preferred Material

Based on the material, the paper & paperboard segment currently holds a substantial share of the global market for wine boxes and it is anticipated to grow 1.8x the current market value from 2025 to 2035. This can be attributed to the rising trend of sustainable packaging and the growing usage of paper & paperboard materials for making wine boxes due to their easy availability and low cost.

Immense features of paper & paperboard including lightweight and less expensive, are making them ideal materials for the production of wine boxes and the trend is likely to continue during the forecast period.

Growing Need for Bulk Packaging Bolstering Demand for Multi Bottle Boxes

As per FMI, the multi-bottle box segment is anticipated to grow at a CAGR of 4.8% during the forecast period of 2025 to 2035. This can be ascribed to the increased need for bulk packaging in the wine industry to carry multi wine bottles at a single time.

Multi-bottle boxes help to easily store and transport multiple bottles simultaneously, thereby reducing the need for extra packaging. As a result, both manufacturers and consumers are showing a preference for multi-bottle wine boxes over single ones.

Leading players are upgrading their products with respect to unique features and properties. To gain a significant market share they are strategizing their goals. Some of these players are acquiring other small companies or are increasing their investments in research and innovations. Some of the development by the key players are as below-

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.3 billion |

| Projected Market Size (2035) | USD 2.1 billion |

| Anticipated Growth Rate (2025 to 2035) | 5.1% CAGR |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Segments Covered | Material, Capacity, Box Type, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Smurfit Kappa Group; Mondi plc; Stora Enso Oyj; Graficas Digraf; Marber S.r.l.; Nordpack GmbH; Scotton SpA; OrCon Industries; Cartotrentina S.r.l.; Shenzhen Qingxin Packaging Co. Ltd.; SCHEFFAUER HOLZWAREN GESELLSCHAFT M.B.H.; YDP Quality Packaging (Shenzhen) Co., Ltd.; Adam Pack; Golden West Packaging Group; DS Smith plc |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

The global wine box market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the wine box market is projected to reach USD 2.1 billion by 2035.

The wine box market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in wine box market are paper & paperboard and wood.

In terms of capacity, single bottle box segment to command 61.1% share in the wine box market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Wine Box Companies

Wine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Wine Fining Agent Market Size and Share Forecast Outlook 2025 to 2035

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Racks Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Wine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Destemmer Market - Growth & Demand 2025 to 2035

Wine Filtering Machine Market Expansion - Filtration & Winemaking Technology 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA