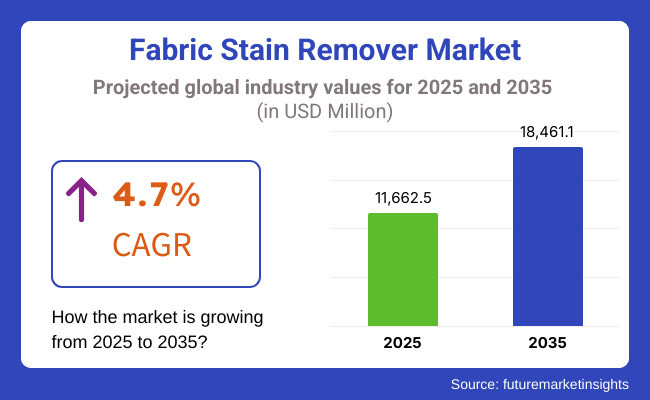

The global fabric stain remover market is poised for substantial expansion, increasing from USD 11.66 billion in 2025 to USD 18.46 billion by 2035. The market is expected to grow at a CAGR of 4.7% from 2025 to 2035.

Fabric stain removers have gained popularity rapidly because of their convenient formulations and efficiency, which are found in many modern households. Market expansion happens swiftly because consumers seek out efficient stain removal solutions that are super flexible and eco-smart. Demand spans multiple economic segments, with fabric stain removers catering predominantly to busy professionals and small-space households in urban areas.

Rising interest in sustainable cleaning products fuels market growth rapidly amidst surging disposable incomes. Modern consumers prioritize functionality with features like enzyme-based formulas enhancing product appeal pretty significantly nowadays overall. Eco-friendly practices gain traction fast, with substantial energy-efficient stain removal solutions driving market expansion forward really quickly nowadays.

Eco-friendly fabric stain removers with advanced features drive market growth rapidly due to their substantial investment potential. Wealthy buyers perceive fancy stain removal technologies as financially savvy moves that boost sales in upscale cleaning markets rapidly. Sustainable products greatly influence purchasing decisions among buyers who prioritize environmental responsibility.

Digital platforms revolutionize the fabric stain remover market, offering consumers remarkably easy access via online portals to numerous models featuring transparent pricing. Younger folks rapidly drive up online sales, leveraging e-commerce platforms for super convenient purchasing and somewhat detailed product comparisons.

The table below presents the expected CAGR for the fabric stain remover industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.2% (2024 to 2034) |

| H2 2024 | 4.3% (2024 to 2034) |

| H1 2025 | 5.5% (2025 to 2035) |

| H2 2025 | 3.9% (2025 to 2035) |

The CAGR exhibits a fluctuating trend, initially increasing by 52 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. However, a slight increase of 55 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external constraints.

Growth rebounds in H2 (2025 to 2035) with a 39 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

Rising Demand for Convenient and Eco-Friendly Cleaning Solutions Drives Fabric Stain Remover Market Growth

The global fabric stain remover market is undergoing very rapid growth today, mainly due to rising demand for daily convenience and eco-efficiency in fabric care solutions. Modern urban dwellers prefer sleek products that fit snugly into busy lifestyles in densely populated city apartments. Luxury consumer goods lean heavily toward advanced fabric stain removers featuring smart application capabilities and superior sustainability.

Manufacturers respond with sleek, multifunctional designs, enhancing convenience beneath remarkably high standards of stain removal performance. Sustainable products gaining popularity rapidly accelerate market growth due to low environmental impact and reduced chemical usage. Digital platforms offer augmented reality previews with personalized recommendations that boost buying experiences significantly, driving sales upward rapidly online.

Growing Popularity of Enzyme-Based and Sustainable Stain Removers Boosts Market Expansion

Sustainability efforts, coupled with hygiene needs, fuel the daily demand for extremely eco-efficient fabric stain removal units. Eco-conscious shoppers perceive sustainable products as savvy financial moves that lower environmental footprints beneath sprawling green initiatives. Globally, governments promote eco-certified stain removers, which significantly influence consumer buying habits daily.

Manufacturers integrate fairly sophisticated enzyme systems, low-impact technology, and enhanced stain-lifting mechanisms that appeal directly to environmentally conscious consumers. Sophisticated stain detection systems coupled with AI-driven formula tweaks become major distinguishing factors somehow. Eco-efficient products will probably thrust market growth upward fairly rapidly over the next few years. Rising Focus on Fabric Care and Convenience Drives Demand for Fabric Stain Removers.

Now, homeowners are getting very fussy about convenience and are thus adopting super compact, easy-to-use, and versatile stain removers for themselves and their consumers. Unlike traditional methods, these units offer easy application, portability, and compatibility with multiple fabric types, making them attractive for renters and travelers.

Innovations like spray applicators and portable sticks enhance product versatility in multiple ways, catering directly to diverse consumer needs. Compact living trends accelerate market growth rapidly in urban areas as consumers opt for efficient fabric care solutions daily.

E-Commerce and Digital Platforms Revolutionize the Fabric Stain Remover Buying Experience

Digital platforms transform the fabric stain remover market with seamless access via various online tools and expert reviews that are readily available everywhere now. Digital stores provide numerous models at fixed prices with flexible payment plans, making fancy stain removers pretty affordable overall nowadays. Virtual product demos boost online shopping with AR-based fabric previews and AI-driven personalized recommendations.

Social media significantly impacts consumer behavior through highly targeted digital marketing campaigns and effective influencer partnerships, steadily boosting sales online. Doorstep delivery convenience and easy return policies will likely keep fueling e-commerce growth rapidly in fabric stain remover market segments overall.

The global fabric stain remover market saw fairly rapid expansion from 2020 to 2024 at an annual rate of 2.7% during that timeframe. Market expansion was fueled rapidly by increasing demand for convenient fabric care solutions, rising urbanization, and growing adoption of eco-friendly cleaning products. The market value has seen a massive upsurge and is expected to touch USD 11,065.0 million by 2024, driven by consumer interest in sustainable convenience.

While the COVID-19 pandemic initially disrupted supply chains, it also accelerated demand for home-cleaning products as consumers shifted their focus toward enhancing hygiene routines for deeper cleaning. In this, e-commerce platforms played a vital role, providing online demonstrations for product purchases, consumer reviews, and flexible financing options that improved accessibility. The rapidly increasing demand for eco-friendly, highly efficient stain removers has considerably boosted market momentum.

The global fabric stain remover market is projected to show rapid growth at a CAGR of 4.7% from 2025 up to USD 18,461.1 million by 2035. Various factors bring in rapid growth due to tremendous technological developments in the integration of enzymes and increased disposable incomes. Buyers would likely prefer stain removers, which offer a sustainable approach with technological features that ensure real-time stain analysis.

The sustainable trends drive market demands hard; companies are using eco-friendly substances and introducing water-saving innovations. Digital platforms will completely change the faces of markets by enhancing the buying experiences by introducing augmented reality previews and AI-enabled virtual assistants. Current fast-growing compact living trends indicate huge expansion opportunities for the fabric stain removers market.

Tier-1 players dominate the global fabric stain remover market, holding a 35-40% share. These firms capitalize on cutting-edge production methods, strong brand recognition, and sprawling international networks to maintain dominance. They prioritize novelty, offering smart-enabled, eco-efficient stain removers with cutting-edge features like enzyme-driven cleaning cycles and IoT connectivity somehow seamlessly. These brands cater to upscale consumers looking for best-in-class sustainable products. Reckitt Benckiser, The Clorox Company, Procter & Gamble, and Unilever are Tier-1 players.

Tier-2 companies, accounting for 30-35% of the market, mainly provide stain removers for mid-range consumers who seek efficacy and affordability. Such organizations channel their efforts on efficacy, using green formulations and products that suit living conditions in crowded cities. They emphasize the regional expansion of their markets through tie-ups with various retailers and e-commerce platforms. Noteworthy examples of Tier-2 companies include Henkel, S.C. Johnson & Son, Church & Dwight, and Colgate-Palmolive.

Tier-3 players work in the niche to value-for-money segment, holding a market share of 15-20%. They focus on compact, low-cost stain removers designed specifically for tiny urban dwellings and frugal buyers. These brands fiercely compete on price, offering basic models with remarkably simple functionalities amidst decent overall quality levels. Notable Tier-3 players include Folex, OxiClean, Spray ‘n Wash, and various private-label brands on online marketplaces.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 5.6 |

| Country | Germany |

|---|---|

| Population (millions) | 84.3 |

| Estimated Per Capita Spending (USD) | 4.75 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 3.9 |

| Country | France |

|---|---|

| Population (millions) | 68.2 |

| Estimated Per Capita Spending (USD) | 3.6 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 67.4 |

| Estimated Per Capita Spending (USD) | 3.5 |

The USA fabric stain remover market, valued at USD 189.2 million, is driven by the high consumer spending on cleaning products, rising inclination toward eco-friendly and efficient stain removers, and a thriving DIY culture. Compact-sized stain removers with attractive designs often appeal to urban consumers, while app-enabled products with smart features are attractive to premium buyers.

Germany's fabric stain remover market, valued at USD 103.4 million, immensely benefits from strong sustainable practices and eco-conscious habits. Green-minded consumers chiefly drive innovation in low-impact stain removers through their preference for sustainable products. Compact models have gained popularity amid urban living trends and the small living spaces of many apartments.

Japan’s fabric stain remover market, valued at USD 36.5 million, thrives heavily on cutting-edge high-tech innovation alongside super compact cleaning solutions. Many households have small living spaces, so demand remains high for slim-profile stain removers. Japanese consumers favor products with sleek designs and numerous features that seamlessly blend into modern lifestyles quietly.

France’s fabric stain remover market, valued at USD 108.7 million, is shaped by urbanization rising rapidly amidst growing single-person households and a huge preference for smart cleaning solutions. French consumers love ultra-sleek stain removers that are beautifully integrated into modern routines. Market insiders notice surprisingly robust interest in portable stain removers and those that work efficiently on delicate fabrics.

The UK fabric stain remover market, valued at USD 113.3 million, is being largely driven by the increased penetration of eco-friendly products alongside fluctuations in busy lifestyles. Contained within densely populated urban areas residing in tight living spaces, there was a high demand for stain removers that would be efficient and easy to carry around. Consumers strongly prefer high-efficacy products featuring adaptable formulations and sustainable packaging mechanisms to meet their various needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| Canada | 6.5% |

| UK | 5.7% |

| China | 10.2% |

| India | 12.1% |

The USA fabric stain remover market will likely grow at a stupendous rate at 4.8% CAGR from here to the year 2025 and beyond, driven by increasing demand of eco-efficient products. Urbanization fuels demand for tiny homes and fabric stain removers, making small rentals super desirable nowadays.

Consumers prioritize sustainability and effectiveness amidst government efforts promoting green products. Smart tech significantly impacts buying decisions as app-connected, enzyme-enhanced stain removers gain popularity very rapidly online. Strong online retail platforms significantly boost market growth by facilitating consumer comparisons of features and providing easy access nearby.

The fabric stain remover market in the UK is estimated to expand at a fervent growth rate of CAGR 5.7% over the next decade, driven by eco-conscious folks. Manufacturers are introducing low-impact models amid concerns about sustainability and hygiene requirements.

Busy urban lifestyles likewise fuel demand since tenants generally prefer portable products that facilitate easy application somehow. Younger buyers seek convenient solutions with sustainable stain removers, which are rapidly gaining traction in today’s fast-paced lifestyle. Nowadays, e-commerce players offer at-home trials and flexible financing options for buyers through various online platforms.

India’s fabric stain remover market is set to grow at an impressive CAGR of 12.1% from 2025 to 2035, fueled by rapid urbanization, an expanding middle class, and increasing adoption of modern cleaning products. Nuclear families rising alongside disposable incomes drive demand for convenient stain removal solutions that don’t need dedicated space.

Growing awareness of hygiene and eco-friendly gizmos fuels the emergence of fabric stain removers as a preferred alternative in urban hubs. The e-commerce boom has made these products extremely accessible through leading platforms offering enormous discounts under easy EMI options and doorstep services. Global brands eye the Indian market, introducing super compact stain remover models suited perfectly for local fabric care habits daily.

| Segment (Product Type) | CAGR (2025 to 2035) |

|---|---|

| Liquid Stain Removers | 5.3% |

The liquid stain remover segment leads the fabric stain remover market and is projected to grow at a CAGR of 5.3% from 2025 to 2035. This growth is fueled by rising adoption in small households and rental apartments, where convenience is a major priority. The increasing demand for eco-efficient and enzyme-based products further propels this segment’s expansion.

Consumers prefer versatile, easy-to-apply stain removers requiring minimal effort, so liquid models have become a highly sought-after option nowadays. Manufacturers integrate smart features like precision applicators and biodegradable formulas, making stain removers more convenient for modern users.

| Segment (Sales Channel) | CAGR (2025 to 2035) |

|---|---|

| Online Retail | 8.2% |

The online retail segment dominates the sales of fabric stain removers and is expected to grow at a CAGR of 8.2% from 2025 to 2035. The convenience of doorstep delivery facilitates easy to access to guides and wide product choices, thus accelerating online purchases rapidly every day. Consumers rely heavily on customer reviews and flexible payment options, making e-commerce platforms a preferred shopping spot online nowadays.

Manufacturers’ shift towards direct-to-consumer sales substantially fortifies this particular sales pathway, allowing brands to offer bespoke models alongside comprehensive post-purchase support services. Partnerships between leading brands and e-commerce giants significantly enhance visibility and accessibility, promoting robust expansion of online sales.

The global fabric stain remover market is highly competitive, with key players such as Reckitt Benckiser, The Clorox Company, Procter & Gamble, Unilever, and Henkel dominating the industry through innovation, sustainability, and advanced technology integration. Reckitt Benckiser is a leading brand recognized for its effective operation and cutting-edge eco-efficient stain removers, particularly its Vanish technology, which enhances stain removal and fabric care. Procter & Gamble stands out with its smart stain remover features, including enzyme-based cycles and app connectivity, catering to tech-savvy consumers looking for convenience.

Apart from these major brands, emerging players like OxiClean and Spray ‘n Wash are redefining the market with affordable and convenient solutions, targeting small households and urban apartments. OxiClean specializes in versatile, portable stain removers with intuitive applicators and quick action, making them ideal for renters. Spray ‘n Wash, on the other hand, focuses on budget-friendly models with targeted stain removal, enhancing accessibility and effectiveness.

The market is witnessing a strong shift toward eco-efficient and smart-enabled stain removers, with brands investing in AI-powered stain detection, sustainability optimization, and voice assistant compatibility. Sustainability and eco-friendly initiatives also play a crucial role as manufacturers develop low-impact stain removers and introduce biodegradable packaging to align with growing environmental concerns.

Recent Industry Developments

Reckitt Benckiser introduced a new AI-powered fabric stain remover that optimizes enzyme use and energy consumption based on stain type and fabric level. This innovation enhances efficiency and sustainability, catering to the growing demand for smart cleaning products with eco-friendly features.

Procter & Gamble expanded its range of compact stain removers by introducing models with app connectivity and voice assistant integration. These stain removers allow users to control applications remotely via a mobile app, improving convenience for consumers in small apartments and busy homes.

The Clorox Company launched an eco-friendly fabric stain remover featuring a biodegradable formula to eliminate stains and odors, ensuring a more sustainable clean. This development aligns with rising consumer concerns about environmental impact and health-conscious cleaning products.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 11.66 billion |

| Projected Market Size (2035) | USD 18.46 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in Kilotons |

| By Product Type | Liquid Stain Removers, Others |

| By Sales Channel | Online Retails, Others |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, MEA |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | The Procter & Gamble Company, Colgate-Palmolive Company, S.C. Johnson & Son Inc., Amway Corporation, Church & Dwight Co., Inc., AlEn USA LLC, Unilever PLC, Henkel Corporation, Reckitt Benckiser Group plc, Kao Corporation, LG Household & Healthcare, Lion Corporation, Oxychem Corporation, Wings Corporation, Blissful Industrial Corporation, The Himalayan Drug Company, Other Players |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

In terms of product type, the industry is divided into liquid fabric stain removers and others.

The industry is further divided by sales channels that are online retailers and other sales channels.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The global fabric stain remover industry is projected to witness a CAGR of 4.7% between 2025 and 2035.

The global fabric stain remover industry stood at USD 11,065.0 million in 2024.

The global fabric stain remover industry is anticipated to reach USD 18.46 billion by 2035.

The GCC region is set to record the highest CAGR of 8.9% in the assessment period.

The key players operating in the global fabric stain remover industry include Reckitt Benckiser, The Clorox Company, Procter & Gamble, Unilever, and OxiClean, among others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 42: Western Europe Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 44: Western Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: Eastern Europe Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 56: Eastern Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 76: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 78: East Asia Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 80: East Asia Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 82: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 84: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Product, 2023 to 2033

Figure 32: Global Market Attractiveness by Nature, 2023 to 2033

Figure 33: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 34: Global Market Attractiveness by End Use, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Product, 2023 to 2033

Figure 68: North America Market Attractiveness by Nature, 2023 to 2033

Figure 69: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 70: North America Market Attractiveness by End Use, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 106: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 120: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 124: Western Europe Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 128: Western Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 132: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 228: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 232: East Asia Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 236: East Asia Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 240: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 244: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Price Range, 2023 to 2033

Figure 250: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Price Range, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Fabric Stain Remover Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Fabric Stain Remover Market Analysis – Size, Share & Trends 2025 to 2035

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Pet Stain Remover & Odor Control Market Analysis - Growth to 2025 to 2035

Stain-Resistant Fabric Market Analysis – Trends, Growth & Forecast 2025-2035

Stainless Steel 330 Refractory Anchor Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel One-touch Fitting Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Direct Acting Solenoid Valve Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Miniature Screw Market Size and Share Forecast Outlook 2025 to 2035

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA