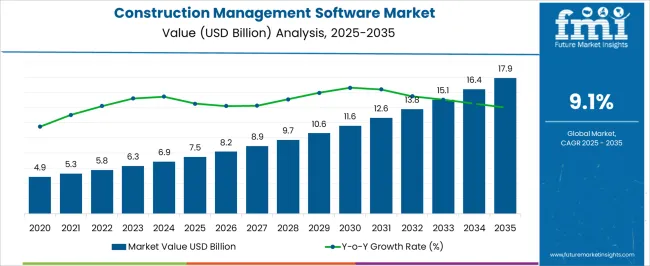

The construction management software category is projected to grow from USD 7.5 billion in 2025 to USD 17.9 billion in 2035 at a CAGR of 9.1%. Year-on-year values rise to 8.2 in 2026, 8.9 in 2027, and 9.7 in 2028, then 10.6 in 2029. Progress to 11.6 in 2030 signals normalization of digital workflows across estimating, scheduling, and submittal control. Field reporting, RFI tracking, and issue logs are being consolidated on mobile platforms that synchronize plans and photos.

The YoY curve looks credible and resilient, driven by rework reduction, faster closeouts, and ready documentation. From 2031 onward, values advance to 12.6 in 2031, 13.8 in 2032, 15.1 in 2033, 16.4 in 2034, and 17.9 in 2035, marking adoption. Contract administration, progress billing, and change order control are being centralized, with integrations to ERP, BIM viewers, and e-signature tools improving handover quality. Owners and EPCs are mandating portfolio-wide rollouts to enforce standard templates and role-based permissions. Vendors that deliver stable uptime, intuitive UX, offline sync, and open APIs will capture share, because operational risk is lowered and claims are resolved faster when evidence is organized from day one.

| Metric | Value |

|---|---|

| Construction Management Software Market Estimated Value in (2025 E) | USD 7.5 billion |

| Construction Management Software Market Forecast Value in (2035 F) | USD 17.9 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The construction management software segment is estimated to account for 28% of the AEC software market, 16% of the project portfolio management software market, 24% of the construction technology software market, 18% of the building information modeling software market, and 12% of the field service management software market, yielding an aggregated share of about 98% across these parent categories. This footprint is viewed as decisive because construction management suites have been positioned as the operational control layer for contractors, owners, and EPC firms.

Core value has been realized through integrated scheduling, cost control, RFIs, submittals, change orders, and punch list execution tied to document control and issue tracking. Decision makers have prioritized mobile stability, offline capture, audit trails, and open APIs that feed estimating, accounting, and ERP stacks, which places platforms with reliable integrations at an advantage. Strong outcomes have been observed where BIM model context informs quantities, progress verification, and clash-driven rework prevention, tightening links between design teams and site crews. Vendor selection has been shaped by total cost of ownership, data governance, and implementation support that secures user adoption across trades.

The construction management software market is witnessing strong growth, driven by the increasing need for digital tools that enhance efficiency, coordination, and transparency in construction projects. Rising adoption of advanced technologies such as cloud computing, artificial intelligence, and real-time analytics is transforming the way construction projects are planned, executed, and monitored. The industry is benefiting from the growing focus on reducing project delays, controlling costs, and improving resource allocation, which is prompting contractors, developers, and project managers to invest in integrated software platforms.

Government initiatives promoting smart infrastructure development and public-private partnerships are further supporting market expansion. Vendors are increasingly offering scalable and customizable solutions to meet diverse needs across residential, commercial, and industrial projects.

The ability of modern platforms to integrate with design tools, procurement systems, and financial management applications is improving workflow efficiency and decision-making. With construction activity expected to rise globally and digital transformation accelerating across the sector, the market is positioned for sustained growth over the coming decade.

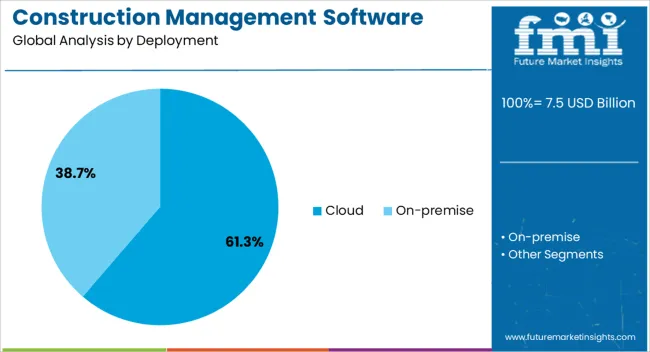

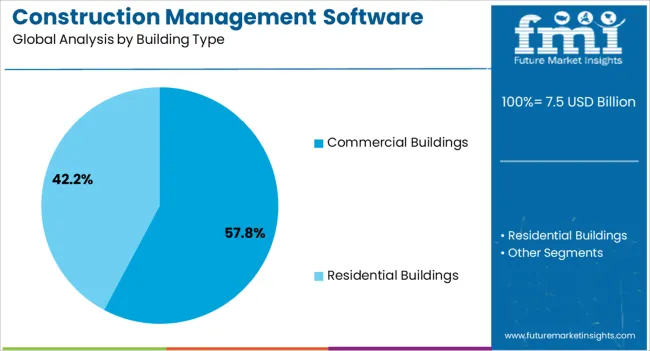

The construction management software market is segmented by deployment, building type, application, end-use, and geographic regions. By deployment, construction management software market is divided into Cloud and On-premise. In terms of building type, construction management software market is classified into Commercial Buildings and Residential Buildings.

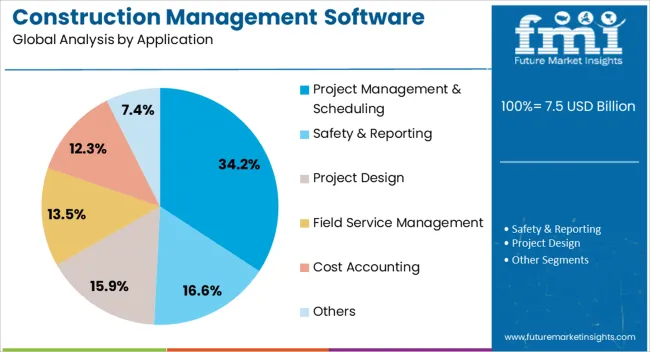

Based on application, construction management software market is segmented into Project Management & Scheduling, Safety & Reporting, Project Design, Field Service Management, Cost Accounting, and Others. By end-use, construction management software market is segmented into Builders & Contractors, Construction Managers, and Engineers & Architects. Regionally, the construction management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud deployment segment is projected to hold 61.3% of the construction management software market revenue share in 2025, making it the dominant deployment type. Its leadership is supported by the flexibility, scalability, and cost-efficiency it offers compared to on-premises solutions. Cloud-based platforms enable remote access to project data from any location, allowing stakeholders to collaborate in real time, which is critical in multi-site and large-scale construction projects.

Regular updates, data backups, and security enhancements are managed by service providers, reducing the burden on in-house IT teams and ensuring systems remain up-to-date. This deployment model also supports seamless integration with mobile applications, enabling field teams to input and retrieve information instantly, improving accuracy and decision-making.

The growing adoption of subscription-based pricing models is making cloud solutions more accessible to small and medium-sized enterprises, further boosting demand. As construction companies increasingly prioritize agility and operational efficiency, cloud deployment is expected to remain the preferred choice, reinforcing its dominant position in the market.

The commercial buildings segment is expected to account for 57.8% of the construction management software market revenue share in 2025, positioning it as the leading building type. Its dominance is being driven by the significant complexity and scale of commercial construction projects, which require robust planning, coordination, and tracking tools to ensure timely delivery and cost control. The software enables integration of various functions such as budgeting, scheduling, procurement, and compliance management, which is critical for high-value projects.

Increasing investment in commercial infrastructure, including office complexes, retail centers, and hospitality facilities, is generating sustained demand for advanced project management tools. The segment is also benefiting from heightened emphasis on sustainability and energy efficiency, as software platforms can support green building certifications and performance monitoring.

Global urbanization trends, coupled with expanding commercial real estate markets in emerging economies, are further reinforcing adoption. As project stakeholders seek to improve transparency, mitigate risks, and streamline workflows, the commercial buildings segment is expected to maintain its leadership in the market.

The project management and scheduling application segment is anticipated to represent 34.2% of the construction management software market revenue share in 2025, making it the leading application area. This leadership is being supported by the critical role scheduling and resource management play in ensuring timely and cost-effective project completion. The software allows project managers to create detailed timelines, allocate resources efficiently, and track progress against milestones in real time.

Enhanced visibility into project workflows helps identify potential delays early, enabling proactive interventions that prevent cost overruns and disruptions. Integration with other modules, such as procurement, budgeting, and quality control, further strengthens the utility of these applications.

The segment is also benefiting from the rising use of mobile and cloud-based solutions, allowing on-site teams to access and update schedules instantly. As construction projects grow in complexity and stakeholders demand greater accountability, project management and scheduling software is expected to remain an indispensable tool, solidifying its position as the largest application segment in the market.

The construction management software market is projected to grow steadily as contractors, owners, and consultants pursue tighter cost control, faster closeout, and transparent collaboration across dispersed project teams. Demand is reinforced by needs around schedule reliability, budget tracking, RFIs, submittals, and field reporting that integrate with accounting and ERP. Opportunities are opening in mid-market design-build firms, specialty trades, and owner-led programs seeking standardized workflows. Trends highlight mobile-first capture, BIM coordination, and analytics tied to earned value. Challenges persist around change management, per-seat pricing clarity, legacy system integration, and uneven jobsite connectivity.

Demand has been strengthened by general contractors, EPCs, and owner representatives that require predictable delivery, audit-ready documentation, and faster decision cycles. Cloud platforms that combine scheduling, cost codes, commitments, change orders, and pay apps with RFIs, submittals, and transmittals are being selected to reduce rework. Field teams favor mobile apps for daily logs, photos, issues, punch lists, and timecards that sync to the master schedule and budget. Safety and quality checklists with geo-tagged evidence help meet contract compliance while reducing disputes. Owners expect real-time dashboards, earned value metrics, and forecast-at-complete views to keep programs on track. In an opinionated view, the most persuasive pull comes from eliminating siloed spreadsheets and email threads. When drawing management, version control, and e-signatures are tied directly to cost events and look-ahead planning, supervisors gain a single source of truth that consistently shortens closeout and improves cash flow timing.

Opportunities are emerging where software connects natively with accounting, payroll, estimating, procurement, and fleet telematics so that budgets, purchase orders, and equipment hours flow without rekeying. Implementation services, template libraries, and data migration packages are being bundled to de-risk adoption for multi-office contractors. Verticalized offerings for healthcare, education, interiors, and civil infrastructure are gaining traction with prebuilt forms, commissioning checklists, and handover packs aligned to each segment. Partner marketplaces that include reality capture, drone mapping, and payment management widen upsell scope. Mid-market builders favor tiered subscriptions and unlimited-project models, while large enterprises seek API access, SSO, audit logs, and regional data residency. In our view, the richest upside arrives when vendors sell outcomes not modules, pairing training, baseline templates, and KPI reviews that lift schedule adherence and change order recovery. Channel alliances with resellers and consultants help accelerate wins on public and PPP frameworks.

Trends point to mobile-first capture with offline sync, QR or NFC location tagging, and photo markups that anchor defects to rooms and assets. BIM coordination is being linked to issue tracking so model elements carry assignments, due dates, and status visible in meetings. Real-time dashboards blend field progress, earned value, production rates, and look-ahead constraints to guide pull planning. Document control emphasizes version history, transmittal logs, and automated distribution lists, reducing plan miscommunication. E-signatures and secure share links ease approvals for inspectors and owners. Data warehousing and open APIs support portfolio analytics, while role-based permissions protect commercial terms. From an opinionated stance, the decisive shift is toward end-to-end traceability. When every task, photo, and cost event is timestamped and reportable, closeout manuals and facilities handover become byproducts of daily work rather than last-minute compilations that stall practical completion.

Challenges arise from field resistance to process change, inconsistent device policies, and spotty connectivity that undermines real-time sync. Per-user pricing, storage overages, and add-on integration fees create budgeting uncertainty for long projects with rotating subcontractors. Legacy ERPs and drawing repositories without modern APIs hinder bi-directional data exchange, forcing manual workarounds. Variations in report formats, naming conventions, and approval matrices across owners increase configuration effort. Data retention rules, audit requirements, and privacy reviews extend procurement cycles. Training gaps lead to underused features, weak photo standards, and incomplete issue closure. Our view is that many setbacks are preventable through offline-first design, transparent SKU packaging, and publishable implementation playbooks. Vendors that offer fixed-scope onboarding, regional support centers, and health-score analytics for user adoption will convert trials to renewals, while tool-only pitches risk churn when deadlines compress and teams revert to email and spreadsheets.

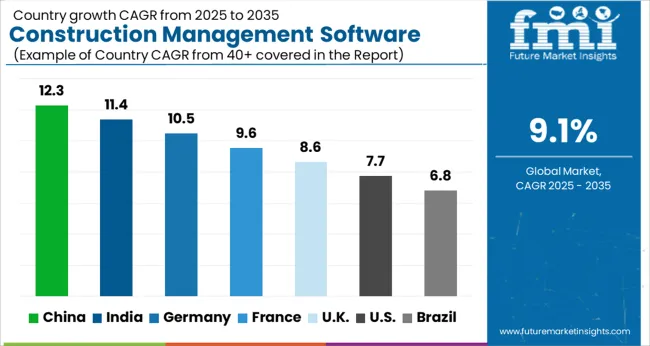

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global construction management software market is projected to grow at 9.1% from 2025 to 2035. China leads at 12.3%, followed by India 11.4% and Germany 10.5%; the United Kingdom 8.6% and United States 7.7% follow. Growth is being pulled by site-to-office coordination, cost and schedule control, and standardized closeout. Mobile field capture, photo mark-ups, RFIs, submittals, and change orders are being consolidated into cloud workflows with BIM/CDE and ERP links. E-signatures, audit trails, and role-based approvals are being favored to reduce disputes. Asia is expected to outpace on volume deployments and localized interfaces; Germany is set to emphasize compliance and documentation rigor; the UK is projected to expand through framework contracts; the US is likely to advance via steady upgrades across established general contractors and specialty trades. This report includes insights on 40+ countries; the top markets are shown here for reference.

The construction management software market in China is expected to expand at 12.3%. Adoption is being driven by public works, mixed-use megaprojects, and prefab programs where punch lists, RFIs, and submittals must be processed at speed. Cloud tenancy within national regions is being specified, and Chinese-language templates for codes and acceptance criteria are being mandated by owners. Mobile apps with offline sync, QR-tagged rooms and equipment, batch assignment, and e-stamps are being used to compress handover. GPS anchoring and dashboard KPIs are being applied to rank subcontractor performance. In our assessment, leadership is likely to be retained as procurement is standardized, defect workflows are codified, and trade coordination is enforced through role-based approvals and documented audit trails across tier-1 and tier-2 cities.

The construction management software market in India is projected to grow at 11.4%. Transport corridors, airports, metros, data centers, and high-density housing are generating structured snagging, RFI routing, and milestone-based payment checks. Multilingual interfaces, WhatsApp share links, and GPS-anchored issues are being requested for dispersed teams. Cloud subscriptions with flexible seats are being adopted by EPCs, while owners insist on timestamped evidence and standardized defect taxonomies to support certification. ERP and e-invoicing connectors aligned to GST are being preferred to avoid reconciliation delays. In our view, consistent gains will be recorded as checklists, geo-fencing, and audit trails become routine, and as contractor training raises on-site usage across tier-1 metros and fast-growing tier-2 clusters.

The construction management software market in Germany is forecast to increase at 10.5%. Uptake is being guided by DIN/VOB requirements, defect-liability periods, and precise trade interfaces on industrial and public buildings. BIM coordination models are being connected to issue logs so clashes and field defects share identifiers, improving traceability. EU-region hosting, immutable audit trails, and template libraries aligned to DIN are being favored. Photo evidence with measurement overlays and controlled distribution lists is being applied to protect warranty positions. It is judged that Germany will sustain premium growth as acceptance protocols, commissioning checklists, and archive exports (PDF/A, IFC refs, CSV) are enforced to preserve records across long service lives.

The construction management software market in the UK is anticipated to rise at 8.6%. Refurb programs, education estates, healthcare builds, and build-to-rent schemes are requiring consistent snag capture and transparent closeout. CDE alignment with ISO 19650 naming and status mapping is being requested, and resident-care portals are being linked for post-handover triage. Mobile snagging with offline modes for basements and tunnels is being standardized, while e-signatures and role-based approvals are being used to support NEC-style contracts. In our view, steady adoption will be underpinned by framework procurement, clear audit trails, and repeatable template packs by trade (M&E, façades, interiors) that reduce dispute risk and compress practical completion timelines.

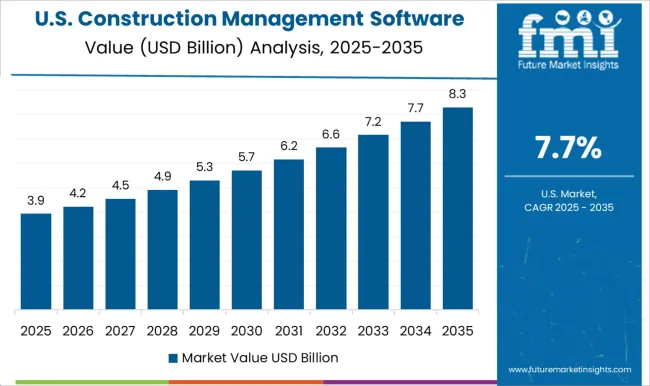

The construction management software market in the United States is expected to grow at 7.7%. Healthcare, life-science labs, logistics hubs, and corporate interiors are sustaining demand where closeout documentation and safety compliance are closely audited. Mobile field tools for photo mark-ups, voice-to-item capture, and batch assignments are being standardized by GC/CM firms. API connectors to scheduling, estimating, and ERP are being valued to link change orders with cost exposure and earned-value metrics. Owner dashboards are being used to surface aging defects and trade performance. It is assessed that steady upgrades will continue as certified payroll, lien waivers, and e-signatures are embedded, raising transparency and shortening pay-app cycles across multi-trade programs.

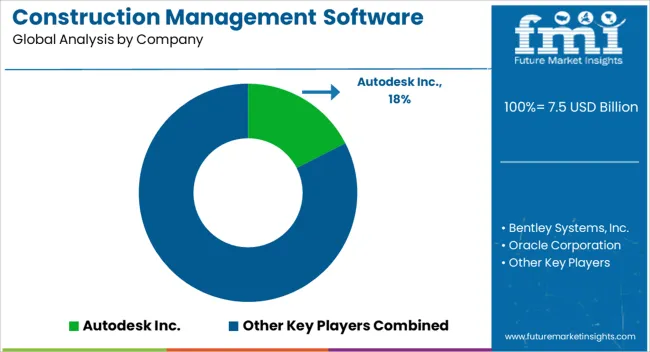

Competition in construction management software has been organized around breadth of workflows, mobile depth, and how clearly brochures turn complexity into step by step control. Autodesk and Procore are positioned as end to end platforms, with brochures emphasizing RFIs, submittals, change orders, drawings, and cost in one environment. Oracle frames Aconex and Primavera as enterprise grade coordination with structured correspondence and schedule governance. Trimble presents Viewpoint as a field to back office spine that ties payroll, equipment, and job cost to site activity. Bentley Systems highlights design model fidelity, 4D planning, and digital delivery for infrastructure programs. E Builder is presented as owner side program management with capital planning and closeout tracking. Across these brands, brochure tables make comparison simple. Mobile capture, offline resilience, markup clarity, revision control, and permission rules are listed explicitly. Claims center on fewer rework loops, faster closeout, and auditable decisions.

Strategy has been executed through documentation that mirrors project life. Sage Group, CMiC, and Jonas Construction Software position ERP strength and job cost accuracy, then connect to field tools through published integrations. Brochures display role based workflows, approval gates, transmittal logs, and photo evidence embedded in issues. Implementation pages show timelines, training formats, and data migration steps. API catalogs, connector lists, and data residency statements reduce IT risk. Pricing tiers are explained with user types and environment limits. Security posture is summarized with encryption, SSO, MFA, and audit trails.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.5 Billion |

| Deployment | Cloud and On-premise |

| Building Type | Commercial Buildings and Residential Buildings |

| Application | Project Management & Scheduling, Safety & Reporting, Project Design, Field Service Management, Cost Accounting, and Others |

| End-Use | Builders & Contractors, Construction Managers, and Engineers & Architects |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Autodesk Inc., Bentley Systems, Inc., Oracle Corporation, Trimble, Inc, Procore Technologies, Sage Group plc, Jonas Construction Software, E-Builder, Inc., and Cmic |

| Additional Attributes | Dollar sales by deployment (cloud, on premise), Dollar sales by module (project management, scheduling, cost control, document management, BIM coordination), Trends in mobile field capture and e signature integrations, Role in RFIs, change orders, compliance reporting, Growth from infrastructure and contractor digitization, Regional adoption across North America, Europe, Asia Pacific. |

The global construction management software market is estimated to be valued at USD 7.5 billion in 2025.

The market size for the construction management software market is projected to reach USD 17.9 billion by 2035.

The construction management software market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in construction management software market are cloud and on-premise.

In terms of building type, commercial buildings segment to command 57.8% share in the construction management software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA