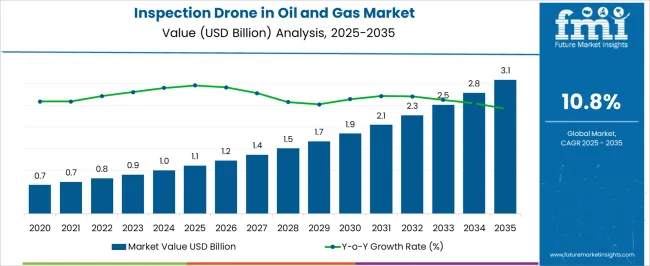

The inspection drone in oil and gas market is projected to grow from USD 1.1 billion in 2025 to USD 3.1 billion by 2035, reflecting a CAGR of 10.8%. During the early adoption phase (2020–2024), oil and gas operators gradually began exploring the use of drones for monitoring pipelines, offshore platforms, and storage facilities.

By 2025, growing awareness of operational efficiency, safety, and inspection accuracy will drive broader adoption. This phase represents the shift from experimental deployments to more structured use in select operations, as companies integrate drones into routine inspection schedules, setting the stage for the scaling phase. From 2025 to 2030, the market enters a scaling phase, marked by increased adoption across upstream, midstream, and downstream operations.

Market value rises from USD 1.1 billion in 2025 as operators deploy drones for frequent inspections, predictive monitoring, and risk assessment. By 2030, drones will become standard tools in inspection workflows, paving the way for market consolidation. Between 2030 and 2035, the market is expected to reach USD 3.1 billion, driven by steady CAGR growth. Consolidation occurs as leading drone manufacturers and service providers expand operations, optimize deployment strategies, and establish long-term contracts, resulting in a more mature and competitive market landscape.

| Metric | Value |

|---|---|

| Inspection Drone in Oil and Gas Market Estimated Value in (2025 E) | USD 1.1 billion |

| Inspection Drone in Oil and Gas Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The inspection drone market in oil and gas is a key segment of the broader industrial drone and unmanned aerial vehicle (UAV) market. In 2025, inspection drones account for approximately 12% of the total industrial drone market, reflecting increasing adoption in monitoring pipelines, offshore platforms, refineries, and storage facilities. The broader industrial drone market is projected to grow at a CAGR of around 7–8% during 2025–2035, driven by demand for automation, operational efficiency, and remote monitoring capabilities across multiple industries. Within the oil and gas sector, inspection drones hold an estimated 25% share of the industrial drone applications in 2025, with the remainder used in construction, mining, and energy infrastructure inspection. By 2030, scaling adoption is expected to increase their share to nearly 30%, as more operators integrate drones into routine maintenance and safety protocols. Between 2030 and 2035, market consolidation is expected, with leading drone manufacturers and service providers expanding deployment networks and forming long-term contracts. By 2035, inspection drones are projected to represent roughly 31–32% of industrial drone applications within oil and gas and nearly 13% of the overall industrial drone market, cementing their role as a critical tool for operational monitoring and revenue growth in the parent market.

The inspection drone in oil and gas market is witnessing significant expansion, driven by the sector’s increasing emphasis on operational efficiency, worker safety, and cost optimization. Adoption of drones has been accelerated by the need for real-time monitoring of infrastructure such as pipelines, offshore rigs, and storage facilities, where manual inspection presents higher safety risks and extended downtime.

The current landscape reflects a shift from experimental deployments to large-scale operational integration, supported by advances in payload capacity, battery life, and autonomous navigation. Regulatory frameworks in key markets are progressively adapting to facilitate beyond-visual-line-of-sight (BVLOS) operations, enhancing the value proposition for oil and gas operators.

The future outlook remains positive, with the technology expected to be increasingly embedded into upstream, midstream, and downstream processes for predictive maintenance and environmental monitoring. Continuous improvements in imaging, thermal sensing, and AI-driven analytics are anticipated to further consolidate drones as a core inspection tool, reducing operational risks while improving asset longevity across the oil and gas value chain.

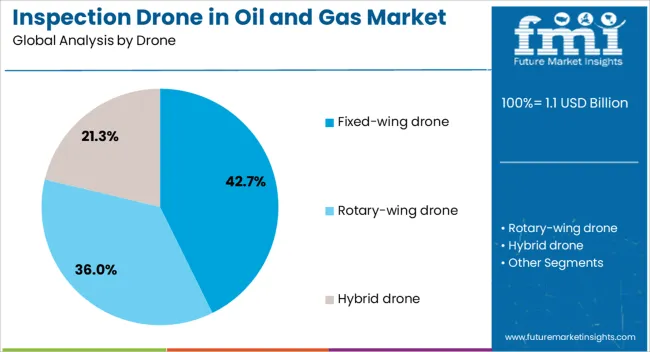

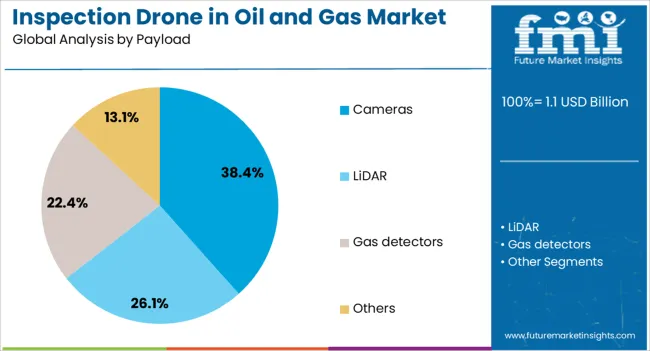

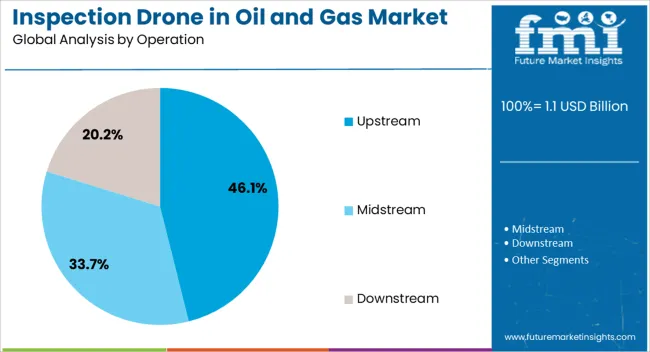

The inspection drone in oil and gas market is segmented by drone, payload, operation, application, and geographic regions. By drone, inspection drone in oil and gas market is divided into Fixed-wing drone, Rotary-wing drone, and Hybrid drone. In terms of payload, inspection drone in oil and gas market is classified into Cameras, LiDAR, Gas detectors, and Others. Based on operation, inspection drone in oil and gas market is segmented into Upstream, Midstream, and Downstream. By application, inspection drone in oil and gas market is segmented into Pipeline inspection, Flare stack inspection, Tank inspection, Environmental monitoring, Well site inspection, and Others. Regionally, the inspection drone in oil and gas industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed-wing drone segment accounts for approximately 42.7% of the market share, reflecting its capability to cover extensive inspection areas with greater flight endurance compared to multi-rotor variants. Its aerodynamic efficiency enables prolonged missions, making it particularly suitable for monitoring long-distance pipeline routes, offshore assets, and vast onshore facilities. Adoption in the oil and gas sector has been supported by its ability to operate in challenging environments, delivering consistent performance under variable weather conditions.

Integration with advanced navigation systems and automated flight planning software has enhanced its operational reliability. Furthermore, fixed-wing drones reduce the need for multiple short flights, thereby lowering inspection time and operational costs.

Their deployment has been reinforced by regulatory approvals for extended-range missions, aligning with industry priorities of minimizing downtime and maximizing asset coverage. The segment’s dominance is expected to persist as technology advancements further increase payload integration capabilities, allowing fixed-wing drones to handle more complex inspection requirements efficiently.

The cameras segment holds the largest share in the payload category, representing around 38.4% of the market. This prominence is attributed to the critical role of high-resolution visual imaging in detecting structural anomalies, corrosion, and surface damage in oil and gas infrastructure. Technological advancements in optical sensors, zoom capabilities, and image stabilization have enhanced the accuracy and efficiency of drone-based inspections.

The segment’s growth is further driven by the integration of AI-powered image analysis, which enables automated defect detection and predictive maintenance planning. Cameras are widely adopted due to their versatility, functioning effectively across upstream, midstream, and downstream applications.

The ability to operate in both daylight and low-light conditions ensures comprehensive inspection coverage, while ongoing miniaturization allows for lighter payloads without compromising image quality. The continued refinement of imaging systems, coupled with increasing adoption of data-driven asset management strategies, is expected to sustain the cameras segment’s leading position in the payload market for oil and gas inspections.

The upstream segment leads the market by operation type, capturing approximately 46.1% of the share. This dominance is driven by the critical need for efficient inspection solutions in exploration, drilling, and production activities, where asset integrity directly impacts operational safety and productivity. Drones have become essential in upstream operations for monitoring drilling rigs, offshore platforms, and subsea infrastructure, enabling rapid identification of maintenance needs and reducing manual inspection risks.

The ability to access remote and hazardous locations without interrupting operations has been a key factor in the segment’s expansion. Upstream applications also benefit from drone integration with advanced sensors, including thermal imaging and methane detection, for environmental compliance and leak prevention.

The high operational costs and safety risks associated with upstream activities have made drone adoption a strategic priority for oil and gas companies. With ongoing exploration in deepwater and challenging environments, the upstream segment is expected to maintain its leadership in drone-based inspection deployment over the forecast period.

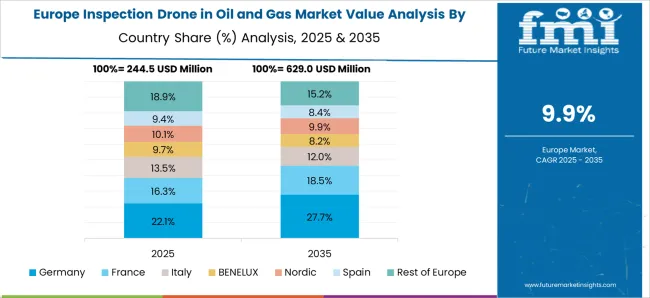

The inspection drone market in oil and gas is growing as operators adopt UAVs for pipeline monitoring, facility inspections, and hazard detection. North America and Europe lead adoption with advanced drone technology, strict safety standards, and regulatory frameworks. Asia-Pacific is rapidly expanding due to increased upstream and downstream infrastructure and government support for unmanned aerial inspections. Manufacturers differentiate through flight endurance, sensor integration, and AI-enabled analytics. Regional differences in infrastructure, regulatory compliance, and operational risk influence adoption, efficiency, and competitive positioning.

Oil and gas operators increasingly deploy drones to inspect pipelines, storage tanks, offshore rigs, and refineries. North America and Europe lead adoption due to mature upstream and downstream networks requiring frequent inspections, adherence to safety regulations, and cost reduction initiatives. Asia-Pacific markets are growing rapidly with new infrastructure projects, including pipelines and LNG facilities, where drones help reduce manual inspection risks and operational downtime. Differences in infrastructure age, complexity, and geographic challenges influence drone design, sensor requirements, and flight endurance. Leading suppliers provide drones with high-resolution imaging, thermal and gas detection sensors, and AI-based anomaly detection, while regional manufacturers focus on cost-effective, compact solutions. Infrastructure contrasts shape adoption, operational efficiency, and global competitiveness.

Safety and risk mitigation are key factors driving drone adoption in oil and gas operations. North America and Europe prioritize UAVs to monitor hazardous zones, detect leaks, and minimize human exposure to dangerous conditions. Asia-Pacific operators adopt drones for similar purposes but often emphasize cost and ease of deployment in remote areas. Differences in regulatory enforcement, workplace safety standards, and incident risk profiles influence the frequency of inspections, payload capabilities, and AI integration. Leading suppliers develop drones with autonomous flight, real-time data transmission, and precision sensors, while regional players provide simplified drones suitable for smaller sites. Safety contrasts accelerate adoption, reduce operational risk, and enhance productivity in global oil and gas inspection operations.

Regulatory frameworks significantly affect inspection drone adoption. North America and Europe enforce strict UAV certification, airspace management, and operational permits for industrial inspections, requiring compliance with FAA, EASA, and national aviation authorities. Asia-Pacific regulations vary; developed regions have robust UAV rules, while emerging countries have flexible frameworks but slower certification processes. Differences in approval timelines, operational restrictions, and reporting requirements influence inspection frequency, drone endurance, and payload selection. Leading suppliers offer fully certified, GPS-enabled drones with automated flight compliance features, while regional providers focus on locally approved, cost-effective systems. Regulatory contrasts shape adoption patterns, operational flexibility, and competitive positioning globally.

Advanced sensors and AI-enabled analytics enhance inspection drone adoption by improving detection accuracy and reducing human intervention. North America and Europe prioritize drones with thermal imaging, LiDAR, gas detection, and real-time AI analysis to optimize preventive maintenance and monitor large-scale operations. Asia-Pacific markets adopt sensor-equipped drones selectively, balancing cost and operational efficiency. Differences in operational scale, complexity, and technology readiness influence payload selection, flight planning, and data processing capabilities. Leading suppliers develop drones with integrated AI platforms for predictive maintenance and anomaly detection, while regional players focus on modular, affordable drones. Sensor and AI integration contrasts drive adoption, operational productivity, and competitiveness across the global oil and gas inspection drone market.

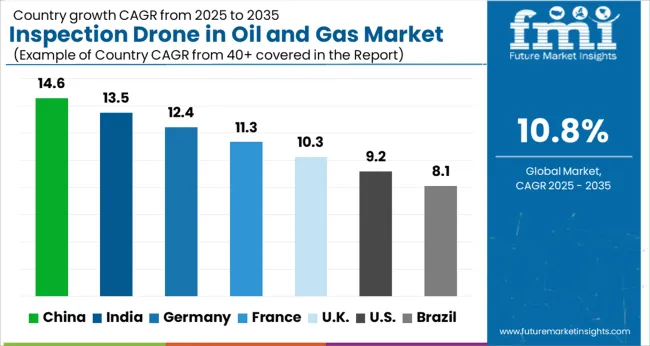

|

Country |

CAGR |

|---|---|

| China | 14.6% |

| India | 13.5% |

| Germany | 12.4% |

| France | 11.3% |

| UK | 10.3% |

| USA | 9.2% |

| Brazil | 8.1% |

The global inspection drone in oil and gas market is projected to grow at a 10.8% CAGR through 2035, driven by demand in pipeline monitoring, offshore platform inspection, and maintenance operations. Among BRICS nations, China led with 14.6% growth as large-scale deployment and operational integration of drones were executed, while India at 13.5% expanded usage across refineries, pipelines, and storage facilities. In the OECD region, Germany at 12.4% maintained steady adoption under strict safety and regulatory standards, while the United Kingdom at 10.3% supported moderate-scale deployment across upstream and midstream sectors. The USA, growing at 9.2%, sustained integration of drones for inspection, monitoring, and maintenance while complying with federal and state-level aviation and industrial regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The inspection drone market in China’s oil and gas sector is growing at a 14.6% CAGR, driven by increasing investments in automation and digital monitoring technologies. Drones are being widely deployed for pipeline inspection, refinery monitoring, and offshore platform surveys, improving safety and operational efficiency. Domestic manufacturers are innovating with AI-enabled drones capable of real-time data collection and predictive maintenance. Government policies and incentives supporting industrial automation and safety compliance are accelerating adoption. Large oil and gas companies are integrating drone operations into maintenance routines, reducing downtime and operational costs. The market is further supported by the rising need for high-resolution imaging and thermal monitoring for leak detection and infrastructure assessment. Collaboration between technology providers and energy companies is fostering innovation and accelerating deployment across upstream and downstream operations.

Inspection drone market in India in the oil and gas sector is registering a 13.5% CAGR, fueled by the need for enhanced safety and efficiency in upstream and downstream operations. Drones are increasingly used for pipeline surveillance, tank inspection, and offshore platform monitoring. Government initiatives promoting industrial automation and digitalization in the energy sector support adoption. Domestic and international manufacturers are providing high-performance drones equipped with thermal imaging and AI analytics to detect faults and prevent accidents. Industrial operators are incorporating drone-based monitoring into routine maintenance schedules to minimize human exposure to hazardous environments. Training programs and pilot projects are helping accelerate adoption. Overall, market growth is driven by efficiency gains, regulatory compliance, and the need for cost-effective, precise inspection solutions.

Inspection drone market in Germany is growing at a 12.4% CAGR, supported by advanced technological adoption in the oil and gas industry. Drones are deployed for pipeline inspection, storage tank monitoring, and offshore facility surveillance, improving safety and reducing operational risks. Domestic manufacturers focus on AI-powered, high-resolution imaging drones capable of predictive maintenance analysis. Stringent regulatory standards ensure safe deployment of drones in industrial settings. Companies are increasingly integrating drones into routine monitoring programs to detect leaks, structural issues, and environmental hazards. Collaborative projects between drone manufacturers, energy companies, and research institutions are accelerating innovation. Sustainability considerations, such as reducing human exposure and minimizing operational downtime, are key drivers. Overall, Germany’s market is characterized by technological sophistication, regulatory compliance, and operational efficiency.

The United Kingdom inspection drone market is expanding at a 10.3% CAGR, driven by rising adoption in pipeline monitoring, offshore platforms, and refinery inspections. Drones enhance safety, reduce operational costs, and provide high-resolution imaging for predictive maintenance. Government guidelines and incentives encourage industrial automation and the integration of unmanned aerial systems. Domestic operators are deploying drones equipped with AI and thermal sensors to monitor critical infrastructure efficiently. Pilot projects and public-private partnerships are accelerating adoption while ensuring compliance with aviation and industrial regulations. Operational efficiency, reduced human risk, and precise monitoring capabilities are key factors driving market expansion. The UK market reflects growing technological adoption in the energy sector combined with regulatory oversight and environmental safety considerations.

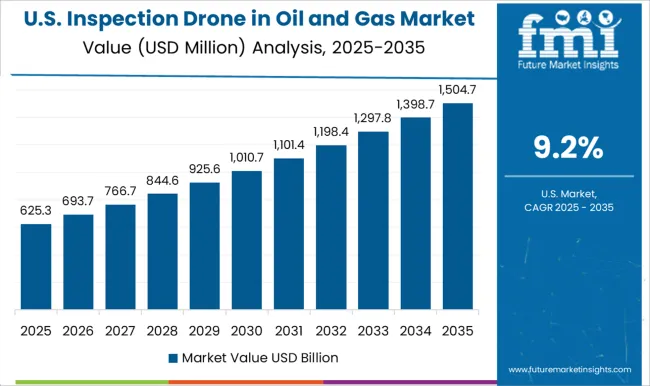

The United States inspection drone market is growing at a 9.2% CAGR, fueled by the need for safer, faster, and more efficient monitoring of oil and gas infrastructure. Drones are widely used for pipeline inspection, storage tank surveys, and offshore platform assessments. Manufacturers are offering advanced drones with AI-based analytics, high-resolution cameras, and thermal imaging to detect leaks and structural faults. Federal and state regulations support safe drone deployment while encouraging technological adoption. Energy companies are integrating drone operations into maintenance schedules to reduce human exposure to hazardous environments and minimize downtime. Partnerships between drone developers, industrial operators, and research institutions are fostering innovation and accelerating deployment. Market growth is shaped by efficiency gains, regulatory compliance, and increasing automation in oil and gas operations.

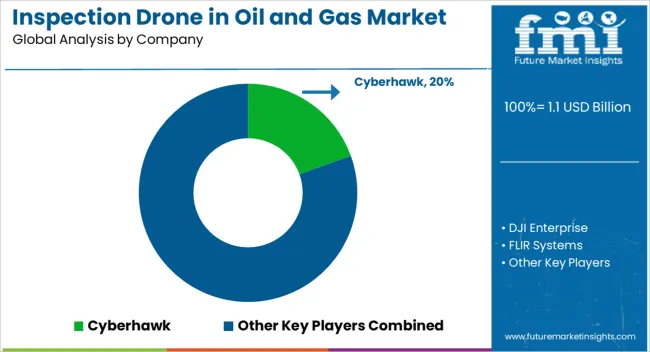

The inspection drone market in the oil and gas sector is dominated by leading suppliers such as Cyberhawk, DJI Enterprise, FLIR Systems, IdeaForge, Percepto, PrecisionHawk, senseFly, Sky-Futures (ICR Group), Terra Drone, and Vantage Robotics. These companies are focused on providing advanced drone solutions for industrial inspections, including pipeline monitoring, offshore platform surveys, and facility inspections. The adoption of drones in the oil and gas industry is driven by the need for enhanced operational efficiency, improved safety, and reduced downtime. Regulatory support, technological innovation, and the increasing complexity of oil and gas infrastructure have further strengthened the market position of these key players.

Technological advancements and innovation are central to maintaining a competitive edge in the inspection drone market. Companies such as Cyberhawk and PrecisionHawk are developing drones equipped with high-resolution cameras, LiDAR sensors, and thermal imaging capabilities for precise monitoring and fault detection. Suppliers like DJI Enterprise and FLIR Systems focus on integrating autonomous navigation, real-time data transmission, and advanced analytics to provide actionable insights for preventive maintenance. Additionally, IdeaForge, Percepto, and Terra Drone are designing drones that operate effectively in harsh environments, including offshore conditions and remote locations, ensuring uninterrupted inspection operations.

Strategic collaborations, global expansion, and service diversification are key drivers for market growth. senseFly, Sky-Futures, and Vantage Robotics are expanding their service offerings to include inspection-as-a-service and remote monitoring solutions, addressing evolving customer needs. Partnerships with oil and gas operators, integration of AI and machine learning for predictive maintenance, and continuous enhancement of drone endurance and payload capabilities have strengthened the market presence of these companies. By emphasizing reliability, efficiency, and safety, these suppliers continue to lead the inspection drone market in oil and gas, meeting the sector’s growing demand for innovative and cost-effective solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Drone | Fixed-wing drone, Rotary-wing drone, and Hybrid drone |

| Payload | Cameras, LiDAR, Gas detectors, and Others |

| Operation | Upstream, Midstream, and Downstream |

| Application | Pipeline inspection, Flare stack inspection, Tank inspection, Environmental monitoring, Well site inspection, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cyberhawk, DJI Enterprise, FLIR Systems, IdeaForge, Percepto, PrecisionHawk, senseFly, Sky-Futures (ICR Group), Terra Drone, and Vantage Robotics |

| Additional Attributes | Dollar sales vary by drone type, including fixed-wing, rotary-wing, and hybrid drones; by application, such as pipeline inspection, offshore platform monitoring, flare stack inspection, and tank farm surveillance; by end-use, spanning upstream, midstream, and downstream oil & gas operators; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by safety regulations, operational efficiency, and adoption of unmanned aerial technologies. |

The global inspection drone in oil and gas market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the inspection drone in oil and gas market is projected to reach USD 3.1 billion by 2035.

The inspection drone in oil and gas market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in inspection drone in oil and gas market are fixed-wing drone, rotary-wing drone and hybrid drone.

In terms of payload, cameras segment to command 38.4% share in the inspection drone in oil and gas market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Inspection Lighting Fixture Market Size and Share Forecast Outlook 2025 to 2035

Inspection Machines Market Growth – Trends & Forecast 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Inspection and Inventory Labels

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

PCB Inspection Microscope Market Size and Share Forecast Outlook 2025 to 2035

Bar Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Tire Inspection System Market - Outlook 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Cargo Inspection Market Size and Share Forecast Outlook 2025 to 2035

Wafer Inspection Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Flight Inspection Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA