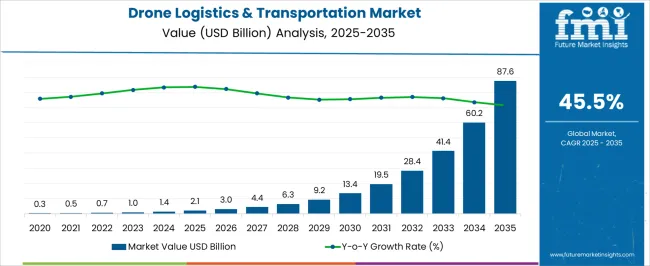

The drone logistics and transportation market is projected to grow from USD 2.1 billion in 2025 to USD 87.6 billion by 2035, with a CAGR of 45.5%. A growth momentum analysis reveals rapid expansion in the early years. In 2024, the market value stands at USD 1.0 billion, with steady growth reaching USD 1.4 billion in 2025. The adoption of drone technology begins to accelerate, reflecting a growing demand for faster, cost-effective delivery solutions. By 2026, the market increases to USD 2.1 billion, driven by early-stage adoption in specific sectors like e-commerce and healthcare. The market continues its upward momentum, reaching USD 3.0 billion in 2027, USD 4.4 billion in 2028, and USD 6.3 billion in 2029. The increase in investment, innovation, and regulatory advancements propel this growth, making drones a reliable option for logistics and transportation. The market accelerates significantly from 2030, reaching USD 9.2 billion in 2030 and USD 13.4 billion in 2032. By 2035, the market is expected to hit USD 87.6 billion, reflecting the mass adoption of drones across industries, supported by advanced technologies and regulatory frameworks that enhance operational efficiency. This sustained growth underscores the transformative potential of drones in global logistics and transportation, providing solutions for last-mile delivery and broader logistical challenges.

| Metric | Value |

|---|---|

| Drone Logistics & Transportation Market Estimated Value in (2025 E) | USD 2.1 billion |

| Drone Logistics & Transportation Market Forecast Value in (2035 F) | USD 87.6 billion |

| Forecast CAGR (2025 to 2035) | 45.5% |

The drone logistics and transportation market is undergoing rapid expansion, supported by innovations in unmanned aerial systems, navigation technologies, and regulatory frameworks enabling autonomous aerial operations. With the growing need for faster, contactless, and cost-efficient delivery models, drones are being actively deployed across sectors such as e-commerce, healthcare, disaster relief, and industrial supply chains. Advancements in propulsion systems, payload capacity, and precision GPS technologies have enabled drones to operate over longer distances with higher reliability.

Investment from logistics giants, aerospace manufacturers, and emerging drone tech startups has accelerated research into AI-based flight systems and adaptive routing algorithms. At the same time, public-private partnerships and pilot programs in urban air mobility are paving the way for future adoption.

The integration of drones into last-mile logistics and mid-range delivery operations is being reinforced by favorable government initiatives in air traffic management and BVLOS (beyond visual line of sight) policy frameworks Looking ahead, the market is expected to evolve rapidly with the inclusion of electric vertical takeoff and landing (eVTOL) technologies and AI-enabled fleet management systems.

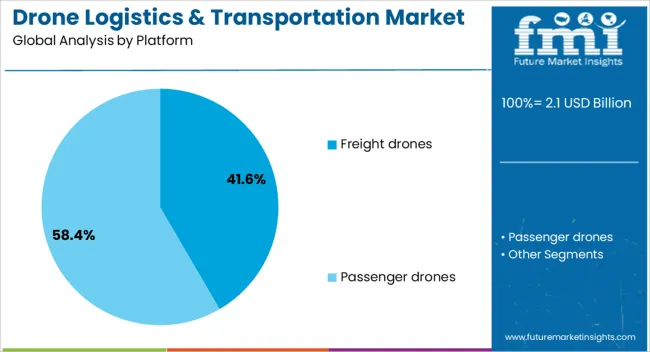

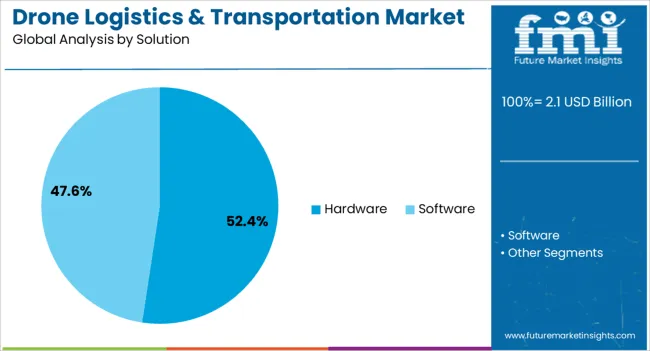

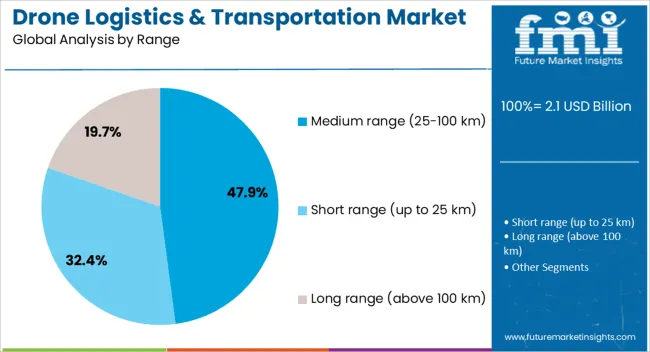

The drone logistics & transportation market is segmented by platform, solution, range, application, and geographic regions. By platform, drone logistics & transportation market is divided into Freight drones and Passenger drones. In terms of solution, drone logistics & transportation market is classified into Hardware and Software. Based on range, drone logistics & transportation market is segmented into Medium range (25-100 km), Short range (up to 25 km), and Long range (above 100 km). By application, drone logistics & transportation market is segmented into Logistics and Transportation. Regionally, the drone logistics & transportation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Freight drones are expected to account for 41.6% of the drone logistics and transportation market revenue share in 2025, positioning them as the most prominent platform type. This dominance is being driven by their ability to carry heavier payloads across varied terrain and their suitability for time-sensitive cargo delivery. The segment’s growth has been supported by advances in battery performance, propulsion systems, and cargo handling automation, which have collectively improved payload efficiency and flight endurance.

Freight drones are being integrated into logistics networks for mid-mile and last-mile delivery operations, especially in areas lacking conventional transport infrastructure. Their deployment has been further encouraged by government-led drone corridors and regulatory pilots in developing air freight routes.

Commercial viability has improved due to economies of scale, operational cost reduction, and minimal dependency on ground-based assets The segment’s rising adoption is also linked to its alignment with sustainability targets, enabling reduced carbon emissions compared to traditional ground freight systems.

The hardware segment is projected to contribute 52.4% of the total revenue in the drone logistics and transportation market in 2025, making it the most significant solution type. This growth is primarily being driven by the rising demand for robust drone frames, propulsion systems, sensors, cameras, and onboard computers. Hardware components remain the foundation of drone performance, directly impacting flight stability, payload capacity, and navigation precision.

Continuous innovation in lightweight composite materials, GPS modules, and power electronics has improved the reliability and energy efficiency of drone operations. Moreover, the growing integration of edge computing chips and AI-optimized flight control systems has enhanced real-time decision-making at the hardware level.

Investment from aerospace companies and electronics manufacturers has further fueled hardware standardization and mass production capabilities The demand for customized drone platforms tailored to specific logistics use cases has intensified the need for scalable and modular hardware configurations, reinforcing this segment’s position in the market.

The medium range segment, covering distances from 25 to 100 kilometers, is anticipated to hold 47.9% of the drone logistics and transportation market revenue in 2025. The segment's growth is being supported by the increasing demand for regional connectivity in logistics, particularly for routes that are too long for short-range drones but inefficient for ground-based delivery. Drones operating in the medium range have become central to bridging supply gaps between urban centers and remote or semi-urban areas.

Advances in battery density, aerodynamic design, and flight control software have enabled greater efficiency across this range without compromising on safety or payload capacity. This operational sweet spot has attracted attention from logistics providers aiming to optimize delivery schedules while minimizing infrastructure dependencies.

Medium range drones also align well with airspace regulations in many regions, allowing controlled expansion without significant regulatory overhaul The segment’s dominance is reinforced by its cost-benefit balance and growing use in healthcare delivery, e-commerce logistics, and industrial supply runs.

The drone logistics and transportation market is experiencing rapid growth, driven by advancements in drone technology and the increasing demand for efficient delivery solutions. Drones offer advantages such as faster delivery times, reduced costs, and the ability to reach remote or challenging locations. This market encompasses various applications, including cargo delivery, medical supplies delivery, food and beverage delivery, and e-commerce delivery. The market's expansion is further supported by regulatory developments and technological innovations, positioning drones as a transformative force in the logistics and transportation industry. As industries continue to embrace automation and seek faster, more sustainable delivery options, the adoption of drone logistics solutions is expected to rise.

The increasing demand for faster and more efficient delivery solutions is driving businesses to adopt drone technology. Drones offer the ability to bypass traffic congestion, reducing delivery times and improving customer satisfaction. Advancements in drone technology, such as improved battery life, enhanced payload capacities, and autonomous navigation systems, have expanded the capabilities of drones, making them viable for various logistics applications. Additionally, the rise of e-commerce has created a need for rapid delivery services, further fueling the adoption of drones in logistics. Regulatory support and the development of infrastructure to accommodate drone operations are also facilitating market growth.

Regulatory hurdles remain a significant barrier, as airspace management and safety standards vary across regions, complicating the implementation of drone operations. Safety concerns, including the risk of mid-air collisions and technical malfunctions, necessitate stringent safety protocols and continuous monitoring. Public acceptance poses another challenge, with concerns over privacy, noise, and the potential for job displacement. The high cost of drone technology and the need for specialized infrastructure, such as landing zones and charging stations, can be prohibitive for widespread adoption. Overcoming these challenges requires effective education and awareness campaigns, as well as the development of user-friendly and secure drone offerings that address the specific needs and concerns of potential customers.

The drone logistics and transportation market presents numerous opportunities for growth and innovation. Advancements in artificial intelligence (AI) and machine learning can enhance drone navigation, enabling more efficient and autonomous operations. The integration of drones with existing logistics networks and infrastructure can streamline supply chains and reduce operational costs. Emerging applications, such as medical supply delivery and humanitarian aid, offer avenues for drones to address critical needs in underserved areas. Collaborations between technology providers, logistics companies, and regulatory bodies can foster the development of standardized frameworks, facilitating the safe and scalable deployment of drone services. As the market matures, further innovations are likely to unlock new applications and further expand market potential.

The adoption of beyond visual line of sight (BVLOS) operations is expanding the range and capabilities of drone deliveries. The development of electric vertical takeoff and landing (eVTOL) aircraft is paving the way for urban air mobility solutions, including drone taxis and cargo transport. The implementation of 5G networks is enhancing real-time communication and data transfer, improving drone performance and reliability. Advancements in battery technology are increasing flight durations and payload capacities, making drones more viable for a broader range of applications. These trends indicate a dynamic and evolving market, with continuous advancements driving the adoption and capabilities of drone logistics technologies across various industries.

| Country | CAGR |

|---|---|

| China | 61.4% |

| India | 56.9% |

| Germany | 52.3% |

| France | 47.8% |

| UK | 43.2% |

| USA | 38.7% |

| Brazil | 34.1% |

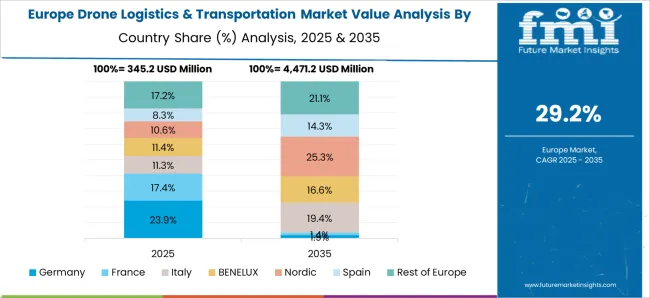

The global drone logistics and transportation market is projected to grow at a CAGR of 45.5% from 2025 to 2035. Among the key markets, China leads with a growth rate of 61.4%, followed by India at 56.9%, and Germany at 52.3%. The United Kingdom and the United States show more moderate growth rates of 43.2% and 38.7%, respectively. Emerging markets like China and India are experiencing rapid growth due to advancements in drone technology, while developed markets focus on integrating drones into existing logistics systems. As industries continue to innovate and invest in autonomous systems, the market for drone logistics and transportation is expected to expand significantly globally. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the global drone logistics and transportation market, growing at a projected CAGR of 61.4% from 2025 to 2035. The country’s rapid technological advancements in drone technology and increasing investments in autonomous delivery systems are major drivers of this growth. China’s government initiatives supporting smart city development and the integration of drones into public services, such as medical delivery, logistics, and e-commerce, are also contributing to the market’s expansion. The rise in demand for quick and cost-efficient delivery solutions, along with the growing interest in drones for last-mile deliveries, is expected to continue fueling market growth in China.

The drone logistics and transportation market in India is projected to grow at a CAGR of 56.9% from 2025 to 2035. The country’s growing e-commerce and logistics sectors, coupled with rising demand for cost-effective, time-efficient delivery solutions, are driving the adoption of drone technology. India’s government has also shown support for drone adoption in the logistics industry, with policies enabling the use of drones for cargo transport and last-mile deliveries. The increasing adoption of drones for medical supplies, agriculture, and e-commerce delivery services will further fuel the market’s growth. As India focuses on innovation and infrastructure development, the drone logistics market is set for substantial growth.

The drone logistics and transportation market in Germany is expected to grow at a CAGR of 52.3% from 2025 to 2035. The country’s strong presence in advanced technology, coupled with its focus on automating supply chains and transportation networks, is driving demand for drone logistics solutions. The rise of e-commerce and the increasing need for efficient, quick, and cost-effective delivery solutions in urban areas are contributing to the market’s growth. Germany’s strong interest in environmental sustainability and innovation in autonomous systems is expected to push the use of drones for various delivery applications, including medical and food delivery services.

The drone logistics and transportation market in the United Kingdom is projected to grow at a CAGR of 43.2% from 2025 to 2035. The UK’s demand for drone logistics solutions is driven by the increasing need for fast, reliable, and cost-effective delivery methods, particularly in urban environments. The rise of e-commerce, along with government support for drone-based services in healthcare, retail, and infrastructure sectors, is expected to contribute to the market’s growth. As the UK continues to innovate in autonomous transportation systems and smart city technologies, the market for drone logistics is set to expand, offering new opportunities for companies in the sector.

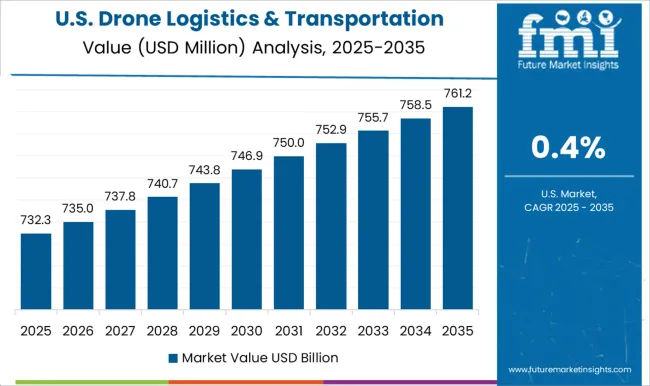

The drone logistics and transportation market in the United States is projected to grow at a CAGR of 38.7% from 2025 to 2035. The country’s strong demand for efficient delivery solutions, particularly in urban and remote areas, is driving the adoption of drones in logistics. The rise in e-commerce, the need for faster delivery services, and advancements in autonomous technologies are contributing to market growth. The USA is also seeing increased use of drones for medical deliveries and other essential services, further fueling market expansion. As the country continues to invest in drone infrastructure, the market for drone logistics is set to grow steadily.

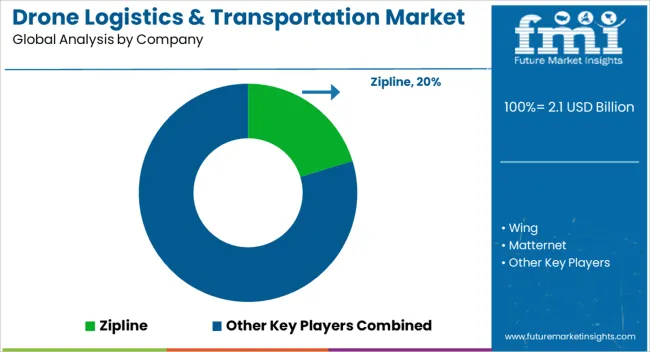

Leading companies in this sector include Zipline, a pioneer in drone deliveries, particularly for medical supplies in regions with limited infrastructure. Wing, a subsidiary of Alphabet Inc., has been conducting drone deliveries in urban areas, offering fast, sustainable delivery options. Matternet specializes in on-demand drone delivery systems, focusing on healthcare and e-commerce sectors, with operations in the USA and Europe. Drone Delivery Canada focuses on delivering goods across Canada, including remote areas, using its advanced drone models.

PINC Solutions provides drone-based inventory management solutions for warehouses, improving operational efficiency. CANA Advisors offers consulting services, helping businesses integrate drone technology into their supply chains. DroneScan develops software solutions for drone-based inventory scanning, enhancing accuracy and speed in warehouse management.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Platform | Freight drones and Passenger drones |

| Solution | Hardware and Software |

| Range | Medium range (25-100 km), Short range (up to 25 km), and Long range (above 100 km) |

| Application | Logistics and Transportation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zipline, Wing, Matternet, Drone Delivery Canada, PINC Solutions, CANA Advisors, and DroneScan |

| Additional Attributes | Dollar sales by product type (freight drones, passenger drones, drone taxis) and end-use segments (healthcare, e-commerce, retail, logistics). Demand dynamics are driven by the increasing need for faster, cost-effective delivery solutions, advancements in drone technology, and supportive regulatory frameworks. Regional trends show strong growth in North America, Europe, and Asia-Pacific, fueled by investments in infrastructure, drone technology, and regulatory development to support efficient delivery and transportation solutions. |

The global drone logistics & transportation market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the drone logistics & transportation market is projected to reach USD 87.6 billion by 2035.

The drone logistics & transportation market is expected to grow at a 45.5% CAGR between 2025 and 2035.

The key product types in drone logistics & transportation market are freight drones, _10kg (delivery drones), _>10kg (cargo drones), passenger drones, _drone taxi, _air shuttle, _personal air vehicle and _ambulance drone.

In terms of solution, hardware segment to command 52.4% share in the drone logistics & transportation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Drone Test Stand Market Size and Share Forecast Outlook 2025 to 2035

Drone Simulator Market Size and Share Forecast Outlook 2025 to 2035

Transportation and Security System Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Drone Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Transportation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

Transportation Infrastructure Construction Market Size and Share Forecast Outlook 2025 to 2035

Transportation Aggregators Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Transportation Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Battery Market Size and Share Forecast Outlook 2025 to 2035

Transportation Analytics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Drone Sensor Market - UAV Advancements & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA