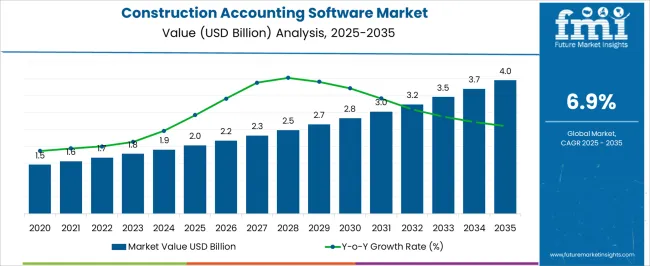

The construction accounting software category is projected to grow from USD 2.0 billion in 2025 to USD 4.0 billion in 2035 at a 6.9% CAGR. The CAGR curve appears steady, with waypoint values of 2.2, 2.3, and 2.5 by 2028, then 2.7 and 2.8 by 2030, before lifting to 3.2 and 3.5, and closing at 4.0. Demand is being shaped by job costing, WIP reporting, and percentage of completion revenue recognition under ASC 606. AIA billing, retainage control, and lien waiver workflows are being standardized across general contractors and specialty trades.

This path is read as disciplined growth anchored in compliance, audit readiness, and project financial control. Adoption is being reinforced by AP automation with OCR capture, three way match, and electronic payments; payroll with certified payroll, union rates, and prevailing wage; and multi entity consolidation across JV structures. Integrations with procurement, inventory, fixed asset accounting, and fleet maintenance are being prioritized to reduce rework and speed close. Connected data with field time capture, change order logs, and budget variance dashboards is being favored by owners and EPCs. Vendor advantage is expected to flow to platforms offering strong audit trails, bank reconciliation at scale, role based permissions, and open APIs. The CAGR pattern signals lasting relevance across contractor finance stacks.

| Metric | Value |

|---|---|

| Construction Accounting Software Market Estimated Value in (2025 E) | USD 2.0 billion |

| Construction Accounting Software Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The construction accounting software segment is estimated to account for about 22% of the AEC software market, roughly 9% of the accounting and financial software market, close to 24% of the construction management software market, nearly 11% of the ERP software market, and around 18% of the project cost control and job costing software market, yielding an aggregated share of approximately 84% across these parent categories. This footprint is regarded as decisive because construction accounting suites anchor job costing, progress billing, retainage handling, and percentage of completion revenue recognition that determine project cash flow and profitability.

Procurement has been guided by certified payroll, multi-entity consolidations, cost code structures, AIA-style billing, change order traceability, and lien waiver tracking, which favors platforms with reliable audit trails and strong integrations to scheduling, procurement, and field capture. Work in progress reporting, committed cost visibility, and cost to complete forecasting have been used by general contractors and specialty trades to reduce variance and claims exposure. Vendor selection is influenced by ease of use for site teams, mobile time and expense capture, subcontractor compliance management, and granular permission controls for auditors and owners. Construction accounting should be treated as the system of record for financial governance on capital projects, with APIs connecting to estimating, document control, and equipment fleets. As templates, dashboards, and closeout routines mature, construction accounting software is expected to retain meaningful weight within these parent markets and to set operational standards for project finance across the built environment.

The construction accounting software market is witnessing steady growth, supported by the increasing complexity of construction projects and the rising need for accurate, real-time financial management tools. Companies are prioritizing digital transformation to improve cost control, streamline workflows, and enhance transparency across projects. Cloud-based innovations, AI-driven analytics, and integration capabilities with project management platforms are significantly enhancing efficiency, while regulatory requirements for accurate reporting are further boosting adoption.

The growing scale of infrastructure development in both developed and emerging economies is creating strong demand for solutions that can manage multi-project financials, compliance, and budgeting in a single interface. Additionally, the pressure to optimize operational costs, reduce errors, and ensure data-driven decision-making is encouraging contractors and developers to invest in advanced accounting platforms.

With competition intensifying in the construction sector, businesses are increasingly leveraging accounting software to improve bid accuracy, track project profitability, and maintain compliance with regional tax laws This trend is expected to accelerate as technology integration becomes a key differentiator in the industry.

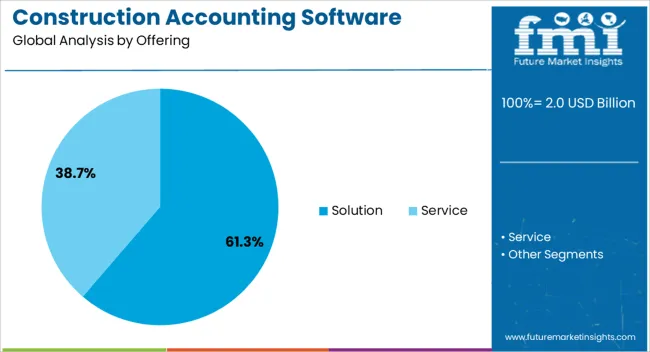

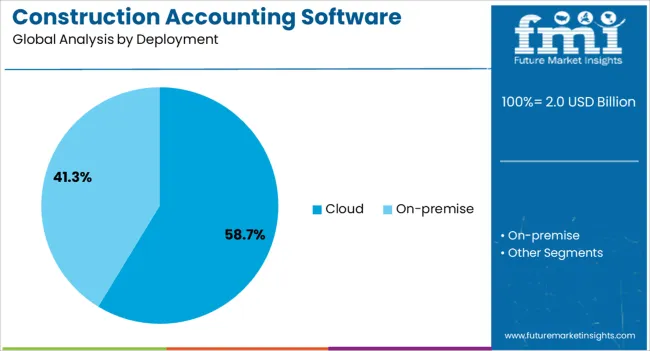

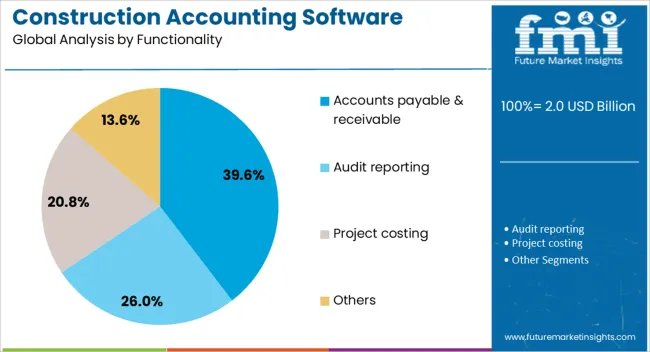

The construction accounting software market is segmented by offering, deployment, functionality, application, and geographic regions. By offering, construction accounting software market is divided into Solution and Service. In terms of deployment, construction accounting software market is classified into Cloud and On-premise. Based on functionality, construction accounting software market is segmented into Accounts payable & receivable, Audit reporting, Project costing, and Others.

By application, construction accounting software market is segmented into Small and mid-sized enterprise and Large sized companies. Regionally, the construction accounting software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution segment is projected to account for 61.3% of the construction accounting software market revenue share in 2025, establishing it as the leading offering category. This dominance is being driven by the demand for comprehensive, feature-rich platforms capable of managing all aspects of financial operations, from budgeting and forecasting to cost tracking and reporting. Solutions provide scalability and customization, allowing construction firms to tailor functionalities to their specific workflows, thereby improving productivity and profitability.

The integration of advanced features such as AI-based forecasting, real-time analytics, and automated compliance checks has further strengthened adoption. As the construction industry becomes increasingly competitive, companies are prioritizing solutions that offer centralized control, enhanced collaboration, and seamless integration with other enterprise systems.

The ability of solution-based offerings to address multiple pain points in project financial management while delivering long-term cost efficiency is reinforcing their market leadership. This is further supported by growing demand for integrated platforms that can adapt to evolving business needs without significant redevelopment or cost.

The cloud deployment segment is anticipated to capture 58.7% of the construction accounting software market revenue share in 2025, making it the dominant deployment mode. Its growth is being driven by the flexibility, scalability, and accessibility that cloud-based platforms offer to construction firms managing projects across multiple locations. Cloud deployment eliminates the need for extensive on-premises infrastructure, reducing upfront costs and enabling faster implementation.

Real-time access to financial data from any location improves decision-making, facilitates collaboration among distributed teams, and ensures that project updates are immediately reflected in accounting records. Enhanced data security features, disaster recovery capabilities, and compliance with global data protection regulations are further contributing to adoption.

As the industry increasingly embraces remote project management and mobile workforce models, cloud deployment is becoming essential for maintaining operational efficiency and responsiveness. The ability to integrate cloud-based accounting systems with other cloud-hosted construction tools is also reinforcing this segment’s leadership in the market.

The accounts payable and receivable functionality segment is projected to hold 39.6% of the construction accounting software market revenue share in 2025, positioning it as the leading functionality category. This segment’s prominence is supported by the critical role it plays in maintaining cash flow stability, managing supplier payments, and tracking client invoices. Efficient management of payables and receivables is essential in the construction industry, where projects often involve multiple contractors, suppliers, and phased payment schedules.

Advanced software functionalities automate invoicing, payment approvals, and reconciliation processes, significantly reducing administrative workload and errors. Real-time visibility into outstanding payments and receivables supports better financial planning and risk management.

The segment is also benefiting from the integration of electronic payment systems, which improve transaction speed and accuracy. As construction companies focus on improving financial transparency and maintaining healthy liquidity, demand for robust accounts payable and receivable management features is expected to remain high, securing this segment’s leadership position in the market.

The construction accounting software market is projected to grow steadily as contractors, developers, and owner-operators pursue tighter cost control, faster closeout, and audit-ready financials across complex projects. Demand is reinforced by the need for accurate job costing, WIP reporting, retainage tracking, and progress billing that syncs with field activity. Opportunities are opening in cloud migrations, service bundles, and deep integrations with estimating, procurement, and project controls. Trends favor mobile capture, AP automation, and analytics tied to earned value. Challenges persist around user adoption, pricing clarity, legacy integrations, tax compliance differences, and uneven jobsite connectivity.

Demand has been reinforced by general contractors, specialty trades, and EPC firms that require precise job costing, cost code discipline, and timely WIP schedules to keep margins intact. Finance teams have favored platforms that connect commitments, change orders, subcontracts, and purchasing with AIA style progress billing, retainage, and lien waiver workflows. Payroll complexity has boosted adoption, since certified payroll, union rules, prevailing wage, and multi-state taxes must be produced without manual rework. Field timecards, materials issues, and equipment hours are being captured on mobile devices and posted to the general ledger, reducing lag between site and back office. Owners and lenders are demanding clearer cash flow forecasts and percentage-of-completion revenue recognition with ASC 606 or IFRS 15 alignment. In an opinionated view, the most durable pull comes when software replaces fragile spreadsheets and generic accounting, delivering one transparent source of truth for project cost, billing, and profitability.

Opportunities are opening where accounting cores integrate natively with project management, estimating, eProcurement, payroll, banking feeds, and document control so data flows without rekeying. Vendors are packaging implementation services, chart-of-accounts mapping, cost code libraries, and change order templates to shorten time to value. AP automation that combines OCR, three-way match, and vendor portals is creating stickier subscriptions, while payment rails and early-pay discounts unlock new monetization. Mid-market builders and regional subcontractors are responding to tiered cloud offerings with multi-entity consolidation, joint-venture accounting, and intercompany billing. Industry-specific packs for healthcare, education, interiors, civil, and industrial projects are gaining traction with prebuilt reports for retainage, certified payroll, and surety bonding. Our view is that the richest upside lies in outcome-based engagements that pair software with training, data migration, and monthly health checks, raising billable utilization and change order recovery across portfolios.

Trends point to mobile-first capture of time, quantities, and receipts, synced to budget line items and cost codes in real time. WIP dashboards blend earned value, production rates, and forecast-at-complete to flag margin fade early, while drill-through reports trace every pay application, waiver, and subcontract change. Open APIs are standardizing exchanges with BIM coordination, scheduling, and field tools, and vendor portals are streamlining approvals with e-signatures. AP departments are leaning into OCR, automated three-way match, and duplicate detection, then pushing payments through integrated rails that maintain audit trails. Revenue recognition and tax handling are tightening with configurable rules for VAT, GST, CIS, and retention. From an opinionated stance, the decisive trend is traceability across the project lifecycle, where every dollar posted carries documentation, timestamps, and responsible parties, turning closeout binders and lender packages into routine exports rather than last-minute fire drills.

Challenges arise from change management in field and back-office teams that are accustomed to email attachments and spreadsheet trackers, which leads to partial use and data gaps. Pricing friction is common when per-user licenses, storage tiers, and integration add-ons create budget uncertainty on long multi-phase programs. Legacy ERPs and archived file stores without modern APIs complicate bidirectional syncing for RFIs, drawings, and as-builts, increasing manual work. Data migration from inconsistent cost codes and historical jobs can extend timelines, while device policies and security reviews slow rollouts. Compliance differences across VAT, GST, withholding, and regional payroll formats require careful configuration. Connectivity at remote jobsites limits real-time updates and photo evidence. In our view, vendors that deliver offline-first apps, transparent packaging, fixed-scope onboarding, and clear naming conventions will convert trials into renewals, whereas tool-only pitches risk churn when schedules tighten and teams revert to email.

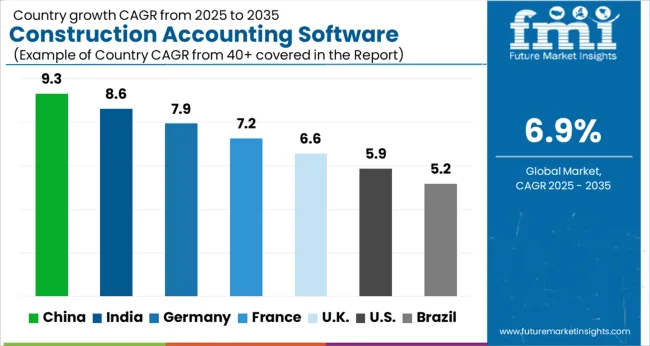

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

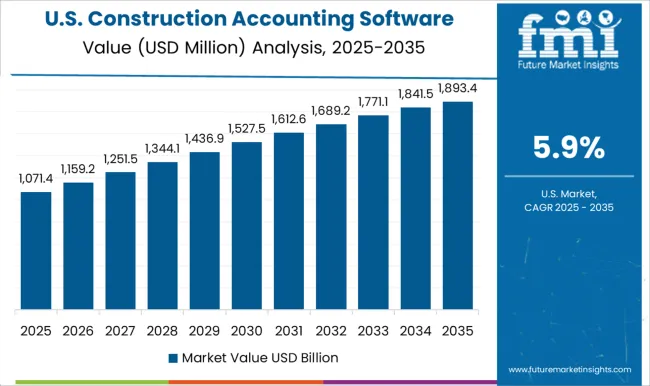

| USA | 5.9% |

| Brazil | 5.2% |

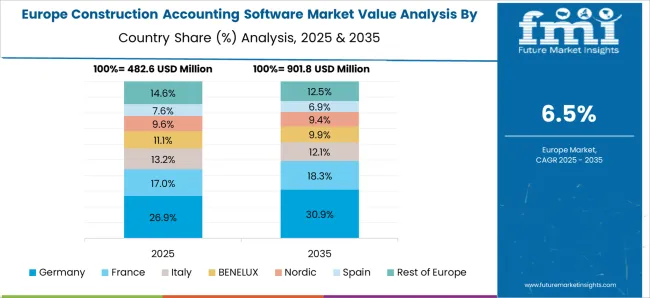

The global construction accounting software market is projected to grow at 9.1% from 2025 to 2035. China leads at 9.3%, followed by India 8.6% and France 7.2%; the United Kingdom 6.6% and United States 5.9% follow. Growth is being pulled by project cost control, WIP reporting, percentage-of-completion revenue, retention tracking, and airtight audit trails. Progress billing, change-order governance, and certified documentation are being centralized to cut disputes and shorten pay cycles. Mobile timekeeping, expense capture, and vendor invoice workflows are being linked to ERP, CDE, and scheduling suites. Asia is set to outpace on volume rollouts and localized tax compliance, Europe on documentation rigor and e-invoicing mandates, and the USA on steady migration from legacy on-prem ledgers to cloud platforms with job-cost depth and integration reach. This report includes insights on 40+ countries; the top markets are shown here for reference.

The construction accounting software market in China is expected to expand at 9.3%. Adoption is being propelled by public works and mixed-use programs where job costing, WIP aging, retention, and progress draws must be reconciled against contract schedules. Golden Tax e-invoicing and fapiao controls are being embedded, with OCR capture and three-way match applied to rein in AP leakage. Multi-entity consolidation and project-level cost codes are being standardized so owners receive consistent reports across EPC and subcontract tiers. Mobile expense capture and supplier portals are being used to trim cycle times, while API links into project management suites keep change orders and budget transfers synchronized. It is judged that China will set the pace through bundled suites, strong data residency assurances, and shared-service centers that centralize AP, AR, and fixed-asset control for large contractors.

The construction accounting software market in India is projected to grow at 8.6%. Acceleration is being shaped by GST e-invoicing, TDS/TCS rules, and milestone-linked payments on highways, metros, and data centers. Job cost ledgers, BOQ-aligned progress billing, and retention/advance management are being formalized to curb leakage. JV accounting and multi-project consolidation are gaining ground as EPC groups scale, while WhatsApp-ready approvals and mobile timesheets ease dispersed site operations. Change-order controls and budget rebaselining are being tied to client approvals to reduce claims friction. It is assessed that steady gains will be recorded as RFPs insist on Indian chart-of-accounts templates, site cashbook digitization, and GST reconciliation dashboards that cut month-end close from weeks to days across tier-1 and tier-2 contractor networks.

The construction accounting software market in France is anticipated to rise at 7.2%. Demand is being guided by French GAAP/IFRS reporting, percentage-of-completion recognition, and retention (“retenue de garantie”) tracking on public contracts. Chorus Pro and phased B2B e-invoicing are being embedded, with SAF-T/FEC exports used to satisfy audits. Cost codes mapped to lots and trades are being required so WIP, claims, and penalty exposures can be traced by work package. Multi-company consolidation and intercompany recharges are being structured for groups operating across regions. It is our view that France will favor platforms with rigorous documentation, decennial warranty evidence, and clear archive exports, allowing prime contractors and precasters to defend margins during acceptance and post-handover periods.

The construction accounting software market in the UK is expected to expand at 6.6%. Uptake is being directed by CIS deduction handling, domestic reverse charge VAT, and NEC/JCT payment mechanics that demand transparent valuations and retention logs. WIP reporting, cost-to-complete, and change-event registers are being synchronized with CDEs to keep site and office aligned. Making Tax Digital requirements are being met through API-ready VAT submissions, while project bank account needs are being handled with segregated ledgers. It is assessed that steady progress will continue as frameworks specify standard cost codes, valuation packs, and audit trails that reduce dispute risk and compress pay-app cycles across refurb, education, healthcare, and build-to-rent schemes.

The construction accounting software market in the United States is projected to grow at 5.9%. Momentum is being supported by ASC 606 percentage-of-completion, AIA-style billing (G702/G703), retainage, and change-order governance on healthcare, industrial, and logistics projects. Certified payroll, union fringes, and prevailing-wage compliance are being embedded for public work, with lien-waiver chains tied to payment approvals. Equipment costing, T&M, and cost-plus contracts are being handled alongside standard job cost codes, while integrations to estimating, scheduling, and procurement keep commitments visible. In our view, migration from aging on-prem ledgers to cloud suites will proceed steadily as contractors pursue faster close, richer audit trails, and tighter cash management across multi-state operations.

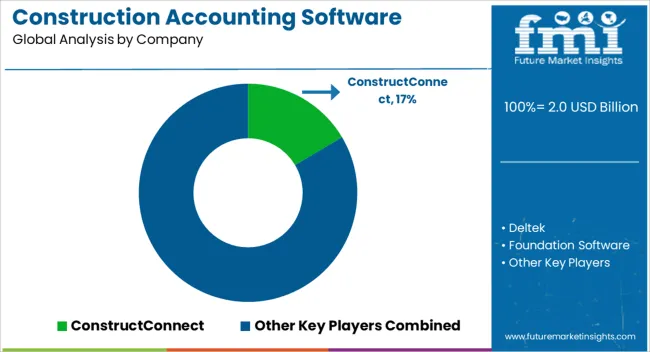

Competition in construction accounting software has been framed by brochures that turn hard finance into simple, job ready workflows. Sage Group positions Sage 100 Contractor and Sage 300 CRE as the benchmark for WIP reporting, AIA-style progress billing, retainage, and committed cost control. Deltek centers brochures on ComputerEase, stressing construction-specific payroll, union and certified payroll, and strong job cost visibility. Foundation Software highlights labor capture, equipment costing, and real-time job cost ledgers built for self-performing trades. Oracle Construction and Engineering promotes schedule to cost governance and payment control, linking estimates, commitments, and subcontractor pay apps with audit trails. Procore Technologies presents Financials as a field-to-office spine that links budgets, change orders, forecasts, and vendor invoices within one interface. Viewpoint, under Trimble, focuses brochures on Vista and Spectrum, pairing deep GL and AP with project costing and payroll at scale. Jonas Construction Software markets an all-in-one ERP with service, inventory, and job cost on the same database. Intuit and Xero position contractor-ready editions and app ecosystems, leaning on ease of use and fast onboarding. ConstructConnect appears as a preconstruction signal source that pushes estimates and vendor data into downstream cost modules through published connectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Offering | Solution and Service |

| Deployment | Cloud and On-premise |

| Functionality | Accounts payable & receivable, Audit reporting, Project costing, and Others |

| Application | Small and mid-sized enterprise and Large sized companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ConstructConnect, Deltek, Foundation Software, Intuit, Jonas Construction Software, Oracle Construction and Engineering, Procore Technologies, Sage Group, Viewpoint, and Xero |

| Additional Attributes | Dollar sales by deployment (cloud, on premise), Dollar sales by customer size (small contractors, mid sized, enterprises), Dollar sales by module (job costing, payroll, AP AR, progress billing, WIP reporting, tax compliance), Trends in real time cost control and e invoicing, Role in GAAP IFRS compliance and retention lien management, Regional adoption across North America, Europe, Asia Pacific. |

The global construction accounting software market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the construction accounting software market is projected to reach USD 4.0 billion by 2035.

The construction accounting software market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in construction accounting software market are solution and service.

In terms of deployment, cloud segment to command 58.7% share in the construction accounting software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA