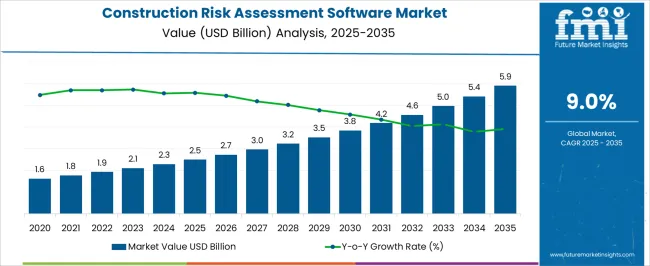

The construction risk assessment software market is expected to grow from USD 2.5 billion in 2025 to USD 5.9 billion by 2035, representing a CAGR of 9%. The increasing reliance on digital tools for risk evaluation, project monitoring, and compliance management within construction projects is driving this growth. Adoption of these solutions is being influenced by the need to minimize project delays, control costs, and enhance operational safety. The software is being integrated into workflows to provide predictive insights and systematic risk mitigation strategies.

Value growth is being observed as more firms prioritize data-driven decision-making to reduce financial and operational uncertainties. Over the forecast period, the construction risk assessment software market is projected to experience steady expansion, with incremental annual gains reflecting growing trust in digital risk management solutions. The adoption of advanced analytical capabilities and scenario modeling is being recognized as a key factor in market growth. Investment in software solutions is being motivated by improved project visibility, workflow optimization, and enhanced reporting capabilities. Competitive advantage is being achieved by providers offering customizable features, real-time monitoring, and integration with existing construction management systems. Market dynamics are being shaped by the increasing demand for reliable, data-centric approaches to construction risk management.

| Metric | Value |

|---|---|

| Construction Risk Assessment Software Market Estimated Value in (2025 E) | USD 2.5 billion |

| Construction Risk Assessment Software Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The construction risk assessment software market is estimated to hold a notable proportion within its parent markets, representing approximately 10-12% of the construction management software market, around 15-16% of the risk management software market, close to 8-9% of the project management software market, about 6-7% of the building information modeling (BIM) software market, and roughly 4-5% of the enterprise risk management software market. Collectively, the cumulative share across these parent segments is observed in the range of 43-49%, reflecting a significant presence of risk assessment solutions across construction, project management, and enterprise software applications.

The market has been influenced by the growing need for accurate risk identification, mitigation planning, and decision support, where operational accuracy, data integration, and predictive analytics are highly prioritized. Adoption is guided by procurement strategies that emphasize system compatibility, user accessibility, and real-time risk monitoring to enhance project reliability and reduce financial exposure. Market participants have focused on advanced algorithms, scenario modeling, and reporting capabilities to ensure consistent performance and actionable insights across diverse construction projects.

As a result, the construction risk assessment software market has not only captured a substantial share within core construction and risk management software domains but has also impacted project management, BIM, and enterprise risk management segments, highlighting its strategic role in improving project safety, resource allocation, and overall operational oversight across the construction sector.

The construction risk assessment software market is experiencing accelerating growth as the industry increasingly embraces digital tools to mitigate delays, safety incidents, and financial losses. The market is being driven by heightened awareness of regulatory compliance, project cost overruns, and the growing complexity of construction projects. As firms prioritize real-time monitoring and predictive analytics, the demand for intelligent software solutions capable of identifying and managing risk across planning, procurement, safety, and execution stages is rising.

Organizations are transitioning from manual or siloed systems toward integrated platforms that offer improved visibility, cross-team collaboration, and proactive decision-making. The increasing push toward digitization, especially among small and medium-sized construction firms, is creating new demand for scalable, cloud-native platforms. Regulatory bodies and insurers are also exerting pressure on contractors to adopt standardized risk protocols, further supporting adoption.

As infrastructure spending continues to rise globally, particularly in urban development and public works, construction risk assessment software is becoming an essential component of project lifecycle management This market is expected to see strong long-term demand driven by technology modernization, operational resilience goals, and stakeholder accountability requirements.

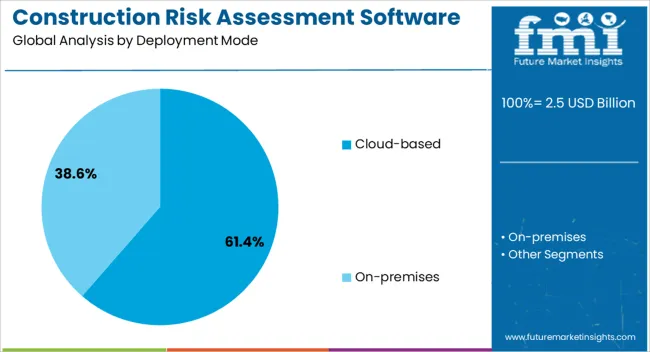

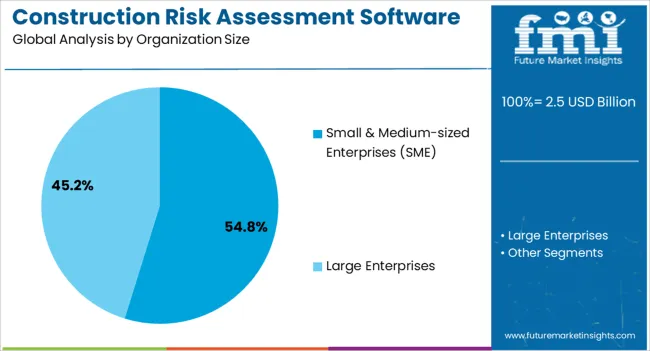

The construction risk assessment software market is segmented by deployment mode, organization size, end user, and geographic regions. By deployment mode, construction risk assessment software market is divided into Cloud-based and On-premises. In terms of organization size, construction risk assessment software market is classified into Small & Medium-sized Enterprises (SME) and Large Enterprises.

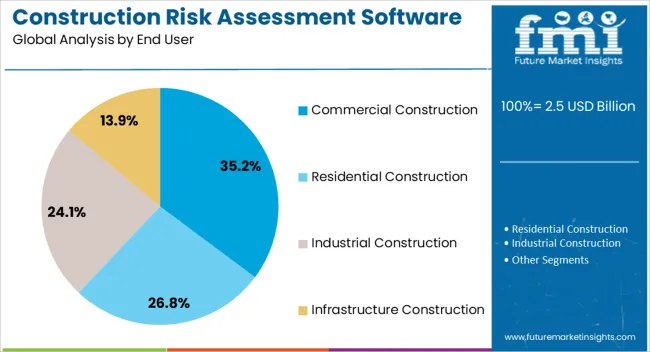

Based on end user, construction risk assessment software market is segmented into Commercial Construction, Residential Construction, Industrial Construction, and Infrastructure Construction. Regionally, the construction risk assessment software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud-based deployment mode is expected to hold 61.4% of the construction risk assessment software market revenue share in 2025, positioning it as the leading deployment model. This dominance is being driven by the increasing demand for scalability, ease of access, and reduced upfront infrastructure costs. Cloud-based platforms allow construction firms to deploy advanced risk assessment tools without the need for extensive IT investments, making them particularly attractive to small and mid-sized companies.

The ability to access real-time risk data and analytics from any location is enhancing collaboration across on-site and remote teams. These solutions also facilitate seamless integration with other construction management tools such as project scheduling, cost tracking, and safety compliance systems. Regular updates, data backups, and lower maintenance responsibilities are further contributing to widespread adoption.

As digital transformation becomes a priority in construction operations, the flexibility and responsiveness of cloud-based solutions are aligning with industry needs. The growing availability of cloud-native applications with advanced machine learning capabilities is reinforcing the segment’s leadership as firms seek to future-proof their risk management strategies.

The small and medium-sized enterprises segment is projected to account for 54.8% of the construction risk assessment software market revenue share in 2025, making it the largest segment by organization size. This leadership is being supported by the growing need among SMEs to manage project risks efficiently while working within limited resources and tighter budgets. As construction complexity increases and client expectations rise, small and mid-sized firms are turning to digital solutions that help prevent cost overruns, delays, and safety issues.

Cloud-based and subscription-based platforms are enabling SMEs to access enterprise-grade features without the burden of significant capital expenditure. Government support for digital transformation and increasing availability of user-friendly software tailored for smaller teams are also facilitating adoption. These firms are often more agile and willing to experiment with new tools that streamline operations and improve client satisfaction.

With risk management becoming a core differentiator in competitive bidding processes, SMEs are increasingly integrating risk assessment software to demonstrate compliance, control variability, and improve project outcomes This trend is expected to continue driving the segment’s expansion in the coming years.

The commercial construction segment is forecasted to capture 35.2% of the construction risk assessment software market revenue share in 2025, making it the leading end-user category. Its dominance is being driven by the heightened risk exposure associated with high-value, deadline-sensitive commercial projects. Developers and contractors in this segment face complex challenges related to site safety, labor availability, budget volatility, and contractual obligations, all of which require structured risk management frameworks.

The use of software platforms enables these stakeholders to identify, assess, and mitigate risks in real time, ensuring projects remain on schedule and within budget. With growing urbanization and the rapid development of office buildings, retail complexes, and hospitality infrastructure, commercial firms are increasingly prioritizing technology investments that reduce liability and enhance operational transparency. Regulatory compliance and insurance requirements are also compelling stakeholders to document and standardize risk control measures.

The scalability and predictive analytics features offered by modern platforms allow commercial builders to handle multiple concurrent projects while minimizing disruption. As competition intensifies and investor scrutiny grows, commercial construction companies are expected to further drive adoption of advanced risk assessment solutions.

The construction risk assessment software market is being driven by demand from large-scale construction projects and growing needs in project management and safety compliance. Cloud-based, integrated, and collaborative software solutions are emerging as dominant trends, while challenges such as high costs and complex data management are being addressed strategically. The market is being reinforced as construction firms increasingly rely on data-driven tools to predict, mitigate, and manage project risks. Growth is being sustained by the critical role of these solutions in ensuring efficient, safe, and financially controlled construction operations.

The demand for construction risk assessment software is being driven by large-scale projects and complex infrastructure developments. Construction firms are increasingly adopting software solutions to identify, evaluate, and mitigate potential risks during project planning and execution. Regulatory compliance, safety monitoring, and resource allocation are being enhanced through digital risk analysis, which reduces financial losses and schedule delays. Contractors and project managers are being supported by software that integrates historical project data, predictive modeling, and scenario analysis. As construction operations become more intricate, reliance on risk assessment software is being reinforced, ensuring that projects are completed efficiently and risks are systematically managed across multiple stages.

Opportunities are being unlocked as construction risk assessment software is being leveraged for project management and safety compliance. Construction companies, engineering consultancies, and infrastructure developers are employing these solutions to maintain workplace safety standards, comply with regulations, and optimize workflow. Integration with scheduling tools, cost estimation, and reporting systems is being adopted to enhance decision-making and operational transparency. The growing focus on risk reduction and financial protection in construction projects is providing software vendors with new growth avenues. Market penetration is being driven by the need for consistent, data-driven strategies to safeguard projects and personnel while reducing unforeseen liabilities.

Trends indicate that cloud-based and integrated risk assessment solutions are being increasingly favored. Construction risk assessment software is being enhanced with remote access, collaborative platforms, and real-time updates to ensure effective project oversight. Integration with Building Information Modeling (BIM), project management suites, and analytics tools is being widely implemented to improve accuracy in risk identification and response planning. Modular and scalable software architectures are being adopted to support multiple project sizes and types. The focus on connected, centralized systems is positioning risk assessment software as a critical tool for streamlined operations and proactive mitigation strategies in construction projects worldwide.

Challenges in the construction risk assessment software market are arising from high implementation costs and complex data management. Organizations face difficulties in software integration with existing systems, employee training, and ongoing maintenance expenses. Managing large volumes of project data while ensuring accuracy and security is being considered a critical concern. Resistance from traditional project management teams and the learning curve associated with new digital tools are slowing adoption in some regions. Companies are compelled to adopt structured change management strategies and invest in user-friendly solutions to overcome these challenges, making operational efficiency and risk control the primary drivers for long-term market acceptance.

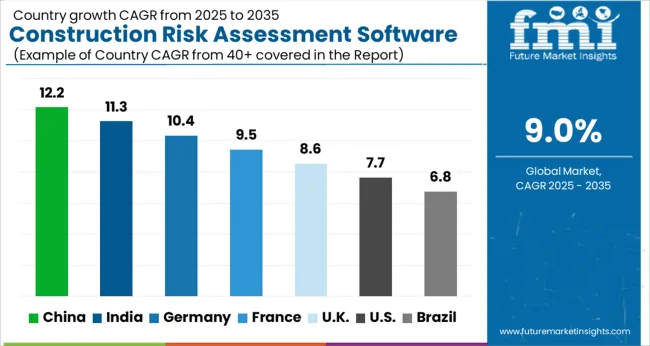

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

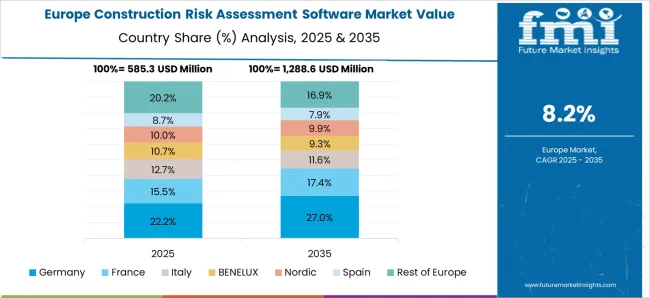

The global construction risk assessment software market is projected to grow at a CAGR of 9% from 2025 to 2035. China leads with a growth rate of 12.2%, followed by India at 11.3%, and France at 9.5%. The United Kingdom records a growth rate of 8.6%, while the United States shows the slowest growth at 7.7%. Increasing construction complexity, growing adoption of digital project management tools, and the need to minimize operational risks are driving market growth. Emerging markets such as China and India benefit from rapid infrastructure development, urban expansion, and government-backed construction projects. Developed markets like the USA, UK, and France focus on regulatory compliance, technological integration, and risk mitigation strategies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The construction risk assessment software market in China is projected to grow at a CAGR of 12.2%, fueled by rapid urbanization, large-scale infrastructure projects, and government initiatives to ensure construction safety. Contractors and project managers increasingly adopt software solutions to identify, monitor, and mitigate risks, enhancing project efficiency and reducing cost overruns. The demand for integrated digital platforms that combine project planning, risk analytics, and compliance tracking is rising. Rising awareness of occupational safety standards, construction quality requirements, and regulatory compliance drives adoption. Investments in AI-enabled predictive risk assessment tools and cloud-based project monitoring systems further strengthen the market presence.

The construction risk assessment software market in India is expected to grow at a CAGR of 11.3%, supported by expanding urban infrastructure, commercial construction, and industrial development. Growing emphasis on construction safety, compliance with local and international standards, and digital project management adoption drives software integration. Contractors leverage these solutions to optimize workflows, monitor hazards, and ensure timely completion of projects. Investments in cloud-based, mobile-accessible platforms enable real-time risk tracking across multiple sites. Rising demand for eco-efficient and cost-effective construction practices also contributes to market expansion. The market benefits from strong government support for urbanization initiatives and infrastructure modernization, further fueling software adoption.

The construction risk assessment software market in France is projected to grow at a CAGR of 9.5%, driven by stringent safety regulations, risk management mandates, and increasing adoption of digital tools in construction management. Large-scale industrial and commercial projects require software solutions that identify hazards, mitigate potential delays, and maintain regulatory compliance. Integration of AI and predictive analytics enhances decision-making in planning and project execution. Growing awareness of environmental safety, labor protection, and operational efficiency is further boosting adoption. Contractors increasingly rely on cloud-based solutions to monitor multiple sites, ensure workflow efficiency, and track compliance in real-time.

The construction risk assessment software market in the UK is expected to grow at a CAGR of 8.6%, supported by demand from urban redevelopment, commercial, and industrial construction projects. Stringent health and safety standards drive adoption of risk monitoring solutions. Contractors and project managers use software to streamline operations, mitigate hazards, and ensure regulatory compliance. Cloud-based platforms and predictive analytics improve decision-making, reduce delays, and lower operational costs. Awareness of risk management practices and the integration of digital technologies into project management enhance market expansion. Adoption is also influenced by government-backed construction projects and increasing private sector investment in smart construction solutions.

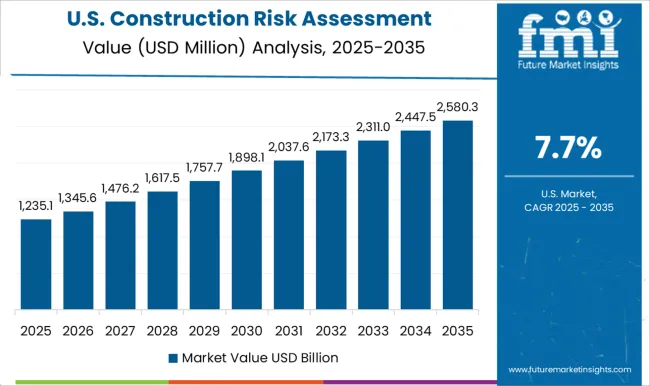

The construction risk assessment software market in the USA is projected to grow at a CAGR of 7.7%, with growth supported by large-scale commercial, industrial, and infrastructure projects. Increasing emphasis on project risk mitigation, regulatory compliance, and digital transformation encourages adoption of advanced software solutions. Contractors use integrated platforms for hazard monitoring, project tracking, and compliance reporting. Investments in AI-enabled predictive tools, cloud computing, and mobile accessibility strengthen operational efficiency. Rising awareness of construction safety standards, environmental requirements, and the need to reduce delays and cost overruns further drive software adoption.

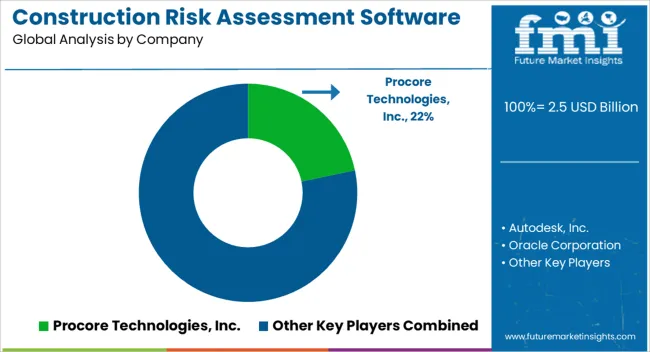

The construction risk assessment software market is increasingly shaped by the need for safety compliance, real-time project monitoring, and risk mitigation in large-scale infrastructure projects. Key players such as Procore Technologies, Inc., Autodesk, Inc., and Oracle Corporation focus on delivering cloud-based platforms that integrate project management, hazard analysis, and reporting tools. Buildertrend Solutions, Inc., Trimble Inc., and Bentley Systems, Incorporated emphasize data-driven risk assessment, leveraging predictive analytics and AI to identify potential project delays, safety incidents, and cost overruns. Software brochures highlight features such as automated risk scoring, customizable dashboards, regulatory compliance tracking, and mobile access, allowing construction managers to make informed decisions while ensuring operational efficiency. Companies such as Raken, Inc. differentiate through mobile-first solutions and field-level risk documentation, enhancing on-site monitoring and accountability. Competition in this market is primarily driven by technological innovation, integration capabilities, and user experience.

Providers aim to offer scalable, customizable platforms that support diverse project types, from commercial buildings to industrial infrastructure. Strategic partnerships and acquisitions are leveraged to expand functionality, while product brochures emphasize workflow automation, safety compliance, and real-time reporting. Market growth is supported by increasing adoption of digital construction solutions, rising regulatory requirements, and the demand for proactive risk management. Overall, the market reflects a convergence of advanced software technology, analytics, and construction expertise, fostering safer and more efficient project execution worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Deployment Mode | Cloud-based and On-premises |

| Organization Size | Small & Medium-sized Enterprises (SME) and Large Enterprises |

| End User | Commercial Construction, Residential Construction, Industrial Construction, and Infrastructure Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procore Technologies, Inc., Autodesk, Inc., Oracle Corporation, Buildertrend Solutions, Inc., Trimble Inc., Bentley Systems, Incorporated, and Raken, Inc. |

| Additional Attributes | Dollar sales by software type (risk analysis, project management, compliance tracking) and deployment model (cloud-based, on-premises) are key metrics. Trends include rising demand for real-time risk monitoring, growth in large-scale construction projects, and adoption of predictive analytics. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global construction risk assessment software market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the construction risk assessment software market is projected to reach USD 5.9 billion by 2035.

The construction risk assessment software market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in construction risk assessment software market are cloud-based and on-premises.

In terms of organization size, small & medium-sized enterprises (sme) segment to command 54.8% share in the construction risk assessment software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA