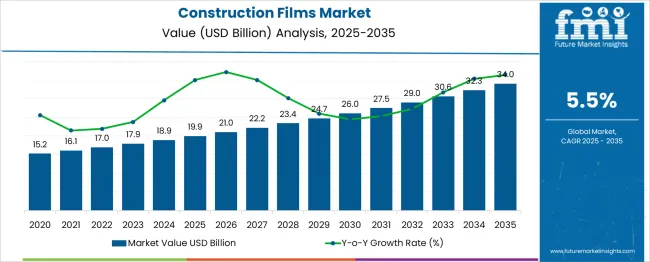

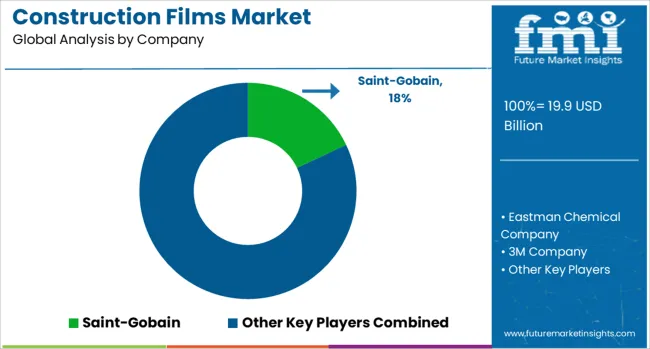

The Construction Films Market is estimated to be valued at USD 19.9 billion in 2025 and is projected to reach USD 34.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. This growth signals an absolute dollar opportunity of USD 18.8 billion over the 15-year period. The increasing use of construction films in applications such as moisture barriers, insulation, and protective coverings drives demand, supported by expanding construction activities globally.

The market growth reflects a rising focus on improving building durability and energy efficiency, especially in residential and commercial construction projects. Between 2020 and 2025, the market value rises from USD 15.2 billion to USD 19.9 billion, marking an early growth phase driven by rising infrastructure investments and urban development.

From 2025 to 2035, the market experiences accelerated growth, increasing by USD 14.1 billion to reach USD 34.0 billion. This later period benefits from advancements in film materials, increasing regulatory emphasis on construction standards, and growing adoption in emerging markets. Overall, the construction films market presents promising opportunities for manufacturers and suppliers to expand their footprint in a growing global construction industry.

| Metric | Value |

|---|---|

| Construction Films Market Estimated Value in (2025 E) | USD 19.9 billion |

| Construction Films Market Forecast Value in (2035 F) | USD 34.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Construction Films market is experiencing strong momentum as global infrastructure development, residential housing demand, and smart building initiatives continue to rise. Increased emphasis on moisture control, energy efficiency, and structural durability has driven the adoption of high-performance films across both developed and emerging regions.

Regulatory frameworks mandating environmental protection and building code compliance have further encouraged the use of advanced materials such as vapor barrier films, UV-resistant coatings, and recyclable resins. Technological innovations in multilayer film extrusion and the use of sustainable resin blends have also enhanced the functionality and lifecycle of construction films.

As green construction practices and modular building systems become more mainstream, demand is expected to grow for materials that offer both protection and regulatory alignment. The integration of construction films into modern building envelopes for thermal insulation, surface protection, and moisture resistance is set to drive sustained expansion, especially with the rise in government-funded infrastructure and commercial real estate development worldwide..

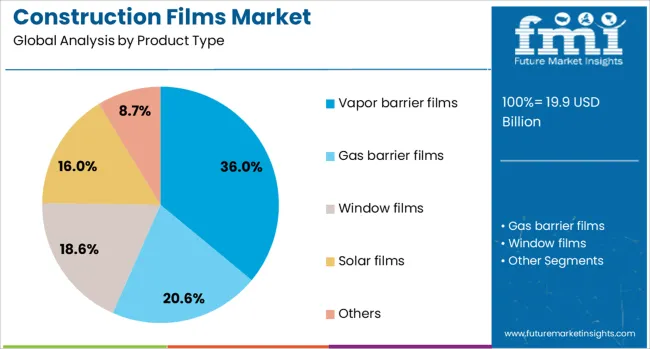

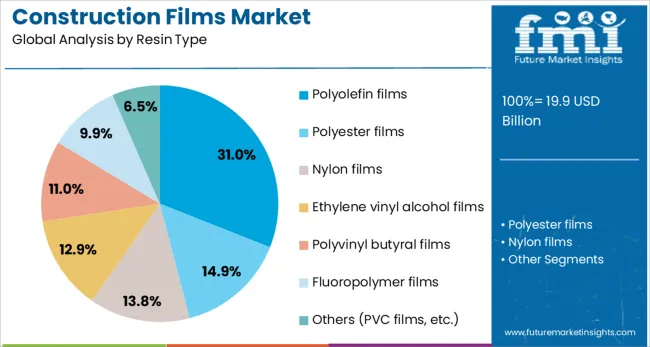

The construction films market is segmented by product type, resin type, function, application, end-use distribution channel, and geographic regions. By product type, the construction films market is divided into Vapor barrier films, Gas barrier films, Window films, Solar films, and others. In terms of resin type, the construction films market is classified into Polyolefin films, Polyester films, Nylon films, Ethylene vinyl alcohol films, Polyvinyl butyral films, Fluoropolymer films, and others (PVC films, etc.).

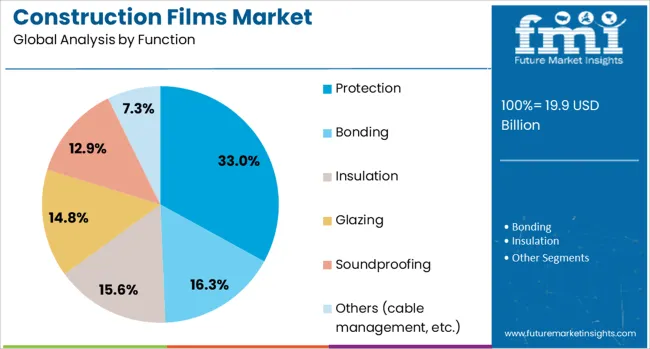

The construction films market is segmented into Protection, Bonding, Insulation, Glazing, Soundproofing, and others (cable management, etc.). The construction films market is segmented into Roofing, Flooring, Walls & ceilings, Windows, Doors, Building & enveloping, Electrical, and Others (HVAC, etc.).

The end use of the construction films market is segmented into Residential, Commercial, and Industrial. The distribution channel of the construction films market is segmented into direct and indirect. Regionally, the construction films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vapor barrier films segment is projected to account for 36% of the Construction Films market revenue share in 2025, establishing it as the leading product type. This growth has been driven by increased awareness regarding moisture-related structural damage and the long-term benefits of preventing vapor transmission through building components. These films have been preferred in applications such as flooring, wall systems, and roofing, where maintaining internal humidity levels and avoiding mold growth are essential.

Construction professionals have increasingly specified vapor barrier films due to their ability to enhance energy efficiency by preventing condensation and air infiltration. Their compatibility with both residential and commercial building standards has further supported market penetration.

As the focus on indoor air quality and thermal performance intensifies, these films have been positioned as a critical component of the modern building envelope. Regulatory support and advancements in film technology have also reinforced their widespread use, particularly in climates that experience extreme temperature and moisture fluctuations..

The polyolefin films segment is expected to hold 31% of the Construction Films market revenue share in 2025, marking it as the dominant resin type. This segment's leadership has been supported by the excellent mechanical strength, chemical resistance, and flexibility offered by polyolefin-based formulations. Their relatively low production cost, combined with high-performance characteristics, has made them the preferred material in multilayer barrier and protection applications.

Construction stakeholders have increasingly selected polyolefin films due to their durability and recyclability, aligning with sustainability goals and regulatory requirements. Furthermore, their compatibility with advanced film extrusion techniques allows manufacturers to produce customized products suited for specific site conditions and application needs.

The versatility of polyolefin films in both indoor and outdoor environments has positioned them as a reliable solution across a wide range of construction functions. As the demand grows for lightweight, cost-effective, and environmentally responsible materials, polyolefin films have continued to dominate resin selection within the industry..

The protection segment is forecasted to contribute 33% to the Construction Films market revenue share in 2025, establishing it as the leading functional application. This segment’s dominance has been attributed to the growing need for surface preservation during construction activities to prevent damage from abrasion, dust, and moisture exposure. Films developed for protection have been utilized extensively in safeguarding windows, flooring, doors, and facade elements throughout the construction cycle.

Their role in reducing post-construction cleaning costs and minimizing material wastage has reinforced their value proposition to builders and contractors. As project timelines tighten and quality control measures intensify, the use of protective films has become a standard protocol across commercial, industrial, and residential sites.

Manufacturers have also responded to this demand by developing films with enhanced UV resistance and anti-slip properties, further improving onsite safety and product performance. The strategic integration of protection films into construction workflows has proven to deliver both cost efficiency and operational reliability, thereby sustaining their market leadership..

The construction films market is growing steadily as the construction industry increasingly adopts protective and functional films for building surfaces, insulation, and moisture barriers. These films, made from materials such as polyethylene and polypropylene, are essential for safeguarding structures during construction, improving energy efficiency, and enhancing durability. Rising urban infrastructure projects and renovation activities worldwide, especially in Asia-Pacific and North America, drive demand. Builders and contractors prefer films that are easy to install, durable, and environmentally friendly, supporting widespread market adoption.

Construction films serve multiple purposes, including vapor barriers, temporary protective covers, insulation layers, and concrete curing sheets. Polyethylene films are common due to their flexibility, moisture resistance, and affordability, while specialized films offer UV resistance and anti-slip properties. Thickness and tensile strength vary based on application requirements. Innovations include multi-layer films combining durability and breathability. Selection depends on climate, building codes, and specific project needs. Manufacturers offering customizable films for different construction phases gain competitive advantages by catering to diverse client demands.

Films contribute significantly to building envelope performance by preventing moisture ingress, reducing heat loss, and protecting surfaces from dust, dirt, and mechanical damage during construction. Effective vapor barriers help mitigate mold growth and structural deterioration. The rising emphasis on energy-efficient buildings and green construction standards increases demand for high-performance films. Temporary protective films reduce repair and cleaning costs by shielding windows, floors, and fixtures. Growing awareness among contractors about long-term benefits supports broader integration of construction films into project specifications.

Construction films must meet stringent regulations related to fire retardancy, chemical safety, and environmental impact. Compliance with standards such as ASTM, ISO, and local building codes is essential for market acceptance. Growing environmental concerns about plastic waste push manufacturers toward recyclable and biodegradable film options. Regulations restricting single-use plastics influence product development and marketing strategies. Navigating diverse regulatory frameworks across regions requires adaptability and certification, increasing operational complexity. Companies focusing on eco-friendly formulations and transparent supply chains enhance their reputation and market reach.

The market includes global chemical manufacturers, specialty film producers, and regional suppliers competing on product quality, innovation, and pricing. Raw material availability and price fluctuations, especially of polymers derived from petroleum, impact production costs. Supply chain disruptions may affect delivery schedules, prompting companies to diversify sourcing and optimize inventories. Strategic partnerships with construction firms and distributors support market penetration. Offering technical support, customization, and reliable logistics enhances customer loyalty. Product differentiation through durability, ease of use, and environmental compliance remains key to success in a competitive environment.

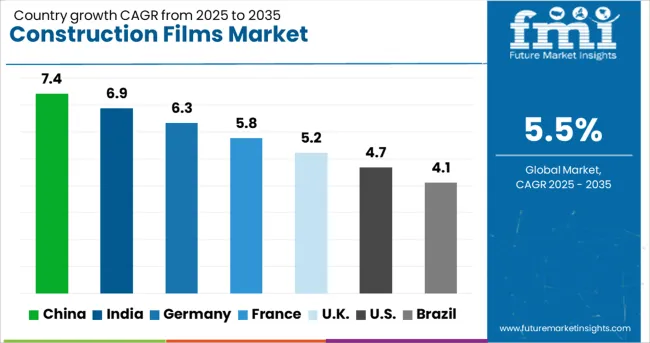

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global construction films market is growing at a 5.5% CAGR, driven by increasing use in building protection and insulation applications. Among BRICS nations, China leads with 7.4% growth, supported by a vast construction industry and manufacturing capabilities. India follows at 6.9%, fueled by rising infrastructure development and urban projects. In the OECD region, Germany records 6.3% growth, reflecting high-quality standards and environmental regulations. The United Kingdom grows at 5.2%, driven by demand for advanced construction materials. The United States, a mature market, shows 4.7% growth, shaped by regulatory compliance and replacement demand. These countries collectively influence market trends through production capacity, regulatory frameworks, and construction sector growth. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the construction films market with a growth rate of 7.4%, driven by rapid infrastructure development and large-scale urban projects. Compared to India, China focuses more on advanced film materials with enhanced durability and weather resistance. The demand is high for protective films used in building construction, such as vapor barriers and surface protection films, due to growing construction activity in residential and commercial sectors. Government investments in infrastructure and environmental protection regulations promote the adoption of eco-friendly films. Local manufacturers are innovating to produce cost-effective films with better performance, catering to both domestic and export markets. Additionally, China’s expanding real estate and industrial construction sectors continue to support the market expansion.

India’s construction films market grows at 6.9%, fueled by increasing residential and commercial construction projects across tier-1 and tier-2 cities. Compared to Germany, India faces challenges with product standardization but benefits from rising awareness of construction film advantages such as moisture control and insulation. Government schemes supporting affordable housing and smart cities stimulate demand for protective and insulating films. Manufacturers are focusing on films that offer UV resistance and strength at affordable prices to suit the price-sensitive market. Growing use of films in scaffolding covers, concrete curing, and surface protection drives expansion. Increasing urban construction activities and infrastructure investments further strengthen the market outlook.

Germany’s construction films market grows at 6.3%, supported by strict building codes and sustainability regulations. Compared to the United Kingdom, Germany places more emphasis on high-performance films used for insulation, vapor barriers, and energy efficiency improvements in construction. The market benefits from advanced polymer technologies and strong demand from residential and industrial construction sectors. Manufacturers focus on durability, fire resistance, and recyclability of films. The growing trend of energy-efficient building renovations and green building certifications increases demand for specialized construction films. The market also sees steady growth due to infrastructure upgrades and replacement of aging buildings with modern energy-saving materials.

The United Kingdom construction films market grows at 5.2%, driven by rising construction and renovation activities. Compared to the United States, the UK market focuses more on films that enhance thermal insulation and moisture resistance in both new builds and retrofit projects. Increasing building regulations around energy efficiency create steady demand for vapor barrier films and protective coverings. Manufacturers are introducing films with improved UV stability and ease of installation to meet contractor requirements. Growth in commercial real estate development and public infrastructure maintenance supports steady market expansion. Additionally, the market is adapting to evolving standards in building safety and environmental impact reduction.

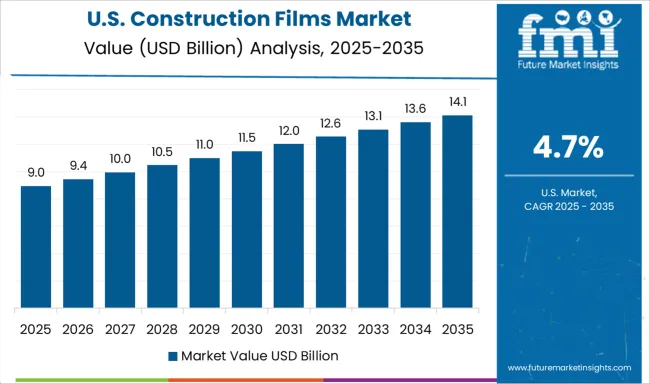

The United States construction films market grows at 4.7%, supported by ongoing residential construction and infrastructure repair activities. Compared to China, the USA market favors high-performance films with superior strength and multi-functionality, including vapor barriers, protective wraps, and concrete curing films. The adoption of films that enhance energy efficiency and weather resistance is increasing due to stricter building codes and environmental standards. Manufacturers invest in research to develop films that balance durability with cost-effectiveness. The expansion of commercial and industrial construction also supports the market. Moreover, growing awareness of film benefits in reducing construction waste and improving project timelines drives steady market growth.

The construction films market is led by industry pioneers specializing in high-performance polymer films that enhance building durability, energy efficiency, and environmental protection. Saint-Gobain stands out with its advanced architectural films designed to improve thermal insulation, UV resistance, and weatherproofing, catering to both new constructions and renovation projects.

Eastman Chemical Company offers innovative specialty films with excellent clarity, strength, and chemical resistance, widely used for protective and vapor barrier applications in the construction sector. 3M Company leverages its expertise in adhesives and film technologies to deliver durable construction films that provide superior moisture control, air sealing, and impact resistance, essential for enhancing building envelope performance.

DuPont contributes with its well-established Tyvek and other barrier films that combine breathability with robust protection against water and air infiltration, promoting energy savings and indoor comfort. Berry Global Inc. focuses on sustainable, recyclable film solutions that address growing environmental concerns while maintaining high functional performance. Competition in this market revolves around continuous innovation in film materials, multi-functionality, and sustainability, driven by increasing regulatory standards for green buildings and energy-efficient construction practices worldwide.

The Construction Films Market focuses on sustainable, eco-friendly materials and expanding in high-growth regions like the Asia-Pacific. Emphasizing technological innovation with smart films, forming strategic partnerships, optimizing costs, and ensuring regulatory compliance are essential. Strong marketing on sustainability and performance drives competitive advantage and market growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.9 Billion |

| Product Type | Vapor barrier films, Gas barrier films, Window films, Solar films, and Others |

| Resin Type | Polyolefin films, Polyester films, Nylon films, Ethylene vinyl alcohol films, Polyvinyl butyral films, Fluoropolymer films, and Others (PVC films, etc.) |

| Function | Protection, Bonding, Insulation, Glazing, Soundproofing, and Others (cable management, etc.) |

| Application | Roofing, Flooring, Walls & ceilings, Windows, Doors, Building & enveloping, Electrical, and Others (HVAC, etc.) |

| End Use | Residential, Commercial, and Industrial |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saint-Gobain, Eastman Chemical Company, 3M Company, DuPont, and Berry Global Inc. |

| Additional Attributes | Dollar sales in the Construction Films Market vary by product type including polyethylene films, polypropylene films, and PVC films, application across roofing, insulation, flooring, and concrete curing, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising construction activities, demand for durable materials, and increasing focus on energy efficiency and weather protection. |

The global construction films market is estimated to be valued at USD 19.9 billion in 2025.

The market size for the construction films market is projected to reach USD 34.0 billion by 2035.

The construction films market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in construction films market are vapor barrier films, gas barrier films, window films, solar films and others.

In terms of resin type, polyolefin films segment to command 31.0% share in the construction films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA