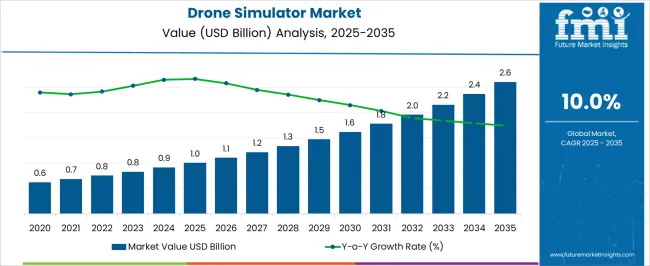

The drone simulator market is valued at USD 1.0 billion in 2025 and is expected to reach USD 2.6 billion by 2035, registering a CAGR of 10.0%. An early versus late growth curve comparison highlights differences in market acceleration, adoption patterns, and value addition over the forecast period. From 2021 to 2025, the market grows from USD 0.6 billion to 1.0 billion, with incremental values of USD 0.7 billion, 0.8 billion, 0.8 billion, and 0.9 billion.

The early growth curve is characterized by moderate expansion, driven by initial adoption in military, commercial, and educational applications, limited awareness, and early-stage technological integration. Between 2026 and 2030, the value increases from USD 1.0 billion to USD 1.6 billion, passing through USD 1.1 billion, USD 1.2 billion, USD 1.3 billion, and USD 1.5 billion. Growth momentum during this mid-phase accelerates as advanced simulator technologies, AI-enabled training modules, and widespread use in commercial drone operations expand market penetration.

From 2031 to 2035, the market is projected to progress from USD 1.8 billion to USD 2.6 billion, with intermediate values of USD 2.0 billion, USD 2.2 billion, and USD 2.4 billion. The late growth curve demonstrates higher absolute gains, reflecting mature adoption, broader integration in defense, logistics, and industrial training, and increased investments in high-fidelity simulation platforms.

| Metric | Value |

|---|---|

| Drone Simulator Market Estimated Value in (2025 E) | USD 1.0 billion |

| Drone Simulator Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The drone simulator market is influenced by five key parent markets that collectively drive its growth, adoption, and technological advancement across civil, defense, and commercial sectors. The unmanned aerial vehicles (UAV) manufacturing market contributes the largest share, about 25-30%, as drone simulators are essential for training operators on navigation, payload management, and mission planning without risking actual hardware.

The defense and military training market adds approximately 20-24%, where simulators are used to prepare personnel for reconnaissance, surveillance, combat, and tactical operations in a safe, controlled environment. The commercial drone services market contributes around 15-18%, as companies offering logistics, surveying, agriculture monitoring, and inspection services leverage simulators to upskill operators and optimize operational efficiency.

The education and research market accounts for roughly 12-15%, where universities, technical institutes, and aviation academies use drone simulators for curriculum-based training, pilot certifications, and experimental studies. The emergency response and public safety market represents about 8-10%, as fire, disaster management, and law enforcement agencies employ simulators to train personnel for search and rescue, firefighting, and surveillance operations.

The drone simulator market is expanding rapidly, supported by the rising adoption of unmanned aerial vehicles across defense, commercial, and recreational sectors. Technological advancements in simulation software have improved realism, enabling pilots and operators to train in complex environments without operational risk.

Industry developments have shown strong demand from defense organizations for pilot readiness programs and from commercial sectors for operator certification training. The growth of drone-based applications in inspection, surveying, and logistics has further driven simulator adoption.

Additionally, regulatory authorities in various regions are mandating simulator-based training for licensing, boosting market penetration. Ongoing innovation in VR/AR integration and AI-enabled simulation modules is expected to enhance training outcomes and broaden market accessibility in the coming years.

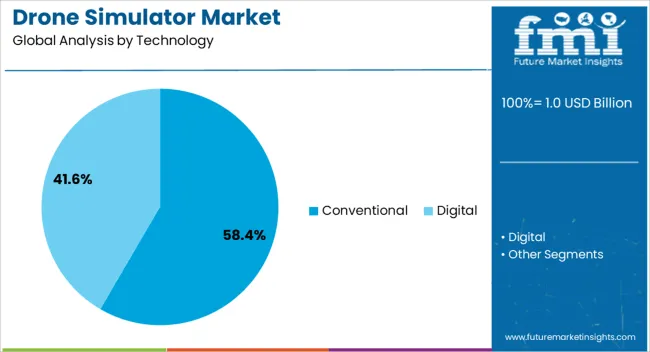

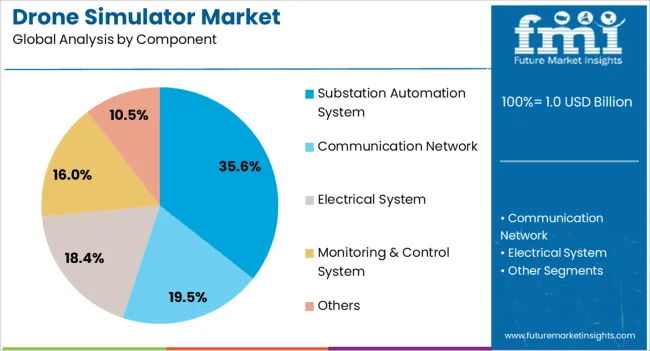

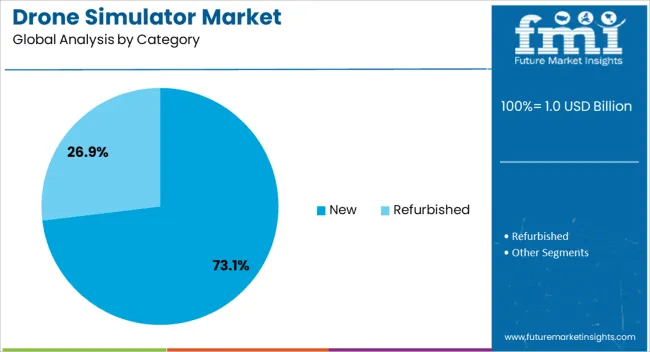

The drone simulator market is segmented by technology, component, category, voltage level, end use, and geographic regions. By technology, drone simulator market is divided into Conventional and Digital. In terms of component, drone simulator market is classified into Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others. Based on category, drone simulator market is segmented into New and Refurbished. By voltage level, drone simulator market is segmented into High, Medium, and Low. By end use, drone simulator market is segmented into Utility and Industrial. Regionally, the drone simulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Conventional segment is projected to account for 58.4% of the drone simulator market revenue in 2025, making it the dominant technology type. Its growth has been driven by the widespread use of established simulation systems that offer proven reliability, lower costs, and ease of integration into existing training frameworks.

Conventional simulators are favored by training institutions and defense agencies due to their compatibility with multiple drone models and operational scenarios. They provide sufficient realism for skill development without requiring the high investment often associated with immersive or specialized simulation technologies.

Additionally, these systems are scalable, allowing training facilities to expand capacity without major infrastructure changes. As budget-conscious buyers in both government and private sectors continue to prioritize cost-effective training solutions, the Conventional segment is expected to maintain its market leadership.

The Substation Automation System component is estimated to contribute 35.6% of market revenue in 2025, establishing it as a significant segment in the drone simulator market. Growth in this segment has been driven by the need for precise and reliable control systems within simulation platforms, ensuring accurate replication of real-world drone operations.

These systems manage multiple operational parameters, enabling smooth communication between simulation software and hardware components. Their role in enhancing response accuracy, reducing latency, and supporting complex operational scenarios has been critical for advanced pilot training programs.

The adaptability of substation automation systems to integrate with various simulator configurations has further increased their adoption among training providers. With the growing complexity of drone missions, demand for advanced automation in simulators is set to remain strong.

The New category is projected to hold 73.1% of the drone simulator market revenue in 2025, indicating strong demand for modern and technologically advanced systems. This growth has been supported by training organizations and enterprises seeking to upgrade from legacy systems to newer platforms offering enhanced realism, better graphics, and improved training analytics.

New systems often incorporate features such as AI-driven performance assessment, customizable training modules, and integration with virtual and augmented reality technologies. These capabilities have been highly valued for preparing operators to handle diverse operational environments and mission complexities.

Furthermore, the reduced maintenance requirements and longer lifecycle of new simulators compared to older models have added to their cost-effectiveness over time. As the drone industry continues to evolve, the New category is expected to dominate due to continuous product innovation and the need for high-fidelity training solutions.

The drone simulator provide realistic flight conditions, VR/AR integration, and multi-drone compatibility, reducing operational risk and enhancing skills. Challenges include high development costs, software complexity, hardware upgrades, and regulatory compliance. Opportunities exist in military training, logistics, agriculture, and infrastructure inspection applications. Manufacturers providing high-fidelity, AI-enabled, and customizable simulators with real-time analytics and scenario replication are best positioned to capture market growth. Asia-Pacific, North America, and Europe remain key regions due to increasing drone deployment and training initiatives.

The drone simulator market is expanding as commercial, defense, and recreational operators increasingly adopt simulation solutions for pilot training, mission planning, and operational safety. Simulators replicate real-world flight conditions, enabling operators to practice navigation, obstacle avoidance, and payload management without risking equipment. Growth is driven by increasing drone adoption in agriculture, delivery services, law enforcement, and aerial surveying across Asia-Pacific, North America, and Europe. Manufacturers focus on high-fidelity simulators with realistic physics, environmental conditions, and interactive controls. Integration with VR/AR technology enhances training experience. Rising emphasis on compliance with aviation regulations, safe flight operations, and skill certification further supports adoption. Providers offering advanced software, customizable scenarios, and multi-platform compatibility are well-positioned to capture global demand for drone training solutions.

High-fidelity simulation requires advanced graphics, real-time physics modeling, and multi-sensor input, increasing production expenses. Compliance with aviation safety standards, regional drone regulations, and operator certification requirements adds complexity for manufacturers and training providers. Compatibility with diverse drone models and payload systems presents additional technical constraints. Customers increasingly demand certified, reliable, and customizable simulators suitable for defense, commercial, and industrial applications. Companies investing in software optimization, VR/AR integration, and scenario customization are better positioned to overcome these challenges, ensuring realistic training experiences, regulatory compliance, and operational efficiency globally.

Opportunities in the drone simulator market are driven by defense, emergency response, logistics, agriculture, and infrastructure inspection applications. Military and paramilitary forces use simulators for tactical training, mission rehearsal, and equipment familiarization. Commercial operators adopt simulators to reduce operational risk, train pilots efficiently, and optimize flight planning. Industrial applications include aerial surveying, precision agriculture, and pipeline monitoring. Asia-Pacific, North America, and Europe exhibit strong growth due to increasing drone fleet deployment, regulatory support, and training initiatives. Manufacturers providing scenario customization, multi-drone simulation, and realistic environmental modeling gain a competitive advantage. Expanding adoption in educational institutions and pilot certification programs further positions drone simulators as essential tools for skill development worldwide.

Technological trends in the drone simulator market include VR/AR integration, AI-driven flight analytics, and real-time environmental modeling. Advanced simulators replicate weather conditions, terrain variations, and sensor feedback to enhance pilot preparedness. AI algorithms analyze operator performance, providing actionable insights for skill improvement and safety enhancement. Integration with cloud-based platforms enables remote training, multi-user simulations, and mission data sharing. Companies are developing lightweight, portable simulators compatible with multiple drone types and controllers. Manufacturers offering high-fidelity, digitally integrated, and AI-enhanced training solutions are positioned to meet growing demand from defense, commercial, and industrial drone operators globally. Continuous innovation ensures realistic, cost-effective, and efficient training experiences.

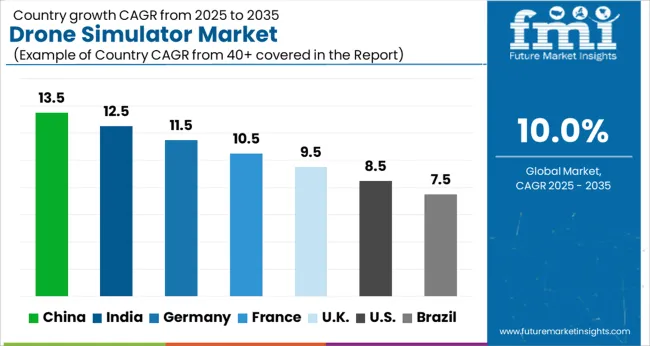

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The global drone simulator market is projected to expand at a CAGR of 10% from 2025 to 2035. China (13.5%) and India (12.5%) are the fastest-growing markets, supported by UAV adoption across commercial, defense, and civil applications, government training programs, and local manufacturing scale-up. Germany (11.5%) emphasizes high-precision simulators and industrial UAV applications, while the UK (9.5%) and USA (8.5%) show steady adoption for defense, logistics, and surveying sectors. Growth drivers include VR/AR-enabled simulation, AI-assisted flight controls, scenario-based training, and multi-drone operations. Suppliers are focusing on modular, high-fidelity, and software-integrated solutions to capture market share globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The drone simulator market in China is projected to grow at a CAGR of 13.5% from 2025 to 2035, driven by rapid adoption of UAVs in commercial, defense, and civil applications. The country’s expanding drone manufacturing industry and government-backed UAV training programs boost demand for high-fidelity simulation platforms. Advanced simulators supporting AI-based navigation, obstacle avoidance, and mission planning are increasingly deployed for pilot training and R&D. Partnerships between simulator providers and drone manufacturers enhance local availability and customization. Growing investments in precision agriculture, logistics, and surveillance applications further drive adoption. Manufacturers focus on immersive virtual reality interfaces, multi-rotor and fixed-wing simulation capabilities, and scenario-based training modules to capture market share.

The drone simulator market in India is expected to grow at a CAGR of 12.5% from 2025 to 2035, fueled by increasing UAV usage in agriculture, defense, and logistics. Government initiatives for UAV training and licensing create demand for advanced simulation platforms. Manufacturers focus on scenario-based training, AI-enabled flight algorithms, and VR/AR integration to enhance pilot readiness. Partnerships with defense organizations, educational institutions, and drone training centers expand market penetration. Adoption is further supported by rising investments in precision agriculture, survey mapping, and disaster management applications. Emphasis on localized software, hardware reliability, and multi-platform compatibility is helping suppliers strengthen competitive positioning.

The drone simulator market in Germany is projected to grow at a CAGR of 11.5% from 2025 to 2035, driven by increasing UAV use in industrial inspections, logistics, and defense. The country’s focus on R&D in aviation technologies and UAV integration supports simulator adoption. Manufacturers offer high-precision simulators with advanced scenario programming, AI-assisted controls, and virtual reality interfaces. Collaborations with universities, aviation schools, and defense institutions enhance training programs. Growing industrial applications, including energy infrastructure inspection and precision mapping, create significant demand. Emphasis on software reliability, realistic physics models, and modular hardware solutions further strengthens market growth.

The UK drone simulator market is expected to grow at a CAGR of 9.5% from 2025 to 2035, supported by UAV adoption in commercial, defense, and recreational segments. Simulator providers focus on realistic flight physics, multi-drone operations, and scenario-based training for pilot skill development. Government UAV programs and licensing regulations increase the need for certified training solutions. Partnerships with drone manufacturers, training academies, and defense organizations strengthen market reach. Growth is further supported by the use of simulators in logistics, surveying, and inspection applications. The integration of VR/AR interfaces and AI-enabled autonomous flight modules improves training efficiency and safety.

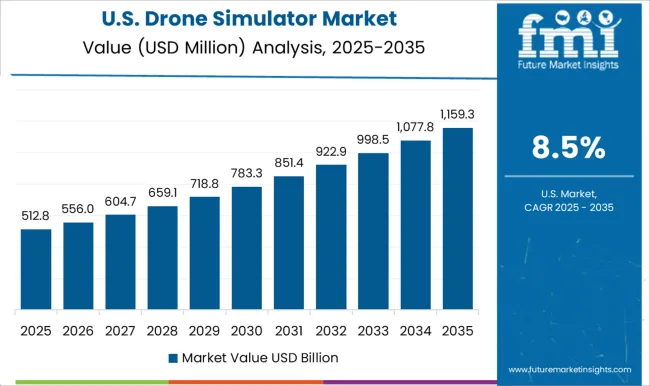

The USA drone simulator market is projected to grow at a CAGR of 8.5% from 2025 to 2035, fueled by widespread UAV deployment in defense, agriculture, logistics, and emergency response. High-fidelity simulators with AI-assisted navigation, multi-drone capabilities, and VR/AR interfaces are increasingly used for training and R&D. Manufacturers focus on scenario-based mission planning, realistic flight physics, and multi-platform compatibility. Partnerships with military, educational institutions, and commercial drone operators enhance market penetration. Adoption is further supported by the need for certified UAV pilots, simulation-based testing, and industrial applications in surveying, mapping, and inspection. Emphasis on software reliability, user-friendly interfaces, and modular hardware designs strengthens market position.

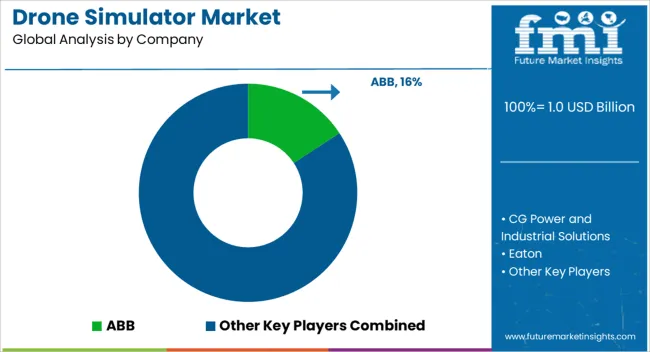

Competition in the drone simulator market is driven by technological innovation, realism, and sector-specific customization. CAE Inc. leads with high-fidelity simulation platforms for both military and commercial UAV applications, emphasizing precision, safety protocols, and interoperability with automated systems. General Atomics Aeronautical Systems focuses on virtual training environments for utility and inspection drones, leveraging realistic flight physics and scenario-based exercises. Israel Aerospace Industries differentiates by integrating energy-efficient simulation modules with scenario analytics for both fixed-wing and multirotor drones. Leonardo S.p.A. provides simulator platforms optimized for mission planning and autonomous navigation, targeting defense, infrastructure inspection, and urban monitoring applications. L3 Harris Technologies offers simulators with advanced sensor emulation and flight dynamics modeling, emphasizing predictive maintenance and operational training for commercial drones. Simlat Ltd. integrates real-time data modeling with drone operations, supporting industrial inspections and powerline monitoring training. Zen Technologies Ltd. delivers modular simulator solutions with scenario customization, emphasizing operator safety and system reliability. ST Engineering provides software-driven simulation platforms, enabling multi-drone coordination, SCADA integration, and networked training environments. Havelsan A.S. offers industrial-focused drone simulators with IoT-enabled control, data analytics, and remote monitoring capabilities. Aegis Technologies Group specializes in simulation technologies for various unmanned systems, including UAVs. Schneider Electric and Siemens leverage digital twin technologies to replicate industrial environments for UAV operator training, supporting predictive scenarios and operational optimization. Texas Instruments contributes via sensor emulation, embedded controllers, and simulation-ready microelectronics for realistic drone behavior. Tesco Automation offers customizable platforms for pilot training, mission rehearsal, and safety evaluation, emphasizing rapid scenario deployment and modular system updates. Product brochures highlight multirotor and fixed-wing simulation, autonomous flight training, sensor and payload emulation, mission planning modules, digital twin integration, and real-time telemetry analysis. Strategies across the market focus on expanding scenario complexity, improving software fidelity, and integrating simulator outputs with real-world drone operations. Collectively, these offerings illustrate a market defined by technological precision, safety compliance, and operator proficiency enhancement.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Technology | Conventional and Digital |

| Component | Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others |

| Category | New and Refurbished |

| Voltage Level | High, Medium, and Low |

| End Use | Utility and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, CG Power and Industrial Solutions, Eaton, Efacec, General Electric, Hitachi Energy, L&T Electrical and Automation, Locamation, Open System International, Rockwell Automation, Schneider Electric, Siemens, Texas Instruments, and Tesco Automation |

| Additional Attributes | Dollar sales by simulator type (software-based, hardware-based, integrated training systems), application (civil aviation, defense, commercial drones, research & development), and user type (military, commercial operators, hobbyists, academic institutions). Demand is driven by the need for cost-effective pilot training, regulatory compliance, and safety enhancement. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, supported by increasing drone adoption, investment in UAV training programs, and rising focus on autonomous aerial technologies. |

The global drone simulator market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the drone simulator market is projected to reach USD 2.6 billion by 2035.

The drone simulator market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in drone simulator market are conventional and digital.

In terms of component, substation automation system segment to command 35.6% share in the drone simulator market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA