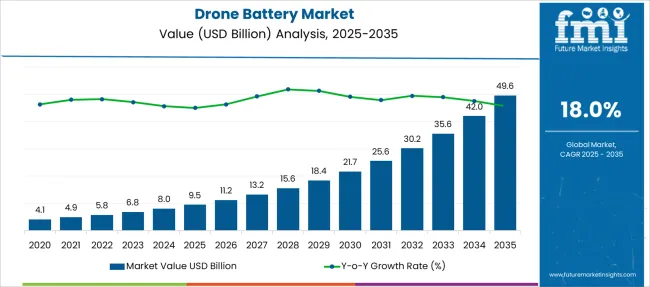

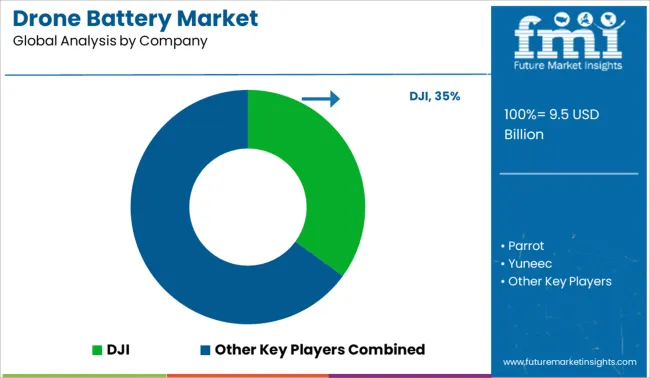

The Drone Battery Market is estimated to be valued at USD 9.5 billion in 2025 and is projected to reach USD 49.6 billion by 2035, registering a compound annual growth rate (CAGR) of 18.0% over the forecast period.

| Metric | Value |

|---|---|

| Drone Battery Market Estimated Value in (2025 E) | USD 9.5 billion |

| Drone Battery Market Forecast Value in (2035 F) | USD 49.6 billion |

| Forecast CAGR (2025 to 2035) | 18.0% |

The drone battery market is undergoing significant growth as technological advancements, rising drone penetration, and evolving use cases drive demand for high-performance energy solutions. The increasing deployment of drones across industries such as delivery, agriculture, surveillance, and filmmaking is creating strong demand for lightweight, durable, and efficient batteries.

Manufacturers are focusing on enhancing energy density, reducing charging time, and extending flight duration, aligning with operational requirements of both recreational and commercial users. Sustainability concerns and regulatory developments are encouraging innovations in recyclable and safer chemistries, further supporting market momentum.

Future growth is expected to be fueled by expanding drone adoption in emerging markets, integration of advanced battery management systems, and increasing investment in high-capacity energy storage technologies that enhance mission capabilities and operational efficiency.

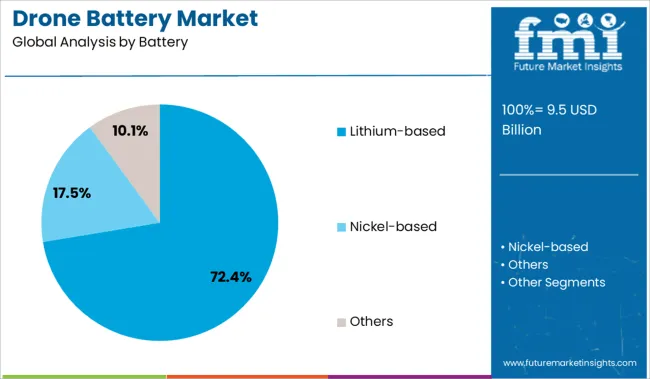

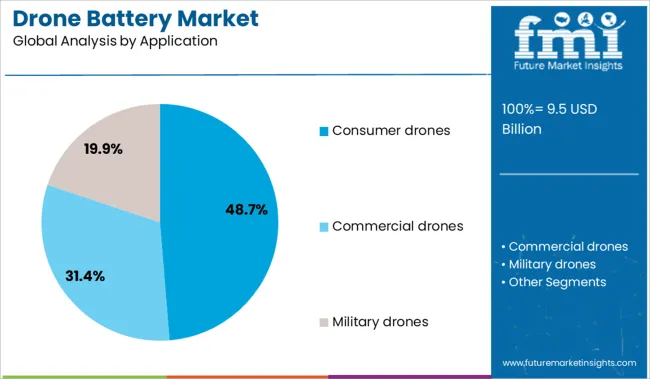

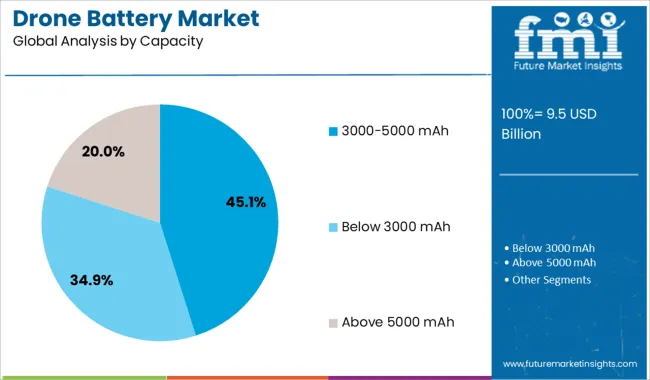

The market is segmented by Battery, Application, Capacity, Drone Type, and region. By Battery, the market is divided into Lithium-based, Nickel-based, and Others. In terms of Application, the market is classified into Consumer drones, Commercial drones, and Military drones. Based on Capacity, the market is segmented into 3000-5000 mAh, Below 3000 mAh, and Above 5000 mAh.

By Drone Type, the market is divided into Rotary wing, Fixed wing drone, and Hybrid wing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by battery type, lithium-based batteries are projected to hold 72.40% of the total market revenue in 2025, making it the leading segment. This dominance is attributed to their superior energy-to-weight ratio, high charge retention, and ability to deliver consistent performance in diverse operating conditions.

Technological innovations in lithium chemistries have enabled extended flight times and reduced charging cycles, addressing critical performance expectations in drone operations. The widespread availability and ongoing cost reductions of lithium cells have further strengthened adoption across both consumer and commercial drone categories.

Their compatibility with advanced battery management systems and safety enhancements have also contributed to their leadership, making lithium-based solutions the preferred choice for manufacturers and end-users seeking reliability and efficiency.

In terms of application, consumer drones are expected to account for 48.70% of the market revenue in 2025, emerging as the top application segment. This leadership is driven by the expanding use of drones among hobbyists, enthusiasts, and semi-professional users, coupled with growing interest in aerial photography, videography, and recreational flying.

Increased accessibility due to falling prices and availability of user-friendly models has broadened the consumer base significantly. Manufacturers have tailored battery solutions to meet the expectations of this segment by focusing on longer flight durations, quick charging, and lightweight designs that enhance user experience.

The strong influence of social media and content creation trends has further propelled the segment’s growth, supported by continuous innovation in compact and efficient battery technologies designed for personal and recreational applications.

When segmented by capacity, batteries in the 3000 to 5000 mAh range are projected to capture 45.10% of the market revenue in 2025, positioning this range as the leading capacity segment. This prominence is attributed to its optimal balance between weight, flight time, and affordability, making it suitable for a wide variety of drone models.

These batteries offer sufficient power for extended flights while maintaining portability and ease of handling, which aligns well with operational needs in both consumer and entry-level commercial drones. Manufacturers have optimized this capacity range to deliver consistent output without compromising on weight constraints that impact flight dynamics.

Additionally, advancements in thermal management and cell design have improved reliability and safety in this range, reinforcing its strong market position among users seeking dependable performance for diverse use cases.

Demand for drone batteries is rising with expanded UAV use in logistics, defense, and inspection services. Sales of lithium-based and hybrid fuel-cell batteries are accelerating as operators prioritize flight time, weight optimization, and fast-charging cycles. Battery design innovation is reshaping payload capability and airspace compliance across commercial drone fleets.

Demand for drone batteries with energy densities above 300Wh/kg rose 23% in 2025, driven by commercial UAV operators seeking longer aerial coverage. Multirotor fleets for agricultural spraying in Brazil and Australia deployed lithium-silicon packs to extend flight duration by 38%. Battery OEMs adopted new anode formulations that reduced volumetric weight while boosting energy throughput. Civil inspection drones in Japan standardized on 6S high-discharge packs, cutting downtime during infrastructure monitoring by 34%. Solid-state lithium prototypes entered pilot trials with drone delivery services in Germany, aiming to support 45-minute continuous flights. Integration of fast-swapping modules also slashed recharge intervals across warehouse-based drone hubs.

Sales of hybrid drone batteries grew 29% YoY in 2025, propelled by tactical UAV applications in border patrol, disaster response, and intelligence missions. Defense ministries in India and Poland funded hybrid propulsion kits combining Li-ion and fuel-cell stacks, enabling multi-hour surveillance runs in rugged terrain. Hydrogen-powered drone programs scaled in South Korea, where onboard reformer units allowed extended flight over 100km without mid-mission landing. Battery management systems evolved with dual-fuel switching algorithms that enhanced thermal efficiency by 17%. Procurement of hybrid drone power units now constitutes over 32% of military UAV tenders globally, reflecting growing trust in redundancy-enhanced flight platforms.

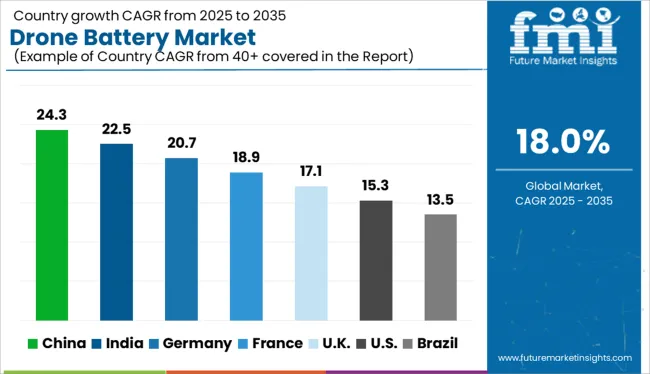

| Country | CAGR |

|---|---|

| China | 22.5% |

| India | 22.5% |

| Germany | 20.7% |

| France | 18.9% |

| UK | 17.1% |

| USA | 15.3% |

| Brazil | 13.5% |

The global drone battery market is set to grow at a CAGR of 18% from 2025 to 2035. China leads with 24.3%, driven by rapid drone industrialization, supply chain maturity, and high-volume manufacturing. India follows at 22.5%, supported by strong government incentives, agricultural drone use, and expanding surveillance applications. Among OECD nations, Germany is advancing at 20.7%, reflecting its role in lithium-ion battery innovation and growing demand for industrial drones. The UK, at 17.1%, benefits from investments in lightweight battery systems and commercial pilot programs.

The USA, growing at 15.3%, continues to scale drone applications in defense and infrastructure inspection, though regulatory hurdles temper its pace. BRICS countries outpace global averages, while ASEAN economies, though not shown here, are expected to contribute meaningfully as commercial drone logistics develop. The global growth pattern highlights the intersection of innovation, regulation, and infrastructure modernization across key economies. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to lead the global drone battery market with a CAGR of 24.3% between 2025 and 2035, driven by its booming UAV manufacturing base and deep integration of drones across logistics, agriculture, and surveillance sectors. Between 2020 and 2024, most drone battery use was centered on consumer drones.

However, the upcoming decade will see a strong shift toward industrial applications, requiring higher energy density and faster-charging battery solutions. Domestic battery makers are ramping up production of lithium-sulfur and solid-state chemistries for next-gen UAV fleets. Additionally, government initiatives like “low-altitude economy” zones are accelerating demand for advanced battery tech compatible with long-range drones.

India is poised for significant advancement in the drone battery market, expected to expand at a CAGR of 22.5% through 2035. While earlier growth from 2020 to 2024 was concentrated in precision agriculture, the future trajectory will include defense, healthcare delivery, and smart city surveillance.

The government’s Production-Linked Incentive (PLI) scheme and the liberalized drone rules are fostering local assembly of high-capacity drone batteries. Meanwhile, startups are focusing on modular battery packs compatible with multi-rotor and fixed-wing drones. Demand for drone batteries is also increasing due to expanded BVLOS (Beyond Visual Line of Sight) trial projects under government supervision.

Germany’s drone battery market is anticipated to register a CAGR of 20.7% during the forecast period, as aerospace-grade energy solutions become vital to meeting EU regulations and commercial drone use standards. From 2020 to 2024, consumer drones and agricultural mapping dominated battery use. Between 2025 and 2035, however, energy storage innovation is accelerating across inspection, firefighting, and traffic monitoring UAVs.

German manufacturers are developing cobalt-free and high-voltage lithium packs that comply with stringent airworthiness guidelines. Public-private collaborations are also supporting the rollout of solar-charged drone hubs requiring ultra-stable energy cells.

A CAGR of 17.1% underscores the steady growth of the drone battery market in the United Kingdom, where strategic drone corridors and regulatory frameworks are fostering industrial adoption. Between 2020 and 2024, drone battery demand remained fragmented across hobbyist and light commercial sectors.

In the coming years, emphasis is shifting toward energy-efficient solutions for medical logistics, infrastructure inspection, and offshore surveillance. Investment in lithium-polymer batteries with enhanced safety ratings is increasing, especially among drone-as-a-service operators. Additionally, academic-industry R&D alliances are prototyping drone batteries with real-time thermal diagnostics.

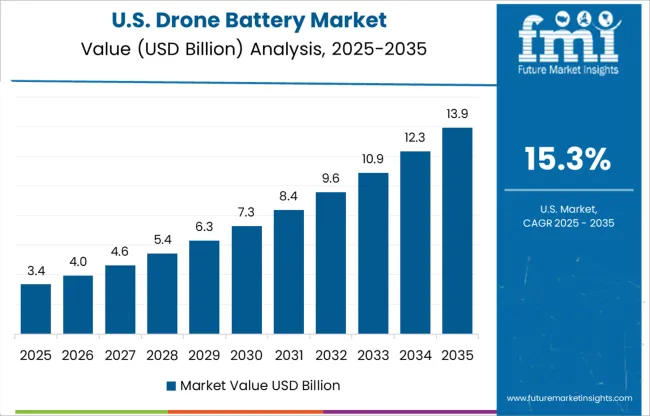

The drone battery market in the United States is forecast to grow at a CAGR of 15.3% from 2025 to 2035, supported by expanding commercial drone programs and FAA-driven certification requirements. From 2020 to 2024, battery demand was largely centered around cinematography and infrastructure surveys.

Going forward, scaling up in delivery networks and defense contracts is creating a need for longer lifecycle and high-recharge-rate battery packs. Manufacturers are investing in silicon-anode and graphene-enhanced battery prototypes to support heavy-lift drones. Federal grants and testing corridors are promoting field validation of next-generation battery formats.

Demand for drone batteries in 2025 is being driven by rising UAV adoption across commercial, defense, and industrial sectors. DJI maintains a commanding share, supported by proprietary lithium polymer battery technology and integrated battery-management systems. Tattu (Gens Ace) and Grepow Battery lead the OEM battery segment with high-density cells tailored for professional and racing drones.

Autel Robotics, Yuneec, and Parrot are expanding their in-house battery solutions to optimize flight time and safety. Military-grade battery demand is boosting sales of drone battery technology from FLIR Systems, Lockheed Martin, and Saft Batteries. Emerging players like Quantum Systems and UAV Factory are investing in swappable smart batteries, while Boeing’s Insitu unit focuses on long-endurance battery packs for surveillance missions.

In November 2024, DJI introduced the Power Expansion Battery 2000, a 2 kWh add-on for its Power 1000 station. This upgrade significantly enhances drone battery backup and field charging efficiency for extended outdoor or industrial drone operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.5 Billion |

| Battery | Lithium-based, Nickel-based, and Others |

| Application | Consumer drones, Commercial drones, and Military drones |

| Capacity | 3000-5000 mAh, Below 3000 mAh, and Above 5000 mAh |

| Drone Type | Rotary wing, Fixed wing drone, and Hybrid wing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DJI, Parrot, Yuneec, Autel Robotics, Hubsan, Walkera, PowerVision, EHang, UAV Factory, Quantum Systems, Skycatch, AeroVironment, FLIR Systems, Draganfly Innovations, Flyability, Boeing (Insitu), Lockheed Martin, Saft Batteries, Grepow Battery, and Tattu (Gens Ace) |

| Additional Attributes | Dollar sales by battery type and drone category, demand dynamics across commercial and defense applications, regional trends in high-density lithium adoption, innovation in solid-state cell architecture, environmental concerns linked to battery disposal and recycling, and emerging use cases in last-mile delivery and precision agriculture. |

The global drone battery market is estimated to be valued at USD 9.5 billion in 2025.

The market size for the drone battery market is projected to reach USD 49.6 billion by 2035.

The drone battery market is expected to grow at a 18.0% CAGR between 2025 and 2035.

The key product types in drone battery market are lithium-based, nickel-based and others.

In terms of application, consumer drones segment to command 48.7% share in the drone battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drone Test Stand Market Size and Share Forecast Outlook 2025 to 2035

Drone Simulator Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Drone Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Drone Sensor Market - UAV Advancements & Forecast 2025 to 2035

Drone Motor Market Growth - Trends & Forecast 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Anti-Drone Technology Market

LiDAR Drone Market Size and Share Forecast Outlook 2025 to 2035

Counter Drone System Market Size and Share Forecast Outlook 2025 to 2035

Medical Drones Market Report – Growth & Forecast 2025-2035

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Consumer Drones Market

Fumigation Drone Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA