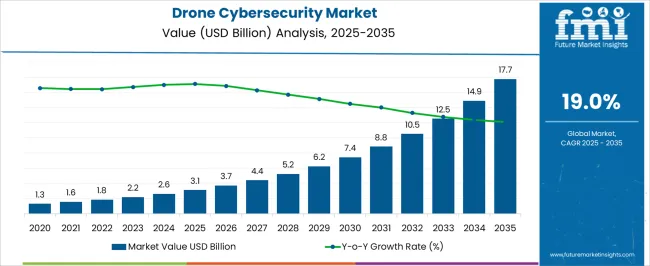

The drone cybersecurity market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 17.7 billion by 2035, registering a compound annual growth rate (CAGR) of 19.0% over the forecast period.

The drone cybersecurity market is valued at USD 3.1 billion in 2025 and is expected to grow to USD 17.7 billion by 2035, with a CAGR of 19.0%. Between 2021 and 2025, the market grows from USD 1.3 billion to USD 3.1 billion, progressing from USD 1.6 billion, 1.8 billion, 2.2 billion, and 2.6 billion. This initial phase shows steady expansion, driven by increasing concerns over cybersecurity risks associated with drone technologies in sectors like defense, logistics, and agriculture. As drones become more integrated into critical infrastructure, the demand for cybersecurity solutions increases to protect against data breaches, hacking, and potential threats to privacy.

Between 2026 and 2030, the market sees accelerated growth, advancing from USD 3.1 billion to USD 8.8 billion. Values progress through USD 3.7 billion, 4.4 billion, 5.2 billion, 6.2 billion, and 7.4 billion, driven by the growing deployment of drones in sensitive areas and advancements in anti-hacking and encryption technologies. During this period, a noticeable peak in market activity aligns with heightened awareness of security risks, prompting a surge in investment.

From 2031 to 2035, the market reaches USD 17.7 billion, with values passing through USD 10.5 billion, 12.5 billion, 14.9 billion, and 17.7 billion. The seasonality is less prominent in this market, as the increasing dependency on drones and the constant rise in cyber threats maintain a steady demand for cybersecurity solutions.

| Metric | Value |

|---|---|

| Drone Cybersecurity Market Estimated Value in (2025 E) | USD 3.1 billion |

| Drone Cybersecurity Market Forecast Value in (2035 F) | USD 17.7 billion |

| Forecast CAGR (2025 to 2035) | 19.0% |

The drone market is the largest contributor, accounting for around 30-35%, as drones are becoming more widely used across various sectors such as logistics, agriculture, defense, and surveillance, which increases the need for robust cybersecurity measures to protect these systems from cyberattacks and data breaches. The aerospace and defense market plays a significant role, contributing approximately 25-30%, as drones are extensively used for military and defense purposes, including surveillance, reconnaissance, and combat operations, making them prime targets for cyber threats that need to be mitigated to ensure national security.

The information technology and security market also contributes around 15-20%, driven by the need for IT security solutions to protect drone data and systems, especially as drones become more reliant on digital technologies, data transfer, and cloud services. The logistics and transportation market contributes approximately 10-12%, with the increasing use of drones in parcel delivery, supply chain management, and transportation, necessitating cybersecurity to protect sensitive data and ensure the reliability of these services.

Lastly, the smart cities and infrastructure market adds around 8-10%, as drones are increasingly deployed for infrastructure monitoring, urban planning, and traffic management in smart cities, requiring strong cybersecurity measures to safeguard urban operations and infrastructure. These parent markets highlight the growing importance of drone cybersecurity across various industries, ensuring secure and reliable drone operations.

The drone cybersecurity market is witnessing accelerated growth as unmanned aerial systems become deeply integrated into military, commercial, and civil sectors. The increasing frequency and sophistication of cyberattacks targeting critical drone systems are prompting stakeholders to invest in advanced cybersecurity solutions to safeguard flight control, communications, navigation, and data transmission modules. As drone usage expands across applications such as surveillance, delivery, and battlefield operations, the need for secure command and control infrastructure is growing in parallel.

Emerging regulatory frameworks and security guidelines from defense and civil aviation authorities are reinforcing the demand for robust cybersecurity protocols in drone deployment. Advancements in encryption technologies, intrusion detection, and autonomous threat response mechanisms are also contributing to market expansion.

With drones becoming more connected and reliant on wireless networks, particularly 5G and satellite links, the risk surface is expanding, making cybersecurity a strategic priority As nations enhance their defense and intelligence capabilities and commercial drone fleets scale rapidly, the market is expected to grow significantly, supported by rising awareness and institutional investment in securing unmanned systems.

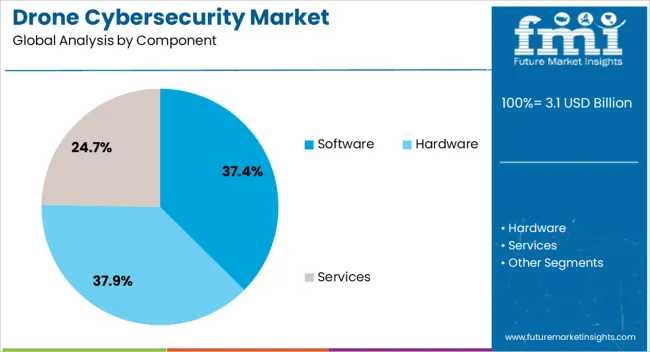

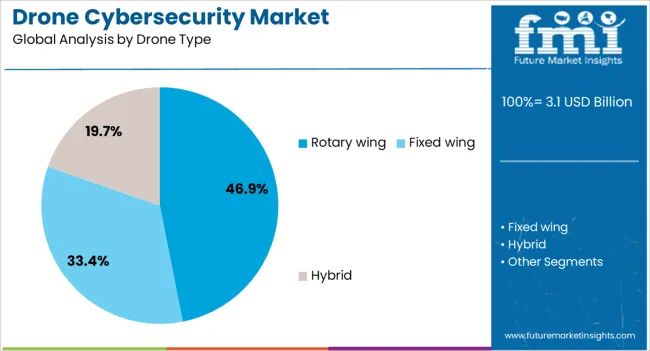

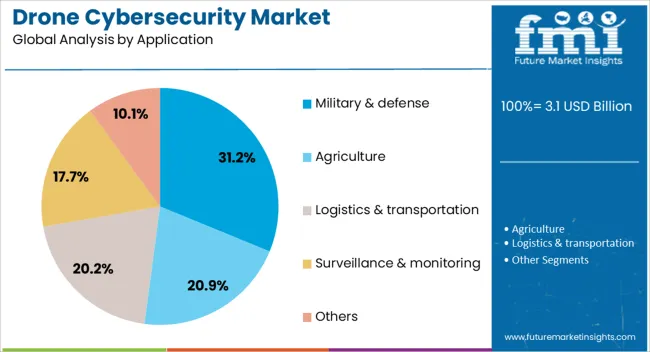

The drone cybersecurity market is segmented by component, drone type, application, and geographic regions. By component, drone cybersecurity market is divided into software, hardware, and services. In terms of drone type, drone cybersecurity market is classified into rotary wing, fixed wing, and hybrid. Based on application, drone cybersecurity market is segmented into military & defense, agriculture, logistics & transportation, surveillance & monitoring, and others. Regionally, the drone cybersecurity industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is projected to hold 37.4% of the drone cybersecurity market revenue share in 2025, positioning it as the leading component segment. This leadership is being supported by the increasing complexity and vulnerability of drone systems, which rely heavily on integrated software for navigation, flight control, communication, and mission execution. The need to protect firmware, operating systems, and application layers from malware, spoofing, and data breaches is elevating the role of software-based security solutions.

Real-time threat detection, end-to-end encryption, secure boot processes, and intrusion response mechanisms are being embedded in drone software architectures to provide continuous protection. As drone fleets expand and their missions become more autonomous, scalable and updatable software solutions are being prioritized over hardware-based approaches.

The software segment is also benefitting from increasing adoption of AI-driven anomaly detection systems and blockchain for data integrity With regulatory bodies mandating stricter compliance and traceability, the demand for secure software frameworks is expected to remain the central driver of this segment's continued growth.

The rotary wing segment is expected to represent 46.9% of the drone cybersecurity market revenue share in 2025, making it the dominant drone type. This leadership is being driven by the widespread deployment of rotary wing drones in both military and commercial applications due to their vertical takeoff and landing capability, maneuverability, and hovering precision.

The increased use of rotary drones for surveillance, reconnaissance, inspection, and delivery functions exposes them to cyber threats targeting their onboard systems and communication links. The segment is also experiencing growth as more rotary drones are integrated with high-definition imaging, GPS navigation, and cloud-based data sharing, all of which demand secure cyber infrastructures.

Enhanced focus on protecting real-time control signals, mission-critical data, and onboard AI modules is encouraging the deployment of advanced cybersecurity layers As regulatory frameworks tighten and drone missions become increasingly data-sensitive, the rotary wing segment is expected to maintain its dominance, supported by the need for agile and secure drone platforms in rapidly evolving operational environments.

The military and defense application segment is projected to capture 31.2% of the drone cybersecurity market revenue share in 2025, solidifying its position as the leading application segment. This dominance is being driven by the critical reliance of armed forces on drones for intelligence, surveillance, reconnaissance, and tactical missions. The sensitivity of mission data and the potential consequences of unauthorized access or control manipulation make cybersecurity a top strategic priority in defense drone operations.

Increasing threats from state-sponsored cyber actors, electronic warfare systems, and GPS spoofing technologies are prompting military organizations to invest in robust end-to-end encryption, secure communication links, and advanced cyber defense protocols for unmanned systems. The integration of autonomous navigation, sensor fusion, and cloud-based mission planning in military drones further amplifies the need for multilayered cybersecurity frameworks.

Governments are also allocating significant budgets to strengthen drone fleets with embedded security mechanisms that can resist cyberattacks in real-time As warfare becomes more technologically driven, the role of cybersecurity in maintaining operational integrity and data superiority is expected to drive sustained demand in this segment.

As drones become more integral to operations, the need for robust cybersecurity measures to protect sensitive data, communication channels, and systems from cyber threats is becoming critical. Key drivers include the rising adoption of drones for commercial applications, regulatory mandates on data privacy and security, and concerns over drone-related cyberattacks. Challenges in the market include the fast-evolving threat landscape, the need for real-time monitoring, and the complexity of securing both hardware and software components of drone systems.

Opportunities exist in the development of advanced encryption techniques, AI-driven security systems, and the integration of cybersecurity solutions with autonomous drone operations. Trends show a growing focus on building resilient, tamper-proof systems and the rise of drone security as a service (DSaaS), with manufacturers and operators prioritizing the implementation of comprehensive cybersecurity protocols.

The drone cybersecurity market is expanding due to the increasing deployment of drones in both commercial and defense sectors, where the risks associated with cyber threats are significant. Drones are increasingly used for critical tasks such as surveillance, delivery, data collection, and infrastructure inspection. The sensitive nature of the data being transmitted and processed by these UAVs makes them attractive targets for cybercriminals.

Additionally, defense agencies rely on drones for national security and surveillance, making cybersecurity a top priority to protect sensitive information and ensure operational integrity. As drone operations become more autonomous and interconnected, the need for comprehensive cybersecurity measures is growing, driving demand for solutions that safeguard communication channels, data integrity, and mission success.

The drone cybersecurity market faces challenges such as high implementation costs, complex regulatory requirements, and technical barriers in securing drone systems. The development and deployment of cybersecurity measures for drones, including advanced encryption and secure communication technologies, can be expensive, particularly for smaller drone operators or emerging markets. Additionally, as drones operate in increasingly complex environments, ensuring security across multiple platforms, communication channels, and devices adds layers of complexity.

Regulatory constraints, particularly in terms of data privacy laws and drone airspace regulations, can also hinder market growth. Compliance with local and international standards is essential but can complicate security protocol implementation. Technical limitations related to securing autonomous drone systems and ensuring real-time, low-latency cybersecurity responses present significant challenges that need to be addressed to maintain secure drone operations.

AI-powered security systems can monitor drone operations in real-time, detect abnormal behaviors, and respond to potential cyber threats instantly, significantly improving the security of drone fleets. The adoption of advanced encryption methods for drone communications and data storage is another critical development, ensuring that sensitive data remains protected from unauthorized access.

As drones become more autonomous, the need for self-secure drones that can autonomously detect and mitigate security threats is rising. These innovations are helping to create more robust and adaptable cybersecurity solutions, further supporting the growth of the market and addressing the unique security challenges faced by drone operators across industries.

The drone cybersecurity market is trending toward the rise of drone security as a service (DSaaS) and cloud-based security solutions. DSaaS enables drone operators to access scalable, cost-effective cybersecurity measures without needing to invest in in-house infrastructure or expertise. Cloud-based security solutions are particularly attractive as they allow for real-time monitoring, threat detection, and updates to be implemented remotely, enhancing the overall security of drone fleets. This model is especially beneficial for smaller drone operators who may not have the resources to develop their own cybersecurity frameworks.

The increasing sophistication of cyberattacks and the need for continuous updates and monitoring are making these solutions more appealing to both commercial and defense sectors. As the market evolves, DSaaS is expected to play a crucial role in providing comprehensive, adaptive, and efficient security solutions for the growing number of drone operators.

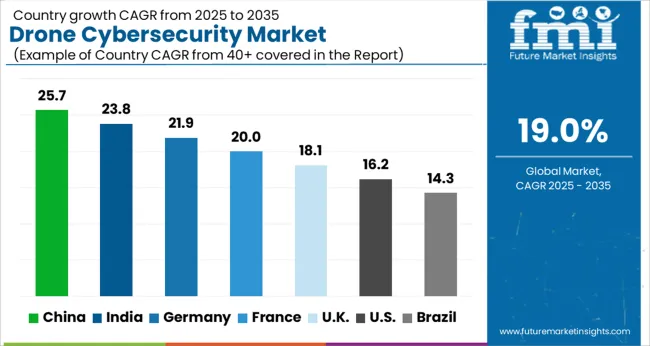

| Country | CAGR |

|---|---|

| China | 25.7% |

| India | 23.8% |

| Germany | 21.9% |

| France | 20.0% |

| UK | 18.1% |

| USA | 16.2% |

| Brazil | 14.3% |

The global drone cybersecurity market is growing at an impressive CAGR of 19% from 2025 to 2035. China leads the market with the highest growth rate of 25.7%, followed by India at 23.8%. France, the UK, and the USA show strong growth at 20.0%, 18.1%, and 16.2%, respectively. The increasing deployment of drones across sectors like defense, logistics, and agriculture, combined with rising cybersecurity threats, is driving the demand for advanced drone protection systems. As governments and industries prioritize data security and system protection, the market for drone cybersecurity technologies is expected to grow significantly. The analysis includes over 40+ countries, with the leading markets detailed below.

China is projected to experience a remarkable growth in the drone cybersecurity market with a CAGR of 25.7% from 2025 to 2035. The country’s rapidly growing drone industry, coupled with its large-scale adoption in sectors like logistics, surveillance, and agriculture, is driving the need for robust cybersecurity measures to protect drone operations from cyber threats. China’s government has been actively investing in technology and defense sectors, including drone safety and security.

The increasing use of drones in national security and defense operations is creating a significant demand for cybersecurity solutions to protect sensitive data and prevent unauthorized access. The rise of 5G technology and AI integration into drone systems further amplifies the need for advanced cybersecurity to safeguard critical infrastructure. As China expands its dominance in the global drone market, securing drone operations is becoming a top priority.

The drone cybersecurity market in India is expected to grow at a CAGR of 23.8% from 2025 to 2035. Growing adoption of drones across sectors like agriculture, defense, and surveillance is driving the need for advanced cybersecurity measures. With the increase in drone usage for commercial and military applications, the potential cybersecurity risks related to data theft, hacking, and system compromise are elevating.

The government’s efforts to regulate drone operations and ensure secure data transmission will further spur the demand for cybersecurity solutions. India’s booming tech industry, with an increasing focus on AI, data analytics, and IoT, also presents an opportunity for the growth of cybersecurity technologies in drone operations. As the demand for drone-based solutions increases in various industries, securing these devices from cyber threats will become crucial.

France is witnessing steady growth in its drone cybersecurity market, with an expected CAGR of 20.0% from 2025 to 2035. Drones are increasingly being deployed in various commercial and military applications across France, including infrastructure inspection, logistics, and defense. As the number of drone operations rises, so does the risk of cyberattacks, leading to the growing need for cybersecurity solutions.

France’s active participation in drone development, especially for defense and security purposes, fuels the demand for secure drone systems. The government’s focus on implementing advanced technological solutions to safeguard critical infrastructure will also contribute to the growth of the drone cybersecurity market. As the country moves toward expanding drone usage for public services and private enterprises, securing these systems becomes increasingly important.

The United Kingdom’s drone cybersecurity market is projected to grow at a CAGR of 18.1% from 2025 to 2035. The UK has been at the forefront of adopting drones for applications such as agriculture, surveillance, and defense. The rapid growth in drone operations has led to rising concerns about cybersecurity, as drones collect and transmit sensitive data.

The government’s push to integrate drone technologies into urban planning, emergency services, and environmental monitoring further fuels the need for robust cybersecurity systems. The UK also has a well-established cybersecurity infrastructure, making it a key market for advanced drone protection solutions. With the potential for drones to play a significant role in the country’s future industries, the demand for drone cybersecurity technologies is expected to increase.

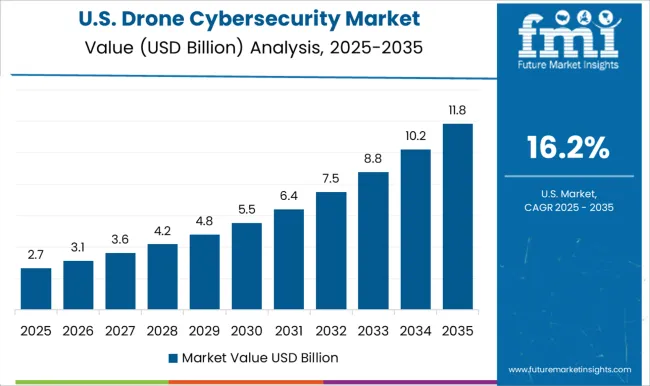

The United States drone cybersecurity market is projected to grow at a CAGR of 16.2% from 2025 to 2035. The USA has a well-established and rapidly growing drone industry, with widespread use in sectors such as agriculture, delivery services, defense, and law enforcement. As the USA continues to deploy drones for both commercial and military purposes, the demand for cybersecurity solutions to protect sensitive data and critical infrastructure will rise.

The government has placed significant emphasis on securing drone systems as part of its broader cybersecurity strategy, leading to increased investment in secure drone technologies. As drone use becomes more prevalent in critical sectors such as transportation and national security, the market for cybersecurity solutions will continue to expand.

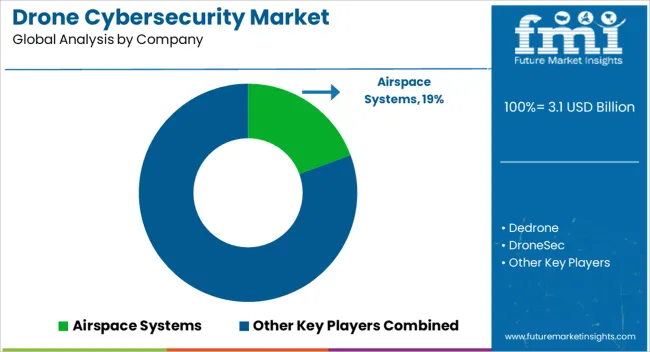

The drone cybersecurity market has grown significantly with the increasing use of drones in both commercial and military sectors. Airspace Systems is a key player, offering a robust cybersecurity platform that integrates advanced radar, signal intelligence, and artificial intelligence. Their system monitors airspace in real-time, providing detection and mitigation of rogue drone threats. This platform is vital for securing critical infrastructure and urban environments. Dedrone competes by focusing on a counter-drone system that combines hardware, software, and cloud-based analytics. Their system specializes in detecting, identifying, and classifying unauthorized drones, providing multi-layered protection for airports and government facilities.

Dedrone emphasizes a scalable, integrated approach that ensures efficient and continuous monitoring. DroneSec offers specialized solutions tailored to both civil and military drone applications, focusing on securing communication systems. Their solutions combine data protection, encryption, and threat detection to prevent cyber-attacks on drones and the networks they interact with. By securing the entire drone ecosystem, DroneSec minimizes vulnerabilities, addressing potential risks that could affect operations in sensitive environments. Fortem Technologies provides an integrated airspace security solution with a focus on both cybersecurity and physical defense. Their TrueView Radar, combined with AI, offers real-time data for detecting and neutralizing drone threats, making them an essential tool for managing secure airspace.

Mobilicom offers an end-to-end cybersecurity platform for unmanned systems, ensuring secure communication and preventing data interception or jamming. Thales Group, with its vast experience in aerospace and defense, integrates cybersecurity capabilities with drone defense systems, providing encrypted communication and drone identification. WhiteFox Defense Technologies focuses on autonomous counter-drone systems that use advanced technologies for fast threat neutralization. These companies emphasize providing integrated solutions that combine real-time monitoring, threat detection, and neutralization, ensuring the secure operation of drones in a variety of applications. Their product brochures highlight advanced features such as AI-driven detection, encrypted communications, and seamless integration with existing infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 billion |

| Component | Software, Hardware, and Services |

| Drone Type | Rotary wing, Fixed wing, and Hybrid |

| Application | Military & defense, Agriculture, Logistics & transportation, Surveillance & monitoring, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airspace Systems, Dedrone, DroneSec, Fortem Technologies, Mobilicom, Thales Group, and WhiteFox Defense Technologies |

| Additional Attributes | Dollar sales by solution type, application, and technology are growing, driven by rising drone use, security concerns, and regulations, with strong demand across North America, Europe, and Asia-Pacific for drone cybersecurity solutions |

The global drone cybersecurity market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the drone cybersecurity market is projected to reach USD 17.7 billion by 2035.

The drone cybersecurity market is expected to grow at a 19.0% CAGR between 2025 and 2035.

The key product types in drone cybersecurity market are software, encryption, threat detection, secure communication, authentication, and others.

In terms of drone type, rotary wing segment to command 46.9% share in the drone cybersecurity market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drone Test Stand Market Size and Share Forecast Outlook 2025 to 2035

Drone Simulator Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Battery Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Drone Sensor Market - UAV Advancements & Forecast 2025 to 2035

Drone Motor Market Growth - Trends & Forecast 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Anti-Drone Technology Market

LiDAR Drone Market Size and Share Forecast Outlook 2025 to 2035

Counter Drone System Market Size and Share Forecast Outlook 2025 to 2035

Medical Drones Market Report – Growth & Forecast 2025-2035

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Consumer Drones Market

Fumigation Drone Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA