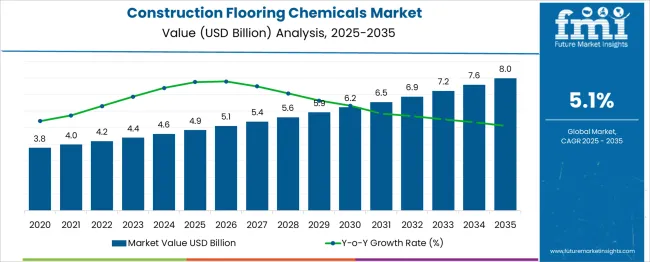

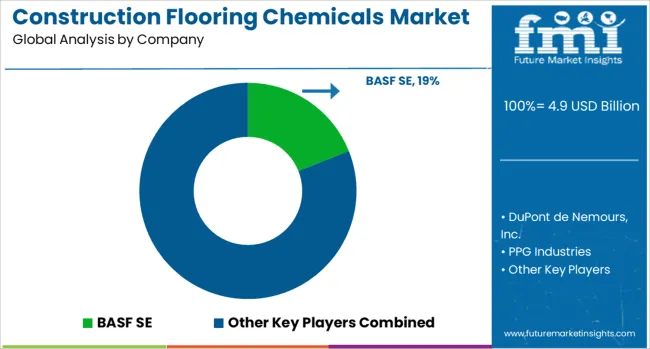

The Construction Flooring Chemicals Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. Between 2020 and 2025, the market expands from USD 3.8 billion to USD 4.9 billion. This period is marked by established chemical manufacturers strengthening their portfolios with innovative products that enhance flooring durability, resistance to wear and chemicals, and aesthetic appeal.

The demand is propelled by increased construction activities in commercial and residential sectors alongside rising renovation projects. Smaller players face challenges due to limited R&D capabilities and distribution reach amidst intensifying competition. From 2026 to 2030, the market advances from USD 5.1 billion to USD 6.5 billion, fueled by new entrants offering eco-friendly and low-VOC chemical solutions in response to stricter environmental regulations and growing consumer awareness about indoor air quality. These companies leverage digital marketing and regional partnerships to gain market share. Between 2031 and 2035, the market is expected to expand from USD 6.9 billion to USD 8.0 billion. Leading manufacturers increase investments in product innovation, including smart and self-healing flooring chemicals, while expanding their global footprint, particularly in emerging economies with rising construction demand. Despite strong growth, some legacy players experience market share erosion due to limited adaptability to changing regulatory and consumer preferences.

| Metric | Value |

|---|---|

| Construction Flooring Chemicals Market Estimated Value in (2025 E) | USD 4.9 billion |

| Construction Flooring Chemicals Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The construction flooring chemicals market is gaining significant momentum due to the rising demand for durable, chemical-resistant, and aesthetic flooring in commercial, industrial, and residential infrastructure. Increased urbanization, stricter building codes, and rising investments in infrastructure refurbishment have led to higher adoption of advanced chemical-based flooring systems.

Technological advancements in formulation chemistry have enabled the development of faster-curing, environmentally compliant, and longer-lasting products. In parallel, sustainability trends are influencing manufacturers to innovate with low-VOC, solvent-free, and bio-based chemicals.

As energy-efficient green buildings become the norm, flooring chemicals that offer thermal stability, wear resistance, and aesthetic appeal are gaining traction across both new-build and retrofitting projects.

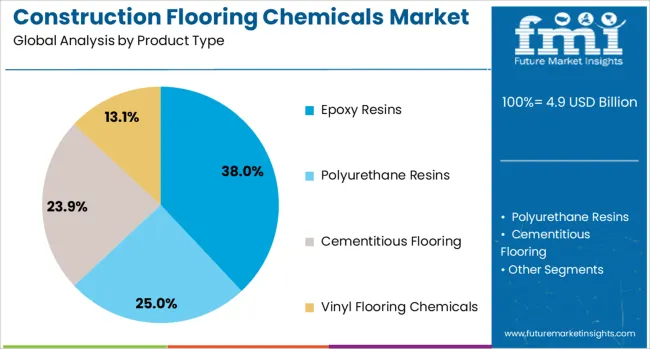

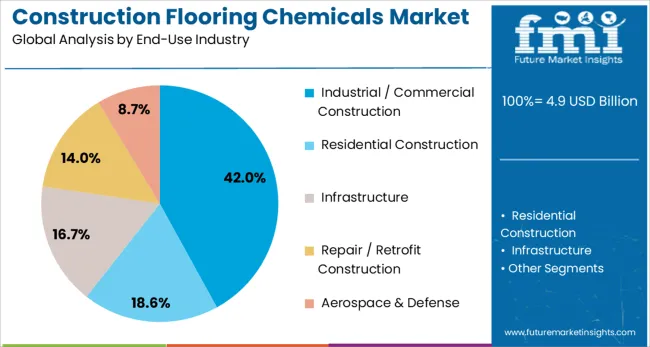

The construction flooring chemicals market is segmented by product type, end-use industry, application, formulation type, flooring type classification, and geographic regions. By product type, the construction flooring chemicals market is divided into Epoxy Resins, Polyurethane Resins, Cementitious Flooring, Vinyl Flooring, and Chemicals. In terms of end-use industry, the construction flooring chemicals market is classified into Industrial / Commercial Construction, Residential Construction, Infrastructure, Repair / Retrofit Construction, and Aerospace & Defense.

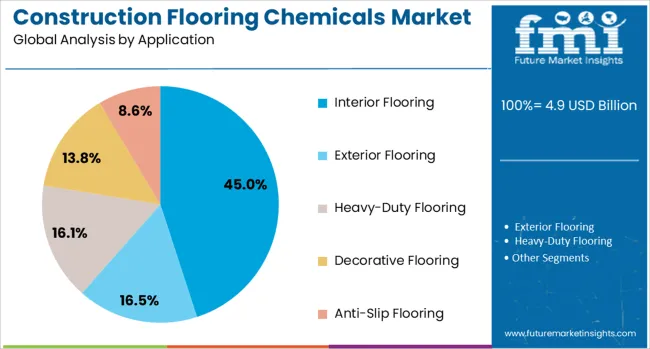

Based on the application, the construction flooring chemicals market is segmented into Interior Flooring, Exterior Flooring, Heavy-Duty Flooring, Decorative Flooring, and Anti-Slip Flooring. By formulation type, the construction flooring chemicals market is segmented into Water-based Formulations, Solvent-based Formulations, Powder-based Formulations, and Hybrid Formulations. By flooring type classification, the construction flooring chemicals market is segmented into Resilient Flooring, Soft Covering, Non-Resilient Flooring, and Others. Regionally, the construction flooring chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Epoxy resins are expected to dominate the construction flooring chemicals market with a 38.00% revenue share by 2025, driven by their superior mechanical strength, chemical resistance, and ease of application. Their widespread usage in high-traffic environments such as warehouses, hospitals, and manufacturing plants stems from their long service life and seamless finish.

The segment is also benefiting from innovations in water-based and solvent-free epoxy formulations that comply with environmental standards.

Rapid industrialization in emerging economies and growing demand for anti-slip, easy-to-maintain surfaces are further cementing the role of epoxy resins in commercial and industrial flooring.

The industrial/commercial construction sector is projected to account for 42.00% of the total market share in 2025, making it the leading end-use industry. This segment’s dominance is fueled by the need for highly durable, hygienic, and impact-resistant flooring in facilities such as factories, malls, airports, and hospitals.

Construction chemicals tailored for this sector are engineered to meet specialized requirements including anti-microbial protection, electrostatic discharge (ESD) control, and high compressive strength.

Additionally, the accelerated growth of logistics centers, cleanrooms, and retail chains is amplifying demand for performance-oriented flooring systems that withstand high operational loads and footfall.

Interior flooring applications are anticipated to lead the construction flooring chemicals market with a 45.00% share by 2025, supported by rising demand for visually appealing, low-maintenance, and resilient flooring in both commercial and residential spaces. This segment’s growth is being influenced by interior designers and architects emphasizing functional aesthetics and floor protection.

Chemical formulations used in interior flooring are optimized for color retention, UV stability, and resistance to abrasion, stains, and moisture.

The renovation wave in aging infrastructure and the rapid rollout of smart buildings are driving investments in specialty flooring solutions, especially in office spaces, educational institutions, and healthcare environments.

Construction flooring chemicals are gaining importance due to demand for durability, safety compliance, and aesthetic performance. Renovation projects and regulatory standards further reinforce the market’s role in enhancing flooring quality across commercial and industrial applications.

Demand for construction flooring chemicals is being influenced by growth in commercial and industrial infrastructure development. The use of epoxy coatings, polyurethane finishes, and advanced sealants has become essential to improve flooring durability and load-bearing capacity. Commercial spaces such as shopping complexes, hospitals, and educational institutions require flooring solutions with anti-slip and chemical-resistant properties. Similarly, industrial facilities adopt these chemicals for heavy-duty floors to minimize abrasion and maintenance costs. Enhanced performance expectations in high-traffic environments create opportunities for suppliers to introduce premium flooring chemical systems. Product adoption is supported by regulations that emphasize surface quality and safety, making these chemicals a preferred choice in flooring applications across varied environments.

Preference for flooring solutions that provide longer service life and cost efficiency is contributing to market expansion. Construction flooring chemicals such as sealers, self-leveling compounds, and admixtures enhance strength and visual appeal, which is crucial for projects in commercial, retail, and hospitality sectors. A growing inclination toward decorative and performance-driven surfaces has increased demand for advanced chemical formulations that provide resistance to moisture and aggressive chemicals. These solutions help minimize downtime during installation, which benefits contractors and project owners seeking quick turnaround. The integration of such products ensures functional and aesthetic performance, reinforcing their necessity in modern flooring systems.

The construction flooring chemicals segment benefits from the increasing volume of repair and refurbishment projects across developed and emerging economies. Renovation in residential buildings, malls, and office spaces is driving repeat demand for coatings, adhesives, and curing compounds. Property owners prioritize flooring solutions that enhance wear resistance and deliver cost efficiency over extended periods. Renovation activities in industrial plants also push demand for chemical treatments that strengthen surfaces without full reconstruction. Such trends highlight the importance of value-added products that improve durability and appearance. Companies are leveraging this demand by offering quick-curing, low-maintenance flooring chemicals designed to meet industry standards for safety and reliability.

Governmental and institutional regulations focusing on safety and performance standards are shaping product development strategies. Compliance with specifications for slip resistance, hygiene, and chemical tolerance in healthcare and food industries has resulted in higher adoption of flooring chemicals. These standards push manufacturers to formulate products with superior adhesion and surface stability to withstand harsh operational environments. In sectors like pharmaceuticals, where contamination risk is critical, flooring chemicals that enable seamless, easy-to-clean surfaces are preferred. Performance certification and third-party validation have become decision-making factors for contractors and end-users, positioning regulated flooring chemical solutions as a priority in critical infrastructure development.

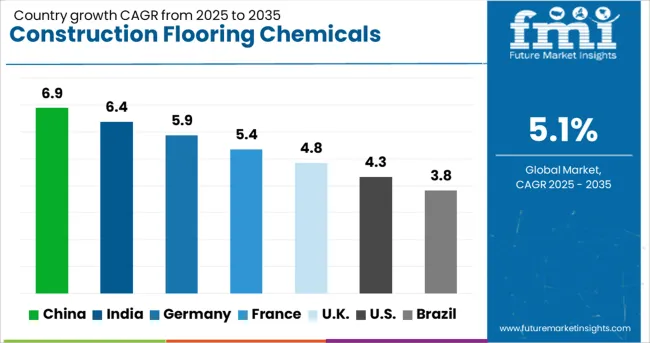

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The construction flooring chemicals market is projected to grow globally at a CAGR of 5.1% from 2025 to 2035, with China leading at 6.9% as industrial and commercial flooring upgrades drive demand for epoxy coatings and advanced sealants. India follows at 6.4%, driven by rapid infrastructure projects and emphasis on cost-efficient yet high-performance flooring solutions. France records a steady 5.4%, supported by refurbishment activity in residential and institutional segments. The UK achieves 4.8% growth, shaped by premium flooring applications in retail and hospitality developments. The USA maintains a moderate 4.3% CAGR, driven by adoption of performance-oriented chemicals for renovation and industrial flooring enhancements, positioning Asia as a key growth center.

The CAGR for the construction flooring chemicals market in the United Kingdom was estimated at 3.6% during 2020-2024 and improved to 4.8% for the 2025–2035 period. This increase in growth is supported by a shift toward premium flooring chemical applications in retail, healthcare, and hospitality projects. Renovation activity in older commercial structures accelerated the demand for epoxy and polyurethane-based solutions, as these provide extended durability and compliance with safety norms. Contractors adopted quick-curing flooring compounds to reduce project downtime, which enhanced product adoption. Consumer awareness of aesthetics and performance has positioned chemical flooring solutions as a critical component in project specifications.

The CAGR for the Chinese construction flooring chemicals market was recorded at 5.4% between 2020-2024 and surged to nearly 6.9% during 2025–2035. This notable rise is driven by extensive industrial flooring projects and increased spending on high-performance chemical solutions for commercial complexes. The rapid expansion of logistics hubs and manufacturing facilities created a strong requirement for abrasion-resistant and chemical-resistant flooring systems. Adoption of advanced sealants and self-leveling compounds became critical as project owners prioritized long-term maintenance cost reduction. Domestic suppliers leveraged regional distribution networks to meet escalating demand from both private and government-backed construction initiatives, positioning China as a central growth driver in Asia.

India’s construction flooring chemicals market registered a CAGR of 5.1% during 2020-2024, which further advanced to 6.4% in the 2025–2035 period. The higher growth projection is associated with expanding infrastructure and residential development, coupled with increasing usage of advanced chemical formulations in high-footfall areas. Adoption of epoxy coatings and sealants in commercial properties enhanced due to their cost-effectiveness and improved lifecycle performance. Industrial warehouses and logistics parks incorporated chemical flooring systems to withstand heavy load operations. Strategic procurement by real estate developers and institutional contractors boosted market penetration for flooring chemicals, while government programs supporting urban redevelopment and public projects indirectly elevated demand in Tier-2 and Tier-3 cities.

The CAGR for France’s construction flooring chemicals segment was nearly 4.3% from 2020-2024, later improving to 5.4% between 2025–2035. Increased renovation across institutional and heritage buildings supported demand for advanced flooring chemicals offering aesthetic enhancement alongside structural strength. Public procurement projects focused on flooring systems with strong adherence and chemical resistance, particularly in educational and municipal facilities. Growing preference for decorative finishes and self-leveling compounds stimulated innovation among regional suppliers. Compliance with hygiene and safety regulations reinforced the use of epoxy and polyurethane-based flooring chemicals across healthcare and hospitality spaces, strengthening market adoption and supplier margins in performance-driven flooring applications.

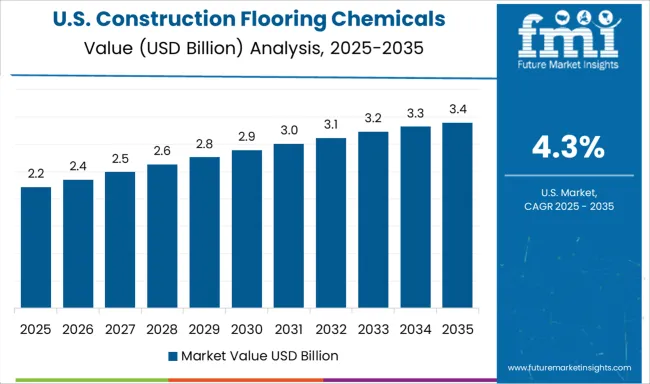

The CAGR for the United States construction flooring chemicals market was estimated at 3.4% during 2020-2024 and later advanced to 4.3% for the 2025–2035 period. This improvement is associated with heightened refurbishment activities in commercial real estate, warehousing, and institutional buildings. Demand for epoxy coatings and polyurethane finishes gained traction as businesses sought flooring systems with superior durability and chemical resistance for industrial environments. Renovation of aging public infrastructure, particularly in healthcare and educational facilities, boosted adoption of self-leveling compounds and sealers to enhance floor strength and compliance with safety standards. The growing need for low-maintenance flooring solutions in large-scale facilities continues to influence procurement decisions.

The construction flooring chemicals market is characterized by the presence of major multinational corporations and specialized chemical producers, each contributing to product innovation and regional market penetration. BASF SE and DuPont de Nemours, Inc. maintain strong portfolios through advanced polymer and resin solutions tailored for flooring applications. PPG Industries leverages its expertise in coatings to deliver high-performance surface treatments, while Mitsubishi Chemical Corporation focuses on formulations enhancing structural integrity and abrasion resistance. RPM International Inc, along with its subsidiary Tremco Inc, emphasizes specialty chemical systems for industrial and commercial flooring requirements.

Ineos Group Ltd. and Forbo Holding AG bring diversified chemical offerings with significant engagement in construction sectors. SABIC (under Saudi Aramco) and The Dow Chemical Company strengthen their global footprint with premium-grade chemical solutions for durability and moisture resistance. ExxonMobil Corporation and LG Chem supply essential raw materials and additives critical for high-performance flooring systems, while Huntsman Corporation develops polyurethane-based innovations for advanced applications. Toray Industries and Sinopec contribute to supply chain stability through material integration and large-scale production capacities, supporting cost-efficient procurement. Competitive differentiation in this segment is defined by rapid-curing compounds, improved chemical resistance, and adherence to evolving safety standards, as companies intensify focus on end-user requirements for functional and aesthetic performance in modern construction projects.

Manufacturers in the construction flooring chemicals segment focused on strategies such as expanding product portfolios with fast-curing and low-VOC formulations, optimizing supply chains for cost efficiency, and strengthening partnerships with distributors in high-growth regions during 2024 and 2025. Demand drivers included rising renovation projects, stricter safety compliance, and increased adoption of performance-based flooring systems in commercial and industrial sectors. Digital procurement platforms and technical service support were also emphasized to boost customer engagement and improve installation efficiency, ensuring strong positioning in competitive markets while meeting evolving end-user expectations for durability and lifecycle performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Product Type | Epoxy Resins, Polyurethane Resins, Cementitious Flooring, and Vinyl Flooring Chemicals |

| End-Use Industry | Industrial / Commercial Construction, Residential Construction, Infrastructure, Repair / Retrofit Construction, and Aerospace & Defense |

| Application | Interior Flooring, Exterior Flooring, Heavy-Duty Flooring, Decorative Flooring, and Anti-Slip Flooring |

| Formulation Type | Water-based Formulations, Solvent-based Formulations, Powder-based Formulations, and Hybrid Formulations |

| Flooring Type Classification | Resilient Flooring, Soft Covering, Non-Resilient Flooring, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, DuPont de Nemours, Inc., PPG Industries, Mitsubishi Chemical Corporation, RPM International Inc, Ineos Group Ltd., Forbo Holding AG, SABIC (Saudi Aramco), The Dow Chemical Company, ExxonMobil Corporation, LG Chem, Huntsman Corporation, Tremco Inc (RPM International Inc), Toray Industries, and Sinopec |

| Additional Attributes | Dollar sales by product type, share by application segment, pricing trends, competitive benchmarking, raw material cost analysis, regional demand outlook, distribution channel performance, regulatory compliance requirements, future growth forecasts. |

The global construction flooring chemicals market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the construction flooring chemicals market is projected to reach USD 8.0 billion by 2035.

The construction flooring chemicals market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in construction flooring chemicals market are epoxy resins, polyurethane resins, cementitious flooring and vinyl flooring chemicals.

In terms of end-use industry, industrial / commercial construction segment to command 42.0% share in the construction flooring chemicals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA