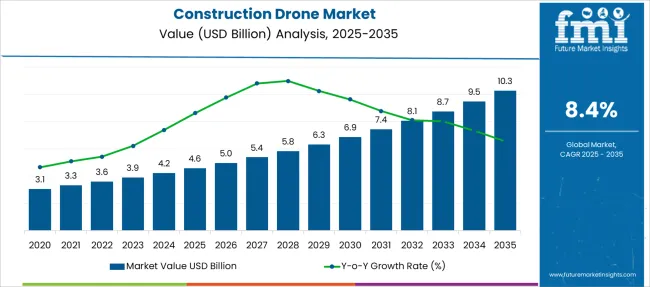

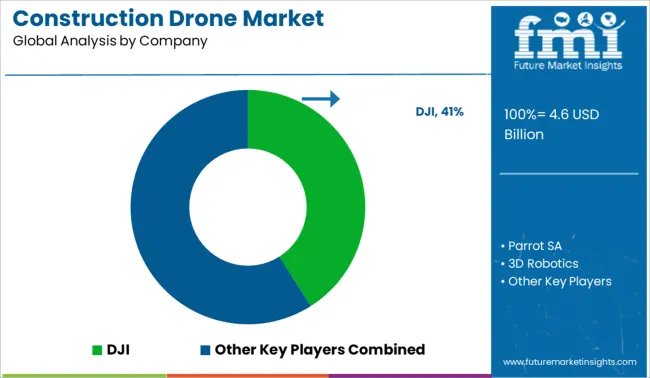

The Construction Drone Market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 10.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Construction Drone Market Estimated Value in (2025 E) | USD 4.6 billion |

| Construction Drone Market Forecast Value in (2035 F) | USD 10.3 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The Construction Drone market is undergoing significant transformation, driven by the accelerating demand for precision, efficiency, and safety across infrastructure development projects. Increased reliance on real-time data, site mapping, and progress tracking has expanded the adoption of drones capable of delivering high-resolution imaging and intelligent analytics. Construction firms are increasingly investing in aerial technologies to enhance project planning, monitor job site conditions, and reduce labor-related inefficiencies.

Government initiatives supporting smart infrastructure and digital twin technologies have further strengthened the market trajectory. The ability of drones to automate surveying, inspection, and material management is leading to considerable cost savings and improved timelines.

Furthermore, rapid advancements in drone hardware and AI-enabled flight control systems are enabling greater accuracy and automation. As global construction projects become more complex and demand for remote monitoring intensifies, the market for construction drones is projected to maintain steady momentum, supported by strong integration with cloud platforms, BIM systems, and geospatial software.

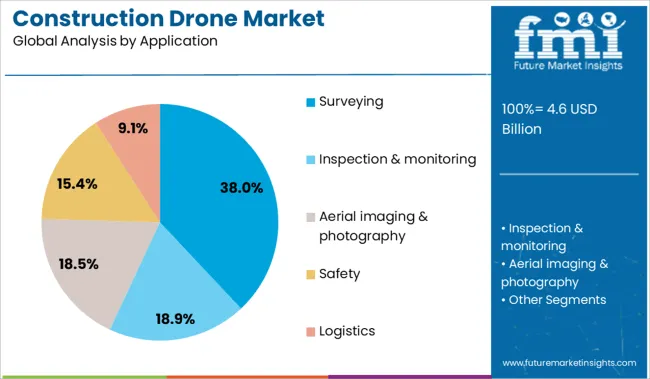

The market is segmented by Drone, Application, Range, and End-Use and region. By Drone, the market is divided into Rotary-wing drone and Fixed-wing drone. In terms of Application, the market is classified into Surveying, Site analysis, Planning & design, Asset Inventory, Others, Inspection & monitoring, Aerial imaging & photography, Safety, and Logistics.

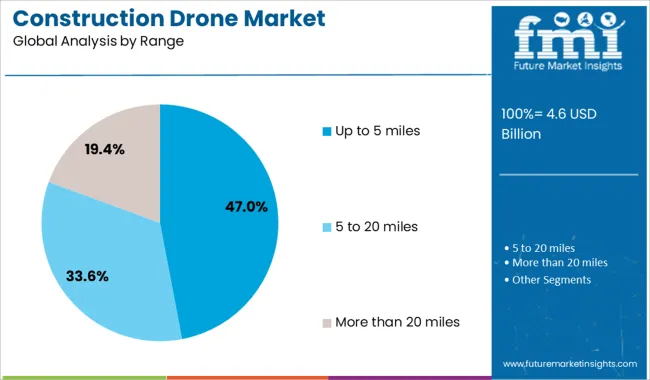

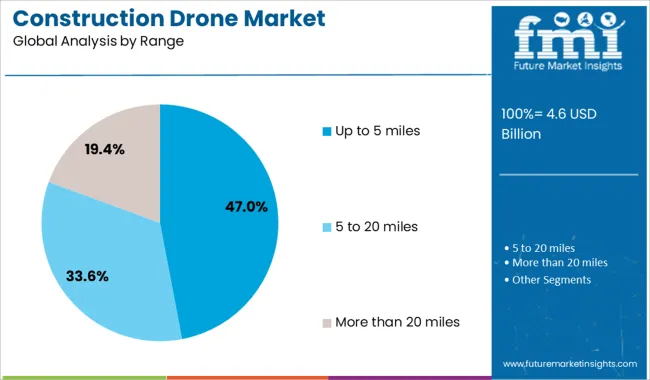

Based on Range, the market is segmented into Up to 5 miles, 5 to 20 miles, and More than 20 miles. By End-Use, the market is divided into Industrial, Commercial, and Residential. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rotary wing drone subsegment is anticipated to hold 72% of the drone segment's revenue share in the Construction Drone market in 2025, making it the dominant subcategory. Growth in this segment has been largely driven by the ability of rotary wing drones to take off and land vertically, hover precisely, and navigate confined or obstacle-rich environments with ease. These features have been especially valuable in construction sites where terrain is uneven or access is limited.

Rotary wing drones have been adopted for their maneuverability and suitability for close-range inspection and detailed imaging, enabling accurate assessment of infrastructure and progress tracking. Software integration and autonomous flight capabilities have further enhanced their operational efficiency.

The segment has also benefited from continuous improvements in payload capacity, battery performance, and stabilization technology. As construction stakeholders prioritize flexible aerial platforms for dynamic job site conditions, rotary wing drones have continued to lead adoption due to their practicality and precision across a wide range of construction use cases.

The surveying subsegment within the application segment is projected to hold 38% of the Construction Drone market revenue share in 2025, positioning it as the leading application area. The dominant position of this subsegment has been shaped by the growing need for accurate, time-efficient, and cost-effective surveying solutions in construction and civil engineering. Drones equipped with advanced imaging and LiDAR technologies have replaced traditional ground-based surveying tools, significantly reducing timeframes and operational costs.

This transition has been particularly important for large-scale infrastructure projects where speed and data accuracy are critical. The integration of real-time kinematic positioning and cloud-based processing platforms has enabled drone-based surveying to deliver high-precision geospatial data for planning and compliance purposes.

Surveying drones have also contributed to enhanced safety by minimizing the need for human presence in hazardous or difficult terrain. These advantages have driven widespread adoption among contractors, engineers, and surveyors seeking to streamline operations and improve project delivery outcomes.

The up to 5 miles subsegment within the range segment is expected to contribute 47% of the Construction Drone market revenue share in 2025, making it the most prominent range category. This leadership has been established due to the suitability of this range for most mid-sized construction projects, urban development zones, and infrastructure monitoring tasks.

Drones operating within this range have offered a balanced combination of flight endurance, connectivity, and regulatory compliance, especially in areas governed by visual line-of-sight restrictions. These drones have been favored for their ability to deliver high-resolution imaging and data collection while maintaining stable communication with ground control systems.

The market has also responded positively to the cost-efficiency and lower maintenance requirements associated with drones in this range, making them accessible to a wider array of construction firms. The up to 5 miles category has continued to expand due to the increasing availability of advanced models offering enhanced flight time, AI-assisted navigation, and modular payload capabilities optimized for short to mid-range missions..

The construction drone market is driven by cost-efficiency, labor optimization, and demand for real-time project insights. However, growth is limited by regulatory hurdles, high equipment costs, and data integration challenges.

The construction drone market is gaining momentum due to rising labor shortages and the need for increased jobsite productivity. With global construction costs escalating by over 15% since 2020, drones offer a cost-effective solution for site surveys, progress monitoring, and asset inspection. Demand is particularly strong in megaprojects and infrastructure developments, where real-time aerial data can reduce project delays by up to 22%. Market players are also capitalizing on regulatory support for aerial mapping and data collection. The construction sector is increasingly integrating drones for volumetric measurement, topographic surveys, and thermal imaging, helping reduce manual labor and downtime.

Despite rapid adoption, the market faces barriers including limited skilled operators and stringent airspace regulations. In countries like India and the UK, strict licensing requirements and flight restrictions near urban zones delay deployment timelines. In addition, data processing limitations remain a concern, up to 35% of drone-captured data is underutilized due to lack of integration with BIM and project management platforms. Connectivity issues on remote sites also hinder real-time analytics. The upfront cost of industrial-grade drones, often exceeding USD 25,000 per unit, poses a challenge for smaller construction firms with limited capital expenditure flexibility.

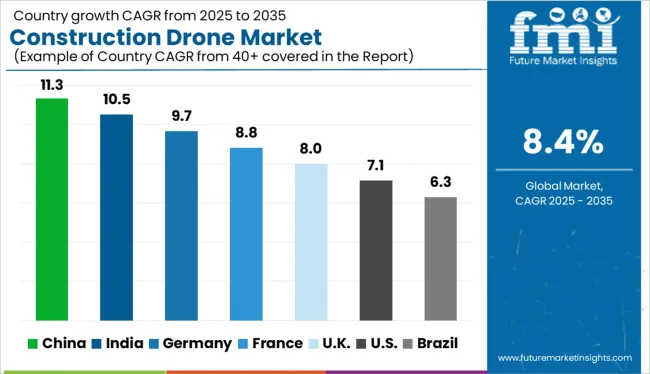

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

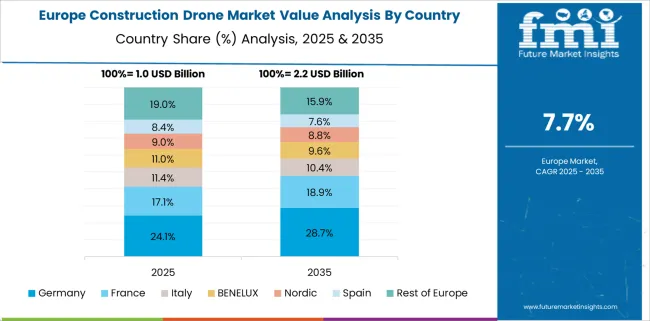

The global construction drone market is projected to grow at a CAGR of 8.0% from 2025 to 2035, driven by rising demand for real-time project monitoring, aerial surveying, and site inspection solutions across commercial and infrastructure development projects. Technological convergence with AI, LiDAR, and cloud analytics is reshaping how construction firms manage timelines and resources. BRICS economies are outpacing the global average, with China at 11.3% and India at 10.5%. China’s construction sector continues to modernize through drone-integrated BIM (Building Information Modeling), while India is deploying drones extensively for highway expansion, smart city initiatives, and mining operations. Among OECD economies, Germany leads with a CAGR of 9.7%, propelled by its push for digital twins and sustainable construction monitoring. The UK (8.0%) is on par with the global average, while the US (7.1%) sees steady adoption in urban planning, large-scale infrastructure, and disaster assessment.

The CAGR for the UK construction drone market was approximately 3.4% during 2020–2024, influenced by stringent regulatory conditions and limited drone integration across mid-size construction firms. However, the CAGR rose to 8.0% during 2025–2035, as UK-based EPC firms and public sector contractors adopted drone-enabled volumetric analysis and safety inspections to reduce insurance premiums and site delays. Revisions in UK Civil Aviation Authority (CAA) drone policies in 2025 streamlined pilot licensing and flight approvals for commercial users. Additionally, HS2 and large-scale redevelopment projects in London and the Midlands accelerated drone procurement.

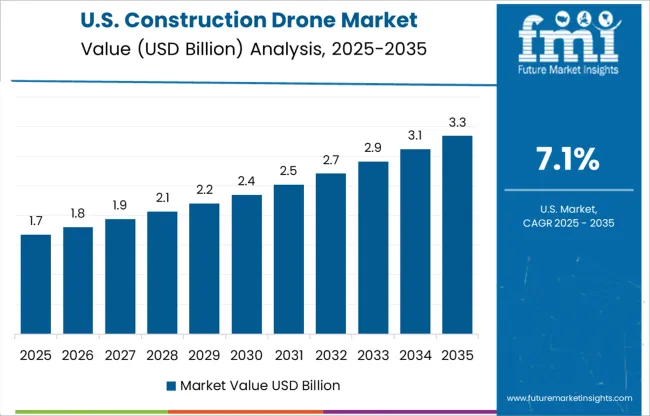

Construction Drone Market Expansion in the United States The USA construction drone market registered a CAGR of 5.6% between 2020–2024, driven by pilot adoption across large-scale industrial, highway, and housing projects. The CAGR accelerated to 7.1% for 2025–2035, aided by the expansion of autonomous drone fleets, FAA policy reforms, and increasing drone-as-a-service (DaaS) platforms for contractors. Federal infrastructure packages approved in 2026 further spurred public infrastructure drone applications. Tier 1 construction firms have also integrated drones with LiDAR and AI analytics to improve productivity.

India recorded a CAGR of 5.2% during 2020–2024, rising to 10.5% for 2025–2035, reflecting the maturing of its drone policy landscape and increasing application in highway, metro, and public housing projects. The Ministry of Civil Aviation’s 2025 revision to the Drone Rules simplified licensing for construction firms and reduced approval timelines. National infrastructure missions such as PM Gati Shakti and Bharatmala Phase II adopted drones for survey and progress tracking. Domestic drone startups also began offering cost-effective UAV leasing models for SMEs.

China’s construction drone market saw a CAGR of 7.8% from 2020–2024, which surged to 11.3% during 2025–2035, propelled by provincial investments in smart infrastructure, high-speed rail, and SEZ projects. Shenzhen, Guangzhou, and Chengdu emerged as drone manufacturing hubs, driving cost advantages and localization. The Ministry of Housing launched a 2025 initiative requiring drone-based inspections on government-funded projects above a certain threshold. Integration with GIS and AI-based project tracking systems is becoming standard among tier-1 and tier-2 contractors.

Germany posted a CAGR of 6.1% from 2020–2024, which climbed to 9.7% during 2025–2035, bolstered by smart city initiatives, energy-efficient retrofitting, and government digitization incentives for mid-size construction enterprises. By 2026, Germany’s Federal Ministry of Transport enabled expanded drone zones over industrial areas, facilitating consistent usage across infrastructure projects. Integration of drone-generated data with BIM and ERP systems has become mainstream among civil engineering firms. Market leaders in Bavaria and NRW also began offering bundled drone and software analytics solutions.

In the construction drone market, leading companies are focusing on advanced aerial mapping, automation, and industry-specific drone solutions to meet rising demand from infrastructure and real estate sectors. DJI dominates with a wide range of commercial UAVs equipped for surveying and thermal imaging. Parrot SA and 3D Robotics are enhancing mid-range offerings with photogrammetry and real-time data sync capabilities. Trimble Inc. leverages its surveying heritage to integrate drones with GNSS and BIM platforms, appealing to large-scale civil projects. AeroVironment, Inc., senseFly, and Kespry are expanding drone-as-a-service models for asset tracking and topography. Delair and Teledyne FLIR focus on industrial drones with LiDAR and thermal payloads for precision analytics.

In July 2025, DJI launched the Power 2000, a portable power station with 2,048Wh capacity and up to 3,000W output, specifically targeting professional users such as construction and production crews.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.6 Billion |

| Drone | Rotary-wing drone and Fixed-wing drone |

| Application | Surveying, Site analysis, Planning & design, Asset Inventory, Others, Inspection & monitoring, Aerial imaging & photography, Safety, and Logistics |

| Range | Up to 5 miles, 5 to 20 miles, and More than 20 miles |

| End-Use | Industrial, Commercial, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DJI, Parrot SA, 3D Robotics, Trimble Inc., AeroVironment, Inc., senseFly, Kespry, Delair, and Teledyne FLIR |

| Additional Attributes | Dollar sales trends, regional share, application-wise share (surveying, inspection), competitor benchmarking, pricing dynamics, fleet deployment rates, and public-private procurement trends. |

The global construction drone market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the construction drone market is projected to reach USD 10.3 billion by 2035.

The construction drone market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in construction drone market are rotary-wing drone and fixed-wing drone.

In terms of application, surveying segment to command 38.0% share in the construction drone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA