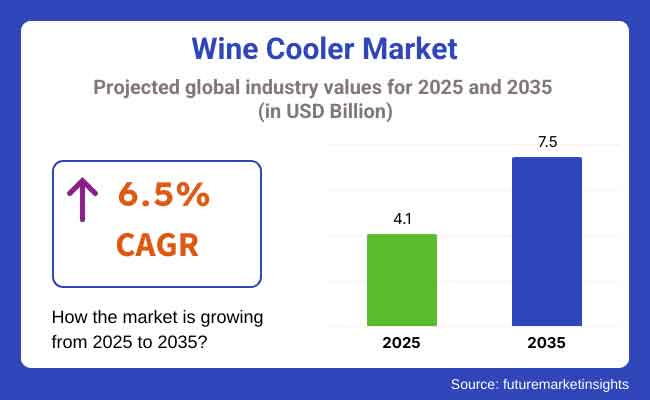

The wine cooler market is projected to experience significant growth from 2025 to 2035, driven by increasing consumer interest in home wine storage solutions, technological advancements in cooling systems, and the growing wine culture worldwide. The market is expected to expand from USD 4.1 billion in 2025 to USD 7.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% over the forecast period.

Crucial factors driving market expansion include rising demand for energy-effective and smart cooling appliances, increased disposable income, and the growing preference for decoration wine storehouse results. Also, advancements in thermoelectric and compressor-grounded cooling technology, along with the integration of Wi-Fi-enabled and app-controlled wine coolers, are reshaping assiduity trends. The emergence of erected-in, countertop, and movable wine coolers is also impacting consumer preferences.

North America and Europe will continue leading the market in demand for high-end, point-rich wine storehouse systems, while Asia-Pacific will witness the fastest growth, fuelled by urbanization, rising wine consumption, and expanding hospitality sectors.

North America remains a leading market for wine coolers, driven by strong wine consumption trends, adding home amusing culture, and high demand for decoration and customizable wine storehouse units. The USA and Canada will see a growing relinquishment of binary-zone wine coolers with precise temperature control, feeding to both red and white wine storehouse needs.

The rise of direct-to-consumer (DTC) wine subscription services and increased investment in smart home appliances will further drive market expansion. Also, brands fastening on energy effectiveness and eco-friendly refrigerants will gain consumer preference.

Europe will emphasize sustainable and high-performance wine cooling results, driven by strict EU energy regulations and the region’s deep-confirmed wine culture. Countries like France, Italy, Germany, and Spain will lead in demand for professional-grade, silent-operation, and moisture-controlled wine coolers.

The adding relinquishment of compact and erected-in wine coolers for civic apartments and the rise of AI-powered temperature optimization systems will further shape market trends.

Asia-Pacific will see the fastest market growth, fuelled by rising disposable income, growing hospitality diligence, and an adding appreciation for fine wines. Countries similar to China, Japan, South Korea, and Australia will drive demand for affordable yet technologically advanced wine coolers.

E-commerce platforms and social media-driven life branding will enhance consumer access to decoration wine storehouse options. Also, customized wine closets and multi-functional libation coolers will attract civic resides looking for space-effective results.

Challenge

The market faces challenges related to high product costs, energy consumption enterprises, and space constraints in lower homes. Consumers are decreasingly looking for affordable, energy-effective, and silent-operation models that align with ultramodern interior designs.

To address these enterprises, brands must invest in low-power consumption cooling technologies, compact designs, and sustainable refrigerants to enhance market relinquishment.

Opportunity

The demand for Wi-Fi-enabled, voice-controlled, and AI-powered wine coolers presents a significant growth occasion. Consumers are seeking real-time temperature monitoring, automatic moisture adaptations, and force operation features for optimal wine storehouses.

Also, expanding luxury home designs, wine-tasting guests, and decoration hospitality investments will drive demand for custom-erected wine storehouse results in high-end domestic and marketable settings

| Country | United States |

|---|---|

| Population (Million) | USD 345.4 Million |

| Estimated Per Capita Spending (USD) | 28.90 |

| Country | China |

|---|---|

| Population (Million) | USD 1,419.3 Million |

| Estimated Per Capita Spending (USD) | 16.50 |

| Country | United Kingdom |

|---|---|

| Population (Million) | USD 68.3 Million |

| Estimated Per Capita Spending (USD) | 23.70 |

| Country | Germany |

|---|---|

| Population (Million) | USD 84.1 Million |

| Estimated Per Capita Spending (USD) | 25.40 |

| Country | Japan |

|---|---|

| Population (Million) | USD 65.6 Million |

| Estimated Per Capita Spending (USD) | 27.80 |

The USA wine cooler market sees a per capita spending of USD 28.90, driven by adding wine consumption and the rise of home-grounded wine collections. Consumers prefer binary- zone cooling, smart temperature control, and energy-effective models. E-commerce platforms and specialty home appliance retailers contribute significantly to market growth.

China’s per capita spending of USD 16.50 reflects a growing appreciation for wine culture. Affluent consumers seek premium wine storage solutions with humidity control features. Smart home integration and compact wine coolers gain traction in urban households.

The UK’s per capita spending of USD 23.70 highlights the strong demand for wine preservation appliances. Consumers favour satiny, under- counter models that blend with ultramodern kitchen aesthetics. Energy effectiveness and vibration-free cooling are crucial considerations.

Germany’s per capita spending of USD 25.40 indicates a preference for high-quality, perfection-controlled wine coolers. Consumers prioritize sustainability, favouring brands that offer energy-effective, noise-reduction, and UV- defended storehouse results.

France’s per capita spending of USD 27.80 underscores a well-established wine culture. Demand for professional-grade wine coolers with multi-temperature zoning and aging capabilities is high. Heritage winemakers and collectors drive decoration member growth.

The market for wine coolers continues to expand with increasing consumer interest in the preservation of wine, home entertainment culture, and advances in technology of cooling. The 300-answer survey in the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and Middle East presents an overview of major purchasing behaviour and market drivers for demand.

Brand image remains important in mature markets because 65% of Koreans and 61% of Japanese are willing to opt for popular brands such as Haier, Kalamata, and Vinotemp. In comparison, 44% of Southeast Asians and 40% of Chinese are more open and look at newer brands and locally made wine coolers in addition to price-friendliness and customized storage space.

Wine cooler technical innovation has a major influence on the behavior of purchasing, and 74% of USA consumers and 71% of UK consumers appreciate such features as dual-zone temperature control, UV-resistant glass doors, and vibration-free cooling. Rising demand for energy-efficient, app-controlled wine coolers presents an opportunity for brands to introduce high-performance, app-controlled models for wine enthusiasts and connoisseurs.

Regional price sensitivity varies. While 58% of US and UK consumers are willing to pay over USD 500 for top-end wine coolers, 35% in Southeast Asia and 38% in China prefer the top-end one. Korea (50%) and Japan (46%) prefer mid-range wine coolers, where the customer seeks a middle option in terms of price, size, and precision of cooling technology.

Online is the most favoured shopping medium, as 60% of US and 62% of Chinese shoppers buy wine coolers online from Amazon, JD.com, and Shoppe. Offline outlets are still a robust retail channel in Korea (52%) and Japan (50%), as customers value shop specialist advice, demonstration, and comparison in person before buying.

| Market Shift | 2020 to 2024 |

|---|---|

| Material Innovations | Manufacturers introduced stainless steel and tempered glass designs for durability and aesthetics. Thermoelectric cooling technology gained popularity for energy efficiency. |

| Cooling & Storage Efficiency | Single-zone and dual-zone coolers became widely available, catering to different wine storage needs. UV-resistant glass doors protected wine quality. |

| Market Expansion | Growth driven by increased wine consumption and home entertainment trends. North America and Europe led in premium wine cooler sales. |

| Sustainability Trends | Energy-efficient cooling systems and CFC-free refrigerants were introduced. Companies focused on recyclable components and eco-conscious manufacturing. |

| Technological Adaptations | Wi-Fi-enabled and app-controlled wine coolers provided real-time temperature monitoring. Digital touch control panels improved user experience. |

| Consumer Preferences & Application Trends | Increased demand for under-counter and built-in wine coolers. Compact, countertop models gained popularity in urban homes. |

| Market Shift | 2025 to 2035 |

|---|---|

| Material Innovations | Advanced self-cleaning and antimicrobial materials dominate. Sustainable, recyclable, and ultra-lightweight materials drive product innovation. |

| Cooling & Storage Efficiency | AI-powered temperature and humidity control systems ensure optimal wine aging. Smart adaptive cooling systems adjust based on wine type and external climate conditions. |

| Market Expansion | Expansion in Asia-Pacific and Latin America due to rising disposable incomes and wine culture adoption. Smart and connected wine coolers gain traction. |

| Sustainability Trends | Solar-powered wine coolers and carbon-neutral production processes become standard. Circular economy models promote long-lasting and repairable designs. |

| Technological Adaptations | AI-integrated wine inventory tracking recommends optimal storage and drinking times. Wireless charging and smart connectivity enhance usability. |

| Consumer Preferences & Application Trends | Customizable storage configurations and modular cooling zones cater to wine collectors. Growth in eco-conscious consumers drives demand for sustainable, high-tech coolers. |

The USA wine cooler market is witnessing steady growth due to rising wine consumption, adding home bar setups, and demand for decoration and smart wine storehouse results. Crucial players include Whirlpool, Frigidaire, and Edge Star.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

The UK wine cooler market is expanding due to adding interest in wine collecting, growth in decoration kitchen appliances, and the rise of luxury home trends. Major brands include Haier, Russell Hobbs, and Bosch.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

Germany’s wine cooler market is growing, driven by strong wine culture, adding preference for high-quality wine storehouse results, and the demand for energy-effective appliances. Leading manufacturers include Liebherr, Caso, and Klarstein

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.1% |

India’s wine cooler market is arising, fuelled by rising disposable inflows, adding urbanization, and growing mindfulness of wine culture and storehouse results. Popular brands include Croma, Voltas, and KAFF.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.0% |

China’s wine cooler market is expanding significantly due to rising wine consumption, adding disposable inflows, and a strong demand for luxury home appliances. Major brands include Haier, Midea, and Xiaomi.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.3% |

Consumers are decreasingly investing in wine coolers to store and save wine at optimal temperatures. The demand for high- end, point-rich wine coolers with binary- zone cooling, moisture control, and UV- resistant glass doors is growing among wine suckers and collectors. Smart wine coolers with app connectivity, temperature monitoring, and voice- adjunct comity are also gaining traction.

With urbanization and the rise of small- space living, compact and under- counter wine coolers are getting popular. erected- in and freestanding models designed to fit ultramodern kitchens, bars, and entertainment areas appeal to homeowners looking for swish and space- saving storehouse options.

Online retail platforms similar as Amazon, Best Buy, and devoted wine storehouse brands dominate deals of wine coolers. Consumers prefer the convenience of online shopping, detailed product reviews, and direct- to- consumer brand immolations. Subscription- grounded wine services that rush coolers with curated wine selections also contribute to market expansion.

Eco-conscious consumers seek energy-effective wine coolers with low energy consumption and environmentally friendly refrigerants. Manufacturers are integrating inverter compressors, thermoelectric cooling technology, and silent operation features to enhance sustainability and stoner convenience.

The global wine cooler market is witnessing steady growth due to increasing consumer interest in wine consumption, wine preservation, and home entertainment. Wine coolers offer an ideal solution for preserving the quality and flavour of wine by maintaining the perfect temperature, which is essential for proper aging and serving. The growing popularity of wine as a lifestyle choice, along with an increase in home-based entertainment and wine-tasting activities, is driving demand for wine coolers.

Innovations in wine cooler designs, such as energy-efficient models, advanced temperature control, and customizable storage, are also contributing to market expansion. Furthermore, the increasing adoption of wine coolers by both wine enthusiasts and casual consumers, along with the rise of e-commerce platforms, is enhancing market accessibility.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Whynter | 20-25% |

| Danby | 15-20% |

| Haier | 10-15% |

| NewAir | 8-12% |

| Frigidaire | 5-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Whynter | Whynter offers a wide range of wine coolers, including models that feature thermoelectric and compressor cooling systems. The company emphasizes energy efficiency, modern designs, and customizable temperature controls. Whynter’s products are designed for both residential and commercial use. |

| Danby | Danby is known for producing wine coolers with a focus on affordability and reliable performance. Their wine coolers come in various sizes and are designed with adjustable shelves, LED lighting, and low-vibration cooling systems. Danby also offers models with reversible doors for flexibility in placement. |

| Haier | Haier’s wine coolers are known for their sleek designs and advanced features, such as multi-zone temperature control, LED display panels, and energy-efficient cooling systems. The company continues to expand its product offerings, targeting both premium and budget-conscious consumers. |

| NewAir | NewAir offers premium wine coolers with advanced features like dual-zone temperature control, large storage capacity, and quiet operation. The brand focuses on high-quality materials and user-friendly designs, making it popular among wine enthusiasts and collectors. |

| Frigidaire | Frigidaire’s wine coolers are designed to provide reliable temperature control and ample storage space for wine bottles. The company offers a variety of models, including compact units and larger, more sophisticated wine storage solutions. Frigidaire also emphasizes energy-efficient features. |

Strategic Outlook of Key Companies

Whynter (20-25%)

Whynter is a leader in the wine cooler market, known for offering high- quality, energy-effective, and sleekly designed wine coolers. The company’s focus on thermoelectric and compressor cooling systems allows it to feed to different client preferences. Whynter continues to expand its product immolations to meet the growing demand for both domestic and marketable wine cooling results. Its emphasis on customization, affordability, and effective performance keeps it a strong contender in the market.

Danby (15-20%)

Danby is known for furnishing dependable and affordable wine coolers that feed to the requirements of budget-conscious consumers. The brand is concentrated on delivering a wide range of models with features similar as malleable shelving, reversible doors, and LED lighting. Danby continues to introduce by introducing energy-effective products and fastening on ease of use, making its wine coolers a popular choice for domestic use.

Haier (10-15%)

Haier offers satiny, ultramodern wine coolers that feature advanced temperature control,multi-zone capabilities, and space-effective designs. The company is expanding its product line to feed to both decoration and budget parts, while also emphasizing energy effectiveness. Haier continues to enhance its presence by offering models with smart technology features and bettered cooling systems, which are appealing to consumers looking for high- performance wine storehouse results

NewAir (8-12%)

NewAir is a decoration player in the wine cooler market, fastening on high- quality, durable products with advanced features similar as binary- zone temperature control and large storehouse capacity. The company is popular among wine suckers and collectors due to its superior product quality and attention to design details. NewAir is continuously enhancing its product portfolio to feed to both domestic and marketable requirements, icing its position in the decoration market member.

Frigidaire (5-9%)

Frigidaire offers a wide range of wine coolers known for their trustability and value for plutocrat. The company’s products come with features like malleable shelves, LED lighting, and harmonious temperature control. Frigidaire continues to concentrate on expanding its product immolations with energy-effective and space- saving models, which are particularly popular among homeowners and apartment residers.

Other Key Players (25-30% Combined)

Several smaller and regional players contribute to the market by offering a variety of wine coolers designed to meet specific consumer needs. These companies focus on niche segments, such as compact wine coolers for small spaces or high-capacity wine refrigerators for wine collectors. Notable brands include:

Compressor Wine Coolers, Thermoelectric Wine Coolers, Single-Zone Wine Coolers, Dual-Zone Wine Coolers, Built-In Wine Coolers, and Freestanding Wine Coolers.

Less than 20 Bottles, 20-50 Bottles, and More than 100 Bottles.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Wine Cooler industry is projected to witness a CAGR of 6.5% between 2025 and 2035.

The Wine Cooler industry stood at USD 3.5 billion in 2024.

The Wine Cooler industry is anticipated to reach USD 7.5 billion by 2035 end.

North America is set to record the highest CAGR of 6.8% in the assessment period.

The key players operating in the Wine Cooler industry include Haier, Danby, Electrolux, LG Electronics, NewAir, and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-use Industry, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Installation, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Installation, 2023 to 2033

Figure 17: Global Market Attractiveness by End-use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Installation, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Installation, 2023 to 2033

Figure 35: North America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Installation, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Installation, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Installation, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Installation, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Installation, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Installation, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-use Industry, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Installation, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Installation, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-use Industry, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Installation, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Installation, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-use Industry, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Installation, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-use Industry, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-use Industry, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-use Industry, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use Industry, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use Industry, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Installation, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-use Industry, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Premium Wine Cooler Market Analysis - Growth & Forecast 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Wine Box Market Size and Share Forecast Outlook 2025 to 2035

Wine Fining Agent Market Size and Share Forecast Outlook 2025 to 2035

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Racks Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Wine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Destemmer Market - Growth & Demand 2025 to 2035

Wine Crusher Market Growth - Winemaking Equipment & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA