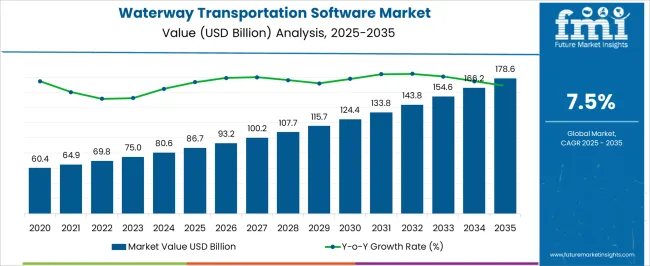

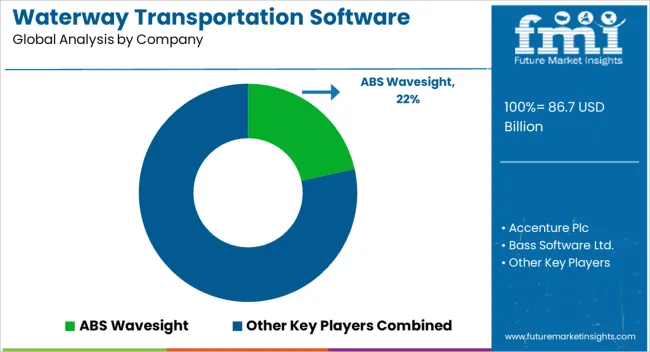

The waterway transportation software market is estimated to be valued at USD 86.7 billion in 2025 and is projected to reach USD 178.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The waterway transportation software market, with an estimated value of USD 86.7 billion in 2025 and projected to reach USD 178.6 billion by 2035 at a CAGR of 7.5%, demonstrates characteristics consistent with a market transitioning from early growth to a more mature adoption phase. Initial uptake, represented by the modest increase from USD 86.7 billion to USD 100.2 billion in the first three years, reflects early adoption by forward-looking shipping operators, port authorities, and logistics integrators seeking operational efficiency, route optimization, and regulatory compliance. This period is indicative of the early majority segment beginning to adopt software solutions that integrate scheduling, cargo tracking, and performance analytics.

From the mid-period of 2028 to 2032, the market experiences accelerated adoption, moving from USD 107.7 billion to USD 124.4 billion, signaling that technology acceptance has broadened across the industry. Factors such as integration with IoT-enabled sensors, AI-based predictive maintenance, and regulatory compliance modules contribute to higher adoption rates, corresponding to the late majority phase in the lifecycle.

The latter phase, covering 2033 to 2035, shows a continued but slightly tempered growth reaching USD 178.6 billion, characteristic of a market approaching maturity with widespread deployment and saturation among large-scale operators. The trajectory suggests that adoption is steadily moving through the early and late majority phases, with incremental gains driven by technological innovation, regulatory alignment, and operational efficiency requirements in global waterway transport.

| Metric | Value |

|---|---|

| Waterway Transportation Software Market Estimated Value in (2025 E) | USD 86.7 billion |

| Waterway Transportation Software Market Forecast Value in (2035 F) | USD 178.6 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The waterway transportation software market represents a specialized segment within the global maritime logistics and transportation management industry, emphasizing operational efficiency, route optimization, and cargo tracking. Within the broader transportation management systems sector, it accounts for about 5.3%, driven by adoption across shipping companies, port operators, and inland waterway networks. In the fleet management and logistics software segment, it holds nearly 4.7%, reflecting demand for scheduling, monitoring, and real-time performance analytics. Across the smart shipping and digital maritime solutions market, the share is 4.2%, supporting integration with IoT devices, sensors, and automated reporting systems. Within the port and terminal operations category, it represents 3.8%, highlighting its role in berth allocation, cargo handling, and efficiency improvement.

In the supply chain visibility and maritime compliance sector, it secures 3.4%, emphasizing regulatory adherence, safety monitoring, and predictive maintenance capabilities. Recent developments in this market have focused on cloud-based platforms, AI analytics, and digital twin integration. Innovations include automated route planning, predictive vessel maintenance, and real-time cargo tracking solutions to enhance operational efficiency. Key players are collaborating with shipping companies, port authorities, and technology providers to deploy end-to-end digital solutions for waterway transport. Adoption of blockchain-enabled cargo documentation, IoT sensor networks, and AI-driven performance analytics is gaining traction to improve transparency, reduce delays, and optimize fuel consumption. The integration with smart port infrastructure and sustainable shipping initiatives is being deployed to support emission reduction and operational efficiency. These trends demonstrate how technology, data-driven decision-making, and connectivity are shaping the market.

The waterway transportation software market is experiencing steady growth driven by the increasing need for efficient fleet management, route optimization, and real time cargo tracking in maritime operations. Rising global trade volumes, coupled with the push for digital transformation in the shipping industry, are encouraging adoption of advanced software solutions.

Integration of analytics, artificial intelligence, and IoT capabilities is enhancing operational visibility, reducing fuel costs, and improving delivery accuracy. Regulatory compliance requirements related to environmental standards and safety are further supporting the shift toward technology enabled management platforms.

As shipping companies seek to modernize infrastructure and optimize resource utilization, the market outlook remains positive, with continued investments expected in software innovation and integration across global maritime supply chains.

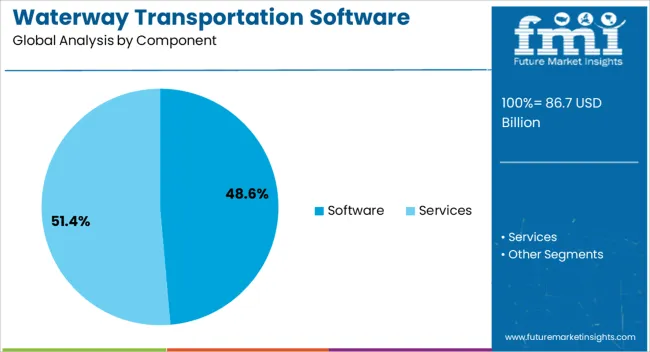

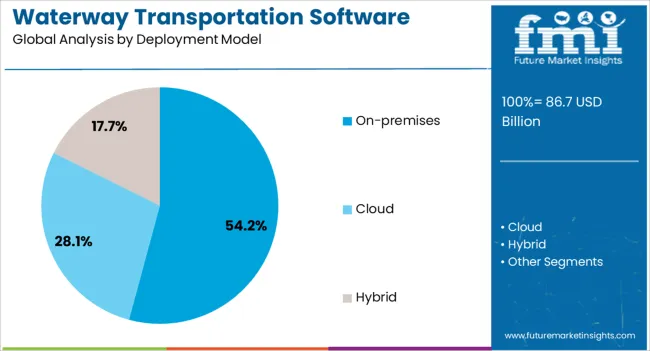

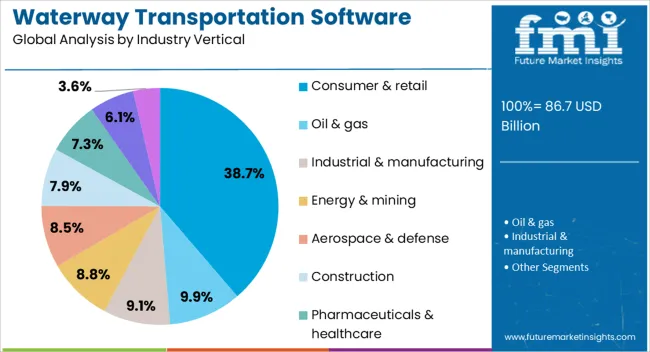

The waterway transportation software market is segmented by component, deployment model, industry vertical, and geographic regions. By component, waterway transportation software market is divided into software and services. In terms of deployment model, waterway transportation software market is classified into on-premises, cloud, and hybrid. Based on industry vertical, waterway transportation software market is segmented into consumer & retail, oil & gas, industrial & manufacturing, energy & mining, aerospace & defense, construction, pharmaceuticals & healthcare, food & beverages, and others. Regionally, the waterway transportation software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is expected to account for 48.6% of total revenue by 2025 within the component category, making it the most significant contributor. Growth is being driven by increasing demand for solutions that enable real time tracking, route optimization, and automated scheduling.

Software platforms provide operational transparency, enhance decision making, and reduce downtime, resulting in cost savings for shipping operators. Their scalability and adaptability across diverse vessel types and cargo operations have further boosted adoption.

As maritime logistics increasingly shift toward data driven operations, the software segment continues to maintain its leading position.

The on premises deployment model segment is projected to represent 54.2% of total market revenue by 2025, positioning it as the dominant deployment approach. This preference is influenced by the need for enhanced data security, control over system customization, and compliance with internal IT governance standards.

Large shipping enterprises and government port authorities often choose on premises solutions to maintain direct oversight of sensitive operational data. Additionally, robust integration with legacy systems and minimized reliance on internet connectivity make this deployment model particularly suitable for critical maritime operations.

These advantages continue to support its market leadership.

The consumer and retail industry vertical is expected to hold 38.7% of total revenue by 2025, making it the largest industry segment. Growth is supported by increasing global demand for fast, reliable, and traceable delivery of consumer goods through maritime routes.

Retailers rely on waterway transportation software to manage inventory flows, optimize delivery schedules, and ensure product availability across international markets. The ability to integrate transportation data with broader supply chain systems has improved efficiency and reduced delays, further strengthening adoption.

As e commerce and cross border retail trade expand, this segment’s reliance on advanced transportation software is expected to deepen, sustaining its leading position in the market.

The market has grown significantly due to the increasing demand for digitization, automation, and operational efficiency in shipping, ports, and inland waterways. These software solutions streamline vessel scheduling, cargo tracking, route optimization, and regulatory compliance while enhancing safety and resource management. Growth has been fueled by the global expansion of maritime trade, adoption of smart shipping technologies, and the need for real-time operational visibility. Integration with IoT devices, GPS systems, and cloud platforms has enabled improved fleet management, predictive maintenance, and data-driven decision-making, allowing shipping companies to optimize costs, reduce downtime, and improve customer satisfaction across commercial and industrial waterborne transportation networks.

Waterway transportation software has been increasingly adopted to optimize fleet operations and enhance efficiency. Features such as automated route planning, cargo load balancing, and vessel performance monitoring enable operators to reduce fuel consumption, turnaround time, and operational costs. Integration with telematics and GPS tracking provides real-time insights into vessel location, speed, and engine performance, facilitating proactive maintenance and scheduling. Port operators and shipping companies leverage these solutions to manage berth allocation, docking schedules, and cargo handling. The automation of repetitive tasks and data-driven analysis reduces human error, improves resource utilization, and supports compliance with maritime regulations, driving broader adoption across commercial and industrial shipping networks.

Technological advancements have transformed waterway transportation software, expanding its functionalities and improving operational outcomes. Cloud-based platforms, machine learning, and predictive analytics have enabled advanced performance forecasting, anomaly detection, and proactive decision-making. IoT-enabled sensors collect vessel and cargo data, supporting route optimization, energy efficiency, and maintenance scheduling. Blockchain integration has facilitated secure documentation, cargo tracking, and compliance verification. Furthermore, real-time weather monitoring and automated risk assessment tools have improved navigational safety and cargo integrity. These innovations have enhanced operational efficiency, reduced costs, and strengthened compliance, positioning software solutions as indispensable tools for modern waterborne transport operations across ports, shipping companies, and inland waterway authorities.

Compliance with international maritime regulations, environmental standards, and safety protocols has driven demand for waterway transportation software. Operators are required to maintain accurate records, track emissions, and implement safety measures for vessels and crew. Software solutions enable automated reporting, regulatory adherence, and monitoring of environmental parameters such as fuel emissions, ballast water management, and waste disposal. Safety modules provide risk assessment, incident reporting, and emergency response management, ensuring crew protection and operational reliability. Adoption of these tools has become crucial for minimizing legal penalties, improving transparency, and enhancing operational credibility, particularly in global shipping and freight transport segments, where adherence to international standards is mandatory.

Despite growing demand, waterway transportation software adoption faces challenges related to integration and cost. Implementing advanced solutions across legacy systems, multiple vessels, and diverse fleet operations requires technical expertise and upfront investment. Smaller shipping companies may find subscription fees, licensing costs, and implementation expenses prohibitive. Compatibility with existing telematics, IoT sensors, and port systems can create operational hurdles, delaying full utilization. Training personnel to use complex software tools and ensuring cybersecurity further contribute to operational complexity. Addressing these challenges through modular, scalable solutions, technical support, and cost optimization strategies is critical for enabling wider adoption and maximizing the efficiency and benefits of waterway transportation software.

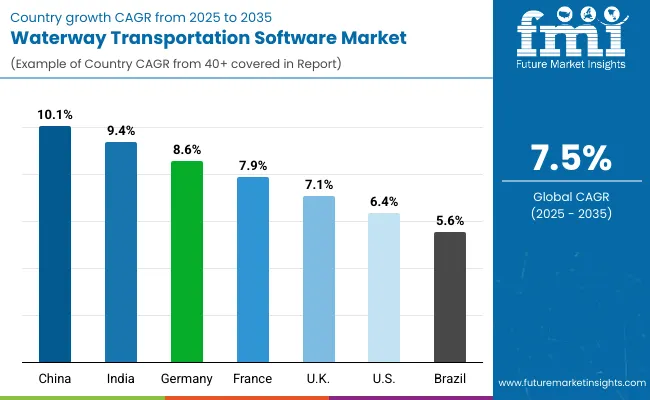

| Countries | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| U.K. | 7.1% |

| U.S. | 6.4% |

| Brazil | 5.6% |

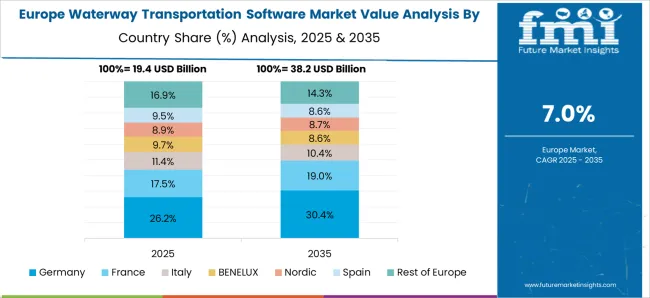

The market is expected to expand at a CAGR of 7.5% from 2025 to 2035, driven by growing digitalization in logistics and fleet management. Germany recorded 8.6%, reflecting adoption of advanced route optimization and cargo tracking systems. China reached 10.1%, fueled by large-scale investments in port automation and inland waterway management. India achieved 9.4%, supported by increasing deployment of integrated software solutions across commercial shipping networks. The United Kingdom reached 7.1%, where modernization of inland and coastal transportation systems spurred software utilization. The United States posted 6.4%, with growth concentrated in smart port solutions and maritime data analytics. Collectively, these markets represent key hubs of technological deployment, operational efficiency, and software innovation in waterway transportation. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 10.1%, driven by the modernization of inland waterways, port digitization, and increasing adoption of fleet management and logistics optimization software. Adoption has been reinforced by government initiatives aimed at improving shipping efficiency, reducing congestion, and integrating smart port systems. Domestic software providers focus on cloud based, AI enabled, and IoT integrated platforms tailored for cargo tracking, route optimization, and port management. Demand is further supported by growth in domestic shipping and cross border trade along major rivers such as Yangtze and Pearl River.

India is expected to expand at a CAGR of 9.4%, supported by rising inland shipping volumes, modernization of ports, and increased investment in digital logistics. Adoption has been reinforced by cloud based and mobile integrated platforms for fleet tracking, cargo management, and performance analytics. Domestic software companies are partnering with public and private shipping operators to provide scalable solutions across the Ganga, Brahmaputra, and coastal shipping networks. Government initiatives such as Sagarmala contribute to technology adoption and efficiency improvements.

Germany is forecast to grow at a CAGR of 8.6%, driven by river and canal traffic management, fleet digitalization, and port operations optimization. Adoption has been reinforced by integration with logistics management systems, IoT enabled monitoring, and automated reporting. Domestic software developers focus on high reliability, security, and compliance with European inland shipping regulations. The Rhine, Elbe, and Danube waterways remain key drivers of software deployment for cargo, passenger, and bulk shipping operations.

The United Kingdom is projected to grow at a CAGR of 7.1%, supported by adoption in commercial ports, inland navigation, and river transport operations. Imports of specialized software platforms complement domestic offerings, while integration with fleet analytics, cargo tracking, and energy efficiency modules drives adoption. Growth is reinforced by regulatory focus on maritime safety, efficient cargo handling, and automation in port operations.

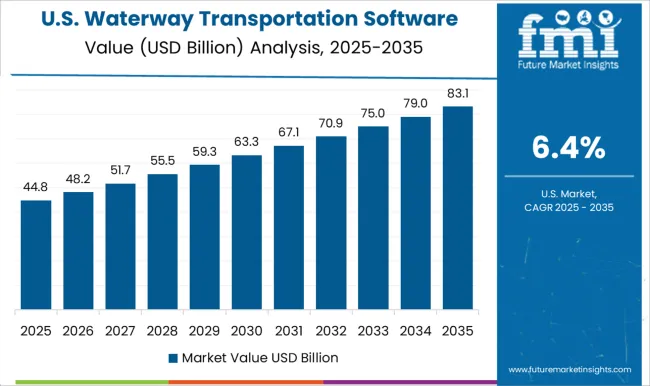

The United States is anticipated to grow at a CAGR of 6.4%, supported by modernization of inland waterways, digitization of fleet management, and adoption of cargo and port management software. Domestic developers focus on cloud based platforms, predictive analytics, and IoT enabled monitoring for barges, cargo vessels, and inland ports. Government programs promoting inland waterway efficiency and safety, particularly along the Mississippi, Ohio, and Columbia rivers, drive market expansion.

The market is driven by global software providers, technology integrators, and maritime-focused solution developers. ABS Wavesight leverages specialized analytics and fleet performance monitoring tools, providing actionable insights to shipping operators. Accenture Plc and Cognizant Technology Solutions Corp. emphasize digital transformation, integrating predictive analytics, logistics optimization, and operational efficiency for maritime clients. Bass Software Ltd. and Descartes Systems Group focus on cargo management, port operations, and compliance solutions, helping shipping companies streamline documentation and improve supply chain visibility. DNV GL combines risk management, vessel performance monitoring, and regulatory compliance tools, establishing a strong presence in safety-focused software solutions.

Flexport Inc. and IBS Software deliver cloud-based platforms enabling end-to-end tracking, scheduling, and optimization for containerized and bulk shipping. Major ERP and enterprise solution providers such as Oracle Corporation and SAP SE integrate waterway transport modules with broader logistics and supply chain systems, enhancing operational planning and resource management. Competitive dynamics in this market emphasize software interoperability, real-time data analytics, cloud adoption, regulatory compliance, and the ability to provide scalable solutions across fleets, ports, and shipping networks worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 86.7 billion |

| Component | Software and Services |

| Deployment Model | On-premises, Cloud, and Hybrid |

| Industry Vertical | Consumer & retail, Oil & gas, Industrial & manufacturing, Energy & mining, Aerospace & defense, Construction, Pharmaceuticals & healthcare, Food & beverages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABS Wavesight, Accenture Plc, Bass Software Ltd., Cognizant Technology Solutions Corp., Descartes Systems Group, DNV GL, Flexport Inc., IBS Software, Oracle Corporation, and SAP SE |

| Additional Attributes | Dollar sales by software type and application, demand dynamics across cargo shipping, passenger transport, and port operations, regional trends in maritime digitalization adoption, innovation in route optimization, fleet monitoring, and predictive analytics, environmental impact of fuel efficiency improvements and emissions reduction, and emerging use cases in smart ports, automated scheduling, and integrated logistics management. |

The global waterway transportation software market is estimated to be valued at USD 86.7 billion in 2025.

The market size for the waterway transportation software market is projected to reach USD 178.6 billion by 2035.

The waterway transportation software market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in waterway transportation software market are software, _warehousing, _vessel tracking, _freight security, _yard management, _audit & claim, _ship broker software, _maritime software, _others, services, _managed services, _consulting/customization services and _training services.

In terms of deployment model, on-premises segment to command 54.2% share in the waterway transportation software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transportation and Security System Market Size and Share Forecast Outlook 2025 to 2035

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Transportation Infrastructure Construction Market Size and Share Forecast Outlook 2025 to 2035

Transportation Aggregators Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Transportation Analytics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Transportation Composites Market Growth – Trends & Forecast 2022 to 2032

Transportation Coating Market Analysis 2022 to 2032

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

AI in Transportation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Transportation Market

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Transportation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA