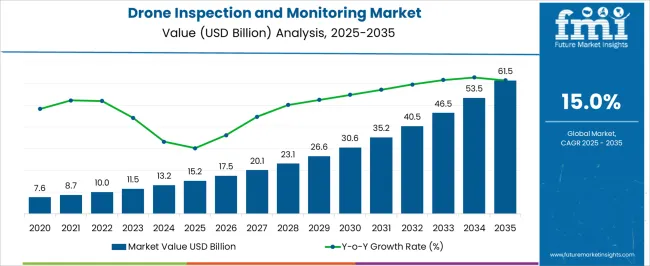

The drone inspection and monitoring market is projected to grow from USD 15.2 billion in 2025 to USD 61.5 billion by 2035, registering a robust CAGR of 15.0%. This growth trajectory suggests that the market is transitioning from an early adoption phase into a more mature stage, where wider commercial and industrial acceptance drives accelerated deployment.

In the initial years, the market’s expansion is driven primarily by early adopters in the energy, utilities, and infrastructure sectors. These applications emphasize operational efficiency, safety, and predictive maintenance, allowing drones to replace conventional inspection methods. Between 2025 and 2028, the market shows gradual adoption, reflecting cautious integration of drone technology into established workflows. By 2029 onwards, a significant acceleration in growth is observed as the technology crosses the early majority threshold. Improved sensor technologies, AI-driven analytics, and regulatory clarity enhance the reliability and scalability of drone operations, prompting broader industrial uptake. This period corresponds to the rapid growth segment of the adoption lifecycle, where organizations increasingly standardize drone-based inspection and monitoring as part of operational protocols.

The market approaches maturity with widespread adoption across multiple sectors, including transportation, agriculture, and industrial monitoring. Incremental growth beyond this point is likely to be driven by continuous technological enhancements, such as autonomous swarm operations and enhanced data integration, indicating that the market is entering a late majority phase where innovation sustains incremental adoption rather than initial expansion.

| Metric | Value |

|---|---|

| Drone Inspection and Monitoring Market Estimated Value in (2025 E) | USD 15.2 billion |

| Drone Inspection and Monitoring Market Forecast Value in (2035 F) | USD 61.5 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The drone inspection and monitoring market represents a specialized segment within the global unmanned aerial systems and industrial monitoring industry, emphasizing efficiency, safety, and real-time data collection. Within the broader commercial drone market, it accounts for about 5.8%, driven by adoption in energy, infrastructure, and industrial inspection applications. In the industrial automation and asset management sector, it holds nearly 4.7%, reflecting use in power lines, pipelines, and manufacturing facility monitoring. Across the construction and civil engineering equipment segment, the market captures 4.2%, supporting structural inspections, surveying, and progress tracking. Within the environmental monitoring and smart city solutions category, it represents 3.6%, highlighting applications in pollution tracking, disaster assessment, and forestry management.

In the transportation and logistics monitoring sector, it secures 3.1%, emphasizing fleet oversight, traffic monitoring, and port inspections. Recent developments in this market have focused on AI integration, autonomous flight, and advanced sensing technologies. Innovations include high-resolution cameras, LiDAR systems, thermal sensors, and multispectral imaging to enhance data accuracy and operational efficiency.

Key players are collaborating with energy companies, infrastructure developers, and governmental agencies to expand industrial inspection services and regulatory compliance. Adoption of automated flight planning, cloud-based analytics, and predictive maintenance tools is gaining traction for real-time decision-making. Additionally, lightweight drone platforms, long-endurance batteries, and modular payloads are being deployed to extend operational reach and versatility.

In 2025, the market is being shaped by rising adoption in infrastructure assessment, energy asset monitoring, environmental surveillance, and industrial inspection.

The ability of drones to access hard-to-reach or hazardous locations while providing real-time, high-resolution data is reducing operational risks and costs for multiple industries. The shift toward automation, combined with improvements in flight stability, sensor capabilities, and AI-driven image processing, is enabling broader applications and enhancing operational efficiency.

Growing regulatory support for commercial drone operations and the expansion of beyond-visual-line-of-sight capabilities are creating new deployment opportunities. As industries seek to optimize maintenance cycles, improve safety compliance, and gather actionable insights faster, drone inspection and monitoring solutions are expected to remain integral to operational strategies in the years ahead.

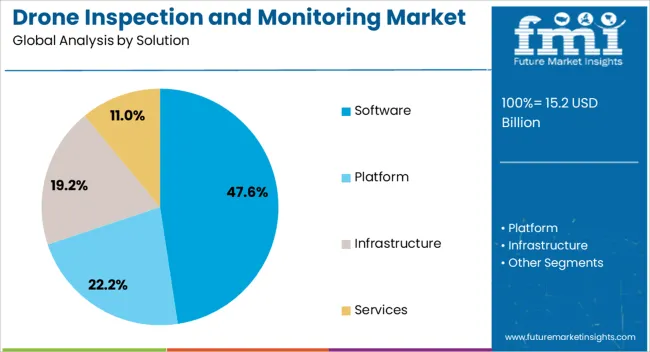

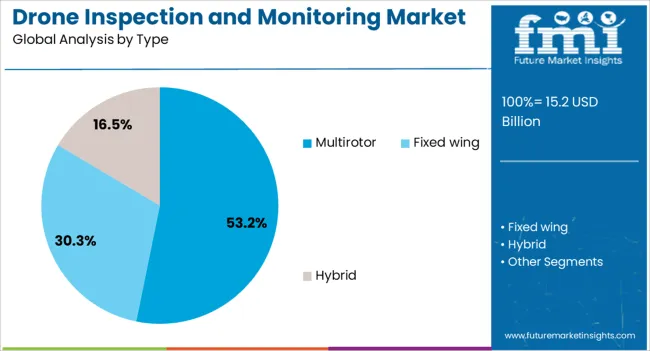

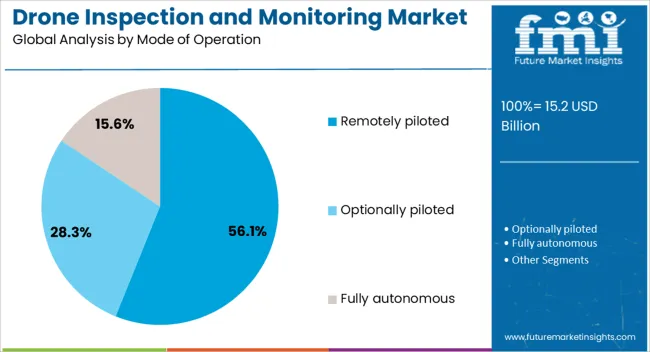

The drone inspection and monitoring market is segmented by solution, type, mode of operation, application, and geographic regions. By solution, drone inspection and monitoring market is divided into software, platform, infrastructure, and services. In terms of type, drone inspection and monitoring market is classified into multirotor, fixed wing, and hybrid. Based on mode of operation, drone inspection and monitoring market is segmented into remotely piloted, optionally piloted, and fully autonomous.

By application, drone inspection and monitoring market is segmented into construction & infrastructure, agriculture, oil & gas, utilities, mining, and others. Regionally, the drone inspection and monitoring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is projected to account for 47.6% of the drone inspection and monitoring market revenue in 2025, making it the leading solution type. This dominance is being supported by the increasing demand for advanced analytics, image processing, and data management capabilities that enhance inspection accuracy and decision-making.

Software platforms enable automated defect detection, predictive maintenance planning, and integration with enterprise asset management systems, which significantly improve operational efficiency. The flexibility to customize analytics workflows for different industry needs has further strengthened adoption.

The ability to store, process, and share inspection data securely across multiple stakeholders has positioned software as a critical enabler of value in drone operations. As the complexity of inspection requirements grows, investment in robust and scalable software platforms is expected to remain a priority for organizations leveraging drones for mission-critical tasks.

The multirotor type is expected to capture 53.2% of the market revenue in 2025, making it the leading platform type. This leadership is being driven by the versatility, maneuverability, and ability of multirotor drones to hover in fixed positions for detailed inspections.

Their compact design and ease of deployment make them well-suited for applications across urban infrastructure, industrial facilities, and confined spaces. The capacity to operate in varied terrains and adapt to different payloads, such as high-resolution cameras and LiDAR sensors, has reinforced their popularity.

Shorter launch preparation times and the capability to capture high-precision imagery from multiple angles have also contributed to the segment’s strong position. As industries increasingly require flexible and cost-effective aerial solutions, multirotor drones are expected to maintain dominance through their adaptability and broad application range.

The remotely piloted mode of operation is anticipated to hold 56.1% of the market revenue in 2025, leading across operational modes. This position is being supported by the operational control and real-time decision-making capabilities that remotely piloted drones provide, allowing operators to adapt flight paths instantly based on inspection needs.

The segment’s growth is being fueled by widespread use in industries where regulatory frameworks favor human oversight, ensuring compliance and safety. Remotely piloted drones are particularly valuable in environments requiring dynamic adjustments to capture critical data points under varying conditions.

Enhanced transmission technologies have enabled stable, high-quality data streaming, further improving inspection efficiency. As operational reliability and safety continue to be prioritized, remotely piloted drones are expected to remain a preferred choice for complex and sensitive inspection tasks.

The market has witnessed rapid growth due to its ability to provide efficient, safe, and cost effective solutions across industries such as energy, oil and gas, construction, transportation, and agriculture. Drones equipped with high resolution cameras, LiDAR sensors, thermal imaging, and GPS technology enable real time data collection, reducing the need for manual inspections in hazardous or hard to reach areas. Increasing emphasis on predictive maintenance, operational efficiency, and regulatory compliance has driven adoption. Investments in autonomous flight capabilities, AI powered analytics, and software integration have further expanded market potential.

The industrial and energy sectors have been significant adopters of drone inspection and monitoring solutions due to the high costs and risks associated with manual inspections. In power generation, transmission lines, wind farms, and solar installations, drones provide detailed structural assessments, identify defects, and monitor operational performance efficiently. Oil and gas pipelines, refineries, and storage tanks also benefit from aerial monitoring, enabling early detection of leaks or corrosion while reducing downtime and labor exposure. Drone integration with analytics platforms allows predictive maintenance planning and real time operational insights. As energy infrastructure expands globally, the reliance on drones for inspection and monitoring continues to grow, emphasizing operational safety, cost reduction, and enhanced asset management.

Transportation and construction industries have increasingly leveraged drones for site surveys, bridge and rail inspections, highway monitoring, and port management. The ability to quickly capture high resolution imagery and topographical data accelerates project planning, progress tracking, and regulatory compliance. Drones minimize the need for manual scaffolding or restricted area access, improving worker safety and operational efficiency. The drones are being used for traffic monitoring, railway line inspection, and urban infrastructure assessment, allowing municipalities and companies to optimize maintenance schedules and respond to potential issues proactively. The growing focus on smart city initiatives and infrastructure modernization has reinforced the adoption of drone based monitoring across large scale civil and transport projects worldwide.

The drone inspection and monitoring market has benefited from rapid technological evolution in sensor systems, AI, and software analytics. Multispectral and LiDAR sensors allow detailed structural, thermal, and material condition assessments, while AI enabled data processing accelerates defect detection and decision making. Integration with cloud platforms, GIS systems, and predictive analytics software enhances actionable insights from collected data. Autonomous flight capabilities, obstacle avoidance, and longer flight durations have increased operational efficiency and reliability. Continuous innovation in battery technology, lightweight materials, and high resolution imaging ensures drones can handle more complex inspection tasks across diverse environments. These technological advancements have expanded the range of applications, making drone inspection a preferred choice for industries seeking efficiency and precision.

Despite the benefits, drone inspection and monitoring adoption faces challenges related to regulatory compliance, airspace restrictions, and operational limitations. Regulations governing unmanned aerial vehicle usage vary by region, impacting flight permissions, safety standards, and data privacy requirements. Weather conditions, payload limitations, and battery life constraints also affect operational reliability. Companies are addressing these challenges by implementing advanced planning tools, real-time monitoring, and integrating drones into controlled industrial workflows. Partnerships with regulatory authorities and the adoption of standardized operational protocols have mitigated some barriers. Continued evolution of global UAV regulations, combined with technological enhancements, is expected to support broader adoption while ensuring safe and compliant drone inspection operations across industries.

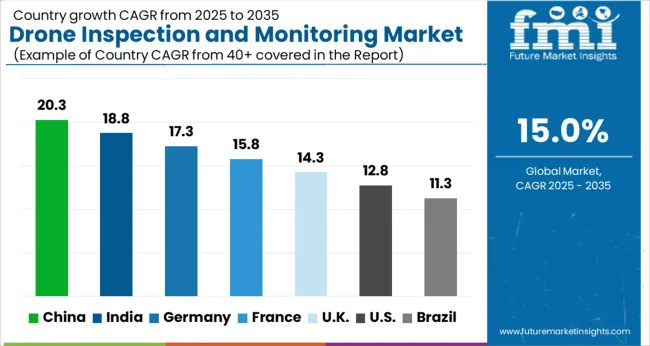

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The market is witnessing significant adoption across energy, infrastructure, and logistics sectors. Germany reaches 17.3%, driven by precision monitoring in industrial and construction applications. India posts 18.8%, supported by growing deployment in agriculture, utilities, and urban infrastructure. China leads at 20.3%, leveraging large-scale manufacturing and rapid integration in commercial inspection services. The United Kingdom achieves 14.3%, propelled by investments in smart infrastructure and research initiatives. The United States records 12.8%, with steady growth fueled by industrial automation and security applications. Collectively, these countries illustrate a dynamic ecosystem of technology adoption, regulatory support, and industrial scaling in drone-based inspection services. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 20.3%, reflecting rapid adoption across industrial, energy, and infrastructure sectors. Drones are increasingly employed for power line inspection, railway monitoring, and large construction projects, where high accuracy and operational efficiency are required. It is considered that China’s extensive investment in smart city initiatives and industrial automation has accelerated drone integration for safety monitoring and real time data collection. Domestic manufacturers such as DJI have strengthened their global footprint while advancing AI and imaging technologies. The market is expected to remain highly competitive, as government incentives and industrial demand continue to support adoption in both commercial and state applications.

India is projected to grow at a CAGR of 18.8% in the market, supported by rising infrastructure projects and renewable energy expansion. Government initiatives such as Smart Cities Mission and National Electric Mobility Mission have encouraged drone adoption for power grid, solar farm, and railway monitoring. It is observed that domestic companies and startups have been developing cost effective drone platforms with thermal and high resolution imaging for industrial inspection. Utility and infrastructure companies are increasingly relying on drones for predictive maintenance and safety compliance, reducing human risk. The market is expected to expand as regulatory frameworks for commercial drone operations continue to mature, fostering increased investment in inspection services across India.

Germany is anticipated to grow at a CAGR of 17.3% in the drone inspection and monitoring market, supported by industrial automation and renewable energy projects. German companies have adopted drones extensively for wind turbine inspections, power line monitoring, and railway infrastructure surveillance. It is considered that regulatory approval processes have streamlined drone operations, enhancing adoption across critical industries. Leading industrial drone suppliers in Germany have focused on integrating AI, thermal imaging, and data analytics for precise inspection capabilities. The market is expected to remain strong due to Germany’s high emphasis on energy efficiency, predictive maintenance, and industrial safety, with drones becoming an essential tool in operational monitoring across sectors.

The United Kingdom is expected to advance at a CAGR of 14.3%, fueled by infrastructure development and renewable energy projects. Adoption has been driven by offshore wind farms, bridges, railways, and utility networks, where drones provide detailed inspection and operational data. It is observed that U K companies are focusing on integrating AI powered image analysis and autonomous flight control for increased efficiency. Drones have also been employed in ports and construction sites to improve safety and optimize maintenance schedules. With regulatory frameworks in place for commercial drone operations, market expansion is expected to remain consistent as both private and public sectors increasingly leverage drone technologies for inspection and monitoring.Drone Inspection and Monitoring Market Growth Outlook in the United States

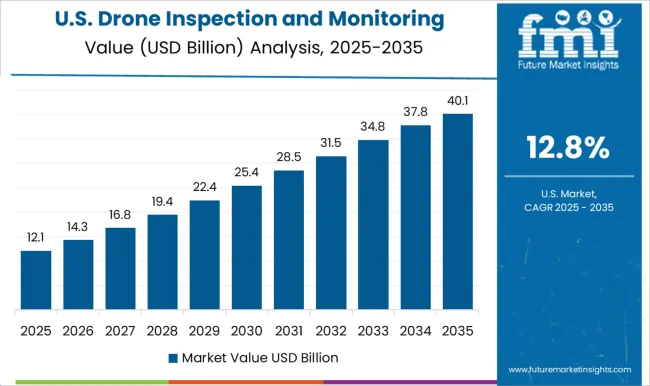

The United States market for drone inspection and monitoring is projected to grow at a CAGR of 12.8%, driven by industrial, energy, and infrastructure applications. Adoption has been accelerated by power utilities, oil and gas companies, and transportation authorities deploying drones for pipeline, bridge, and railway inspections. It is considered that U S drone manufacturers and service providers are integrating AI, LiDAR, and thermal imaging technologies for precision inspection and predictive maintenance. Regulatory support from the Federal Aviation Administration for commercial operations has further facilitated market growth. The U S market is expected to continue expanding as industrial operators increasingly rely on drones to improve safety, reduce inspection costs, and enhance operational efficiency

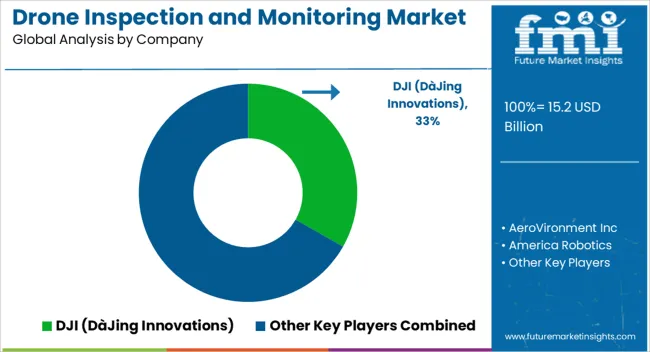

The market is defined by a blend of technology innovators, defense contractors, and specialized service providers delivering end-to-end inspection solutions across energy, infrastructure, and industrial sectors. DJI (DàJing Innovations) leads the consumer and commercial segment with advanced drone platforms offering high-resolution imaging, autonomous flight capabilities, and integrated AI for real-time monitoring, enabling rapid deployment and scalable operations. AeroVironment Inc. and America Robotics strengthen the market through niche applications such as industrial inspection, surveillance, and remote sensing, emphasizing lightweight, durable designs and extended flight endurance. Companies like Cyberhawk Innovations and Flyability provide tailored inspection services, combining drones with proprietary software platforms for asset management, predictive maintenance, and safety compliance. Defense and aerospace giants such as Lockheed Martin Corporation, Northrop Grumman Corporation, and Intel Corporation bring advanced sensing technologies, AI-enabled analytics, and robust flight control systems, addressing high-security, critical infrastructure, and large-scale industrial requirements.

Kespry and Intertek Group plc focus on mining, construction, and energy sectors, offering integrated aerial data collection and analytics solutions to optimize operational efficiency. Market competitiveness is driven by technology differentiation, regulatory compliance, data analytics capabilities, and integration of AI and IoT solutions. Strategic partnerships, regional adaptation, and service expansion remain key tactics for companies to consolidate market share and capitalize on increasing demand for automated, reliable, and safe inspection operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.2 billion |

| Solution | Software, Platform, Infrastructure, and Services |

| Type | Multirotor, Fixed wing, and Hybrid |

| Mode of Operation | Remotely piloted, Optionally piloted, and Fully autonomous |

| Application | Construction & infrastructure, Agriculture, Oil & Gas, Utilities, Mining, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DJI (DàJing Innovations), AeroVironment Inc, America Robotics, Cyberhawk Innovations, Flyability, Intertek Group plc, Intel Corporation, Kespry, Lockheed Martin Corporation, Mistras Group plc, and Northrop Grumman Corporation |

| Additional Attributes | Dollar sales by drone type and application, demand dynamics across infrastructure, energy, and environmental monitoring sectors, regional trends in UAV adoption, innovation in sensor integration, AI-powered analytics, and flight endurance, environmental impact of reduced manual inspections and fuel use, and emerging use cases in pipeline monitoring, power line inspection, and precision agriculture. |

The global drone inspection and monitoring market is estimated to be valued at USD 15.2 billion in 2025.

The market size for the drone inspection and monitoring market is projected to reach USD 61.5 billion by 2035.

The drone inspection and monitoring market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in drone inspection and monitoring market are software, platform, infrastructure and services.

In terms of type, multirotor segment to command 53.2% share in the drone inspection and monitoring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drone Simulator Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Drone Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Battery Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Drone Sensor Market - UAV Advancements & Forecast 2025 to 2035

Drone Motor Market Growth - Trends & Forecast 2025 to 2035

Drone Test Stand Market Size and Share Forecast Outlook 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Anti-Drone Technology Market

LiDAR Drone Market Size and Share Forecast Outlook 2025 to 2035

Counter Drone System Market Size and Share Forecast Outlook 2025 to 2035

Medical Drones Market Report – Growth & Forecast 2025-2035

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Consumer Drones Market

Fumigation Drone Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA