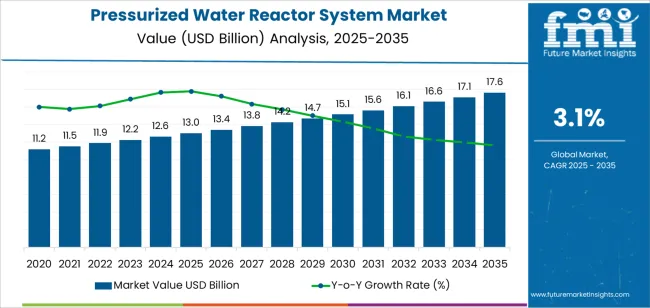

The global pressurized water reactor (PWR) system market is valued at USD 13.0 billion in 2025 and is projected to reach USD 17.6 billion by 2035, expanding at a CAGR of 3.1%. This increase represents an absolute dollar opportunity of USD 4.6 billion over the forecast period. Based on annualized variance modeling, the Growth Rate Volatility Index (GRVI) for the 2025 to 2035 period is 0.17, reflecting a low-volatility growth curve driven by steady investment in nuclear infrastructure modernization and controlled reactor fleet expansion across key regions.

Market stability is reinforced by long project lifecycles, government-backed funding mechanisms, and consistent maintenance demand from operational reactors. The transition toward advanced PWR designs featuring enhanced thermal efficiency, improved safety systems, and digital monitoring integration continues to support predictable capital flow and moderate technological turnover.

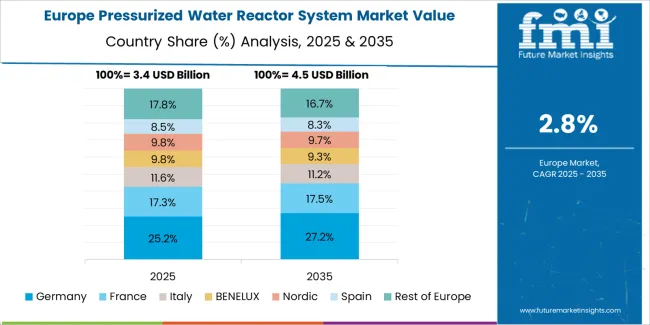

Asia Pacific, led by China, India, and South Korea, remains the most dynamic region in terms of reactor construction and capacity additions. Europe and North America sustain moderate replacement and refurbishment activity, focusing on extending reactor lifespans and meeting carbon reduction targets. Through 2035, regulatory harmonization, component localization, and safety standardization will preserve structural growth consistency, maintaining low GRVI levels and ensuring stable expansion across the global PWR system market.

Between 2025 and 2030, the Pressurized Water Reactor (PWR) System Market is anticipated to grow from USD 13.0 billion to USD 15.1 billion, marking an accelerated growth phase of 16.2% over five years. This acceleration reflects the renewed global interest in nuclear power as a reliable low-carbon energy source. Governments and utilities are increasing investments in reactor modernization, safety enhancement, and next-generation pressurized water reactor designs. The transition toward small modular reactors (SMRs) and the extension of existing reactor lifespans are driving early-cycle growth. Additionally, advancements in digital monitoring, fuel efficiency, and reactor cooling systems are reinforcing the technology’s role in achieving long-term decarbonization targets.

From 2030 to 2035, the market is expected to expand from USD 15.1 billion to USD 17.6 billion, representing a slight deceleration in growth at 16.6% over the subsequent period. This deceleration corresponds with the market’s entry into a maturity phase, where large-scale infrastructure projects stabilize and new installations are offset by longer approval cycles and stringent regulatory frameworks. However, the demand for safer, more efficient reactors will persist, supported by advancements in reactor materials, passive safety systems, and nuclear waste minimization. Strategic collaborations between reactor technology developers, governments, and energy utilities will continue to sustain innovation, ensuring stable, long-term market performance.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 13.0 billion |

| Market Forecast Value (2035) | USD 17.6 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The pressurized water reactor (PWR) system market is gaining momentum as nations pursue stable, low-emission power generation amid rising global electricity demand. PWR technology, which uses high-pressure water as both coolant and moderator, remains the most widely adopted nuclear reactor design due to its operational reliability, thermal efficiency, and established safety record. Countries expanding nuclear infrastructure-including China, India, and the United States continue investing in large-scale and small modular PWR units to diversify energy portfolios and reduce dependence on fossil fuels. System suppliers focus on refining core design, corrosion-resistant materials, and digital control integration to enhance long-term efficiency and safety margins.

Market development is supported by government-led nuclear modernization programs and international collaboration in reactor lifecycle management. Upgrades to existing facilities, including replacement of pressure vessels, steam generators, and control rod mechanisms, sustain aftermarket demand. Growing attention to fuel-cycle optimization and waste minimization also stimulates innovation in reactor coolant chemistry and material science. Despite persistent public scrutiny and regulatory complexity, the market benefits from policy frameworks linking nuclear energy to decarbonization objectives. Technological advances in modular construction, remote diagnostics, and accident-tolerant fuel systems reinforce the continued viability of pressurized water reactors as a critical component of future energy infrastructure worldwide.

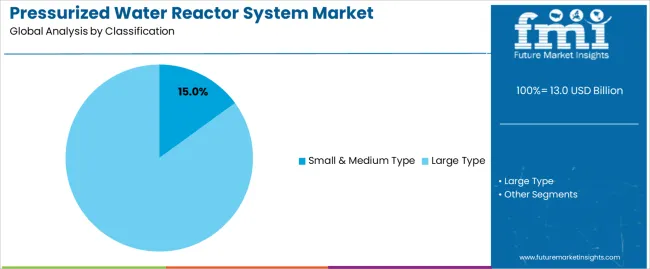

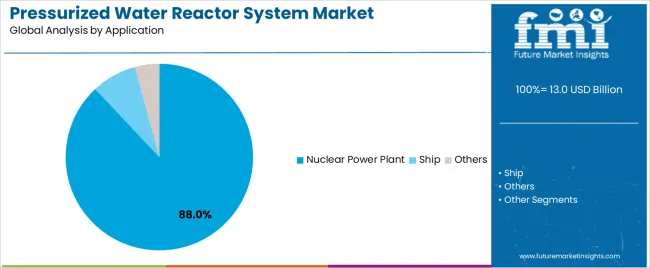

The pressurized water reactor (PWR) system market is segmented by classification, application, and region. By classification, the market is divided into small and medium type and large type reactors. Based on application, it is categorized into nuclear power plants, ships, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments capture reactor scale differentiation, end-use deployment, and regional infrastructure trends shaping global nuclear technology adoption and power generation strategies.

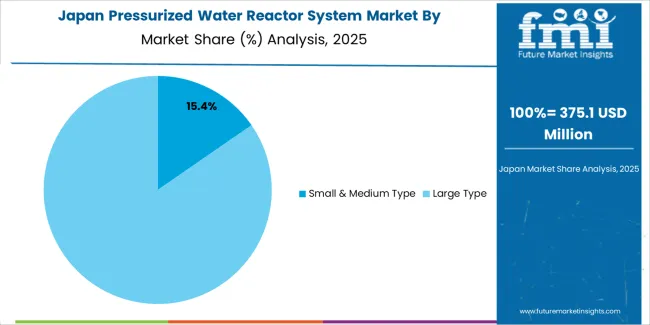

The small and medium type segment accounts for approximately 15.0% of the global pressurized water reactor system market in 2025, maintaining a key position in reactor development and deployment. This segment’s importance lies in its operational flexibility, modular construction, and suitability for decentralized power generation. Small and medium reactors (SMRs) offer advantages in scalability, safety, and siting flexibility, enabling installation in regions with limited grid capacity or high seismic activity.

The segment is supported by continued research into compact reactor designs emphasizing enhanced passive safety systems and reduced capital expenditure. These reactors are increasingly favored for their potential integration into hybrid energy systems combining nuclear and renewable sources. Governments and energy operators in East Asia, North America, and Europe are actively investing in pilot SMR projects to diversify national energy portfolios. The segment also benefits from reduced construction timelines and simplified maintenance procedures, improving economic feasibility for smaller-scale utilities. The growing emphasis on modular, low-carbon energy infrastructure continues to reinforce the strategic relevance of small and medium type PWR systems within the global nuclear technology market landscape.

The nuclear power plant segment represents about 88.0% of the total pressurized water reactor system market in 2025, making it the dominant application category. This leadership reflects the role of PWR technology as the cornerstone of global civilian nuclear power generation. Pressurized water reactors provide high thermal efficiency, reliable operation, and stable control characteristics, making them the preferred choice for base-load electricity production in large-scale power facilities.

The segment’s expansion is driven by ongoing demand for low-carbon energy and modernization of existing reactor fleets in countries with established nuclear programs. PWR systems are employed in the majority of operational nuclear power stations across North America, Europe, Russia, and East Asia, supported by standardized safety frameworks and proven performance history. Recent technological developments focus on fuel efficiency optimization, reactor lifetime extension, and digital control integration. Emerging economies continue to invest in PWR infrastructure to address rising energy consumption while meeting emission reduction commitments. The nuclear power plant segment remains the core of the global PWR market, underpinning energy stability and security across industrialized and developing regions pursuing sustainable base-load generation capacity.

The pressurized water reactor (PWR) system market is advancing as nuclear energy re-emerges as a critical component of global low-carbon power strategies. PWR systems remain the dominant reactor type worldwide and are being adopted both in new builds and in upgrades to existing plants. Expansion is supported by strong energy-security goals, heightened demand for baseload power, and progressive regulatory frameworks favouring clean technologies. The market is tempered by high capital expenditures, lengthy licensing processes, and concerns over nuclear safety and waste management. Suppliers and utilities are moving towards modular designs, digital monitoring systems, and standardised global platforms to reduce cost and timeline risk.

Governments and utilities are increasingly investing in PWR systems as part of their energy transition strategies and efforts to ensure reliable, carbon-free baseload power. The USP for system providers in this context is “fully integrated turn-key PWR solutions with modularisation and global certification pathways that shorten licensing time and minimise up-front risk” helping utilities meet policy targets and secure financing. As nuclear power is recognised for low-emission output and long-term operation, these investments drive demand for mature PWR technologies across regions including Europe, Asia-Pacific and Middle East.

Despite strong driver momentum, PWR system deployment is constrained by several factors. Large initial capital investment, complex engineering scope and extended construction timelines increase financial risk for utilities and investors. Public concern over safety, waste disposal and decommissioning cost further limits project risk-appetite. For equipment providers and EPC contractors, a meaningful USP is “pre-approved digital engineering packages and pre-qualified supplier frameworks that reduce project schedule over-run and cost escalation” thereby helping clients mitigate these adoption barriers in new or retrofit PWR programmes.

The PWR market is moving toward standardised modular reactors, advanced fuel cycles, digital twin operations and remote monitoring to improve competitiveness and safety performance. Suppliers are developing integral and factory-built PWR modules to reduce on-site construction time and improve scalability. A key USP for emerging-technology providers is “factory-produced integral PWR modules with proven licensing basis and digital operations platform for lifecycle cost reduction”, enabling utilities to deploy nuclear capacity more flexibly and with lower through-life risk. As capital flows shift toward emerging economies and retrofit markets, these trends are expected to shape global PWR dynamics.

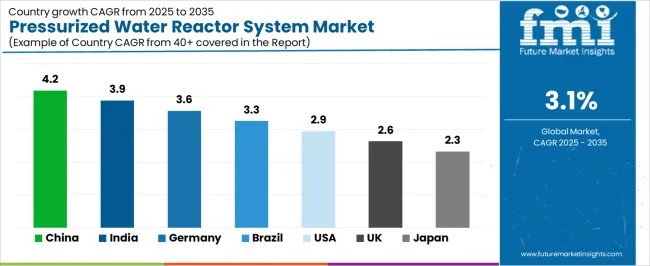

| Country | CAGR (%) |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| Brazil | 3.3% |

| USA | 2.9% |

| UK | 2.6% |

| Japan | 2.3% |

The pressurized water reactor system market is expanding steadily across major economies, with China leading at a 4.2% CAGR through 2035, driven by ongoing nuclear capacity additions, state-supported reactor development programs, and advanced safety technology integration. India follows at 3.9%, supported by nuclear expansion projects, public-private collaboration, and the adoption of next-generation reactor components. Germany grows at 3.6%, reflecting modernization in nuclear technology research despite energy diversification trends. Brazil records 3.3%, benefitting from energy infrastructure enhancement and increased focus on nuclear efficiency. The USA, at 2.9%, remains a stable market focused on reactor upgrades and maintenance, while the UK (2.6%) and Japan (2.3%) show gradual recovery in nuclear investment, emphasizing safety compliance and sustainable reactor operation frameworks.

China is showing sustained development in the pressurized water reactor system market, projected to grow at a CAGR of 4.2% through 2035. Expanding national energy infrastructure and strong government focus on low-carbon electricity generation are driving new reactor construction. Domestic technology integration, supported by indigenous reactor designs such as Hualong One, enhances self-sufficiency in core components. Continuous safety upgrades, advanced fuel cycle management, and modernization of cooling systems reinforce the country’s capacity for efficient and reliable nuclear power generation.

India is witnessing steady progress in the pressurized water reactor system market, increasing at a CAGR of 3.9%, supported by the government’s push toward nuclear energy as a sustainable power source. Development of pressurized heavy water and light water reactor projects is reinforcing the country’s nuclear infrastructure. Collaborations with international suppliers enhance technology transfer and reactor safety performance. Rising electricity demand and decarbonization targets are encouraging further investment in advanced nuclear systems across key industrial states.

Across Germany, the pressurized water reactor system market is advancing at a CAGR of 3.6%, driven by decommissioning projects, nuclear safety research, and engineering consultancy services. Although the country has phased out active nuclear generation, expertise in reactor component testing and safety simulation remains globally relevant. German firms continue to support international PWR system upgrades through engineering design and control technology. Ongoing participation in global nuclear safety programs maintains the country’s influence in reactor technology development.

Brazil is recording moderate progress in the pressurized water reactor system market, expected to grow at a CAGR of 3.3% through 2035. Expansion of the Angra nuclear complex and associated modernization programs continue to drive equipment and component procurement. Partnerships with global engineering firms support reactor operation efficiency and safety compliance. Domestic policy emphasis on low-carbon power generation sustains long-term investment in nuclear energy infrastructure, despite a gradual pace of new project development.

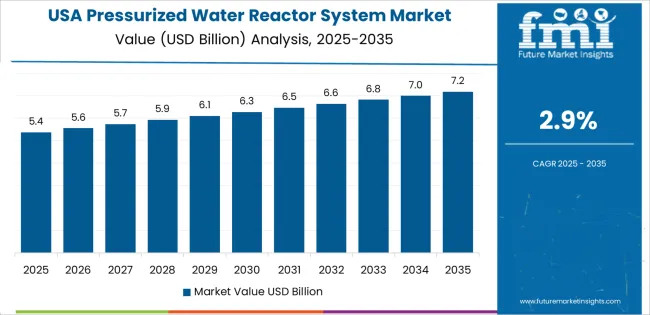

In the United States, the pressurized water reactor system market is growing at a CAGR of 2.9%, supported by the modernization of existing reactors and investment in small modular reactor (SMR) programs. Utility companies are prioritizing digital control systems, advanced fuel assemblies, and long-life reactor components. Federal initiatives promoting nuclear safety and carbon-free energy reinforce steady investment in system upgrades. Ongoing research into accident-tolerant fuels and thermal management solutions supports future operational efficiency.

Across the United Kingdom, the pressurized water reactor system market is advancing at a CAGR of 2.6%, supported by investments in reactor life-extension projects and nuclear research programs. Modernization of existing PWR facilities and planning for new reactors under government-backed energy security initiatives are sustaining market participation. Collaboration between engineering consultancies, universities, and reactor operators fosters technological refinement. Emphasis on low-emission energy diversification continues to strengthen long-term commitment to nuclear infrastructure.

Japan is experiencing gradual recovery in the pressurized water reactor system market, projected to rise at a CAGR of 2.3% through 2035. Restart of select nuclear facilities following rigorous safety evaluations has renewed demand for inspection, control, and containment systems. Domestic manufacturers are emphasizing seismic-resistant designs, advanced cooling systems, and digital monitoring integration. Continued government oversight and public safety initiatives ensure that modernization efforts proceed steadily across operational and maintenance projects.

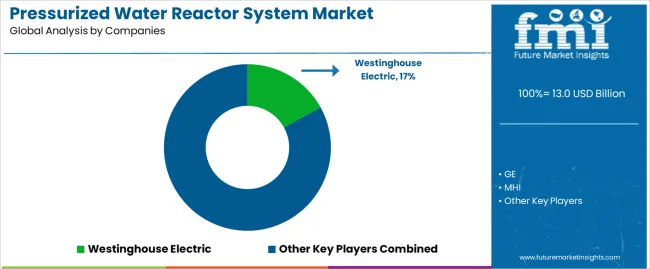

The global pressurized water reactor (PWR) system market is characterized by high entry barriers and a limited number of specialized nuclear technology providers with global operational reach. Westinghouse Electric leads the market with an estimated 17% share, supported by its AP1000 reactor design and long-term partnerships with utilities worldwide. GE, MHI, and Babcock & Wilcox (B&W) maintain strong positions through decades of engineering experience and system integration capabilities across both new build and refurbishment projects. Framatome and Siemens contribute advanced fuel cycle and instrumentation systems, emphasizing safety modernization and lifecycle efficiency. BBR and Atommash focus on heavy component manufacturing, including pressure vessels and reactor internals, supporting large-scale nuclear infrastructure programs across Europe and Asia.

Purolite and Rolls-Royce enhance competitiveness through specialized water chemistry and control system solutions. Toshiba and KHNP play key roles in regional deployment, integrating proven reactor technologies with localized engineering expertise. Rosatom and CNNC dominate government-backed nuclear expansion initiatives in Eurasia and China, respectively, delivering standardized reactor designs with domestic manufacturing capability. Shanghai Electric and Doosan contribute to reactor component production and export collaboration under joint venture frameworks. Holtec International strengthens global competitiveness through modular reactor innovation and decommissioning expertise. Competition within this market is defined by safety compliance, project financing capacity, and technology licensing agreements. Strategic differentiation increasingly depends on modularization, passive safety design, and digital reactor monitoring integration for next-generation PWR development and modernization.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Small & Medium Type, Large Type |

| Application | Nuclear Power Plant, Ship, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Westinghouse Electric, GE, MHI, Babcock & Wilcox (B&W), Framatome, Siemens, BBR, Atommash, Purolite, Rolls-Royce, Toshiba, KHNP, Rosatom, CNNC, Shanghai Electric, Doosan, Holtec International |

| Additional Attributes | Dollar sales by reactor type and application; regional adoption and modernization trends across major nuclear markets; competitive landscape covering OEMs, component suppliers, and lifecycle service providers. |

The global pressurized water reactor system market is estimated to be valued at USD 13.0 billion in 2025.

The market size for the pressurized water reactor system market is projected to reach USD 17.6 billion by 2035.

The pressurized water reactor system market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in pressurized water reactor system market are small & medium type and large type.

In terms of application, nuclear power plant segment to command 88.0% share in the pressurized water reactor system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pressurized Metal Containers Market

Pressurized Wine Filter System Market Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA