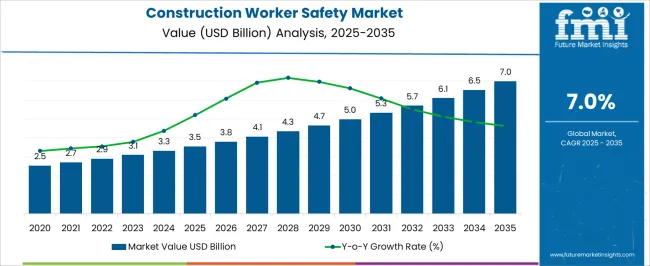

The global construction worker safety market is anticipated to rise from USD 3.5 billion in 2025 to USD 7.0 billion by 2035, reflecting a CAGR of 7.0%. An analysis of volume versus price contribution highlights how market expansion is influenced by both increasing unit adoption and changes in product pricing over the decade. Between 2025 and 2030, the market grows from USD 3.5 billion to USD 5.0 billion, with volume-driven growth accounting for the majority of revenue expansion.

This early phase reflects rising adoption of personal protective equipment (PPE), fall protection systems, helmets, and safety harnesses, driven by stricter occupational safety regulations, increasing construction activities, and heightened awareness of worker health and safety standards globally. From 2030 to 2035, the market further advances from USD 5.0 billion to USD 7.0 billion, with price growth contributing more noticeably to overall expansion.

This late-stage phase is characterized by the introduction of technologically advanced, smart, and high-durability safety equipment, including connected wearable devices and sensor-enabled protective gear, which command premium pricing. Regional dynamics show Asia-Pacific leading volume adoption due to booming infrastructure projects, while North America and Europe drive price growth through premium and innovative safety solutions.

| Metric | Value |

|---|---|

| Construction Worker Safety Market Estimated Value in (2025 E) | USD 3.5 billion |

| Construction Worker Safety Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The construction worker safety market is primarily driven by the personal protective equipment (PPE) market, which accounts for approximately 40–45% of total demand, as helmets, safety vests, gloves, and protective footwear are essential for safeguarding construction workers against injuries and occupational hazards. The construction and infrastructure market contributes around 20–22%, reflecting the rise in industrial, commercial, and urban development projects that require comprehensive safety measures for on-site personnel.

The occupational safety and health services market holds roughly 15–17%, driven by training programs, risk assessments, safety audits, and compliance solutions that ensure adherence to workplace safety standards. The wearable technology and IoT in construction market contributes approximately 12–14%, as smart helmets, sensor-enabled vests, and biometric devices enable real-time monitoring, accident prevention, and workforce health management.

The government regulations and safety compliance market accounts for 5–6%, promoting adoption through mandatory labor laws, inspection frameworks, and safety standards enforcement.

The construction worker safety market is experiencing robust expansion, supported by heightened regulatory enforcement, rising awareness of workplace hazards, and advancements in safety technologies. Demand is being driven by infrastructure development projects, urbanization, and the need to reduce occupational injuries, while global supply chains for safety products are becoming more resilient through diversified sourcing and localized manufacturing.

The market’s growth is further reinforced by the integration of smart safety solutions, enabling real-time monitoring and incident prevention. Rising investments in worker training and safety compliance are boosting adoption rates, particularly in high-risk construction environments.

Additionally, employers are increasingly prioritizing employee welfare as a strategic imperative, aligning with ESG and corporate responsibility frameworks In the coming years, continuous innovation in protective gear, coupled with the expansion of smart wearable technologies, is expected to accelerate market penetration, especially in emerging economies where construction activities are intensifying and safety compliance frameworks are evolving rapidly.

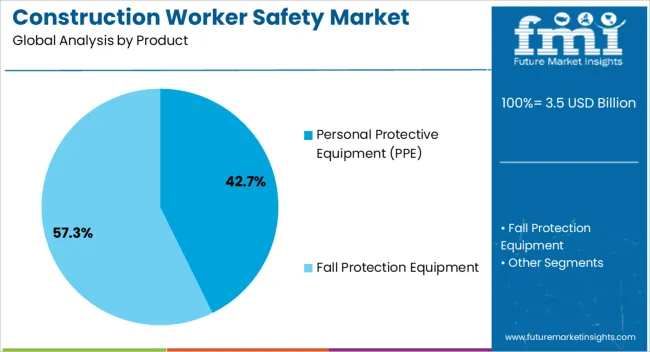

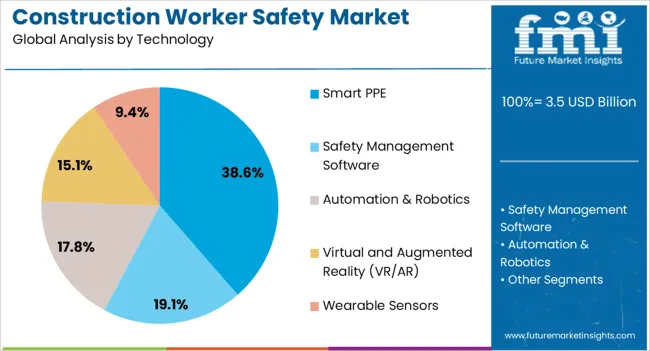

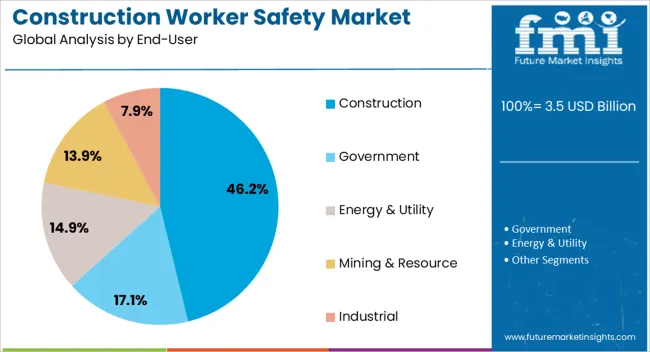

The construction worker safety market is segmented by product, technology, end-user, and geographic regions. By product, construction worker safety market is divided into Personal Protective Equipment (PPE), Fall Protection Equipment, Environmental Monitoring & Detection Systems, and On-Site Safety Systems. In terms of technology, construction worker safety market is classified into Smart PPE, Safety Management Software, Automation & Robotics, Virtual and Augmented Reality (VR/AR), and Wearable Sensors.

Based on end-user, construction worker safety market is segmented into Construction, Government, Energy & Utility, Mining & Resource, and Industrial. Regionally, the construction worker safety industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The personal protective equipment (PPE) segment, accounting for 42.70% of the product category, has maintained a leading position due to its essential role in safeguarding workers from physical, chemical, and environmental hazards on construction sites. This segment’s dominance is reinforced by regulatory mandates requiring standardized safety gear for all on-site personnel.

Continuous improvements in material strength, comfort, and ergonomic design are enhancing usability, thereby encouraging consistent adoption among workers. Market demand is being sustained by the need for head-to-toe protection solutions, including helmets, gloves, eyewear, and protective clothing, which remain indispensable in both small-scale and large-scale construction projects.

Bulk procurement by major contractors, combined with government-backed distribution programs in developing economies, has strengthened the segment’s market share. Furthermore, innovations in lightweight composites and breathable fabrics are increasing compliance by reducing wearer fatigue, ensuring the PPE segment remains a cornerstone of the construction worker safety market.

The smart PPE segment, holding 38.60% of the technology category, has emerged as a transformative driver in enhancing safety standards through the integration of sensors, IoT connectivity, and data analytics. This segment’s growth is underpinned by its ability to deliver real-time hazard detection, biometric monitoring, and geolocation tracking, significantly improving incident prevention capabilities.

Adoption has been particularly strong among large contractors and high-risk project sites where proactive safety measures can reduce downtime and mitigate costly accidents. Technological advancements are enabling improved battery life, wireless communication, and integration with central safety management platforms, thereby increasing operational efficiency.

The segment’s competitive advantage is reinforced by its alignment with Industry 4.0 trends, allowing data-driven safety decisions As costs decline and device miniaturization improves, the deployment of smart PPE is expected to broaden across both developed and emerging markets, strengthening its contribution to overall market growth.

The construction segment, representing 46.20% of the end-user category, remains the largest consumer of safety products and technologies due to the inherently hazardous nature of construction activities. Its leading position is supported by strict regulatory compliance requirements, mandatory safety audits, and rising adoption of advanced protective solutions to minimize risks associated with falls, equipment handling, and exposure to hazardous materials.

Large-scale infrastructure projects, urban redevelopment programs, and an uptick in residential and commercial construction activities globally are reinforcing the demand. Contractors are increasingly integrating safety investments into project budgets, recognizing the financial and reputational benefits of maintaining high safety standards.

Partnerships between safety equipment providers and construction firms are enhancing product customization and workforce training initiatives. With the ongoing expansion of smart construction practices and a growing emphasis on zero-incident workplaces, the construction end-user segment is expected to sustain its dominance in driving market revenues over the forecast period.

The construction worker safety market is expanding as companies prioritize reducing on-site accidents, improving compliance with occupational regulations, and enhancing worker protection in high-risk environments. Safety solutions, including helmets, harnesses, protective clothing, fall detection systems, and wearable sensors, are being adopted across commercial, residential, and infrastructure projects.

Rising awareness of workplace safety standards, insurance requirements, and liability concerns is driving demand. Suppliers offering certified, durable, and easy-to-use safety equipment combined with technical support, training, and integration guidance are well-positioned to capture long-term adoption among construction firms, contractors, and government projects globally.

Construction firms are increasingly investing in worker safety solutions to prevent accidents, minimize downtime, and ensure compliance with local and international safety regulations. Personal protective equipment (PPE) such as helmets, gloves, boots, high-visibility clothing, and fall arrest systems are standard across high-risk worksites. Smart wearables, connected sensors, and location tracking are enhancing real-time monitoring of worker health, fatigue, and exposure to hazardous conditions. The integration of digital safety management platforms, employee training programs, and contractor safety audits further drives adoption. Suppliers that provide durable, certified, and easy-to-deploy solutions with technical guidance and training support are best positioned to serve construction companies aiming to enhance operational efficiency while reducing workplace risks.

Supply chain limitations, especially for specialized or imported equipment, can delay availability and increase procurement costs. Regulatory compliance with local occupational safety laws, certification requirements, and equipment testing standards adds operational complexity. Technical challenges include ensuring compatibility of smart devices with communication systems, reliability under harsh conditions, and durability over extended use. Buyers increasingly demand suppliers providing certified equipment, training, reliable logistics, and post-sale support to mitigate operational risks, enhance safety performance, and maintain compliance in diverse construction environments.

Opportunities are emerging in smart PPE, wearable sensors, real-time monitoring systems, and integrated digital platforms for construction safety management. Adoption is growing in large-scale infrastructure projects, high-rise construction, and industrial sites where remote monitoring and predictive safety analytics enhance protection. Integration of safety data with workforce management systems allows proactive risk mitigation and improved emergency response. Suppliers offering turnkey solutions, including equipment, installation, training, and ongoing technical support, are well-positioned to capture market growth. Partnerships with contractors, safety consultants, and technology providers enable customized safety programs and enhance adoption rates. Emerging markets in Asia-Pacific, North America, and Europe present significant potential due to expanding construction activity and rising safety awareness.

The market is trending toward digital safety solutions incorporating IoT-enabled wearables, real-time location tracking, and predictive analytics for risk detection. Smart helmets, harnesses, and wearable sensors monitor vital signs, fatigue, and environmental hazards, alerting workers and supervisors proactively. Integration with safety management software provides actionable insights for compliance, training, and incident prevention. Emphasis on ergonomics, comfort, and lightweight materials is increasing to encourage consistent use among workers. Suppliers offering certified, technically advanced, and user-friendly solutions with robust data analytics capabilities are best positioned to meet evolving construction safety requirements while improving workforce protection and operational efficiency globally.

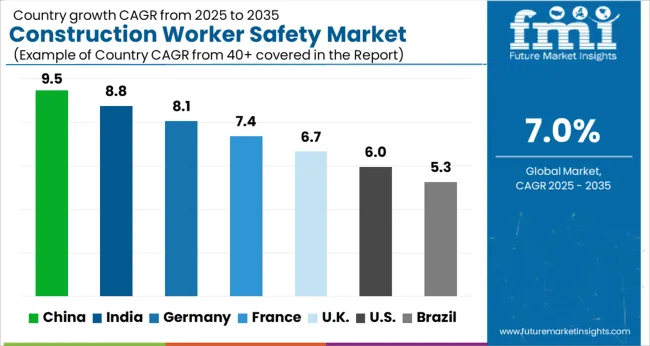

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global construction worker safety market is projected to grow at a CAGR of 7.0% from 2025 to 2035. China leads with 9.5%, followed by India at 8.8%, Germany at 8.1%, the UK at 6.7%, and the USA at 6.0%. Growth is driven by rising construction and industrial projects, strict safety regulations, and increased awareness of workplace hazards. Adoption of helmets, gloves, harnesses, high-visibility clothing, and smart PPE devices is accelerating. Digital monitoring, IoT-enabled wearables, and modular solutions are further enhancing safety standards. Asia remains the fastest-growing market, while Europe and North America focus on compliance, technology integration, and ergonomic equipment. The analysis includes over 40+ countries, with the leading markets detailed below.

The construction worker safety market in China is projected to expand at a CAGR of 9.5% from 2025 to 2035, driven by rapid urbanization, large-scale infrastructure projects, and the modernization of industrial construction sites. Demand is rising for personal protective equipment (PPE) such as helmets, high-visibility clothing, safety footwear, gloves, and fall protection systems. Digital safety solutions, including wearable sensors, real-time hazard monitoring, and safety management software, are increasingly adopted to improve worker compliance and reduce accident rates. Government regulations and strict occupational health standards are further promoting the use of advanced safety equipment. Major construction zones, industrial parks, and metro rail projects are contributing to heightened demand for reliable safety products. E-commerce platforms are facilitating wider access to safety gear for small and medium contractors.

The construction worker safety market in India is anticipated to grow at a CAGR of 8.8% during 2025–2035. The rise of residential, commercial, and infrastructure projects is increasing demand for helmets, gloves, harnesses, high-visibility clothing, and respiratory protection. The enforcement of occupational health and safety regulations is driving compliance among contractors and labor-intensive industries. E-commerce penetration enables easier procurement of certified safety products for smaller construction sites. Awareness campaigns by government and private organizations are educating workers about the importance of safety equipment. Large-scale industrial hubs, metro rail expansions, and renewable energy projects are also fueling the market. Suppliers are offering customized kits and modular PPE solutions to meet specific job requirements.

Germany’s market is projected to grow at a CAGR of 8.1% from 2025 to 2035. Strict labor laws, safety regulations, and insurance requirements are major drivers for construction safety equipment adoption. Demand is concentrated on high-quality helmets, fall protection systems, respiratory equipment, and industrial gloves. Large infrastructure projects, industrial plants, and civil engineering initiatives require compliance with EN safety standards. Technological integration such as IoT-enabled wearables, real-time location monitoring, and connected PPE devices is gaining traction. Training programs and certification for safety personnel further support market growth. Suppliers focus on providing durable, ergonomic, and certified equipment suitable for European standards.

The UK market is growing at a CAGR of 6.7% through 2035, driven by infrastructure upgrades, residential and commercial construction, and industrial projects. Contractors are increasingly investing in PPE including helmets, gloves, high-visibility clothing, harnesses, and respiratory protection to meet strict HSE regulations. Integration of wearable safety devices and digital monitoring platforms enhances compliance and reduces workplace accidents. Suppliers provide tailored solutions for large construction companies and smaller contractors alike. Temporary sites, urban redevelopment projects, and high-rise construction are fueling demand for portable and modular safety systems. E-commerce and B2B platforms facilitate quick access to certified safety equipment across regions.

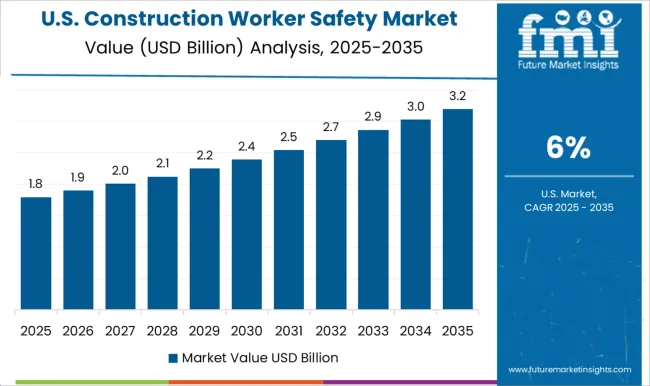

The USA market is projected to grow at a CAGR of 6.0% from 2025 to 2035, supported by infrastructure modernization, commercial construction, and energy sector projects. Demand for personal protective equipment such as helmets, gloves, fall arrest systems, safety footwear, and respiratory gear is increasing across industrial and construction sectors. OSHA regulations and workplace safety programs drive compliance and adoption of advanced safety tools. IoT-enabled PPE, smart helmets, and wearable sensors for real-time hazard alerts are being deployed at large construction sites. E-commerce channels and leasing options provide contractors with easy access to certified safety gear. Training programs and safety awareness campaigns complement equipment adoption, reducing accidents and improving productivity.

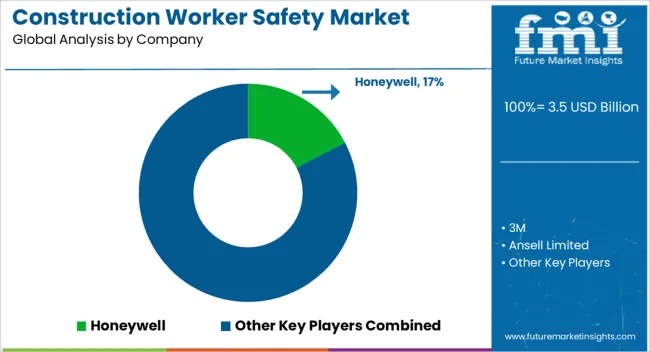

Competition in the construction worker safety market is defined by product reliability, regulatory compliance, and ergonomics. Honeywell leads with comprehensive safety solutions, including helmets, respirators, and protective eyewear designed for industrial and construction environments. 3M competes through advanced personal protective equipment (PPE) integrating filtration, impact resistance, and comfort. Ansell Limited emphasizes hand protection with cut-, chemical-, and heat-resistant gloves tailored to various construction tasks. Delta Plus Group focuses on modular safety gear and PPE kits for site-wide protection, while Drägerwerk AG & Co.

KGaA differentiates with gas detection and respiratory systems engineered for high-risk environments. DuPont specializes in engineered fabrics, coveralls, and high-visibility apparel for enhanced protection. MSA Safety Incorporated emphasizes helmets, harnesses, and fall protection solutions with integrated smart monitoring for worker safety. Strategies revolve around regulatory adherence, product innovation, and site adaptability. Advanced materials, ergonomic designs, and smart monitoring systems are deployed to enhance comfort and reduce fatigue during prolonged use. Partnerships with construction firms and safety consultants support on-site assessments and tailored solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Product | Personal Protective Equipment (PPE), Fall Protection Equipment, Environmental Monitoring & Detection Systems, and On-Site Safety Systems |

| Technology | Smart PPE, Safety Management Software, Automation & Robotics, Virtual and Augmented Reality (VR/AR), and Wearable Sensors |

| End-User | Construction, Government, Energy & Utility, Mining & Resource, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell, 3M, Ansell Limited, Delta Plus Group, Drägerwerk AG & Co. KGaA, DuPont, and MSA Safety Incorporated |

| Additional Attributes | Dollar sales by fiber type (biodegradable, non-biodegradable), drug integration method (encapsulation, coating, blending), and application (wound care, tissue engineering, implants, drug delivery). Demand is fueled by increasing adoption of advanced biomaterials, precision medicine, and regenerative therapies. Regional trends indicate growing opportunities in North America and Europe due to healthcare innovation, regulatory support, and rising clinical adoption of advanced polymer fiber solutions. |

The global construction worker safety market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the construction worker safety market is projected to reach USD 7.0 billion by 2035.

The construction worker safety market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in construction worker safety market are personal protective equipment (PPE), helmets, safety glasses/goggles, safety gloves, safety footwear, hearing protection, high-visibility clothing, respiratory protection, fall protection equipment, harnesses, lanyards, anchor points, guardrails, safety nets, environmental monitoring & detection systems, gas detection systems, noise monitoring devices, dust monitoring devices, on-site safety systems, alarms & emergency systems, safety signage & barriers, first-aid kits/stations and fire extinguishing equipment.

In terms of technology, the smart PPE segment is expected to command a 38.6% share in the construction worker safety market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA