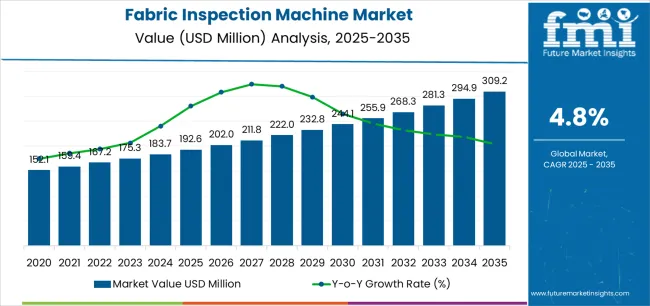

The Fabric Inspection Machine Market is estimated to be valued at USD 192.6 million in 2025 and is projected to reach USD 309.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The fabric inspection machine market is experiencing steady growth. Rising demand for quality assurance across textile manufacturing and apparel production has been driving adoption. The market is being supported by automation trends, efficiency optimization, and the growing need to minimize defects and wastage in large-scale production lines.

Technological advancements such as digital imaging, machine learning, and sensor-based inspection have strengthened process accuracy and throughput. Regulatory emphasis on product quality and export standards has further accelerated equipment modernization. Market participants are focusing on integrating smart systems with real-time monitoring to enhance operational control and data-driven decision-making.

Increasing production volumes in emerging textile hubs and expansion of garment exports are creating consistent demand for advanced inspection systems Over the forecast period, the market is expected to expand due to continued industrial automation, rising labor costs encouraging machine adoption, and the evolution of end-user industries prioritizing productivity, traceability, and defect-free output.

| Metric | Value |

|---|---|

| Fabric Inspection Machine Market Estimated Value in (2025 E) | USD 192.6 million |

| Fabric Inspection Machine Market Forecast Value in (2035 F) | USD 309.2 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

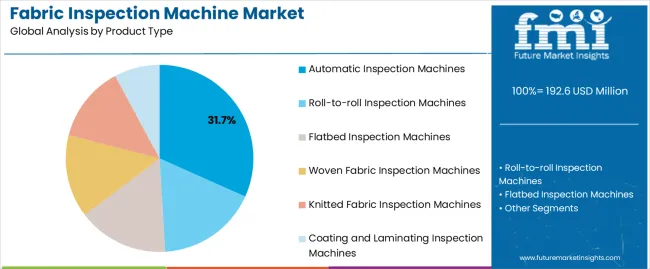

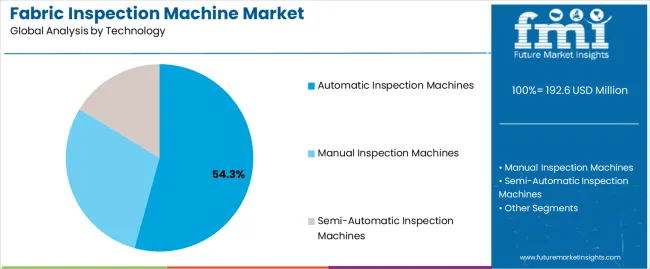

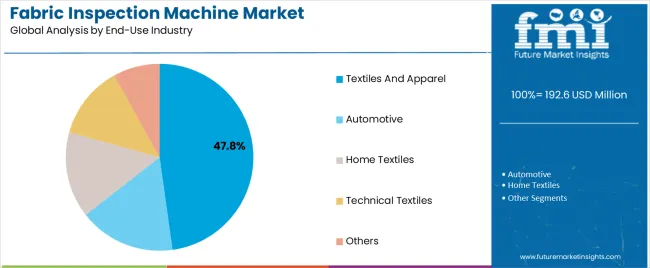

The market is segmented by Product Type, Technology, and End-Use Industry and region. By Product Type, the market is divided into Automatic Inspection Machines, Roll-to-roll Inspection Machines, Flatbed Inspection Machines, Woven Fabric Inspection Machines, Knitted Fabric Inspection Machines, and Coating and Laminating Inspection Machines. In terms of Technology, the market is classified into Automatic Inspection Machines, Manual Inspection Machines, and Semi-Automatic Inspection Machines. Based on End-Use Industry, the market is segmented into Textiles And Apparel, Automotive, Home Textiles, Technical Textiles, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic inspection machines segment, accounting for 31.70% of the product type category, has been leading the market due to its superior efficiency, precision, and consistency in detecting fabric irregularities. Adoption has been driven by the need to replace manual inspection systems that are time-consuming and prone to human error.

Automated systems offer higher inspection speeds, consistent quality outcomes, and better integration with downstream manufacturing processes. The segment’s dominance has been reinforced by manufacturers’ focus on achieving zero-defect production and reducing operational costs.

The incorporation of real-time defect mapping, digital visualization, and AI-based algorithms has further enhanced accuracy and user convenience Ongoing innovation in machine design and the availability of modular systems suitable for varied fabric types are expected to sustain the segment’s growth and strengthen its leadership within the market.

The automatic inspection machines segment, representing 54.30% of the technology category, has maintained its leading position through advancements in automation and sensor-based systems that enable rapid, precise, and repeatable fabric evaluation. The transition from semi-automatic to fully automatic technology has been driven by demand for higher productivity and lower defect rates in textile manufacturing.

Integration of digital cameras, pattern recognition software, and smart defect classification has optimized inspection workflows and reduced manual intervention. The technology’s scalability and compatibility with both woven and nonwoven fabrics have expanded its applicability across production environments.

Continued R&D investment focused on machine vision and real-time analytics is expected to further improve performance reliability and cost efficiency, ensuring that automatic technology remains the preferred choice among textile manufacturers worldwide.

The textiles and apparel segment, holding 47.80% of the end-use industry category, has been dominating the market due to its extensive reliance on inspection machines to maintain product quality and compliance with global standards. The segment’s demand has been supported by large-scale fabric processing, garment production, and the growing emphasis on export-oriented manufacturing.

Increasing competition among apparel producers has heightened the focus on defect-free output and consistency in fabric grading. The adoption of advanced inspection systems has improved production visibility, reduced rework, and enhanced operational efficiency.

Expanding garment manufacturing in Asia Pacific and the strengthening of textile supply chains in emerging economies are further contributing to market growth Ongoing modernization of textile facilities and the integration of smart inspection technologies are expected to sustain this segment’s leadership throughout the forecast period.

The global fabric inspection machine market is predicted to expand around 1.6x through 2035, amid a 2.2% surge in expected CAGR compared to the historical one. Increased industrialization is a key growth driving factor. Burgeoning global industrial activities contribute to heightened demand for fabric inspection machines, especially in sectors like textile.

Ongoing technological advancements, heightened emphasis on quality control in textile production, and automation trends are also expected to boost demand. The expanding global textile industry and the imperative to comply with stringent regulatory standards are set to aid demand.

The aforementioned factors are projected to propel adoption of textile inspection machines as manufacturers seek more efficient and accurate inspection processes. These are expected to align with growing demand for high-quality textiles and the shift toward automation.

Staying abreast of evolving market trends and technological innovations is anticipated to be crucial for stakeholders navigating this dynamic landscape. By 2035, the total fabric inspection machine market revenue is set to reach USD 301.4 million.

East Asia is expected to retain its command in the field of cloth inspection machines during the forecast period. It is set to hold around 41.4% of the global fabric inspection machine market share in 2035.

Robust growth of the textile industry in countries like China and Japan, which are leading manufacturing hubs, is expected to drive demand. Technological innovations and increasing automation in production processes are also anticipated to bolster demand.

A strong commitment to maintaining high-quality standards in textile manufacturing contributes to East Asia's commanding position in the fabric inspection machine market. China is considered one of the largest manufacturers of textiles in the world.

China’s textile industry has developed significantly over the past 20 years, becoming one of the key drivers of the national economy. The country offers low-cost and extensive labor availability to textile manufacturing companies. At the same time, it provides a robust material supply chain and low commercial barriers.

The economic growth in East Asia fosters increased industrial activities and investments, amplifying the need for garment inspection machines in diverse applications. The region's heightened awareness of workplace safety further solidifies its position as a key consumer in the global fabric inspection machine market.

Roll-to-roll inspection machines are expected to dominate the global fabric inspection machine market in 2025. These are anticipated to witness a 5.4% CAGR during the forecast period.

The roll-to-roll tubular fabric inspection machine segment stands as a dominant force in the global fabric inspection machine market, reflecting its widespread adoption in textile manufacturing. The segment's prominence can be attributed to its versatility and efficiency in handling continuous fabric rolls.

Roll-to-roll inspection machines further offer seamless integration into production lines, enabling manufacturers to inspect woven and knitted fabrics. These also provide manufacturers with laminated or coated materials and high precision & speed.

The consistent demand for these machines is set to be fueled by their ability to streamline the inspection process, ensuring the quality and integrity of fabrics on a large scale. Roll-to-roll inspection machines are anticipated to showcase exponential growth as industries increasingly prioritize efficiency and automation.

Fabric inspection machine sales grew at a CAGR of 2.9% between 2020 to 2025. Total market revenue reached about USD 192.6 million in 2025. In the forecast period, the worldwide fabric inspection machine industry is set to thrive at a CAGR of 5.1%.

| Historical CAGR (2020 to 2025) | 2.9% |

|---|---|

| Forecast CAGR (2025 to 2035) | 5.1% |

Expanding Textile Industry Fuels Demand for Fabric Inspection Equipment

Surging Demand for Quality to Propel Fabric Inspection Machine Sales

Technological Advancements Drive the Evolution of Fabric Inspection Machines

Limited Adoption of Fabric Inspection Machines in Small-scale Textile Operations

The table below highlights fabric inspection machine market revenues of several countries. China, the United States, India, and Japan are expected to reach valuations of USD 309.2 million, USD 36.5 million, USD 28.3 million, and USD 24.7 million, respectively, in 2035.

| Countries | Fabric Inspection Machine Market Revenue (2035) |

|---|---|

| China | USD 309.2 million |

| United States | USD 36.5 million |

| India | USD 28.3 million |

| Japan | USD 24.7 million |

| Germany | USD 14.5 million |

| United Kingdom | USD 7.8 million |

The table below shows the estimated growth rates of several countries in the global fabric roll inspection system market. India, China, and the United States are set to record high CAGRs of 4.7%, 3.9%, and 2.8%, respectively, through 2035.

| Countries | Projected Fabric Inspection Machine Market CAGR (2025 to 2035) |

|---|---|

| India | 4.7% |

| China | 3.9% |

| United States | 2.8% |

| Japan | 2.3% |

| Germany | 1.9% |

| United Kingdom | 1.6% |

Sales of fabric inspection machines in the United States are projected to soar at a CAGR of around 2.8% during the assessment period. Total valuation in the country is anticipated to reach USD 36.5 million by 2035.

China’s fabric inspection machine market size is projected to reach USD 309.2 million by 2035. Over the assessment period, demand for fabric inspection machines in China is set to rise at 3.9% CAGR.

India's fabric inspection machine market is poised to exhibit a CAGR of 4.7% during the assessment period. It is expected to attain a fabric quality control machine market valuation of USD 28.3 million by 2035.

The section below shows the roll-to-roll inspection machines segment dominating based on product type in the textile inspection equipment market. It is forecast to thrive at 5.6% CAGR between 2025 to 2035.

Based on the end-use industry, the textiles and apparel segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 5.1% during the forecast period.

| Top Segment (Product Type) | Roll-to-roll Inspection Machines |

|---|---|

| Predicted CAGR (2025 to 2035) | 5.6% |

| Top Segment (End-use Industry) | Textiles and Apparel |

|---|---|

| Projected CAGR (2025 to 2035) | 5.1% |

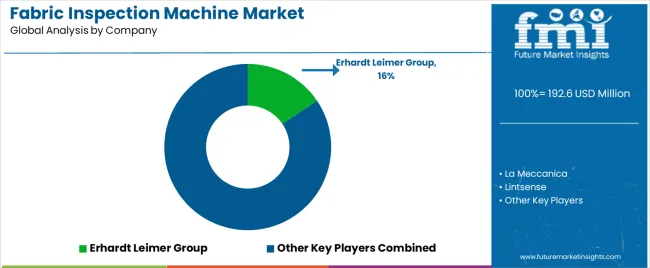

The global fabric inspection machine market is consolidated, with leading players accounting for about 40 to 45% share. La Meccanica, Lintsense, A. Monforts Textilmaschinen GmbH & Co. KG, BST eltromat International GmbH., Erhardt Leimer Group., FEW Textile Machinery Company, Tecnorama, Zhejiang LICHENG Group, and Embee Corporation are the leading manufacturers and suppliers of fabric inspection machines listed in the report.

Leading fabric inspection machine manufacturers are focusing on technological advancements in their existing product lines to attract a large consumer base. They are aiming to develop new production facilities across niche areas. A few other players are engaging in mergers and acquisitions to co-develop innovative systems. They are showcasing their unique products in exhibitions.

Recent Developments in Fabric Inspection Machine Market

| Attribute | Details |

|---|---|

| Estimated Fabric Inspection Machine Market Size (2025) | USD 183.3 million |

| Projected Fabric Inspection Machine Market Size (2035) | USD 301.4 million |

| Anticipated Growth Rate of Fabric Inspection Machine Market (2025 to 2035) | 5.1% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (units) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Fabric Inspection Machine Market Segments Covered | Product Type, Technology, End-use Industry, Region |

| Regions Covered | North America; Latin America; Eastern Europe; Western Europe; East Asia; South Asia Pacific; Middle East Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, BENELUX, NORDICS, Poland, Hungary, Balkan and Baltics, Russia, India, Association of Southeast Asian Nations, Australia and New Zealand, China, Japan, South Korea, Kingdom of Saudi Arabia, Other GCC Countries, Türkiye, Other African Union, South Africa |

| Key Companies Profiled | La Meccanica; Lintsense; A. Monforts Textilmaschinen GmbH & Co. KG; BST eltromat International GmbH; Erhardt Leimer Group; FEW Textile Machinery Company; Tecnorama; Carù Srl; Dantex Group; Zhejiang LICHENG Group; Embee Corporation; Yuyao Textile Machinery; Matic; MTS Maschinenbau; PLM Impianti; Chevalerin; Caron Technology; Menzel Maschinenbau |

The global fabric inspection machine market is estimated to be valued at USD 192.6 million in 2025.

The market size for the fabric inspection machine market is projected to reach USD 309.2 million by 2035.

The fabric inspection machine market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in fabric inspection machine market are automatic inspection machines, roll-to-roll inspection machines, flatbed inspection machines, woven fabric inspection machines, knitted fabric inspection machines and coating and laminating inspection machines.

In terms of technology, automatic inspection machines segment to command 54.3% share in the fabric inspection machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inspection Machines Market Growth – Trends & Forecast 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Global Fabric Cutting Machine Market Share Analysis – Trends & Forecast 2025–2035

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

SMT First Article Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Packaging Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Inspection Management Software Market Size and Share Forecast Outlook 2025 to 2035

Inspection Robots Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA