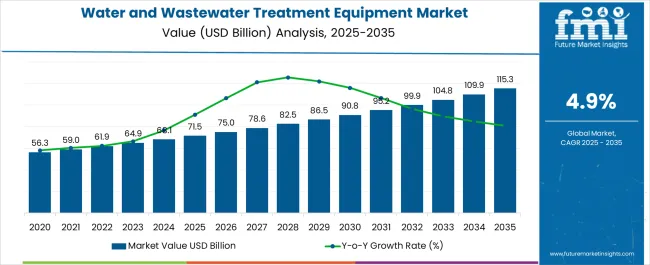

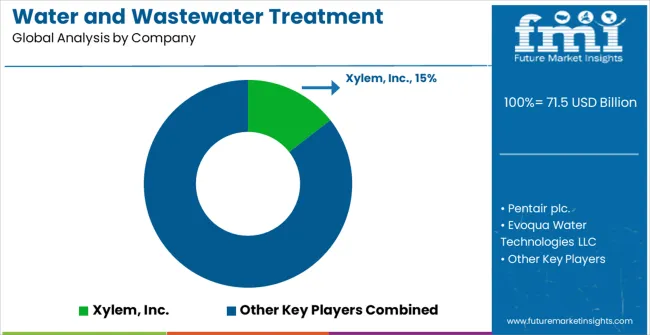

The Water and Wastewater Treatment Equipment Market is estimated to be valued at USD 71.5 billion in 2025 and is projected to reach USD 115.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Water and Wastewater Treatment Equipment Market Estimated Value in (2025 E) | USD 71.5 billion |

| Water and Wastewater Treatment Equipment Market Forecast Value in (2035 F) | USD 115.3 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The Water and Wastewater Treatment Equipment market is witnessing robust growth, supported by increasing global demand for clean water, stricter environmental regulations, and rising investments in industrial and municipal infrastructure. Industrial activities, urbanization, and population growth are placing immense pressure on existing water resources, which is accelerating the adoption of advanced treatment technologies. Companies are investing in modern equipment to enhance operational efficiency, reduce energy consumption, and meet sustainability goals.

Technologies integrating automation, IoT monitoring, and energy-efficient processes are gaining traction as they support real-time management and cost reduction. Governments worldwide are enforcing stricter standards on water discharge and reuse, driving industries to adopt specialized solutions. Additionally, the circular economy model, which emphasizes water reuse and resource recovery, is playing a critical role in shaping market expansion.

As climate change intensifies the need for water conservation and pollution control, industries and municipalities are increasingly turning to advanced treatment equipment With ongoing innovation in biological, physical, and chemical treatment systems, the market is expected to maintain long-term momentum across both developed and emerging regions.

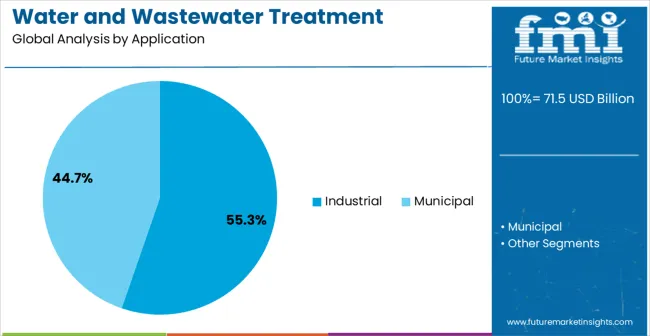

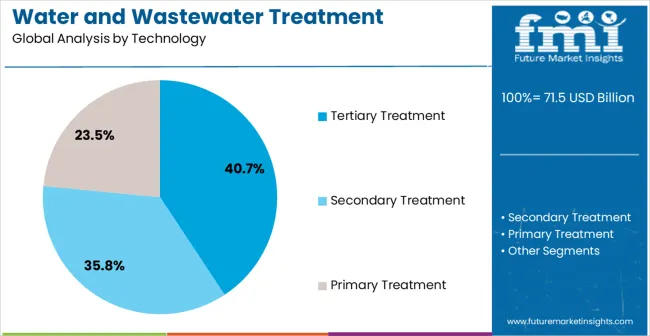

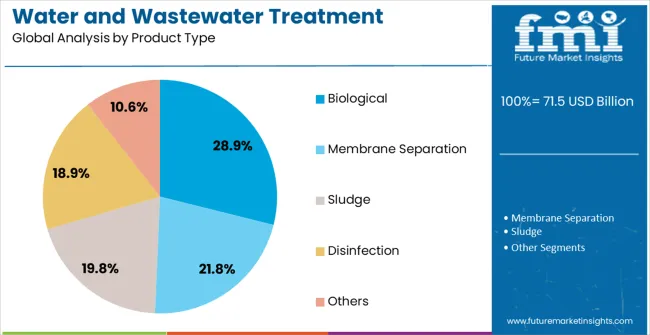

The water and wastewater treatment equipment market is segmented by application, technology, product type, and geographic regions. By application, water and wastewater treatment equipment market is divided into Industrial and Municipal. In terms of technology, water and wastewater treatment equipment market is classified into Tertiary Treatment, Secondary Treatment, and Primary Treatment. Based on product type, water and wastewater treatment equipment market is segmented into Biological, Membrane Separation, Sludge, Disinfection, and Others. Regionally, the water and wastewater treatment equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial application segment is projected to account for 55.3% of the market revenue in 2025, making it the leading application area. Growth is primarily being driven by rising water consumption across sectors such as power generation, food and beverage, pharmaceuticals, and chemicals, all of which require reliable treatment solutions for both process optimization and regulatory compliance. Industrial wastewater is often highly complex, containing toxic substances, oils, and heavy metals, making advanced treatment equipment critical for ensuring safe discharge or reuse.

Companies are increasingly investing in energy-efficient and automated systems that reduce costs and improve sustainability performance. The industrial sector is also benefiting from stricter discharge regulations, which mandate compliance with stringent water quality standards, thereby boosting equipment adoption. Recycling and reuse of water within industrial plants are becoming a standard practice, further enhancing demand.

Moreover, the integration of smart monitoring tools and predictive maintenance solutions is improving operational reliability As industries continue to prioritize sustainability and efficiency, the industrial application segment is expected to maintain its leadership, supported by consistent global investments.

The tertiary treatment segment is expected to hold 40.7% of the market revenue in 2025, establishing it as the leading technology type. Growth is supported by the increasing demand for advanced purification methods that can remove residual contaminants, nutrients, and pathogens not addressed by primary and secondary treatment. Tertiary systems play a critical role in enabling water reuse for industrial processes, irrigation, and even potable applications, which aligns with global efforts to address water scarcity.

Adoption is being reinforced by stricter government regulations that require higher water quality standards for discharge into the environment. Tertiary treatment technologies such as membrane filtration, UV disinfection, and advanced oxidation processes are being increasingly deployed due to their effectiveness and efficiency. Additionally, the ability of these systems to be customized for different applications enhances their versatility.

Industrial users and municipalities are adopting tertiary systems not only to comply with regulations but also to reduce dependence on freshwater sources As water reuse becomes a central element of sustainable water management, tertiary treatment is set to remain the dominant technology in the market.

The biological product type segment is projected to capture 28.9% of the market revenue in 2025, making it a key contributor within the product category. Its growth is being fueled by the rising demand for environmentally friendly solutions that use natural processes involving microorganisms to break down organic matter. Biological treatment equipment is widely adopted due to its cost effectiveness, scalability, and ability to manage large volumes of wastewater efficiently.

Industries and municipalities favor these systems as they align with sustainability goals and offer reduced reliance on chemical-intensive processes. The segment is also gaining traction as stricter environmental regulations push organizations toward green treatment technologies that ensure compliance while minimizing ecological impact. Innovations such as advanced bioreactors, aerobic and anaerobic systems, and biofilm technologies are enhancing performance and adaptability across diverse wastewater streams.

The reduced energy footprint and operational flexibility of biological systems further add to their appeal As global initiatives increasingly prioritize sustainable water management, biological treatment equipment is expected to expand steadily and strengthen its position in the market.

Key players in water and wastewater treatment equipment market are increasing their focus towards expanding their reach in different geographies, by means of distributing their products in lucrative regions.

As per industry experts, manufacturers in water and wastewater treatment equipment market are projected to make sizeable investments and over-all improvement, in the backdrop of following factors:

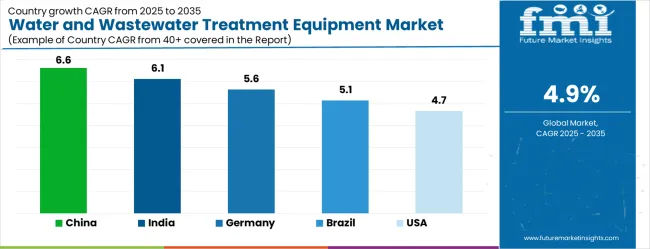

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

The Water and Wastewater Treatment Equipment Market is expected to register a CAGR of 4.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.6%, followed by India at 6.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.7%, yet still underscores a broadly positive trajectory for the global Water and Wastewater Treatment Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.6%. The USA Water and Wastewater Treatment Equipment Market is estimated to be valued at USD 24.6 billion in 2025 and is anticipated to reach a valuation of USD 24.6 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 3.6 billion and USD 2.2 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 71.5 Billion |

| Application | Industrial and Municipal |

| Technology | Tertiary Treatment, Secondary Treatment, and Primary Treatment |

| Product Type | Biological, Membrane Separation, Sludge, Disinfection, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Xylem, Inc., Pentair plc., Evoqua Water Technologies LLC, Aquatech International LLC, Ecolab Inc., DuPont, Calgon Carbon Corporation, Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION), Veolia Group, Ecologix Environmental Systems, LLC, Evonik Industries AG, and Parkson Corporation |

The global water and wastewater treatment equipment market is estimated to be valued at USD 71.5 billion in 2025.

The market size for the water and wastewater treatment equipment market is projected to reach USD 115.3 billion by 2035.

The water and wastewater treatment equipment market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in water and wastewater treatment equipment market are industrial and municipal.

In terms of technology, tertiary treatment segment to command 40.7% share in the water and wastewater treatment equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Coatings Market Size and Share Forecast Outlook 2025 to 2035

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA