The wine fining agent market is estimated to be valued at USD 794.6 million in 2025. Demand is projected to reach USD 1450.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. This represents a growth multiplier of 1.82x over the decade, driven by rising adoption of protein, polysaccharide, and synthetic fining solutions aimed at wine clarity, stability, and allergen reduction.

The CAGR of 6.2% indicates consistent and sustained expansion, supported by technological advancements in natural fining agents and premium wine production trends globally. The trajectory reflects gradual scaling in the early phase, where market value rises from USD 794.6 million to USD 1,073.4 million by 2030, contributing USD 278.8 million, or 42.5% of total growth.

The second half, from 2030 to 2035, adds USD 376.7 million, representing 57.5% of incremental gains, highlighting accelerated adoption due to stricter regulatory norms for clarity and allergen safety, and higher consumption in emerging wine-producing regions. Growth multipliers reinforce this acceleration: 1.35x in the first five years (2025–2030) and 1.35x in the latter half (2030–2035), reflecting a stable and predictable demand pattern. Producers focusing on plant-based alternatives, enzymatic clarification methods, and sustainability-certified formulations will capture the greatest share of this USD 655 million opportunity.

| Metric | Value |

|---|---|

| Wine Fining Agent Market Estimated Value in (2025 E) | USD 794.6 million |

| Wine Fining Agent Market Forecast Value in (2035 F) | USD 1450.1 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The wine fining agent market occupies a specialized yet essential position across several beverage and processing aid segments. In the wine processing aids market, it holds a dominant share of approximately 40–45%, as fining is a critical step in achieving clarity and stability in wines. Within the beverage additives market, its share is relatively small at 3–4%, since this category includes sweeteners, flavors, colors, and preservatives across all beverages. In the alcoholic beverages processing market, wine fining agents account for around 6–7%, driven by their application in premium and mass-market wine production. The food and beverage clarifying agents market sees a higher share of nearly 25–28%, given fining agents’ extensive use in filtration and stabilization processes.

In the oenological products market, their share stands at about 15–18%, as this category also includes enzymes, yeasts, and fermentation nutrients. Growth in this segment is fueled by increasing global wine consumption, premiumization trends, and a strong demand for visually appealing, high-quality wines. Rising interest in vegan and allergen-free wines has also driven innovation in alternative fining agents such as bentonite, pea protein, and silica-based products. As wineries emphasize quality and regulatory compliance, the wine fining agent market is set to maintain and expand its share within these parent markets.

Growth is being influenced by the rising global demand for premium wines and the need to meet evolving consumer preferences for clarity and consistency. Regulatory standards on permissible additives and growing awareness of clean-label trends are further shaping adoption patterns. Future outlook remains positive as innovation in fining formulations and techniques aligns with sustainability goals and consumer expectations for natural and allergen-free products.

Partnerships between ingredient suppliers and wineries are fostering the development of efficient, residue-minimizing agents, paving the way for broader acceptance across regions and wine styles. The market is anticipated to benefit from technological advances in production processes and continued investment in research on alternative, plant-based, and sustainable fining solutions.

The wine fining agent market is segmented by form, type, wine type, and geographic regions. The wine fining agent market is divided into Liquid and Powder. In terms of the type of wine fining agent, the market is classified into Protein-based fining agents and Natural plant-based protein fining agents. Based on the wine type, the wine fining agent market is segmented into Red wine, Rosé wine, White wine, and Others. Regionally, the wine fining agent industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

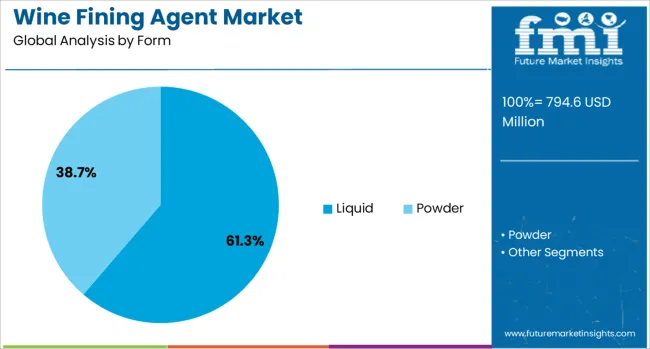

When segmented by form, the liquid segment is projected to account for 61.30% of total market revenue in 2025, positioning it as the leading form. This leadership is being supported by the ease of handling, faster dispersion, and more consistent results offered by liquid formulations compared to solid alternatives.

Winemakers have been favoring liquid agents due to their ability to integrate seamlessly into production lines, reducing preparation time and minimizing dosing errors. Uniformity in application and reduced risk of clumping or incomplete mixing have contributed to operational efficiency and improved wine quality outcomes.

Enhanced shelf stability and adaptability across various wine types and production scales have further reinforced the dominance of the liquid segment, making it the preferred choice for modern wineries seeking reliability and speed in clarification processes.

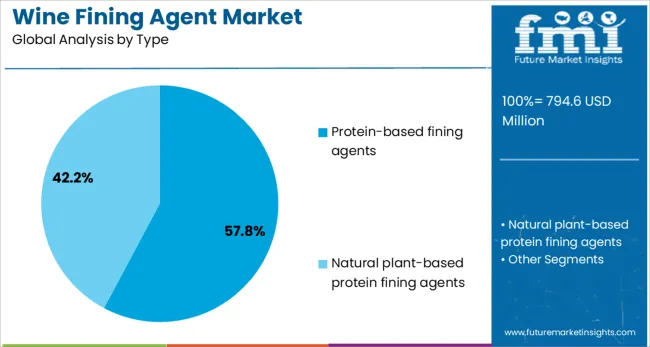

Segmented by type, protein based fining agents are expected to capture 57.8% of the market revenue in 2025, maintaining their leading position. This dominance is being attributed to their high efficacy in removing phenolic compounds, tannins, and other haze-forming particles that can negatively affect flavor and appearance.

Wineries have been relying on protein based agents due to their proven ability to improve mouthfeel and reduce bitterness, particularly in red and full-bodied wines. The natural origin of many protein based agents has aligned well with consumer preferences for traditional and minimally processed inputs, enhancing their appeal.

Consistent performance across different wine styles and favorable regulatory acceptance have supported sustained adoption. Their versatility and the continued development of allergen-reduced and plant derived options have solidified the leadership of this segment.

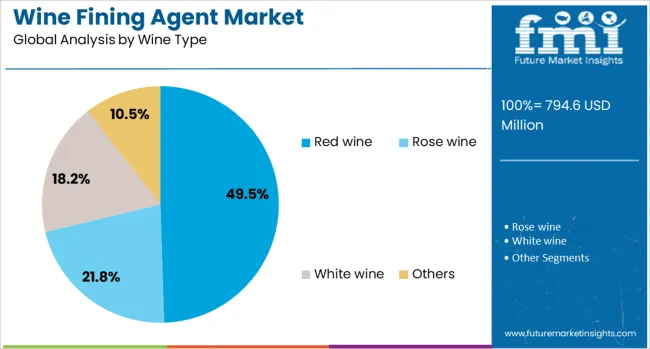

When segmented by wine type, red wine is anticipated to hold 49.5% of the market revenue in 2025, establishing itself as the leading wine type segment. This prominence is being driven by the complex structure and higher tannin content in red wines, which necessitate effective fining to achieve desired clarity, smoothness, and balance.

Producers have been prioritizing fining in red wines to manage astringency and stabilize color while preserving sensory attributes. The growing global consumption of premium red wines and consumer expectations for refined taste profiles have intensified the use of specialized fining agents in this category.

Red wine’s higher susceptibility to haze formation and oxidative instability compared to white or rosé wines has further underscored the critical role of fining in ensuring quality. This segment’s leadership continues to be reinforced by its dominant share in global wine production and enduring popularity among consumers.

The wine fining agent market is propelled by growing wine consumption and rising demand for clear, stable products. Consumer preference for allergen‑free, plant‑based clarifiers and premium wine types has strengthened market appeal in 2024–2025. Opportunities are seen in vegan‑friendly agents and expansion into emerging wine‑producing regions. Trends highlight increased adoption of alternative clay and synthetic polymers over animal‑derived agents. Restraints include regulation complexity and competition from non‑fining clarification methods. The market is expected to have reached around USD 748 million in 2024, with forecast growth above 6% through 2034

Demand has been driven by increasing global wine consumption, particularly in Asia-Pacific and North America, and a stronger emphasis on clarity and stability in premium, red and white wines. In 2024, wineries across Europe and the US expanded use of bentonite, gelatin and PVPP to remove haze and enhance sensory quality. Rising winery counts and stricter quality control standards enforced by regulatory bodies such as OIV have further supported market expansion. It is believed that awareness about the impact on taste and consistency has encouraged broader adoption of effective fining agents.

Opportunities are evident in the shift toward plant‑based, non‑animal fining agents such as pea protein, activated charcoal, and synthetic polymers. In 2025, suppliers increased production of allergen-free and vegan-certified clay-based agents to meet evolving preferences. Expansion into emerging markets like China and India, where wine consumption is growing rapidly, opened new export channels. Producers offering clay or yeast-derived clarifiers have been seen gaining traction with boutique and organic wine brands. It is held that firms targeting ethical and label‑transparent segments may capture emerging demand effectively.

A key trend is the rising adoption of bentonite, PVPP and activated carbon, replacing traditional egg albumen and casein fining. By 2024, many commercial and boutique wineries had standardized the use of alternative agents to achieve clarity without animal derivatives. Growth in liquid form agents, valued for convenience and reliability, was notable, with powder formats gaining due to longer shelf life. Broader regulatory support for clean‑label wine production is believed to be influencing selections. These trends are viewed as reshaping the agent mix used across major wine regions.

A restraint has been noted in growing acceptance of minimal‑intervention winemaking practices, where fining is reduced or avoided entirely. Natural wine segments increasingly forgo fining, citing flavor preservation. Diverse regional regulations have created compliance challenges and higher entry costs for suppliers expanding globally. Additionally, fluctuations in raw material costs for bentonite and synthetic polymers have squeezed margins. Smaller producers lacking strategic sourcing or R&D resources are considered most vulnerable under these constraints

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

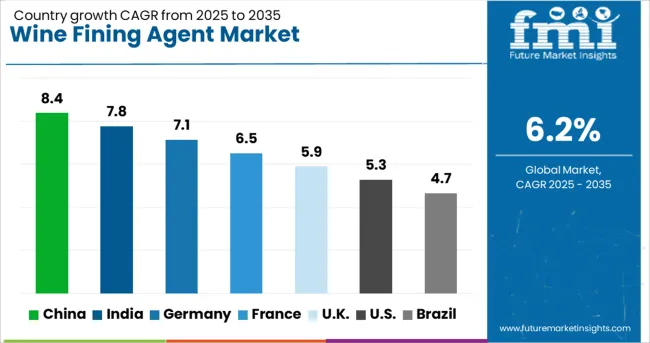

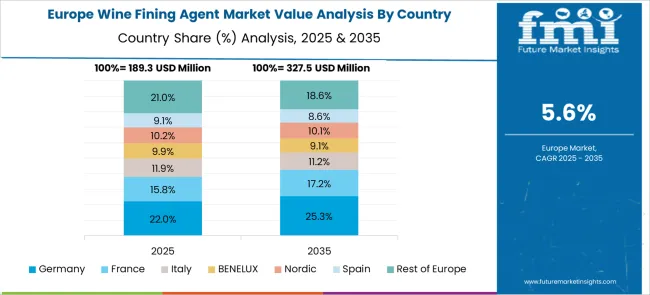

The global wine fining agent market is projected to grow at a CAGR of 6.2% from 2025 to 2035. China leads with 8.4%, followed by India at 7.8% and Germany at 7.1%. France records 6.5%, while the United Kingdom posts 5.9%. Growth is driven by the rising demand for premium wines, adoption of clean-label fining solutions, and expansion of wine production in emerging markets. China and India dominate due to increasing local wine consumption and winery investments, while Germany focuses on vegan and allergen-free fining agents. France and the UK emphasize high-quality clarifying solutions for traditional wine-making practices.

The wine fining agent market in China is projected to grow at 8.4%, supported by rapid growth in domestic wine production and consumer preference for premium varietals. Bentonite-based fining agents dominate due to effectiveness in protein stabilization. Manufacturers introduce liquid and ready-to-use formats for operational convenience. Growing export opportunities for Chinese wines drive demand for international-grade fining standards.

The wine fining agent market in India is forecast to grow at 7.8%, driven by expansion of boutique wineries and rising interest in fruit-based wines. Plant-derived fining agents dominate as consumers prefer vegan-friendly products. Manufacturers develop allergen-free and organic-certified fining solutions to cater to niche markets. Increasing adoption of modern wine clarification systems accelerates the transition from traditional practices.

The wine fining agent market in Germany is expected to grow at 7.1%, supported by strong demand for vegan wines and adherence to EU safety regulations. Silica sol and PVPP-based agents dominate filtration for white and sparkling wines. Manufacturers focus on developing sustainable fining alternatives to replace animal-derived agents. Growth of organic wine production strengthens demand for chemical-free clarifiers.

The wine fining agent market in France is projected to grow at 6.5%, driven by modernization of traditional wineries and expansion in organic wine production. Casein and plant-based fining agents dominate due to compatibility with premium wine-making standards. Manufacturers incorporate precision dosing systems for quality consistency. Consumer-driven demand for allergen-free wine products further promotes alternative fining solutions.

The wine fining agent market in the UK is forecast to grow at 5.9%, supported by steady demand for clear and stable wines across retail and hospitality sectors. Isinglass and synthetic polymer agents dominate smaller wineries and premium wine brands. Manufacturers develop ready-to-use fining kits for micro-wineries. Increased focus on sustainable sourcing of fining materials aligns with eco-conscious consumer trends.

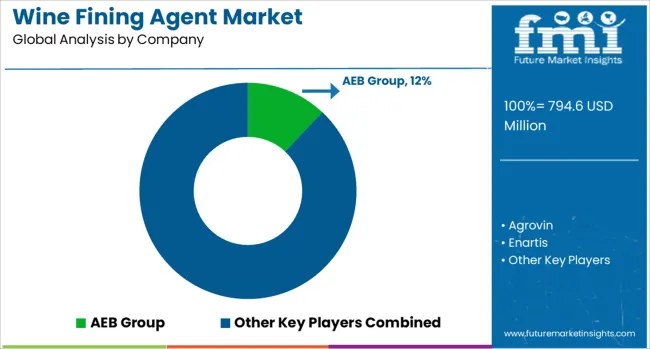

The wine fining agent market is moderately fragmented, with AEB Group recognized as a leading player due to its comprehensive range of fining and clarification solutions designed for stability, clarity, and improved sensory profiles in wines. The company’s strong technical expertise and global distribution network make it a preferred choice among wineries and beverage producers. Key players include Agrovin, Enartis, Enogrup, Enologica Vason, Laffort, Lamothe-Abiet, Lesaffre, Perdomini, Presque Isle Wine Cellars, and Winemakeri.

These companies provide a variety of fining agents such as bentonite, gelatin, PVPP, casein, and plant-based alternatives to address tannin management, protein stabilization, and color correction. Their offerings are tailored to meet the growing demand for both traditional and vegan-friendly wine processing options. Market growth is driven by rising global wine consumption, consumer preference for high-quality and visually appealing wines, and the increasing adoption of organic and allergen-free fining agents.

Leading players are investing in research to develop sustainable, plant-based clarifiers that align with clean-label trends and regulatory compliance. Europe dominates the market due to its strong wine production base, while North America and Asia-Pacific are experiencing rapid growth fueled by expanding wine consumption and premiumization trends.

Sustainable, plant-based, and vegan-friendly fining agents, such as pea protein, activated charcoal, and PVPP, are increasingly adopted. These formulations address consumer demand for organic wines and eco-conscious production, while preserving wine sensory qualities such as clarity and flavor.

| Item | Value |

|---|---|

| Quantitative Units | USD 794.6 Million |

| Form | Liquid and Powder |

| Type | Protein-based fining agents and Natural plant-based protein fining agents |

| Wine Type | Red wine, Rose wine, White wine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AEB Group, Agrovin, Enartis, Enogrup, Enologica Vason, Laffort, Lamothe-Abiet, Lesaffre, Perdomini, Presque Isle Wine Cellars, and Winemakeri |

| Additional Attributes | Dollar sales by agent type (animal-protein, bentonite/clay, PVPP, activated carbon) and application (red, white, rosé wines), regional demand trends (Europe/North America dominance; Asia-Pacific fastest growth), competitive landscape (AEB Group, Enartis, Agrovin, Laffort), consumer preference for vegan and plant-based alternatives, integration with premium and organic wine production, innovations in sustainable, precision-engineered, and low-flavor-impact fining formulations. |

The global wine fining agent market is estimated to be valued at USD 794.6 million in 2025.

The market size for the wine fining agent market is projected to reach USD 1,450.1 million by 2035.

The wine fining agent market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in wine fining agent market are liquid and powder.

In terms of type, protein-based fining agents segment to command 57.8% share in the wine fining agent market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Bag Market Forecast and Outlook 2025 to 2035

Wine Cork Market Size and Share Forecast Outlook 2025 to 2035

Wine Barrel Market Size and Share Forecast Outlook 2025 to 2035

Wine Cellar Market Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Wine Box Market Size and Share Forecast Outlook 2025 to 2035

Wine, Scotch, and Whiskey Barrels Market Size and Share Forecast Outlook 2025 to 2035

Wine Totes Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wine Fermentation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Racks Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Wine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wine Destemmer Market - Growth & Demand 2025 to 2035

Wine Filtering Machine Market Expansion - Filtration & Winemaking Technology 2025 to 2035

Wine Crusher Market Growth - Winemaking Equipment & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA