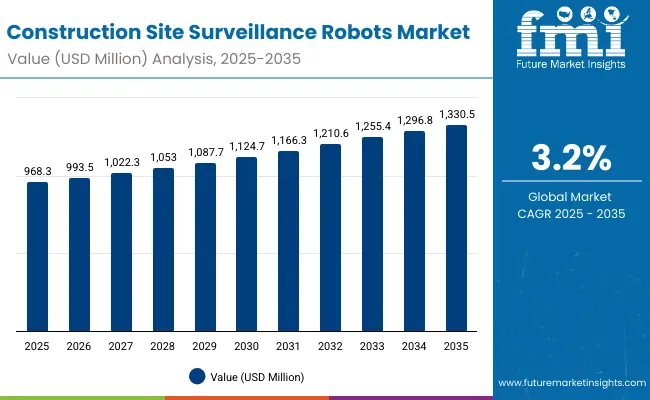

The construction site surveillance robots market is projected to grow from USD 968.3 million in 2025 to approximately USD 1330.5 million by 2035, recording an absolute increase of USD 362.2 million over the forecast period. This translates into a total growth of 37.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.37X during the same period, supported by the rising adoption of autonomous surveillance technologies and increasing demand for enhanced security measures at construction sites following rising theft incidents and safety regulations.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 968.3 million |

| Industry Value (2035F) | USD 1,330.5 million |

| CAGR (2025 to 2035) | 3.2% |

Between 2025 and 2030, the Construction Site Surveillance Robots market is projected to expand from USD 968.3 million to USD 1130.2 million, resulting in a value increase of USD 161.9 million, which represents 44.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising construction activity in emerging markets, increasing awareness of workplace security risks, and growing insurance requirements for enhanced site monitoring. Service providers are expanding their robot deployment capabilities to address the growing complexity of modern construction security requirements and compliance standards.

From 2030 to 2035, the market is forecast to grow from USD 1,130.2 million to USD 1,330.5 million, adding another USD 200.3 million, which constitutes 55.3% of the overall ten-year expansion. This period is expected to be characterized by expansion of AI-powered surveillance capabilities, integration of advanced analytics platforms, and development of standardized security protocols across different construction environments. The growing adoption of autonomous construction equipment will drive demand for integrated surveillance systems and specialized monitoring technologies.

Between 2020 and 2025, the Construction Site Surveillance Robots market experienced steady expansion, driven by increasing construction site theft incidents and growing awareness of security requirements following high-profile equipment losses. The market developed as construction companies recognized the need for continuous monitoring systems to protect valuable equipment and materials. Insurance companies and regulatory bodies began emphasizing proper surveillance implementation to maintain coverage and compliance with safety standards.

Market expansion is being supported by the significant increase in construction site theft incidents worldwide and the corresponding need for automated surveillance systems that can operate continuously without human intervention. Modern construction sites contain expensive equipment, materials, and tools that require comprehensive monitoring to prevent unauthorized access and theft. Even temporary lapses in surveillance can result in substantial financial losses, making continuous robotic monitoring systems essential for maintaining site security and operational continuity.

The growing complexity of construction security challenges and increasing liability concerns are driving demand for professional surveillance robots from certified providers with appropriate technology and expertise. Insurance companies are increasingly requiring proper surveillance documentation following incidents to maintain coverage and ensure site security compliance. OSHA requirements and construction industry safety standards are establishing standardized security procedures that require specialized monitoring systems and trained security protocols.

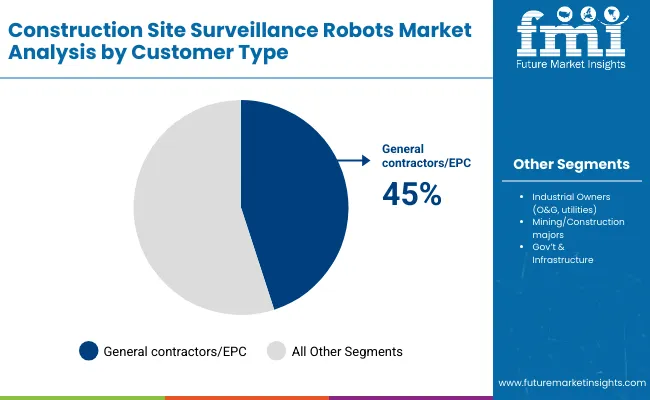

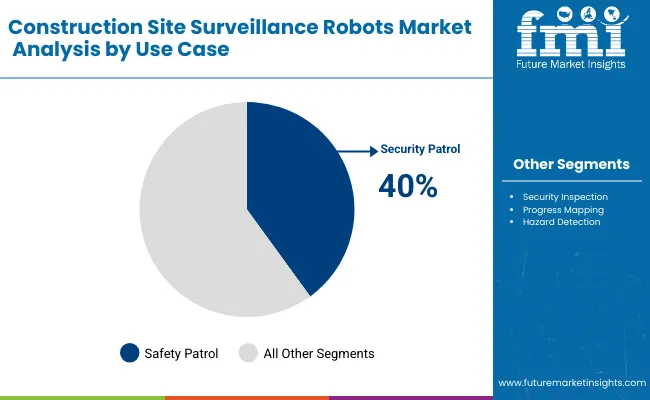

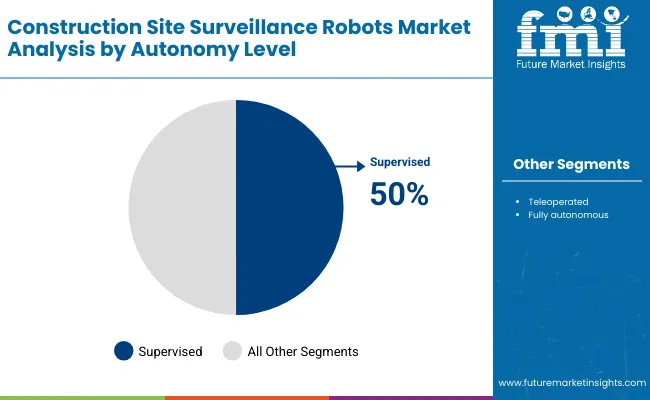

The market is segmented by mobility type, use case, end user, technology type, and region. By mobility type, the market is divided into wheeled UGV, tracked UGV, and other configurations. Based on use case, the market is categorized into security patrol, security inspection, progress monitoring, and hazard detection. In terms of end user, the market is segmented into residential construction, commercial construction, industrial construction, and infrastructure projects. By technology type, the market is classified into autonomous navigation, remote control, and hybrid systems. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The wheeled unmanned ground vehicle (UGV) segment is projected to account for a commanding 45% share of the construction site surveillance robots market in 2025. This dominance stems from the segment’s ability to deliver a compelling combination of versatility, cost-efficiency, and adaptability to the challenging but relatively predictable terrain conditions found in most construction environments.

Wheeled robots provide an optimal balance between speed, payload capacity, and energy efficiency, making them particularly well suited for continuous patrol operations across large-scale sites. Unlike tracked or legged systems that may excel in highly uneven or hostile terrains but come with higher costs and maintenance demands, wheeled UGVs are simple to deploy, easier to maintain, and benefit from well-established mechanical design standards. Their lower power consumption also extends operational endurance, reducing the need for frequent recharging or battery swaps an important factor for surveillance applications that demand near-continuous uptime.

From a deployment perspective, wheeled UGVs are supported by a mature manufacturing ecosystem. Multiple suppliers across North America, Europe, and Asia already have the production lines, integration expertise, and distribution networks to scale wheeled platforms quickly. This availability not only lowers acquisition costs but also accelerates procurement cycles for construction companies seeking immediate surveillance upgrades. Moreover, the platforms readily integrate with advanced technologies such as LiDAR, thermal imaging, and AI-drivenanalytics, enabling seamless incorporation into existing security frameworks without extensive customization.

Construction firms increasingly favor wheeled UGVs because they offer a pragmatic solution to balancing cost and functionality. The segment’s wide adoption reflects not just its suitability for current site conditions but also its role as a proven, low-risk option for companies that prioritize reliable surveillance coverage while keeping capital expenditure and operating costs manageable. As technology advances, wheeled UGVs are likely to retain their lead, though competition from tracked and hybrid mobility platforms will intensify as projects move into more rugged or highly automated environments.

The security patrol use case is projected to represent 40% of construction site surveillance robot demand in 2025, underscoring its position as the core driver of adoption in this market. Construction sites, particularly those located in urban and semi-urban environments, face persistent risks of theft, vandalism, and unauthorized intrusions, all of which can lead to costly project delays. Robots configured for perimeter patrol provide a visible deterrent presence, reducing the likelihood of such incidents while also ensuring 24/7 monitoring coverage that human guards alone cannot consistently deliver.

Modern patrol robots are equipped with autonomous route-following capabilities, GPS-based mapping, and real-time alerting systems that allow them to identify anomalies such as unauthorized entry, tampering with equipment, or even fire and environmental hazards. Beyond active deterrence, these robots create digital documentation trails archived video feeds, incident logs, and AI-generated alerts that strengthen compliance with insurance requirements and provide clear evidence in the event of disputes.

The growing emphasis on insurance mandates and regulatory requirements for comprehensive monitoring is accelerating adoption. In many jurisdictions, insurers now incentivize or require the deployment of technology-enabled surveillance for high-value projects. As a result, security patrol robots are no longer seen as optional tools but as baseline infrastructure for risk management, reinforcing their dominant role in market demand.

The commercial construction sector is projected to contribute 35% of the construction site surveillance robots market in 2025, reflecting its demand for high-intensity, large-scale security solutions. Projects such as office complexes, shopping malls, healthcare facilities, and large mixed-use developments typically involve multi-million-dollar equipment inventories spread over vast sites, often in densely populated urban areas where the risk of unauthorized access and theft is amplified.

Unlike smaller residential projects, commercial construction sites also feature longer project timelines that make manual security staffing costly and inconsistent. Surveillance robots fill this gap by providing continuous, predictable, and scalable monitoring that can cover expansive perimeters without fatigue. Their ability to integrate with central command centers, building information models (BIM), and cloud-based monitoring platforms ensures that developers can track security status in real time and respond proactively to incidents.

Economies of scale also work in favor of robotic adoption in this segment. The upfront investment in surveillance robots though significant becomes cost-effective when spread across high-value projects with large budgets and when weighed against potential insurance savings. Developers and insurers alike increasingly view robotic surveillance as an operational necessity rather than an experimental add-on, solidifying the segment’s 35% contribution.

The autonomous navigation technology segment is estimated to command a 50% share of the market in 2025, illustrating the shift toward hands-free, intelligent surveillance operations. Unlike semi-autonomous or remotely operated systems that require human oversight, autonomous robots are designed to operate independently along dynamic or preprogrammed routes, adapting to site changes in real time. This capability is particularly valuable for construction sites, where terrain layouts and obstruction patterns change frequently as projects progress.

Advancements in LiDAR, computer vision, and AI-driven pathfinding algorithms are enabling surveillance robots to navigate with greater precision and safety. These systems can detect and avoid obstacles, adjust patrol patterns based on site activity, and even collaborate with other robots or drones to create a layered security net. For construction firms, this means a significant reduction in labor costs, as fewer remote operators or on-site supervisors are needed to manage the fleet.

Customer preference is increasingly skewed toward solutions that minimize human intervention while maximizing uptime and consistency. By providing operational efficiency, scalability, and cost-effectiveness, autonomous navigation technology is not only dominating current adoption but also shaping future expectations for what a "standard" construction site surveillance robot should deliver. Over time, as AI-driven autonomy becomes more reliable, this segment is likely to expand even further, reinforcing its role as the technological backbone of the market.

The construction site surveillance robots market is advancing steadily as the industry grapples with rising security risks, tightening insurance mandates, and increasing pressure to protect valuable assets on job sites. A growing number of developers and contractors are recognizing the benefits of autonomous monitoring systems, which combine round-the-clock patrol capabilities with intelligent threat detection. These technologies are becoming more attractive as labor shortages in the security industry push companies toward automation. However, the market’s growth trajectory is shaped not only by these adoption drivers but also by persistent barriers, such as the high upfront investment in robotic platforms, the need for frequent software and hardware upgrades, and the difficulty of deploying uniform solutions across highly varied construction environments.

Rising Security Threats and Loss Prevention Needs Construction sites are increasingly vulnerable to theft of materials, machinery, and tools, as well as vandalism. Traditional guard-based security often proves inconsistent, especially on large or multi-site projects. Surveillance robots address this challenge by providing consistent, fatigue-free monitoring, deterring unauthorized entry, and capturing digital evidence to support insurance claims and liability disputes.

Expansion of AI-Powered Analytics and Threat Detection

AI integration is redefining the role of surveillance robots from passive observers to active security agents. By leveraging machine learning algorithms, robots can identify suspicious behavior, detect anomalies in movement patterns, and distinguish between authorized workers and potential intruders. They also generate automated incident reports with time-stamped evidence, improving accountability and reducing the burden on site managers. For large projects where scaling security personnel is impractical, AI-enabled robots deliver predictive alerts and faster response times, positioning them as indispensable tools for modern construction security.

Integration of Multi-Sensor Platforms and Environmental Monitoring

Construction sites are adopting robots that do more than just guard perimeters. Multi-sensor integration including thermal cameras, acoustic sensors, gas detectors, and air quality monitors is transforming these platforms into multi-functional site management tools. Beyond surveillance, they can track worker safety conditions, monitor environmental compliance (e.g., dust, noise, emissions), and provide data for regulatory reporting. This convergence of security and environmental monitoring is attractive to developers who want to consolidate functions and maximize ROI from their robotic investments.

Standardization and Workforce Training Initiatives

Industry bodies and technology vendors are gradually moving toward standards for robot deployment, data handling, and AI-based threat analysis, which will reduce operational friction for end users. Alongside, new training programs are emerging to familiarize site managers and security teams with robotic operations, ensuring smoother adoption. These efforts are critical to moving the market from fragmented pilot deployments to scalable, mainstream adoption.

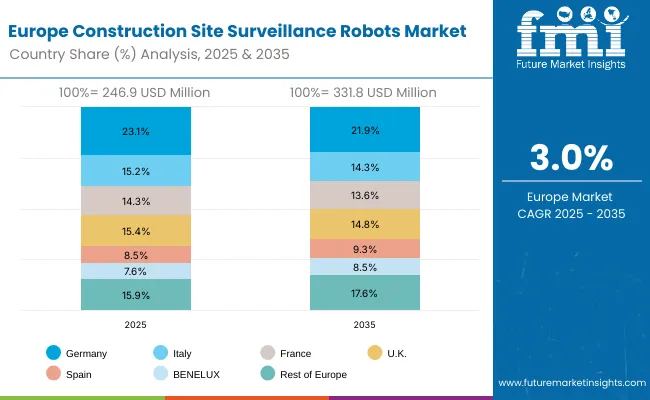

The Construction Site Surveillance Robots market in Europe is projected to grow from USD 241.3 million in 2025 to USD 319.1 million by 2035, registering a CAGR of 2.8% over the forecast period. Germany is expected to maintain its leadership despite a slight reduction in share from 24.2% in 2025 to 23.1% by 2035, supported by its extensive construction industry and advanced automation adoption rates.

The Rest of Europe region is projected to gain ground, expanding its share from 16.3% to 18.1%, attributed to rising security automation adoption in Eastern European construction markets and Nordic infrastructure projects. France and the UK will also see moderate gains, while Italy and Spain show marginal declines, likely due to mature construction markets and slower adoption of autonomous surveillance technologies.

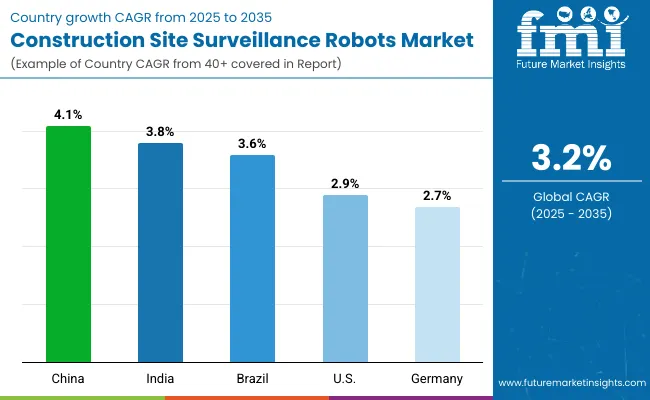

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Brazil | 3.6% |

| USA | 2.9% |

| Germany | 2.7% |

The construction site surveillance robots market is growing rapidly, with China leading at a 4.1% CAGR through 2035, driven by massive infrastructure development, smart city initiatives, and expanding construction automation adoption. India follows at 3.8%, supported by growing construction sector investments and increasing security awareness in urban development projects. Brazil grows steadily at 3.6%, integrating surveillance robots into established construction operations. The USA records 2.9%, emphasizing regulatory compliance and insurance-driven security requirements. Germany shows the most modest growth at 2.7%, focusing on precision technology and integration with existing construction management systems.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from construction site surveillance robots in China is projected to exhibit the highest growth rate with a CAGR of 4.1% through 2035, driven by massive infrastructure development programs and government initiatives promoting construction automation technologies. The country's expanding smart city projects and digital technology integration in urban planning are creating significant demand for advanced surveillance systems. Major construction companies and government agencies are establishing comprehensive surveillance networks to support the growing scale of construction projects across urban and industrial developments.

Government technology advancement programs are supporting development of specialized surveillance capabilities and training programs that enhance service quality and technical expertise across construction networks. Construction industry modernization initiatives are facilitating adoption of automated surveillance technologies that support comprehensive security management and regulatory compliance requirements. Professional development programs are creating technical expertise among security providers, enabling specialized surveillance services that meet evolving construction technology requirements.

Revenue from construction site surveillance robots in India is expanding at a CAGR of 3.8%, supported by increasing infrastructure investments and growing awareness of construction site security requirements. The country's expanding construction sector and rising urban development projects are driving demand for professional surveillance services that can support large-scale construction activities. Government infrastructure programs and private construction companies are gradually establishing capabilities to deploy advanced surveillance technologies.

Construction industry growth and infrastructure development programs are creating opportunities for specialized surveillance service providers that can support diverse construction technologies and project requirements. Professional training and technology adoption programs are developing technical expertise among security providers, enabling comprehensive surveillance services that meet international quality and safety standards for major construction projects.

Revenue from construction site surveillance robots in Brazil is growing at a CAGR of 3.6%, driven by integration of surveillance technologies into established construction operations and growing recognition of security automation benefits. The country's construction industry is gradually adopting advanced surveillance capabilities to address security challenges and regulatory requirements. Construction companies and security providers are investing in surveillance technologies and training to enhance project security management.

Construction sector modernization programs are facilitating adoption of surveillance automation technologies that support comprehensive security management across residential and commercial construction projects. Professional service development initiatives are enhancing technical capabilities among security providers, enabling specialized surveillance services that meet evolving construction security requirements and regulatory standards.

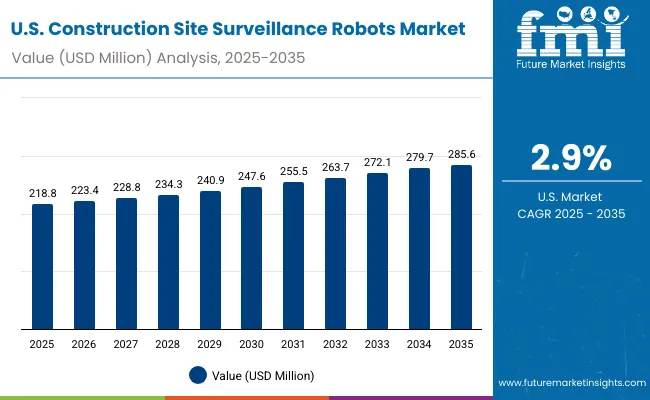

Demand for construction site surveillance robots in the USA is projected to grow at a CAGR of 2.9%, supported by stringent regulatory compliance requirements and insurance industry mandates for enhanced site security. American construction companies are implementing comprehensive surveillance systems to meet liability requirements and maintain insurance coverage. The market is characterized by focus on integration with existing construction management systems and compliance with occupational safety regulations.

Construction industry regulatory requirements are prioritizing surveillance technologies that demonstrate superior compliance monitoring and safety management while meeting American construction quality and insurance standards. Professional certification programs are ensuring comprehensive technical expertise among security providers, enabling specialized surveillance services that support diverse construction projects and regulatory compliance requirements.

Demand for construction site surveillance robots in Germany is expanding at a CAGR of 2.7%, driven by the country's emphasis on precision engineering and advanced technology integration in construction operations. German construction companies are implementing surveillance systems that meet stringent quality standards and demonstrate exceptional reliability and integration capabilities. The market is characterized by focus on technical excellence, advanced sensor integration, and compliance with comprehensive construction safety regulations.

Construction technology industry investments are prioritizing surveillance systems that demonstrate superior precision and integration capabilities while meeting German construction quality and safety standards. Professional development programs are ensuring comprehensive technical expertise among service providers, enabling specialized surveillance capabilities that support diverse construction technologies and regulatory compliance requirements.

In Europe, the construction site surveillance robots market is predominantly driven by wheeled UGV platforms, which account for 42% of total deployment in 2025. The preference for wheeled systems reflects the diverse terrain conditions across European construction sites and the established infrastructure for ground-based surveillance operations. These platforms provide optimal balance between mobility, sensor capacity, and operational endurance for European construction environments. Advanced navigation systems and sensor integration make wheeled platforms suitable for complex urban construction sites common throughout major European markets.

Wheeled surveillance robots benefit from established maintenance networks and technical support infrastructure across European markets. The integration of advanced AI capabilities and multi-sensor platforms enhances detection accuracy and operational efficiency in diverse construction environments. European construction companies increasingly rely on wheeled surveillance systems for comprehensive site monitoring and regulatory compliance documentation.

Security patrol represents the primary application for construction surveillance robots in Europe, holding 38% of market deployment in 2025. European construction sites utilize patrol robots for perimeter monitoring, access control, and deterrent presence during non-operational hours. The emphasis on continuous site security reflects stringent insurance requirements and regulatory compliance standards common across European construction markets. Patrol robots provide cost-effective security coverage that reduces reliance on human guards while maintaining comprehensive monitoring capabilities.

European security patrol implementations focus on integration with existing construction management systems and compliance documentation requirements. Advanced patrol robots incorporate environmental monitoring capabilities that support occupational safety compliance while maintaining primary security functions. The growing adoption of autonomous patrol systems reflects European construction industry emphasis on operational efficiency and regulatory compliance.

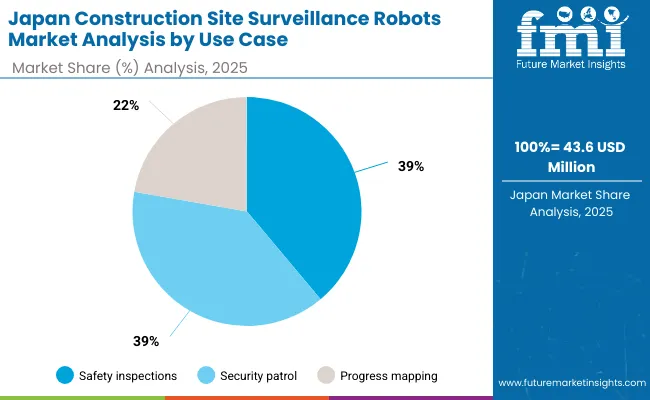

In Japan, the construction site surveillance robots market is largely driven by commercial construction projects, which account for 48% of total robot deployment in 2025. The high concentration of commercial construction activity in urban areas and the stringent security requirements for large-scale projects are key contributing factors. Japanese commercial construction emphasizes precision scheduling and asset protection, making continuous surveillance critical for project success. Advanced robotics integration reflects Japan's leadership in automation technology and construction industry innovation.

Commercial construction surveillance robots in Japan incorporate sophisticated AI analytics and predictive maintenance capabilities that enhance operational efficiency. The integration of surveillance systems with construction management platforms enables comprehensive project monitoring and security documentation. Japanese construction companies increasingly rely on autonomous surveillance technologies to maintain competitive advantages in complex urban construction environments.

Autonomous navigation technology represents the dominant technical approach for construction surveillance robots in Japan, holding 52% of market share in 2025. Japanese construction companies prioritize autonomous systems that require minimal human intervention while providing consistent monitoring performance. The emphasis on autonomous operation reflects Japan's advanced robotics capabilities and construction industry focus on operational efficiency. Sophisticated navigation systems enable effective operation in complex construction environments common in dense urban areas.

Japanese autonomous surveillance implementations emphasize integration with broader construction automation ecosystems and quality management systems. Advanced navigation capabilities support precise patrol routes and consistent monitoring coverage that meets stringent Japanese construction quality standards. The growing adoption of fully autonomous systems reflects Japanese construction industry leadership in advanced automation technologies and operational optimization.

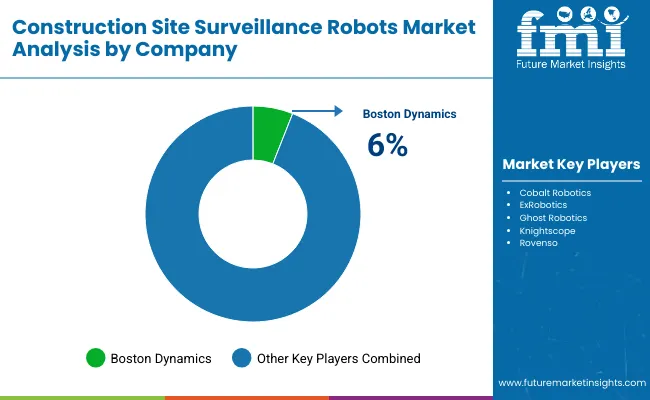

The construction site surveillance robots market is highly competitive, shaped by robotics manufacturers, security service providers, and construction technology firms that are racing to differentiate on mobility, autonomy, and multi-sensor intelligence. At one end of the spectrum, companies such as Boston Dynamics are pushing the frontier of sophisticated mobility platforms, bringing quadruped robots with payload flexibility into rugged, dynamic construction environments. At the other, providers like SMP Robotics and Knightscope are focusing on scalable wheeled UGVs and visible deterrent systems that combine AI-powered analytics with continuous patrol capabilities. This creates a bifurcated market premium innovators commanding attention with high-performance systems, and practical suppliers capturing share through cost-effective, outdoor-ready patrol robots.

Another layer of competition comes from firms emphasizing integrated security ecosystems rather than standalone hardware. Cobalt Robotics and Ava Robotics highlight the convergence of surveillance with human-robot collaboration and telepresence monitoring, targeting indoor facilities, staging areas, and remote management use cases. Drone-focused players such as Nightingale Security, DJI Enterprise, Parrot Professional, and Autel Robotics bring aerial coverage and rapid response capabilities, complementing ground patrols with wide-area visibility. Together, these approaches reveal an industry that is no longer about robots alone, but about comprehensive monitoring platforms that blend ground, aerial, and remote oversight into unified site-management systems.

Overall, the market is moving toward service-driven competition where innovation extends beyond hardware to include AI-driven threat detection, insurance-aligned reporting, and environmental monitoring compliance. Partnerships between robot OEMs, insurers, and construction technology vendors are emerging as decisive differentiators, since end users increasingly demand solutions that deliver cost efficiency, compliance assurance, and multi-functional value. In this landscape, success depends less on being the most advanced in mobility and more on being the most integrated into the workflows, budgets, and risk frameworks of modern construction projects.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Mobility Type | Wheeled UGV, Tracked UGV, and Other Configurations |

| Use Case | Security Patrol, Security Inspection, Progress Monitoring, and Hazard Detection |

| End User | Residential Construction, Commercial Construction, Industrial Construction, and Infrastructure Projects |

| Technology Type | Autonomous Navigation, Remote Control, and Hybrid Systems |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Boston Dynamics, SMP Robotics, Knightscope Inc., Cobalt Robotics, Ava Robotics, Nightingale Security, DJI Enterprise, Parrot Professional, Autel Robotics |

| Additional Attributes | Revenue analysis by mobility type, use case, and end user segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape assessment with established players and emerging technology providers, adoption patterns for autonomous versus remote-controlled systems, integration capabilities with existing construction management platforms, innovations in AI-powered analytics and multi-sensor surveillance technologies, and deployment strategies for various construction environments including urban, industrial, and infrastructure project applications. |

The global construction site surveillance robots market is valued at USD 968.3 million in 2025.

The size for the construction site surveillance robots market is projected to reach USD 1,330.5 million by 2035.

The construction site surveillance robots market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key mobility type segments in the construction site surveillance robots market are wheeled UGV, tracked UGV, and other configurations.

In terms of use case, security patrol segment is set to command 40.0% share in the construction site surveillance robots market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA